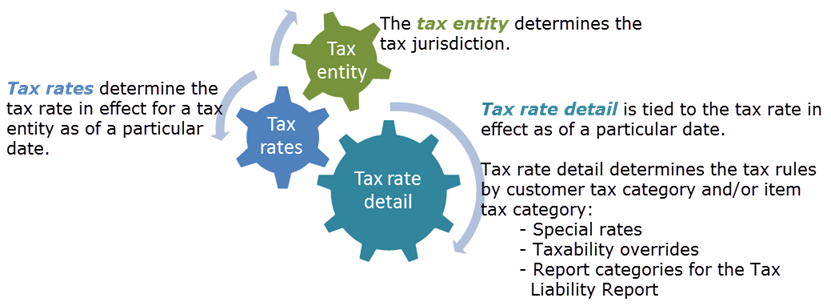

ActivityHD uses tax entities to compute the taxes your organization must remit to the various tax jurisdictions which affect your organization's operations.

The structure of AR tax entities is hierarchical. Each tax entity, except for top-level tax entities, has exactly one immediate parent tax entity. Top-level tax entities do not have a parent entity and typically represent federal tax entities. Although the USA does not currently have a federal sales tax, the "U" entity is the built-in top-level tax entity for the USA. All state-level tax entities for the USA are required to have "U" as their immediate parent. As implied, state (or province) tax entities are at the second level of the hierarchy. You can have up to eight additional levels of tax jurisdictions in the hierarchy structure representing entities such as counties, cities, transportation districts, SPDs, and MTAs.

You can assign a default tax entity for a customer on the customer location. When you enter an invoice for the customer, ActivityHD uses the default tax entity from the invoice location as the default destination tax entity for the invoice.

Tax can be levied based upon the destination tax entity or the origin tax entity. In the United States, the destination tax entity is used on interstate sales and the origin tax entity is used on in-state sales. Settings on the destination tax entity determine whether the tax is calculated based on the destination or origin. This is why two tax entities (destination and origin) are necessary on each invoice. The destination tax entity defaults from the invoice location specified on an invoice. The origin tax entity is determined by the tax entity flagged as the default tax entity for the company.

![]() Supported sales tax calculations

Supported sales tax calculations

ActivityHD's Accounts Receivable supports the following types of sales tax calculations:

- Sales to a nontaxable customer

- Sales of a nontaxable product

- Nontaxable sales of a product to a customer

- Sales to a customer who is taxed at a different rate than the standard rate

- Sales of a product that is taxed at a different rate than the standard rate

- Sales of a product to a customer that are taxed at a different rate than the standard rate

- A tax rate that is superseded by a new rate as of a particular date

The following types of sales tax calculations are NOT currently supported:

- Sales of a product with a tax ceiling. The product is taxed through a certain amount and the remainder is nontaxable.

- Sales of a product with a tax floor. The product is nontaxable until a certain amount and the remainder is taxable.

- Sales of a product with rate splits. The product is taxed at one rate through a certain amount and the remainder is taxed at a different rate.

- Sales of products taxed on a mixed calculation basis. One type of product is taxed as a percentage; another type is taxed at an amount per quantity.

- Tax is charged up to a maximum amount; after that, no tax is charged.

- A product is taxed at one rate if the detail amount is below a certain point; taxed at a different rate if the invoice detail amount is above that point. In either case, one rate is applied to the entire amount.

- A product is taxed only if the invoice detail amount exceeds a certain amount. If it does, the entire amount is taxable.

The following image points out the fields in the AR Invoice window which impact sales tax calculations.

The diagram below illustrates the relationship between tax entities and tax categories.

Tax entities are assigned to customer locations. Tax entities establish rates and rules about taxation. Tax categories are assigned to customers and to ARCodes to determine taxability and/or to group them under tax entity rules.

Notice that nontaxable and taxable customers for the same tax jurisdiction have the same tax entity. However, the nontaxable customer has a tax category which makes its invoices nontaxable.

Nontaxable customers

There are numerous examples of nontaxable customers: government, non-profit organizations, schools, churches, etc. To create customer tax categories for nontaxable customers, first examine your state or province's rules to determine the reportable reasons for nontaxability. If your state or province requires reporting of sales to government separately from sales to schools, you need at least two nontaxable customer tax categories.

Note

AccountingWare recommends that you set up more than one customer tax category for nontaxable customers. Different tax jurisdictions require different levels of tax reporting. Carefully research the tax forms from your tax jurisdictions to determine the number of tax categories you need to create in order to properly categorize customers for the Tax Liability Report.

Taxable customers

In general, a taxable customer does not need a tax category assignment because all customers are considered taxable by default.

However, some jurisdictions require taxable sales to be reported by customer type and/or product type. For example, your state may want all paper products reported separately or all sales to Native Americans reported separately. While these sales may be charged at the prevailing sales tax rate, you may need to break out these sales on tax forms.

To accommodate situations like those described above, you may need additional tax categories to use as reporting groups on the Tax Liability Report. These groups are still taxable according to the tax entity rules, but the taxes paid are reported separately.

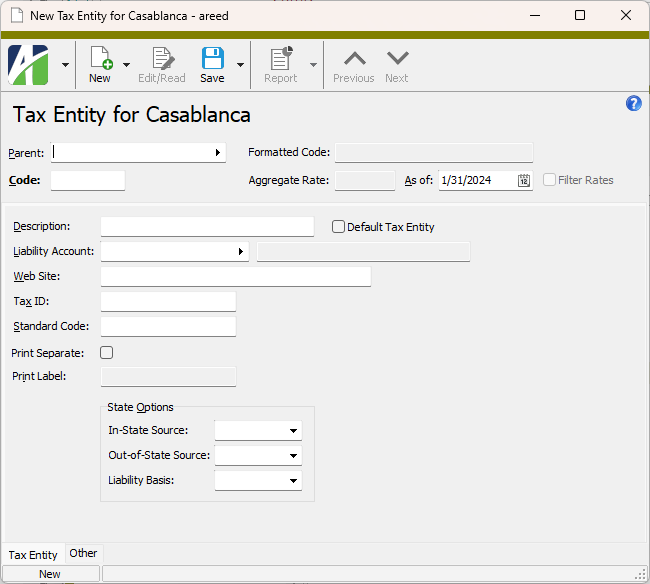

Create a tax entity

- In the Navigation pane, highlight the Accounts Receivable > Setup > Tax Entities folder.

- Click

. The New Tax Entity window opens.

. The New Tax Entity window opens.

- Unless this is a top-level tax entity, select the immediate Parent of the tax entity.

-

Enter a Code for the tax entity. The parent code joined to the tax entity code must be unique.

Tip

For states or provinces, consider using the two-character postal abbreviation as the code.

When you tab out of this field, the complete code displays in the Formatted Code field.

- Enter a Description of the tax entity.

- If this tax entity represents the tax jurisdiction for the primary location where your organization originates sales, mark the Default Tax Entity checkbox. This causes the tax entity to be loaded as the default origin tax entity on all new invoices.

-

In the Liability Account field, enter the GL account mask for the tax liability account for the tax entity. If you want the tax entity to inherit the liability account from its parent tax entity, leave this field blank.

Example

If you have separate tax liability accounts for each state, enter a liability account on each state tax entity. All tax entities below the state tax entity in the hierarchy automatically use their state's tax liability account. If you have separate tax liability accounts by operating unit (such as store, division, or unit), enter wildcards in that part of the tax liability account mask. Wildcards can be replaced with the corresponding characters from the sales tax liability account masks from attributes with AR usage at invoice entry time.

- In the Web Site field, enter the URL of the tax entity's website. Your entry becomes a hyperlink that you can use to open the web page by pressing Ctrl+click.

- In the Tax ID field, enter your tax identification number with the tax entity. The tax ID is for reporting purposes only.

- In the Standard Code field, enter the code or description that identifies the tax entity (county, city, municipality, SPD, MTA, etc.).

- If you want the tax entity's amount to print on a separate line on invoices, mark the Print Separate checkbox.

- If you marked the Print Separate checkbox, the Print Label field is enabled. Enter the label to print next to the tax entity's amounts on invoices. You can use up to 20 characters.

- In the State section from the In-State Source drop-down list, select the default tax entity source on an invoice when this tax entity is used as the destination tax entity and the origin and destination tax entities are within the same state (or province). Your options are:

- Origin. Use the origin tax entity on the invoice as the tax entity for calculating tax on the invoice.

- Destination. Use the destination tax entity on the invoice as the tax entity for calculating tax on the invoice.

- From the Out-of-State Source drop-down list, select the default tax entity source on an invoice when the tax entity is used as the destination tax entity and the origin and destination tax entities are from different states (or provinces). Your options are:

- Origin. Use the origin tax entity on the invoice as the tax entity for calculating tax on the invoice.

- Destination. Use the destination tax entity on the invoice as the tax entity for calculating tax on the invoice.

- From the Liability Basis drop-down list, select the basis to use for determining tax liability for the tax entity. (The Tax Liability Report lets you limit the tax entities by liability basis.) Your options are:

- Invoice (accrual)

- Receipt (cash)

- Save the new tax entity.

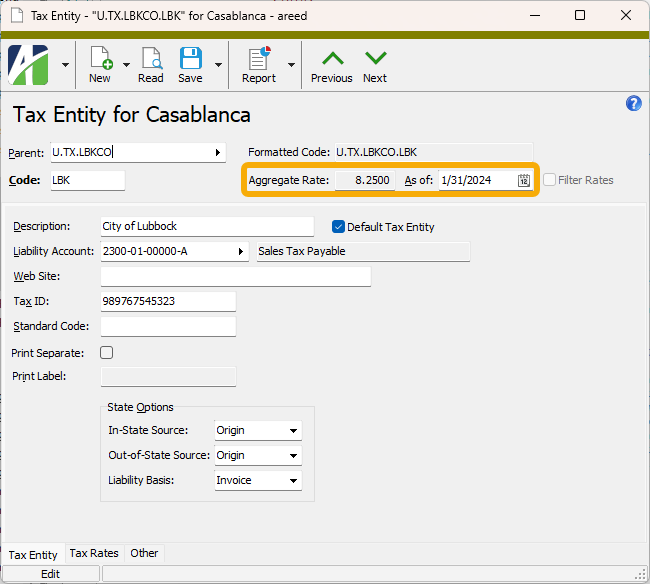

![]() Determine the aggregate rate for a tax entity as of a given date

Determine the aggregate rate for a tax entity as of a given date

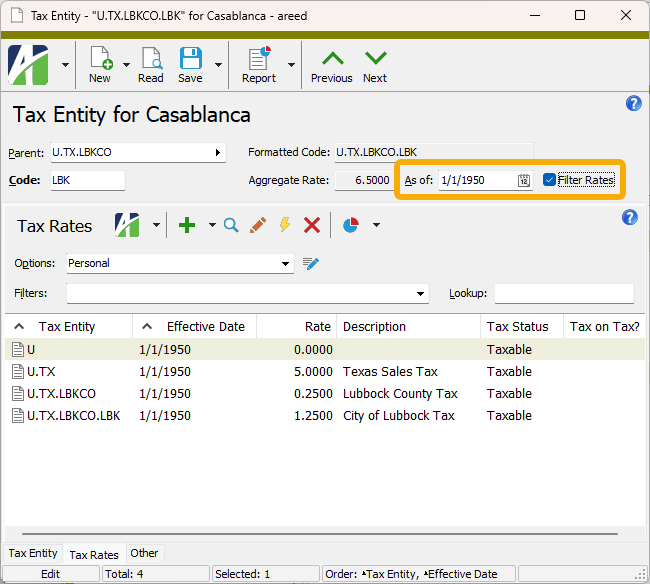

For existing tax entities with historical tax rate records, you can use the Aggregate Rate field in combination with the As of field to see the aggregate tax rate as of the date you specify.

- In the Navigation pane, highlight the Accounts Receivable > Setup > Tax Entities folder.

-

In the HD view, locate and double-click the tax entity you want to investigate aggregate tax rates for to open it in the Tax Entity window.

- In the As of field, enter the date as of which you want to see the aggregate rate, then press TAB. The Aggregate Rate field updates to show the rate as of the date you specified.

- Repeat as desired.

- When you finish, close the tax entity record.

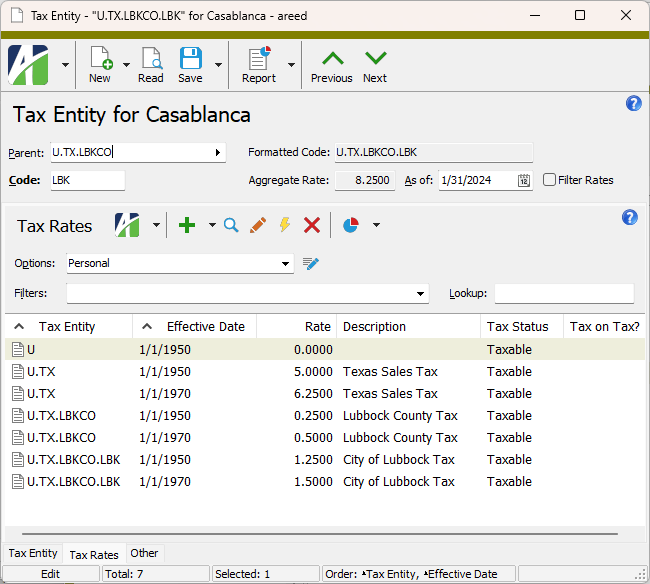

![]() View tax rates of a tax entity

View tax rates of a tax entity

The Tax Entity window includes a Tax Rates tab where you can view the tax rates for a tax entity. If desired, you can filter the tax rates by an effective date.

- In the Navigation pane, highlight the Accounts Receivable > Setup > Tax Entities folder.

- In the HD view, locate and double-click the tax entity you want to view tax rates for to open it in the Tax Entity window.

- Select the Tax Rates tab.

- To filter the list of tax rates by date, enter a date in the As of field and then mark the Filter Rates checkbox. The list shows the tax rates effective as of the date you specified and the Aggregate Rate field updates to show the effective rate on that date.

Tax Entity Record ID

The immediate parent tax entity of this tax entity. If this is a top-level (federal) tax entity, you can leave this field blank.

The structure of AR tax entities is hierarchical. Each tax entity, except for top-level tax entities, has exactly one immediate parent tax entity. Top-level tax entities do not have a parent entity and typically represent federal tax entities. Although the USA does not currently have a federal sales tax, the "U" entity is the built-in top-level tax entity for the USA. All state-level tax entities for the USA are required to have "U" as their immediate parent. As implied, state (or province) tax entities are at the second level of the hierarchy. You can have up to eight additional levels of tax jurisdictions in the hierarchy structure representing entities such as counties, cities, transportation districts, SPDs, and MTAs.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

A code for the tax entity; the shorter, the better. The parent code joined to the tax entity code must be unique.

Tip

For states or provinces, consider using the two-character postal abbreviation as the code.

This field displays the complete identifier for the tax entity, the parent code combined with the current tax entity's code.

The formatted tax entity code is derived by concatenating the immediate parent entity code with a period and then with the code for the immediate jurisdiction. So, the state code for Texas is "U" + "." + "TX" = U.TX. The county code for Dallas County might be "U.TX" + "." + "DAL" = U.TX.DAL.

Example

| Tax Entity | Description | Tax Rate |

|---|---|---|

| U | United States | 0.0000% |

| TX | State of Texas | 6.2500% |

| DAL | Dallas County, Texas | 1.0000% |

| MTA | Dallas MTA Transit | 1.0000% |

| Aggregate rate for U.TX.DAL.MTA | 8.2500% | |

The date as of which to calculate the aggregate rate for the entity. The default date is today's date. Change the date in this field to see the aggregate rates on other dates. This field is for investigational purposes only; changes to the As of date and the Aggregate Rate are not saved when the tax entity record is saved.

When you view the Tax Rates tab, you can use this field in conjunction with the Filter Rates checkbox to only show the tax rates that contribute to the aggregate rate as of the date you enter.

Tax Entity tab

The GL account mask for the tax liability account to use for the tax entity. If you want the tax entity to inherit the liability account from its parent tax entity, leave this field blank.

Example

If you have separate tax liability accounts for each state, enter a liability account on each state tax entity. All tax entities below the state tax entity in the hierarchy automatically use their state's tax liability account. If you have separate tax liability accounts by operating unit (such as store, division, or unit), enter wildcards in that part of the tax liability account mask. Wildcards can be replaced with the corresponding characters from the sales tax liability account masks from attributes with AR usage at invoice entry time.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

- Origin. Use the origin tax entity on the invoice as the tax entity for calculating tax on the invoice.

- Destination. Use the destination tax entity on the invoice as the tax entity for calculating tax on the invoice.

- Origin. Use the origin tax entity on the invoice as the tax entity for calculating tax on the invoice.

- Destination. Use the destination tax entity on the invoice as the tax entity for calculating tax on the invoice.

- Invoice (accrual)

- Receipt (cash)

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Tax Rates tab

The Tax Rates pane shows the Tax Rates HD view filtered to show the tax rates for the selected tax entity. You can enter an effective date in the As of field and mark the Filter Rates checkbox above this pane to show only the tax rates that contributed to the aggregate rate as of the effective date.

Double-click a row in the pane to drill down to its record in the Tax Rate window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

| Tax Entity Code | Description | Type | Rate | Aggregate Rate |

|---|---|---|---|---|

| U | United States | Federal | 0.0000 | 0.0000 |

|

|

Tax entities security

Common accesses available on tax entities

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |