A deposit is identified by its deposit type, GL date, and instance. The instance is an ordered number assigned to a deposit to distinguish it from other deposits of the same type created on the same GL date.

There are two standard ways to create a deposit and assign it to receipts:

- Let ActivityHD generate it. When you enter a receipt, you can enter a deposit type on the receipt and let ActivityHD either assign the receipt to an existing open deposit with the correct deposit type and GL date (if there is one) or create a new deposit to assign it to when the receipt is saved. The deposit and receipt inherit the GL batch and bank account from the deposit type.

- Create a deposit first and assign receipts to it later. When you create a receipt, you can assign an existing open deposit to it. In this case, the deposit type is determined from the deposit that is assigned. The GL batch, GL date, and bank account are inherited from the deposit. This allows all receipts in the deposit to be summarized into a single GL entry detail line so that one Bank Reconciliation transaction is created per deposit. You can create one deposit per deposit type per day for a specified range of dates using the Create Deposits wizard or you can create deposits individually as described in the following procedure.

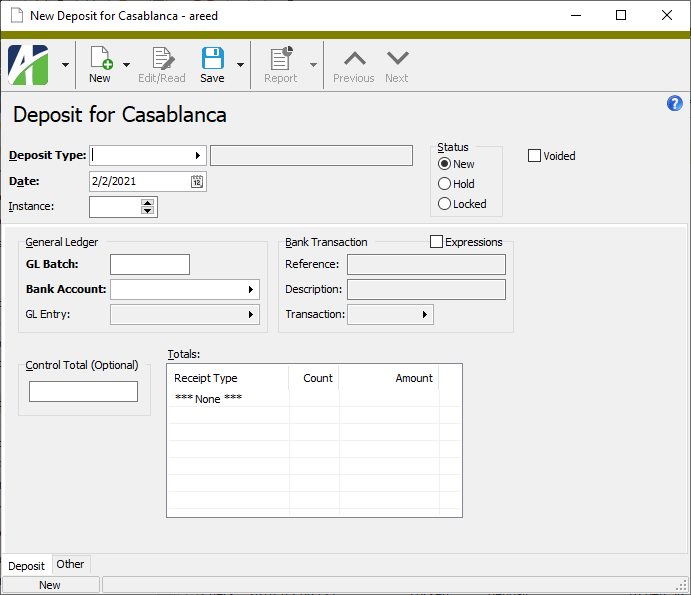

To create an individual deposit:

Create an individual deposit

- In the Navigation pane, highlight the Accounts Receivable > Deposits folder.

- Click

. The New Deposit window opens.

. The New Deposit window opens.

- Select the Deposit Type. The deposit type determines the default GL batch, bank account, reference expression, and description expression for the deposit.

-

The Date field defaults to the current date. This date becomes the GL posting date for all receipts linked to the deposit. If another deposit of this type already exists for the same date, ActivityHD increments the instance counter by 1 so that the deposit is uniquely identified. If you need to change the date, enter the deposit date.

Notes

If you change the date on a deposit with unmerged receipts, the receipts are flagged as having "Invalid GL" until you update their GL dates to match. Receipts with invalid GL cannot be merged until the issue is resolved. Either edit the receipts one-by-one or run the Validate GL wizard on them in the Receipts folder.

If you change the date on a deposit with merged receipts, you are unable to merge the associated GL entry until the GL dates on all the deposit's receipts match the deposit date.

- In the Status field, accept the status of "New".

-

The GL Batch defaults from the deposit type. If you need to change the batch name, enter the name in this field. The batch name is copied to all receipts linked to the deposit. Related receipts must have the same batch name so that they can be summarized into the same GL entry detail line and into a single Bank Reconciliation transaction.

Notes

If you change the GL batch on a deposit with receipts, the receipts are flagged as having "Invalid GL" until you update their GL batches to match. Receipts with invalid GL cannot be merged until the issue is resolved. Either edit the receipts one-by-one or run the Validate GL wizard on them in the Receipts folder.

-

The Bank Account defaults from the deposit type. If you need to change the bank account, select the bank account number. The bank account number is copied to all receipts linked to the deposit. Related receipts must have the same bank account so that they can be summarized into the same GL entry detail line and into a single Bank Reconcilation transaction.

Notes

If you change the bank account on a deposit with receipts, the receipts are flagged as having "Invalid GL" until you update their bank accounts to match. Receipts with invalid GL cannot be merged until the issue is resolved. Either edit the receipts one-by-one or run the Validate GL wizard on them in the Receipts folder.

-

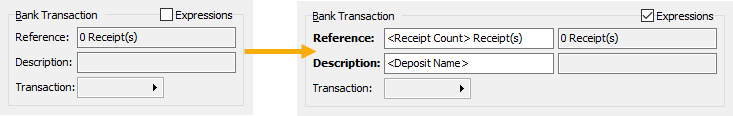

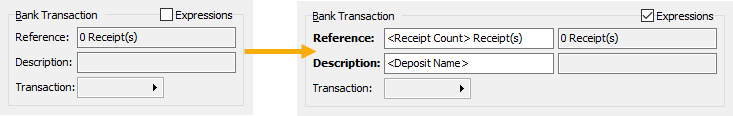

If you want to view or edit the expressions used to create the bank transaction reference and description, mark the Expressions checkbox. The Bank Transaction section expands to show the Reference and Description entry fields. The default expressions come from the deposit type but can be changed on a deposit-by-deposit basis.

To edit the expressions:

- In the Reference field, enter the literal text and/or keywords to use to generate the deposit reference you want to appear on this deposit. The reference value is copied to the Reference field on the bank transaction that is created during the GL merge.

- In the Description field, enter the literal text and/or keywords to use to generate the deposit description you want to appear on this deposit. The description value is copied to the Description field on the bank transaction that is created during the GL merge.

- If you know the total deposit amount, you can enter it in the Control Total field. This helps validate that all receipts are included in the deposit. ActivityHD does not let you change the status of the deposit to "Hold" or "Locked" until the total receipts add up to this amount. If you don't know the deposit total now or if you don't want the extra validation, you can leave this field blank.

- Save the new deposit.

A deposit cannot be deleted if it is assigned to a receipt.

To delete a deposit that is unassigned, highlight the deposit record in the HD view and click ![]() , or open the deposit and select

, or open the deposit and select ![]() > Edit > Delete. In either case, ActivityHD prompts you to confirm your action. Click Delete to delete the deposit.

> Edit > Delete. In either case, ActivityHD prompts you to confirm your action. Click Delete to delete the deposit.

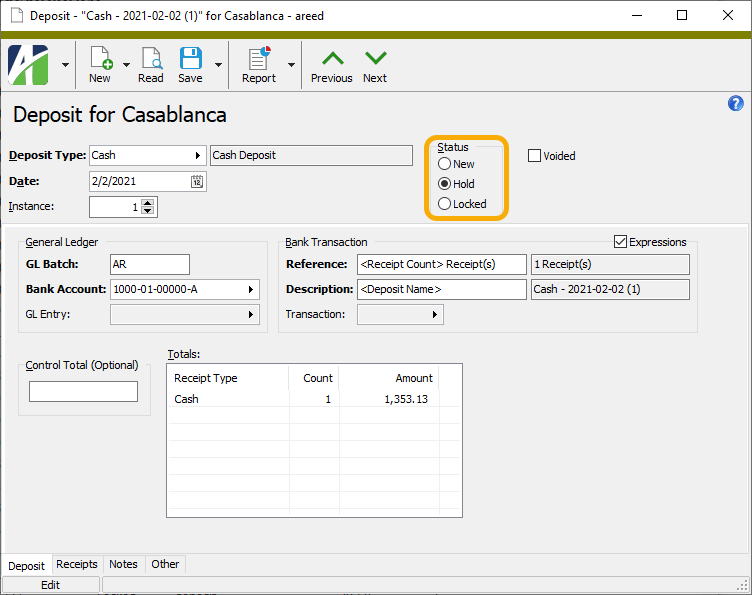

"Hold" status indicates that a deposit has not been taken to the bank and it is not currently available to be assigned to receipts or to be removed from receipts. A deposit cannot be put on hold if it references an unmerged receipt or if its control total doesn't match the total receipt amount. You might want to put a deposit on hold if you're waiting to find out the actual deposit date but you don't want any other changes made to the receipts in the deposit.

To put a deposit on hold:

- In the Navigation pane, highlight the Accounts Receivable > Deposits folder.

- In the HD view, locate and double-click the deposit you need to put on hold to open it in the Receipt window.

- In the Status field, select "Hold".

- Save your changes.

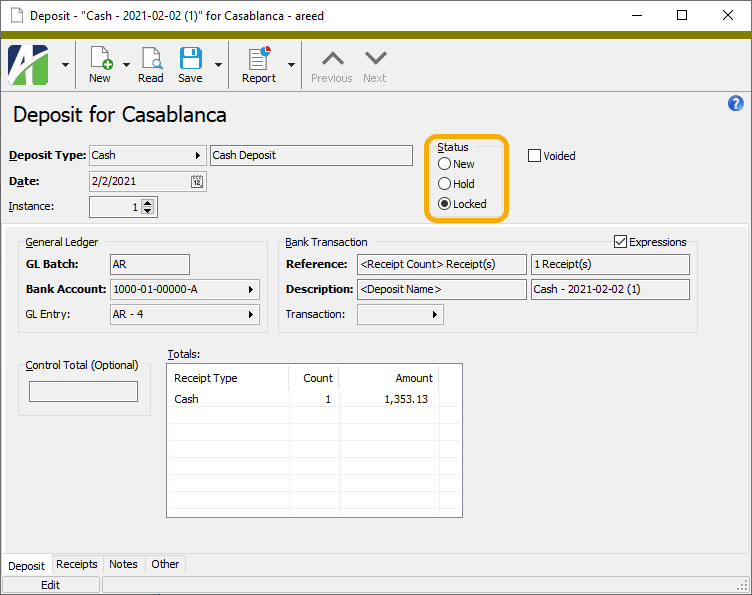

Change a deposit's status to "Locked" when it has been taken to the bank. You cannot merge the GL entry for a receipt unless its deposit is locked. This protects the integrity of the Bank Reconciliation transaction that is created during the GL merge for the deposit. You cannot change the status of a locked deposit once its GL entry is merged. A locked deposit cannot be removed from receipts or assigned to receipts.

You cannot lock a deposit that references an unmerged receipt or if its control total doesn't match the total receipt amount.

To lock a deposit:

- In the Navigation pane, highlight the Accounts Receivable > Deposits folder.

- In the HD view, locate and double-click the deposit you need to lock to open it in the Receipt window.

- In the Status field, select "Locked".

- Save your changes.

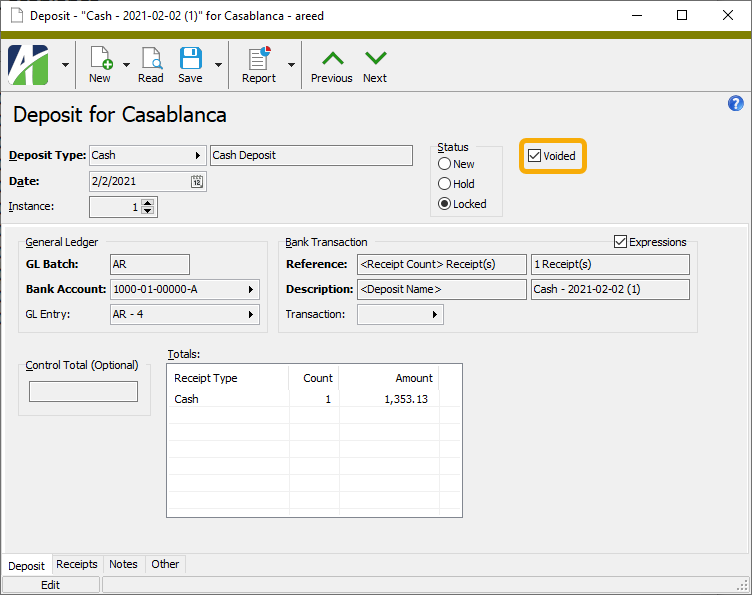

Void a deposit

A deposit cannot be voided directly. A deposit is considered voided when its status is "Hold" or "Locked" and all its receipts are voided. See "Void receipts".

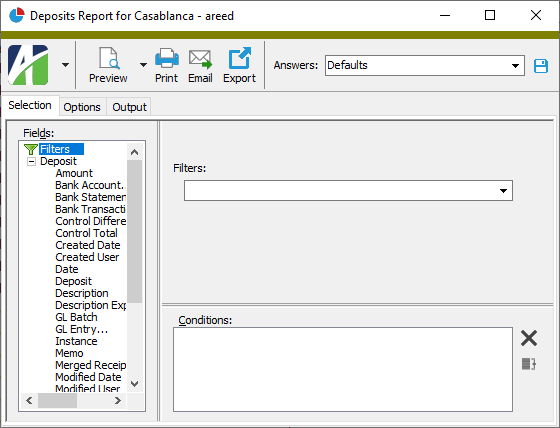

Deposits Report

Purpose

The Deposits Report provides a list of deposits in the Accounts Receivable package.

Content

For each deposit included on the report, the report shows:

- status

- reference

- description

- bank account

- count of receipts in the deposit

- deposit total.

For each receipt type in a deposit, the report shows:

- receipt type

- count of receipts of the receipt type

- deposit total for the receipt type.

In addition, you can include one or more of the following:

- receipt detail (receipt batch - entry number, receipt date, reference, payment customer, amount)

- timestamps

- memos

- custom fields.

The following totals appear on the report:

- grand totals.

Print the report

- In the Navigation pane, highlight the Accounts Receivable > Deposits folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of deposits:

- Right-click the Deposits folder and select Select and Report > Deposits Report from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected deposits:

- In the HD view, select the deposits to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To report on a particular deposit from the Deposit window:

- In the HD view, locate and double-click the deposit to report on. The Deposit window opens with the deposit loaded.

- Click

.

.

- To report on all or a filtered subset of deposits:

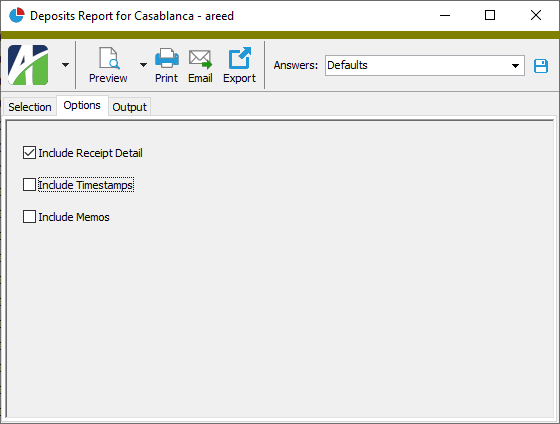

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Receipt Detail

- Report Options. To include a section at the end of the report with the report settings used to produce the report, leave the checkbox marked. To produce the report without this information, clear the checkbox.

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Deposits

- Receipts

Deposit Record ID

The deposit type. The deposit type determines the default GL batch, bank account, reference expression, and description expression for the deposit.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

The deposit date. The default date is the current date. The deposit date becomes the GL posting date for all receipts linked to the deposit. If another deposit of this type already exists for the same date, ActivityHD increments the instance counter by 1 so that the deposit is uniquely identified.

Notes

If you change the date on a deposit with unmerged receipts, the receipts are flagged as having "Invalid GL" until you update their GL dates to match. Receipts with invalid GL cannot be merged until the issue is resolved. Either edit the receipts one-by-one or run the Validate GL wizard on them in the Receipts folder.

If you change the date on a deposit with merged receipts, you are unable to merge the associated GL entry until the GL dates on all the deposit's receipts match the deposit date.

- New. A new deposit has not been taken to the bank and is eligible to be assigned to receipts. A new deposit can be assigned to any unmerged receipt or to any merged receipt with an unmerged GL entry.

- Hold. The deposit has not been taken to the bank and it is not available for assignment to or removal from receipts. A deposit cannot be placed on hold if it references an unmerged receipt or if its control total and receipt amount do not match. Use "Hold" status, for example, if you are waiting on the actual deposit date but do not want changes made to any of the receipts in the deposit.

- Locked. Set a deposit's status to "Locked" when it has been taken to the bank. ActivityHD does not allow the deposit to be assigned to or removed from any receipt. Locking a deposit prevents changes to the deposit and preserves its receipt detail indefinitely. A deposit cannot be locked if it references an unmerged receipt or if its control total and the receipt amount do not match. A receipt's GL entry cannot be merged unless the deposit status is "Locked". This protects the integrity of the bank transaction that is created during the GL merge for the deposit. Once the associated GL entry is merged, the status on a locked deposit cannot be changed.

Deposit tab

The GL batch name defaults from the deposit type. If you need to change the batch name, enter the name in this field. The batch name is copied to all receipts linked to the deposit. Related receipts must have the same batch name so that they can be summarized into the same GL entry detail line and into a single Bank Reconciliation transaction.

Note

If you change the GL batch on a deposit with receipts, the receipts are flagged as having "Invalid GL" until you update their GL batches to match. Receipts with invalid GL cannot be merged until the issue is resolved. Either edit the receipts one-by-one or run the Validate GL wizard on them in the Receipts folder.

The bank account defaults from the deposit type. If you need to change the bank account, select the appropriate bank account number. The bank account number is copied to all receipts linked to the deposit. Related receipts must have the same bank account so that they can be summarized into the same GL entry detail line and into a single Bank Reconcilation transaction.

Note

If you change the bank account on a deposit with receipts, the receipts are flagged as having "Invalid GL" until you update their bank accounts to match. Receipts with invalid GL cannot be merged until the issue is resolved. Either edit the receipts one-by-one or run the Validate GL wizard on them in the Receipts folder.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

The batch and entry number of the GL entry associated with the receipts in the deposit. This field is blank until the deposit's receipts are merged.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Mark this checkbox if you want to view or edit the expressions used to generate the bank transaction reference and description. The Bank Transaction section expands to show the Reference and Description entry fields.

Reference expression. This field is visible if you mark the Expressions checkbox. The expression in this field defaults from the deposit type. You can build the reference using literal text and/or keywords that pull information from the deposit, receipt, or customer (receipt and customer information can only be used if the deposit contains exactly one receipt). The resulting reference value can contain up to 20 characters. The reference value is copied to the Reference field on the bank transaction when the transaction is created during GL merge.

Reference value. This field displays the actual reference that results from the reference expression. This reference is used on the bank transaction.

Description expression. This field is visible if you mark the Expressions checkbox. The expression in this field defaults from the deposit type. You can build a description using literal text and/or keywords that pull information from the deposit, receipt, or customer (receipt and customer information can only be used if the deposit contains exactly one receipt). The resulting description value can contain up to 40 characters. The description value is copied to the Description field on the bank transaction when the transaction is created during GL merge.

Description value. This field displays the actual description that results from the description expression. This description is used on the bank transaction.

The bank transaction associated with the deposit. This field is blank until the deposit's GL entry is merged.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Receipts tab

The Receipts pane shows the Receipts HD view filtered to show all receipts on the selected deposit.

Double-click a row in the pane to drill down to its record in the Receipt window.

Notes tab

The Notes pane shows the Notes HD view filtered to show all notes for the selected deposit.

Double-click a row in the pane to drill down to its record in the Note window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Deposits security

Common accesses available on deposits

Deposit filters

| Filter Name | Effect |

|---|---|

| ? Amount | Prompts for a range of amounts and lists the deposits for amounts in that range. |

| ? Bank Account | Prompts for a bank account and lists the deposits to that account. |

| ? Deposit Created Date | Prompts for a range of dates and lists deposits created in that date range. |

| ? Deposit Date | Prompts for a range of dates and lists deposits with a deposit date in that date range. |

| ? Deposit Type | Prompts for a deposit type and lists deposits with a deposit type that contains the specified search string. |

| Deposits for This Week | Lists deposits for the current week. |

| Deposits for Today | Lists deposits with a deposit date of today. |

| New Deposits | Lists deposits with a status of "New". |

| Unlocked Deposits | Lists deposits that do not have a status of "Locked". |

Deposit statuses

Deposit statuses control whether receipts can be added to or removed from a deposit. Deposits have three possible statuses:

- New. A new deposit has not been taken to the bank and is eligible to be assigned to receipts. A new deposit can be assigned to any unmerged receipt or to any merged receipt with an unmerged GL entry.

- Hold. The deposit has not been taken to the bank and it is not available for assignment to or removal from receipts. A deposit cannot be placed on hold if it references an unmerged receipt or if its control total and the receipt amount do not match. Use "Hold" status, for example, if you are waiting on the actual deposit date but do not want changes made to any of the receipts in the deposit.

- Locked. Set a deposit's status to "Locked" when it has been taken to the bank. ActivityHD does not allow the deposit to be assigned to or removed from any receipt. Locking a deposit prevents changes to the deposit and preserves its receipt detail indefinitely. A deposit cannot be locked if it references an unmerged receipt or if its control total and the receipt amount do not match. A receipt's GL entry cannot be merged unless the deposit status is "Locked". This protects the integrity of the bank transaction that is created during the GL merge for the deposit. Once the associated GL entry is merged, the status on a locked deposit cannot be changed.

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

AR deposit expression keywords

The lists below shows keywords which can be used in deposit expressions. Deposit expressions can be used to define the deposit reference and deposit description on deposit types.

Deposit information

- <Receipt Count>

- <Deposit Name>

- <Deposit Type>

- <Deposit Date>

- <Deposit Instance>

Example

For a multi-receipt deposit, consider these expressions:

- Reference Expression: <Receipt Count> Receipt(s)

- Description Expression: <Deposit Name>

Receipt and customer information

The following keywords are only valid when you specify "one receipt per deposit". Do not use these keywords on multi-receipt deposit types.

- <Receipt Reference>

- <Receipt Description>

- <Customer Code>

- <Customer Name>

Example

Suppose you have a deposit type set up to handle American Express credit card receipts. Since this type of receipt allows only one receipt per deposit, you can use the receipt and customer information keywords. Let's build a reference which contains the credit card machine's ID number (78) and the "batch out" number. The "batch out" number is stored in the Receipt Reference. Because you are using different AR customers to group these charges, you want to show the customer name in the deposit description. These expressions do the trick:

- Reference Expression: 78 - <Receipt Reference>

- Description Expression: <Customer Name>

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |