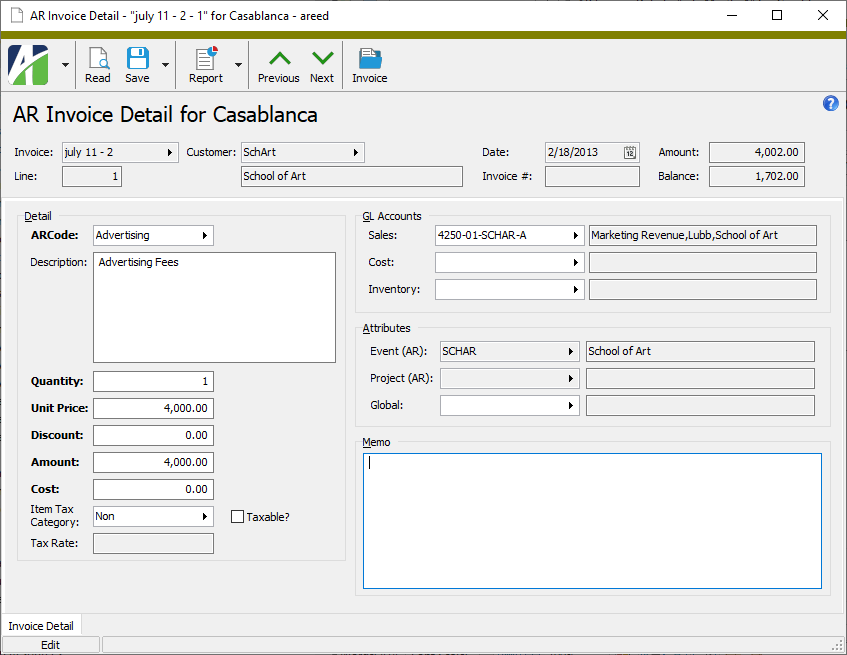

The Invoice Detail folder contains the detail lines for your AR invoices.

The Invoice Detail window shows the detail for an individual detail line.

You can edit the Description and Memo for any AR invoice. If the AR invoice is unmerged, you can edit all editable detail fields. If the AR invoice is merged but not merged to GL, you can edit the Description, Item Tax Category, GL Accounts, Invoice Detail Attributes, and Memo fields. If the AR invoiced is merged and merged to GL, you can edit the Description, Item Tax Category, Invoice Detail Attributes, and Memo fields. For voided or reversal invoices, you can only edit the Description and Memo fields.

The ARCode on a detail line affects the detail line in the following ways:

- Categorizes the detail line for reporting purposes.

- Provides masks for deriving GL account numbers for the sales, cost, and inventory accounts.

- Controls whether the detail line is subject to sales tax.

- Controls whether the detail line is eligible for a discount.

An invoice detail line is considered to have invalid GL if any of the following is true:

- The sales account is blank or invalid.

- The cost is non-zero and the cost account is blank or invalid.

- The cost is non-zero and the inventory account is blank or invalid.

When you have a detail line record open, you can click ![]() to drill down to the AR invoice that contains the detail line.

to drill down to the AR invoice that contains the detail line.

AR Sales Analysis

Purpose

The Sales Analysis report helps you measure and track sales performance. Using its flexible sorting, subtotaling, and totaling options, you can use the report to analyze sales from a variety of perspectives.

Content

When the report is run showing invoice detail, for each detail line included on the report, the report shows:

- invoice or GL date

- invoice number

- ARCode

- customer code

- salesperson

- quantity sold

- amount of sale.

(If you run the report and do not include detail, the report only shows grand totals for quantity and amount. If you do not include detail but do specify a subtotal option, the report also shows quantity and amount for each subtotal group.)

In addition, you can include information for one or more of the following:

- unmerged invoices not on hold

- credits

- voids.

The following totals appear on the report:

- subtotals (optional, by sort option)

- grand totals.

Print the report

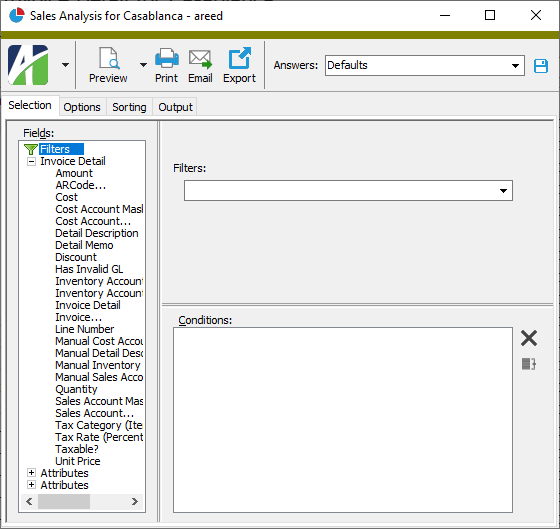

- In the Navigation pane, highlight the Accounts Receivable > Invoices > Invoice Detail folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of invoice detail records:

- Right-click the Invoice Detail folder and select Select and Report > Sales Analysis from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected invoice detail records:

- In the HD view, select the invoice detail records to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To report on a particular invoice detail record from the Invoice Detail window:

- In the HD view, locate and double-click the invoice detail record to report on. The Invoice Detail window opens with the invoice detail record loaded.

- Click

.

.

- To report on all or a filtered subset of invoice detail records:

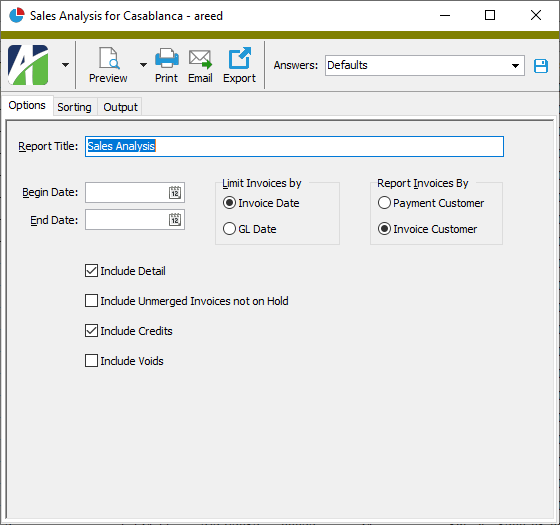

- Select the Options tab.

- In the Report Title field, type a title for the report. You can use up to 100 characters.

- In the Begin Date and End Date fields, enter the range of dates for which to include invoice detail records on the report.

- In the Limit Invoices by field, select the type of date to compare against the date range to determine which invoice detail records are included on the report. Your options are:

- Invoice Date

- GL Date

- In the Report Invoices By field, select which customer type to reference on the report. Your options are:

- Payment Customer. Use the payment customer from the customer record.

- Invoice Customer. Use the customer from the invoice record.

- Mark the checkbox(es) for the additional information to include:

- Detail

- Unmerged Invoices Not on Hold

- Credits

- Voids. Mark this checkbox to include voided and reversal invoices on the report. (If you use the original invoice date on reversal invoices when voiding, this option is probably not needed.) This option is most valuable when the original invoice date differs from the reversal date. Voids, reversals, and totals which include a voided and/or reversal amount are indicated by an asterisk (*).

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

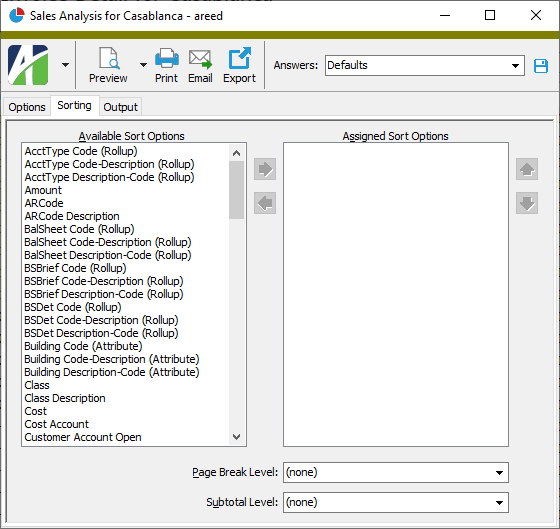

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the field(s) to sort the report by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - If you want the report to start a new page for each change in one of the sorting options you specified, select the sorting option to break on from the Page Break Level drop-down list. If you do not want to insert page breaks, accept "(none)".

- If you want the report to subtotal based on one of the sorting options you specified, select the sorting option to subtotal on from the Subtotal Through Level drop-down list. If you do not want to show subtotals, accept "(none)".

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Customers

- Invoices

- Invoice detail

- Summary invoices

Invoice Detail Record ID

Displays the batch name and entry number of the invoice that contains the detail line.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Displays the customer associated with the invoice that contains the detail line.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Invoice Detail tab

The ARCode assigned to the detail line. This field is disabled if the invoice is merged.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

The item tax category assigned to the detail line. This field is disabled on voided or reversal invoices.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

The sales account used for the invoice detail line. This field is disabled if the GL entry is merged.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

The cost account used for the invoice detail line. This field is disabled if the GL entry is merged.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

The inventory account used for the invoice detail line. This field is disabled if the GL entry is merged.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

An attribute item that applies for the invoice detail line. If the attribute is a required attribute, you must select an attribute item. If the attribute is also enabled for AR invoice usage, this field defaults to the attribute used on the invoice, if applicable. Overriding the default attribute will cause the new value to display in purple.

Attribute items provide additional ways to categorize invoice detail lines for reporting and they can contribute to the GL account masks used to derive the GL accounts used during invoice posting.

You can change an attribute item on a merged invoice; however, related changes to GL accounts only occur if the account was not manually entered and the associated GL entry is not merged.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Invoice detail security

Common accesses available on invoice detail

Invoice detail filters

| Filter Name | Effect |

|---|---|

| ? Amount | Prompts for a range of amounts and lists the invoice detail records with an amount in that range. |

| ? ARCode | Prompts for an ARCode and lists the invoice detail records with an ARCode that contains the specified search string. |

| ? Customer Class | Prompts for a customer class and lists the invoice detail records for customers with a class code that contains the specified search string. |

| ? Customer Code | Prompts for a customer code and lists the invoice detail records for customers with a customer code that contains the specified search string. |

| ? Customer Name | Prompts for a customer name and lists the invoice detail records for customers with a name that contains the specified search string. |

| ? Invoice Date | Prompts for a range of dates and lists the invoice detail records with an invoice date in that range. |

| ? Sales Account | Prompts for a sales account number and lists the invoice detail records with a sales account that contains the specified search string. |

| ? Sales Account Mask | Prompts for a sales account mask and lists the invoice detail records with a sales account that matches the specified account mask. |

| ? Tax Category (Item) | Prompts for an item tax category and lists the invoice detail records with an item tax category that contains the specified search string. |

| Has Invalid GL | Lists invoice detail records with general ledger problems. |

| Taxable | Lists taxable invoice detail records only. |

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |