State W-4 records help you withhold the correct amount of state income tax from an employee's earnings. ActivityHD has a state W-4 record type for storing employees' state withholding allowance details. You can also attach a copy of the actual state W-4 to the state W-4 record.

Note

"State W-4" refers to the state withholding certificate that is the state analog of the federal Form W-4. The form name and number vary from state to state; however, references to "state W-4" should be understood to refer to the particular withholding certificate for the state under discussion.

The StateW4.Withholding payroll check calculation function is used to calculate state income tax withholding based on the state W-4 in effect for the employee as of the check date. If no state W-4 has been submitted or if the state W-4 has expired as of a particular check date, ActivityHD applies the specific rules of the employee's state to determine how much to withhold. For instance, some states require that maximum withholding be figured based on single filing status with no dependents when no valid state W-4 is in effect. Several states fall back to the elections on the employee's current federal W-4 and apply those to state withholding.

Note

ActivityHD supports the calculation of local income tax for a few locations where the state W-4 provides for entry of a local taxing authority. In these cases, a state W-4 must exist for an employee in order to calculate the local income tax; otherwise, the local tax amount will be shown as 0.00.

The StateW4.ExtraWithholding payroll check calculation function uses the Extra Withholding (or Additional Amount, Additional Withholding) field on the state W-4 to determine the extra withholding amount.

Record a state W-4

Tip

AccountingWare suggests that you attach an electronic copy of the state W-4 form to the state W-4 record.

Note

You cannot create two state W-4s for the same employee, state, and date. If you absolutely must have two state W-4 records with the same identifying information, you must mark one of the records as obsolete; i.e., create one record, mark it obsolete, then create the other record.

Expand the link for the state you need to record a state withholding certificate for.

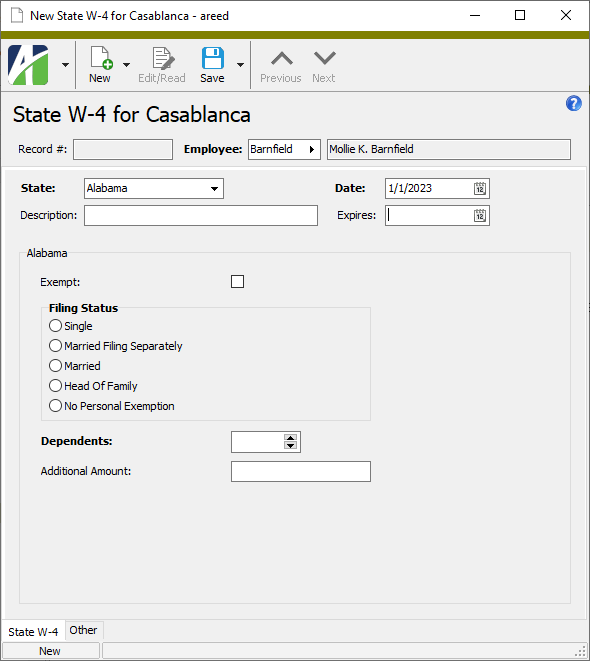

Record an Alabama state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an A4 for.

-

From the State drop-down list, select "Alabama". The Alabama-specific fields load in the window.

- Enter a Description of the A4 record.

- Enter the Date the A4 was received. This date acts as an effective date for the A4 and supersedes A4 records with an earlier effective date.

- If the A4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee claims to be exempt from Alabama withholding and skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married Filing Separately

- Married

- Head of Family

- No Personal Exemption

- The Dependents field is enabled unless you select the "No Personal Exemption" filing status. Enter the number of dependents the employee claimed on line 4 of Form A4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld on line 5 of the A4 form.

- Save the new A4 record.

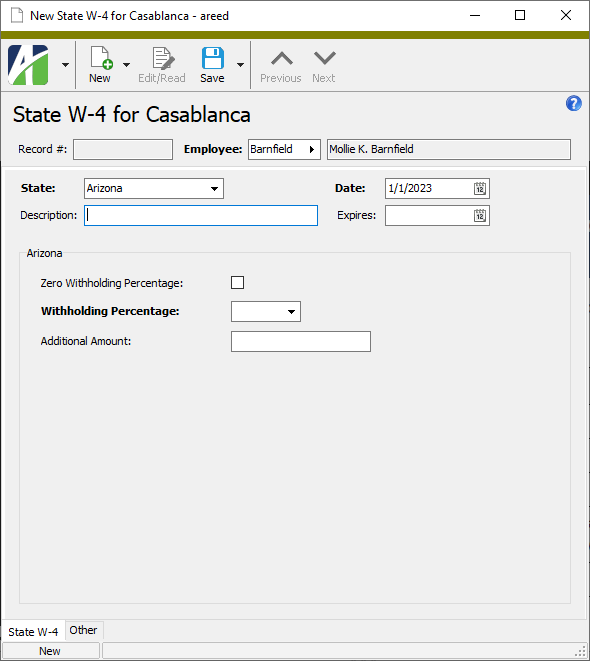

Record an Arizona state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an A-4 for.

-

From the State drop-down list, select "Arizona". The Arizona-specific fields load in the window.

- Enter a Description of the A-4 record.

- Enter the Date the A-4 was received. This date acts as an effective date for the A-4 and supersedes A-4 records with an earlier effective date.

- If the A-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Zero Withholding Percentage checkbox if the employee elected no withholding on line 2 and skip to step 11.

- From the Withholding Percentage dropdown, select the withholding percentage the employee elected. Valid percentages for 2023 and beyond are:

- 0.5%

- 1.0%

- 1.5%

- 2.0%

- 2.5%

- 3.0%

- 3.5%

- In the Additional Amount field, enter any additional amount the employee requested to be withheld on line 1 of the A-4 form. Continue at step 11.

- Save the new A-4 record.

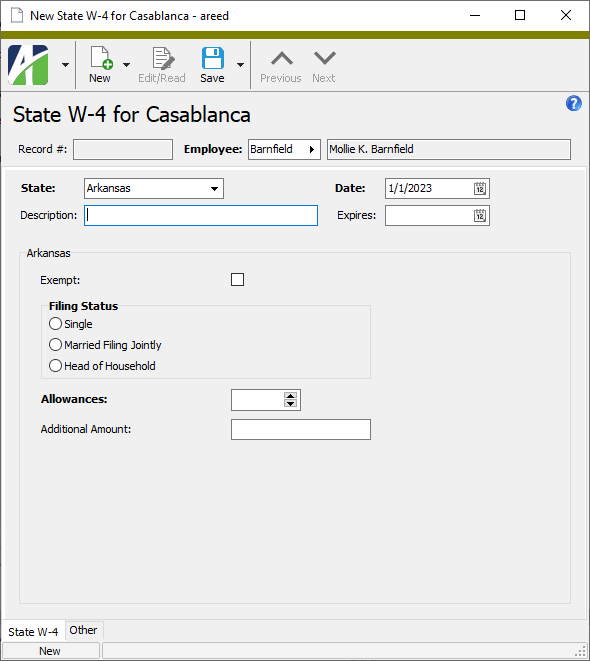

Record an Arkansas state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an AR4EC for.

-

From the State drop-down list, select "Arkansas". The Arkansas-specific fields load in the window.

- Enter a Description of the AR4EC record.

- Enter the Date the AR4EC was received. This date acts as an effective date for the AR4EC and supersedes AR4EC records with an earlier effective date.

- If the AR4EC is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee claimed exemption from withholding on a separate form, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married Filing Jointly

- Head of Household

- In the Allowances field, enter the number of exemptions the employee claimed on line 3 of Form AR4EC.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld on line 4 of the AR4EC form.

- Save the new AR4EC record.

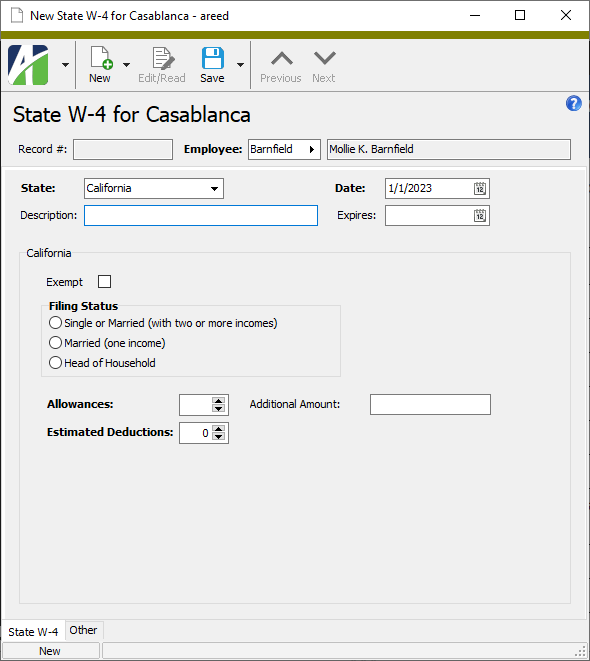

Record a California state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a DE 4 for.

-

From the State drop-down list, select "California". The California-specific fields load in the window.

- Enter a Description of the DE 4 record.

- Enter the Date the DE 4 was received. This date acts as an effective date for the DE 4 and supersedes DE 4 records with an earlier effective date.

- If the DE 4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee marked the checkbox on either line 3 or line 4 of the DE 4 form and skip to step 13.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single or Married (with two or more incomes)

- Married (one income)

- Head of Household

- Enter the number of Allowances the employee claimed on line 1 of the DE 4 form.

- If applicable, enter the number of Estimated Deductions from Worksheet B, line 8.

- In the Additional Amount field, enter the additional amount the employee requested to be withheld on line 2 of the DE 4 form.

- Save the new DE 4 record.

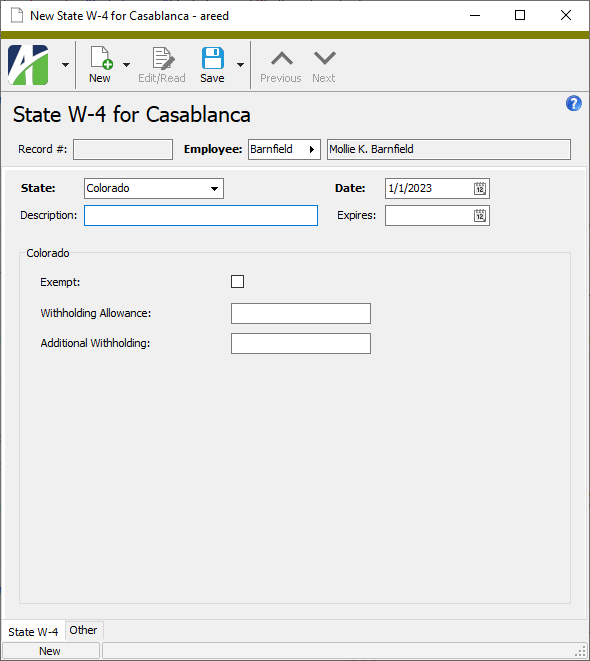

Until 2022, Colorado's state withholding was calculated based on values from the USA Form W-4 only. In 2022, Colorado introduced Form DR 0004, their equivalent of a state W-4. The DR 0004 is optional; if an employee does not submit a DR 0004 to you, withholding is based on values from the USA Form W-4 as before. If an employee has a Form USA W-4 that is newer than the last filed DR 0004, the DR 0004 is ignored and the USA W-4 is used to calculate state withholding.

Record a Colorado state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a DR 0004 record for.

-

From the State drop-down list, select "Colorado". The Colorado-specific fields load in the window.

- Enter a Description of the DR 0004 record.

- Enter the Date the DR 0004 information was received. This date acts as an effective date for the DR 0004 and supersedes DR 0004 records with an earlier effective date.

- If the DR 0004 information is invalid after a certain date, enter the date the information Expires.

- Mark the Exempt checkbox to indicate the employee claimed exemption from state withholding. If you mark the checkbox, skip to step 11.

- If the effective date of the DR 0004 record is on or after 1/1/2022, the Withholding Allowance field is enabled. Enter the amount (if any) from line 2 of the employee's form DR 0004.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck for state withholding. This field is disabled if the Exempt checkbox is marked.

- Save the new DR 0004 record.

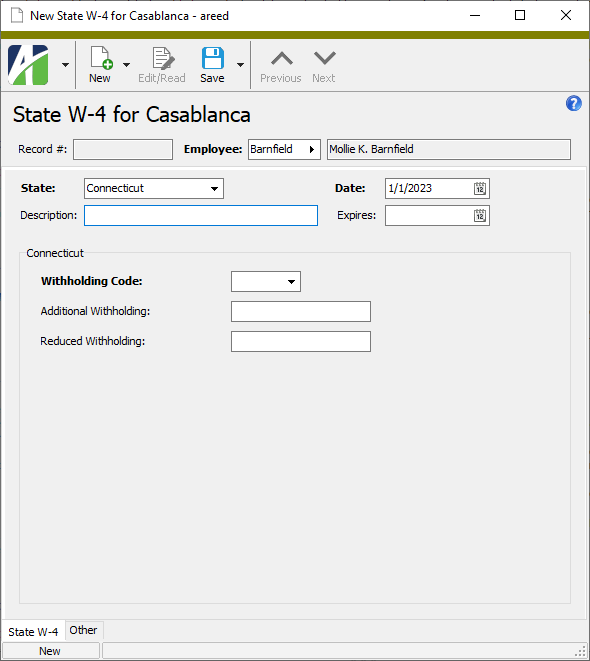

Record a Connecticut state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a CT-W4 for.

-

From the State drop-down list, select "Connecticut". The Connecticut-specific fields load in the window.

- Enter a Description of the CT-W4 record.

- Enter the Date the CT-W4 was received. This date acts as an effective date for the CT-W4 and supersedes CT-W4 records with an earlier effective date.

- If the CT-W4 is invalid after a certain date, enter the date the withholding certificate Expires.

- From the Withholding Code dropdown, select the withholding code the employee specified on line 1 of the CT-W4 form. Valid withholding codes are:

- A

- B

- C

- D

- E. If you select this option, the remaining fields are disabled. Skip to step 11.

- F

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld on line 2 of the CT-W4 form. You cannot enter both an additional amount and a reduced amount.

- In the Reduced Withholding field, enter any amount the employee requested to reduce withholding by on line 3 of the CT-W4 form. You cannot enter both an additional amount and a reduced amount.

- Save the new CT-W4 record.

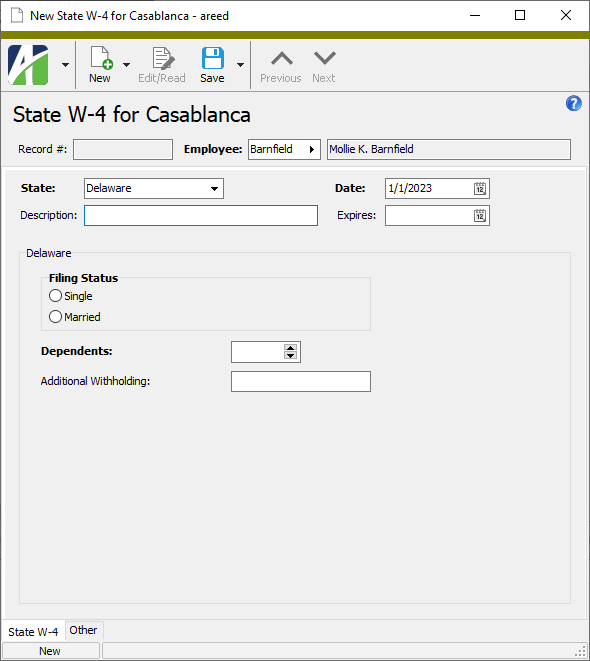

Record a Delaware state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a DE W-4 for.

-

From the State drop-down list, select "Delaware". The Delaware-specific fields load in the window.

- Enter a Description of the DE W-4 record.

- Enter the Date the DE W-4 was received. This date acts as an effective date for the DE W-4 and supersedes DE W-4 records with an earlier effective date.

- If the DE W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- In the Dependents field, enter the number of dependents the employee claimed on line 4 of Form DE W-4.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld on line 5 of Form DE W-4.

- Save the new DE W-4 record.

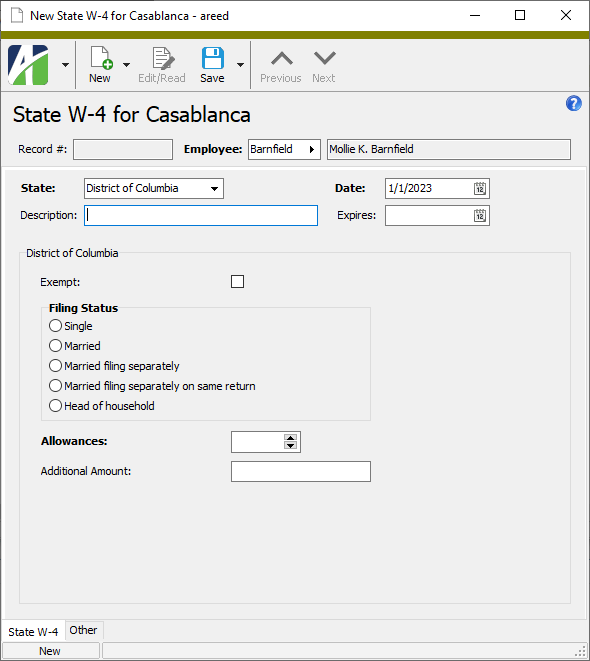

Record a District of Columbia state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a D-4 for.

-

From the State drop-down list, select "District of Columbia". The District of Columbia-specific fields load in the window.

- Enter a Description of the D-4 record.

- Enter the Date the D-4 was received. This date acts as an effective date for the D-4 and supersedes D-4 records with an earlier effective date.

- If the D-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee wrote "EXEMPT" in the box on line 4 of the D-4, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married filing separately

- Married filing separately on same return

- Head of household

- In the Allowances field, enter the total number of allowances the employee claimed on line 2 of Form D-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 3 of the D-4 form.

- Save the new D-4 record.

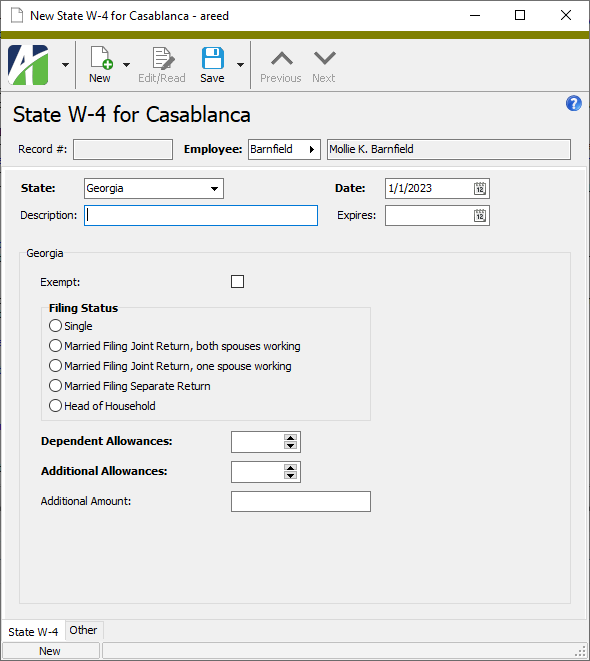

Record a Georgia state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a G-4 for.

-

From the State drop-down list, select "Georgia". The Georgia-specific fields load in the window.

- Enter a Description of the G-4 record.

- Enter the Date the G-4 was received. This date acts as an effective date for the G-4 and supersedes G-4 records with an earlier effective date.

- If the G-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee claimed exemption from withholding in line 8 of the G-4, then skip to step 13.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married Filing Joint Return, both spouses working

- Married Filing Joint Return, one spouse working

- Married Filing Separate Return

- Head of Household

- In the Dependent Allowances field, enter the number of dependent allowances the employee claimed on line 4 of Form G-4.

- In the Additional Allowances field, enter the number of additional allowances the employee claimed on line 5 of Form G-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 6 of Form G-4.

- Save the new G-4 record.

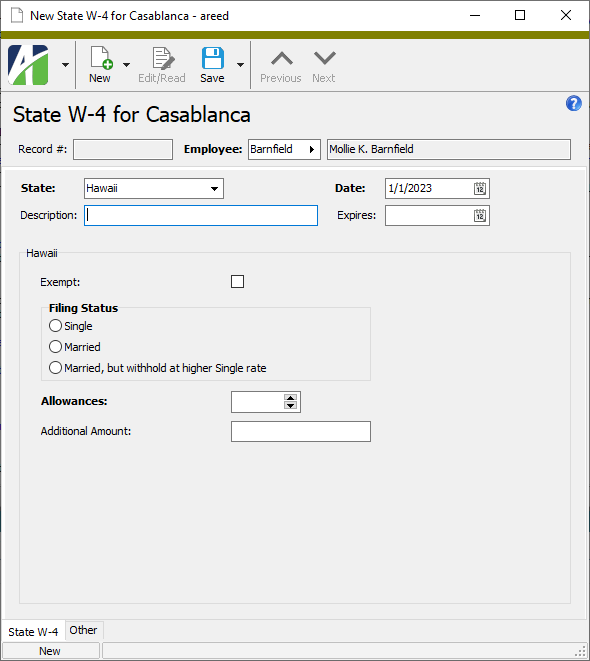

Record a Hawaii state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an HW-4 for.

-

From the State drop-down list, select "Hawaii". The Hawaii-specific fields load in the window.

- Enter a Description of the HW-4 record.

- Enter the Date the HW-4 was received. This date acts as an effective date for the HW-4 and supersedes HW-4 records with an earlier effective date.

- If the HW-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee marked the "Certified Disabled Person (not subject to withholding)" or the "Nonresident Military Spouse (not subject to withholding)" checkbox in line 3 of Form HW-4, then skip to step 12.

Note

Hawaii does not otherwise allow "EXEMPT" status for withholding purposes.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married, but withhold at higher Single rate

- In the Allowances field, enter the total number of allowances the employee claimed on line 4 of Form HW-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 5 of Form HW-4.

- Save the new HW-4 record.

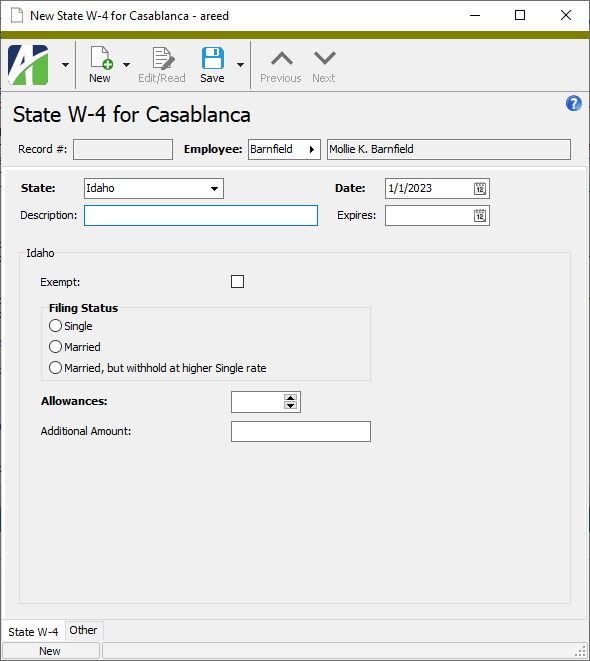

Record an Idaho state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an ID W-4 for.

-

From the State drop-down list, select "Idaho". The Idaho-specific fields load in the window.

- Enter a Description of the ID W-4 record.

- Enter the Date the ID W-4 was received. This date acts as an effective date for the ID W-4 and supersedes ID W-4 records with an earlier effective date.

- If the ID W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee wrote "Exempt" on line 1 of Form ID W-4, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married, but withhold at higher Single rate

- In the Allowances field, enter the total number of allowances the employee claimed on line 1 of Form ID W-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 2 of Form ID W-4.

- Save the new ID W-4 record.

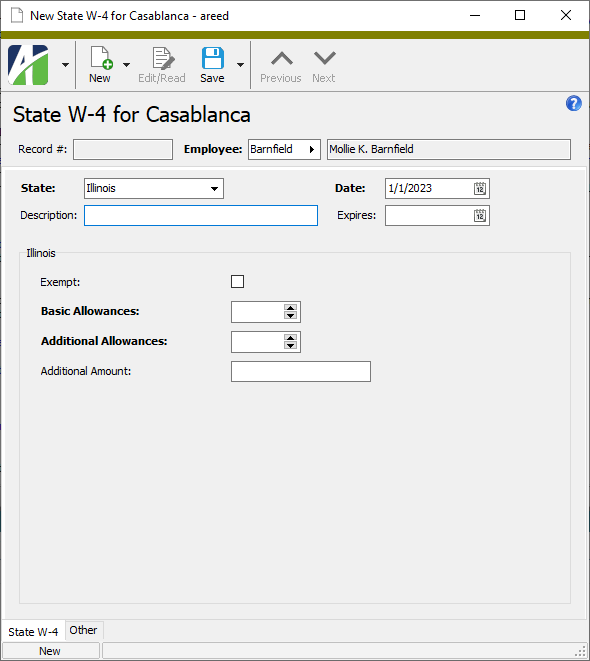

Record an Illinois state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an IL-W-4 for.

-

From the State drop-down list, select "Illinois". The Illinois-specific fields load in the window.

- Enter a Description of the IL-W-4 record.

- Enter the Date the IL-W-4 was received. This date acts as an effective date for the IL-W-4 and supersedes IL-W-4 records with an earlier effective date.

- If the IL-W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee marked the checkbox on Form IL-W-4 indicating exemption from state and federal income tax, then skip to step 12.

- In the Basic Allowances field, enter the total number of allowances the employee claimed on line 1 of Form IL-W-4.

- In the Additional Allowances field, enter the total number of additional allowances the employee claimed on line 2 of Form IL-W-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 3 of Form IL-W-4.

- Save the new IL-W-4 record.

Record an Indiana state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a WH-4 for.

-

From the State drop-down list, select "Indiana". The Indiana-specific fields load in the window.

- Enter a Description of the WH-4 record.

- Enter the Date the WH-4 was received. This date acts as an effective date for the WH-4 and supersedes WH-4 records with an earlier effective date.

- If the WH-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee claimed exemption from withholding on a separate form, then skip to step 17.

- In the County of Residence as of Jan 1 field, select the employee's county of residence. The employee's resident withholding will be calculated for the specified county. If the employee is not an Indiana resident, leave this field blank.

- In the County of Employment as of Jan 1 field, select the employee's county of principal employment. If the County of Residence field is blank, the specified county of employment will be used to calculate non-resident withholding for the employee.

- In the Exemptions field, enter the total number of exemptions the employee claimed on line 5 of Form WH-4.

- In the Dependents field, enter the number of dependents the employee claimed on line 6 of Form WH-4.

- In the First-time Dependents field, enter the number of first-time dependents the employee claimed on line 7 of Form WH-4.

- In the Adopted Dependents field, enter the number of qualifying adopted dependents the employee claimed on line 8 of Form WH-4.

- In the Additional State Withholding field, enter any additional amount the employee requested to be withheld per pay check on line 9 of Form WH-4 for state withholding.

- In the Additional County Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 10 of Form WH-4 for county withholding.

- Save the new WH-4 record.

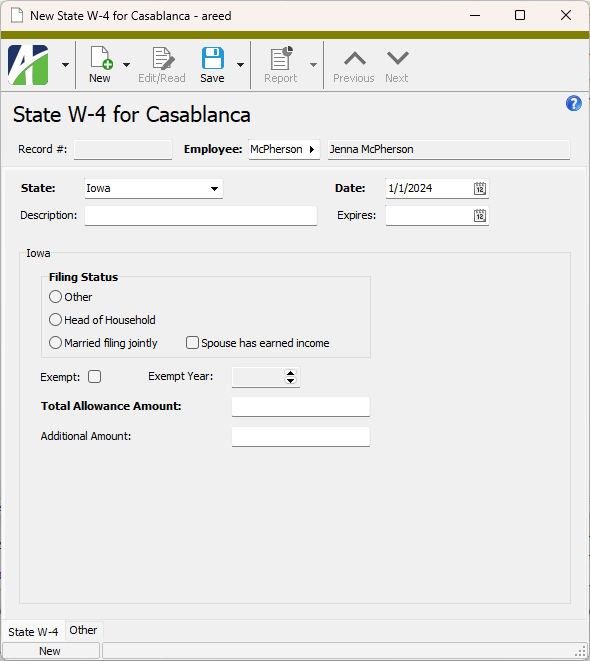

Record an Iowa state W-4

Note

In 2024, Iowa introduced a new Form IA W-4 which expanded the filing status options and changed the method of determining withholding allowance amounts. As a result, new IA W-4s were required of employees in Iowa as of 1/1/2024. Employees who did not submit a new IA W-4 for 2024 are subject to withholding using a status of "Other", total allowance amount of $40, and no additional withholding.

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an IA W-4 for.

-

From the State drop-down list, select "Iowa". The Iowa-specific fields load in the window.

- Enter a Description of the IA W-4 record.

- Enter the Date the IA W-4 was received. This date acts as an effective date for the IA W-4 and supersedes IA W-4 records with an earlier effective date.

- If the IA W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Other

- Head of Household

- Married filing jointly. If the employee marked the "Married filing jointly" checkbox on Form IA W-4 and marked "Yes" for the "If so, does your spouse also have earned income?" question, also mark the Spouse has earned income checkbox.

- Mark the Exempt checkbox if the employee wrote "Exempt" in the "Exemption from withholding" section of Form IA W-4, then enter the exemption year in the Exempt Year field. If you mark the Exempt checkbox, the Exempt Year is required. If you do not mark the Exempt checkbox, skip to step 10.

Note

The employee will be exempt from withholding only for the year entered on Form IA W-4. If the employee needs to claim exempt status in a future year, a new Form IA W-4 is required. If a new Form IA W-4 is not submitted, the filing status, the total allowance amount, and the additional withholding specified are applied when calculating paychecks for other years.

- In the Total Allowance Amount field, enter the total amount of allowances the employee claimed on line 6 of Form IA W-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 7 of Form IA W-4.

- Save the new IA W-4 record.

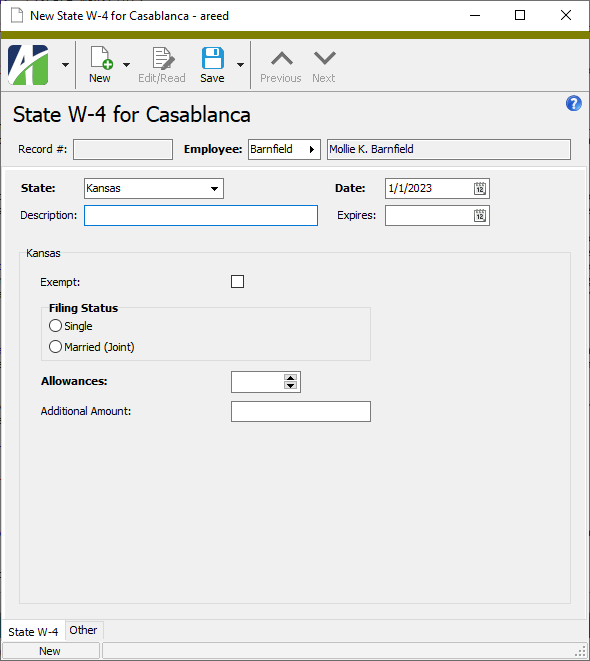

Record a Kansas state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a K-4 for.

-

From the State drop-down list, select "Kansas". The Kansas-specific fields load in the window.

- Enter a Description of the K-4 record.

- Enter the Date the K-4 was received. This date acts as an effective date for the K-4 and supersedes K-4 records with an earlier effective date.

- If the K-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee wrote "Exempt" on line 6 of Form K-4, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married (Joint)

- In the Allowances field, enter the total number of allowances the employee claimed on line 4 of Form K-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 5 of Form K-4.

- Save the new K-4 record.

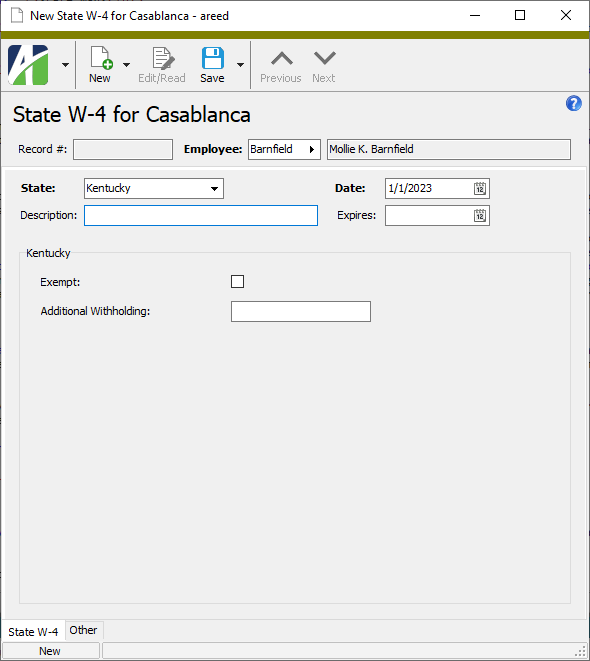

Record a Kentucky state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a K-4 for.

-

From the State drop-down list, select "Kentucky". The Kentucky-specific fields load in the window.

- Enter a Description of the K-4 record.

- Enter the Date the K-4 was received. This date acts as an effective date for the K-4 and supersedes K-4 records with an earlier effective date.

- If the K-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee marked any of the exempt checkboxes on lines 1-4, then skip to step 10.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on Form K-4.

- Save the new K-4 record.

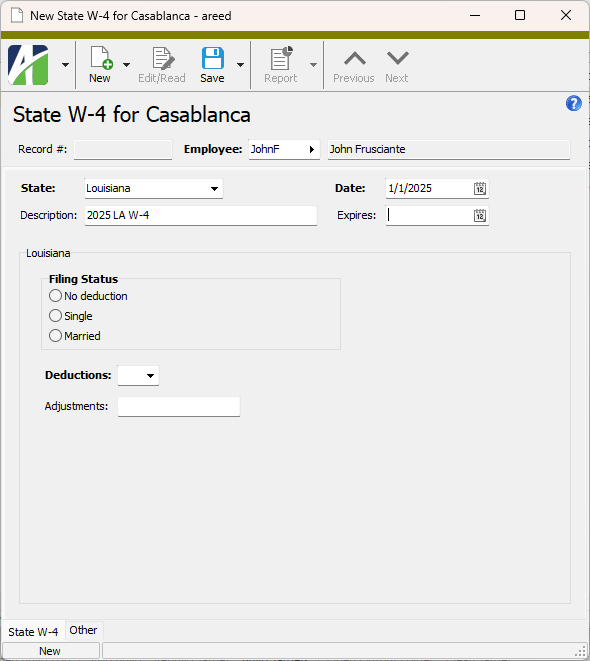

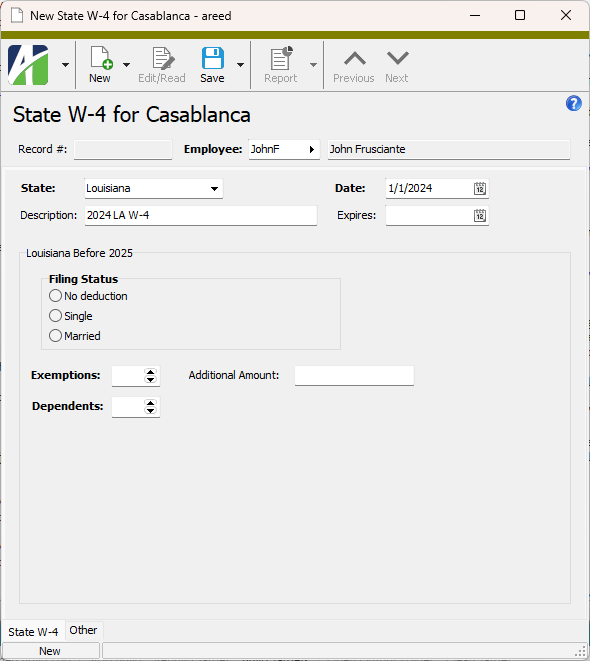

Record a Louisiana state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an L-4 for.

-

From the State drop-down list, select "Louisiana". The Louisiana-specific fields load in the window.

- Enter a Description of the L-4 record.

- Enter the Date the L-4 was received. This date acts as an effective date for the L-4 and supersedes L-4 records with an earlier effective date.

- If the L-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- No deduction

- Single

- Married

Notice that the Deductions field updates to the default number of deductions for the selected filing status.

-

The Deductions field is enabled if you selected "Single" or "Married" filing status. Enter the number of deductions the employee claimed on line 6 of the L-4 form.

Valid values are "0" and "1" when the filing status is "Single"; "0", "1", or "2" for "Married".

- In the Adjustments field, enter the amount the employee requested as an adjustment to withholding on line 7 of the L-4 form. The amount can be negative to decrease the amount of withholding or positive to increase it.

- Save the new L-4 record.

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an L-4 for.

-

From the State drop-down list, select "Louisiana". The Louisiana-specific fields load in the window.

- Enter a Description of the L-4 record.

- Enter the Date the L-4 was received. This date acts as an effective date for the L-4 and supersedes L-4 records with an earlier effective date. When you leave this field, the pre-2025 fields load in the window.

- If the L-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- No deductions

- Single

- Married

Notice that the Exemptions field updates with the default number of exemptions for the selected filing status and the Dependents field defaults to "0".

-

In the Exemptions field, enter the number of exemptions claimed on line 6 of the L-4 form.

If you selected a filing status of "No deductions", the Exemptions field is set to "0" and is disabled. Valid values are "0" and "1" when the filing status is "Single"; "0", "1", or "2" for "Married".

- The Dependents field is enabled if you selected "Single" or "Married" filing status. Enter the number of Dependents the employee claimed on line 7 of the L-4 form.

- In the Additional Amount field, enter the additional amount the employee requested to be withheld on line 8 of the L-4 form. The "additional" amount can be negative or positive; i.e., a decrease or increase in withholding.

- Save the new L-4 record.

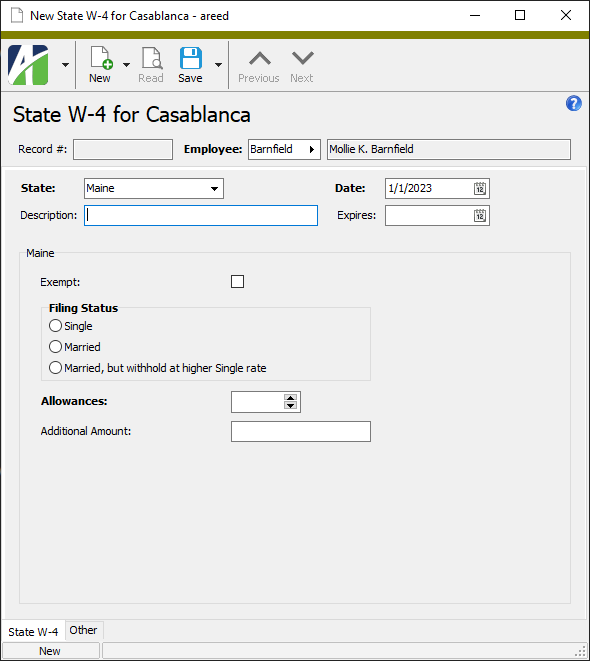

Record a Maine state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a W-4ME for.

-

From the State drop-down list, select "Maine". The Maine-specific fields load in the window.

- Enter a Description of the W-4ME record.

- Enter the Date the W-4ME was received. This date acts as an effective date for the W-4ME and supersedes W-4ME records with an earlier effective date.

- If the W-4ME is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee marked any of the checkboxes on line 6 of Form W-4ME, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single or Head of Household

- Married

- Married, but withhold at higher Single rate

- In the Allowances field, enter the total number of allowances the employee claimed on line 4 of Form W-4ME.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 5 of Form W-4ME.

- Save the new W-4ME record.

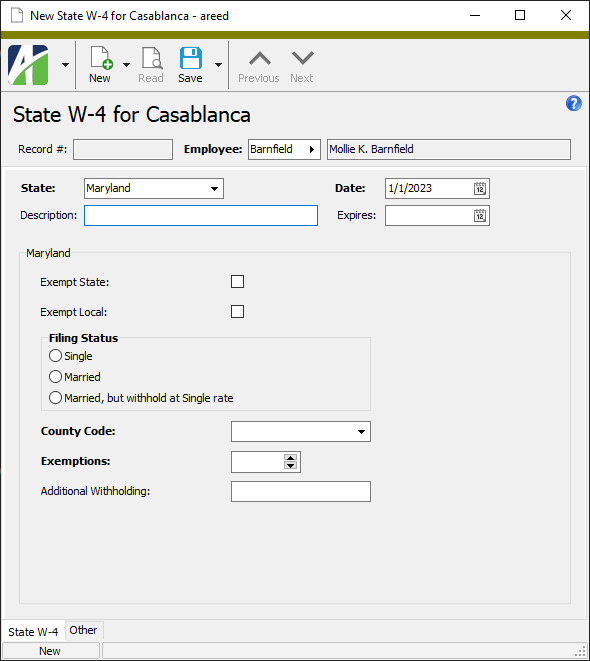

Record a Maryland state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an MW507 for.

-

From the State drop-down list, select "Maryland". The Maryland-specific fields load in the window.

- Enter a Description of the MW507 record.

- Enter the Date the MW507 was received. This date acts as an effective date for the MW507 and supersedes MW507 records with an earlier effective date.

- If the MW507 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt State checkbox if the employee wrote "EXEMPT" on line 3, 4, 5, or 8 of Form MW507.

- Mark the Exempt Local checkbox if the employee wrote "EXEMPT" on line 6 or 7 of Form MW507.

- If you marked both Exempt State and Exempt Local, skip to step 14; otherwise, continue.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married (surviving spouse or unmarried Head of Household)

- Married, but withhold at Single rate

- From the County Code dropdown, select the employee's county of residence. Select "Non-Resident" if the employee is a resident of a nonreciprocal state. Select "Delaware" if the employee is a resident of Maryland but works and pays withholding taxes in Delaware or any other nonreciprocal state.

- In the Exemptions field, enter the total number of exemptions the employee claimed on line 1 of Form MW507.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 2 of Form MW507.

- Save the new MW507 record.

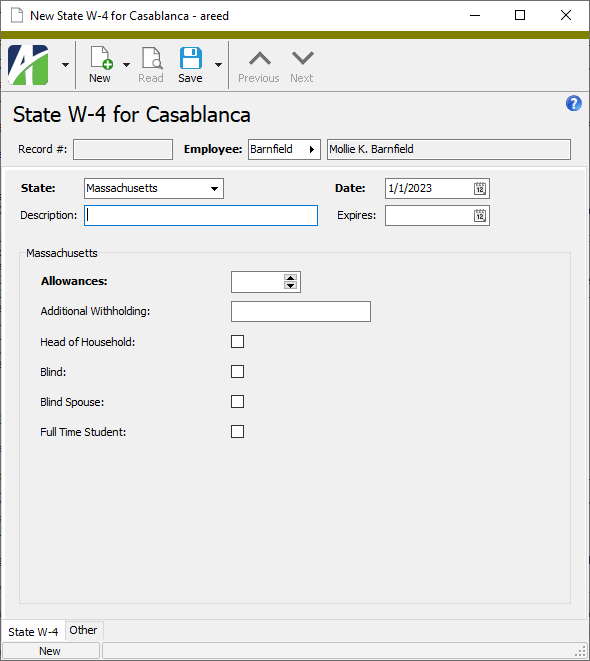

Record a Massachusetts state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an M-4 for.

-

From the State drop-down list, select "Massachusetts". The Massachusetts-specific fields load in the window.

- Enter a Description of the M-4 record.

- Enter the Date the M-4 was received. This date acts as an effective date for the M-4 and supersedes M-4 records with an earlier effective date.

- If the M-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- In the Allowances field, enter the total number of exemptions the employee claimed on line 4 of Form M-4. This field is cleared and disabled if you subsequently mark the Full Time Student checkbox.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 5 of Form M-4. This field is cleared and disabled if you subsequently mark the Full Time Student checkbox.

- Mark the Head of Household checkbox if the employee marked box A on Form M-4.

- Mark the Blind checkbox if the employee marked box B on Form M-4.

- Mark the Blind Spouse checkbox if the employee marked box C on Form M-4.

- Mark the Full Time Student checkbox if the employee marked box D on Form M-4.

- Save the new M-4 record.

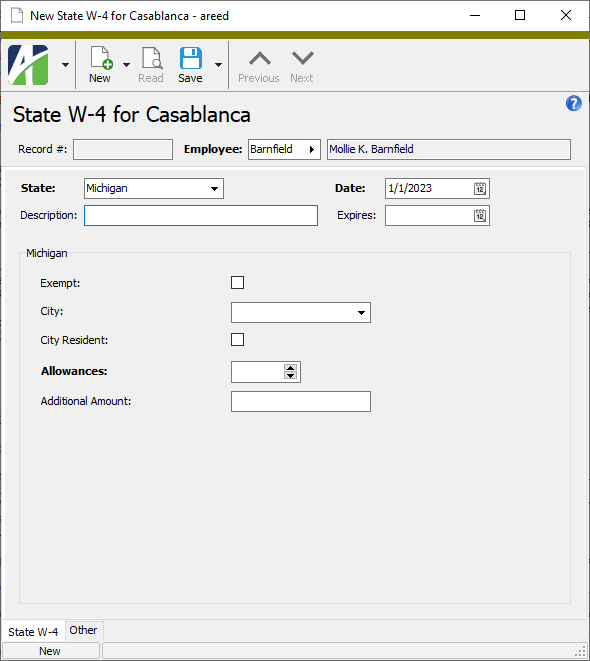

Record a Michigan state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an MI-W4 for.

-

From the State drop-down list, select "Michigan". The Michigan-specific fields load in the window.

- Enter a Description of the MI-W4 record.

- Enter the Date the MI-W4 was received. This date acts as an effective date for the MI-W4 and supersedes MI-W4 records with an earlier effective date.

- If the MI-W4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee marked any of the exempt checkboxes on line 8 of Form MI-W4, then skip to step 13.

- If the employee is subject to local income tax, select the city with taxing authority from the City drop-down list. If the employee is not subject to city income tax, leave this field blank.

- The City Resident checkbox is enabled if you selected a city in the City field. If the employee resides in the specified city, mark the City Resident checkbox. The employee will be withheld at the resident rate for local income tax. If the employee works but does not reside in the specified city, ensure that the checkbox is cleared. The employee will be withheld at the non-resident rate for local income tax.

- In the Allowances field, enter the total number of exemptions the employee claimed on line 6 of Form MI-W4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 7 of Form MI-W4.

- Save the new MI-W4 record.

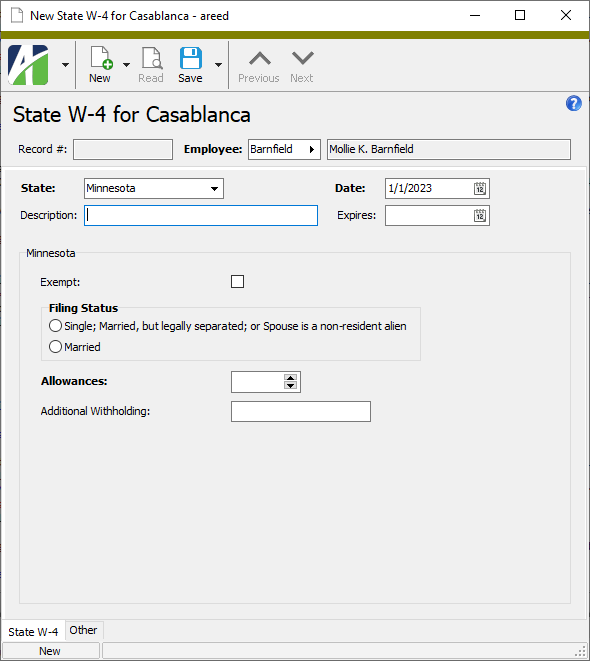

Record a Minnesota state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a W-4MN for.

-

From the State drop-down list, select "Minnesota". The Minnesota-specific fields load in the window.

- Enter a Description of the W-4MN record.

- Enter the Date the W-4MN was received. This date acts as an effective date for the W-4MN and supersedes W-4MN records with an earlier effective date.

- If the W-4MN is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee marked any of the checkboxes in Section 2 of Form W-4MN, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single; Married, but legally separated; or Spouse is a non-resident alien

- Married

- In the Allowances field, enter the total number of allowances the employee claimed on line 1 of Form W-4MN.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 2 of Form W-4MN.

- Save the new W-4MN record.

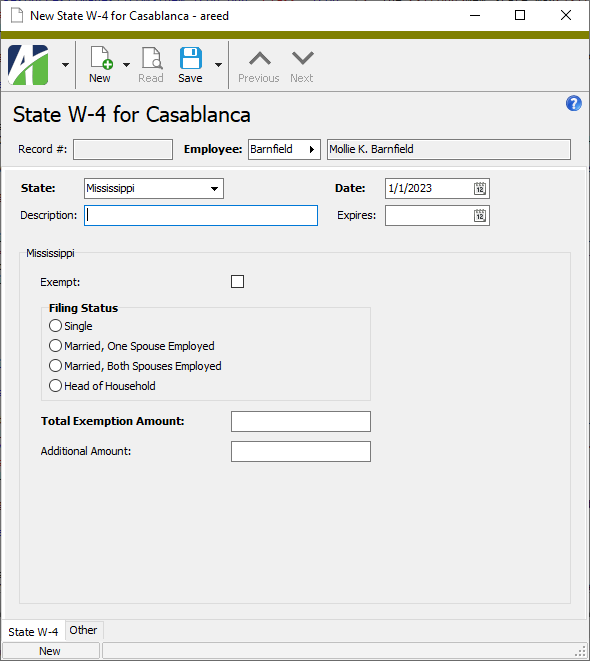

Record a Mississippi state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an 89-350 for.

-

From the State drop-down list, select "Mississippi". The Mississippi-specific fields load in the window.

- Enter a Description of the 89-350 record.

- Enter the Date the 89-350 was received. This date acts as an effective date for the 89-350 and supersedes 89-350 records with an earlier effective date.

- If the 89-350 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee wrote "Exempt" on line 8 of Form 89-350, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married, One Spouse Employed

- Married, Both Spouses Employed

- Head of Household

- In the Total Exemption Amount field, enter the total exemption amount the employee claimed on line 6 of Form 89-350.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 7 of Form 89-350.

- Save the new 89-350 record.

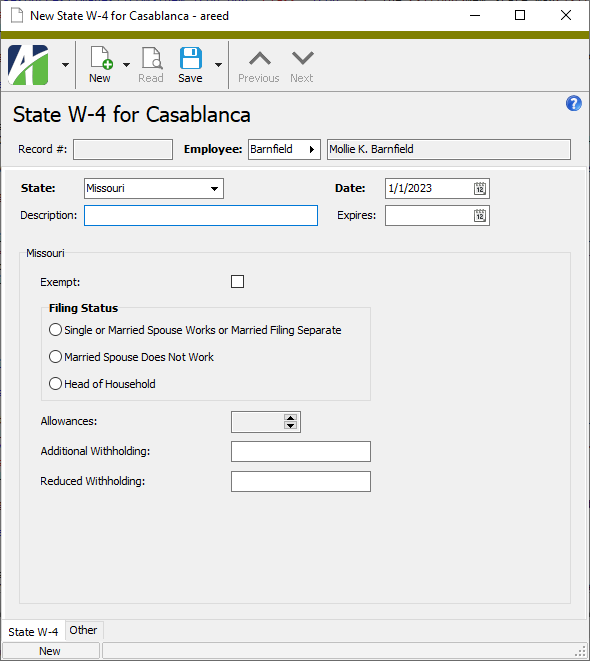

Record a Missouri state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an MO W-4 for.

-

From the State drop-down list, select "Missouri". The Missouri-specific fields load in the window.

- Enter a Description of the MO W-4 record.

- Enter the Date the MO W-4 was received. This date acts as an effective date for the MO W-4 and supersedes MO W-4 records with an earlier effective date.

- If the MO W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee wrote "EXEMPT" on line 4 of a post-2019 Form MO W-4 or on line 7 of a pre-2019 Form MO W-4, then skip to step 13.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single or Married Spouse Works or Married Filing Separate

- Married Spouse Does Not Work

- Head of Household

- The Allowances field is enabled if the state W-4 record is dated before 2019. Enter the total number of allowances the employee claimed on line 5 of Form MO W-4.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld on line 2 of a post-2019 MO W-4 form or on line 6 of a pre-2019 MO W-4 form. You cannot enter both an additional amount and a reduced amount.

- The Reduced Withholding field is enabled if the state W-4 record is dated after 2019. Enter any amount the employee requested to reduce withholding on line 3 of the MO W-4 form. You cannot enter both an additional amount and a reduced amount.

- Save the new MO W-4 record.

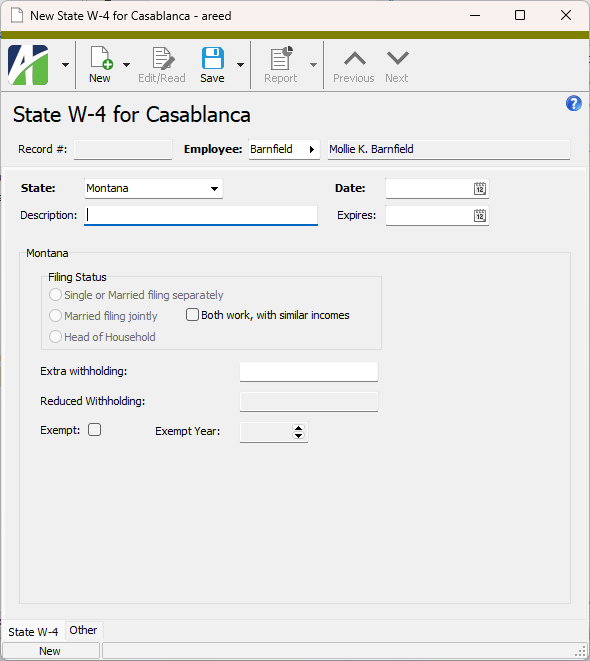

Record a Montana state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a Form MW-4 for.

-

From the State drop-down list, select "Montana". The Montana-specific fields load in the window.

- Enter a Description of the MW-4 record.

- Enter the Date Form MW-4 was received. This date acts as an effective date for the MW-4 and supersedes MW-4 records with an earlier effective date.

- If the Form MW-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- In the Filing Status field, select the employee's filing status. Valid options are:

- Single or Married filing separately

- Married filing jointly. If you select this option, the Both work, with similar incomes checkbox is enabled. If the employee marked the checkbox in step 2 on Form MW-4, mark the Both work... checkbox.

- Head of Household

- If the employee wants additional tax withheld from each check, enter the amount to withhold per paycheck in the Extra withholding field. If the employee wants withholding reduced by a specified amount, enter the amount to reduce withholding per paycheck in the Reduced Withholding field. You cannot enter amounts in both fields.

- Mark the Exempt checkbox if the employee marked one of the exempt checkboxes in step 5 of Form MW-4.

- If you marked the Exempt checkbox, the Exempt Year is required. Enter the year for which the employee claimed exemption.

Note

The employee will be exempt from withholding only for the year entered on Form MW-4. If the employee needs to claim exempt status in a future year, a new Form MW-4 is required. If a new Form MW-4 is not submitted, the filing status and the extra or reduced withholding specified are applied when calculating paychecks for other years.

- Save the new MW-4 record.

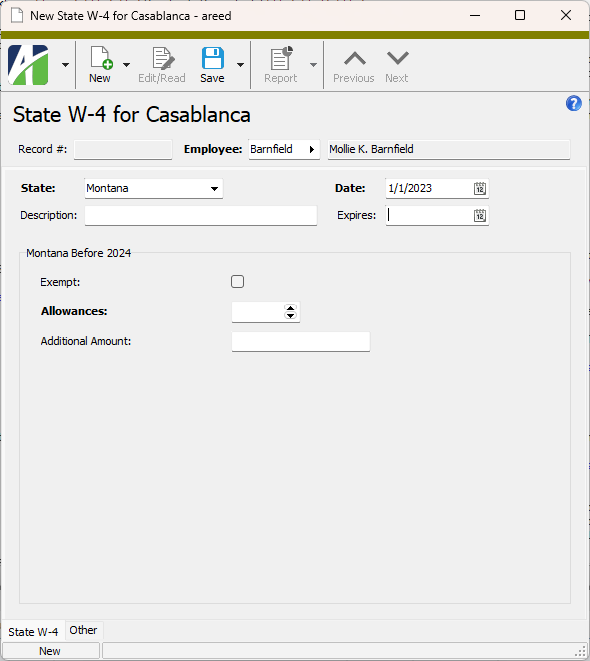

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a Form MW-4 for.

-

From the State drop-down list, select "Montana". The Montana-specific fields load in the window.

- Enter a Description of the MW-4 record.

- Enter the Date Form MW-4 was received. This date acts as an effective date for the MW-4 and supersedes MW-4 records with an earlier effective date. If the date entered is earlier than 1/1/2024, the fields reload to show the pre-2024 fields.

- If the Form MW-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee marked one of the exempt checkboxes in Section 2, then skip to step 11.

- In the Allowances field, enter the total number of allowances the employee claimed on line G of Section 1 of Form MW-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line H of Section 1 of Form MW-4.

- Save the new MW-4 record.

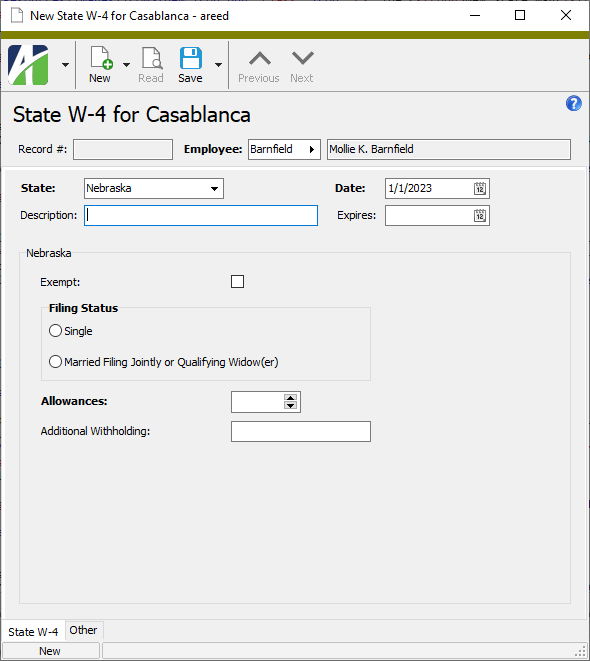

Record a Nebraska state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a W-4N for.

-

From the State drop-down list, select "Nebraska". The Nebraska-specific fields load in the window.

- Enter a Description of the W-4N record.

- Enter the Date the W-4N was received. This date acts as an effective date for the W-4N and supersedes W-4N records with an earlier effective date.

- If the W-4N is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee wrote "Exempt" on line 3 of Form W-4N, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married Filing Jointly or Qualifying Widow(er)

- In the Allowances field, enter the total number of allowances the employee claimed on line 1 of Form W-4N.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 2 of Form W-4N.

- Save the new W-4N record.

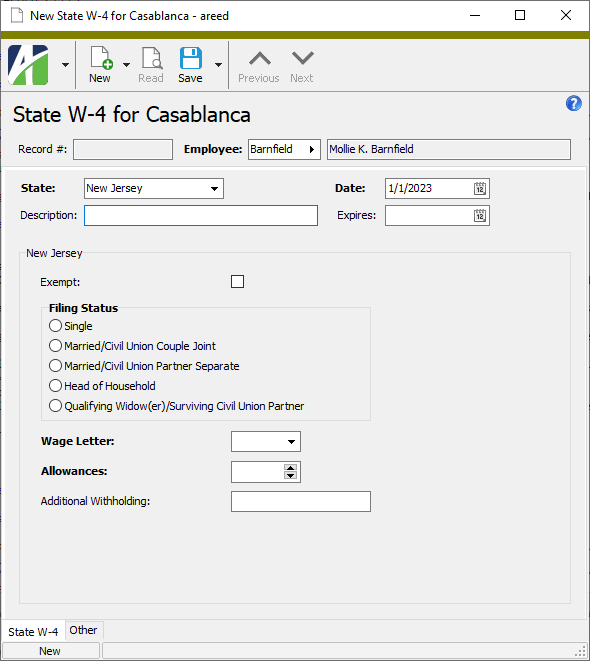

Record a New Jersey state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an NJ-W4 for.

-

From the State drop-down list, select "New Jersey". The New Jersey-specific fields load in the window.

- Enter a Description of the NJ-W4 record.

- Enter the Date the NJ-W4 was received. This date acts as an effective date for the NJ-W4 and supersedes NJ-W4 records with an earlier effective date.

- If the NJ-W4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee wrote "EXEMPT" on line 6 of Form NJ-W4, then skip to step 13.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married/Civil Union Couple Joint

- Married/Civil Union Partner Separate

- Head of Household

- Qualified Widow(er)/Surviving Civil Union Partner

- The Wage Letter dropdown is enabled unless you selected "Single" or "Married/Civil Union Partner Separate" in the Filing Status field. Select the letter, if any, that the employee entered on line 3 of Form NJ-W4.

- In the Allowances field, enter the total number of allowances the employee claimed on line 4 of Form NJ-W4.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 5 of Form NJ-W4.

- Save the new NJ-W4 record.

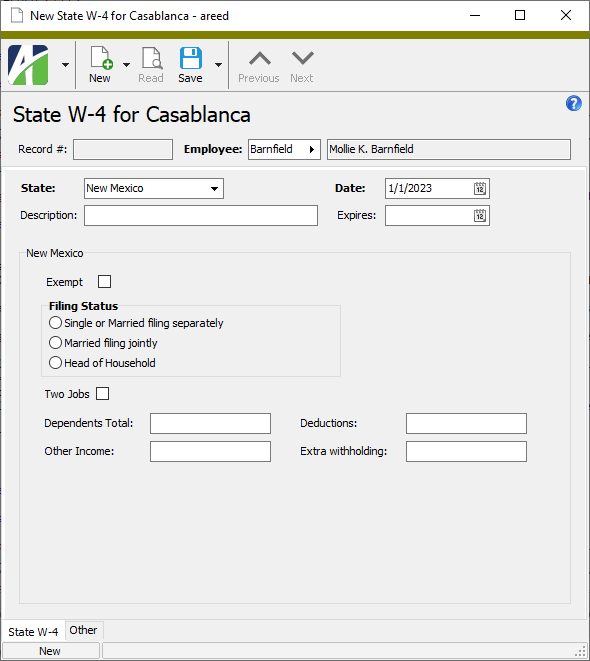

Record a New Mexico state W-4

Note

The W-4 form referred to in these instructions is an employee's federal W-4 form which is designated as "For New Mexico State Withholding Only".

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a W-4 for.

-

From the State drop-down list, select "New Mexico". The New Mexico-specific fields load in the window.

- Enter a Description of the W-4 record.

- Enter the Date the W-4 was received. This date acts as an effective date for the W-4 and supersedes W-4 records with an earlier effective date.

- If the W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee wrote "EXEMPT" on line 7 of the W-4 (pre-2020) or in the space below Step 4(c) (2020 and later), then skip to step 15.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single or Married filing separately

- Married filing jointly

- Head of household

- Mark the Two Jobs checkbox if the employee marked the checkbox in Step 2(c) of the W-4 (2020 and later).

- In the Dependents Total field, enter the amount from line 3 of the W-4 (2020 and later).

- In the Other Income field, enter the amount from line 4(a) of the W-4 (2020 and later).

- In the Deductions field, enter the amount from line 4(b) of the W-4 (2020 and later).

- In the Extra withholding field, enter the extra amount the employee requested to be withheld on line 4(c) of the W-4 (2020 and later).

- Save the new W-4 record.

Steps 10-13 are not needed for the New Mexico income tax calculation. Completing these steps is optional. If you skip them, continue at step 14.

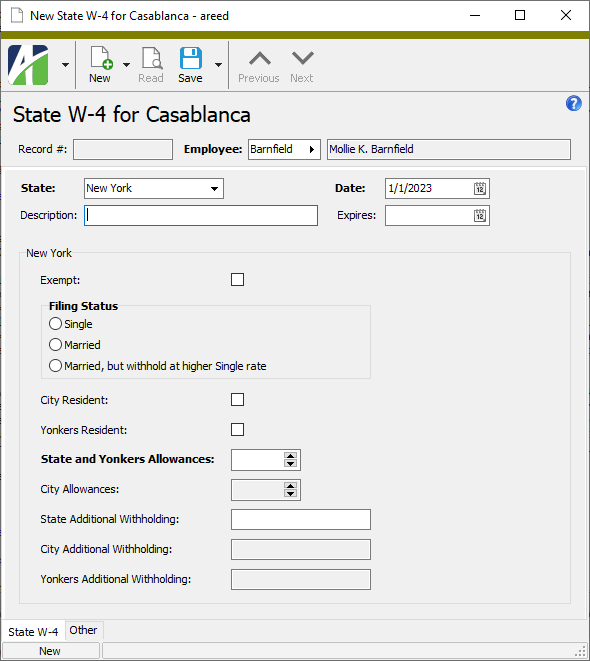

Record a New York state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an IT-2104 for.

-

From the State drop-down list, select "New York". The New York-specific fields load in the window.

- Enter a Description of the IT-2104 record.

- Enter the Date the IT-2104 was received. This date acts as an effective date for the IT-2104 and supersedes IT-2104 records with an earlier effective date.

- If the IT-2104 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee submitted Form IT-2104-E, then skip to step 17.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married, but withhold at higher Single rate

- If the employee answered "Yes" to the "Are you a resident of New York City?" question, mark the City Resident checkbox. You cannot mark both the City Resident and Yonkers Resident checkboxes.

- If the employee answered "Yes" to the "Are you a resident of Yonkers?" question, mark the Yonkers Resident checkbox. You cannot mark both the City Resident and Yonkers Resident checkboxes.

- In the State and Yonkers Allowances field, enter the total number of allowances the employee claimed on line 1 of Form IT-2104.

- The City Allowances field is enabled if you marked the City Resident checkbox. Enter the total number of New York City allowances the employee claimed on line 2 of Form IT-2104.

- In the State Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 3 of Form IT-2104.

- The City Additional Withholding checkbox is enabled if you marked the City Resident checkbox. Enter any additional amount the employee requested to be withheld on line 4 of Form IT-2104.

- The Yonkers Additional Withholding checkbox is enabled if you marked the Yonkers Resident checkbox. Enter any additional amount the employee requested to be withheld on line 5 of Form IT-2104.

- Save the new IT-2104 record.

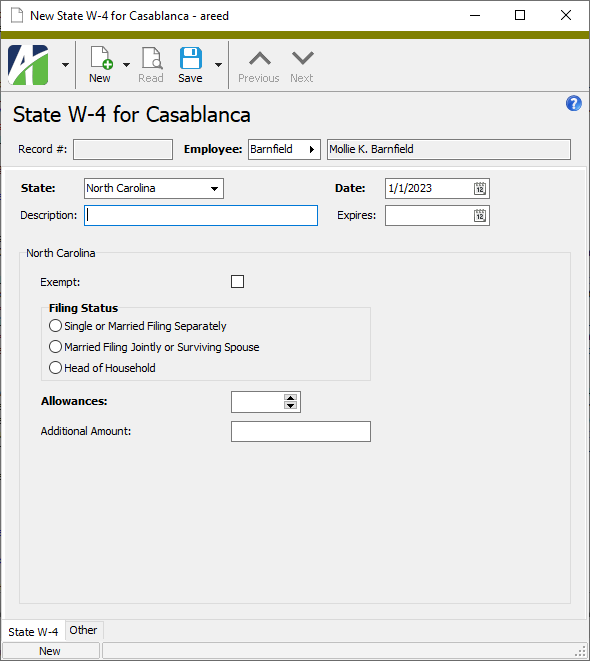

Record a North Carolina state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an NC-4 for.

-

From the State drop-down list, select "North Carolina". The North Carolina-specific fields load in the window.

- Enter a Description of the NC-4 record.

- Enter the Date the NC-4 was received. This date acts as an effective date for the NC-4 and supersedes NC-4 records with an earlier effective date.

- If the NC-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee submitted Form NC-4 EZ and marked either of the checkboxes on line 3 or line 4 of that form, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single or Married Filing Separately

- Married Filing Jointly or Surviving Spouse

- Head of Household

- In the Allowances field, enter the total number of allowances the employee claimed on line 1 of Form NC-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 2 of Form NC-4.

- Save the new NC-4 record.

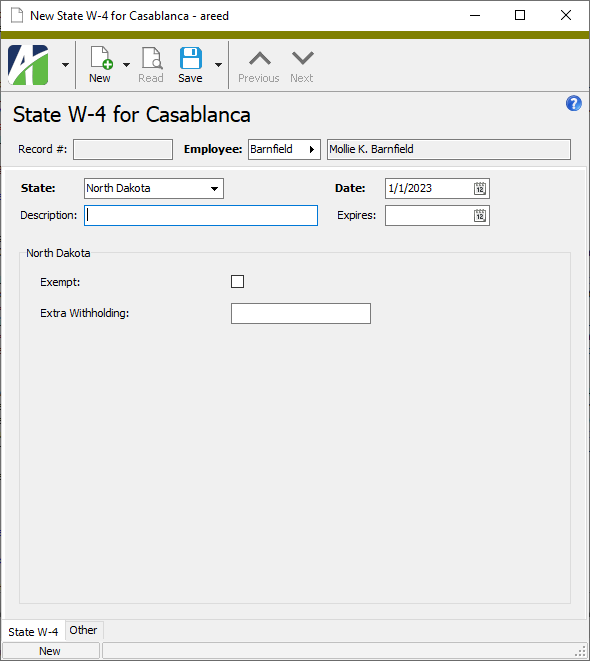

Record a North Dakota state W-4

North Dakota's state withholding is calculated based on values from the USA Form W-4; however, some state withholding situations, namely exemption from withholding and additional state withholding, are not handled by the USA W-4. For this reason, you can create state W-4 records for North Dakotans who claim exemption from withholding or who request additional withholding. It is not necessary to create a state W-4 record for North Dakota employees for whom neither of these circumstances apply.

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a state W-4 record for.

-

From the State drop-down list, select "North Dakota". The North Dakota-specific fields load in the window.

- Enter a Description of the state W-4 record.

- Enter the Date the state W-4 information was received. This date acts as an effective date for the state W-4 and supersedes state W-4 records with an earlier effective date.

- If the state W-4 information is invalid after a certain date, enter the date the information Expires.

- Mark the Exempt checkbox to indicate the employee claimed exemption from state withholding. If you mark the checkbox, skip to step 10.

- In the Extra Withholding field, enter any additional amount the employee requested to be withheld per paycheck for state withholding.

- Save the new state W-4 record.

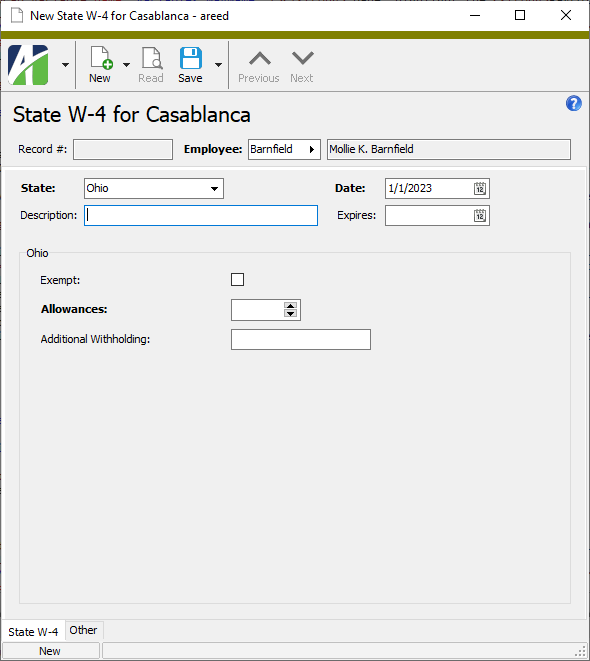

Record an Ohio state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an IT-4 for.

-

From the State drop-down list, select "Ohio". The Ohio-specific fields load in the window.

- Enter a Description of the IT-4 record.

- Enter the Date the IT-4 was received. This date acts as an effective date for the IT-4 and supersedes IT-4 records with an earlier effective date.

- If the IT-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee submitted Form IT-4 EZ and marked either of the checkboxes on line 3 or line 4 of that form, then skip to step 11.

- In the Allowances field, enter the total number of exemptions the employee claimed on line 4 of Form IT-4.

- In the Additional Withholding field, enter any additional amount the employee requested to be withheld per paycheck on line 5 of Form IT-4.

- Save the new IT-4 record.

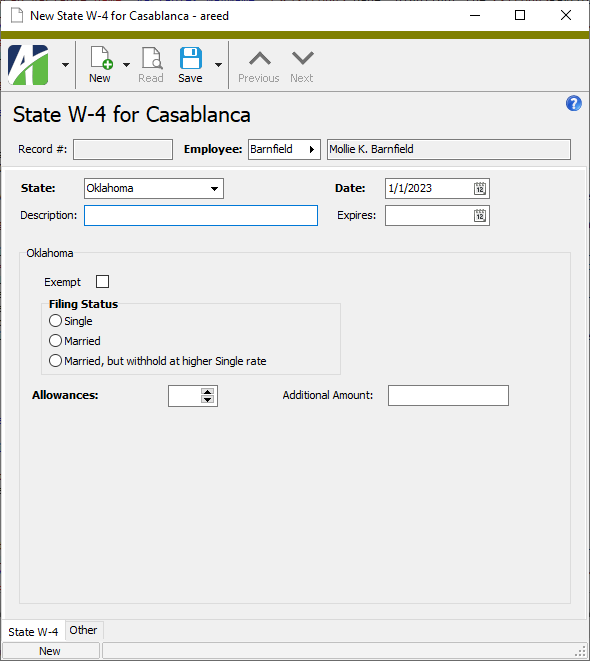

Record an Oklahoma state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an OK-W-4 for.

-

From the State drop-down list, select "Oklahoma". The Oklahoma-specific fields load in the window.

- Enter a Description of the OK-W-4 record.

- Enter the Date the OK-W-4 was received. This date acts as an effective date for the OK-W-4 and supersedes OK-W-4 records with an earlier effective date.

- If the OK-W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee wrote "EXEMPT" on line 7, 8, or 9 of the OK-W-4 form and skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married, but withhold at higher Single rate

- Enter the number of Allowances the employee claimed on line 5 of the OK-W-4 form.

- In the Additional Amount field, enter the additional amount the employee requested to be withheld per paycheck on line 6 of the OK-W-4 form.

- Save the new OK-W-4 record.

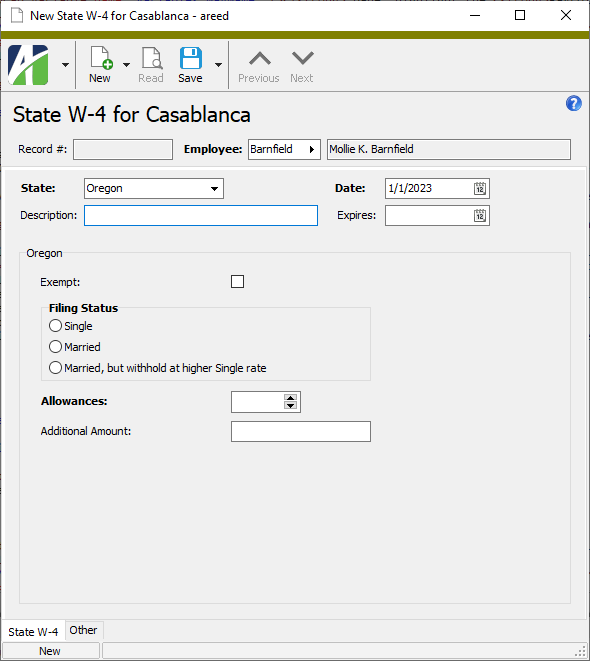

Record an Oregon state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an OR-W-4 for.

-

From the State drop-down list, select "Oregon". The Oregon-specific fields load in the window.

- Enter a Description of the OR-W-4 record.

- Enter the Date the OR-W-4 was received. This date acts as an effective date for the OR-W-4 and supersedes OR-W-4 records with an earlier effective date.

- If the OR-W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee entered an exemption code on line 4a of Form OR-W-4 and wrote "Exempt" on line 4b of that form, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married, but withhold at higher Single rate

- In the Allowances field, enter the total number of allowances the employee claimed on line 2 of Form OR-W-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 3 of Form OR-W-4.

- Save the new OR-W-4 record.

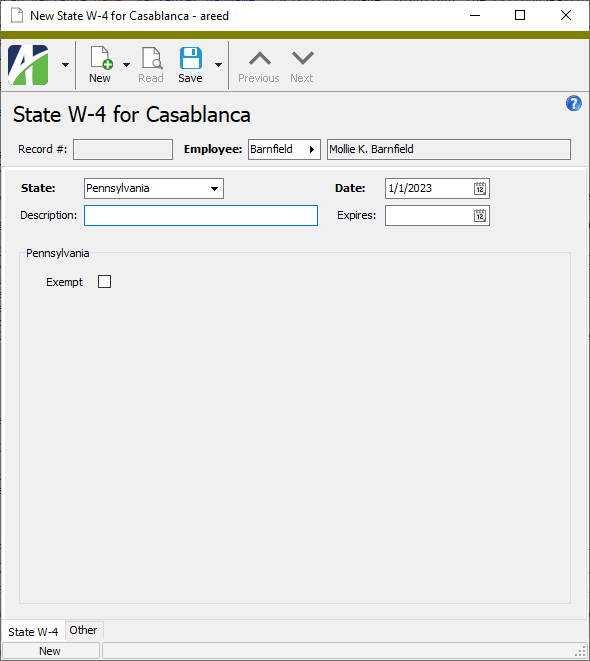

Record a Pennsylvania REV-419

Pennsylvania's state tax is a flat tax on employee compensation. As such, Pennsylvania has no state W-4 equivalent; however, it is possible for an employee to claim exemption from Pennsylvania state tax. Therefore, you should use the state W-4 record to record form REV-419 for any employees who claim exemption from state tax. It is not necessary to create state W-4 records for employees who do not claim they are exempt from state tax.

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a REV-419 for.

-

From the State drop-down list, select "Pennsylvania". The Pennsylvania-specific field loads in the window.

- Enter a Description of the REV-419 record.

- Enter the Date the REV-419 was received. This date acts as an effective date for the REV-419 and supersedes REV-419 records with an earlier effective date.

- If the REV-419 is invalid after a certain date, enter the date the nonwithholding certificate Expires.

- Mark the Exempt checkbox indicating that a Form REV-419 was received from the employee.

- Save the new REV-419 record.

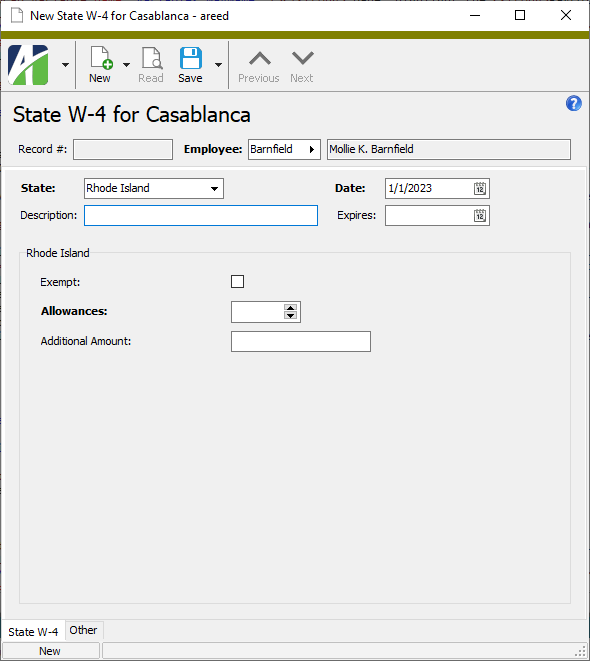

Record a Rhode Island state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an RI W-4 for.

-

From the State drop-down list, select "Rhode Island". The Rhode Island-specific fields load in the window.

- Enter a Description of the RI W-4 record.

- Enter the Date the RI W-4 was received. This date acts as an effective date for the RI W-4 and supersedes RI W-4 records with an earlier effective date.

- If the RI W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee wrote "EXEMPT" or "EXEMPT-MS" on line 3 of Form RI W-4, then skip to step 11.

- In the Allowances field, enter the total number of allowances the employee claimed on line 1 of Form RI W-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 2 of Form RI W-4.

- Save the new RI W-4 record.

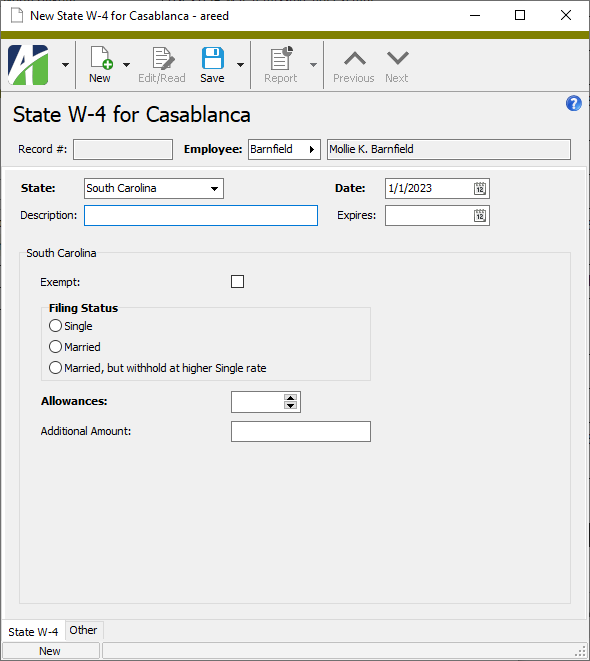

Record a South Carolina state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record an SC W-4 for.

-

From the State drop-down list, select "South Carolina". The South Carolina-specific fields load in the window.

- Enter a Description of the SC W-4 record.

- Enter the Date the SC W-4 was received. This date acts as an effective date for the SC W-4 and supersedes SC W-4 records with an earlier effective date.

- If the SC W-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee marked either of the checkboxes in step 7 and wrote "Exempt" on line 7 of Form SC W-4, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married, but withhold at higher Single rate

- Enter the number of Allowances the employee claimed on line 5 of Form SC W-4.

- In the Additional Amount field, enter the additional amount the employee requested to be withheld per paycheck on line 6 of Form SC W-4.

- Save the new SC W-4 record.

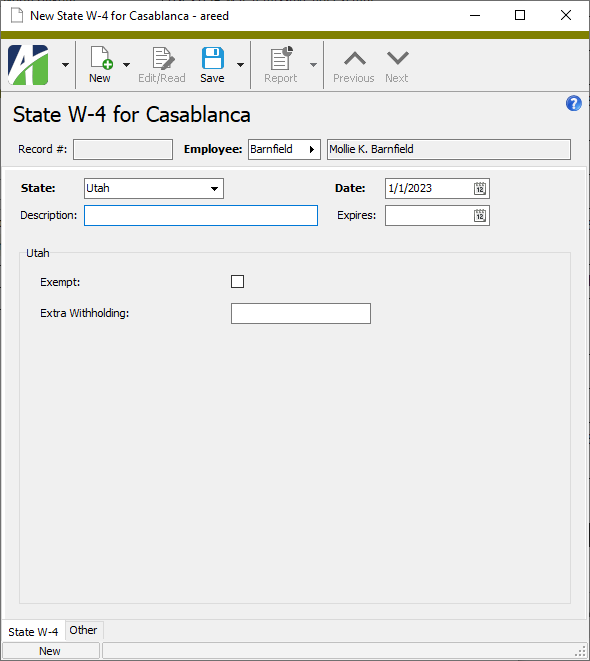

Record a Utah state W-4

Utah's state withholding is calculated based on values from the USA Form W-4; however, some state withholding situations, namely exemption from withholding and additional state withholding, are not handled by the USA W-4. For this reason, you can create state W-4 records for Utahns who claim exemption from withholding or who request additional withholding. It is not necessary to create a state W-4 record for Utah employees for whom neither of these circumstances apply.

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a state W-4 record for.

-

From the State drop-down list, select "Utah". The Utah-specific fields load in the window.

- Enter a Description of the state W-4 record.

- Enter the Date the state W-4 information was received. This date acts as an effective date for the state W-4 and supersedes state W-4 records with an earlier effective date.

- If the state W-4 information is invalid after a certain date, enter the date the information Expires.

- Mark the Exempt checkbox to indicate the employee claimed exemption from state withholding. If you mark the checkbox, skip to step 10.

- In the Extra Withholding field, enter any additional amount the employee requested to be withheld per paycheck for state withholding.

- Save the new state W-4 record.

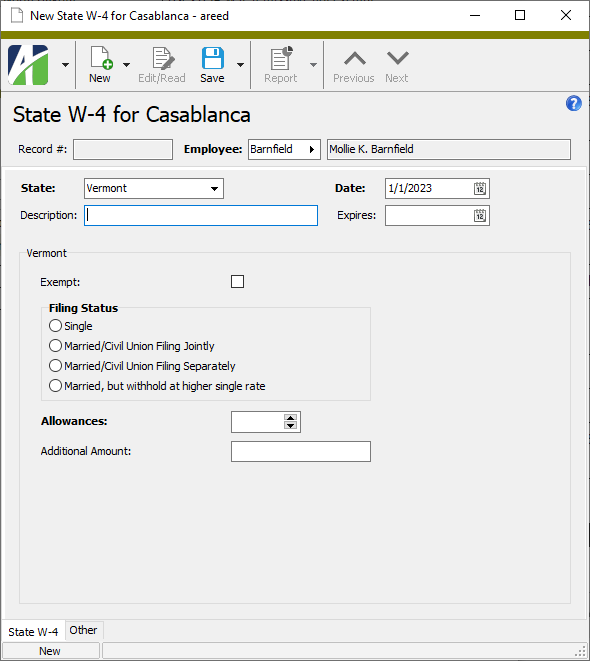

Record a Vermont state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a W-4VT for.

-

From the State drop-down list, select "Vermont". The Vermont-specific fields load in the window.

- Enter a Description of the W-4VT record.

- Enter the Date the W-4VT was received. This date acts as an effective date for the W-4VT and supersedes W-4VT records with an earlier effective date.

- If the W-4VT is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee wrote "Exempt" on the line below line 6 of Form W-4VT, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married/Civil Union Filing Jointly

- Married/Civil Union Filing Separately

- Married, but withhold at higher single rate

- Enter the total number of Allowances the employee claimed on line 5 of Form W-4VT.

- In the Additional Amount field, enter the additional amount the employee requested to be withheld per paycheck on line 6 of Form W-4VT.

- Save the new W-4VT record.

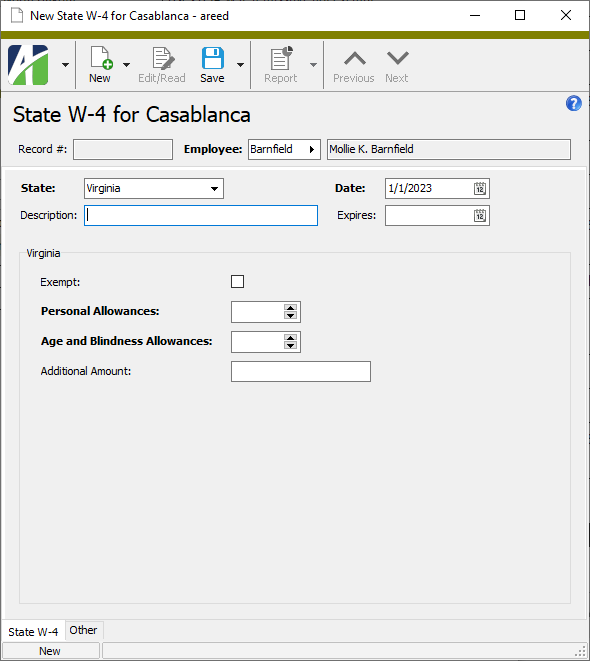

Record a Virginia state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a VA-4 for.

-

From the State drop-down list, select "Virginia". The Virginia-specific fields load in the window.

- Enter a Description of the VA-4 record.

- Enter the Date the VA-4 was received. This date acts as an effective date for the VA-4 and supersedes VA-4 records with an earlier effective date.

- If the VA-4 is invalid after a certain date, enter the date the withholding certificate Expires.

-

Mark the Exempt checkbox if the employee marked either the checkbox on line 3 or the checkbox on line 4 of Form VA-4, then skip to step 12.

- In the Personal Allowances field, enter the total number of personal exemptions the employee claimed on line 1a of Form VA-4.

- In the Age and Blindness Allowances field, enter the total number of age and blindness exemptions the employee claimed on line 1b of Form VA-4.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 2 of Form VA-4.

- Save the new VA-4 record.

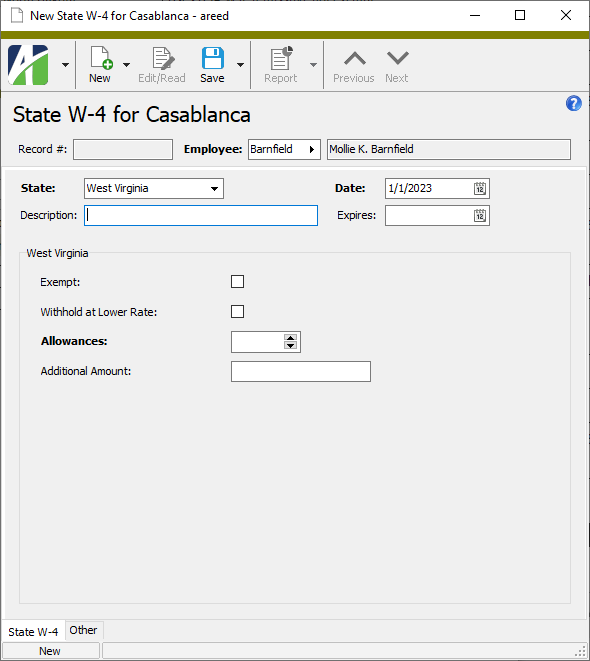

Record a West Virginia state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a WV/IT-104 for.

-

From the State drop-down list, select "West Virginia". The West Virginia-specific fields load in the window.

- Enter a Description of the WV/IT-104 record.

- Enter the Date the WV/IT-104 was received. This date acts as an effective date for the WV/IT-104 and supersedes WV/IT-104 records with an earlier effective date.

- If the WV/IT-104 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee completed and returned the "West Virginia Certificate of Nonresidence", then skip to step 12.

- Mark the Withhold at Lower Rate checkbox if the employee marked the checkbox on line 5 of Form WV/IT-104.

- In the Allowances field, enter the total number of exemptions the employee claimed on line 4 of Form WV/IT-104.

- In the Additional Amount field, enter any additional amount the employee requested to be withheld per paycheck on line 6 of Form WV/IT-104.

- Save the new WV/IT-104 record.

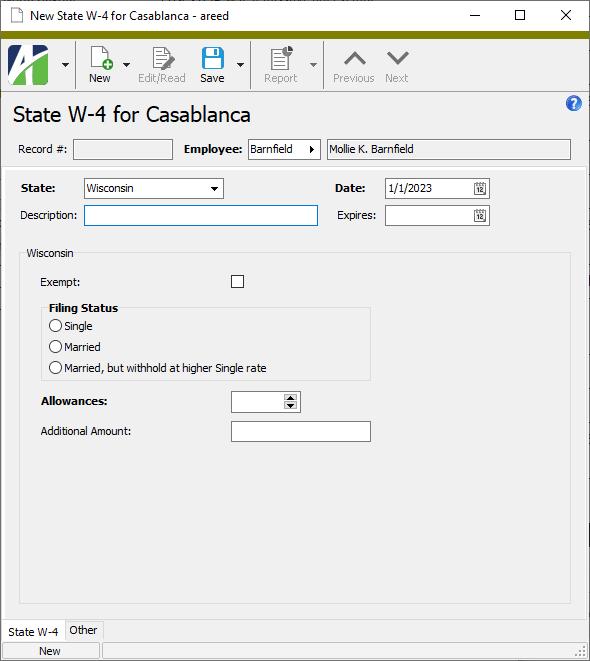

Record a Wisconsin state W-4

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > State W-4s folder.

- Click

. The New State W-4 window opens.

. The New State W-4 window opens.

- In the Employee field, select the employee code to record a WT-4 for.

-

From the State drop-down list, select "Wisconsin". The Wisconsin-specific fields load in the window.

- Enter a Description of the WT-4 record.

- Enter the Date the WT-4 was received. This date acts as an effective date for the WT-4 and supersedes WT-4 records with an earlier effective date.

- If the WT-4 is invalid after a certain date, enter the date the withholding certificate Expires.

- Mark the Exempt checkbox if the employee wrote "Exempt" on line 3 of Form WT-4, then skip to step 12.

- In the Filing Status field, select the employee's designated filing status. Valid options are:

- Single

- Married

- Married, but withhold at higher Single rate

- Enter the total number of Allowances the employee claimed on line 1d of Form WT-4.

- In the Additional Amount field, enter the additional amount the employee requested to be withheld per paycheck on line 2 of Form WT-4.

- Save the new WT-4 record.

State W-4 Record ID

The employee associated with the state W-4 record.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

State W-4 tab

The remainder of the fields on the State W-4 tab depend on the state selected. Expand the link for the applicable state.

- Single

- Married Filing Separately

- Married

- Head Of Family

- No Personal Exemption

- 0.5%

- 1.0%

- 1.5%

- 2.0%

- 2.5%

- 3.0%

- 3.5%

- Single

- Married Filing Jointly

- Head Of Household

- Single or Married (with two or more incomes)

- Married (one income)

- Head of Household

- A

- B

- C

- D

- E. If this option is selected, the remaining fields are disabled.

- F

- Single

- Married

- Single

- Married

- Married filing separately

- Married filing separately on same return

- Head of household

- Single

- Married Filing Joint Return, both spouses working

- Married Filing Joint Return, one spouse working

- Married Filing Separate Return

- Head of Household

Indicates the employee marked the "Certified Disabled Person (not subject to withholding)" or the "Nonresident Military Spouse (not subject to withholding)" checkbox in line 3 of Form HW-4. If you mark this checkbox, the remaining fields are disabled.

Note

Hawaii does not otherwise allow "EXEMPT" status for withholding purposes.

- Single

- Married

- Married, but withhold at higher Single rate

- Single

- Married

- Married, but withhold at higher Single rate

- Other

- Head of Household

- Married filing jointly. If this option is selected, the Spouse has earned income checkbox is enabled. If the checkbox is marked, indicates the employee responded "Yes" to the "If so, does your spouse also have earned income?" question on Form IA W-4.

Note

The employee will be exempt from withholding only for the year entered on Form IA W-4. If the employee needs to claim exempt status in a future year, a new Form IA W-4 is required. If a new Form IA W-4 is not submitted, the filing status, the total allowance amount, and the additional withholding specified are applied when calculating paychecks for other years.

- Single

- Married (Joint)

- No deductions

- Single

- Married

The number of deductions claimed on line 6 of the L-4 form.

If the filing status is "No deductions", this field is set to "0" and disabled.

If the filing status is "Single", valid values are "0" or "1".

If the filing status is "Married", valid values are "0", "1", or "2".

- No deductions

- Single

- Married

The number of exemptions claimed on line 6 of the L-4 form.

If the filing status is "No deductions", this field is set to "0" and disabled.

If the filing status is "Single", valid values are "0" or "1".

If the filing status is "Married", valid values are "0", "1", or "2".

- Single or Head of Household

- Married

- Married, but withhold at higher Single rate

- Single

- Married (surviving spouse or unmarried Head of Household)

- Married, but withhold at Single rate

- Single; Married, but legally separated; or Spouse is a non-resident alien

- Married

- Single

- Married, One Spouse Employed

- Married, Both Spouses Employed

- Head of Household

- Single or Married Spouse Works or Married Filing Separate

- Married Spouse Does Not Work

- Head of Household

- Single or Married filing separately

- Married filing jointly. If this option is selected, the Both work, with similar incomes checkbox is enabled. If the checkbox is marked, indicates the employee marked the checkbox on step 2 of Form MW-4.

- Head of Household

Note

The employee will be exempt from withholding only for the year entered on Form MW-4. If the employee needs to claim exempt status in a future year, a new Form MW-4 is required. If a new MW-4 is not submitted, the filing status and the extra or reduced withholding specified are applied when calculating paychecks for other years.

- Single

- Married Filing Jointly or Qualifying Widow(er)

- Single

- Married/Civil Union Couple Joint

- Married/Civil Union Partner Separate

- Head of Household

- Qualifying Widow(er)/Surviving Civil Union Partner

- Single or Married filing separately

- Married filing jointly

- Head of household

- Single

- Married

- Married, but withhold at higher Single rate

- Single or Married Filing Separately

- Married Filing Jointly or Surviving Spouse

- Head of Household

- Single

- Married

- Married, but withhold at higher Single rate

- Single

- Married

- Married, but withhold at higher Single rate

- Single

- Married

- Married, but withhold at higher Single rate

- Single

- Married/Civil Union Filing Jointly

- Married/Civil Union Filing Separately

- Married, but withhold at higher single rate

- Single

- Married

- Married, but withhold at higher Single rate

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Notes tab

The Notes pane shows the Notes HD view filtered to show all notes for the selected state W-4.

Double-click a row in the pane to drill down to its record in the Note window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab