Use the Proof 1095-Cs wizard to verify that 1095-C offer codes and safe harbor codes are assigned to employees correctly. The values that appear on the proof report are calculated from ACA result records.

When you run the process, ActivityHD validates that each employee has offer codes during the tax year, has a Social Security number, address, city, state, and zip code on file, and that there are 18 or fewer covered individuals on the employee's insurance coverage record (for self-insured employers only).

The employer identification number (EIN) on 1095-C forms is validated using the Employer ID field on the USA tax entity record.

If Advanced Security is installed, you must have "Run Report" access to 1095-Cs to run the proof report.

Proof 1095-Cs

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the Proof 1095-Cs wizard.

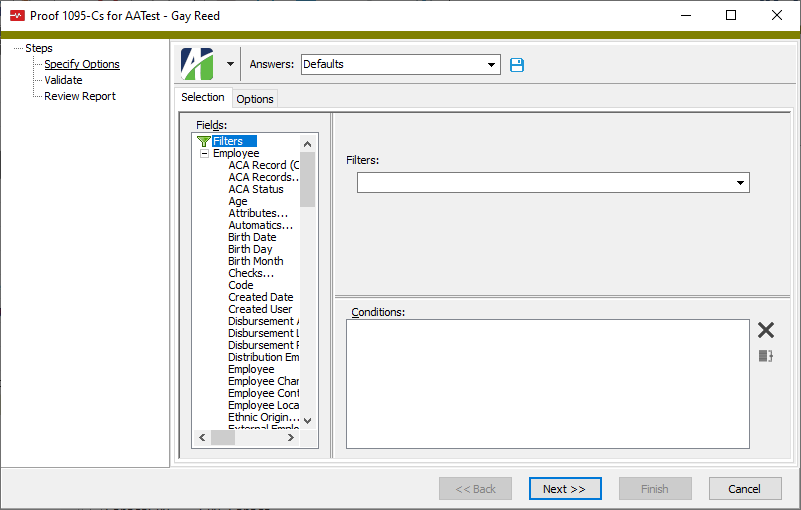

- To proof all or a filtered subset of 1095-Cs:

- Right-click the Employees folder and select ACA Processing > Select and Proof 1095-Cs Report from the shortcut menu.

- On the Selection tab, define any filters to apply to the 1095-Cs.

- To proof 1095-Cs for specifically selected employees:

- In the HD view, select the employees to proof 1095-Cs for. You can use Ctrl and/or Shift selection to select multiple employees.

- Right-click and select ACA Processing > Proof 1095-Cs Report from the shortcut menu.

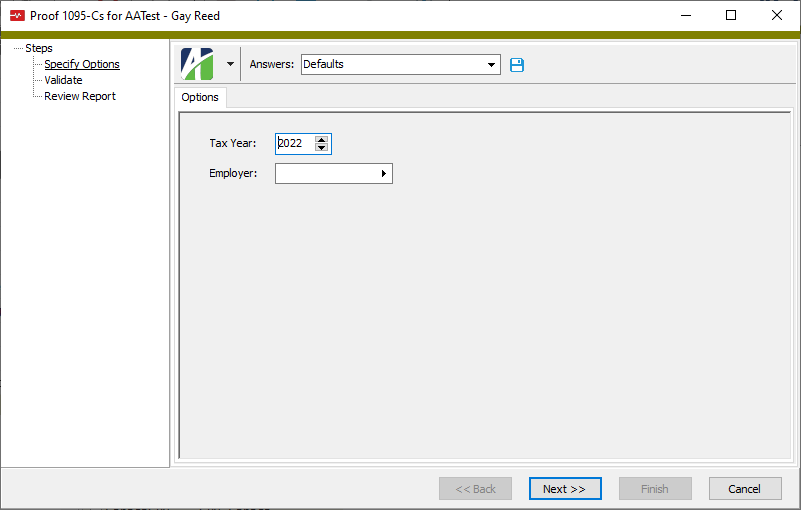

- To proof all or a filtered subset of 1095-Cs:

- On the Options tab, enter the Tax Year you are preparing 1095-Cs for.

- In the Employer field, select the export employer associated with the 1095-Cs.

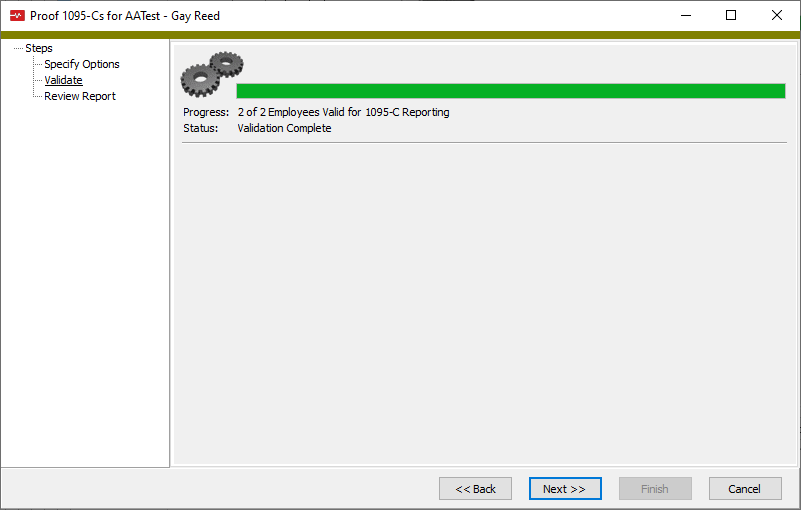

- Click Next >>. ActivityHD validates the employee records for 1095-C reporting and reports its results.

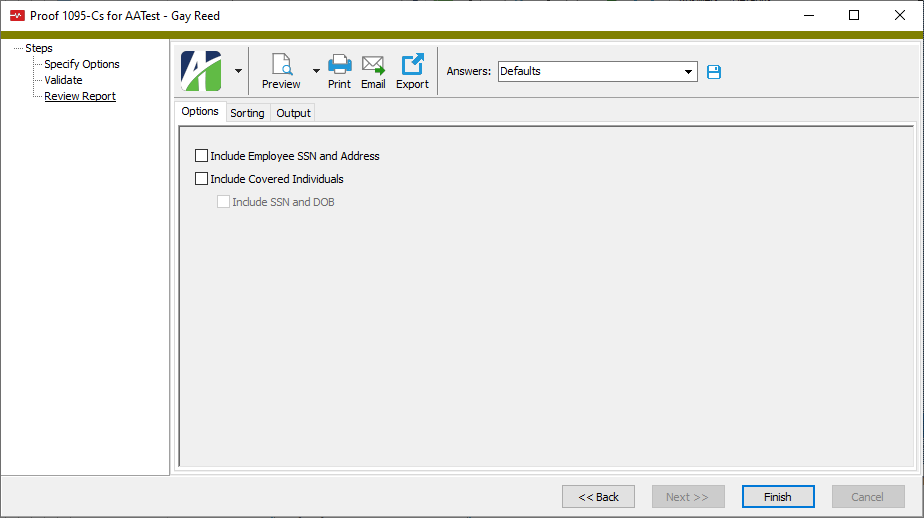

- Click Next >>.

- On the Options tab, mark the checkbox(es) for the information to include on the proof report. Your options are:

- Employee SSN and Address

- Covered Individuals

- SSN and DOB. This checkbox is enabled if you mark the Include Covered Individuals checkbox.

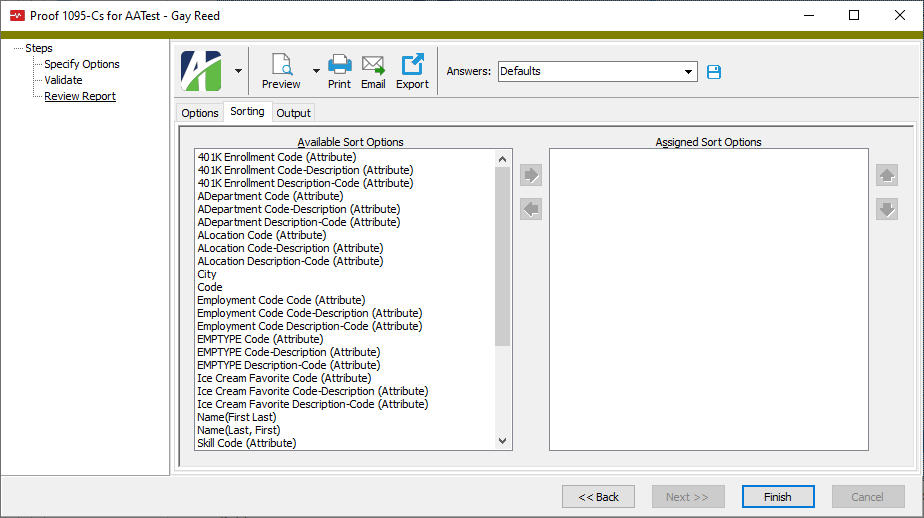

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the fields to sort by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- When you finish reviewing the proof report, click Finish.

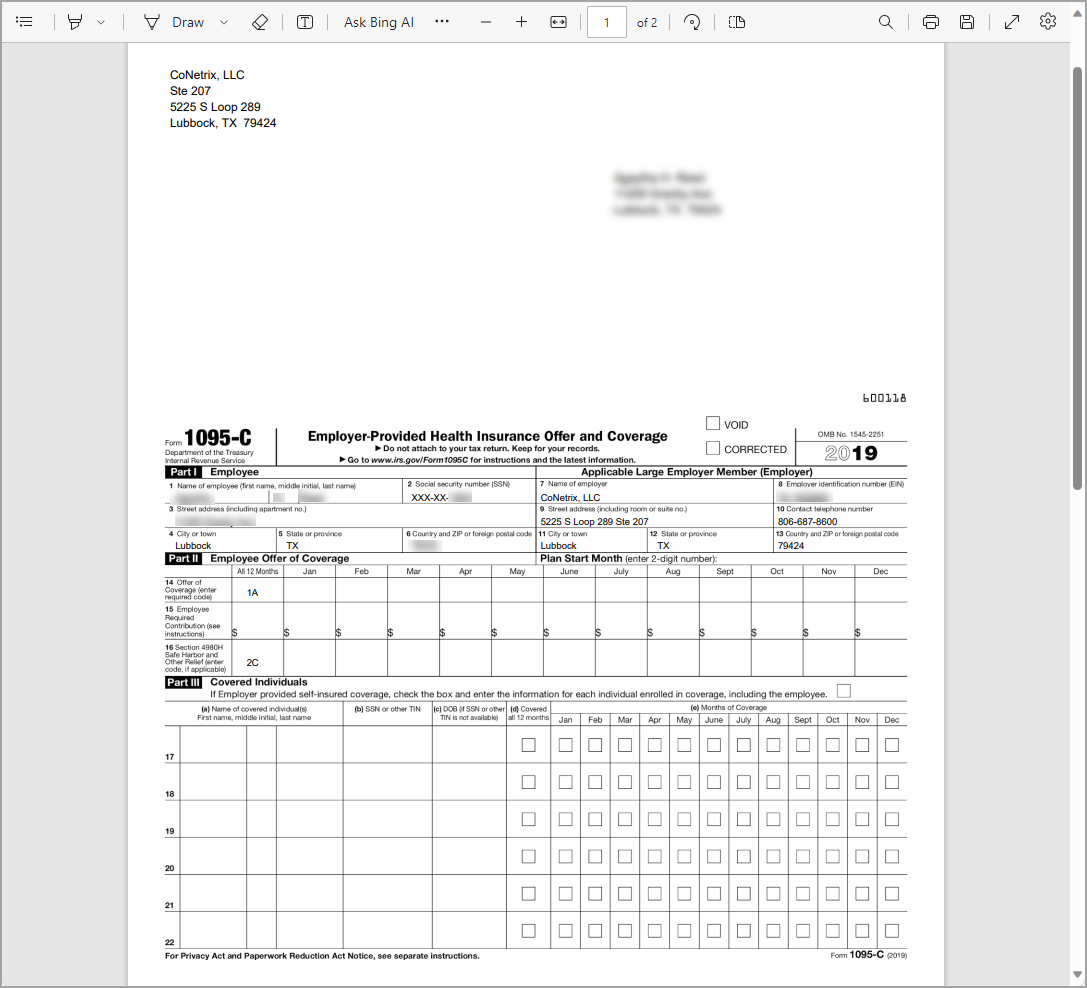

Use the Print Employee 1095-Cs wizard to print the Forms 1095-C to issue to your employees. The values that appear on the 1095-Cs are calculated from ACA result records.

The employer identification number (EIN) on 1095-C forms is validated using the Employer ID field on the USA tax entity record.

1095-C forms are set up to print on blank paper, either two-sided or two separate pages.

If Advanced Security is installed, you must have "Process" access to 1095-Cs to run this process. "Data" access to the Images folder is required to process the Print 1095-Cs step.

Print Employee 1095-Cs

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the Print Employee 1095-Cs wizard.

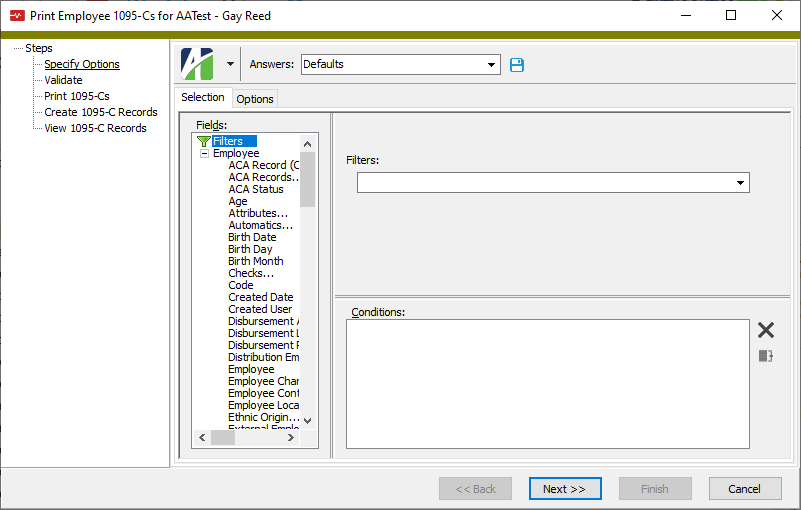

- To print all or a filtered subset of 1095-Cs:

- Right-click the Employees folder and select ACA Processing > Select and Print Employee 1095-Cs from the shortcut menu.

- On the Selection tab, define any filters to apply to the 1095-Cs.

- To print 1095-Cs for specifically selected employees:

- In the HD view, select the employees to print 1095-Cs for. You can use Ctrl and/or Shift selection to select multiple employees.

- Right-click and select ACA Processing > Print Employee 1095-Cs from the shortcut menu.

- To print all or a filtered subset of 1095-Cs:

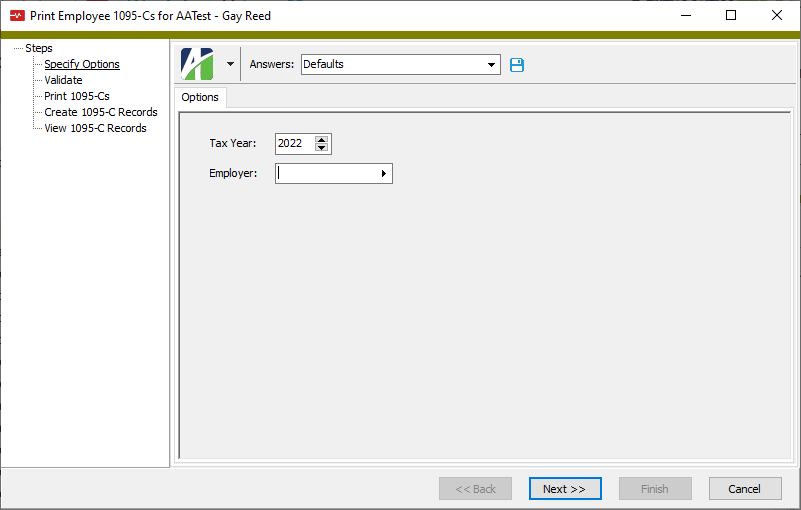

- On the Options tab, enter the Tax Year you are preparing 1095-Cs for.

- In the Employer field, select the export employer associated with the 1095-Cs.

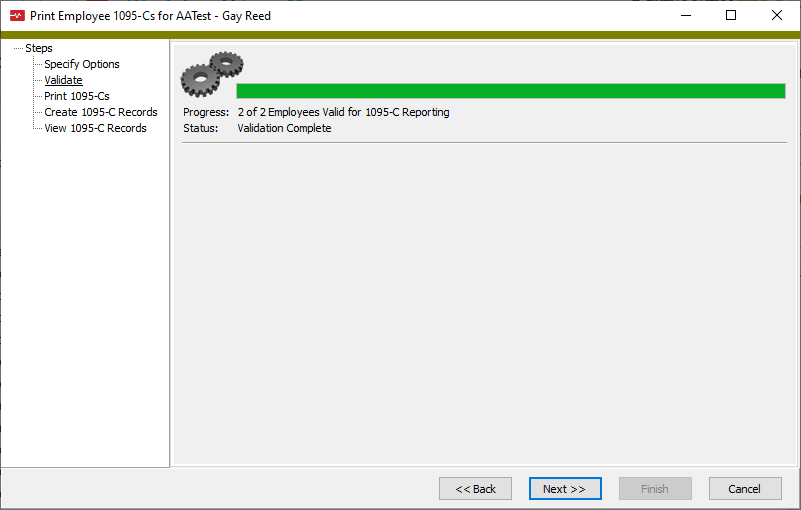

- Click Next >>. ActivityHD validates the employee records for 1095-C printing and reports its results.

- Click Next >>.

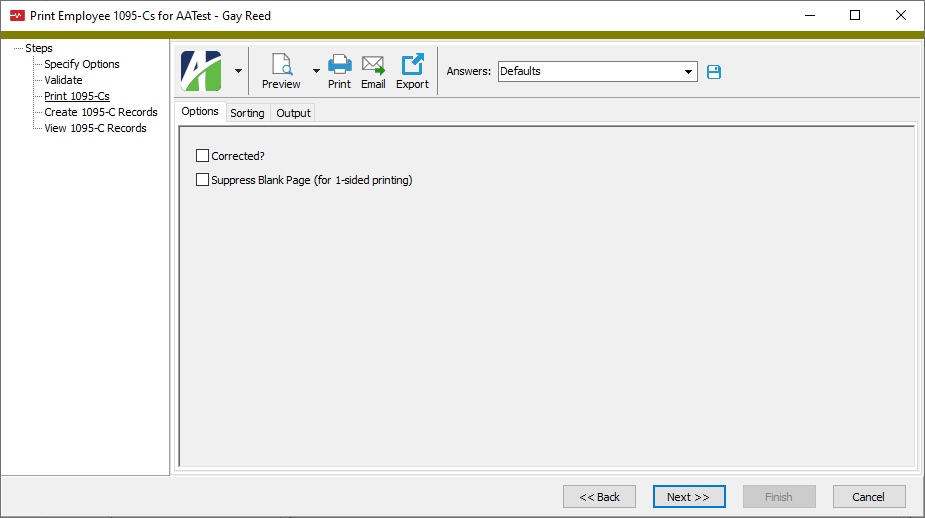

- On the Options tab, if this printing represents a correction and you want an "X" to print in the Corrected box on the 1095-C forms, mark the Corrected? checkbox.

-

If you are printing one-sided and want to omit the blank page that prints to accommodate two-sided printing, mark the Suppress Blank Page (for 1-sided printing) checkbox.

Note

According to Publication 5223: General Rules and Specifications for Affordable Care Act Substitute Forms 1095-A, 1094-B, 1094-C, and 1095-C, page 3 (Part III) should be provided to the recipient even if the employer is not self-insured.

All data fields must be included on the form. For example, it is unacceptable to furnish a Form 1095-C which does not include Part III. Instructions for the recipient must also be included along with the form.

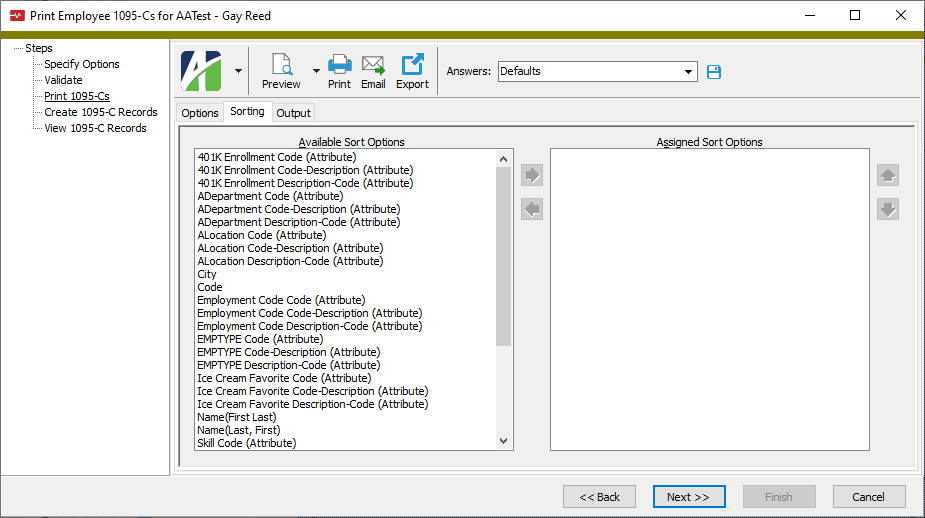

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the fields to sort by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

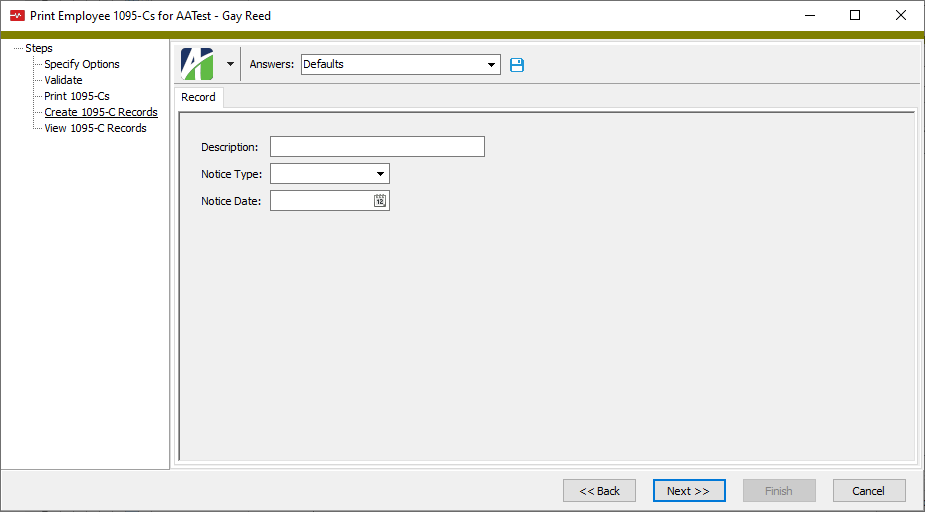

- When you finish producing the 1095-C forms, click Next to create the 1095-C records the 1095-C forms will be attached to (provided attachments are enabled).

- Enter a Description for the 1095-C records.

- From the Notice Type drop-down list, select how the Forms 1095-C will be provided to employees. Your options are:

- Web

- Other

- In the Notice Date field, enter the date that 1095-Cs will be sent to employees.

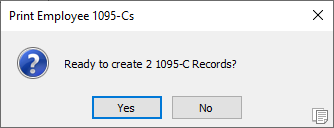

- Click Next >>. ActivityHD prompts you to confirm that you want to create 1095-C records.

-

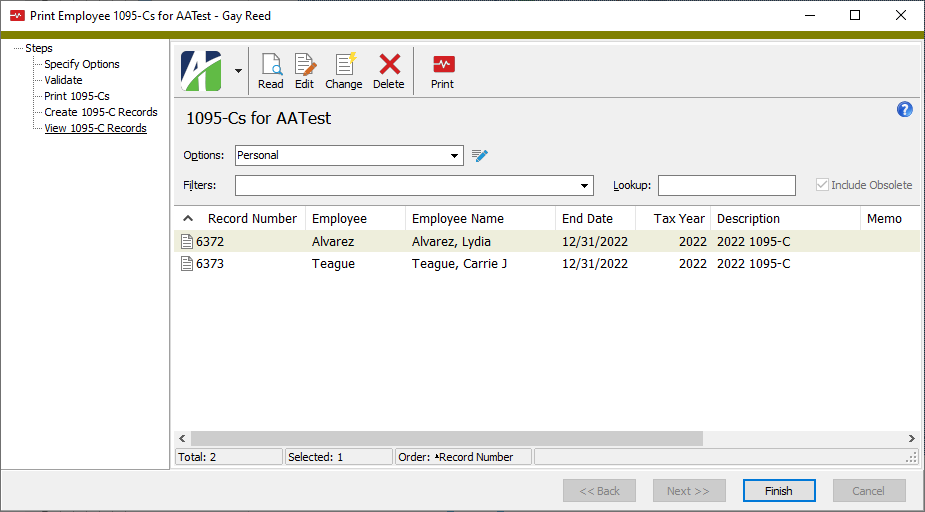

Click Yes. ActivityHD creates the 1095-C records and attaches the Forms 1095-C to them. When the process completes, ActivityHD presents a list of the 1095-C records created.

At this point, you can view, edit, or delete 1095-C records.

- When you finish, click Finish.

Note

You cannot move to the Create 1095-C Records step until you preview or print 1095-Cs.

Use the Print IRS 1095-Cs wizard to generate the Forms 1095-C for submission to the IRS.

Print IRS 1095-Cs

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the Print IRS 1095-Cs wizard.

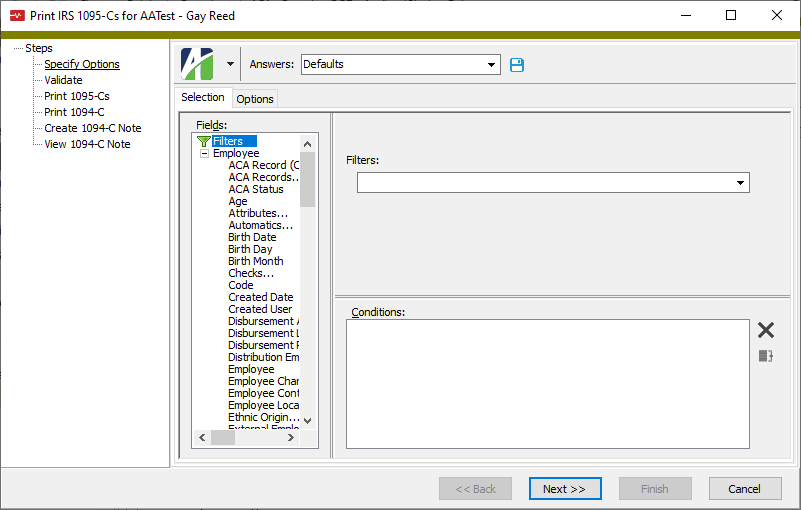

- To generate all or a filtered subset of 1095-Cs:

- Right-click the Employees folder and select ACA Processing > Select and Print IRS 1095-Cs from the shortcut menu.

- On the Selection tab, define any filters to apply to the 1095-Cs.

- To print 1095-Cs for specifically selected employees:

- In the HD view, select the employees to print 1095-Cs for. You can use Ctrl and/or Shift selection to select multiple employees.

- Right-click and select ACA Processing > Print IRS 1095-Cs from the shortcut menu.

- To generate all or a filtered subset of 1095-Cs:

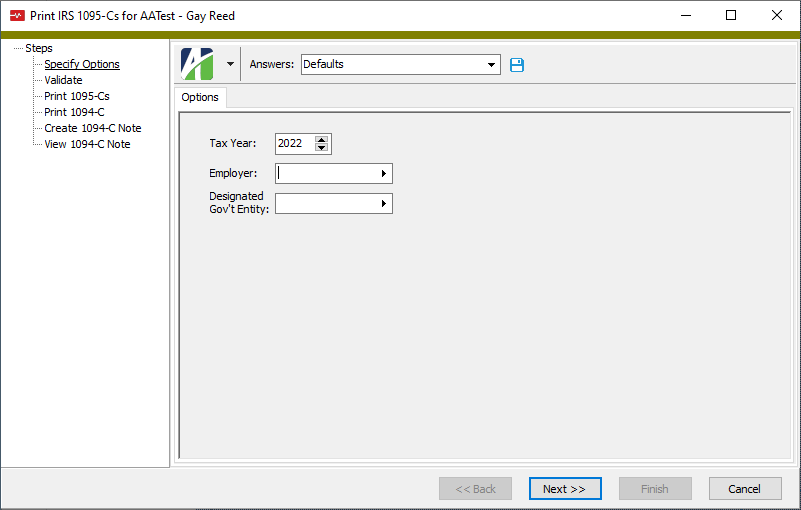

- On the Options tab, enter the Tax Year you are preparing 1095-Cs for.

- In the Employer field, select the export employer associated with the 1095-Cs.

- If the employer is a governmental unit designated to file for another governmental unit, select the export submitter record to use in the Designated Gov't Entity field.

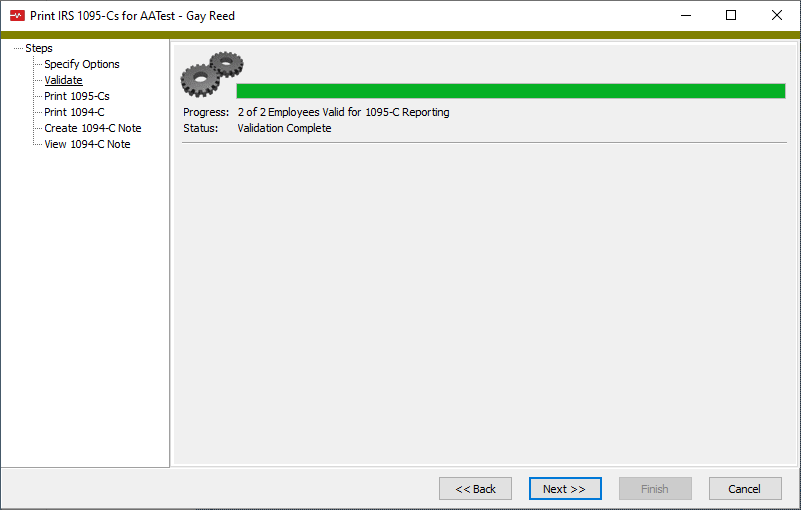

- Click Next >>. ActivityHD validates the employee records for 1095-C printing and reports its results.

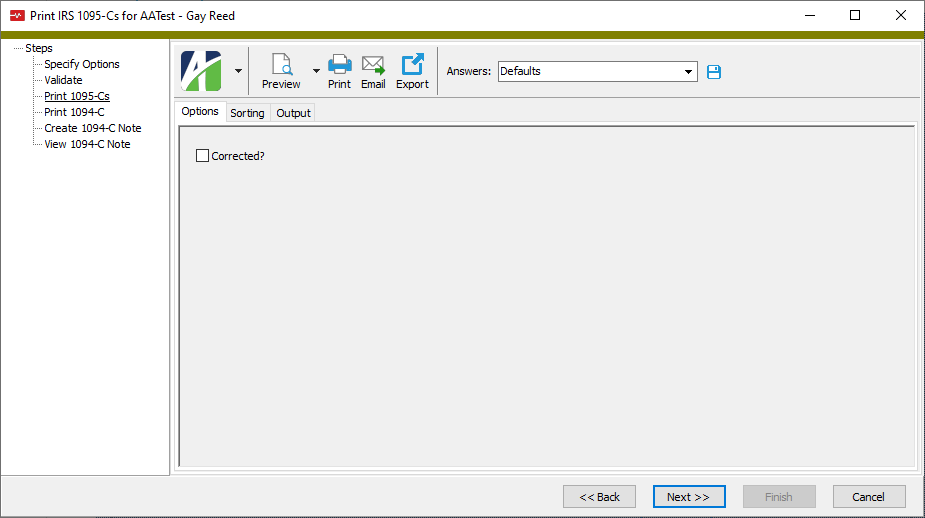

- Click Next >>.

- On the Options tab, if this printing represents a correction and you want an "X" to print in the Corrected box on the 1095-C forms, mark the Corrected? checkbox.

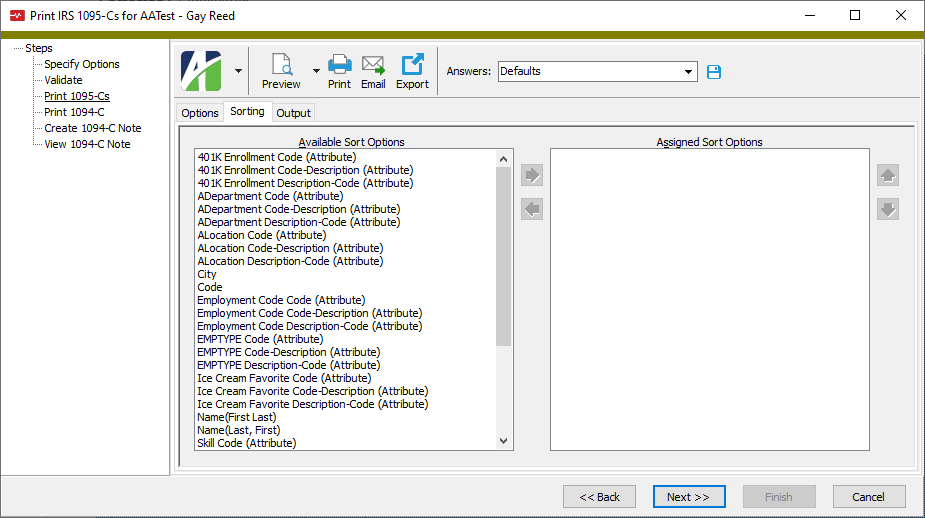

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the fields to sort by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

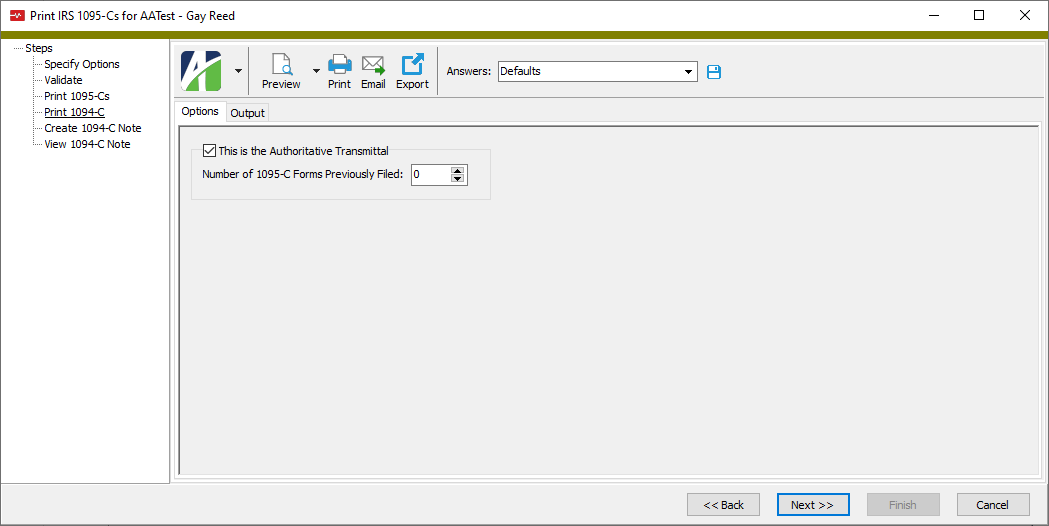

- When you finish generating the 1095-C forms, click Next to set up and create the 1094-C form.

-

On the Options tab, the This is the Authoritative Transmittal checkbox is marked by default. If this transmittal reports the aggregate employer-level data, ensure the checkbox is marked. Otherwise, clear the checkbox.

Note

Only one authoritative transmittal can be filed per employer. If you are filing only one 1094-C, it must report aggregate employer-level data and be flagged as the authoritative transmittal. If you are filing multiple 1094-Cs because not all Forms 1095-C are being attached to a single Form 1094-C, one of the Forms 1094-C must report aggregate employer-level data for the employer and must be flagged as the authoritative transmittal.

- In the Number of 1095-C Forms Previously Filed field, enter or select the number of 1095-C forms already transmitted for the tax year.

- Click Next >>.

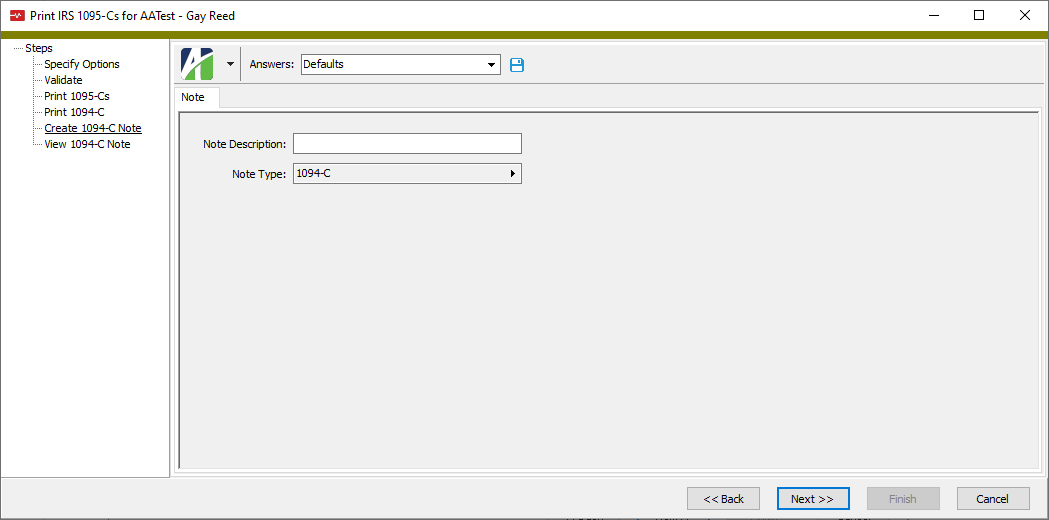

- In the Note Description field, enter the description to apply to the note the 1094-C will be attached to (provided attachments are enabled).

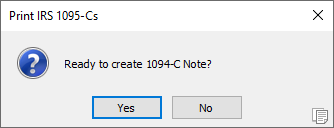

- Click Next >>. ActivityHD prompts you to confirm that you want to create the 1094-C note.

-

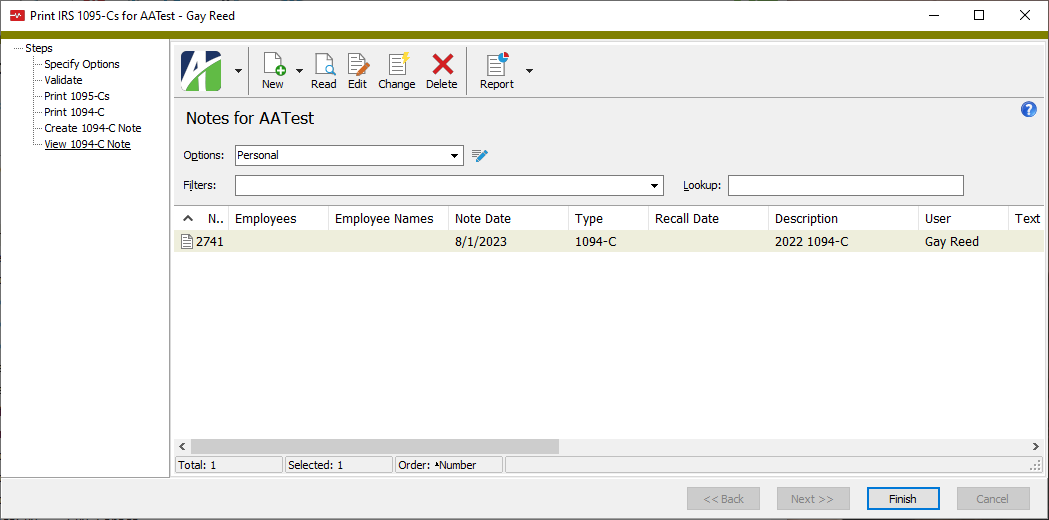

Click Yes. ActivityHD creates the 1094-C note and attaches the Form 1094-C to it. When the process completes, ActivityHD presents a list with the 1094-C that was created.

At this point, you can view, edit, or delete the note, or print a notes report.

- When you finish, click Finish.

Tip

If you need to make the same change(s) to multiple records, consider using the mass changer.

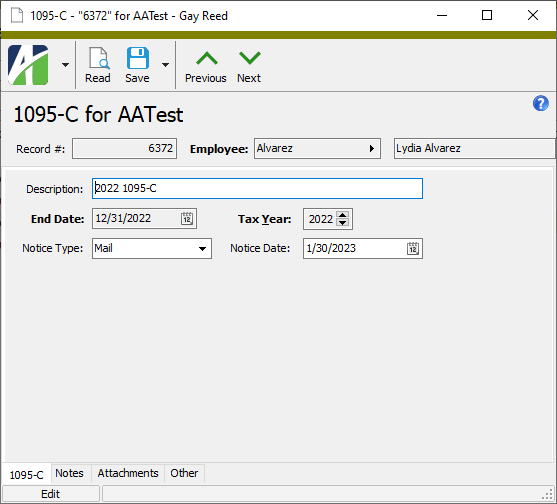

Update a 1095-C record

- In the Navigation pane, highlight the Payroll/Human Resources > Employees > Records > 1095-Cs folder.

- In the HD view, locate and double-click the 1095-C record you want to edit to open it in the 1095-C window.

- If you need to update the Description, enter a new description.

- If you need to change the Notice Type assigned to the 1095-C, select the format type from the drop-down list. Valid options are:

- <blank>

- Web

- Other

- If you need to change the date the notification was sent, enter a new Notice Date.

- When you finish, save your changes.

1095-C Record ID

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

1095-C tab

- <blank>

- Web

- Other

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Notes tab

The Notes pane shows the Notes HD view filtered to show all notes for the selected 1095-C record.

Double-click a row in the pane to drill down to its record in the Note window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

If your site uses the Payroll Self-Serve feature, employees can view their 1095-C information through your web portal. To do so, log on to Self-Serve and then:

- In the Employees menu, click 1095-Cs.

- In the table of 1095-Cs, locate the 1095-C to view, then click its View 1095-C link. The 1095-C loads in a separate tab of your browser.

1095-C records security

Common accesses available on 1095-C records

Special accesses available on 1095-Cs

| Access | A user with this access can... |

|---|---|

| Process | Process 1095-C records. |

1095-C filters

The following built-in filters are available for 1095-Cs:

| Filter Name | Effect |

|---|---|

| Current Employees | Lists 1095-C records for current employees. |

| Terminated Employees | Lists 1095-C records for terminated employees. |

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |