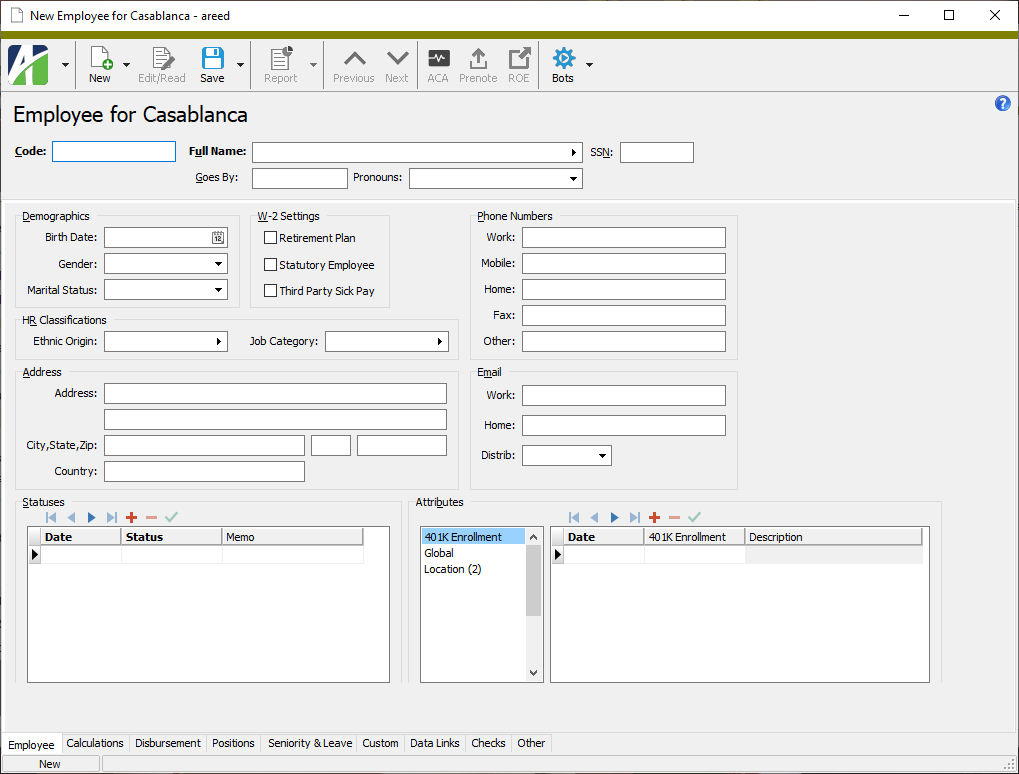

Employees are the central entity of the Payroll system and creating them is the first step in setting up the Payroll package.

Create a new employee record

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Click

. The New Employee window opens.

. The New Employee window opens.

- Enter a unique Code for the employee.

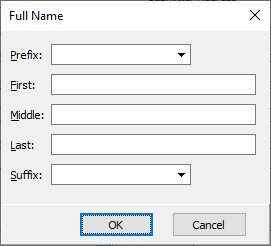

- Enter the employee's Full Name or click the right arrow to open the Full Name dialog box where you can enter the name in parts.

The Full Name field and the Full Name dialog box are synced so that changes you make to one are updated to the other.

- If the employee goes by a different name than the one entered in the Full Name field, enter the name in the Goes By field.

- From the Pronouns drop-down list, select the pronouns by which the employee prefers to be addressed, or enter the pronouns if they are not listed. Valid options include:

- She/Her/Hers

- He/Him/His

- They/Them/Theirs

-

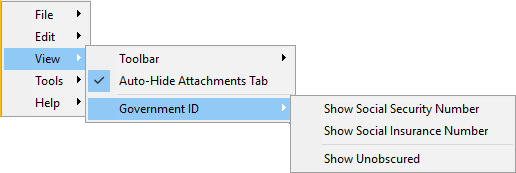

In the SSN or SIN field, enter the employee's social security number (USA) or social insurance number (Canada). The social security number/social insurance number must be unique across all employees.

Note

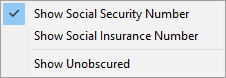

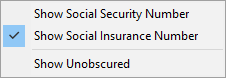

Which of these fields displays depends on your security privileges and on the settings in the View > Government ID menu.

The menu has the following options:

-

Show Social Security Number. Select this option to show the SSN field. After you select this option, the menu shows a checkmark next to the option.

-

Show Social Insurance Number. Select this option to show the SIN field. After you select this option, the menu shows a checkmark next to the option.

-

Show Unobscured. Without this setting, the contents of the SSN or SIN field display as a series of dots.

Select this option to show the actual government ID.

-

At this point you have entered the minimum information needed to save the employee record. To continue building the employee record, expand the instructions for the tabs you want to complete.

-

Enter the employee's Birth Date.

Note

If a new employee record shares the same last name and birth date as an existing employee record, you are warned of the possible duplicate record when you attempt to save the new employee.

- Select the employee's Gender from the drop-down list. Your options are:

- <blank>

- Female

- Male

- Non-Binary

- Select the employee's Marital Status from the drop-down list. Your options are:

- <blank>

- Single

- Married

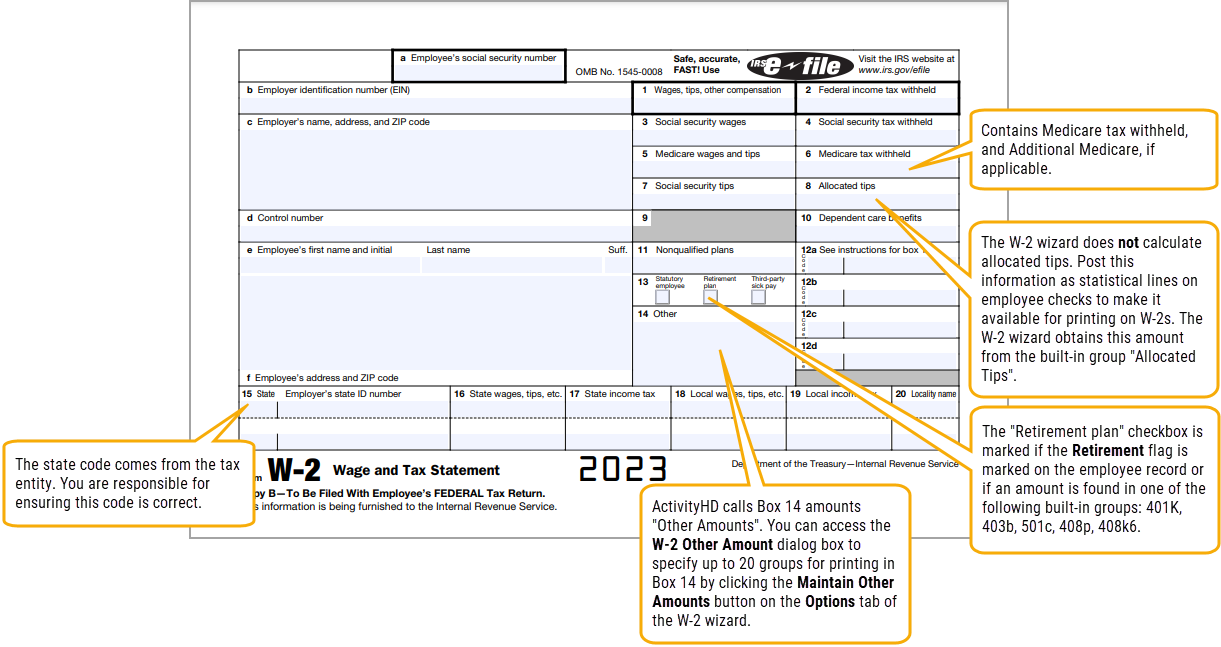

- In the W-2 Settings section, mark the Retirement Plan checkbox if the employee was an active participant for any part of the year in one or more of the following:

- A qualified pension, profit-sharing, or stock-bonus plan described in IRS section 401(a) (including a 401(k) plan).

- An annuity plan described in IRS section 403(a).

- An annuity contract or custodial account described in IRS section 403(b).

- A simplified employee pension (SEP) plan described in IRS section 408(k).

- A SIMPLE retirement account described in IRS section 408(p).

- A trust described in IRS section 501(c)(18).

- A plan for federal, state, or local government employees or by an agency or instrumentality thereof (other than an IRS section 457(b) plan).

-

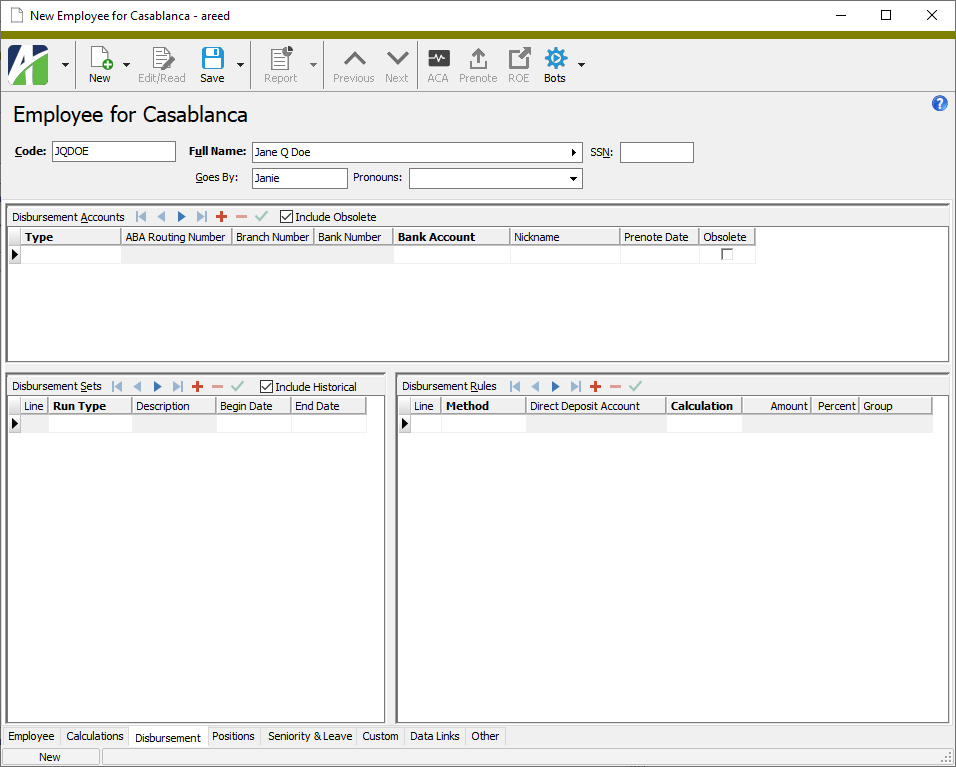

Mark the Statutory Employee checkbox if the "employee" is an independent contractor treated as an employee by statute for the purpose of withholding Medicare and Social Security taxes.

More...

More...From irs.gov:

- Mark the Third-Party Sick Pay checkbox if you are a third-party sick pay payer who files a Form W-2 for an insured employee or you are an employer reporting sick pay payments made by a third party to this employee.

- In the Ethnic Origin field, select the employee's ethnicity.

- In the Job Category field, select the employee's job classification.

-

In the Address fields, provide the Address, City, State, Zip, and Country of the employee.

Note

When the employee record is saved, the Address section is replaced by a Locations section. A home-type location record is created from the address information provided and is initially used as the default primary, disbursement, and government location for the employee. Change the location type and add more employee locations as needed.

- In the Locations section, select the address(es) to use for the employee based on the purpose of the communication. In most cases, one address is applicable for all three purposes.

- Primary. Select the employee's primary location (probably the employee's residence).

- Disbursement. Select the employee location to use for check disbursements, direct deposit prenotes, and pay statements.

- Government. Select the employee location to use for government documents such as W-2s, 1095-Cs, and ROE and T4 slips (Canada only).

- In the Phone Numbers section, enter one or more phone numbers for the employee.

- In the Email section, enter a Work email address and a Home email address.

- From the Distrib drop-down list, select the email address to distribute the employee's pay information to. Your options are:

- <blank>

- Home

- Work

- In the Statuses table, enter the employee's status details:

- Enter the status Date. For new hires, this is typically the first day of work.

- Select the employee's work Status.

- In the Memo field, enter additional information about the status change if needed. You can press F2 to open a popup box where you can more easily enter long text.

- In the Attributes table, do the following for each attribute you need to assign an attribute item to for the employee:

- In the list box, highlight the attribute to assign an attribute item to.

- In the Attributes table in the Date column, enter the effective date of the attribute item.

- In the <Attribute> column, select the attribute item.

Note

For begin-of-day statuses, the date entered here is the effective date of the status. For end-of-day statuses, the date entered here is the last day worked and the following day is the effective date of the status. To see the effect of the effective date rule on employee statuses, view the statuses in the Employee Statuses HD view with the "Effective Date Rule" and "Effective Date" columns visible.

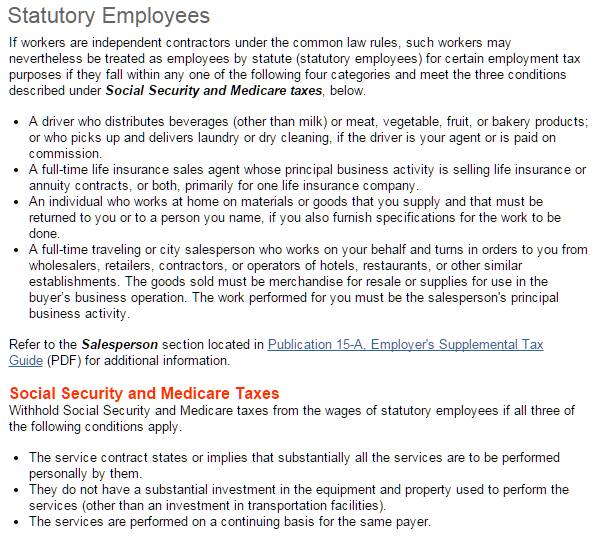

Use this tab to predefine payroll check information for the employee. The information entered on this tab automatically produces check lines for the employee when a payroll run is processed.

-

In the Automatics table, build the list of PRCodes which will normally be used to calculate the employee's pay checks. Lines for automatics only appear on checks generated using the Process Payroll Run wizard. The wizard creates automatic lines based on the run type being processed matching the run type on the PRCode and with a check date between the PRCode's begin and end dates. PRCodes with no run type are always processed.

Note

If an employee has a garnishment record, ActivityHD automatically adds the garnishment into the Automatics table.

For each PRCode you need, do the following:

-

In the PRCode column, select a PRCode.

Tip

Use the drop-down list in the table header to filter the PRCode Find dialog box by type. Your options are:

- All

- Pay

- Deductions

- Taxes

- Statistics

- In the Begin Date column, enter the date the PRCode takes effect.

-

In the End Date column, enter the last date the PRCode is valid for the employee, if known. Leave this field blank if you do not know the end date or if the PRCode should remain in effect indefinitely.

Note

Begin and end dates allow you to set up PRCodes in advance and to expire old PRCodes when needed.

-

-

In the Parameters and Values tables, enter the segment item parameters that are available on the employee and specify the corresponding parameter values. Parameters represent variable values which contribute to check calculations such as salary, base rate, and 401(k) percentage.

For each parameter you need, do the following:

-

In the Parameter column, select a parameter.

Tip

Use the drop-down list in the Parameters table header to filter the parameter Find dialog box. Your options are:

- All. This is the initial default selection for the filter. Thereafter, the filter remembers the last filter value used.

- Automatics. If you select this option, the Find dialog box shows the parameters available for the automatic that is currently selected in the Automatics table.

- Pay

- Deductions

- Taxes

- Statistics

- Obsolete. If you select this option, only obsolete segment item parameters are shown.

- With the same row still selected in the Parameters table, move to the Values table and enter the effective date for the parameter value in the Date column.

-

In the Value column, enter the parameter value as of the date you just entered.

Notes

If the effective date you entered falls on or before today (provided you don't have a subsequent effective date), the value you enter in this row is loaded to the Current Value column in the Parameters table.

Parameters are declared on segment items but values for parameters can be entered on the segment item or on the employee. If both the segment item and employee have a current value for a particular parameter, the value on the employee record takes precedence.

- Enter a Description for the parameter value, if desired.

-

If you need to enter additional effective dates and parameter values for the selected parameter, repeat steps b-d for each date-parameter value combination.

Example

You might want to enter a future effective date and parameter value for the pay rate of an employee on probation for 90 days who will be raised to his regular pay rate after completing probation.

-

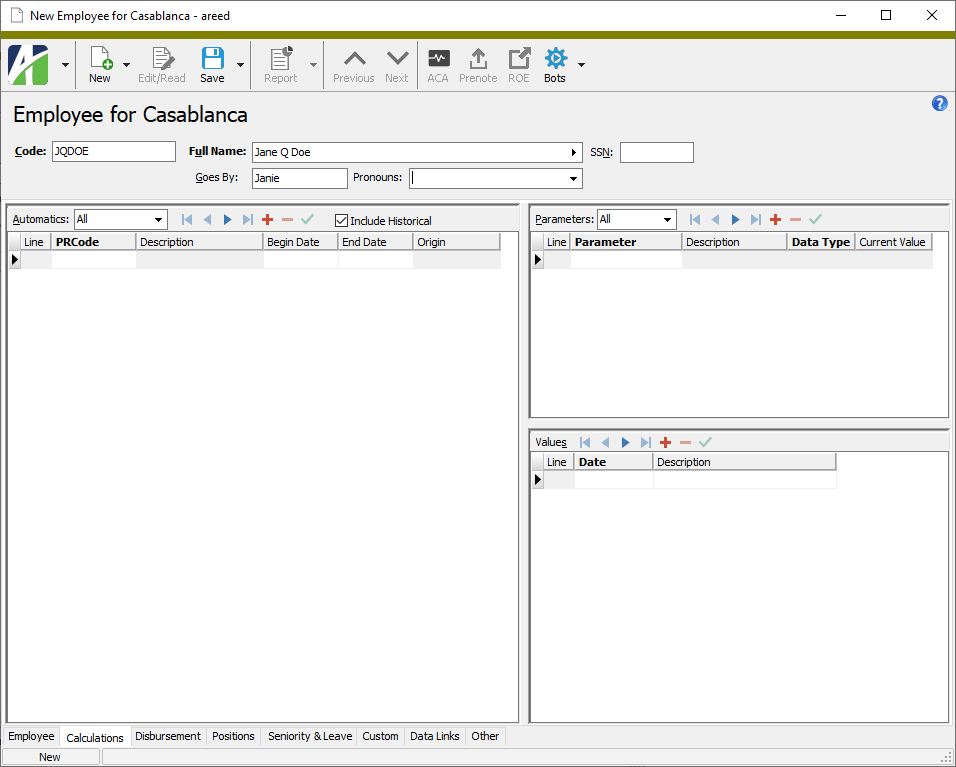

Fill in the Disbursement Accounts table only if the employee will be paid by direct deposit.

If you need to set up a disbursement for Canadian EFT, view the alternate step 25 for Canada.

-

In the Disbursement Accounts table, perform the following steps for each of the accounts to disburse some of the employee's pay to:

- From the Type drop-down list, select the type of disbursement account. Your options are:

- Checking

- Savings

- In the ABA Routing Number column, enter the routing number of the employee's bank.

- In the Bank Account column, enter the employee's account number with the bank.

- Enter a Nickname for the account.

- If you want to include the account in a prenote file for verifying that EFT information is correct before sending live transactions to the account, leave the Prenote Date column blank. ActivityHD maintains this date when you generate and submit prenotes. If you want to skip prenoting, enter a date in this column.

- From the Type drop-down list, select the type of disbursement account. Your options are:

- In the Disbursement Sets and Disbursement Rules tables, add the run types for the employee and the disbursement rules to use with each run type. Run types determine which disbursement rules are applied when a payroll run is processed. Disbursement rules are only used in conjunction with a payroll run. For each run type you need to add for the employee, do the following:

- In the Disbursement Sets table in the Run Type column, select the run type.

- In the Begin Date column, enter the earliest date the run type is valid for the employee. If the run type is valid now, you can leave the column blank.

- In the End Date column, enter the date the run type expires for the employee. If the run type should remain in effect indefinitely, you can leave the column blank.

- With the same row still selected in the Disbursement Sets table, move to the Disbursement Rules table and select a disbursement method from the Method drop-down list. Your options are:

- Direct Deposit. This option is visible only if you set up one or more accounts in the Disbursement Accounts table. If you select this option, the Direct Deposit Account column is enabled. From the drop-down list, select the bank account to disburse funds to.

- Printed Check

- In the Calculation column, select how to determine the amount to disburse by the selected method. Your options are:

- Amount. If you select this option, the Amount column is enabled. Enter the flat amount to disburse by the selected method.

- Percent. If you select this option, the Percent column is enabled. Enter the percentage of pay to disburse by the selected method.

- Group. If you select this option, the Group column is enabled. Select a check line group. The amount of the disbursement equals the total result for the check lines in the selected group.

Remainder. If you select this option, the remainder of the employee's pay after any other disbursement rules are applied (if any) will be disbursed by the selected method.

Notes

The last disbursement rule for every disbursement set must be a remainder-type calculation.

If all pay is to be disbursed according to one rule, use a remainder-type calculation.

Deduction. Select this option to create a deduction disbursement, an employee-specific payment for a deduction or tax that was made on the check. A deduction disbursement credits the GL bank account but debits the original deduction line's liability account (instead of the check's payroll liability account). If you select this option, the Group column is enabled. Select a check line group. The amount of the disbursement equals the total result for the check lines in the selected group.

Example

You can use deduction disbursements to create employee-specific Health Savings Account (HSA) deposits without including the HSA amount in net pay. To do so:

- Create a group for HSA deduction lines.

- Create PRCodes for employee HSA deductions and employer HSA contributions.

- Add the PRCodes you just created to the group from step 1 and to the appropriate pre-tax groups (if you are excluding employee HSA deductions from income tax, Social Security, and Medicare).

- Create a disbursement account on the employee record for the employee's HSA bank account.

- Create a disbursement rule to make a direct deposit to the HSA bank account:

- Method: "Direct Deposit"

- Direct Deposit Account: disbursement account from step 4

- Calculation: "Deduction"

- Group: group created in step 1

- Repeat steps d-e for each disbursement rule you need to set up for the selected run type.

- Repeat steps a-f for each run type you need to set up for the employee.

Note

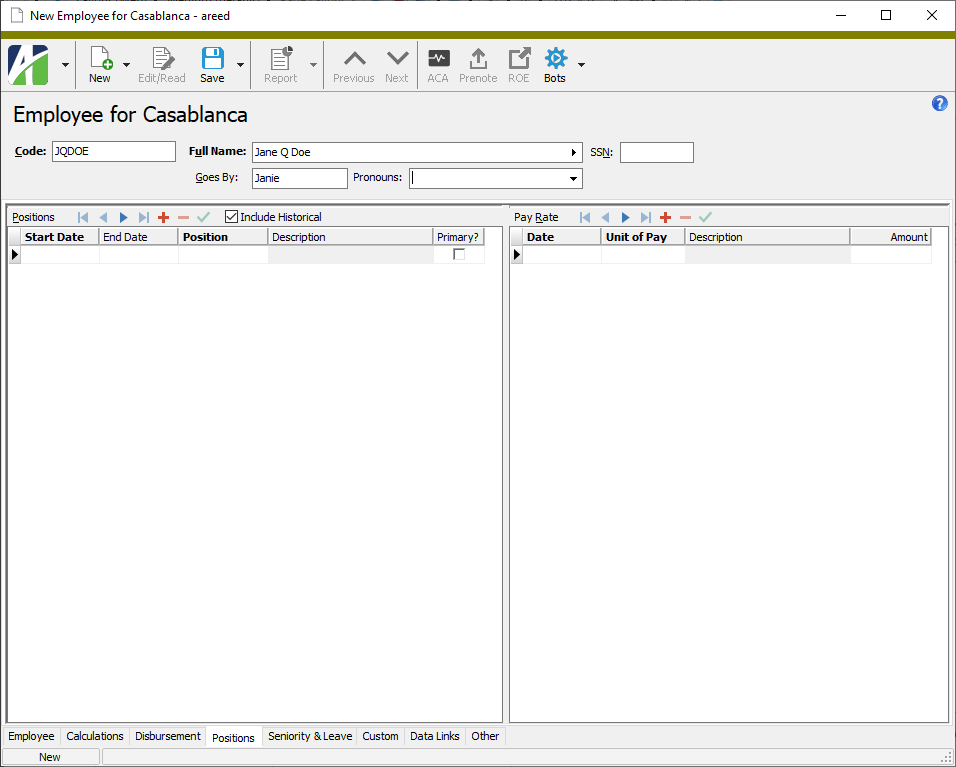

The Positions tab is only available if the Human Resources package is installed.

- To set up positions and pay rates for the employee, perform the following steps for each position:

- In the Positions table in the Start Date column, enter the date the employee started in the position.

- If you know when the employee's term in the position will end, you can enter an End Date.

- In the Position column, select the employee's position.

- If this is the employee's primary position, mark the Primary? checkbox. The primary position is used on employment reports like the EEO-4. The primary position is also used to supply values to check calculations when a PRCode has no position assigned to it.

- With the same row still selected in the Positions table, move to the Pay Rate table and enter the effective date of the pay rate in the Date column.

- In the Unit of Pay column, select the unit that pay for the position is based on.

In the Amount column, enter the amount of pay per unit of pay.

Example

If the unit of pay is "Hourly", enter the employee's hourly rate.

If the unit of pay is "Salary", enter the employee's annual salary.

- If you need to enter another pay rate for the selected position, add a row to the Pay Rate table and repeat steps e-g.

- If you need to add another position for the employee, add a row to the Positions table and repeat steps a-h.

- One position is assigned to the employee on that day.

- If multiple positions are assigned to the employee on that day, one and only one of the positions must be flagged as the primary position.

Note

On any given day one of the following must be true:

Errors will occur if multiple positions are assigned on the same day and neither is marked primary or two or more are marked primary. Be sure to enter an end date for positions which are not currently in effect.

![]() Complete the Seniority & Leave tab

Complete the Seniority & Leave tab

Note

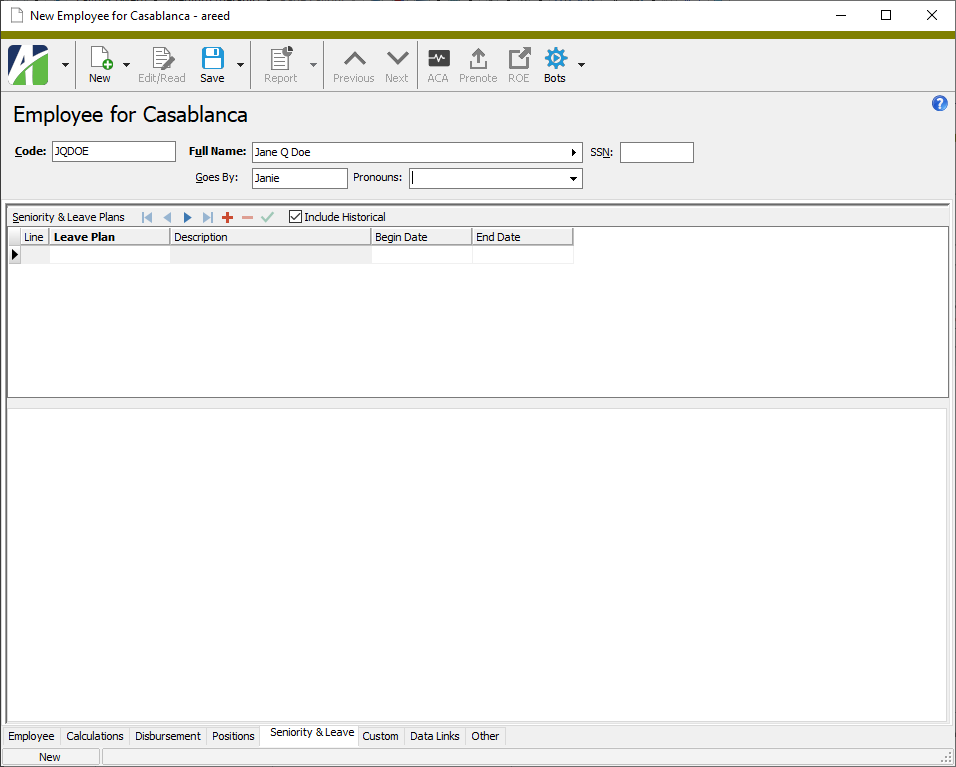

The Seniority & Leave tab is only available if the Human Resources package is installed.

- In the Seniority & Leave Plans table, enter the leave plans that apply to the employee. Do the following for each leave plan you need to enter:

- In the Leave Plan column, select a leave plan.

- In the Begin Date and End Date columns, enter the range of effective dates for the leave plan. If the leave plan is already in effect, you can leave the Begin Date blank. If the leave plan is in effect indefinitely, you can leave the End Date blank.

Tip

AccountingWare recommends that you create new leave entries rather than edit existing ones in order to maintain an accurate audit trail.

- When you finish, save the new employee record.

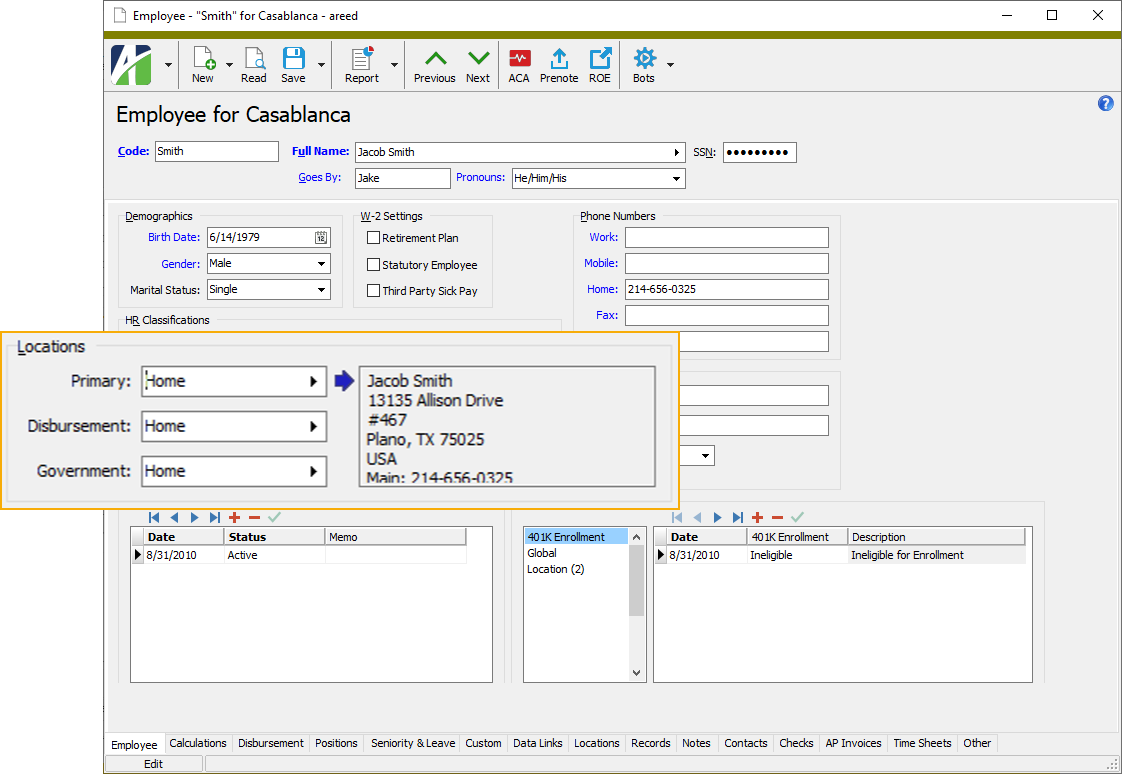

When you initially create a new employee record, you are prompted for an employee address. After you save the employee record, the Address section morphs into a Locations section where you can specify up to three locations for an employee based on the usage of the address. Often an employee has a single address for all three usages (primary, disbursement, government).

Manage employee locations

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

-

In the HD view, locate and double-click the employee record you need to manage locations for in order to open the record in the Employee window.

Note

If an address was entered when the employee record was created, the fields in the Locations section initially default to "Home" for all three usages. If no address was provided, these fields are blank.

- In the Locations section, select the address(es) to use for the employee based on the purpose of the communication. In many cases, one address is applicable for all three purposes.

- Primary. Select the employee's primary location (probably the employee's residence).

- Disbursement. Select the employee location to use for check disbursements, direct deposit prenotes, and pay statements.

- Government. Select the employee location to use for government documents such as W-2s, 1095-Cs, and ROE and T4 slips (Canada only).

- When you finish, save your changes.

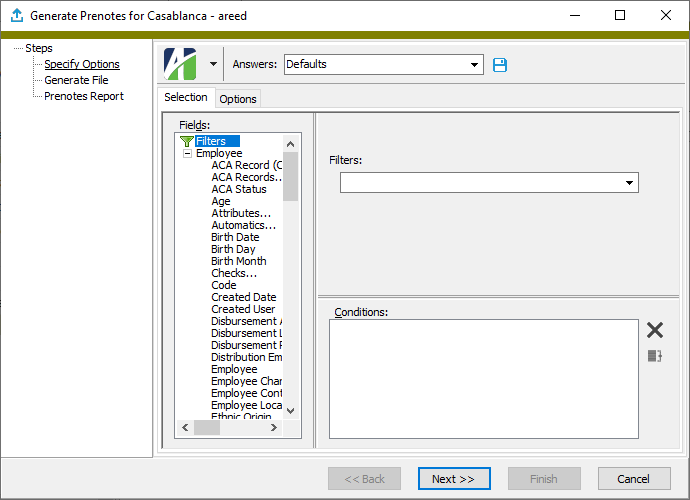

The Generate Prenotes wizard creates an ACH file that you can submit to your bank to verify EFT information stored on employee records: ABA routing number, account number, and account type. No money is actually deposited into the account. If your bank is able to process the prenote transactions successfully, no error is generated, and you can mark the employee's bank account as successfully "Prenoted".

Running the Generate Prenotes wizard is an optional process.

Note

The Generate Prenotes wizard does not currently support Canadian EFT.

Generate prenotes

To generate prenotes for employee bank accounts:

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the Generate Prenotes wizard:

- To generate prenotes for all or a filtered subset of eligible employees:

- Right-click and select Select and Generate Prenotes from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To generate prenotes for specifically selected employees:

- In the HD view, select the employees to prenote. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To generate a prenote for a particular employee from the Employee window:

- In the HD view, locate and double-click the employee whose bank account you want to prenote. The Employee window opens with the employee record loaded.

- Click

.

.

- To generate prenotes for all or a filtered subset of eligible employees:

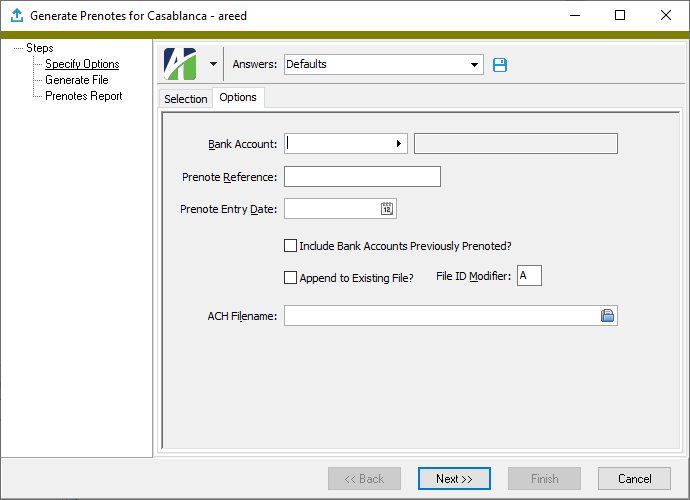

- Select the Options tab.

- In the Bank Account field, select the bank account from which funds for direct deposit will be drawn.

- In the Prenote Reference field, enter a code to indicate any special handling needed for all the entries in the batch.

- In the Prenote Entry Date field, enter the date to prenote the bank accounts.

- If you want to prenote all accounts in your selection, mark the Include Bank Accounts Previously Prenoted checkbox.

- If you are generating prenotes to add to an existing prenote file, mark the Append to Existing File checkbox.

- The File ID Modifier distinguishes multiple ACH files generated on the same day for the same participants. If this is the first or only ACH file you are generating today for the same participants, accept "A". Otherwise, enter a modifier (upper case A-Z or 0-9) to distinguish this file from other files generated today for the same participants.

- In the ACH Filename field, enter the path and file name for the prenote file or browse to the location.

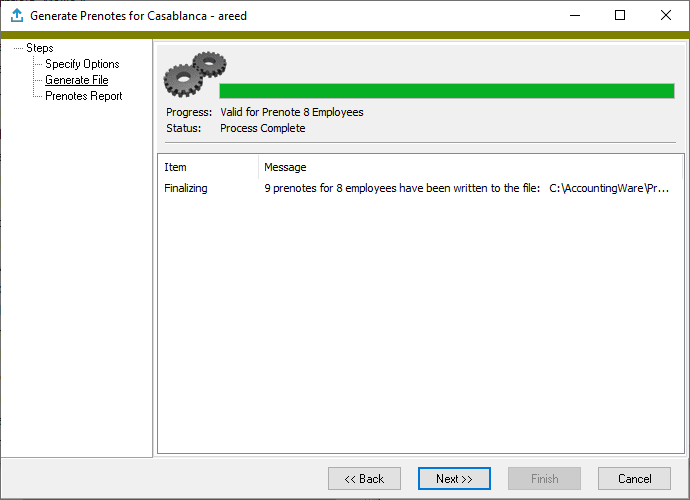

- Click Next >>. ActivityHD generates the prenote file.

- Click Next >>. ActivityHD prompts you to set up and run the prenote report.

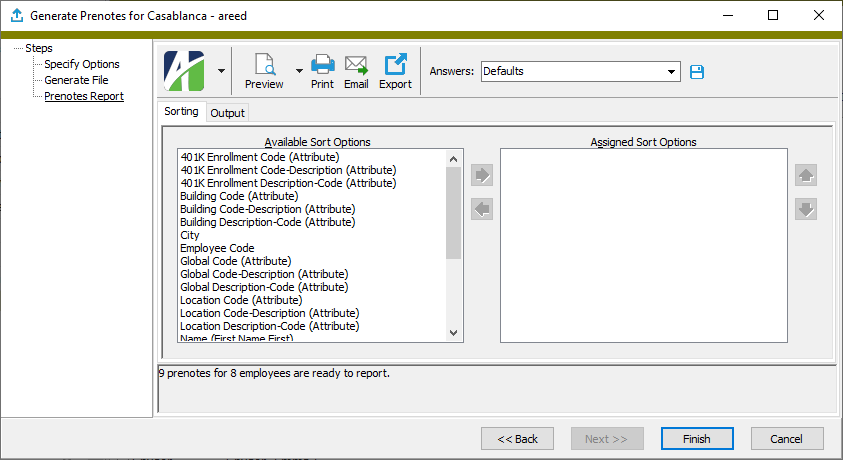

- On the Sorting tab in the Available Sort Options list box, highlight the field(s) to sort by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

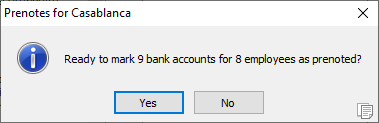

- Click Finish. ActivityHD prompts you to mark the employees as prenoted.

- Click Yes.

The following data extensions are available for the prenote report:

- Employees

- Employee bank accounts

Note

Effective 1/1/2015, the Social Security Administration will return electronic and paper wage reports which contain a W-2 with any of the following:

- Medicare Wages and Tips less than the sum of Social Security Wages and Social Security Tips.

- Social Security Tax greater than zero, but Social Security Wages and Social Security Tips equal to zero.

- Medicare Tax greater than zero, but Medicare Wages and Tips equal to zero.

The Generate W-2s wizard validates for these conditions.

ActivityHD produces W-2s for employees with any of the following:

- Non-zero income tax wages for federal, state, or local

- Non-zero Social Security wages

- Non-zero Medicare wages

- Box 12 amounts

- Box 14 amounts

In addition to generating W-2s, the W-2 process produces the W-3 form and creates a W-3 note to which it attaches a PDF of the W-3.

Because the W-2 process can create a W-2 record to which a PDF of the W-2 can be attached and a W-3 note to which a PDF of the W-3 can be attached, it is preferable that you enable attachments to take full advantage of the W-2 process features. However, the W-2 process can be completed without enabling attachments. If attachments are not enabled, W-2 records and W-3 notes are not created.

If Advanced Security is installed, you must have "Generate" access on PR W-2s in order to see and run the Generate W-2s wizard.

Some notes about creating W-2s for multiple states and localities

- The first W-2 is considered the primary W-2. The primary W-2 contains federal amounts unless the "State/Local" option is selected in the Amounts field on the Options tab of the Generate W-2s wizard. Subsequent pages for states and localities will have blank federal amounts and, if continuing with localities, the state amounts are blank.

- To create a separate W-2 for each state/local combination, set the '_MaxStateLocalCount' formula to "1" in the Crystal Reports .rpt file.

- It is possible to have state amounts without local amounts and local amounts without state amounts.

- Localities are always printed in the context of a state.

- If you mark Limit by State/Local Tax Entity on the Options tab and have a state of Ohio and locality of Cincinnati, then Cincinnati and Ohio print on one form. If the state is New Mexico and the locality is Cincinnati, then New Mexico prints on one form and Cincinnati on another (showing Ohio as the state).

![]() A few things you should know about generating W-2s

A few things you should know about generating W-2s

W-2 information is based on the built-in groups assigned to the PRCodes used on employee checks.

Some groups use only the employee side of the PRCodes which contribute W-2 information to them; namely: 401K, Social Security, Medicare, 403b, 408k6, 408p, and 501c. The Archer group uses only the employer side.

Caveats and reminders

Important!

ActivityHD does not enforce limits or federally mandated cutoffs during W-2 generation. You are responsible for maintaining all cutoffs in calculation expressions.

The figure below highlights some areas to consider when using ActivityHD to generate and print W-2s.

Missing Social Security Numbers

In compliance with the W-2 instructions, printed W-2s without social security numbers print "APPLIED FOR" in their place.

AccountingWare recommends that you avoid blank social security numbers altogether for the following reasons:

- Once the social security number is known, you will need to file a corrected W-2, Form W-2c.

- Social security numbers for new employees should be verified with the Social Security Administration.

- New hire reports require employees' social security numbers.

- E-Verify requires a social security number to determine if an employee is eligible to work in the United States.

IRS Printing Specifications

The IRS has the following guidelines for printing W-2s:

- Use black ink only.

- Ensure that entries are not too small or too large. 12-point Courier font is preferable.

- Do not use dollar signs in monetary fields.

- Do not inappropriately mark the Retirement Plan checkbox.

- In block e, enter only the employee's first name and initial in the first box, last name in the second box, and suffix (optional) in the third box.

Built-in layouts

ActivityHD provides two built-in W-2 layouts:

- Copy A 5201 - Prints on the standard layout for the IRS's Copy A form.

- L4UP Blank Paper - Prints the complete W-2 form plus data. This form requires blank 4-up stock with full backer information for the employee.

Generate W-2s

Generate W-2s

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the Generate W-2s wizard.

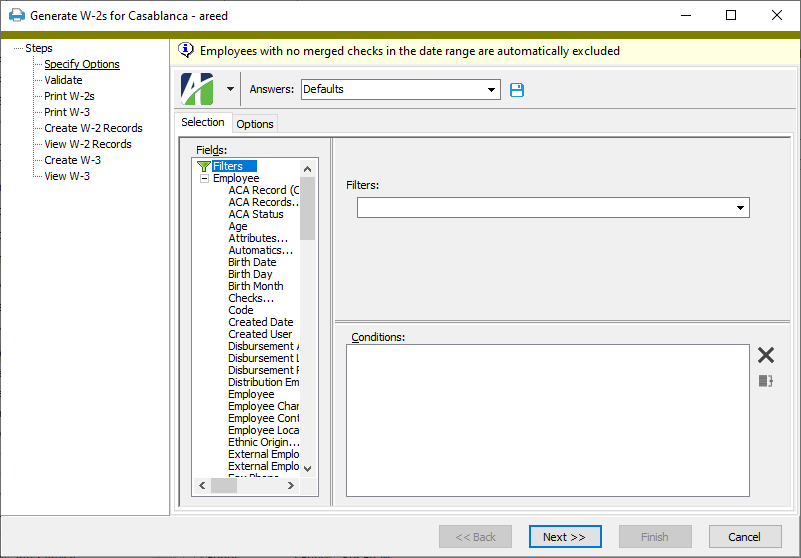

- To generate W-2s for all or a filtered subset of employees:

- Right-click and select Select and Generate W-2s from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

Note

Employees with no merged checks in the date range that you specify on the Options tab are automatically excluded from your selection.

- To generate W-2s for specifically selected employees:

- In the HD view, select the employees to generate W-2s for. You can use Ctrl and/or Shift selection to select multiple records.

- Select

> Edit > Generate W-2s.

> Edit > Generate W-2s.

- To generate a W-2 for a particular employee from the Employee window:

- In the HD view, locate and double-click the employee to generate a W-2 for. The Employee window opens with the employee record loaded.

- Select

> Edit > Generate W-2s..

> Edit > Generate W-2s..

- To generate W-2s for all or a filtered subset of employees:

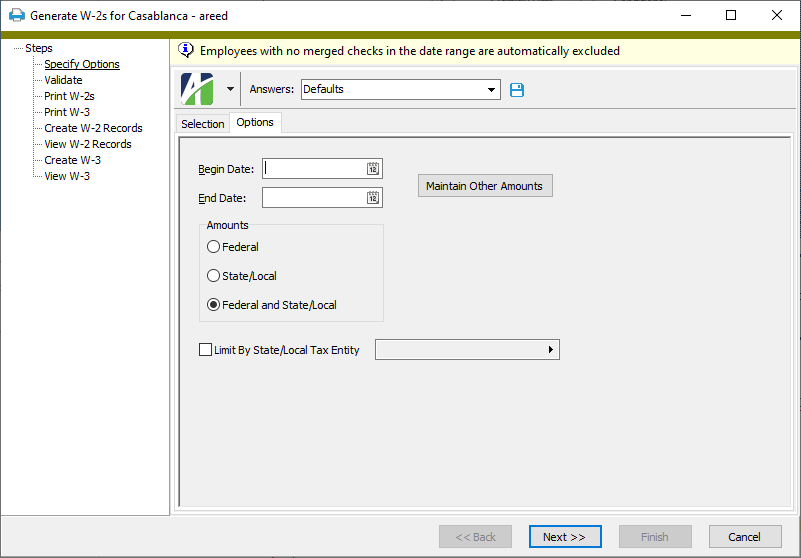

- Select the Options tab.

- In the Begin Date and End Date fields, enter the range of dates for which to select data to include when generating the W-2s.

- In the Amounts field, select the type of government for which to print W-2 information. Your options are:

- Federal

- State/Local

- Federal and State/Local

- If you selected "State/Local" or "Federal and State/Local" in the Amounts field, the Limit by State/Local Tax Entity checkbox is enabled. Mark the checkbox to enable the adjacent field so you can specify the state or local tax entity to report W-2 information for.

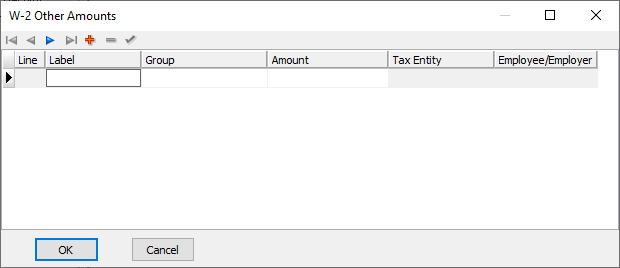

- Click Maintain Other Amounts to open the W-2 Other Amounts dialog box where you specify the amounts to report in Box 14.

-

For each Box 14 item you need to set up, perform the following steps:

Click here to see special notes for specific tax years.

- In the Label column, enter the label to print in Box 14 for the amount.

- In the Group column, select the group that provides the Box 14 amount.

- From the Amount drop-down list, select the type of amount to print in Box 14. The options vary depending on the group you selected.

- If the group you selected is qualified by tax entity, the Tax Entity column is enabled. Select the tax entity to report amounts for.

- If the group you selected is qualified by employee or employer, the Employee/Employer column is enabled. From the drop-down list, select the qualifier that applies to the Box 14 amount. Your options are:

- <blank>

- Employee

- Employer

Note

ActivityHD supports up to 8 Box 14 amounts per W-2 form. All built-in 4-up report designs can accommodate up to 5 amounts.

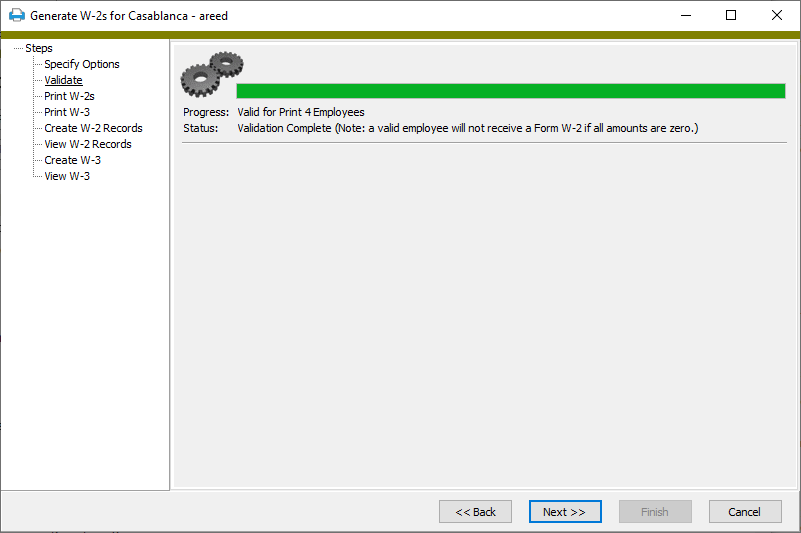

- Click Next >>. ActivityHD validates the W-2 information and reports any errors or warnings.

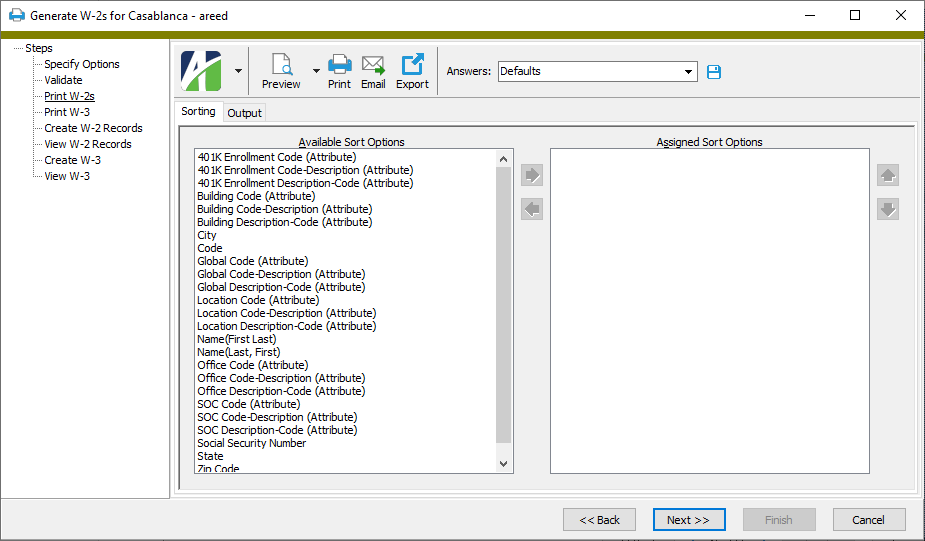

- Click Next >> to reveal the Sorting tab.

- In the Available Sort Options list box, highlight the field(s) to sort the report by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

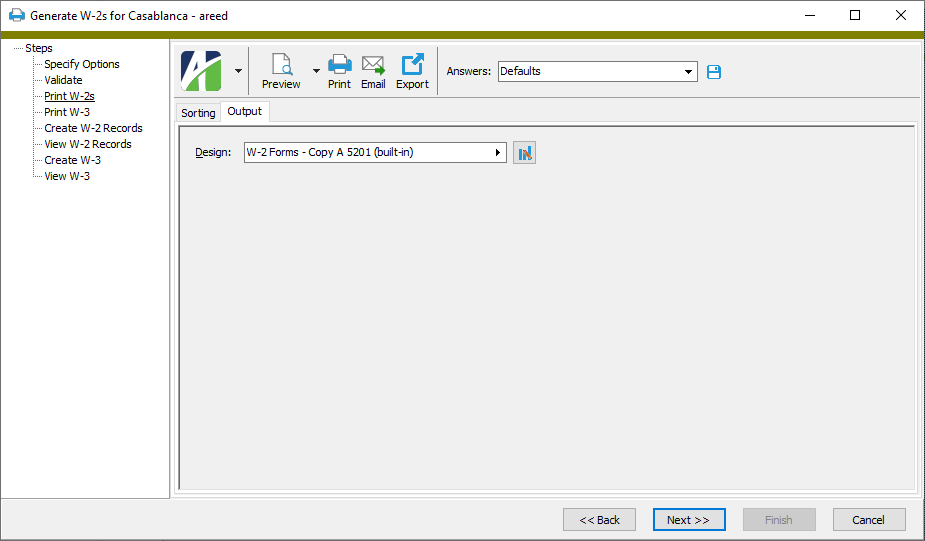

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the W-2 form to print.

There are two built-in designs for W-2s:

- W-2 Forms - Copy A 5201

- W-2 Forms - L4UP Blank Paper

Tip

If you're printing hard copies of the W-2 forms, correctly load the paper in the printer and print a test copy to check for proper alignment before committing to printing all the forms!

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

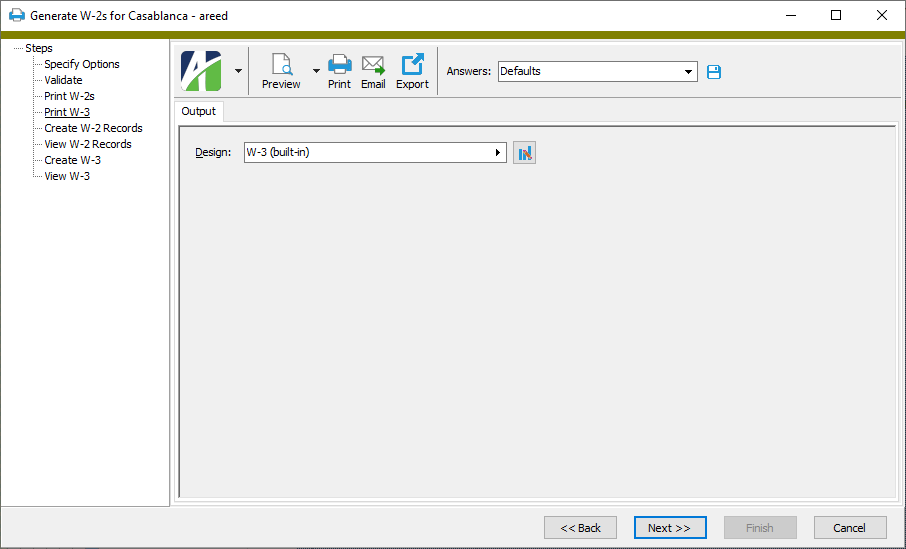

- Click Next >>. The Output tab for W-3s displays.

- In the Design field, look up and select the W-3 form to print.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

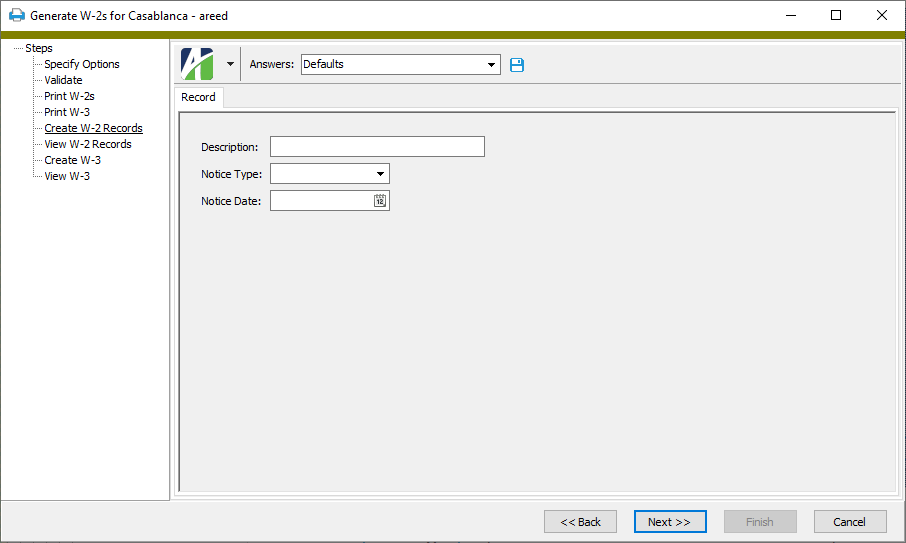

- Click Next >>. The Record tab displays.

- Enter a Description to associate with the W-2 records you are creating.

- From the Notice Type drop-down list, select how to deliver W-2 notices. Your options are:

- <blank>

- Web

- Other

- In the Notice Date field, enter the notice date for W-2 records.

-

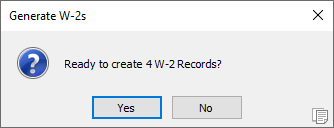

Click Next >>. ActivityHD prompts you to confirm that you're ready to create W-2 records.

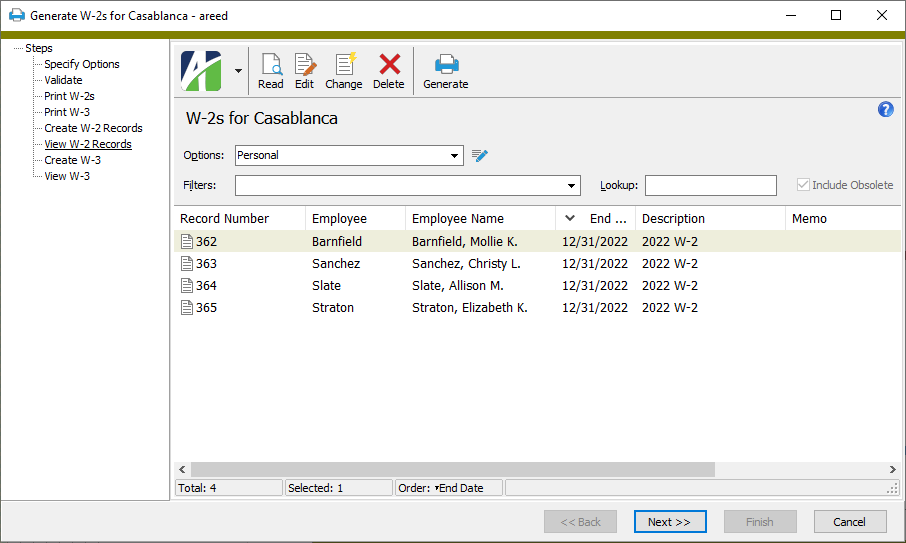

- Click Yes. ActivityHD creates the W-2 records for each employee in your selection and attaches a PDF of each employee's W-2.

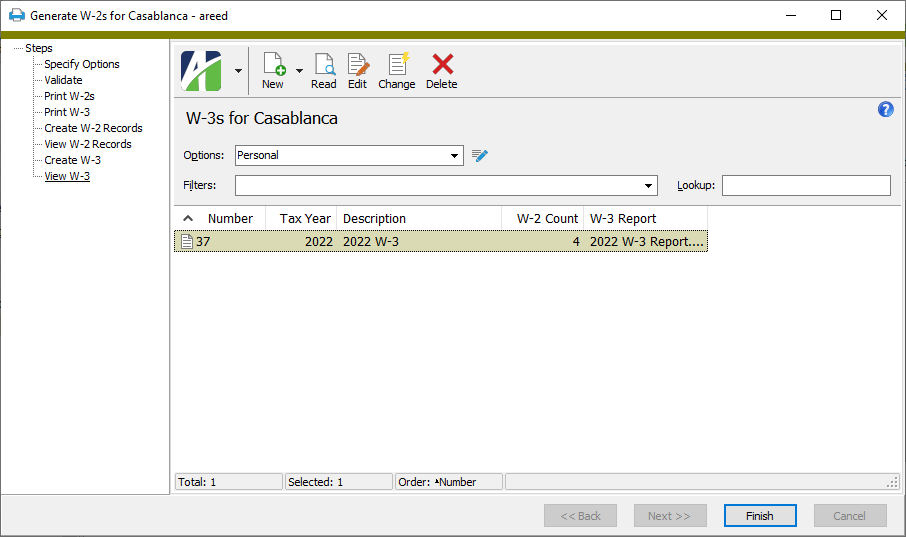

At this point, you can double-click the items in the right pane to drill down to the underlying W-2 records.

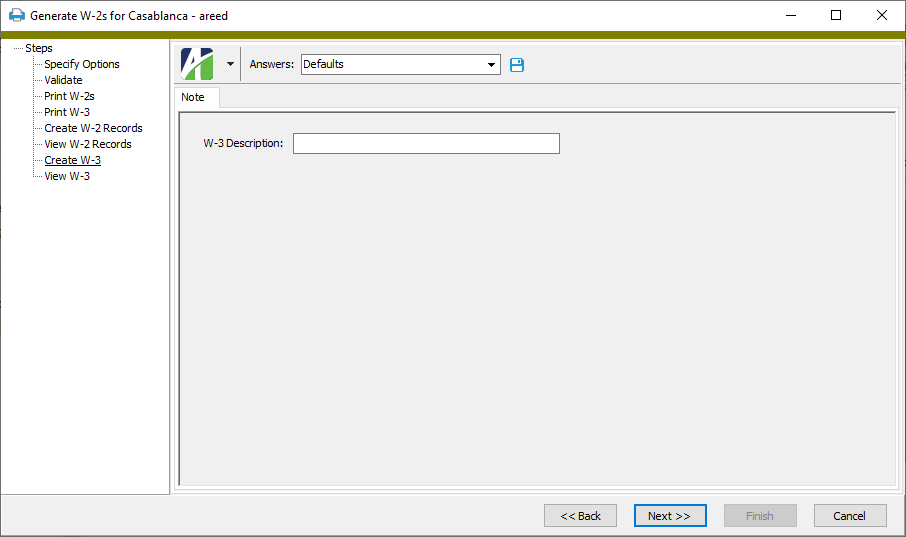

- Click Next >>. The Note tab displays.

- Enter a W-3 Description for the W-3.

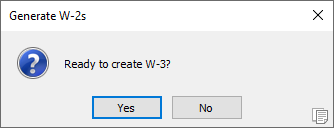

- Click Next >>. ActivityHD prompts you to confirm that you're ready to create the W-3 record.

-

Click Yes. ActivityHD creates the W-3 record and attaches a PDF of the W-3 to it. The record contains references to each of the W-2s created in the process.

At this point, you can double-click the W-3 item in the right pane to drill down to the actual W-3 record.

- Click Finish.

The Employee Create Totals File wizard creates a file of employee totals based on the record and field definitions in an export control you designate. Only merged checks are selected for inclusion in employee totals. Depending on the content set up in the export control, the export totals file can be sent to government entities (e.g., for electronic filing of W-2s, new hire reporting), insurance and retirement administrators, company managers and supervisors, et al.

Note

Check-specific information such as batch sequence numbers and check numbers are not available for inclusion in the employee totals file.

Before you attempt to create an employee totals file, ensure that the address on the company record, as well as the export control, export submitter (if required by the export control), and export employer (if required by the export control) records are set up.

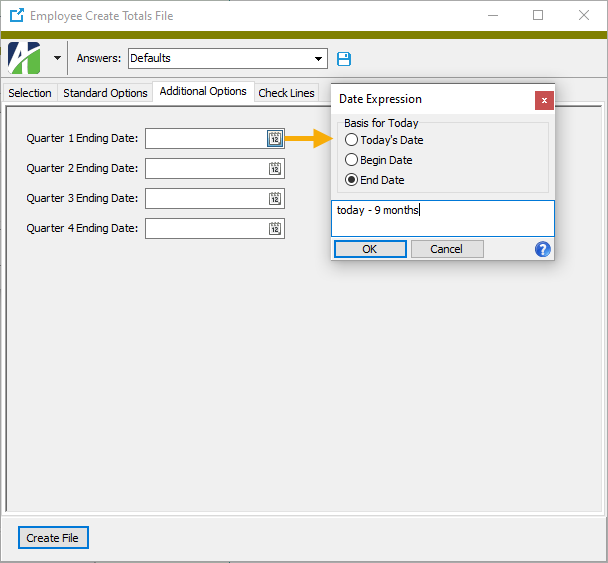

Tip: Use date expressions and saved answers to streamline totals file creation year over year

Using the begin or end date from the Standard Options tab along with date expressions on date fields on the Additional Options tab, you can simplify and standardize export totals file creation.

- Ensure the export control you plan to use to create the export totals file has prompts for the dates you want to report by; for example, to report by quarter, set up prompts for Quarters 1, 2, 3, and 4.

- On the Additional Options tab of the Employee Create Totals File process, enter date expressions relative to the begin or end date to determine the dates to report on. For example, if the Additional Options tab has prompts for each of the four quarters and you want to base the dates on the end date that the user enters on the Standard Options tab, you could designate the following date expressions:

- For quarter 1, use "today - 9 months".

- For quarter 2, use "today - 6 months".

- For quarter 3, use "today - 3 months".

- For quarter 4, use "today".

- Configure any other options for the export totals file, leaving the date fields on the Standard Options tab blank.

- Create a saved answer based on the options settings.

- In the future, any time you run the Employee Create Totals File process for the export control, load the saved answer you created in the previous step.

- On the Standard Options tab, enter the appropriate begin date or end date. The dates on the Additional Options tab are calculated for you!

- Click Create File.

Create an employee totals file

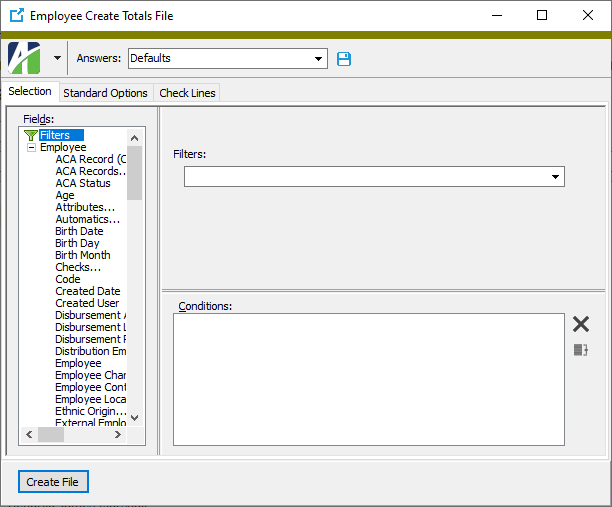

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the Employee Create Totals File wizard.

- To report totals for all or a filtered subset of employees:

- Right-click the Employees folder and select Select and Create Totals File from the shortcut menu.

On the Selection tab, define any filters to apply to the data.

- To report totals for specifically selected employees:

- In the HD view, select the employees to include in the totals. You can use Ctrl and/or Shift selection to select multiple records.

- Right-click and select Create Totals File from the shortcut menu.

- To report totals for all or a filtered subset of employees:

-

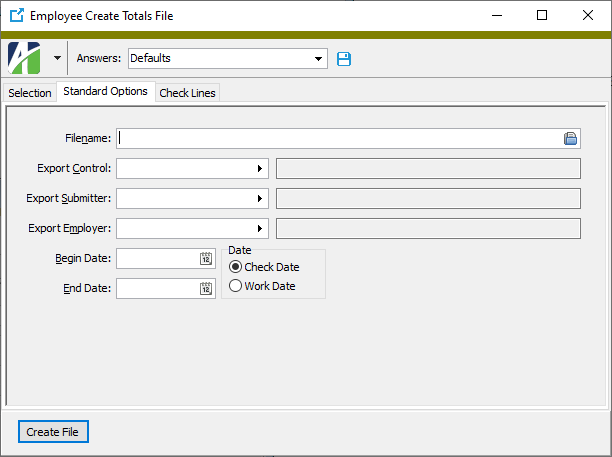

Select the Standard Options tab.

- In the Filename field, enter the path and file name for the export totals file or browse to the location. Append an appropriate file extension (.xml, .csv, .txt, etc.).

- Select the Export Control to use to create the export totals file. The export control specifies the record and field definitions used to create the totals file.

- The Export Submitter field is enabled if the selected export control has fields with submitter as the origin. Select the submitter to use for the creation of the export totals file.

- The Export Employer field is enabled if the selected export control has fields with employer as the origin. Select the employer to use for the creation of the export totals file.

- In the Begin Date and End Date fields, enter the range of dates for which to include information for the totals file.

- In the Date field, select the type of date to limit employee group totals by. Your options are:

- Check Date. Selects check lines by the date on the check that contains the check line.

- Work Date. Selects check lines by the work date on the check line.

-

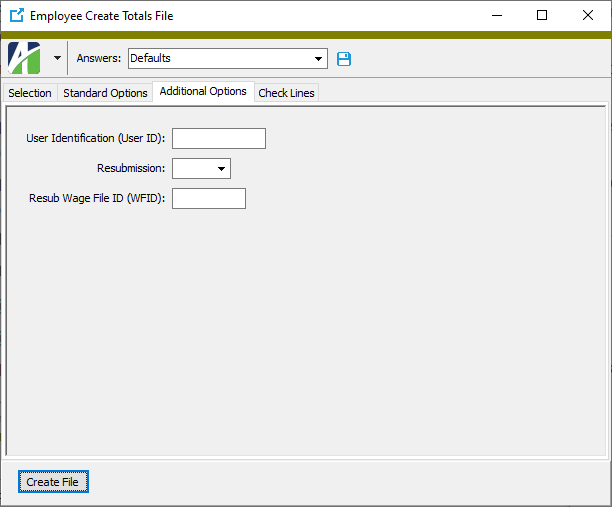

If the export control you selected contains fields set up to prompt for more information, the Additional Options tab is visible. Select the tab.

- Respond to each of the prompts as appropriate.

-

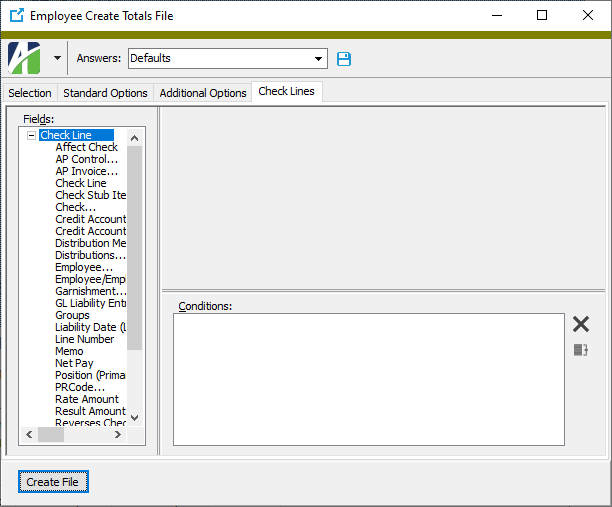

Select the Check Lines tab.

- Define any conditions on check lines to apply to the data.

-

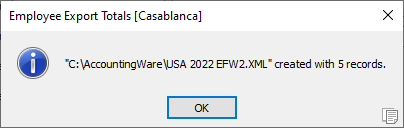

Click Create File. ActivityHD notifies you how many records were created.

- Click OK. The totals file is created and saved to the designated location. You can open the file in Excel.

Tip

You can run the Employee Totals File Report to view the contents of the employee totals file.

![]() Create an export totals file for SUTA reporting

Create an export totals file for SUTA reporting

You can use export controls to create state unemployment upload files. ActivityHD provides export controls with the distribution files at ...\Extras\Payroll\Export Controls\State Unemployment\. The file names have the format XX20nn SUTA.xml, where XX is the two-character postal code for the state and nn is the last two digits of the tax year.

Create an export totals file for SUTA reporting

Preparation

Import the export control.

Import the export control.

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > Export Controls folder.

-

Right-click and select Import from the shortcut menu. The Import Export Controls wizard starts.

-

In the File field, click

and browse to and select the export control to import. Find SUTA export control files at ...\Extras\Payroll\Export Controls\State Unemployment\.

and browse to and select the export control to import. Find SUTA export control files at ...\Extras\Payroll\Export Controls\State Unemployment\. - Click Open to load the file.

- Click Next >>. You are prompted to confirm the import.

- Click Yes. You are notified when the import completes.

- Click Finish.

The export control is now available in the Export Controls folder.

- Create an export submitter record, if needed. Typically, you can use the same export submitter that you use for federal and state W-2 files.

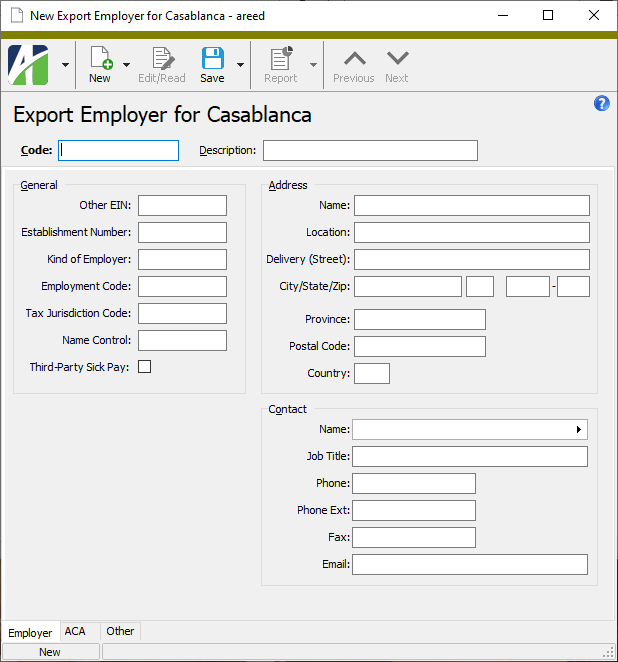

Create an export employer record for the state you are creating the upload file for if one does not already exist. For this record, you need only fill in the Code, Description, and Other EIN fields. In the Other EIN field, enter your state UI account number.

Create an export employer record for the state you are creating the upload file for if one does not already exist. For this record, you need only fill in the Code, Description, and Other EIN fields. In the Other EIN field, enter your state UI account number.

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > Export Employers folder.

- Click

. The New Export Employer window opens.

. The New Export Employer window opens.

- Enter a unique Code for the export employer.

- Enter a Description of the export employer.

- In the Other EIN field enter your state UI account number.

- Save the new export employer record.

Note

Some state SUTA export controls require special setup before they can be imported. Namely:

- "HrWorkAll" group. A number of states require you to report hours worked. The SUTA export controls calculate hours worked from the total Source amount of the check lines in the HrWorkAll group. HrWorkAll is not a built-in group. If you use a different group for hours, either edit the XML file before importing the export control or rename your hours group temporarily, import the export control, and then rename it back to the original name.

- "AK Geographic Code" attribute. Assign attribute values as appropriate to employees in Alaska. (Refer to https://labor.alaska.gov/estax/forms/TQ01D.pdf for codes and descriptions.)

- "DC Worker Relationship" attribute. Assign attribute values as appropriate to employees in the District of Columbia. (See Appendix 12.1 in https://essp.does.dc.gov/ESSP%20File%20Specifications%20V1_07.pdf.)

- IN "WComp" attribute. Assign attribute values as appropriate to employees in Indiana. This attribute determines the Standard Occupation Class (SOC) code.

- IN "EmpType" attribute. Assign attribute values as appropriate to employees in Indiana. This attribute indicates the Seasonal code (FT = full-time, PT = part-time, nn = seasonal, where nn is a two-digit seasonal code).

- NM "PRDept" attribute. This attribute is used in New Mexico to determine the owner/officer (Dept 4 = Y, Other = N).

- NM "NMWComp" group. This group is used to calculate New Mexico workers' compensation fees (total Result amount). Before you import the NM export control, create the group or rename your existing group.

- VT "PayType" attribute. Vermont uses this attribute to determine hourly employees (PayType = H).

Create the state unemployment upload file

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Right-click the Employees folder and select Select and Create Totals File from the shortcut menu.

- On the Selection tab, define any filters to apply to the data. In general, you can skip the Selection tab when creating the state unemployment upload file since the export control selects only employees with non-zero compensation in the state.

- Select the Standard Options tab.

- In the Filename field, enter the path and file name for the output or browse to the location. Append an appropriate file extension (.xml, .csv, .txt, etc.) Some states dictate the name of the file.

- In the Export Control field, select "XX20nn SUTA", where XX is the two-character postal code of the state you are creating the upload file for and nn is the tax year.

- The Export Submitter field is enabled if the selected export control has fields with submitter as the origin. Select the submitter to use for the state unemployment upload file.

- The Export Employer field is enabled if the selected export control has fields with employer as the origin. Select the employer to use for the state unemployment upload file.

- In the Begin Date and End Date fields, enter the range of dates for which to include information in the file.

- In the Date field, select "Check Date".

- If the export control you selected contains fields set up to prompt for more information, the Additional Options tab is visible. Select the tab.

- Respond to each of the prompts as appropriate.

- Select the Check Lines tab.

- Define any conditions on check lines to apply to the data.

- Click Create File. ActivityHD notifies you how many records were created.

- Click OK. The totals file is created and saved to the designated location.

Review the upload file

Files saved in CSV (comma-separated values) format can be reviewed in Excel. If you change something in the Excel file, ensure that you do not change the file extension from .csv when you save the file.

To review files saved as text, run the Employee Totals File Report (Payroll/Human Resources > Employees > [right-click] > Report Totals File). Simply enter the name of the output file and the export control you used to produce it.

Finally, some states allow you to review your file online after it is uploaded.

Upload the file

Visit the state's upload site to upload the state unemployment file. Note that many states allow more than one upload format, so pay heed to the description of the export control to ensure you select the correct upload format.

Calculation details

For information on the field sources used in calculating state unemployment, click ![]() here.

here.

| Field | Source | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Federal EIN | The employer ID on tax entity "USA". | ||||||||||

| UI Account Number | From the export employer record specified in the Create Totals file. | ||||||||||

| Wages | All SUTA export controls use the following formulas to calculate wages. Sometimes only Total Wages are reported; sometimes Total Wages, Taxable Wages, and Excess SUTA are all reported. Regardless, these values are calculated the same way.

|

||||||||||

| Out-of-state Wages | Calculated same as "Wages" above except uses all wages not in tax entity "USA" and not in the state tax entity. | ||||||||||

| Hours Worked | Total Source amount of check lines in the HRWorkAll group (or your equivalent group). | ||||||||||

| Weeks Worked | Hours worked/40, not to exceed 13 or 14 (depending on state rules). | ||||||||||

| UI Due | Taxable unemployment wages * SUTA percent [(Tax:SUTA:Percent amount from built-in state segment item)/100]. |

You can delete an employee provided the employee has no checks, time sheets, or leave entries. When you delete an employee, the employee's contacts are automatically deleted.

To delete an employee, highlight the employee record in the HD view and click ![]() , or open the employee record and select

, or open the employee record and select ![]() > Edit > Delete. In either case, ActivityHD prompts you to confirm your action. Click Delete to delete the employee and its contacts.

> Edit > Delete. In either case, ActivityHD prompts you to confirm your action. Click Delete to delete the employee and its contacts.

![]() Flag an employee record as obsolete

Flag an employee record as obsolete

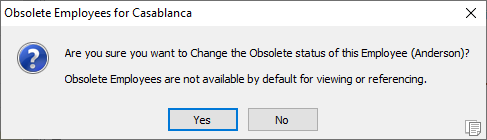

Flagging an employee record as obsolete also makes the employee's associated records obsolete. In other words, when an employee record is obsolete, the associated locations, contacts, W-2s, W-4s, garnishments, notes, etc., are obsolete. When viewed, each associated record displays a banner which indicates that the employee record is obsolete.

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- In the HD view, locate and highlight the employee record you need to flag as obsolete.

-

Right-click and select Obsolete from the shortcut menu. You are prompted to confirm that you want to change the status of the employee to obsolete.

- Click Yes.

Employees Listing

Purpose

The Employees Listing provides a list of employees tracked in Payroll.

Content

For each employee included on the report, the listing shows:

- employee code

- employee full name

- employee "goes by" name

- employee's preferred pronouns

- position

- hire date

- birth date

- current employment status.

In addition, you can include one or more of the following:

- employee details including: name and emergency contact, phone and address, email address, gender and marital status, W-2 information, social security number, social insurance number, statuses, employee locations (address lines 1 and 2, name lines 1 and 2, city, state, zip, country), attributes

- calculation details including: parameter references, parameter values, automatics

- disbursement information including: disbursement sets, disbursement rules, bank accounts

- Human Resources information including: job categories, ethnic origins, contacts, position pay rates

- seniority and leave plans

- notes

- timestamps

- memos

- custom fields.

The following total appears on the report:

- record count.

Print the report

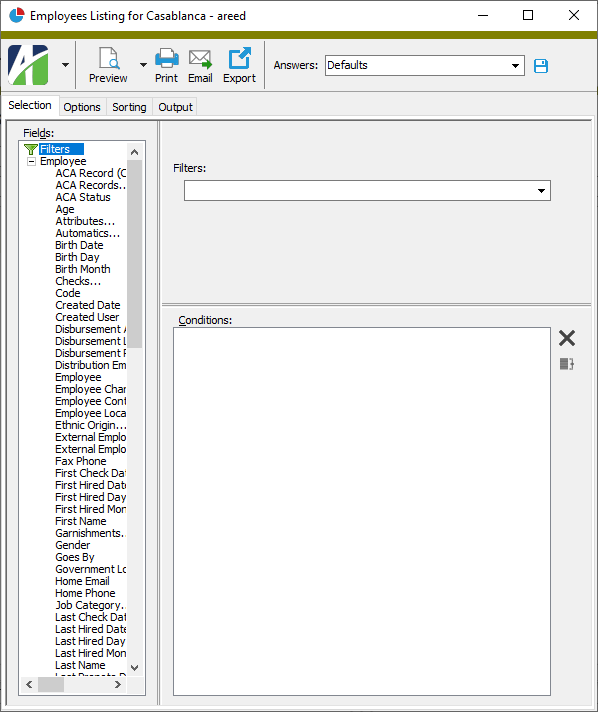

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of employees:

- Right-click the Employees folder and select Select and Report > Employees Listing from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected employees:

- In the HD view, select the employees to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select Employees Listing from the drop-down menu.

and select Employees Listing from the drop-down menu.

- To report on a particular employee from the Employee window:

- In the HD view, locate and double-click the employee to report on. The Employee window opens with the employee record loaded.

- Click

and select Employees Listing from the drop-down menu.

and select Employees Listing from the drop-down menu.

- To report on all or a filtered subset of employees:

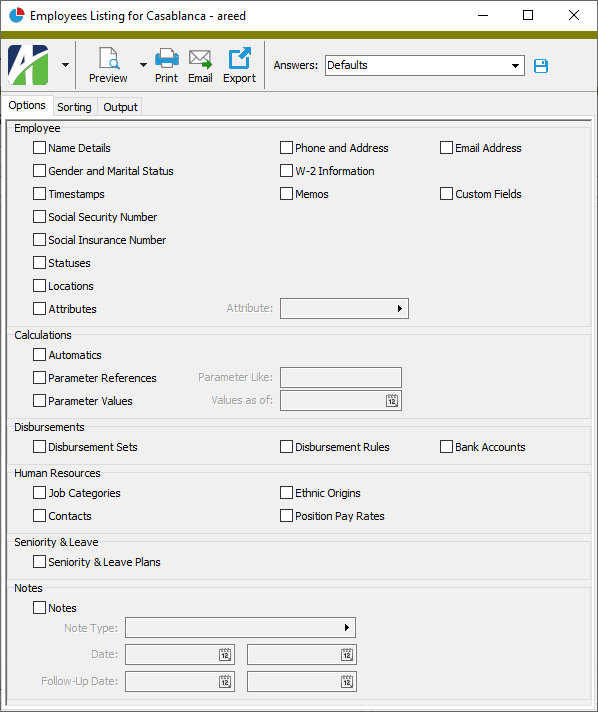

- Select the Options tab.

- Mark the checkbox(es) in the Employee section for the additional information to include:

- Name Details

- Phone and Address

- Email Address

- Gender and Marital Status

- W-2 Information

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Social Security Number (only visible if you have the appropriate access)

- Social Insurance Number (only visible if you have the appropriate access)

- Statuses

- Locations

- Attributes - If you mark this checkbox, the Attribute field is enabled. Select the attribute to include.

- Mark the checkbox(es) in the Calculations section for the additional information to include:

- Automatics

- Parameter References - If you mark this checkbox, the Parameter Like field is enabled. Enter a parameter mask or specific parameter to restrict which parameter references appear on the report.

- Parameter Values - If you mark this checkbox, the Parameter Values as of field is enabled. Enter the effective date as of which to include parameter values on the report.

- Mark the checkbox(es) in the Disbursements section for the additional information to include:

- Disbursement Sets

- Disbursement Rules

- Bank Accounts

- Mark the checkbox(es) in the Human Resources section for the additional information to include:

- Job Categories

- Ethnic Origins

- Contacts

- Position Pay Rates (this option is available if the Human Resources package is installed and you have appropriate access)

- Mark the Seniority & Leave Plans checkbox if you want to include seniority and leave plan information on the report.

- Mark the Notes checkbox if you want to include employee notes on the report. If you mark the checkbox, the remaining fields in the Notes section are enabled:

- To restrict notes on the report to a particular type, select the type in the Note Type field.

- To restrict notes to those entered in a particular date range, enter the range of dates in the Date fields.

- To restrict notes to those flagged for follow-up in a particular date range, enter the range of follow-up dates in the Follow-Up Date fields.

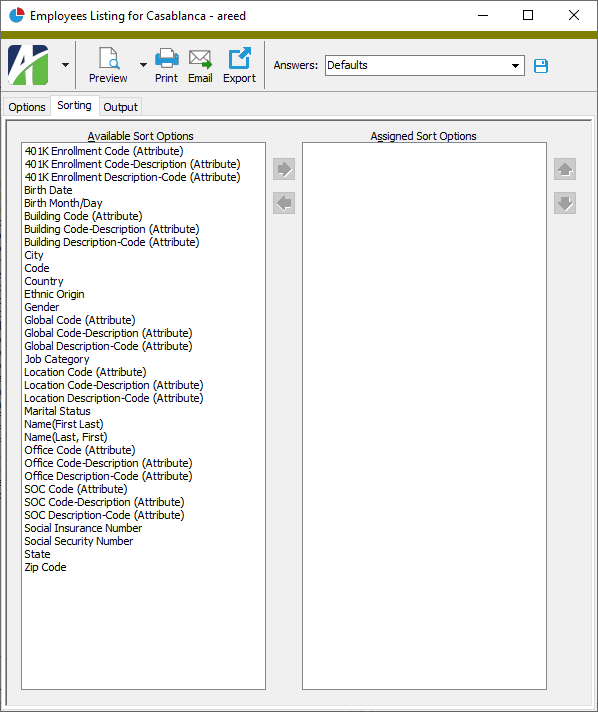

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the field(s) to sort the report by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Employees

- Locations

- Employee statuses

- Employee bank accounts

- Employee automatics

- Employee parameter values

- Employee attribute items

- Contacts

- Employee leave plans

Employee Balances Report

Purpose

The Employee Balances Report shows accrual and usage amounts by employee.

Content

For each employee on the report, the report shows:

- employee name

- beginning balance

- accrual amount

- usage amount

- balance.

In addition, you can include the following:

- check detail with running balances.

The following totals appear on the report:

- employee count

- grand totals.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the report set-up wizard.

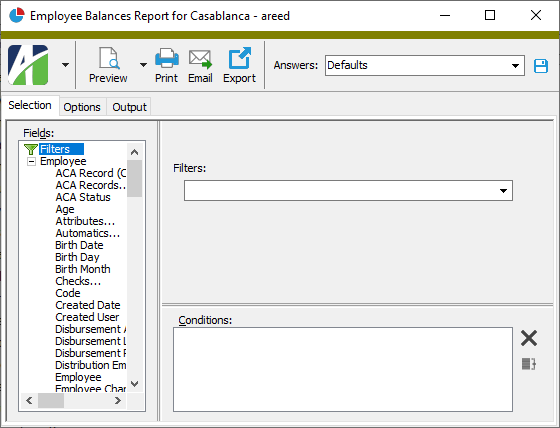

- To report on all or a filtered subset of employees:

- Right-click the Employees folder and select Select and Report > Employee Balances Report from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected employees:

- In the HD view, select the employees to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select Employee Balances Report from the drop-down menu.

and select Employee Balances Report from the drop-down menu.

- To report on a particular employee from the Employee window:

- In the HD view, locate and double-click the employee to report on. The Employee window opens with the employee loaded.

- Click

and select Employee Balances Report from the drop-down menu.

and select Employee Balances Report from the drop-down menu.

- To report on all or a filtered subset of employees:

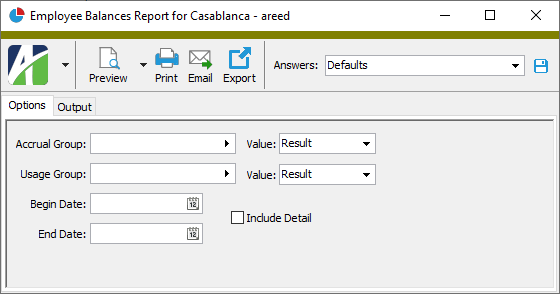

- Select the Options tab.

- In the Accrual Group field, select the payroll group to use as the accrual side of the employee balance.

- From the Accrual Group Value drop-down list, select which value to derive the accrual amount from. Your options are:

- Source

- Result

- In the Usage Group field, select the payroll group to use as the usage side of the employee balance.

- From the Usage Group Value drop-down list, select which value to derive the usage amount from. Your options are:

- Source

- Result

- In the Begin Date and End Date fields, enter the range of dates for which to include employee balance information on the report.

- To include the check detail that contributes to the employee balances, mark the Include Detail checkbox.

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extension is available for the report:

- Employees

Employee Labels

Purpose

Employee Labels produces a list of employee names or names and addresses formatted for label printing.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

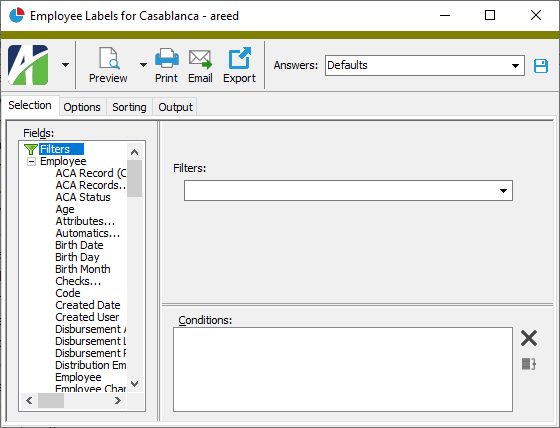

- Start the report set-up wizard.

- To create labels for all or a filtered subset of employees:

- Right-click the Employees folder and select Select and Report > Employee Labels from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To create labels for specifically selected employees:

- In the HD view, select the employees to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select Employee Labels from the drop-down menu.

and select Employee Labels from the drop-down menu.

- To create a label for a particular employee from the Employee window:

- In the HD view, locate and double-click the employee you want to create a label for. The Employee window opens with the employee loaded.

- Click

and select Employee Labels from the drop-down menu.

and select Employee Labels from the drop-down menu.

- To create labels for all or a filtered subset of employees:

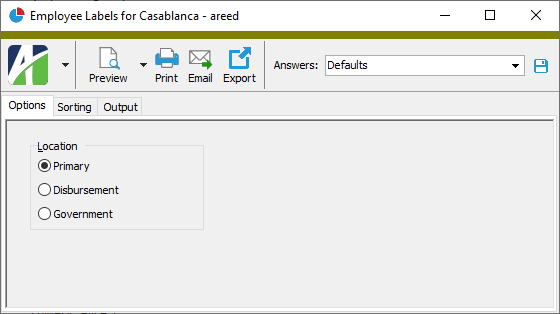

- Select the Options tab.

- Select the Location for which to print employee labels. Your options are:

- Primary

- Disbursement

- Government

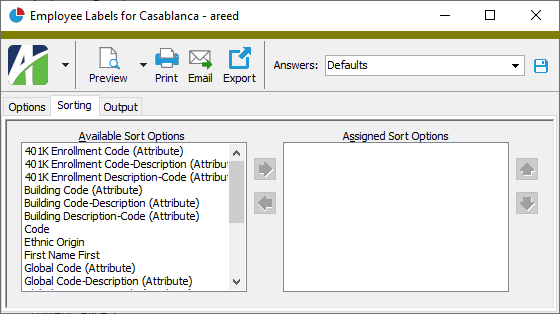

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the field(s) to sort the labels by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the report design to use.

There are two built-in report designs for Employee Labels:

- Employee Labels - Produces folder labels.

- Employee Address Labels - Produces mailing labels which include address lines 1 and 2, name lines 1 and 2, city, state, zip, and country.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extension is available for the report:

- Employees

Employee History Report

Purpose

The Employee History Report shows note, status, attribute, parameter value, position, pay rate, and/or record history by date for each employee included on the report. Beginning with version 8.26-0, record history includes information for state W-4s, I-9s, 1095-Cs, ACA, insurance coverage, and W-2s plus more information for garnishments and W-4s.

Content

For each employee on the report, the report shows:

- the employee name and code

- the employee's history records.

For each employee history record on the report, the report shows:

- the date

- the item type

- the item value(s) as of the indicated date

- related memos, descriptions, or note content

The following total appears on the report:

- employee count.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of employees:

- Right-click the Employees folder and select Select and Report > Employee History from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected employees:

- In the HD view, select the employees to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select Employee History from the drop-down menu.

and select Employee History from the drop-down menu.

- To report on a particular employee from the Employee window:

- In the HD view, locate and double-click the employee to report on. The Employee window opens with the employee loaded.

- Click

and select Employee History from the drop-down menu.

and select Employee History from the drop-down menu.

- To report on all or a filtered subset of employees:

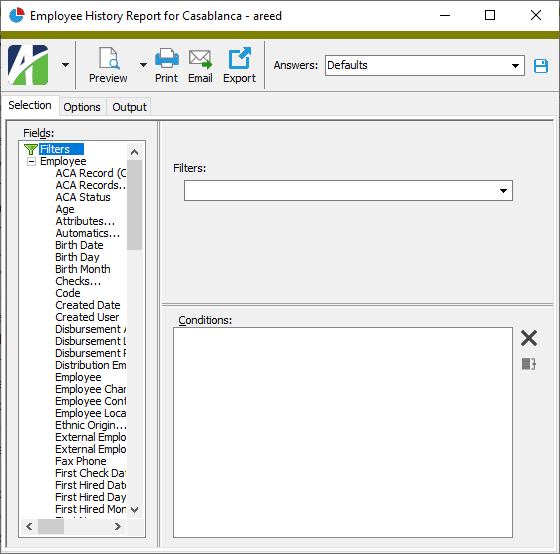

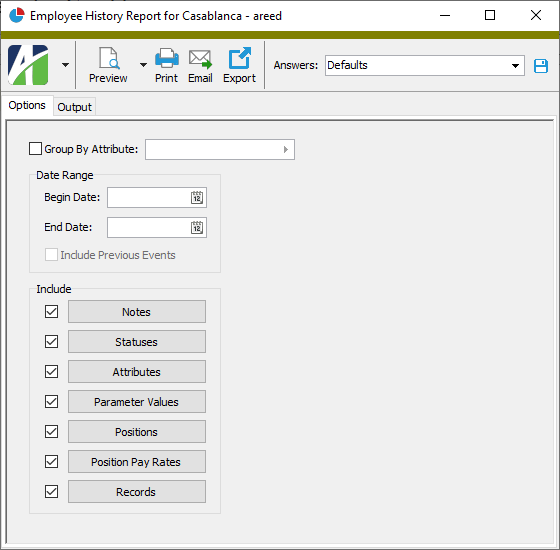

- Select the Options tab.

- To group information on the report by a particular attribute, mark the Group by Attribute checkbox and select the attribute in the field to the right.

- In the Begin Date and End Date fields, enter the range of dates for which to include employee history on the report.

- If you entered a begin date, the Include Previous Events checkbox is enabled. Mark this checkbox if you want the report to include history records that show the most recent past value for the same type of record for the same employee on the report (if a previous value exists). Previous events are included for statuses, attributes, parameter values, positions, position pay rates, and W-4 records. Previous events are not available for notes, garnishments, 1095-Cs, ACA records, insurance coverage records, T4s, and W-2s.

Example

Suppose an employee had a pay rate change during the reporting period and the last previous reported pay rate change for the employee occurred before the reporting period. If you mark the Include Previous Events checkbox, both the record with the pay rate change in the reporting period and the most recent past pay rate change would be included on the report.

- In the Include section, ensure that the checkbox(es) next to the type(s) of information you want to include history for are marked. You must include at least one detail type. By default, all checkboxes are marked. The information types include:

- Notes

- Statuses

- Attributes

- Parameter Values

- Positions (only visible if you are licensed for the Human Resources package)

- Position Pay Rates (only visible if you are licensed for the Human Resources package)

- Records

- To limit the information that appears for a selected information type, click the corresponding button to open the Selection dialog box, define any filters to apply to the data, and click OK. Repeat this step for each information type you want to filter.

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extension is available for the report:

- Employees

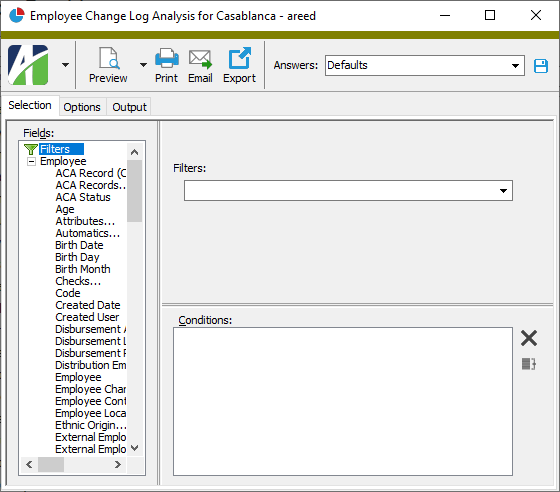

Employee Change Log Analysis

Purpose

The Employee Change Log Analysis report helps you investigate changes to employee records. In particular, the report shows when a change was made, who made the change, and the old and new values.

Content

For each employee on the report, the report shows:

- the changes made to the employee record.

For each change record on the report, the report shows:

- log name and sequence number of the change

- identifier

- type of change

- user who made the change

- date and time of the change

- field changed

- value before the change

- value after the change.

The following total appears on the report:

- record count.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of employees:

- Right-click the Employees folder and select Select and Report > Employee Change Log Analysis from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected employees:

- In the HD view, select the employees to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select Employee Change Log Analysis from the drop-down menu.

and select Employee Change Log Analysis from the drop-down menu.

- To report on a particular employee from the Employee window:

- In the HD view, locate and double-click the employee to report on. The Employee window opens with the employee loaded.

- Click

and select Employee Change Log Analysis from the drop-down menu.

and select Employee Change Log Analysis from the drop-down menu.

- To report on all or a filtered subset of employees:

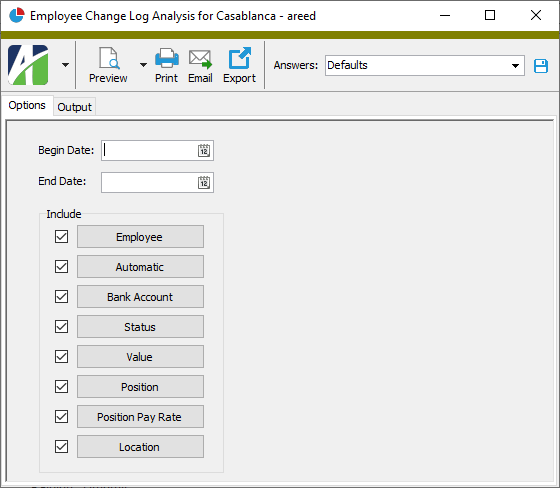

- Select the Options tab.

- In the Begin Date and End Date fields, enter the range of dates for which to include changes on the report.

- In the Include section, ensure the checkbox(es) next to the change log(s) you want to include changes for are marked. By default, all checkboxes are marked. The change logs may include:

- Employee

- Automatic

- Bank Account

- Status

- Value

- Position

- Position Pay Rate

- Location

Note

Buttons are only visible for change logs that are currently activated.

- To limit the changes that appear for a selected change log, click the change log button to open the Selection dialog box, define any filters to apply to the data, and click OK. Repeat this step for each change log you want to filter.

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extension is available for the report:

- Employees

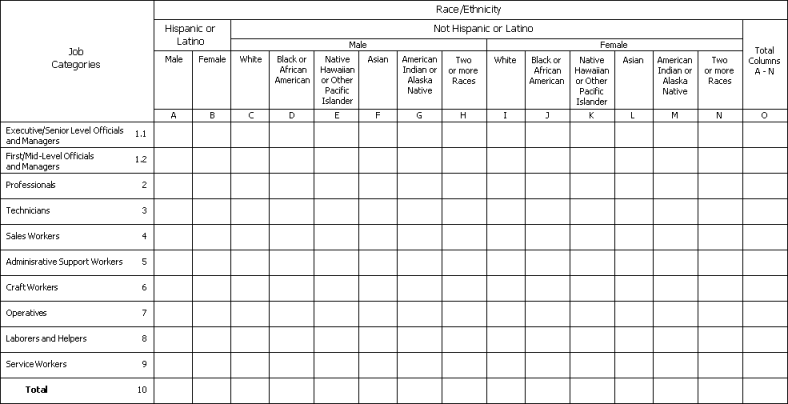

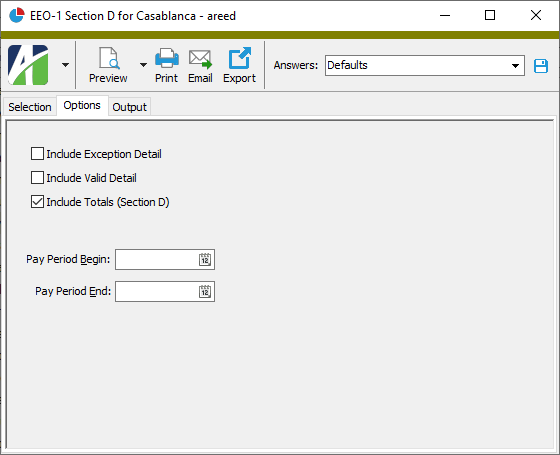

EEO-1 Section D

Purpose

The EEO-1 Section D report categorizes your employees by race/ethnicity, gender, and job category as prescribed by the Equal Employment Opportunity Commission.

Note

Currently, employees with gender set to "Non-Binary" are reflected in the exception detail section of the report. If you have employees classified as non-binary, you should run the report with the Exception Detail checkbox marked and use this information to enter a manual comment when you submit your data.

Content

In addition to the Section D information, you can include one or more of the following:

- exception detail

- valid detail (count of employees broken down by job category, sex, and ethnicity).

The following totals appear on the report:

- job category totals

- grand totals.

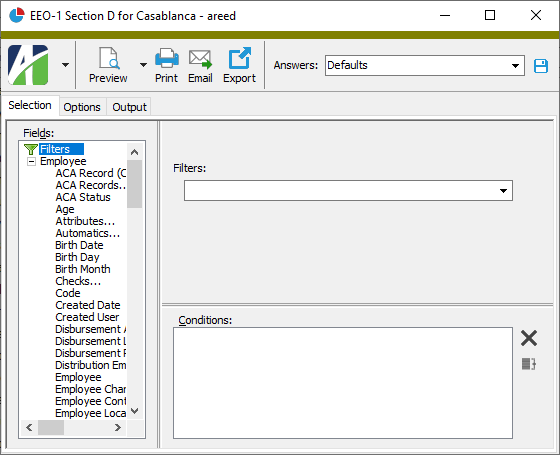

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of employees:

- Right-click the Employees folder and select Select and Report > EEO-1 Section D from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected employees:

- In the HD view, select the employees to include on the report. You can use Ctrl and/or Shift selection to select multiple records.