Tax deposit types let you identify the fields to track for calculating payroll tax deposits (income tax, Medicare, social security, unemployment). You can specify a payroll group for the fields that can be calculated from check lines.

You specify a tax deposit type when you create a tax deposit. Tax deposits record payments to federal, state, and local tax jurisdictions.

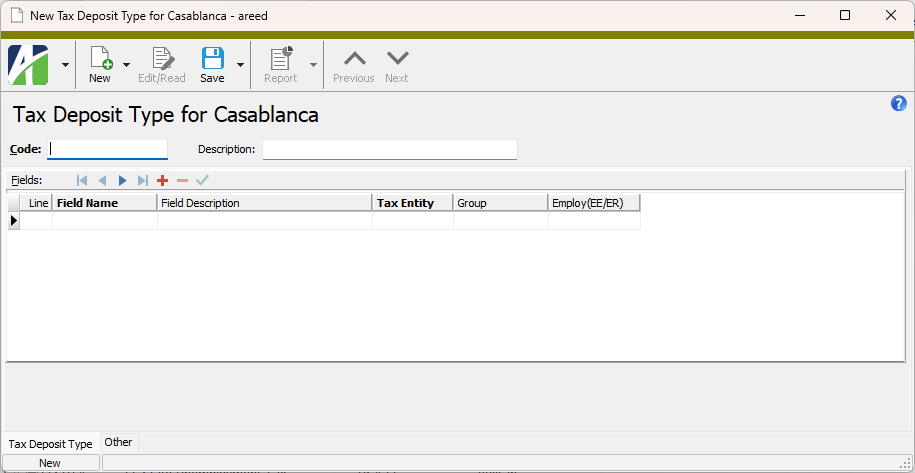

Create a tax deposit type

Create a tax deposit type

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > Tax Deposit Types folder.

- Click

. The New Tax Deposit Type window opens.

. The New Tax Deposit Type window opens.

- Enter a unique Code for the tax deposit type.

- Enter a Description of the tax deposit type.

- For each field for which you need to track amounts for the tax deposit type, do the following in the Fields table:

- In the Field Name column, enter a name for the field.

- In the Field Description column, enter a description of the field.

- In the Tax Entity column, select the tax jurisdiction that collects the tax.

- In the Group column, select the payroll group used to calculate the check line that contains the tax amount.

- From the Employ(EE/ER) drop-down list, select the party responsible for paying the tax. Valid options are:

- <blank>

- Employee

- Employer

- When you finish, save the new tax deposit type.

Tax Deposit Type Record ID

Tax Deposit Type tab

The rows in this table define the fields used to track amounts for the tax deposit type.

Tip

Line numbers in the Fields table are editable for user-defined tax deposit types. You can change the line numbers in order to reorder the rows in the table.

The tax entity for the jurisdiction which collects this type of tax.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

The group to use to calculate the check line that contains the tax amount.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

- <blank>

- Employee

- Employer

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Tax Deposits tab

The Tax Deposits pane shows the Tax Deposits HD view filtered to show all tax deposits of the selected tax deposit type.

Double-click a row in the pane to drill down to its record in the Tax Deposit window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

| Code | Description | Tax Entity(ies) | Purpose |

|---|---|---|---|

| USA | USA Federal Income Tax | USA | Total of tax deposits with type "USA" are reported on Form 941 |

| USAFUTA | USA Federal Unemployment Tax | USA | Total of tax deposits with type "USAFUTA" are reported on Form 940 |

| XX, where XX is the two-character state postal code (states with income tax only) | State Name Income Tax | USA.XX (for California, also USA.CA.SDI) | Total of tax deposits with type "XX" are reported for state XX income tax |

| XXSUTA, where XX is the two-character state postal code | XX State Unemployment Tax | USA.XX | Total of tax deposits with type "XXSUTA" used to calculate the amount of state XX unemployment taxes paid on time (Form 940, line 10) |

| COFAMLI | Colorado FAMLI Tax | USA.CO |

|

Extras\Payroll\PRBuiltInStateData.sql |

Tax deposit types security

Common accesses available on tax deposit types

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |