Some functions of segment items:

- Segment items define which groups a check line contributes to.

- Segment items that contribute to lists on check stubs or direct deposit advices are assigned to a check stub item.

- Segment items define how items are posted to the general ledger. One segment of a PRCode can determine the main part of the GL account, and dependent segments can determine other segments. The combined PRCode produces a combined GL account. Any parts of the account that are still missing can be supplied from the employee or can be entered manually during check entry.

- Segment items determine how to calculate sources, rates, and results for a check line.

- Segment items that define income tax calculations are assigned a federal, state, or local tax entity.

- Segment items define the scale for the source, rate, and result.

- Segment items declare parameters.

- Segment items determine if a deduction or tax PRCode is qualified by employee or employer.

- Segment items define which run type a PRCode belongs to.

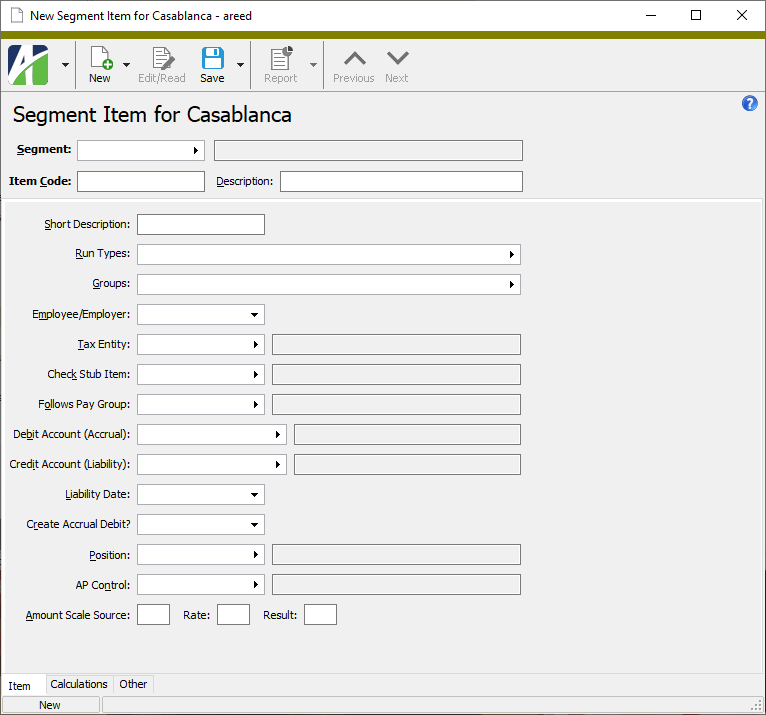

Create a segment item

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > Segment Items folder.

- Click

. The New Segment Item window opens.

. The New Segment Item window opens.

- In the Segment field, select the segment that the segment item belongs to.

-

Enter an Item Code for the segment item.

Note

Together, the segment and item code must be unique. You can reuse an item code on a different segment.

-

Enter a Description of the segment item. This description is used on reports and listings. Use the description to indicate what to expect in source, rate, and result amounts.

Example

"Hourly Pay" might imply a source amount of hours, an hourly pay rate, and the resulting dollars.

- Enter a Short Description of the segment item. The short descriptions of all segment items in a PRCode are combined to create a description for the PRCode. Descriptions are always separated by comma + space; blank short descriptions are skipped.

-

In the Run Types field, select the run types the segment item contributes to. The run type determines which check lines are created from employee automatics when payroll is processed. If you enter multiple run types, separate them with commas.

Note

The Ctrl and Shift selection features are available in the Find dialog box so you can select multiple run types. If you use this method to enter run types, ActivityHD automatically separates your selections with commas.

-

In the Groups field, select the check line groups to assign the segment item to. If you enter multiple groups, separate them with commas.

Note

The Ctrl and Shift features are available in the Find dialog box so you can select multiple groups. If you use this method to enter groups, ActivityHD automatically separates your selections with commas.

- The Employee/Employer drop-down list is enabled if the segment associated with this segment item is a deduction or tax segment. From the drop-down list, select the party responsible for the deduction or tax. Your options are:

- <blank>

- Employee. The deduction or tax is the employee's responsibility. The check line is subtracted from the check and a credit account is required to offset the bank account.

- Employer. The deduction or tax is the employer's responsibility. (We're using the term "deduction" loosely here since these are not deductions in the strictest sense.) Employer check lines do not affect the check; both a debit and a credit are required.

This setting does not apply to pay segments because pay items are always added to the check and post to a debit account. It does not apply to statistics segments because statistics items never affect the check; they either post a debit to a statistical ledger or do nothing.

-

Some groups, such as the built-in IncomeTax group, are qualified by a tax entity. In the Tax Entity field, select the tax entity to use to help define the total. If tax entities are assigned to more than one segment item in a PRCode, the tax entity on the rightmost segment wins.

While historically tax entities were only assigned to tax-type PRCodes, a tax entity can be assigned to any PRCode; thus, they can contribute to groups which are qualified by tax entity.

If this is a Type:Pay segment item and you only pay employees in a single state, select the tax entity to use for the segment item so that all subsequent pay PRCodes automatically inherit the tax entity. This renders it unnecessary to set up a PayState segment if you are a single-state employer.

- Select the Check Stub Item to assign this segment item to.

-

If the accrual debits for this segment item are in the same proportion as a group of pay lines, the segment item "follows pay". If the segment item follows pay, select the check line group it follows in the Follows Pay Group field. Any check line with a debit can be allocated against other pay lines. The Follows Pay Group field is disabled if the segment item represents employee taxes or employee deductions since these cannot follow pay.

Example

You can split employer Social Security expenses to GL departments in the same ratio as pay.

To do so, assign a group named "Wages" to the pay PRCodes that are the source of the follows pay. On the employer Social Security item, enter "Wages" as the follows pay group. Enter the Social Security expense account with wildcards in the GL department. If you distribute pay lines in the Wages group to three different departments, the employer portion of Social Security will be distributed to the same departments in the same proportions.

- The Debit Account (Accrual) field is enabled for employer deduction and tax items, for pay items, and for statistic items. Select the GL account to post the item to.

- The Credit Account (Liability) field is enabled for deduction and tax items. Select the payroll liability account to use for the cash posting from pay checks.

- The Liability Date field is enabled for deduction and tax items. Enter the date to post the GL liability entry. Your options are:

- <blank>. Inherit the top-level item's value (typically "Check Date").

- Check Date. Accrue the liability as of the check date.

- Work Date. Accrue the liability as of the check line's work date.

- The Create Accrual Debit? field is enabled for statistic items. From the drop-down list, select "Yes" to create a GL debit posting; otherwise, select "No".

- The Position field is enabled for pay items. If the PRCodes containing this segment item pay a specific position, select the position.

- The AP Control field is visible if you have the PR to AP interface installed and enabled for deduction and tax segment items. Select the default AP control to use for posting check lines with this segment item to AP.

- In the Amount Scale fields, enter the number of decimal places for the Source, Rate, and Result amounts. Acceptable values are 0-4. All entries of these amounts are automatically rounded to the number of decimal places you specify. Check calculations automatically round to this scale. The scale of a PRCode amount comes from the rightmost item of the PRCode that has a non-blank scale. By default, the scale of the built-in pay, deduction, tax, and statistic items is 2, which effectively makes 2 the default for all PRCodes. Change the scale of the built-in items or set the scale of the dependent items if you need to override that value. Changing this value changes the scale of all historical check lines.

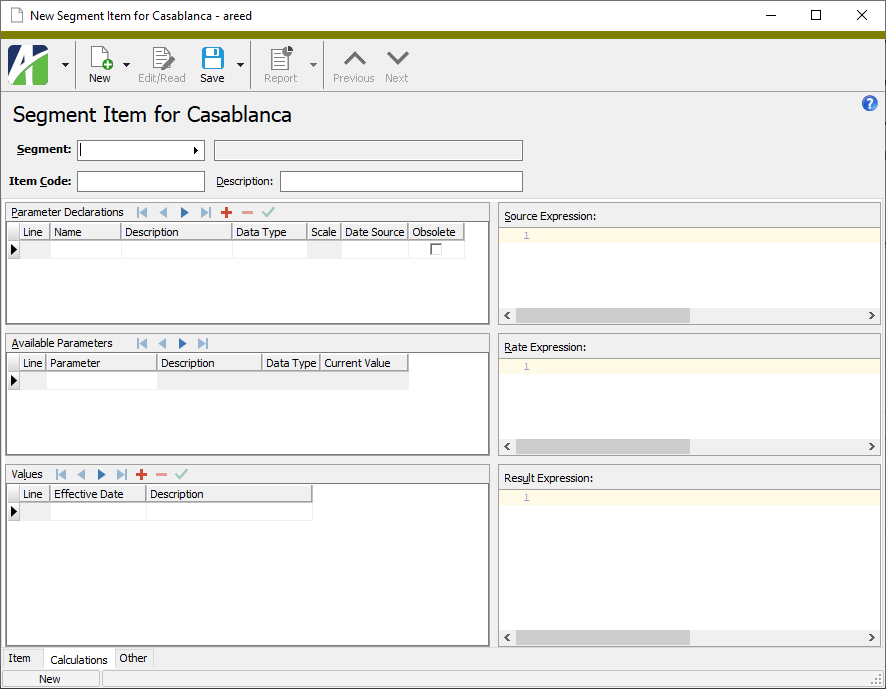

- Select the Calculations tab.

- In the Parameter Declarations table, declare any parameters you need for the calculation. To do so, do the following for each parameter you need to declare:

- In the Name column, enter a name for the parameter. The name must be unique among all parameters for the segment item. The name must begin with a letter and contain only alphanumeric characters.

- Enter a Description of the parameter.

- From the Data Type drop-down list, select the type of values to accept for the parameter. Your options are:

- Date

- Number

- String

- True/False

- The Scale column is enabled if you selected "Number" in the Data Type column. Enter the number of decimal places to allow in the parameter value.

- From the Date Source drop-down list, select the type of date which affects the parameter values. Your options are:

- Check

- Work

Example

An hourly pay rate might be effective as of a particular work date while a Medicare withholding rate would be based on the check date.

-

The Available Parameters table shows the parameters defined on this segment item as well as other segment items higher up in the segment item hierarchy. Select the row in the Available Parameters table for which you need to input a parameter value.

Note

Obsolete segment item parameters appear in this table only if a value is assigned.

- To enter a value for the selected parameter, do the following:

- In the Values table in the Effective Date column, enter the date that the parameter value takes effect.

- In the Value column, enter the value of the parameter as of the effective date.

- In the Description column, enter a description that explains the value entered.

Note

Parameter values defined on the employee override the values on the segment item.

- Repeat steps 22-23 for each parameter you need to input a value for.

-

In the Source Expression, Rate Expression, and Result Expression text boxes, enter the calculation expressions that produce the source amount, rate, and result amount, respectively, for a check line that contains this segment item.

Note

The expression fields have special editor features to simplify the process of composing expressions. Among the editor features are:

- Expression syntax highlighting

- Matching parenthesis detection

- Undo and redo

- Bookmarks navigation

- Line numbering in the margin

- Unsaved lines indication

- Search/case sensitive search

Calculation expressions can only refer to parameters declared on this segment item or on segment items higher up the hierarchy. Each parameter can have values assigned on this segment item, on a descendant segment item, or on the employee.

If the source expression is left blank, the source amount must be entered manually during check processing. If the rate expression is left blank but the result expression refers to it, the rate must be entered manually during check processing.

In addition to other parameters and functions available in calculation expressions, the result expression can use the keywords "Source" and "Rate" to refer to the corresponding values.

- Save the new payroll segment item.

A segment item cannot be deleted if it is associated with a PRCode.

To delete a segment item that is not associated with a PRCode, highlight the segment item record in the HD view and click ![]() , or open the segment item and select

, or open the segment item and select ![]() > Edit > Delete. In either case, ActivityHD prompts you to confirm your action. Click Delete to delete the segment item.

> Edit > Delete. In either case, ActivityHD prompts you to confirm your action. Click Delete to delete the segment item.

![]() Use segment items to control GL postings

Use segment items to control GL postings

Segment items (and by extension, PRCodes) control whether payroll check lines produce an accrual debit posting or liability credit posting to the general ledger (or both or neither).

An accrual debit posting is created when the check line contains:

- a pay PRCode

- a deduction PRCode that is qualified by employer

- a tax PRCode that is qualified by employer

- a statistic PRCode with the Create Accrual Debit? flag set to "Yes"

A liability credit posting is created when the check line contains:

- a deduction PRCode that is qualified by employee or employer

- a tax PRCode that is qualified by employee or employer

Parts of the GL account for a check line can be derived from different pieces of the PRCode. For instance, the top-level PRCode segment item can supply the main GL account segment (e.g., salary expense) and dependent segment items can supply pieces for additional GL account segments (e.g., department, position, and/or project). Parts of the debit accounts for accrual postings (distributions) can also be defined on attributes. Debit accounts for accrual postings are the only accounts that can be incomplete when the PRCode is applied on a check; otherwise, the check will not merge.

![]() Flag a segment item parameter as obsolete

Flag a segment item parameter as obsolete

You can flag individual segment item parameters, even built-in parameters, as obsolete from their associated segment item records. When a parameter is marked obsolete, its values also become obsolete. Since numerous built-in parameters are available, marking those you do not use as obsolete effectively "hides" them from your view while leaving them accessible in case you need them in the future.

Like other obsolete items in Payroll, obsolete parameters and their values are still used for payroll processing and reporting.

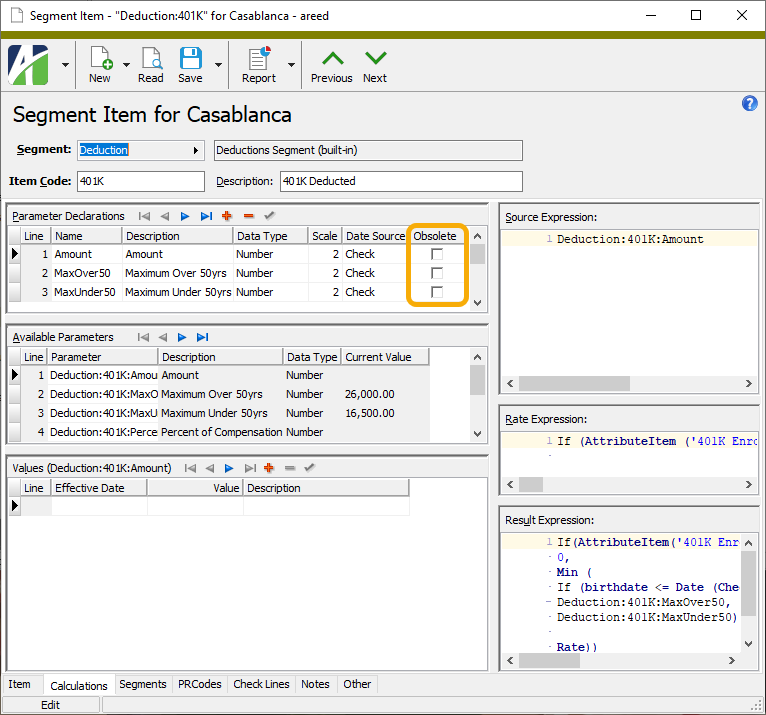

To flag a segment item parameter as obsolete from its associated segment item:

- Open the segment item with the parameter(s) you need to flag as obsolete.

-

Select the Calculations tab.

- In the Parameter Declarations table, locate the parameter you need to flag as obsolete and mark the corresponding Obsolete checkbox.

- Save your changes.

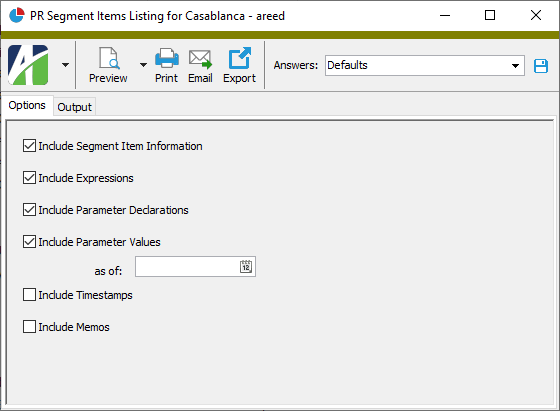

PR Segment Items Listing

Purpose

The Payroll Segment Items Listing provides a list of segment items defined in Payroll.

Content

For each segment item included on the report, the listing shows:

- segment code: item code

- short description

- whether the calculated amount is deducted from employee wages or is paid by the employer

- debit account (accrual)

- credit account (liability)

- type of date used as liability date

- tax entity.

In addition, you can include one or more of the following:

- segment item information (pay type, follows pay group, position, check stub item, run types, groups, source scale, rate scale, result scale)

- expressions (source expression, rate expression, result expression)

- parameter declarations (for each declaration: parameter, description, data type, scale, date source, whether the parameter is obsolete)

- parameter values (for each parameter: parameter, effective date, value, description)

- timestamps

- memos

- custom fields.

The following total appears on the report:

- record count.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > Segment Items folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of payroll segment items:

- Right-click the Segment Items folder and select Select and Report > PR Segment Items Listing from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected payroll segment items:

- In the HD view, select the payroll segment items to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To report on a particular segment item from the Segment Item window:

- In the HD view, locate and double-click the segment item to report on. The Segment Item window opens with the segment item loaded.

- Click

.

.

- To report on all or a filtered subset of payroll segment items:

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Segment Item Information

- Expressions

- Parameter Declarations

- Parameter Values - If this checkbox is marked, the as of field is enabled. Enter the parameter value effective date as of which to include parameter values on the report.

- Report Options. To include a section at the end of the report with the report settings used to produce the report, leave the checkbox marked. To produce the report without this information, clear the checkbox.

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Segments

- Segment items

Segment Item Record ID

The segment the segment item is associated with. This field is disabled after you save the segment item.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

A description of the segment item. This description is used on reports and listings. Use the description to indicate what to expect in source, rate, and result amounts.

Example

"Hourly Pay" might imply a source amount of hours, an hourly pay rate, and the resulting dollars.

Item tab

The run types to which the segment item contributes. The run type determines which check lines are created from employee automatics when payroll is processed. If you enter multiple run types, separate them with commas.

Note

The Ctrl and Shift selection features are available in the Find dialog box so that you can select multiple run types. If you use this method to enter run types, ActivityHD automatically separates your selections with commas.

Press F2 to open the Run Types popup where you can add run types to or remove run types from your selection.

Press F3 to look up the value.

The check line groups to assign the segment item to. If you enter multiple groups, separate them with commas.

Note

The Ctrl and Shift selection features are available in the Find dialog box so that you can select multiple run types. If you use this method to enter groups, ActivityHD automatically separates your selections with commas.

Press F2 to open the Groups popup where you can add groups to or remove groups from your selection.

Press F3 to look up the value.

- <blank>

- Employee. The deduction or tax is the employee's responsibility. The check line is subtracted from the check and a credit account is required to offset the bank account.

- Employer. The deduction or tax is the employer's responsibility. (We're using the term "deduction" loosely here since these are not deductions in the strictest sense of the word.) Employer check lines do not affect the check; both a debit and a credit are required.

Some groups, such as the built-in IncomeTax group, are qualified by a tax entity. This is the tax entity used to help define the total. If tax entities are assigned to more than one segment in a PRCode, the tax entity on the rightmost segment prevails.

While historically tax entities were only assigned to tax-type PRCodes, a tax entity can be assigned to any PRCode; thus, they can contribute to groups which are qualified by tax entity.

If this is a Type:Pay segment item and you only pay employees in a single state, select the tax entity to use for the segment item so that all subsequent pay PRCodes automatically inherit the tax entity. This renders it unnecessary to set up a PayState segment if you are a single-state employer.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

The check stub item the segment item is assigned to.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

This field is enabled for all segment items except for those that represent employee-paid deductions or taxes. If the accrual debits for a segment item are in the same proportion as a group of pay lines, the segment item "follows pay". If this is the case for this segment item, this is the check line group the segment item follows.

Any check line with a debit can be allocated against other pay lines.

Example

You can split employer Social Security expenses to GL departments in the same ratio as pay.

To do so, assign a group named "Wages" to the pay PRCodes that are the source of the follows pay. On the employer Social Security item, enter "Wages" as the follows pay group. Enter the Social Security expense account with wildcards in the GL department. If you distribute pay lines in the Wages group to three different departments, the employer portion of Social Security is distributed to the same departments in the same proportions.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

This field is enabled for all segment items except employee-paid deductions or taxes. This is the GL account the item posts to.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

This field is enabled for deduction and tax segment items. This is the payroll liability account used for the cash posting from pay checks.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

- <blank>. Inherit the top-level segment item's value (typically "Check Date").

- Check Date. Accrue the liability as of the check date.

- Work Date. Accrue the liability as of the check line's work date.

This field is enabled for pay segment items. If the PRCodes that contain this segment item pay a specific position, this is the position.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

This field is visible if the Payroll to AP interface is installed and is enabled for deduction and tax segment items. This is the default AP control used to post check lines with this segment item to AP.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

The number of places (0-4) to the right of the decimal for source amounts. The scale of a PRCode item comes from the rightmost item that has a non-blank scale.

Note

Changing the scale here changes the scale of all historical check lines from PRCodes with this segment item.

The number of places (0-4) to the right of the decimal for rate amounts. The scale of a PRCode item comes from the rightmost item that has a non-blank scale.

Note

Changing the scale here changes the scale of all historical check lines from PRCodes with this segment item.

The number of places (0-4) to the right of the decimal for result amounts. The scale of a PRCode item comes from the rightmost item that has a non-blank scale.

Note

Changing the scale here changes the scale of all historical check lines from PRCodes with this segment item.

Calculations tab

- Date

- Number

- String

- True/False

- Check

- Work

Example

An hourly pay rate might be effective as of a particular work date while a Medicare withholding rate would be based on the check date.

This table shows the parameters defined on this segment item as well as on other segment items higher up in the segment item hierarchy. To enter parameter values in the Values table, select the row in this table that contains the parameter you need to enter a value for.

Note

Obsolete segment item parameters appear in this table only if a value is assigned.

- Date

- Number

- String

- True/False

Note

The expression fields have special editor features to simplify the process of composing expressions. Among the editor features are:

- Expression syntax highlighting

- Matching parenthesis detection

- Undo and redo

- Bookmarks navigation

- Line numbering in the margin

- Unsaved lines indication

- Search/case sensitive search

The calculation expression needed to determine the source amount for a check line that contains this segment item. Calculation expressions can only refer to parameters declared on this segment item or on segment items higher up the hierarchy. Each parameter can have values assigned on this segment item, on a descendant segment item, or on the employee. If you leave the source expression blank, the source amount must be entered manually during check processing.

The calculation expression needed to determine the rate amount for a check line that contains this segment item. Calculation expressions can only refer to parameters declared on this segment item or on segment items higher up the hierarchy. Each parameter can have values assigned on this segment item, on a descendant segment item, or on the employee. If the rate expression is left blank but the result expression refers to it, the rate must be entered manually during check processing.

The calculation expression needed to determine the result amount for a check line that contains this segment item. Calculation expressions can only refer to parameters declared on this segment item or on segment items higher up the hierarchy. Each parameter can have values assigned on this segment item, on a descendant segment item, or on the employee. In addition to the other parameters and functions available in calculation expressions, the result expression can use the keywords "Source" and "Rate" to refer to the output of the source expression and rate expression, respectively.

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Segments tab

The Segments pane shows the Segments HD view filtered to show all segments that the selected segment item is a parent of.

Double-click a row in the pane to drill down to its record in the Segment window.

PRCodes tab

The PRCodes pane shows the PRCodes HD view filtered to show all PRCodes that contain the selected segment item.

Double-click a row in the pane to drill down to its record in the PRCode window.

Check Lines tab

The Check Lines pane shows the Check Lines HD view filtered to show all check lines generated from PRCodes which contain the selected segment item.

Double-click a row in the pane to drill down to its record in the Check Line window.

Notes tab

The Notes pane shows the Notes HD view filtered to show all notes which reference the selected segment item.

Double-click a row in the pane to drill down to its record in the Note window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Note

With the proliferation of built-in state segment items, managing the list of segment items can seem unwieldy, especially for sites with only a handful of states to support. As of ActivityHD version 8.0-0, any built-in payroll segment item can be set to obsolete, allowing companies to see only the segment items which apply to them. When you make a segment item obsolete, its parameters are also set to obsolete.

| Segment | Item | Description | Notes |

|---|---|---|---|

| Tax | CPP2 | CPP Second Contribution - Employee | |

| Tax | CPP2ER | CPP Second Contribution - Employer | |

| Tax | FUTA | Federal Unemployment Tax | Result expression: Source x Rate |

| Tax | MedAdd | Medicare Tax - Additional | |

| Tax | MedEE | Medicare Tax - Employee | |

| Tax | MedER | Medicare Tax - Employer | |

| Tax | SocSecEE | Social Security - Employee | |

| Tax | SocSecER | Social Security - Employer | |

| Tax | State | State Tax | |

| Tax | SUTA | State Unemployment Tax | |

| Tax | USA | Federal Withholding | |

| Tax | USAx | Federal Withholding - Extra | |

| TaxState | XX, where XX is the two-character postal code for the state | State Name Income Tax | |

| Tax State | XXx, where XX is the two-character postal code for the state | State Name Extra Amount | |

| TaxState | CASDI | CA State Disability Insurance | |

| Tax State | COFamliEE | Colorado FAMLI Tax - Employee | |

| Tax State | COFamliER | Colorado FAMLI Tax - Employer | |

| TaxState | INnn, where nn is the two-digit Indiana county code | County Name Indiana Tax | |

| TaxState | INnnx, where nn is the two-digit Indiana county code | County Name Indiana Tax Extra | |

| TaxState | MIXXX, where XXX is the two- or three-character Michigan city code | City Name Michigan Tax | |

| TaxState | MIXXXx, where XXX is the two- or three-character Michigan city code | City Name Michigan Tax Extra | |

| TaxSUTA | XX, where XX is the two-character postal code for the state | State Name Unemployment | Result expression: Source x Rate |

| TaxSUTA | NJEE | New Jersey Unemployment Employee | |

| TaxSUTA | PAEE | Pennsylvania Unemployment Employee | |

| Type | Ded | Deduction Type | |

| Type | Pay | Pay Type | |

| Type | Stat | Statistic Type | |

| Type | Tax | Tax Type |

|

Extras\Payroll\Import Segment Items.xls; Import Segment Item Position Codes.xls; Change Segment Item AP Controls.xls; Change Segment Item Expressions.xls; Change Segment Item GL Accounts.xls; PRBuiltInStateData.sql |

Tax:FUTA

Calculation

Source:

Min

(SumCheck('Compensation Result') - SumCheck('PreUnemployment Result')

, Max(0,FUTA.MaxWages - SumHistory('Unemployment Source USA ER',Date(CheckDate,'Begin of Year'),Date(CheckDate,'End of Year')))

)

Rate: FUTA.Rate

Result:

Min

(Source * Rate

, (FUTA.MaxWages * FUTA.Rate) - SumHistory('Unemployment Result USA ER',Date(CheckDate,'Begin of Year'),Date(CheckDate,'End of Year'))

)

Groups: Unemployment

Tax:MedAdd

Calculation

Source:

Min

(Max(0, SumCheck('Compensation Result') - SumCheck('PreMedicare Result'))

, Max

(0

, SumCheck('Compensation Result') - SumCheck('PreMedicare Result')

+ SumHistory('Medicare Source EE',Date(CheckDate,'begin of year'), Date(CheckDate,'end of year'))

- Type:Tax:MedEEThreshold

)

)

Rate: Type:Tax:MedEEAddPercent

Result: Source * Rate / 100

Groups: DispDed, MedicareAdd

Tax:MedEE

Calculation

Source:

If

(IsNull(Type:Tax:MedExempt,False)

, 0

, SumCheck('Compensation Result') - SumCheck('PreMedicare Result')

)

Rate: Type:Tax:MedEEPercent

Result: Source * Rate / 100

Groups: DispDed, Medicare

Tax:MedER

Calculation

Source: SumCheck('Medicare Source EE')

Rate: Type:Tax:MedERPercent

Result: Source * Rate / 100

Groups: Medicare

Tax:SocSecEE

Calculation

Source:

If

(IsNull(Type:Tax:SocSecExempt,False)

, 0

, Min

(SumCheck('Compensation Result') - SumCheck('PreSocialSecurity Result')

, Type:Tax:SocSecMax - SumHistory('SocialSecurity Source EE',Date(CheckDate,'Begin of Year'),Date(CheckDate,'End of Year'))

)

)

Rate: Type:Tax:SocSecEEPercent

Result: Source * Rate / 100

Groups: DispDed, SocialSecurity

Tax:SocSecER

Calculation

Source:

If

(IsNull(Type:Tax:SocSecExempt,False)

, 0

, Min

(SumCheck('Compensation Result') - SumCheck('PreSocialSecurity Result')

, Type:Tax:SocSecMax - SumHistory('SocialSecurity Source ER',Date(CheckDate,'Begin of Year'),Date(CheckDate,'End of Year'))

)

)

Rate: Type:Tax:SocSecERPercent

Result: Source * Rate / 100

Groups: SocialSecurity

Tax:USA

Calculation

Source: SumCheck('Compensation Result') - SumCheck('PreIncomeTax Result')

Result:

If

(ISNULL(Tax:USA:SuppMethodAggregate,False)

, W4.Withholding(AggregateRate)

, W4.Withholding(FixedRate)

)

Groups: DispDed, IncomeTax

Tax:USAx

Calculation

Result: W4.ExtraWithholding

Groups: DispDed, IncomeTax

Segment items security

Common accesses available on segment items

Segment items filters

The following built-in filters are available for segment items:

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |