The phrase "keeping multiple sets of books" has long been associated with shady or downright illegal accounting practices. Still, there are legitimate reasons to keep multiple sets of books, also known as reporting ledgers. Reporting ledgers were initially used by multinational companies that had to follow different accounting rules for other countries. However, you can benefit from reporting ledgers even if your company does not do any international business.

Problems that reporting ledgers can solve

Extra periods for closing entries

Many companies keep a particular, one-day period at the end of the year where they post all their adjustments and closing entries. Isolating your once-a-year entries in their period allows you to meaningfully compare periods without worrying about year-end postings skewing your numbers in December. Using an additional ledger to record these year-end postings will enable you to keep your closing entries separate from your day-to-day business without a particular period and keep you from unintentionally posting your day-to-day entries to a year-end posting period.

Tax vs. GAAP depreciation

Generally Accepted Accounting Principles (GAAP) and tax rules are often vastly different when keeping your books. Banks or regulatory agencies may require you to keep your books per GAAP, as well as most investors expect to see audited GAAP financial statements. Still, your tax preparer might also require that you provide them information about your books based on specific tax requirements. Generally, most companies end up producing both GAAP and tax basis financials, but other accounting systems only have GAAP financials. Because of this, tax basis financials are usually calculated manually, outside of the accounting system, making them prone to error and difficult to create. By using ActivReporter's reporting ledger feature to keep your books per GAAP and tax rules simultaneously, you can quickly produce accurate and timely tax basis financials.

Statutory adjustments

There are many differences between GAAP and International Financial Reporting Standards (IFRS), where having the flexibility of multiple reporting ledgers can save you time and headache. For example, IFRS does not allow inventory valuation based on the LIFO method (last in, first out). With ActivReporter, you can maintain LIFO inventory valuation for your GAAP books and an alternative method for your IFRS books, such as FIFO (first in, first out) or weighted average. Another example is fixed asset valuation, where GAAP only allows the cost model to be used (cost less depreciated value). In contrast, IFRS provides for the use of the revaluation model (fair value). ActivReporter gives you the flexibility you need to track and maintain multiple accounting standards within the same software.

Transfer pricing

If you are providing or purchasing goods/ services to a subsidiary, parent, or sister company, those goods or services may be provided at a reduced rate. Normally, the effect of these intercompany transactions is backed out of consolidating financial statements. By isolating these transactions in a separate ledger, they do not affect normal period to period reporting but can be included if needed by reporting on both ledgers combined.

Parent company adjustments

Sometimes your parent company will ask you to adjust to match their accounting system. You can isolate these in a separate ledger, so your original numbers are still available to inform business decisions.

Using reporting ledgers in ActivReporter

Enable reporting ledgers in GP

To use reporting ledgers in ActivReporter, you must first enable them in GP. Navigate to Setup > Financial > General Ledger > Reporting Ledgers and check the box marked "Allow." This will allow two extra ledgers: IFRS and Local (you can rename these if you want). Now, when you post in GP, there will be a dropdown under Currency ID where you can select the reporting ledger you want to use for that posting.

Using them in ActivReporter

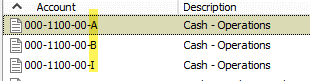

In ActivReporter, reporting ledgers are indicated by a letter at the end of the account number. This makes it easy to tell which ledger your entries are posted to and streamlines report creation.

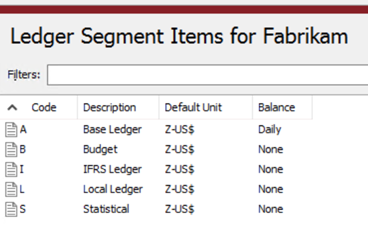

By default, reporting ledgers include a segment labeled '-A' for actual. Actual balances represent your everyday operations. With ActivReporter, you can add as many reporting ledgers as needed. For example, B for budget, I for International Financial Reporting Standards (IFRS), or T for tax basis. ActivReporter also allows you to set whether the ledger includes only balancing journal entries. For example, budget ledgers typically do not need balanced journal entries.

Statistical reporting ledgers (labeled with an S) are another powerful tool ActivReporter can use to empower your financial reporting. Statistical information such as barrels per day and tons per shipment give your stakeholders the critical information they need to make financial decisions.