Good financial statements empower your company to make better strategic decisions, but how do you know if your financial statements are good? If they're not, how do you make them better? Some basic principles separate the good from the bad, but your financial statement quality also depends on how well suited it is to your audience.

This blog is the second of a three-part series on how to create better financial statements:

Part 1: 6 Elements of a Good Financial Design Statement

Part 2: Formatting Best Practices for Financial Statements

Part 3: Data Visualizations for Financial Statements

What makes a financial statement useful?

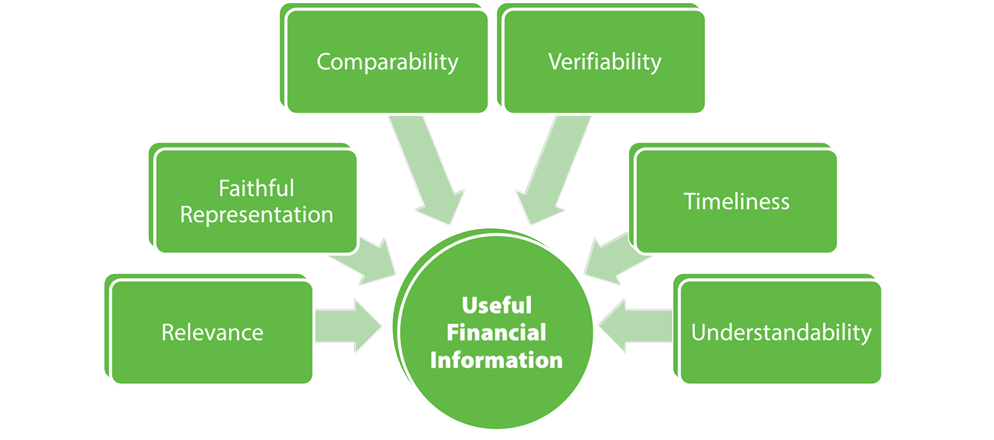

FASB (Financial Accounting Standards Board) lists six qualitative characteristics that determine the quality of financial information: Relevance, Faithful Representation, Comparability, Verifiability, Timeliness, and Understandability.

Relevance

Information is relevant if it is capable of affecting users' decisions, either because it helps them predict future business conditions or because it provides feedback on prior predictions. Irrelevant information takes up valuable report space and may confuse users.

Faithful Representation

To faithfully represent information, it must be complete, unbiased, and error-free. Perfectly faithful representation is rarely possible but try to get as close as you can.

Comparability

Information is more useful when it can be compared with similar information about another entity or with similar information about the same entity from a different time period. Being consistent about how you format your reports and what information you include will help with their comparability.

Verifiability

Information is verifiable if different knowledgeable and independent observers could reach a consensus that the information is faithfully represented. Verifiability gives users confidence about the accuracy, completeness, and neutrality of the information.

Timeliness

Information needs to be available to decision-makers in time to be capable of influencing their decisions. Older information can still be timely if it allows users to identify and assess trends.

Understandability

Information should be clear and concise and fit the audience's knowledge level.

Sometimes it is not possible to meet all of the above criteria at once. For example, you may spend so much time ensuring that the information on a report is complete that it ceases to be timely. Good report writing requires you to find an acceptable balance between conflicting goals.

Matching your reports to your audience

There are two main types of reports: financial reports and management reports. Which one you choose depends on your audience.

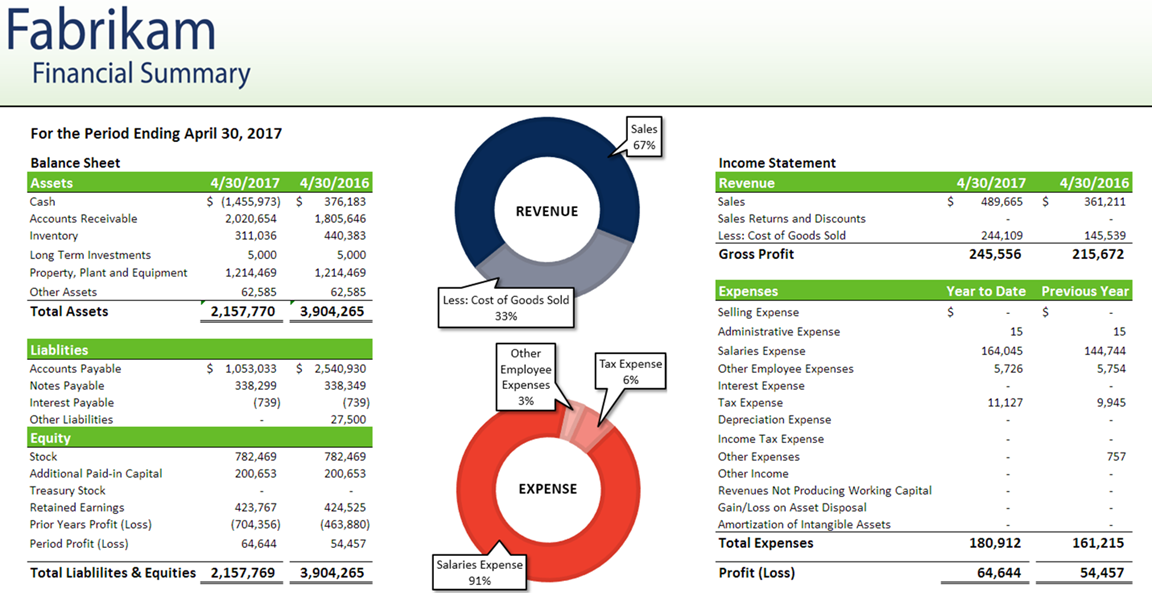

Financial reporting

Financial reports are aimed at external users who need to make decisions regarding your company, such as whether to invest or to extend a line of credit. They are more formal in structure and content because they must follow GAAP rules. Since all companies follow the same structure and content rules, it is easier for users to compare two companies' reports.

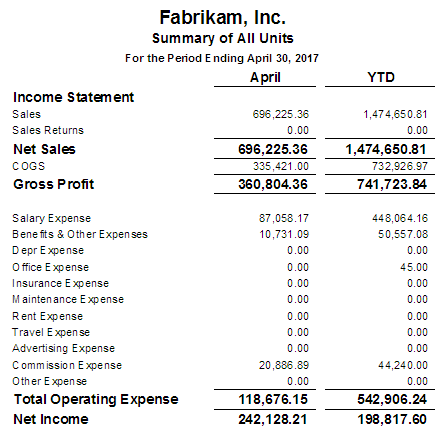

Management reporting

Management reports are aimed at internal users who need to make decisions on the company's behalf. Since these reports are not seen by outsiders, you can provide more in-depth information without giving away proprietary information. You do not need to follow the strict structure and content rules that apply to financial reports, but you should still ensure your reports meet the FASB qualitative characteristics. While you have more freedom when creating management reports, you also have to make more decisions and therefore have more room for error.

How ActivReporter makes your reports better

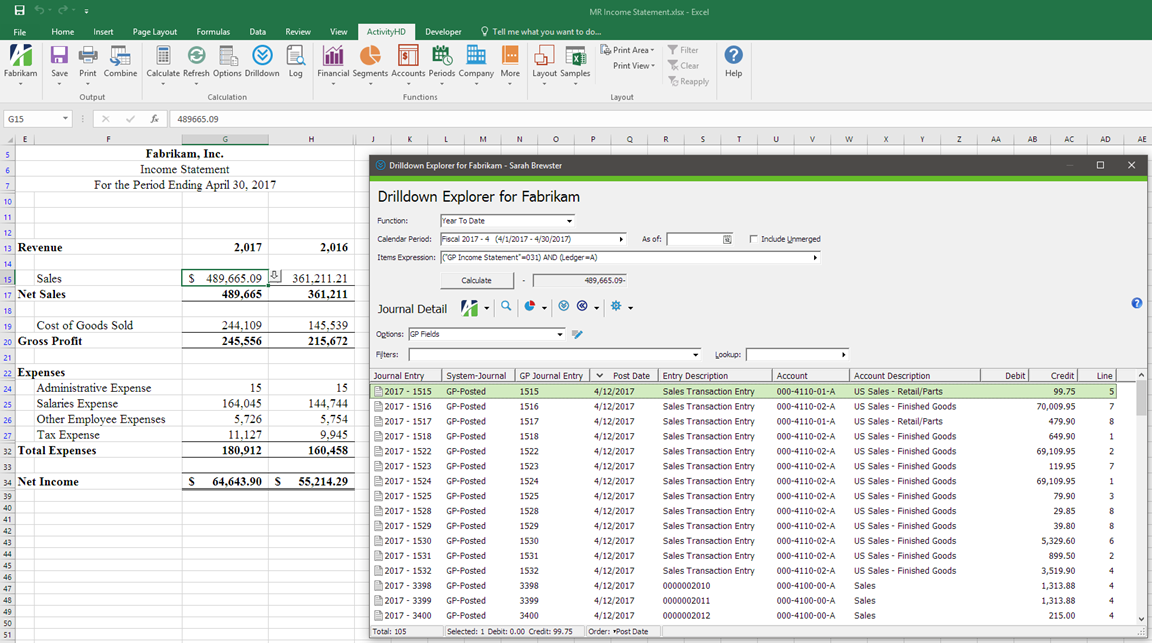

ActivReporter's drilldown feature allows authorized users to obtain detailed information about the individual transactions that make up the big picture numbers, while published reports provide the necessary information to external users without giving away non-public information.

Report templates allow you to quickly create consistent, up-to-date financial reports, while the native excel features make it easier to create any management report imaginable. ActivReporter's security permissions allow you to tightly control which members of your organization can see which pieces of information.

During our series on how to create better financial statements we've shared some best practices for formatting both types of reports, looked at various data visualizations, and in this blog, discussed FASB's qualitative characteristics of useful financial information, and the differences in purpose between financial and management reporting. Now you should be ready to present your financial designs to your team!