Accounting for deferred revenue presents unique challenges for performing arts venues and companies.

What is deferred revenue?

Under the accrual method of accounting, revenues must be recorded when they are earned, regardless of when money changes hands. If a customer pays for a service in advance, the money is not treated as revenue until the service is provided. Instead, that transaction is recorded in a liability account (commonly called deferred revenues or unearned revenues) until it has been earned and can be moved to a normal revenue account.

How does deferred revenue apply to performing arts companies?

If you're in the performing arts business, one of your primary sources of revenue is ticket sales. For tickets sold at the door immediately before the performance, deferred revenue is not an issue, but for tickets sold days, weeks, or months in advance, the money won't count as revenue until after the performance is over.

Challenges for tracking deferred revenue in performing arts

For most companies, deferred revenues come from a small number of large prepayments, as customers put down deposits or prepay for several months of service. Since there are not many of these transactions, they are not too difficult to keep up with. In the performing arts industry, things are reversed – lots of ticket prepayments in relatively small amounts. This increased number of prepayments means a lot more work for the accounting department, especially if management wants to track revenues for each individual performance instead of the production as a whole.

The way that your performances and advance ticket sales are set up affects the complexity of your deferred revenue accounting. If you have multiple productions running at once, or if tickets for the next production go on sale before the current production is over, this will make deferred revenues more difficult to track.

Managing your performers just got easier with ActivityHD

Production vs performance

Unless your productions are all single-instance, "one night only" performances, you will have to decide whether to track your deferred revenue at the production level or the performance level.

Production level

At the production level, you need only one deferred revenue account for each production, regardless of how many performances there are. Accounting is easier when there are fewer accounts to keep up with. However, unless you have a system for tracking how much of the deferred revenue comes from each performance, you won't be able to move the money from the deferred revenues account to your ticket sales revenue account until the entire production is over. This is not a serious issue if the production only spans a single weekend, but if your production runs for months, this method may result in the company accounts not accurately reflecting your company's profitability for each month, as the revenues will be lumped together at the end of the production run rather than being evenly spread out.

Performance level

Tracking at the performance level will require a separate deferred revenues account for each performance, complicating the accounting for box office sales. However, the money in each deferred revenues account can be moved to a normal revenue account as soon as the performance is over, providing a more up-to-date picture of your company's finances. Tracking by performances allows leadership to see the profitability of individual performance times and more accurately compare profitability for different productions.

A hybrid approach

Some accounting software has features that allow you to track deferred revenue at both the performance and production levels while using a single deferred revenue account. ActivityHD can do this through a feature called Attributes. Attributes operate as a sort of tagging system, allowing you to categorize your revenues and expenses quickly and easily.

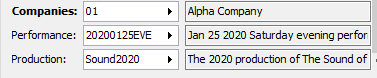

*An example of Performance and Production Attributes in use

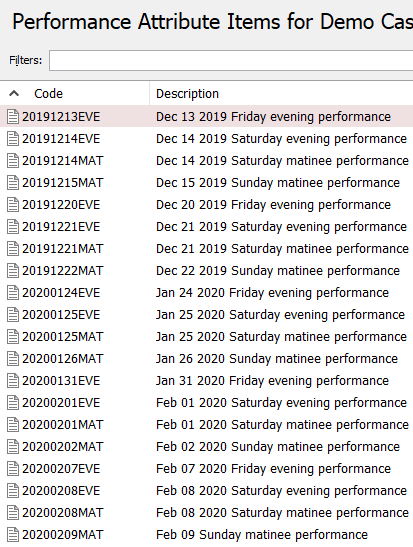

Attributes are fully customizable, so they can be tailored to fit any accounting need. They allow detailed, granular reporting without exploding your chart of accounts. Attributes allow you to put all prepaid ticket sales into one deferred revenues account, then find only those for a particular performance so that they can be moved to a normal revenue account as those revenues are earned. You can use as many Attributes as you want, and use them to compare revenues by production, performance, location, time of day, intended audience, or any other characteristic you can think of.

*An example set of Performance Attribute Items that can be used to assign transactions to individual performances