Fixed Assets

ActivFA - Fixed Asset Management Software

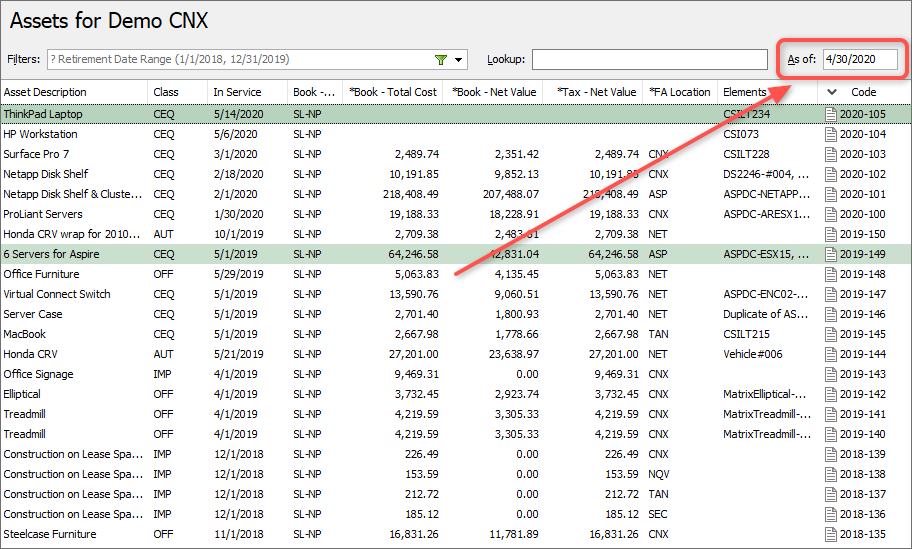

Our fixed asset software encompasses so much more than just pushing periodic depreciation numbers through to your financials. Enhanced features allow for detailed reporting of asset purchases, additional investments during the life of an asset, disposition, and ancillary data for the asset. Track separate valuations of your assets for state and federal tax purposes, insurance, property tax, and more.

One-Stop-Shop

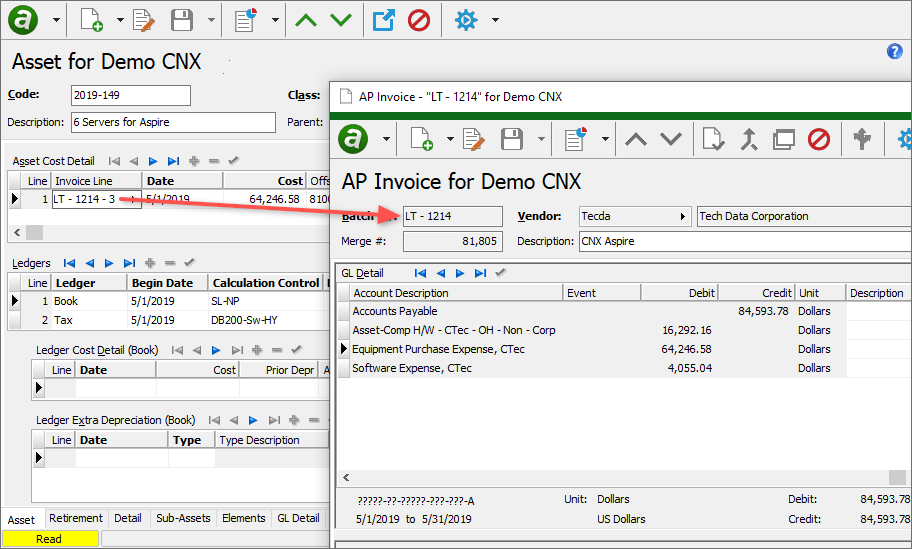

All details about any fixed asset, such as purchase information, in-service dates, depreciation methods, accounts to charge, notes, retirement details, ancillary data, and attachments can be viewed quickly on one convenient location. All data and information is in one easy-to-navigate application.

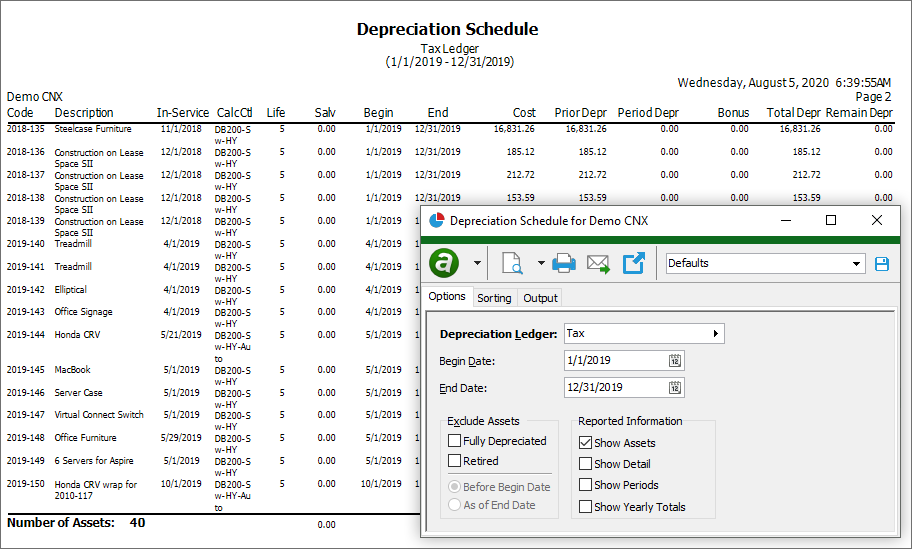

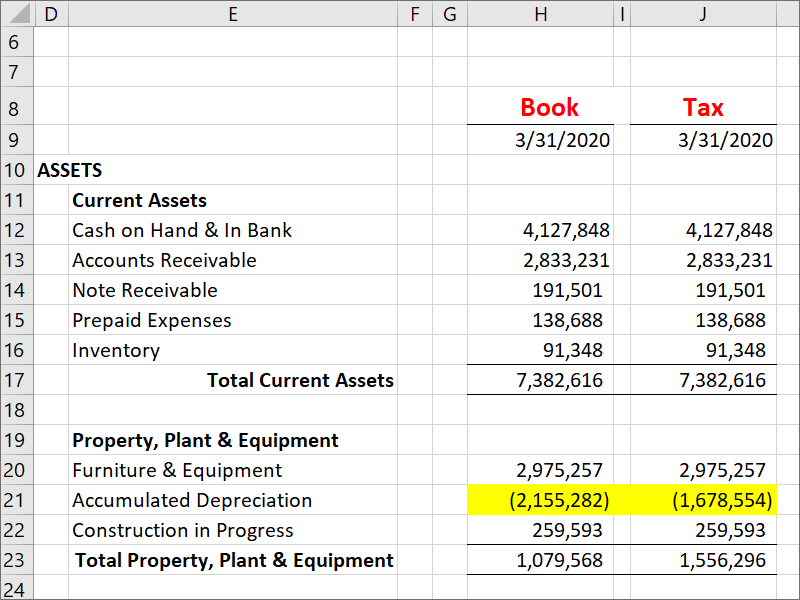

Multiple Depreciation Ledgers

ActivFA can create distinct depreciation ledgers for Book, Federal Tax, Local Tax, Insurance roll, Property Tax roll, and more. You can post any or all these ledgers to the general ledger. With our integrated general ledger application, ActivGL, you can create both a tax and book financial statement based on these postings.

Ease of Correction

It is not uncommon to incorrectly assign the life of an asset, the in-service date, or method of depreciation. ActivFA can “automagically” fix these problems and make the appropriate postings in the correct periods for the General Ledger. Corrections can even happen after the accounting records are closed for the period by forcing the corrections into an open period.

Tracking Ancillary data

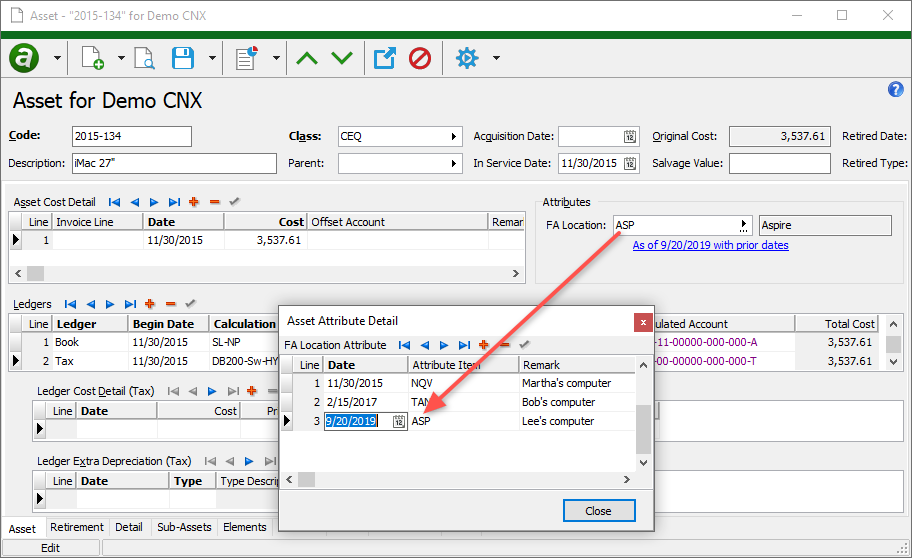

ActivFA can record and maintain complex records for different types of assets. In competing fixed asset systems, this is typically done with custom fields. In ActivFA, each asset type (auto, computer, building, etc.) can have its own list of data items (VIN #, computer cpu, building sq ft, etc.) which is unique to the type of asset. You can sort, filter, and examine based on each data item. Photographs, original invoices, and other data can be attached to the electronic asset record.

Additional Features

In addition to the features outlined above, you will also have the ability to:

- Integrate with ActivPO/ActivAP (for purchases) and ActivGL (for depreciation expense, disposition, etc.)

- Allocate depreciation expense to multiple locations, departments, or even companies

- Set up multiple ledgers like book, tax, property tax roll for each asset

- Support extra depreciation types: Section 168, 179, Bonus

- Support manual depreciation entries

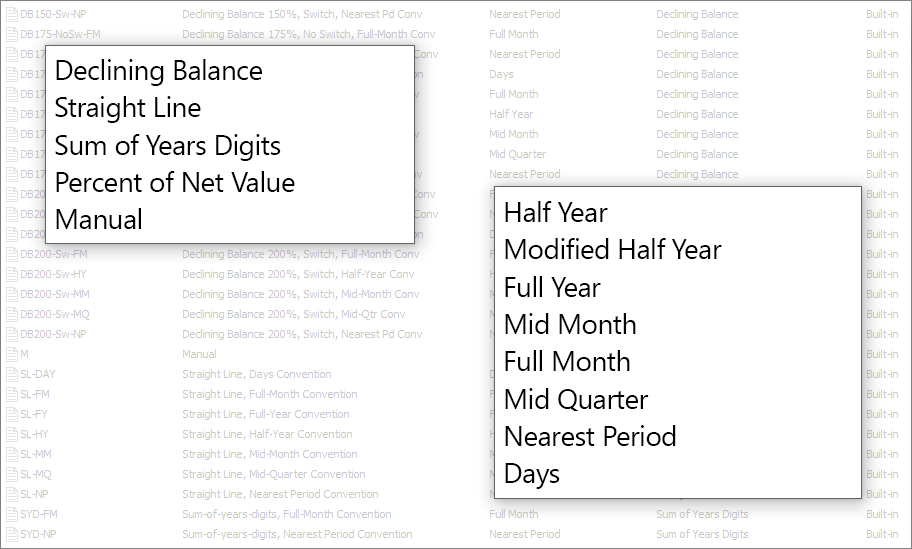

- Support switch to straight line from accelerated depreciation

- Attach photos, purchase invoices, warranty records, insurance, etc. to the asset record

- Track the location of the asset over time

- Import assets from spreadsheets

- Automate any process in ActivFA such as importing assets from spreadsheets

"We write a minimum of 200 checks a month to one time vendors every month. This used to take 1 1/2 days a month, now it takes literally five minutes (less if my printer was faster). They deliver what they promise and more."

"The functionality of the software to generate financial statements within minutes is phenomenal! The ability of the system to reduce journal entries because of the accounts payable & accounts receivable systems to do accrual with the extra GL feature makes operations more efficient!"

"We currently use all packages that the software offers, and run multiple companies in the software. They are on the cutting edge of technology but keep a customer service level that is second to none."

"AccountingWare provides great customizable software that can be used for an entire company in all aspects of the accounting system including asset management, payroll, and bank rec. It ties back to the General Ledger account codes and is very easy to manipulate."

Frequently Asked Questions

Accelerated depreciation can have a big impact on the enterprise tax bill. Any intra-year tax planning will require you to know the consequences of tax depreciation. You can manage your tax liabilities by keeping internal records.

Yes. There is an option to tag the asset to a location using what we call “attributes.” This location attribute is date driven and can be assigned as frequently as desired. This attribute determines the GL distribution of the expense.

Yes. ActivFA does not directly support multi-company and create due-to/due-from entries. However, you can post depreciation to a suspense account and then use the multi-company features of ActivGL to distribute to multiple companies.

Yes.

Yes.

ActivFA has provided most of the depreciation calculations by combining the depreciation methods, calculation controls and averaging conventions. However, if future tax or GAAP changes require additional methods, they can be constructed from the basic building blocks.

Yes. There is a report that gives all assets retired in any date range. It includes partial retirements and gain/loss for each retirement. This report can be run for any Ledger, e.g. Tax, Book, etc.

Yes. The “percent of net value” is a depreciation method commonly used in Canada.

Yes. Sometimes a company needs to keep up with assets for purposes other than depreciation. You can use the ActivFA system to track these assets and keep location and ancillary data for these assets also.