ActivityHD supports four types of check lines:

- Pay lines are check lines which add to the amount of the check.

- Deduction lines and tax lines subtract from the check amount if they are the employee's responsibility. They have no effect on the check amount if they are the employer's responsibility.

- Statistic lines do not affect the check amount.

Calculation expressions facilitate check line calculation. Calculation expressions are similar to the formulas you see in spreadsheets. For any check line, there can be three calculation expressions: one for the source, one for the rate, and one for the result. The expressions perform mathematical operations based on the current check line, on other check lines, and on historical totals. Special functions are used to calculate taxes or garnishments.

Oftentimes a calculation expression needs a total from groups of other check lines. You can define check line groups for this purpose and assign relevant segment items to the group.

Example

Medicare Gross is the total of all compensation pay lines minus the total amount of employee deductions which are not subject to Medicare tax. So, in this case, you can define a Compensation group and assign the applicable pay lines to the group. You can also define a PreMedicare group and assign the deduction lines which reduce Medicare wages to it. The source expression for the Medicare tax line would then be:

Compensation - PreMedicare

Calculation expressions can refer to parameters. Parameters are variables that you define to help you calculate a check line. Parameters can represent numbers (salaries, rates, multipliers, percentages, number of exemptions), alphanumeric codes (tax filing status, garnishment table code), dates, or yes/no answers (exempt from Social Security?, exempt from Medicare?). Some commonly used parameters are built in to ActivityHD; others are user-defined. You can define as few or as many parameters as you need and you can refer to them however you want.

Values are assigned to parameters. A value can be specific to a particular employee (e.g., salary amount) or can be global (e.g., the Medicare withholding rate). You can also set up values that are nearly global but can be overridden in employee-specific cases. Parameter values are date-driven, so you can enter values in advance and have them take effect later. This characteristic of parameter values helps prevent last-minute payday changes.

Parameter values can be based on the check date or the work date. The work date is assigned to pay lines and is a date within the current pay period. The default work date is the pay period end date. Because you can specify multiple pay lines with different work dates, you can access more than one value for the same parameter within a pay period.

Example

Suppose an employee receives a pay raise during a pay period. The employee works the first two days of the week at the old pay rate and the last three days at the new rate. If the rate parameter is based on work date and you have entered both rates with appropriate effective dates, then entering a correct work date causes ActivityHD to retrieve the correct rates automatically.

Most check lines result in postings to at least one GL account. Pay lines can be distributed to one or more GL accounts so that you can break down pay by department or project. Furthermore, pay lines can be distributed to one or more GL periods (split period). A distribution line includes a distribution date, a GL account, a source amount, and a result amount. The distribution date defaults to the work date on the pay line. If the GL account needs to be qualified by department or project, you can provide the missing values in the account mask. The total distributed amount must match the result amounts on the pay line.

Check lines which represent an expense (e.g., employer deduction lines, employer tax lines, statistic lines, other pay lines) can be marked as "follows pay". "Follows pay" check lines are automatically distributed to the same departments or projects and in the same proportion (based on result amounts) as the group of pay lines they follow. You cannot change the distribution lines on a "follows pay" distribution.

Up until the check containing it is merged, most of a check line's fields can be changed. After the check is merged but before its GL entry is merged, the AP Control, Distribution Method, Liability Date, and Memo fields may be editable (depending on the PRCode type). After the GL entry is merged, only the AP Control, Distribution Method, and Memo fields may be editable.

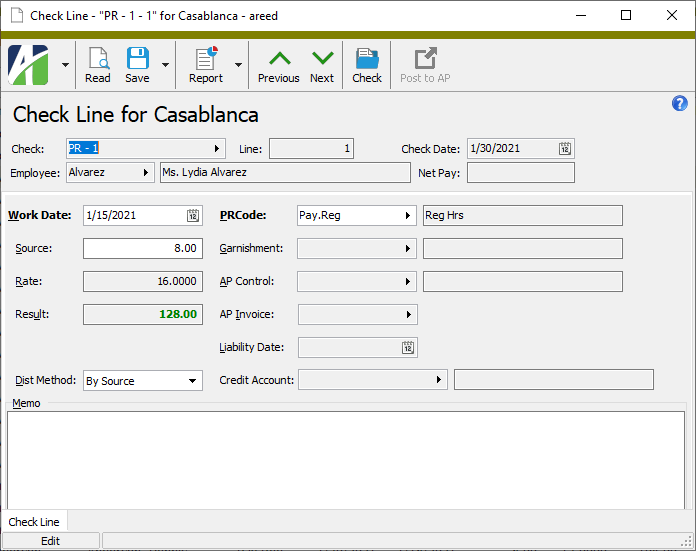

To maintain a check line:

Maintain a check line

- In the Navigation pane, highlight the Payroll/Human Resources > Checks > Check Lines folder.

- In the HD view, locate and double-click the check line you want to maintain to load it in the Check Line window.

-

In the Work Date field, enter the work date for the check line. The work date must fall in the pay period defined on the payroll run. Typically, the work date is the last day of the pay period; however, the work date can be any day in the period.

Example

If an employee's pay rate changed during the pay period, your entry could have a different work date within the pay period.

-

The Source, Rate, and Result fields are conditionally enabled depending on the requirements of the PRCode. Enter the appropriate value(s) for the check line.

Note

If you need to override the value in one of these fields and it is disabled, place your cursor in the field and select

> Tools > Unlock Source/Rate/Result or press Ctrl+Alt+U to unlock the field for data entry.

> Tools > Unlock Source/Rate/Result or press Ctrl+Alt+U to unlock the field for data entry. - In the PRCode field, select the PRCode to use to calculate this check line.

- If this check line represents a garnishment, the Garnishment field is enabled. Select the garnishment record associated with this check line.

- If you have the Payroll to AP interface enabled, the AP Control field is visible. If an AP invoice will be generated to pay this check line, select the AP control to use.

-

If the PRCode for the check line represents a deduction or tax, the Liability Date field is enabled. Enter the date to post the GL liability entry for this check line. Typically, this is either the check date or the work date. The default liability date type (check date, work date) can be set at the segment item level.

Note

If you override the date in this field, but the liability date source is "Check Date" or "Work Date" and the check date or work date, respectively, changes, the date is replaced by the new check date or work date.

- The Credit Account field becomes enabled if the account is not fully qualified or does not exist and the value is corrected on the source entity or if you select

> Tools > Unlock Credit Account or if you press Ctrl+Alt+U to unlock the field for data entry. Select the liability credit account for the check line.

> Tools > Unlock Credit Account or if you press Ctrl+Alt+U to unlock the field for data entry. Select the liability credit account for the check line. - If the check line is a pay line or an employer-side deduction or tax line, the Distribution Method field is enabled. The field is disabled if the check line comes from a voided or reversal check. From the drop-down list, select how to distribute the check line. Your options are:

- By Source. The account number is determined from the PRCode, the employee, or both.

- Follows Pay. Distributions are automatically generated for selected PRCodes. The distributions are proportional to the distributions for a selected group of other check lines. "Follows Pay" is defined on the PRCode segment item.

- Manual. Account numbers are entered manually.

- Split Period. The distribution splits the check line between two GL periods.

- In the Memo field, enter any additional information you want to record about the check line. If the check line was created as a result of processing time sheets, the default memo was copied from the memo on the corresponding time sheet line.

- Save your changes.

Perform only the steps you need to update the check line. The steps that follow describe all fields which may be enabled before the check containing the check line is merged. If the check has been merged or if the GL entry has been merged, fewer fields are available for data entry.

Note

Post to AP is only available if the Payroll to AP interface is enabled.

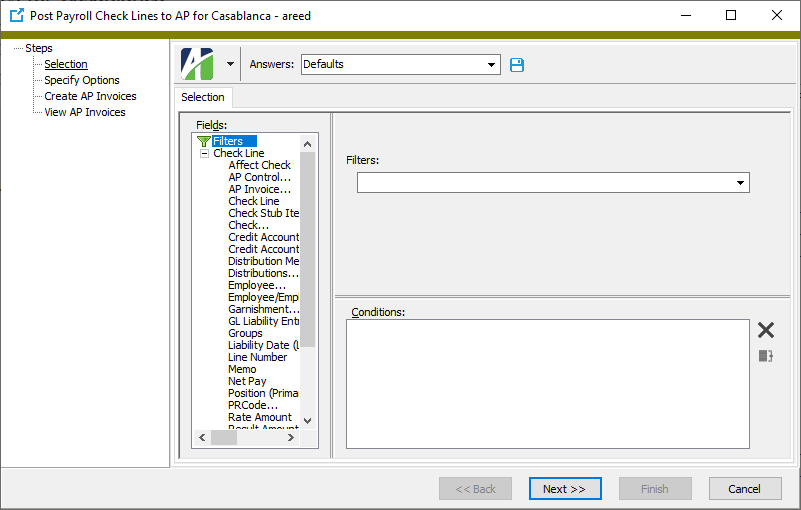

The Post to AP process takes payroll check lines, transforms them into invoices, and posts the invoices to AP. The process occurs in four steps:

-

Select the check lines to post.

Note

Post to AP only processes check lines with an AP control assigned to them.

- Specify options for your selections.

- Create and post AP invoices.

- View AP invoices.

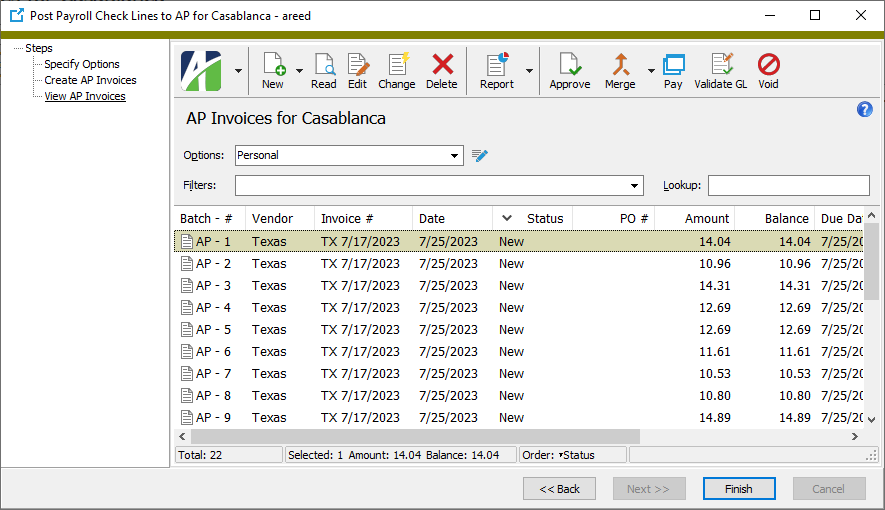

You can merge and pay the AP invoices from the "View AP Invoices" page of the Post Payroll Check Lines to AP wizard, or you can merge and pay the invoices later in Accounts Payable.

To post check lines to AP:

Post check lines to AP

- In the Navigation pane, highlight the Payroll/Human Resources > Checks > Check Lines folder.

- Start the Post Payroll Check Lines to AP wizard.

- To process all or a filtered subset of check lines:

- Right-click the Check Lines folder and select Select and Post to AP from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

Tip

Apply the "Ready to Post to AP" filter to select check lines that have an AP control, are merged, are not voided, and have not already been posted to AP.

- Click Next >>.

- To process specifically selected check lines:

In the HD view, select the check lines to include in the process. You can use Ctrl and/or Shift selection to select multiple records.

Tip

Apply the "Ready to Post to AP" filter to see all check lines that have an AP control, are merged, are not voided, and have not already been posted to AP.

- Click

.

.

- To process a particular check line from the Check Line window:

- In the HD view, locate and double-click the check line to process. The Check Line window opens with the check line loaded.

- Click

.

.

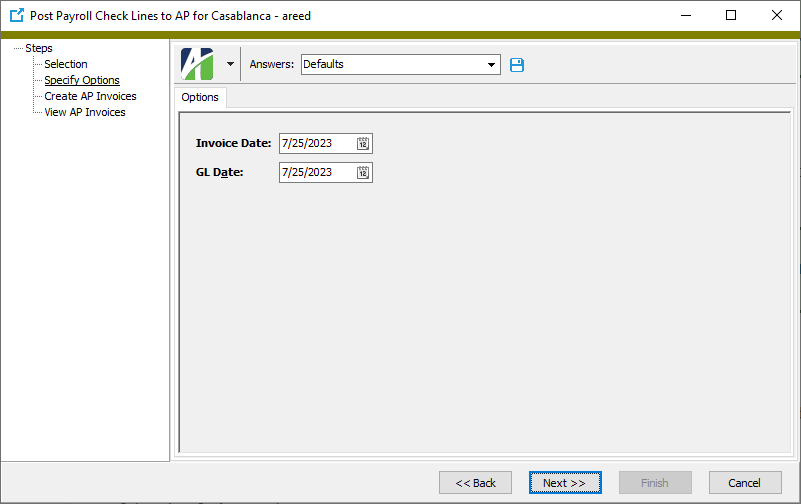

- To process all or a filtered subset of check lines:

- Select the Options tab.

- In the Invoice Date field, enter the date to print on the invoices.

- In the GL Date field, enter the date to post transactions to the general ledger.

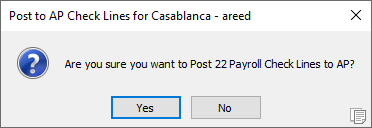

- Click Next >>. ActivityHD prompts you to confirm that you want to post the check line(s) to AP.

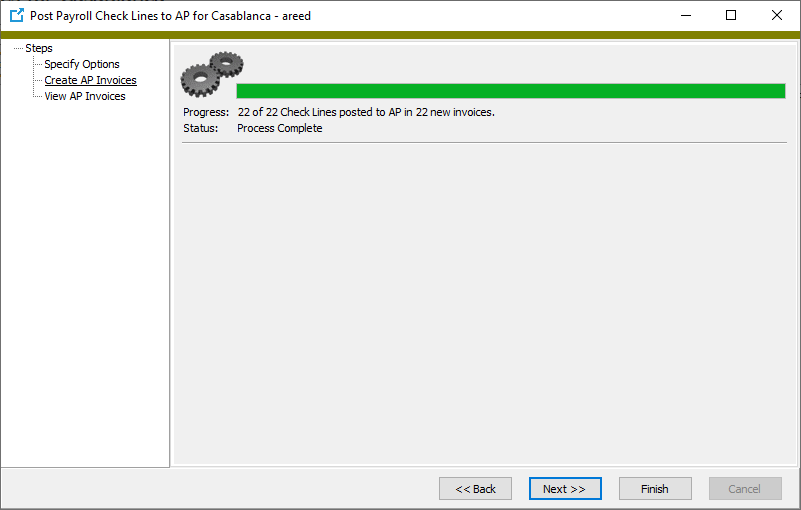

- Click Yes. ActivityHD creates the appropriate invoices and posts them to AP.

- Click Next >>. At this point you can view the invoices created. From this view page you can also proof, merge, and pay the invoices if desired.

- Click Finish.

Check Lines Listing

Purpose

The Check Lines Listing provides a list of check lines recorded in Payroll.

Content

For each check line included on the report, the listing shows:

- PRCode and description

- batch - entry number

- for garnishments, the garnishment record number

- work date

- source

- rate

- result.

In addition, you can include:

- memos.

The following totals appear on the report:

- employee totals (check line count, pay, deductions, tax, source, result) or PRCode totals (check line count, source, result)

- report totals (check line count, pay, deductions, tax, source, result).

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Checks > Check Lines folder.

- Start the report set-up wizard.

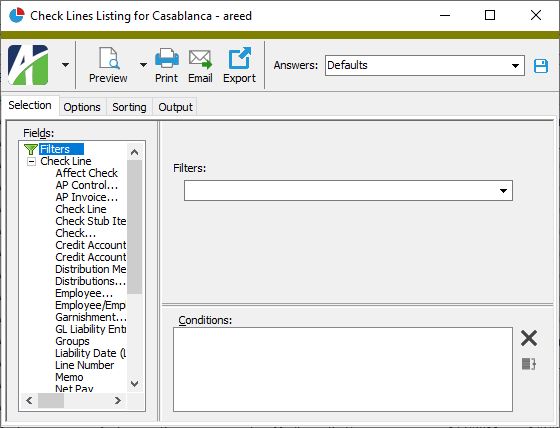

- To report on all or a filtered subset of check lines:

- Right-click the Check Lines folder and select Select and Report > Check Lines Listing from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected check lines:

- In the HD view, select the check lines to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select Check Lines Listing from the drop-down menu.

and select Check Lines Listing from the drop-down menu.

- To report on a particular check line from the Check Line window:

- In the HD view, locate and double-click the check line to report on. The Check Line window opens with the check line loaded.

- Click

and select Check Lines Listing from the drop-down menu.

and select Check Lines Listing from the drop-down menu.

- To report on all or a filtered subset of check lines:

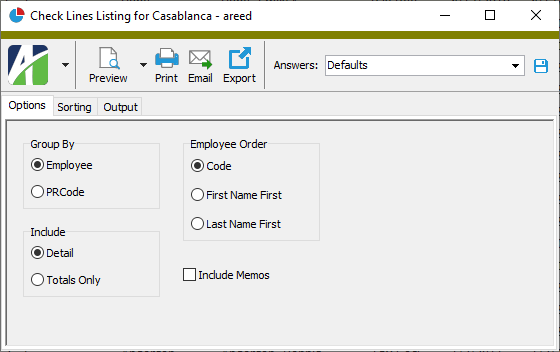

- Select the Options tab.

- In the Group By field, select how to group check lines on the report. Your options are:

- Employee

- PRCode

- In the Include field, select the information to include on the report. Your options are:

- Detail

- Totals Only

- In the Employee Order field, select the sort order for employee records on the report. Your options are:

- Code - Base the sort order on the employee code.

- First Name First

- Last Name First

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

- To include check line memos on the report, mark the Include Memos checkbox.

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the field(s) to sort the report by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Employees

- Checks

- Check lines

Payroll Group Analysis

Purpose

The Payroll Group Analysis report shows payroll details by check line group. You can specify a list of groups and up to five levels of subtotals. You can even subtotal on custom fields defined for employees and checks. This report can produce the numbers you need to fill out Form 940.

Content

When run to show detail, for each check line included on the report, the report shows:

- employee code

- employee name

- check date or work date

- batch - entry number - line number

- PRCode

- garnishment record number (when applicable)

- source

- rate

- result.

The following totals appear on the report:

- grand totals.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Checks > Check Lines folder.

- Start the report set-up wizard.

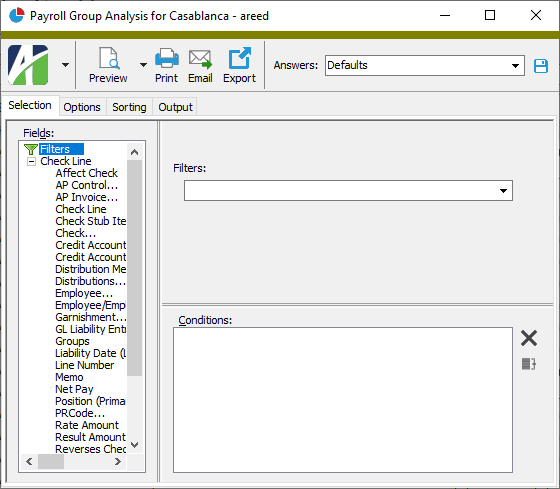

- To report on all or a filtered subset of check lines:

- Right-click the Check Lines folder and select Select and Report > Payroll Group Analysis from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected check lines:

- In the HD view, select the check lines to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select Payroll Group Analysis from the drop-down menu.

and select Payroll Group Analysis from the drop-down menu.

- To report on a particular check line from the Check Line window:

- In the HD view, locate and double-click the check line to report on. The Check Line window opens with the check line loaded.

- Click

and select Payroll Group Analysis from the drop-down menu.

and select Payroll Group Analysis from the drop-down menu.

- To report on all or a filtered subset of check lines:

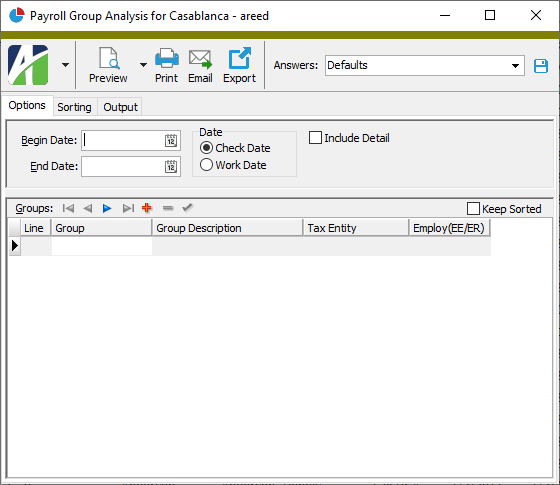

- Select the Options tab.

- In the Begin Date and End Date fields, enter the range of dates for which to include information on the report.

- In the Date field, select the type of date to use to select the check lines to include on the report. Your options are:

- Check Date

- Work Date

Note

The type of date you select here affects only the selection of check lines included on the report. Other information reflected on the report (e.g., employee attributes, position, supervisor, pay rate) is always evaluated as of the work date on the check line.

- To see check line detail rather than report totals only, mark the Include Detail checkbox.

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

- In the Groups table, enter the check line group(s) to include information for on the report.

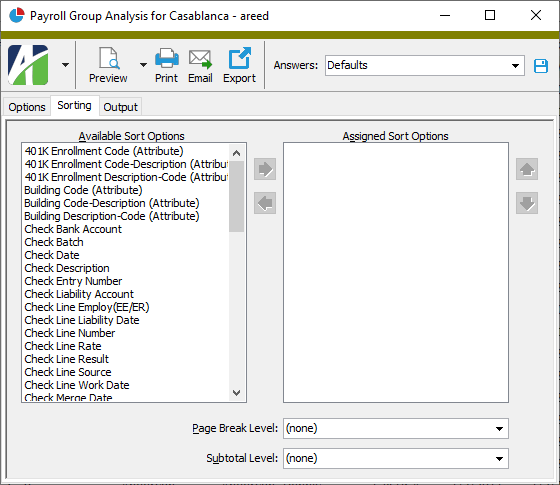

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the field(s) to sort the report by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box. - If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied. - To start a new page for each change in one of the sorting options you specified, select the sorting option to break on from the Page Break Level drop-down list. If you do not want to insert page breaks, accept "(none)".

- To subtotal on one of the sorting options you specified, select the sorting option to subtotal on from the Subtotal Through Level drop-down list. If you do not want to show subtotals, accept "(none)".

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Employees

- Checks

- Check lines

- Groups

Check Line Record ID

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Check Line tab

Depending on how the PRCode for the check line is set up, the Source, Rate, and Result fields may default their values from calculation expressions and parameter values on the PRCode and on the employee. If the check has not been merged, one or more of these fields may be enabled. If you need to edit one of these fields and it is not enabled, you can unlock the field by selecting it and then selecting ![]() > Tools > Unlock Source/Rate/Result or pressing Ctrl+Alt+U.

> Tools > Unlock Source/Rate/Result or pressing Ctrl+Alt+U.

The source amount used to calculate the check line result. The source amount comes from the source expression on the PRCode.

Example

For a check line that represents pay, the source amount could be hours worked.

- By Source. The account number is determined by the PRCode, the employee, or both.

- Follows Pay. Distributions are automatically generated for the selected PRCodes. The distributions are proportional to the distributions for a selected group of other check lines. "Follows Pay" is defined on the PRCode segment item.

- Manual. Account numbers are entered manually.

- Split Period. The distribution splits the check between two GL periods.

This field is disabled if the check line comes from a voided or reversal check.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

If the check line represents a garnishment, this field shows the garnishment record associated with the check line.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

This field is visible if the Payroll to AP interface is enabled. This field shows the AP control used for posting Payroll amounts on this check line to Accounts Payable.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

This field is visible if the Payroll to AP interface is enabled. This field shows the invoice created for this check line. You can drill down to the invoice from this field if you need to investigate payroll vendor payments.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

For deduction and tax items, the GL posting date of the liability entry. The default liability date type (check date, work date) can be set at the segment item level.

Note

If you override the date in this field, but the liability date source is "Check Date" or "Work Date" and the check date or work date, respectively, changes, the date is replaced by the new check date or work date.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

|

Extras\Payroll\Import Check Lines.xls; Change Check Lines.xls, Change Check Lines Distribution Attributes.xls |

Payroll check lines security

Common accesses available on check lines

Special accesses available on check lines

| Access | A user with this access can... |

|---|---|

| Post to AP | Post check lines to Accounts Payable. |

Payroll check lines filters

The following built-in filters are available for check lines:

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |