Purpose

The Pay Statements report produces employee notices about pay, whether printed check or direct deposit. The report is formatted like a direct deposit stub.

If your organization uses employee Self-Serve, you can post employees' pay statements online. ActivityHD makes the primary attachment on check records viewable on the Self-Serve site. By default, the pay statement is set as the primary attachment on check records.

Note

Only pay statements for merged checks with a pay statement attachment can be viewed in Employees Self-Serve.

Tip

Pay statements can be scheduled for background printing. So, if you generate payroll on a Monday but do not want pay statements to go out until Wednesday when the funds are available, you can schedule the pay statements to be emailed automatically on Wednesday morning.

Content

For each check for which you are creating a pay statement, the pay statement shows:

- employee name

- pay period end date

- FINAL/CORRECTION indicator, if applicable

- check date

- employee code

- current and year-to-date taxable gross

- current and year-to-date net pay

- wage information (segment item code, hours, rate, current amount, year-to-date amount, totals)

- deduction information (segment item code, current amount, year-to-date amount, totals)

- paid benefit information (segment item code, current amount, year-to-date amount, totals)

- tax information (segment item code, current amount, year-to-date amount, totals)

- reimbursement information (segment item code, current amount, year-to-date amount, totals)

- disbursements (pay method, account number, account type, current amount, year-to-date amount, source).

In addition, you can include:

- unmerged checks

- unmarked disbursements.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Checks folder.

- Start the report set-up wizard.

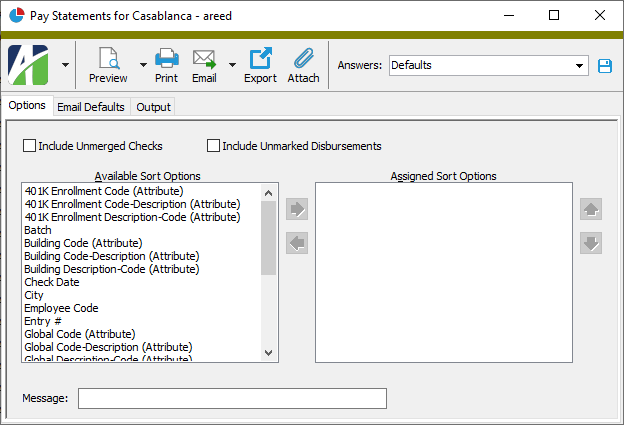

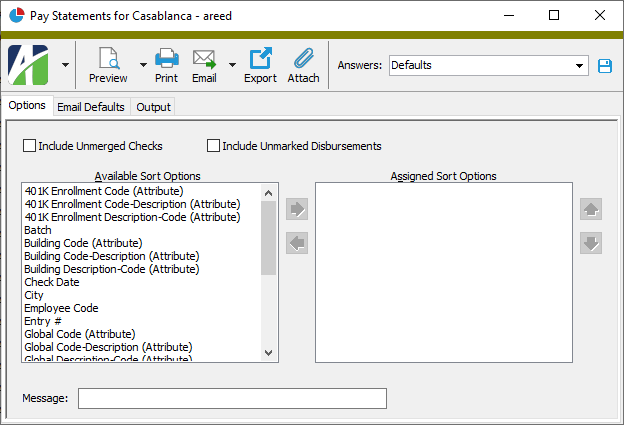

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Unmerged Checks

- Unmarked Disbursements

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

- In the Available Sort Options list box, highlight the field(s) to sort the pay statements by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box.

- If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied.

-

To include a message on the pay statements (provided the selected pay statement design incorporates it), enter the text in the Message field.

Note

The built-in sample pay statement design, "Pay Statement Sample", incorporates the message field.

-

To send pay statements to employees using the Email > Email to Employees feature, select the Email Defaults tab to set up the default email content. Otherwise, skip to step 13.

- From the From drop-down list, select the email account from which to send the email. Your options are:

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

- Use the CC and BCC fields to enter any email addresses to copy and/or blind copy on the pay statement emails. Separate email addresses with semi-colons.

- Enter a Subject and body for the email. You can use keywords to customize the content of the subject line and body text of the email. Keywords are replaced in the resulting email with the corresponding check and employee information. Click here to see the keywords available for use when you customize an email for pay statements.

- Select the Output tab.

-

In the Design field, look up and select the report design to use.

Note

Federal W-4 and state W-4 information is available in the data stream for easy inclusion on pay statements. Contact AccountingWare Support for assistance.

- In the toolbar, click the icon for the type of output you want:

Data extensions

The following data extensions are available for the report:

- Checks

- Employees

- Check disbursements

- Check stub items

×

Pay statement email keywords

The following keywords are available for use in the subject and body of email produced by the Pay Statement report:

| <EMPLOYEE CODE> |

<EMPLOYEE NAME SUFFIX> |

<CHECK DATE> |

| <EMPLOYEE NAME PREFIX> |

<EMPLOYEE FIRST NAME FIRST> |

<DESCRIPTION> |

| <EMPLOYEE FIRST NAME> |

<EMPLOYEE LAST NAME FIRST> |

<MEMO> |

| <EMPLOYEE MIDDLE NAME> |

<PERIOD BEGIN DATE> |

<IS SEPARATION> |

| <EMPLOYEE LAST NAME> |

<PERIOD END DATE> |

<PAY PERIODS PER YEAR> |