Note

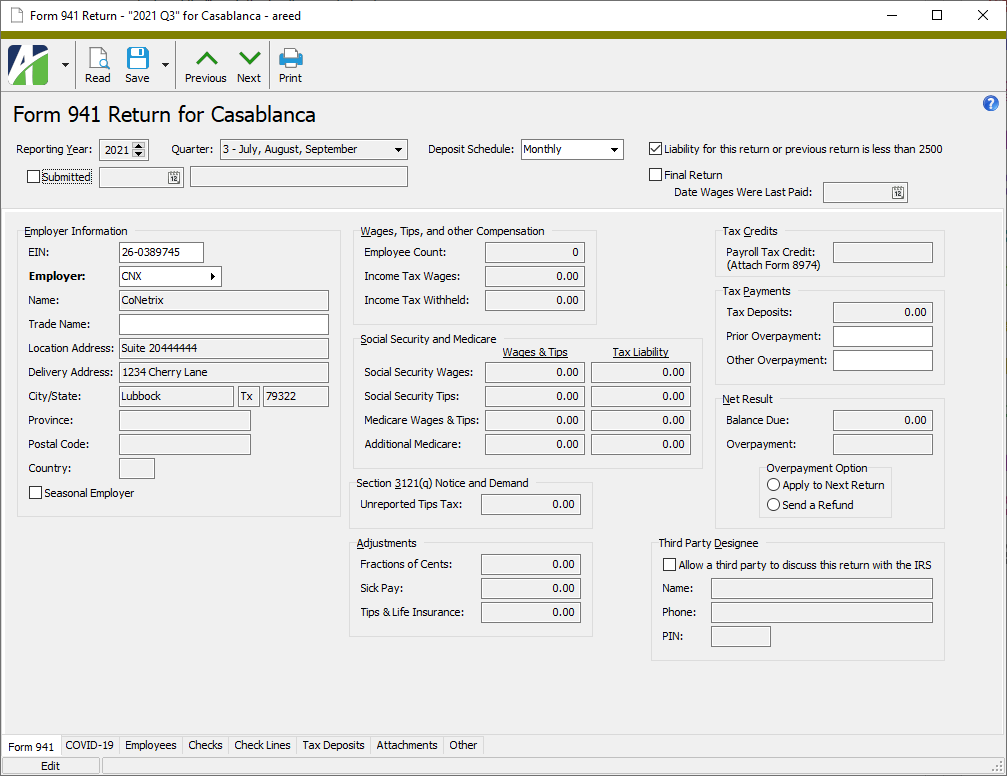

Some 941 return information can or must be maintained after form generation. Information can be maintained in the Form 941 Return window, using mass change, or using automation.

Note

The amount on line 11a is entered on the Options tab of the Generate 941s process. The amounts on lines 11b and 11d are entered on the COVID-19 tab. While you can view these amounts in the Form 941 window, you cannot change them there. If the amounts are incorrect, you must delete the Form 941 record and regenerate it.

Generate a 941 return

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

Click

. The Generate Form 941 wizard starts.

. The Generate Form 941 wizard starts.

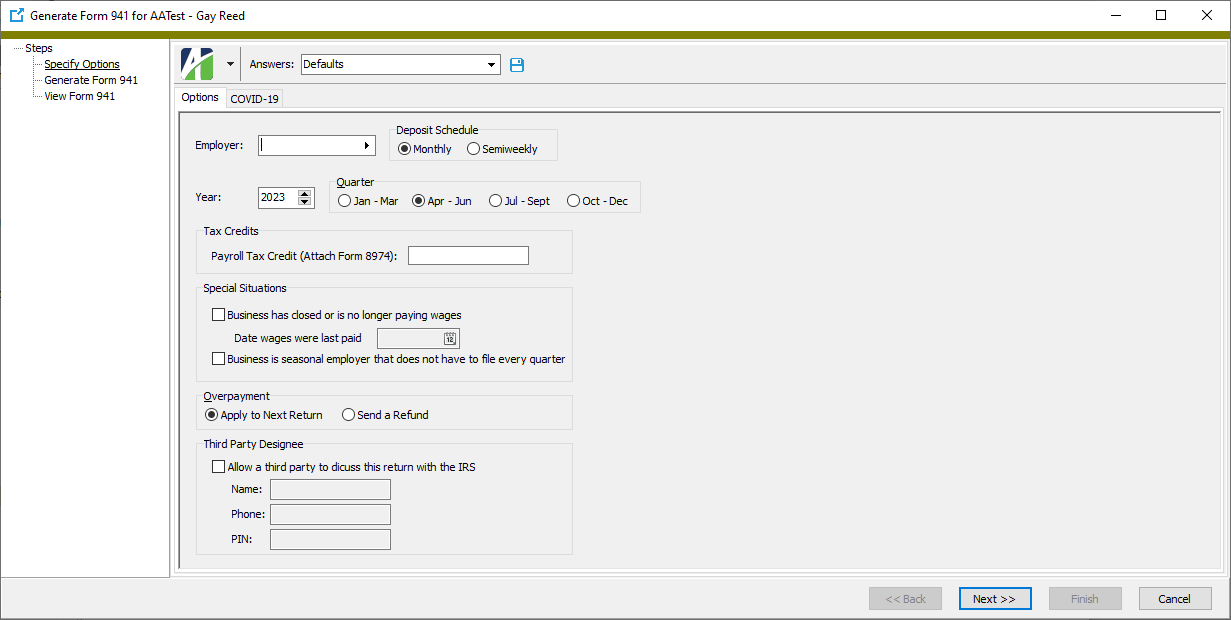

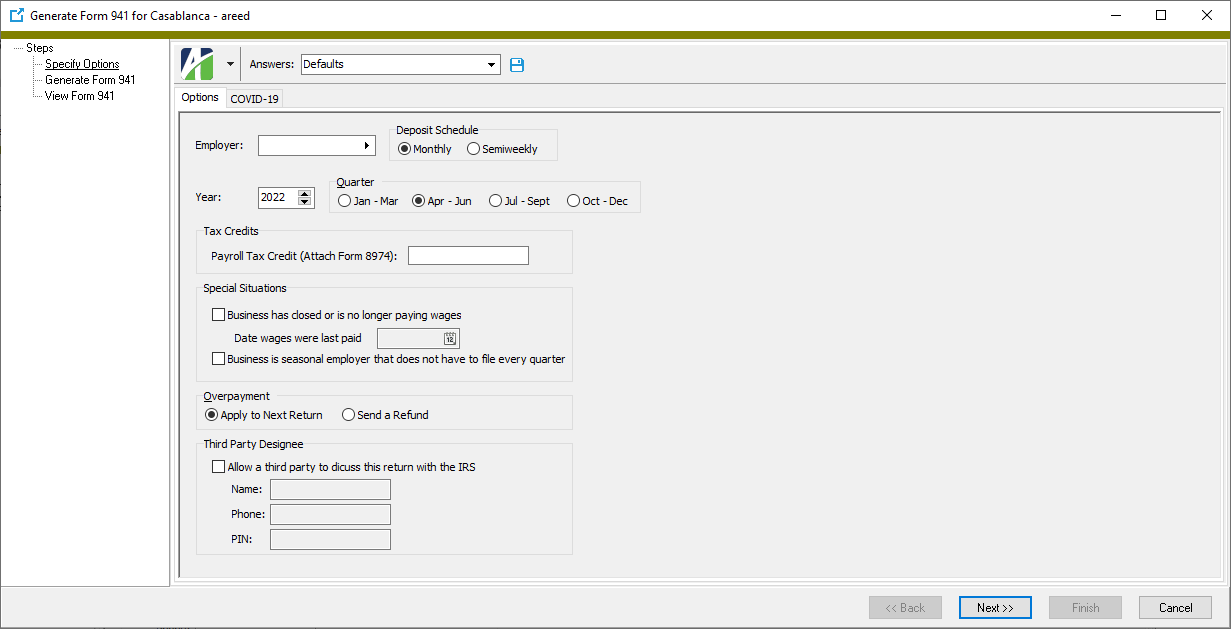

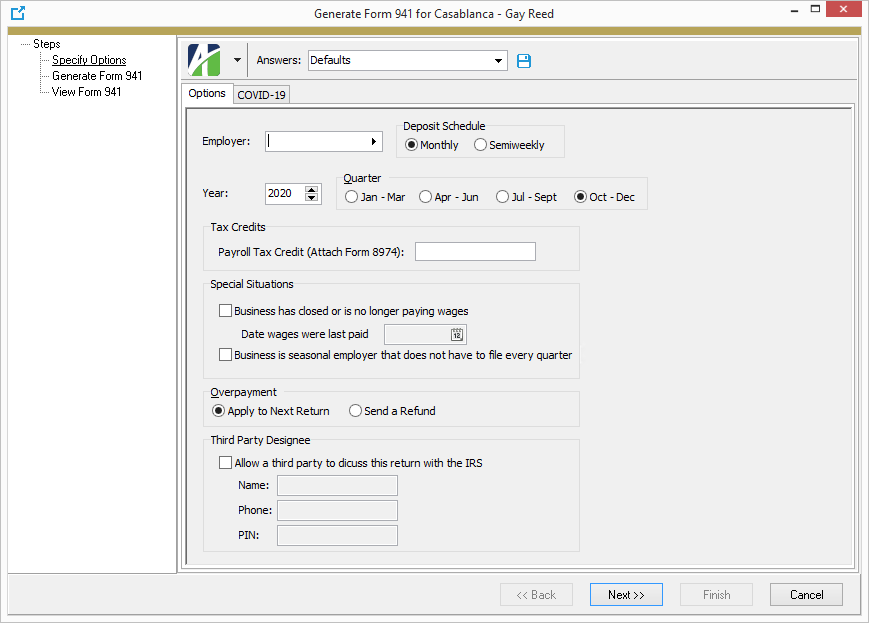

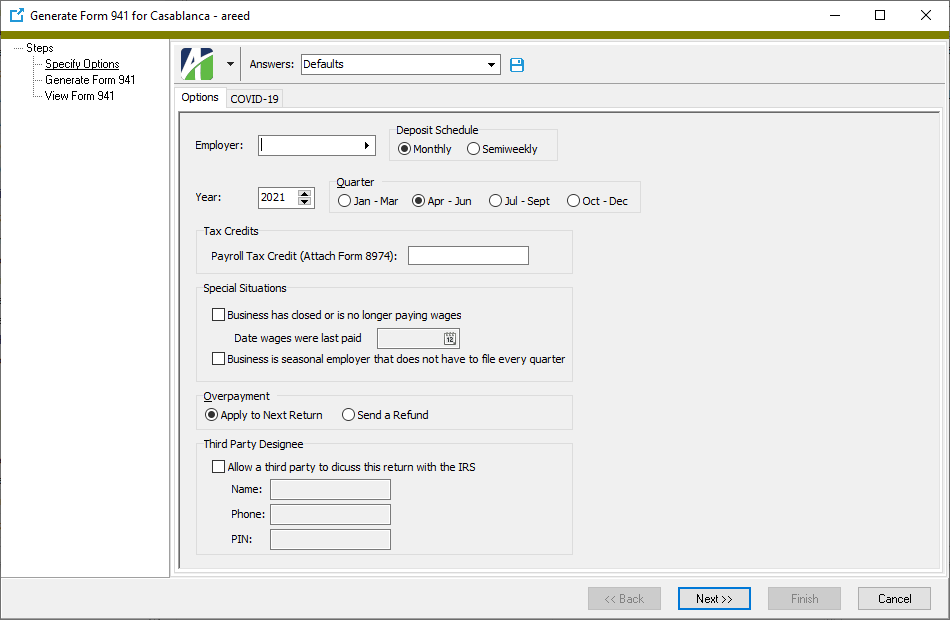

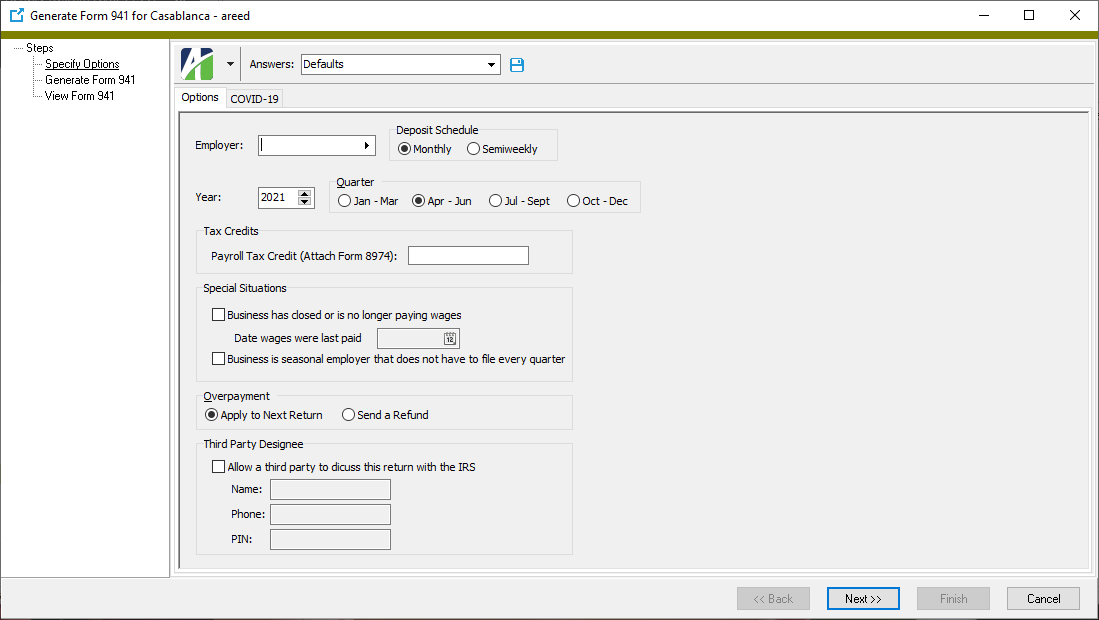

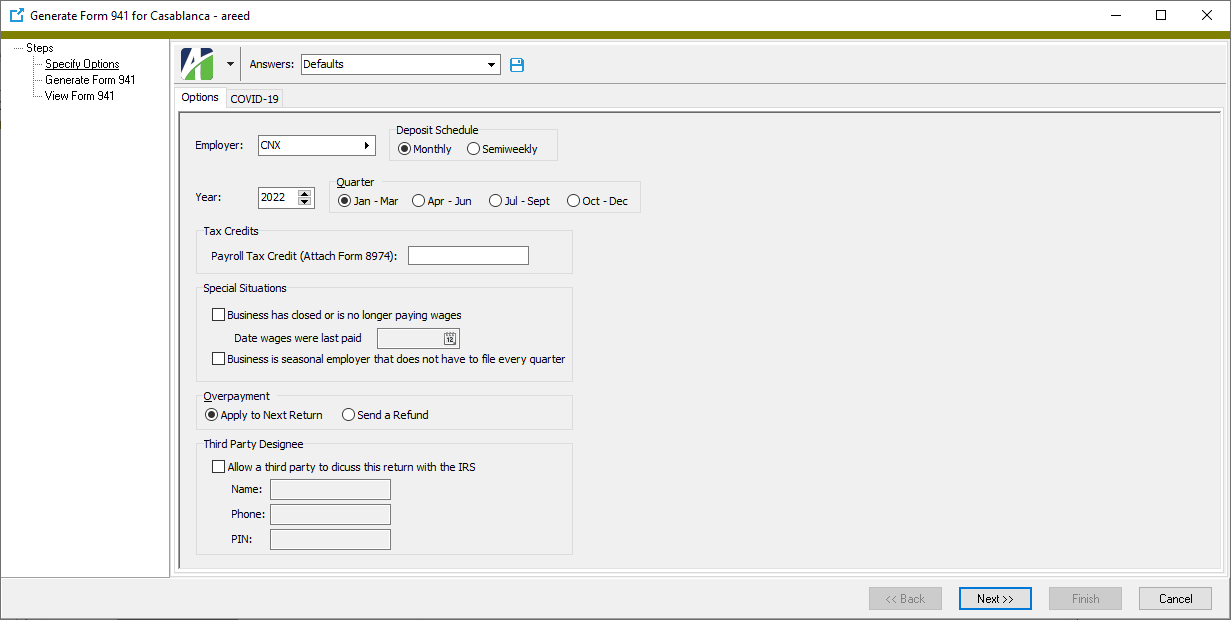

- On the Options tab in the Employer field, select the export employer to generate the 941 file for.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period (see $100,000 Next-Day Deposit Rule in Circular E).

- Enter the Year you are reporting on.

- Select the Quarter you are reporting on.

- In the Payroll Tax Credit (Attach Form 8974) field, enter the amount for the small business payroll tax credit for increasing research activities from line 12 of Form 8974, if applicable. If you enter an amount in this field, you must attach Form 8974 to the Form 941 return.

- The options in the Special Situations section apply only if your business has closed or you are a seasonal employer.

- Business has closed or is no longer paying wages. Mark this checkbox if the statement is true. If you mark the checkbox, the Date wages were last paid field is enabled. Enter the last date on which your business paid wages to its employees.

- Business is a seasonal employer that does not have to file every quarter. Mark this checkbox if the statement is true.

- In the Overpayment field, select how you want the IRS to handle excess tax payments. Your options are:

- Apply to Next Return

- Send a Refund

- If you want to Allow a third party to discuss this return with the IRS, mark the checkbox in the Third Party Designee section. The authorization is effective for one year from the 941 return due date and allows the designee to provide missing information from your return, call the IRS about your return, and respond to IRS notices that you have shared with the third party designee. If you mark the checkbox, the remaining fields in the section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

-

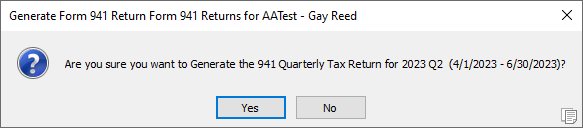

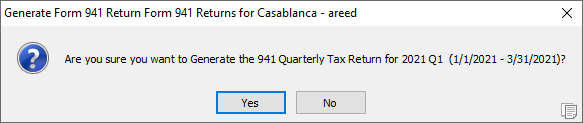

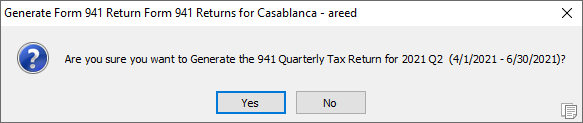

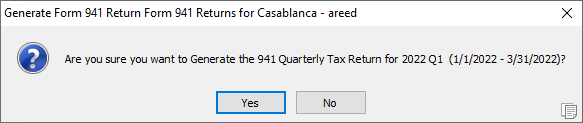

Click Next >>. ActivityHD prompts you to confirm that you want to generate the 941 return.

-

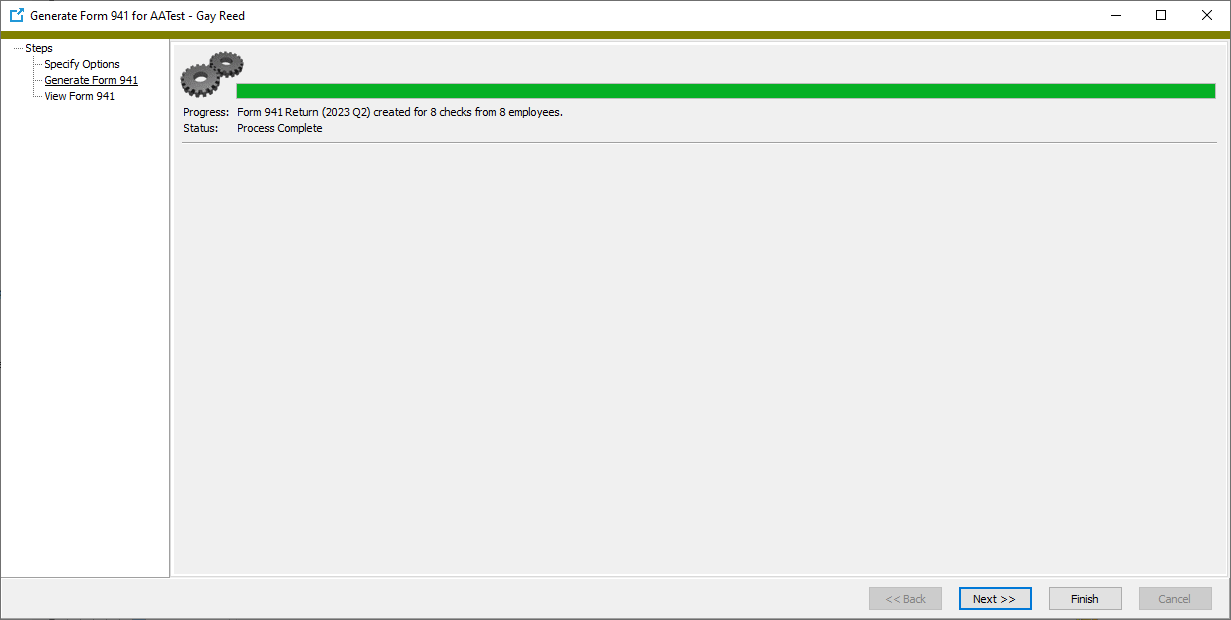

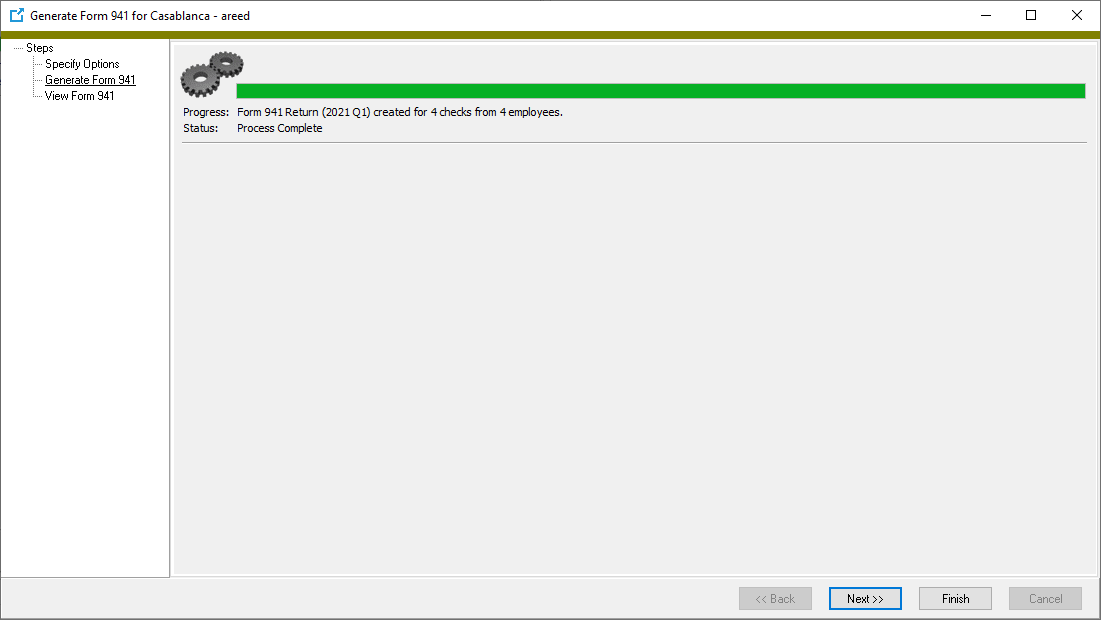

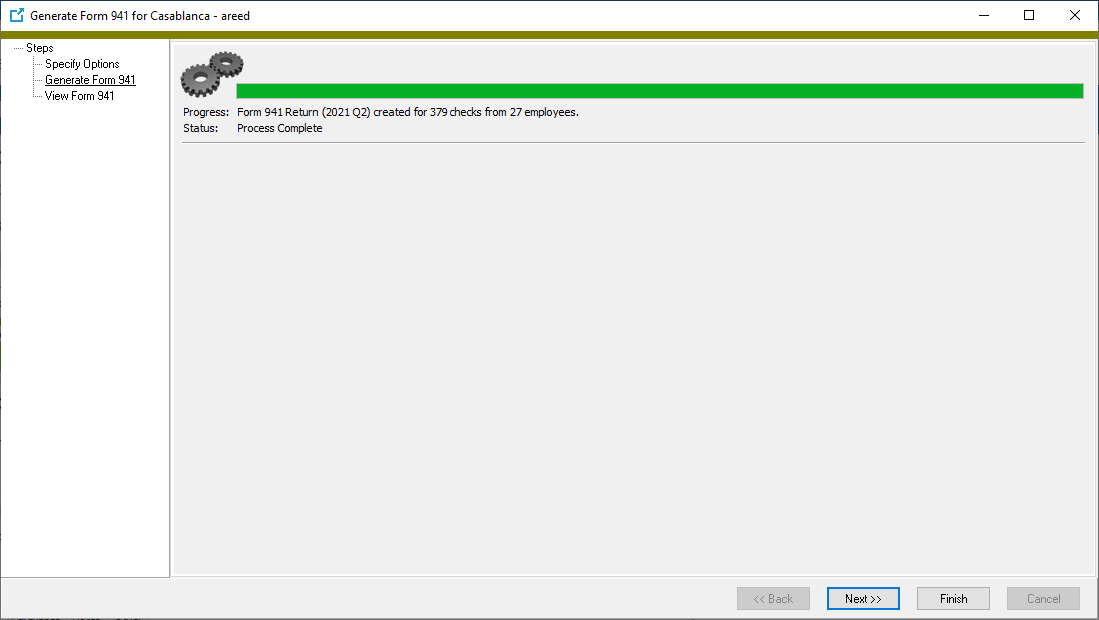

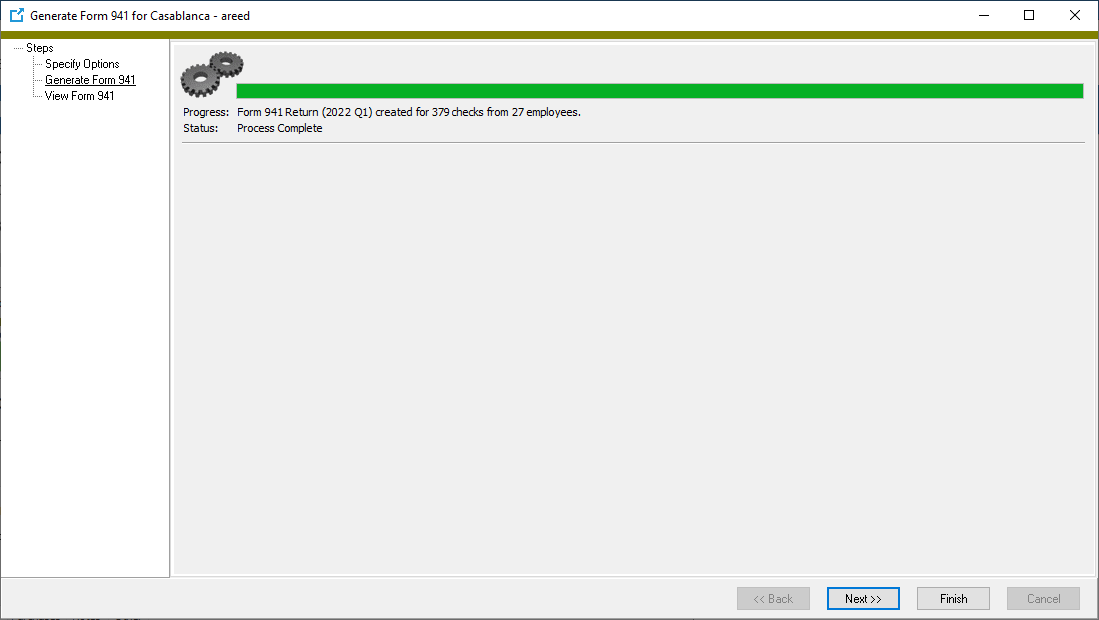

Click Yes. ActivityHD informs you when the process is complete and reports its results.

-

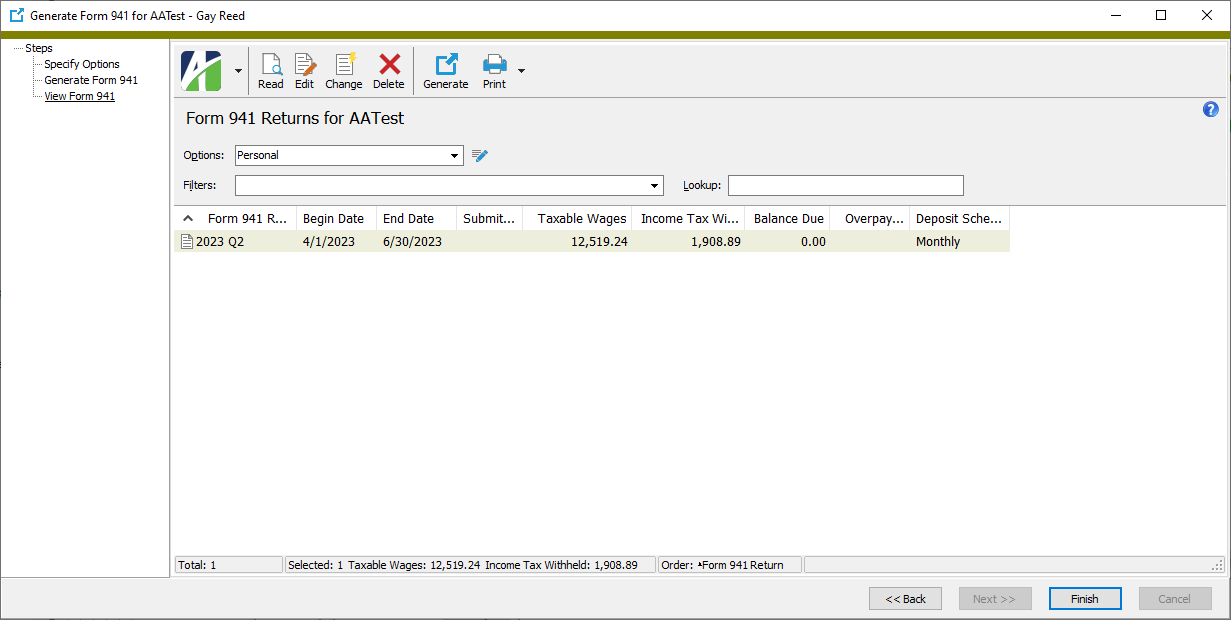

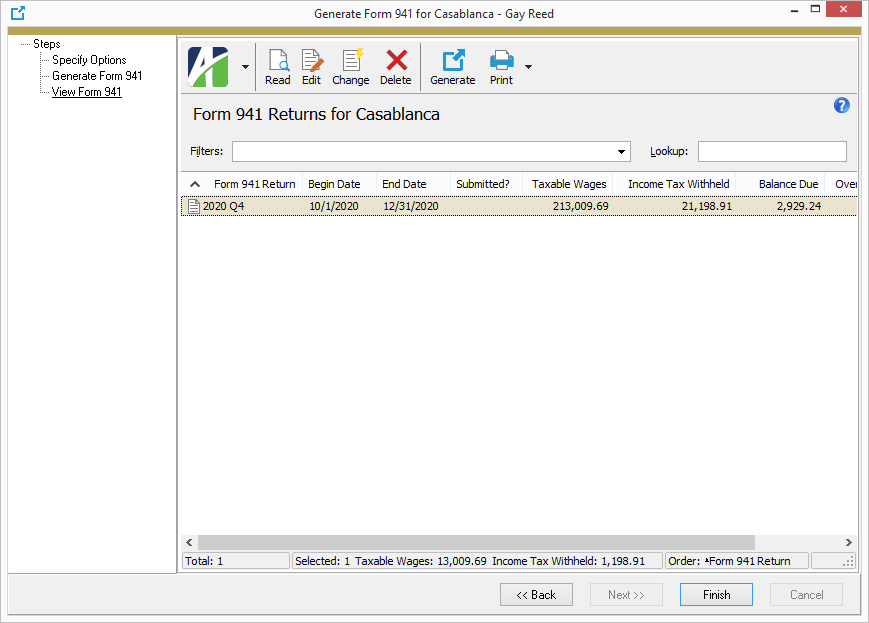

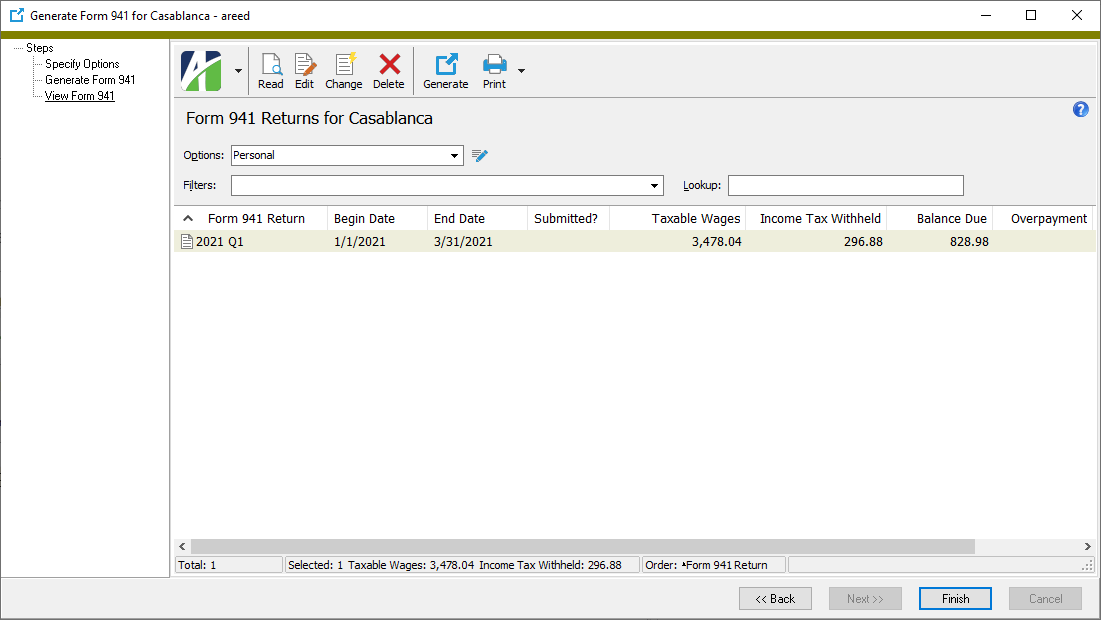

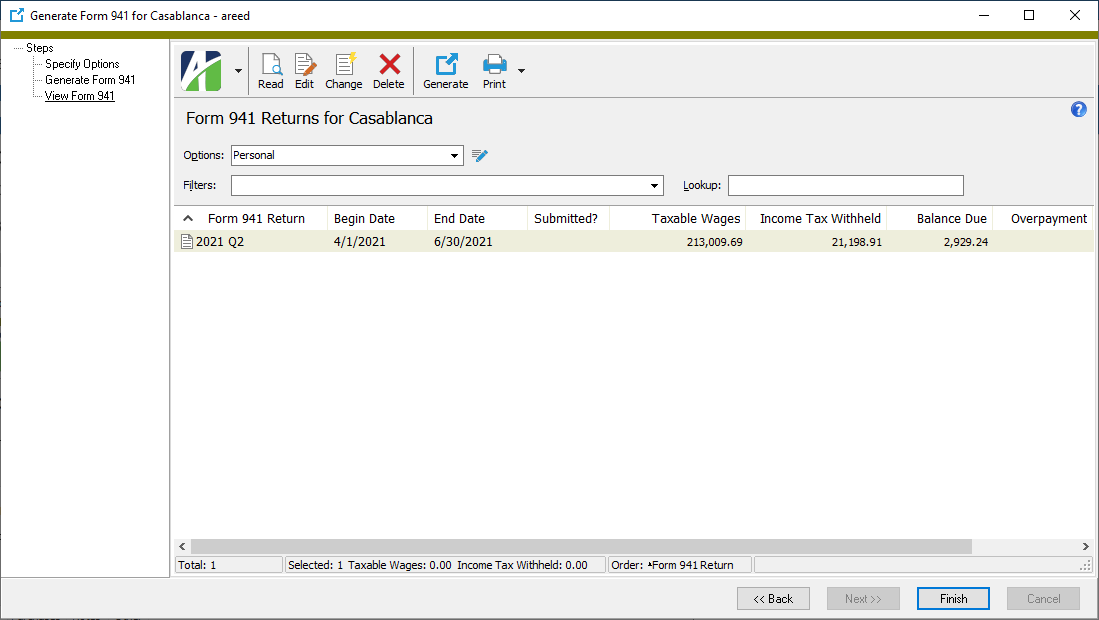

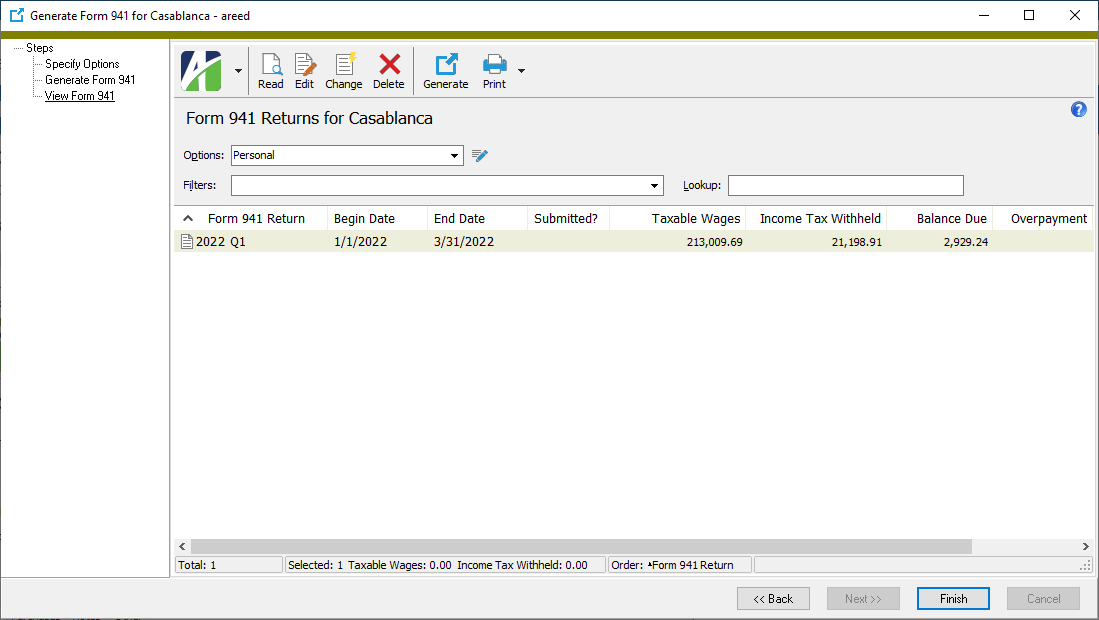

Click Next >>. ActivityHD shows the return that was created.

At this point, you can double-click the return in the right pane to drill down to the Form 941 Return window or you can print the return.

- When you finish viewing or working with the return, click Finish.

![]() SPECIAL: Generate a 941 return for quarters affected by COVID-19 (Quarters 2, 3, 4 of 2022)

SPECIAL: Generate a 941 return for quarters affected by COVID-19 (Quarters 2, 3, 4 of 2022)

Before generating 941s for quarter 2, 3, or 4 of 2022, ensure that the following built-in groups are assigned to the appropriate segment items:

- COVIDQualifiedFamily. COVID Qualified family leave wages

- COVIDQualifiedSick. COVID Qualified sick leave wages

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

Click

. The Generate Form 941 wizard starts.

. The Generate Form 941 wizard starts.

- On the Options tab in the Employer field, select the export employer to generate the 941 file for.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period (see $100,000 Next-Day Deposit Rule in Circular E).

- Enter the Year "2022".

- Select the Quarter you are reporting on. These instructions apply to quarters 2, 3, and 4 of 2022 only.

- In the Payroll Tax Credit (Attach Form 8974) field, enter the amount for the small business payroll tax credit for increasing research activities from line 12 of Form 8974, if applicable.

- The options in the Special Situations section apply only if your business has closed or you are a seasonal employer.

- Business has closed or is no longer paying wages. Mark this checkbox if the statement is true. If you mark the checkbox, the Date wages were last paid field is enabled. Enter the last date on which your business paid wages to its employees.

- Business is a seasonal employer that does not have to file every quarter. Mark this checkbox if the statement is true.

- In the Overpayment field, select how you want the IRS to handle excess tax payments. Your options are:

- Apply to Next Return

- Send a Refund

- If you want to Allow a third party to discuss this return with the IRS, mark the checkbox in the Third Party Designee section. The authorization is effective for one year from the 941 return due date and allows the designee to provide missing information from your return, call the IRS about your return, and respond to IRS notices that you have shared with the third party designee. If you mark the checkbox, the remaining fields in the section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

-

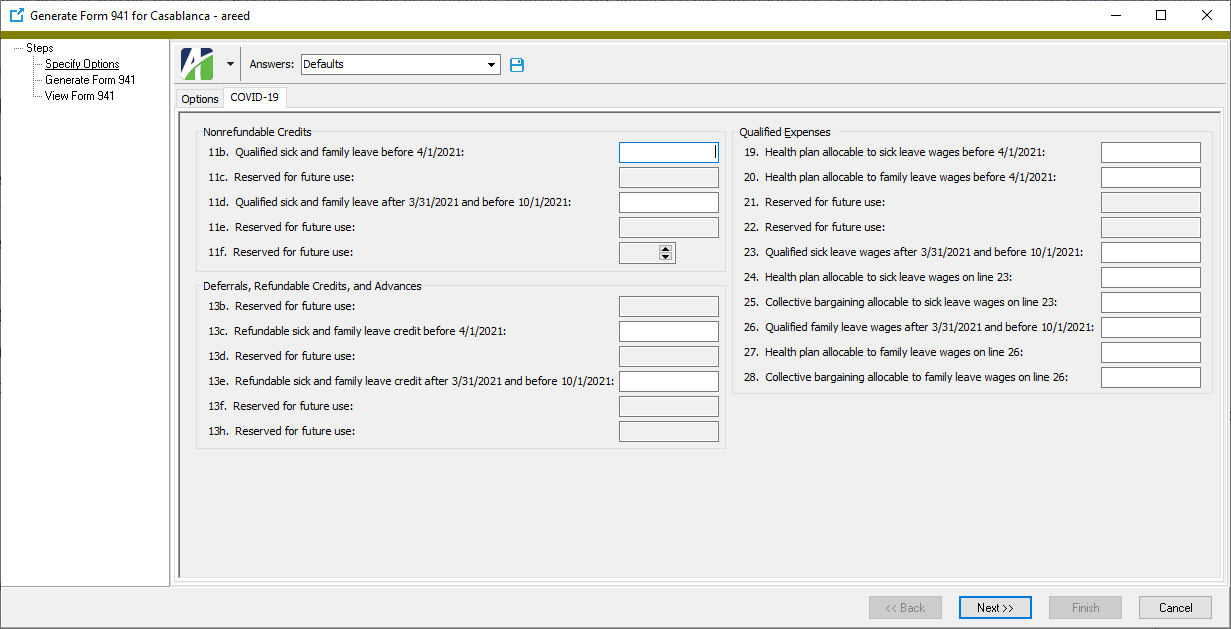

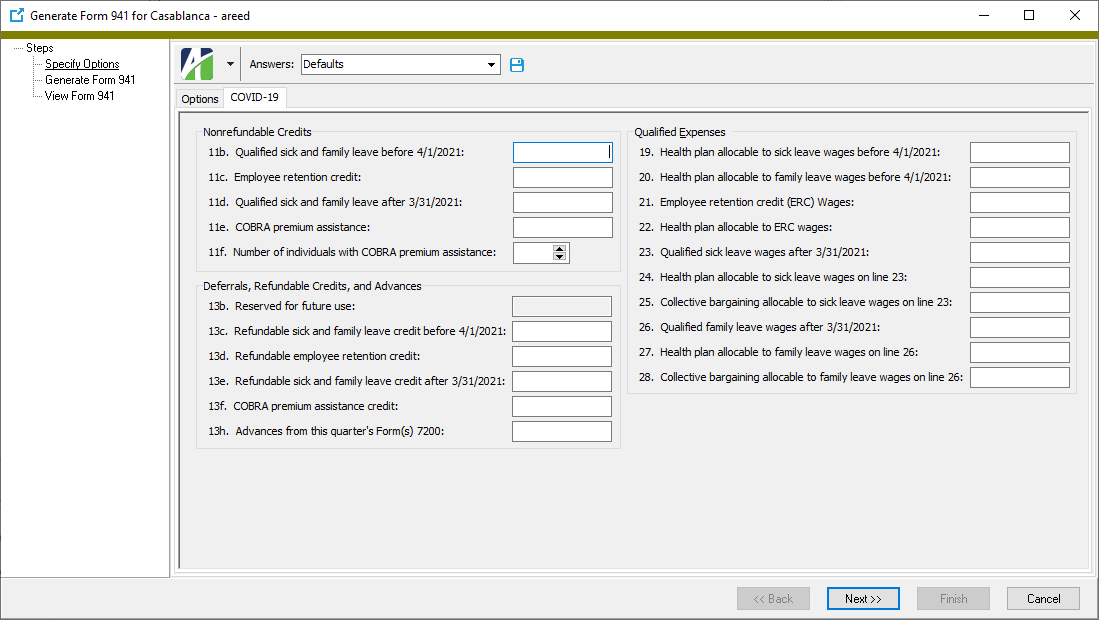

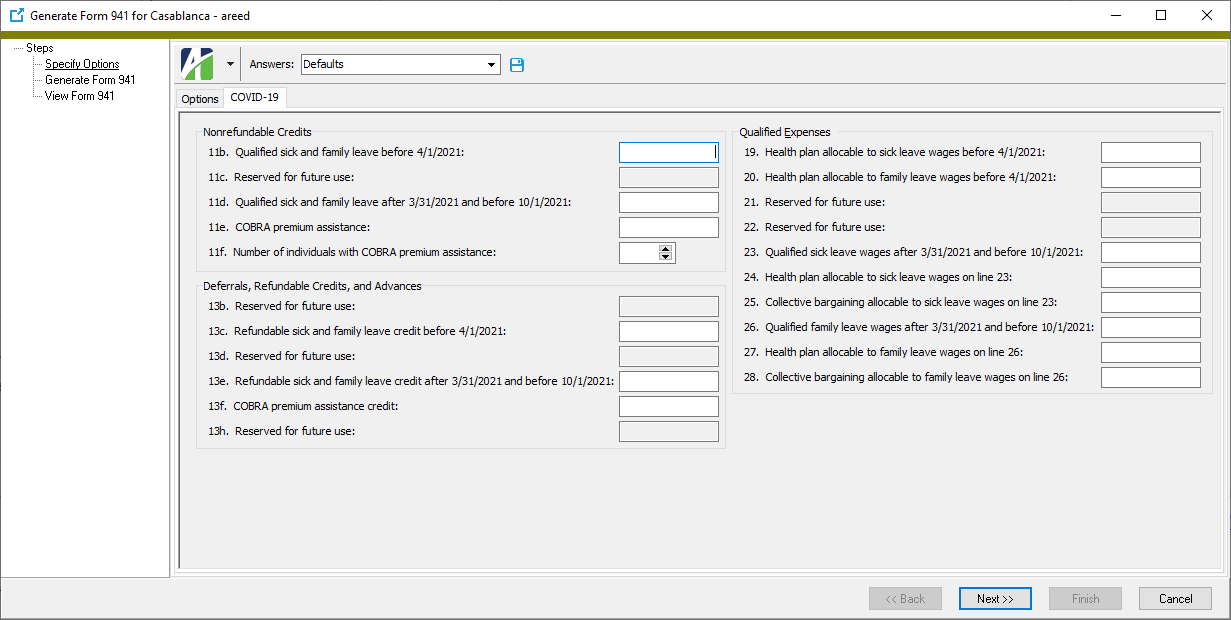

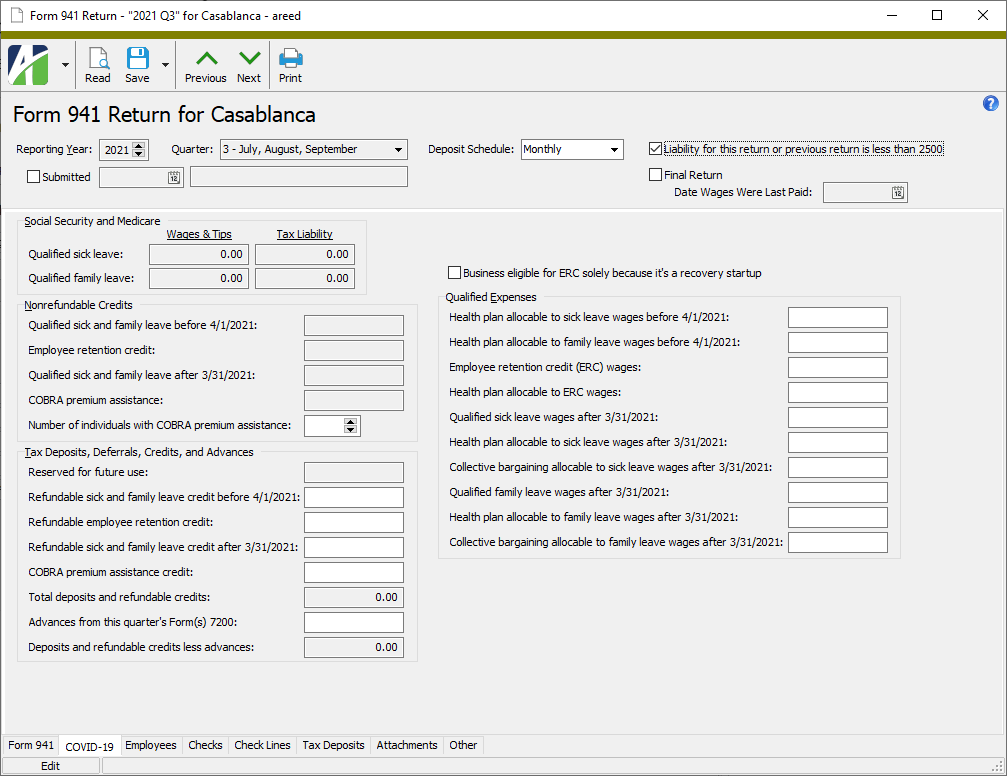

Select the COVID-19 tab.

- In the 11b. Qualified sick and family leave before 4/1/2021 field, enter the nonrefundable portion of the credit for qualified sick and family leave wages before 4/1/2021 from Worksheet 1, line 2j.

- In the 11d. Qualified sick and family leave after 3/31/2021 and before 10/1/2021 field, enter the nonrefundable portion of the credit for qualified sick and family leave wages after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2p.

- In the 13c. Refundable sick and family leave credit before 4/1/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages before 4/1/2021 from Worksheet 1, line 2k.

- In the 13e. Refundable sick and family leave credit after 3/31/2021 and before 10/1/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages taken after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2q.

- In the 19. Health plan allocable to sick leave wages before 4/1/2021 field, enter the amount of qualified health plan expenses allocable to qualified sick leave wages for leave taken before 4/1/2021 from Worksheet 1, line 2b.

- In the 20. Health plan allocable to family leave wages field, enter the amount of qualified health plan expenses allocable to qualified family leave wages for leave taken before 4/1/2021 from Worksheet 1, line 2f.

- In the 23. Qualified sick leave wages after 3/31/2021 and before 10/1/2021 field, enter the qualified sick leave wages for leave taken after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2a.

- In the 24. Health plan allocable to sick leave wages on line 23 field, enter the qualified health plan expenses allocable to qualified sick leave wages reported on line 23. This is the amount from Worksheet 2, line 2b.

- In the 25. Collective bargaining allocable to sick leave wages on line 23 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to sick leave wages reported on line 23. This is the amount from Worksheet 2, line 2c.

- In the 26. Qualified family leave wages after 3/31/2021 and before 10/1/2021 field, enter the qualified family leave wages paid to your employees for leave taken after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2g.

- In the 27. Health plan allocable to family leave wages on line 26 field, enter the qualified health plan expenses allocable to qualified family leave wages reported on line 26. This is the amount from Worksheet 2, line 2h.

- In the 28. Collective bargaining allocable to family leave wages on line 26 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to qualified family leave wages reported on line 26. This is the amount from Worksheet 2, line 2i.

-

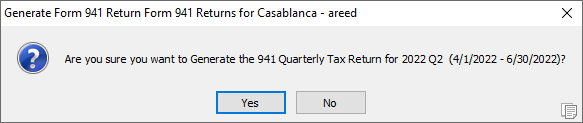

Click Next >>. ActivityHD prompts you to confirm that you want to generate the 941 return.

-

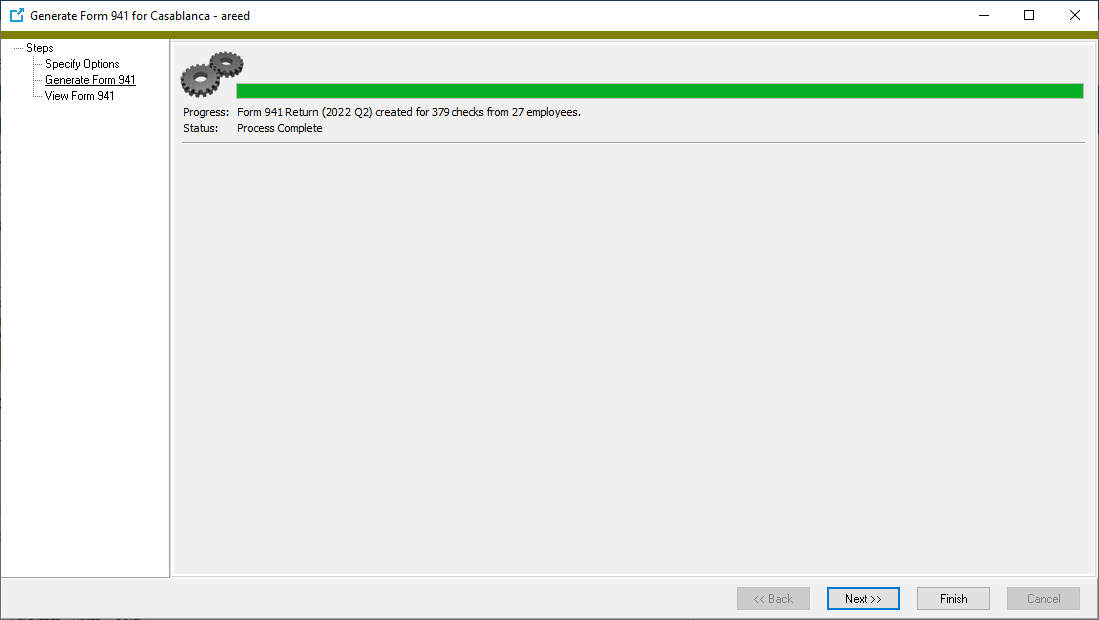

Click Yes. ActivityHD informs you when the process is complete and reports its results.

-

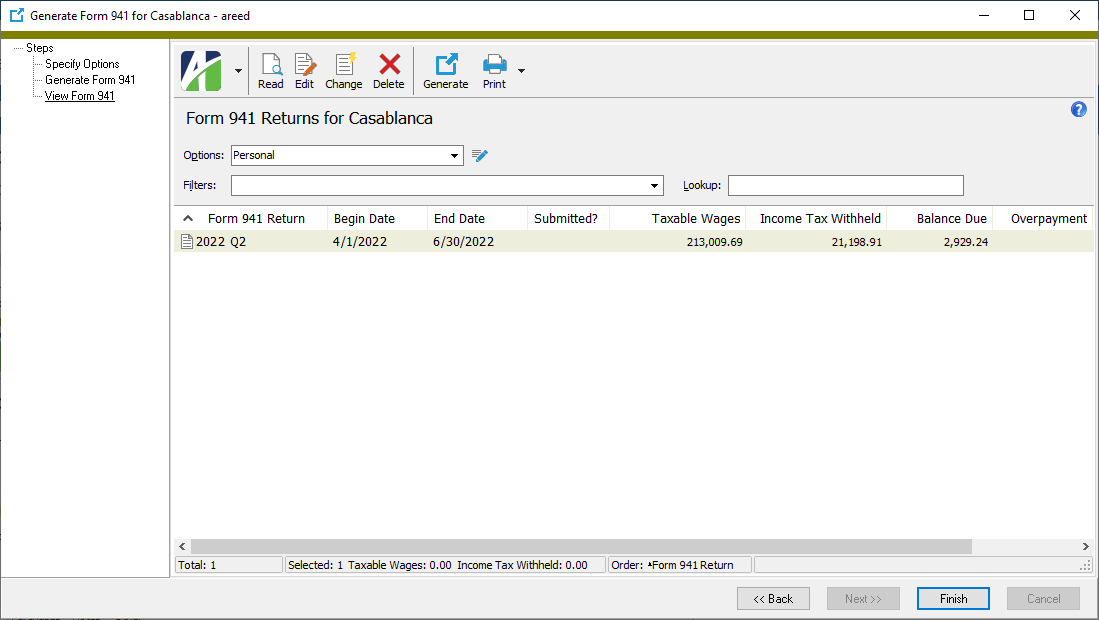

Click Next >>. ActivityHD shows the return that was created.

At this point, you can double-click the return in the right pane to drill down to the Form 941 Return window or you can print the return.

- When you finish viewing or working with the return, click Finish.

![]() SPECIAL: Generate/maintain a 941 return for past COVID-affected quarters

SPECIAL: Generate/maintain a 941 return for past COVID-affected quarters

![]() SPECIAL: Use the Form 941 COVID Worksheet to determine manual entry values (Q2 2020)

SPECIAL: Use the Form 941 COVID Worksheet to determine manual entry values (Q2 2020)

Version 7.41 of ActivityHD introduced the COVID-19 fields for Form 941. While Qualified Sick Leave and Qualified Family Leave values are calculated in the Form 941 Generation process, the remaining COVID-19 values must be entered manually. An export control is available to assist in determining these values.

Setup

- If you do not already have a TotalHours group, create one. Alternatively, you can modify the XML file imported in the next step to replace TotalHours with an appropriate group.

- Import the Form 941 COVID Worksheet 1.XML export control from your distribution. The export control is located in the ...\Extras\Payroll\Export Controls\ folder.

- A built-in COVIDEmpRetention group is available to track Employee Retention Credit wages during this time. If you paid any Employee Retention Credit wages, assign this group to the appropriate segment items.

Create the totals file

Follow these instructions to prepare the totals file with the additional COVID-19 information:

- In the Navigation pane, highlight the Payroll/Human Resources > Employees folder.

- Right-click the Employees folder and select Select and Create Totals File. The Employee Create Totals wizard starts.

- On the Standard Options tab, specify the following:

- Filename. Specify a file name with a .csv extension.

- Export Control. Select the "Form 941 COVID Worksheet 1" file you imported.

- Begin/End Dates. Specify the begin and end dates of the quarter you are reporting on.

- Date. Limit by "Check Date".

- On the Additional Options tab, specify the following:

- Enter March 13, 2020. Enter 3/13/2020.

- Enter March 31, 2020. Enter 3/31/2020.

- Credit Form 8974. Enter the value from Form 8974.

- Credit Form 5884-C. Enter the value from Form 5884-C.

- Click Create File.

- Open the output file and review the totals. Notice that the file includes a value for every line on Form 941, Worksheet 1. The column headings indicate where to enter the values in the Generate Form 941 process.

Calculations

The following table lists the Form 941, Worksheet 1 steps and describes how their values are calculated.

| Step # | Description

Calculation |

|---|---|

| 1 | Determine the employer share of social security tax this quarter after it is reduced by any credit claimed on Form 8974 and any credit to be claimed on Form 5884-C |

| These fields are calculated using the same formula as the Generate Form 941 process. The values for the Form 8974 and Form 5884-C credits come from the entries on the Additional Options tab of the Employee Create Total Files wizard. | |

| 2 | Figure the sick and family leave credit |

| According to the IRS, employers may use "any reasonable method" to determine the amount of health expenses that are allocable to COVID wages. (See question 33 of this FAQ.)

The export control uses the following formula for each affected employee:

The components of the formula are calculated as follows:

Note The values of lines 2a(i) and 2e(i) for sick or family leave wages not included on Form 941 are zero. The source expression for built-in segment item Tax:SocSecER was written to avoid this issue. |

|

| 3 | Figure the employee retention credit |

| The same formula used in Step 2 is applied in Step 3, except that the built-in COVIDEmpRetention group is used in place of COVIDQualifiedSick or COVIDQualifiedFamily. Lines 3c and 3d use the same formula; however, the calculation of health expense, employee retention hours, and total hours is limited to checks dated between March 13, 2020 and March 31, 2020. The values for lines 3c and 3d are zero except in quarter 2. |

![]() SPECIAL: Generate a 941 return for quarters affected by COVID-19 (2020)

SPECIAL: Generate a 941 return for quarters affected by COVID-19 (2020)

Before generating 941s for quarters 2 through 4 of 2020, ensure that the following built-in groups are assigned to the appropriate segment items:

- COVIDEmpRetention. COVID Employee Retention Credit wages

- COVIDQualifiedFamily. COVID Qualified family leave wages

- COVIDQualifiedSick. COVID Qualified sick leave wages

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

Click

. The Generate Form 941 wizard starts.

. The Generate Form 941 wizard starts.

- On the Options tab in the Employer field, select the export employer to generate the 941 file for.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period (see $100,000 Next-Day Deposit Rule in Circular E).

- Enter the Year "2020".

- Select the Quarter you are reporting on. For 2020, the COVID-19 changes apply to quarters 2, 3, and 4 only.

- The options in the Special Situations section apply only if your business has closed or you are a seasonal employer.

- Business has closed or is no longer paying wages. Mark this checkbox if the statement is true. If you mark the checkbox, the Date wages were last paid field is enabled. Enter the last date on which your business paid wages to its employees.

- Business is a seasonal employer that does not have to file every quarter. Mark this checkbox if the statement is true.

- In the Overpayment field, select how you want the IRS to handle excess tax payments. Your options are:

- Apply to Next Return

- Send a Refund

- If you want to Allow a third party to discuss this return with the IRS, mark the checkbox in the Third Party Designee section. The authorization is effective for one year from the 941 return due date and allows the designee to provide missing information from your return, call the IRS about your return, and respond to IRS notices that you have shared with the third party designee. If you mark the checkbox, the remaining fields in the section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

-

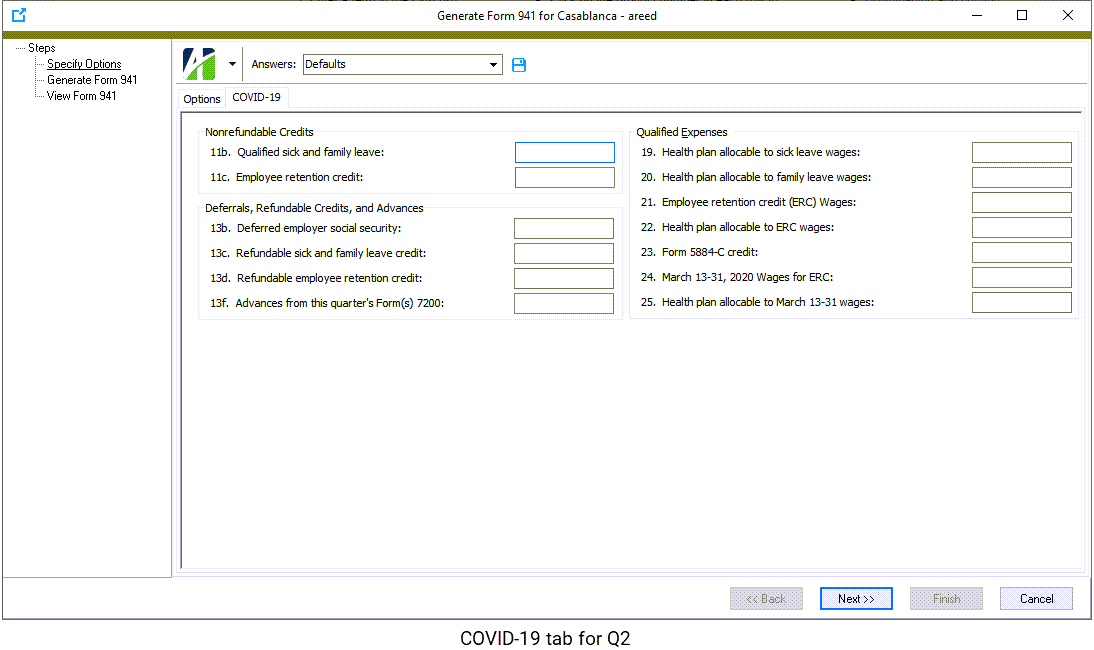

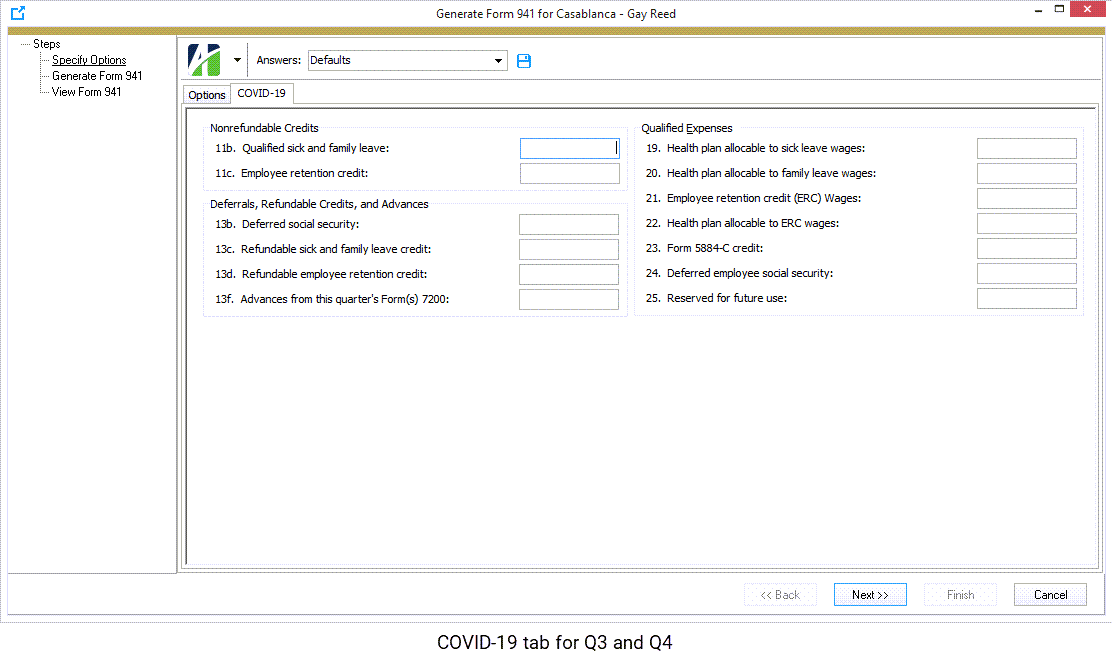

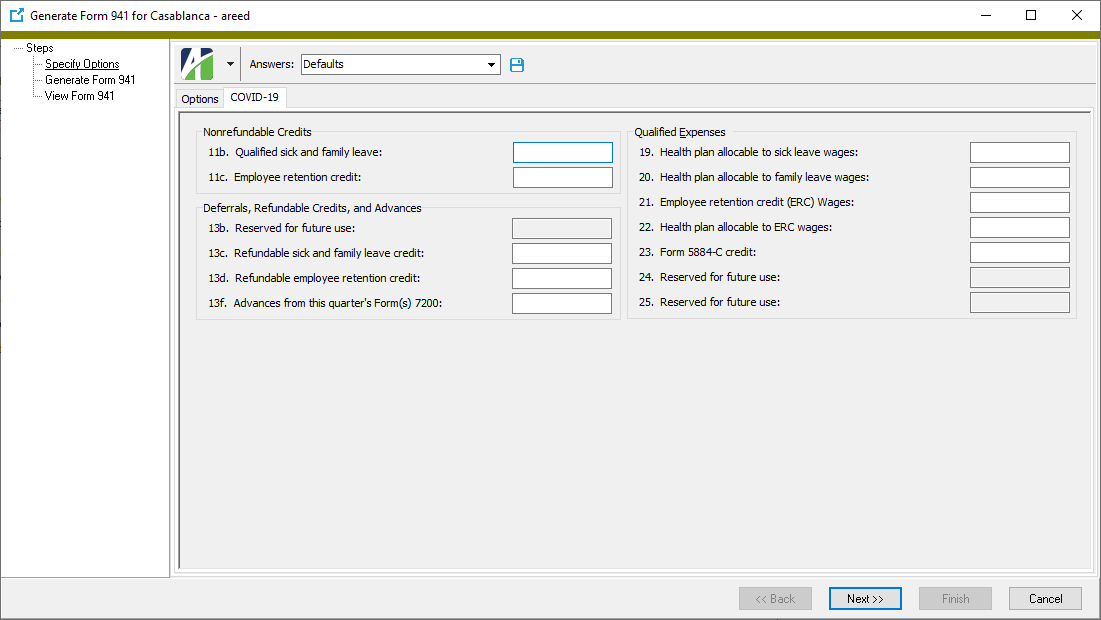

Select the COVID-19 tab.

- In the 11b. Qualified sick and family leave field, enter the nonrefundable portion of the credit for qualified sick and family leave wages from Worksheet 1.

- In the 11c. Employee retention credit field, enter the nonrefundable portion of the employee retention credit from Worksheet 1.

-

Q2: In the 13b. Deferred employer social security field, enter the deferred amount of the employer's share of social security tax.

Q3-4: In the 13b. Deferred social security field, enter the deferred amount of the employer's plus employees' share of social security tax.

- In the 13c. Refundable sick and family leave credit field, enter the refundable portion of the credit for qualified sick and family leave wages from Worksheet 1.

- In the 13d. Refundable employee retention credit field, enter the refundable portion of the employee retention credit from Worksheet 1.

- In the 13f. Advances from this quarter's Form(s) 7200 field, enter the total amount of advances received from filing Form(s) 7200 for the quarter.

- In the 19. Health plan allocable to sick leave wages field, enter the amount of qualified health plan expenses allocable to qualified sick leave wages.

- In the 20. Health plan allocable to family leave wages field, enter the amount of qualified health plan expenses allocable to qualified family leave wages.

- In the 21. Employee retention credit (ERC) wages field, enter the amount of qualified wages for the employee retention credit.

- In the 22. Health plan allocable to ERC wages field, enter the qualified health plan expenses allocable to wages reported on line 21.

- In the 23. Form 5884-C credit field, enter the credit amount from line 11 of Form 5884-C for this quarter.

-

Q2: In the 24. March 13-31, 2020 wages for ERC field, enter the qualified wages paid between March 13 and March 31, 2020 for the employee retention credit.

Q3-4: In the 24. Deferred employee social security field, enter the deferred amount of employees' social security tax.

-

Q2: In the 25. Health plan allocable to March 13-31 wages field, enter the qualified health plan expenses allocable to wages reported on line 24.

Q3-4: As indicated, the field labeled 25. Reserved for future use does not require input. Continue at the next step.

-

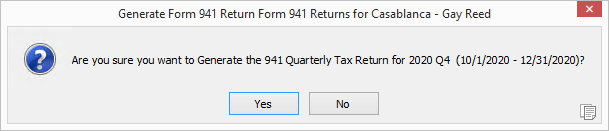

Click Next >>. ActivityHD prompts you to confirm that you want to generate the 941 return.

-

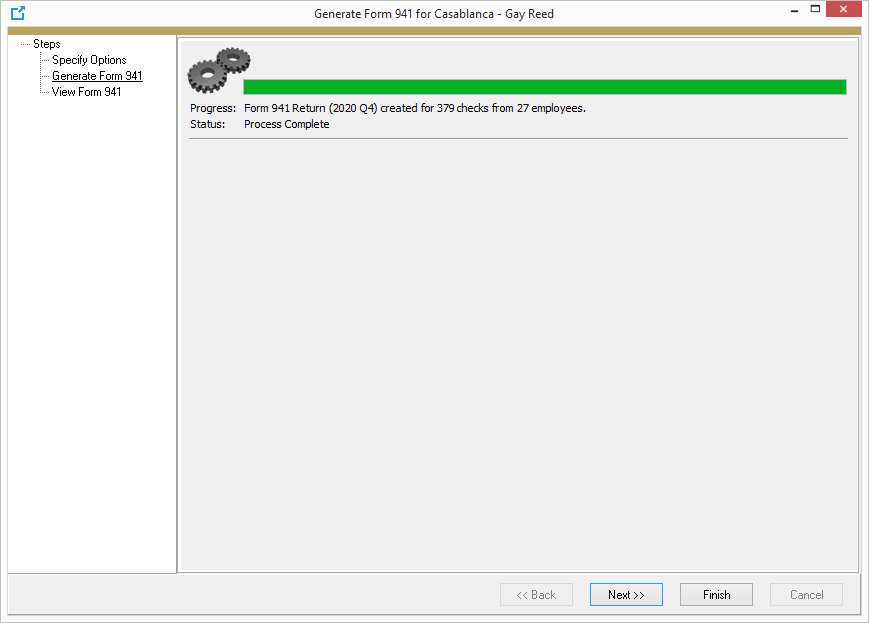

Click Yes. ActivityHD informs you when the process is complete and reports its results.

-

Click Next >>. ActivityHD shows the return that was created.

At this point, you can double-click the return in the right pane to drill down to the Form 941 Return window or you can print the return.

- When you finish viewing or working with the return, click Finish.

![]() SPECIAL: Generate a 941 return for quarter 1 2021 affected by COVID-19

SPECIAL: Generate a 941 return for quarter 1 2021 affected by COVID-19

Before generating 941s for quarter 1 of 2021, ensure that the following built-in groups are assigned to the appropriate segment items:

- COVIDEmpRetention. COVID Employee Retention Credit wages

- COVIDQualifiedFamily. COVID Qualified family leave wages

- COVIDQualifiedSick. COVID Qualified sick leave wages

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

Click

. The Generate Form 941 wizard starts.

. The Generate Form 941 wizard starts.

- On the Options tab in the Employer field, select the export employer to generate the 941 file for.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period (see $100,000 Next-Day Deposit Rule in Circular E).

- Enter the Year "2021".

- In the Quarter field, select "Jan-Mar".

- In the Payroll Tax Credit (Attach Form 8974) field, enter the amount for the small business payroll tax credit for increasing research activities from line 12 of Form 8974, if applicable.

- The options in the Special Situations section apply only if your business has closed or you are a seasonal employer.

- Business has closed or is no longer paying wages. Mark this checkbox if the statement is true. If you mark the checkbox, the Date wages were last paid field is enabled. Enter the last date on which your business paid wages to its employees.

- Business is a seasonal employer that does not have to file every quarter. Mark this checkbox if the statement is true.

- In the Overpayment field, select how you want the IRS to handle excess tax payments. Your options are:

- Apply to Next Return

- Send a Refund

- If you want to Allow a third party to discuss this return with the IRS, mark the checkbox in the Third Party Designee section. The authorization is effective for one year from the 941 return due date and allows the designee to provide missing information from your return, call the IRS about your return, and respond to IRS notices that you have shared with the third party designee. If you mark the checkbox, the remaining fields in the section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

-

Select the COVID-19 tab.

- In the 11b. Qualified sick and family leave field, enter the nonrefundable portion of the credit for qualified sick and family leave wages from Worksheet 1.

- In the 11c. Employee retention credit field, enter the nonrefundable portion of the employee retention credit from Worksheet 1.

- In the 13c. Refundable sick and family leave credit field, enter the refundable portion of the credit for qualified sick and family leave wages from Worksheet 1.

- In the 13d. Refundable employee retention credit field, enter the refundable portion of the employee retention credit from Worksheet 1.

- In the 13f. Advances from this quarter's Form(s) 7200 field, enter the total amount of advances received from filing Form(s) 7200 for the quarter.

- In the 19. Health plan allocable to sick leave wages field, enter the amount of qualified health plan expenses allocable to qualified sick leave wages.

- In the 20. Health plan allocable to family leave wages field, enter the amount of qualified health plan expenses allocable to qualified family leave wages.

- In the 21. Employee Retention Credit (ERC) Wages field, enter the amount of qualified wages for the employee retention credit.

- In the 22. Health plan allocable to ERC wages field, enter the qualified health plan expenses allocable to wages reported on line 21.

- In the 23. Form 5884-C credit field, enter the credit amount from line 11 of Form 5884-C for this quarter.

-

Click Next >>. ActivityHD prompts you to confirm that you want to generate the 941 return.

-

Click Yes. ActivityHD informs you when the process is complete and reports its results.

-

Click Next >>. ActivityHD shows the return that was created.

At this point, you can double-click the return in the right pane to drill down to the Form 941 Return window or you can print the return.

- When you finish viewing or working with the return, click Finish.

![]() SPECIAL: Generate a 941 return for quarters affected by COVID-19 (Quarters 2, 3, 4 of 2021)

SPECIAL: Generate a 941 return for quarters affected by COVID-19 (Quarters 2, 3, 4 of 2021)

Before generating 941s for quarters 2 through 4 of 2021, ensure that the following built-in groups are assigned to the appropriate segment items:

- COVIDEmpRetention. COVID Employee Retention Credit wages

- COVIDQualifiedFamily. COVID Qualified family leave wages

- COVIDQualifiedSick. COVID Qualified sick leave wages

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

Click

. The Generate Form 941 wizard starts.

. The Generate Form 941 wizard starts.

- On the Options tab in the Employer field, select the export employer to generate the 941 file for.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period (see $100,000 Next-Day Deposit Rule in Circular E).

- Enter the Year "2021".

- Select the Quarter you are reporting on. These instructions apply to quarters 2, 3, and 4 of 2021 only.

- In the Payroll Tax Credit (Attach Form 8974) field, enter the amount for the small business payroll tax credit for increasing research activities from line 12 of Form 8974, if applicable.

- The options in the Special Situations section apply only if your business has closed or you are a seasonal employer.

- Business has closed or is no longer paying wages. Mark this checkbox if the statement is true. If you mark the checkbox, the Date wages were last paid field is enabled. Enter the last date on which your business paid wages to its employees.

- Business is a seasonal employer that does not have to file every quarter. Mark this checkbox if the statement is true.

- In the Overpayment field, select how you want the IRS to handle excess tax payments. Your options are:

- Apply to Next Return

- Send a Refund

- If you want to Allow a third party to discuss this return with the IRS, mark the checkbox in the Third Party Designee section. The authorization is effective for one year from the 941 return due date and allows the designee to provide missing information from your return, call the IRS about your return, and respond to IRS notices that you have shared with the third party designee. If you mark the checkbox, the remaining fields in the section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

-

Select the COVID-19 tab.

- In the 11b. Qualified sick and family leave before 4/1/2021 field, enter the nonrefundable portion of the credit for qualified sick and family leave wages before 4/1/2021 from Worksheet 1, line 2j.

- In the 11c. Employee retention credit field, enter the nonrefundable portion of the employee retention credit from Worksheet 2, line 2h for quarter 2 or from Worksheet 4, line 2h for quarters 3 and 4.

- In the 11d. Qualified sick and family leave after 3/31/2021 field, enter the nonrefundable portion of the credit for qualified sick and family leave wages after 3/31/2021 from Worksheet 3, line 2r.

- In the 11e. COBRA premium assistance field, enter the amount of COBRA premium assistance provided in the quarter from Worksheet 5, line 2g.

- In the 11f. Number of individuals with COBRA premium assistance field, enter the number of individuals provided COBRA premium assistance during the quarter.

- In the 13c. Refundable sick and family leave credit before 4/1/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages before 4/1/2021 from Worksheet 1, line 2k.

- In the 13d. Refundable employee retention credit field, enter the refundable portion of the employee retention credit from Worksheet 2, line 2i for quarter 2 or from Worksheet 4, line 2i for quarters 3 and 4.

- In the 13e. Refundable sick and family leave credit after 3/31/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages taken after 3/31/2021 from Worksheet 3, line 2s.

- In the 13f. COBRA premium assistance credit field, enter the refundable portion of the COBRA premium assistance credit from Worksheet 5, line 2h.

- In the 13h. Advances from this quarter's Form(s) 7200 field, enter the total advances received from filing Form(s) 7200 for the quarter. Do not include advances requested but not received by the time you file Form 941.

- If you selected quarter 3 or quarter 4 of 2021 on the Options tab, the 18b. Business eligible for ERC solely because it's a recovery startup checkbox is visible. Mark the checkbox if you qualify for the employee retention credit solely because your business is a recovery startup business.

- In the 19. Health plan allocable to sick leave wages before 4/1/2021 field, enter the amount of qualified health plan expenses allocable to qualified sick leave wages for leave taken before 4/1/2021 from Worksheet 1, line 2b.

- In the 20. Health plan allocable to family leave wages field, enter the amount of qualified health plan expenses allocable to qualified family leave wages for leave taken before 4/1/2021 from Worksheet 1, line 2f.

- In the 21. Employee retention credit (ERC) wages field, enter the amount of qualified wages for the employee retention credit from Worksheet 2, line 2a for quarter 2 or from Worksheet 4, line 2a for quarters 3 and 4.

- In the 22. Health plan allocable to ERC wages field, enter the qualified health plan expenses allocable to wages from Worksheet 2, line 2b for quarter 2 or from Worksheet 4, line 2b for quarters 3 and 4.

- In the 23. Qualified sick leave wages after 3/31/2021 field, enter the qualified sick leave wages for leave taken after 3/31/2021 from Worksheet 3, line 2a.

- In the 24. Health plan allocable to sick leave wages on line 23 field, enter the qualified health plan expenses allocable to qualified sick leave wages reported on line 23. This is the amount from Worksheet 3, line 2b

- In the 25. Collective bargaining allocable to sick leave wages on line 23 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to sick leave wages reported on line 23. This is the amount from Worksheet 3, line 2c.

- In the 26. Qualified family leave wages after 3/31/2021 field, enter the qualified family leave wages paid to your employees for leave taken after 3/31/2021 from Worksheet 3, line 2g.

- In the 27. Health plan allocable to family leave wages on line 26 field, enter the qualified health plan expenses allocable to qualified family leave wages reported on line 26. This is the amount from Worksheet 3, line 2h.

- In the 28. Collective bargaining allocable to family leave wages on line 26 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to qualified family leave wages reported on line 26. This is the amount from Worksheet 3, line 2i.

-

Click Next >>. ActivityHD prompts you to confirm that you want to generate the 941 return.

-

Click Yes. ActivityHD informs you when the process is complete and reports its results.

-

Click Next >>. ActivityHD shows the return that was created.

At this point, you can double-click the return in the right pane to drill down to the Form 941 Return window or you can print the return.

- When you finish viewing or working with the return, click Finish.

![]() SPECIAL: Generate a 941 return for quarters affected by COVID-19 (Quarter 1 of 2022)

SPECIAL: Generate a 941 return for quarters affected by COVID-19 (Quarter 1 of 2022)

Before generating 941s for quarter 1 of 2022, ensure that the following built-in groups are assigned to the appropriate segment items:

- COVIDQualifiedFamily. COVID Qualified family leave wages

- COVIDQualifiedSick. COVID Qualified sick leave wages

Note

The Employee Retention Credit expired as of 10/1/2021 except for recovery startup businesses. The credit expired entirely as of 1/1/2022. As a result, the COVIDEmpRetention group is not applicable for the first quarter of 2022.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

Click

. The Generate Form 941 wizard starts.

. The Generate Form 941 wizard starts.

- On the Options tab in the Employer field, select the export employer to generate the 941 file for.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period (see $100,000 Next-Day Deposit Rule in Circular E).

- Enter the Year "2022".

- Select the Quarter you are reporting on. These instructions apply to quarter 1 of 2022 only.

- In the Payroll Tax Credit (Attach Form 8974) field, enter the amount for the small business payroll tax credit for increasing research activities from line 12 of Form 8974, if applicable.

- The options in the Special Situations section apply only if your business has closed or you are a seasonal employer.

- Business has closed or is no longer paying wages. Mark this checkbox if the statement is true. If you mark the checkbox, the Date wages were last paid field is enabled. Enter the last date on which your business paid wages to its employees.

- Business is a seasonal employer that does not have to file every quarter. Mark this checkbox if the statement is true.

- In the Overpayment field, select how you want the IRS to handle excess tax payments. Your options are:

- Apply to Next Return

- Send a Refund

- If you want to Allow a third party to discuss this return with the IRS, mark the checkbox in the Third Party Designee section. The authorization is effective for one year from the 941 return due date and allows the designee to provide missing information from your return, call the IRS about your return, and respond to IRS notices that you have shared with the third party designee. If you mark the checkbox, the remaining fields in the section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

-

Select the COVID-19 tab.

- In the 11b. Qualified sick and family leave before 4/1/2021 field, enter the nonrefundable portion of the credit for qualified sick and family leave wages before 4/1/2021 from Worksheet 1, line 2j.

- In the 11d. Qualified sick and family leave after 3/31/2021 and before 10/1/2021 field, enter the nonrefundable portion of the credit for qualified sick and family leave wages after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2p.

- In the 11e. COBRA premium assistance field, enter the amount of COBRA premium assistance provided in the quarter from Worksheet 3, line 2e.

- In the 11f. Number of individuals with COBRA premium assistance field, enter the number of individuals provided COBRA premium assistance during the quarter.

- In the 13c. Refundable sick and family leave credit before 4/1/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages before 4/1/2021 from Worksheet 1, line 2k.

- In the 13e. Refundable sick and family leave credit after 3/31/2021 and before 10/1/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages taken after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2q.

- In the 13f. COBRA premium assistance credit field, enter the refundable portion of the COBRA premium assistance credit from Worksheet 3, line 2f.

- In the 19. Health plan allocable to sick leave wages before 4/1/2021 field, enter the amount of qualified health plan expenses allocable to qualified sick leave wages for leave taken before 4/1/2021 from Worksheet 1, line 2b.

- In the 20. Health plan allocable to family leave wages field, enter the amount of qualified health plan expenses allocable to qualified family leave wages for leave taken before 4/1/2021 from Worksheet 1, line 2f.

- In the 23. Qualified sick leave wages after 3/31/2021 and before 10/1/2021 field, enter the qualified sick leave wages for leave taken after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2a.

- In the 24. Health plan allocable to sick leave wages on line 23 field, enter the qualified health plan expenses allocable to qualified sick leave wages reported on line 23. This is the amount from Worksheet 2, line 2b.

- In the 25. Collective bargaining allocable to sick leave wages on line 23 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to sick leave wages reported on line 23. This is the amount from Worksheet 2, line 2c.

- In the 26. Qualified family leave wages after 3/31/2021 and before 10/1/2021 field, enter the qualified family leave wages paid to your employees for leave taken after 3/31/2021 and before 10/1/2021 from Worksheet 2, line 2g.

- In the 27. Health plan allocable to family leave wages on line 26 field, enter the qualified health plan expenses allocable to qualified family leave wages reported on line 26. This is the amount from Worksheet 2, line 2h.

- In the 28. Collective bargaining allocable to family leave wages on line 26 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to qualified family leave wages reported on line 26. This is the amount from Worksheet 2, line 2i.

-

Click Next >>. ActivityHD prompts you to confirm that you want to generate the 941 return.

-

Click Yes. ActivityHD informs you when the process is complete and reports its results.

-

Click Next >>. ActivityHD shows the return that was created.

At this point, you can double-click the return in the right pane to drill down to the Form 941 Return window or you can print the return.

- When you finish viewing or working with the return, click Finish.

![]() SPECIAL: Maintain a 941 return for quarters affected by COVID-19 (Quarters 2, 3, 4 of 2021)

SPECIAL: Maintain a 941 return for quarters affected by COVID-19 (Quarters 2, 3, 4 of 2021)

Until a 941 return is flagged as "Submitted", you can still make limited changes to the return record.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

In the HD view, locate and double-click the return you want to make changes to. The return record opens in the Form 941 Return window.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period.

-

If the Final Return checkbox is marked and this, in fact, is not your final 941 return, clear the checkbox.

If the Final Return checkbox in not marked and this is your final 941 return, mark the checkbox and enter the Date Wages Were Last Paid to your employees.

- In the EIN field, enter your Employer Identification Number (EIN). The default value is the employer ID from your federal tax entity.

- In the Employer field, select the export employer record to associate with the return. The default employer is the employer designated when the 941 return was generated.

- If your trade name is the same as the value in the Name field, leave the Trade Name field blank. If you are a sole proprietor, enter your trade name in this field.

- In the Prior Overpayment field, enter the amount of any overpayment for a prior quarter.

- In the Other Overpayment field, enter the amount of any overpayment you applied from filing Form 941-X or 944-X in the current quarter.

-

If there is an amount in the Overpayment field, the Overpayment Option field is enabled. Select how to handle the overpayment amount. Your options are:

- Apply to Next Return

- Send a Refund

- If the Allow a third party to discuss this return with the IRS checkbox is marked and you need to revoke authorization, clear the checkbox. If the checkbox is clear and you need to authorize a third party, mark the checkbox and then enter information in the Third Party Designee section.

- If the Allow a third party to discuss this return with the IRS checkbox is marked, the fields in the Third Party Designee section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

- Select the COVID-19 tab.

- In the Number of individuals with COBRA premium assistance field, enter the number of individuals provided COBRA premium assistance during the quarter.

- In the Refundable sick and family leave credit before 4/1/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages for leave taken before 4/1/2021.

- In the Refundable employee retention credit field, enter the refundable portion of the employee retention credit.

- In the Refundable sick and family leave credit after 3/31/2021 field, enter the refundable portion of the credit for qualified sick and family leave wages for leave taken after 3/31/2021.

- In the COBRA premium assistance credit field, enter the refundable portion of the COBRA premium assistance credit.

- In the Advances from this quarter's Form(s) 7200 field, enter the total advances received from filing Form(s) 7200 for the quarter. Do not include advances requested but not received by the time you file Form 941.

- If this return is for quarter 3 or 4 of 2021, the Business eligible for ERC solely because it's a recovery startup checkbox is visible. Mark the checkbox if you qualify for the employee retention credit solely because your business is a recovery startup business.

- In the Health plan allocable to sick leave wages before 4/1/2021 field, enter the amount of qualified health plan expenses allocable to qualified sick leave wages for leave taken before 4/1/2021.

- In the Health plan allocable to family leave wages before 4/1/2021 field, enter the amount of qualified health plan expenses allocable to qualified family leave wages for leave taken before 4/1/2021.

- In the Employee retention credit (ERC) wages field, enter the amount of qualified wages for the employee retention credit.

- In the Health plan allocable to ERC wages field, enter the qualified health plan expenses allocable to ERC wages.

- In the Qualified sick leave wages after 3/31/2021 field, enter the qualified sick leave wages for leave taken after 3/31/2021.

- In the Health plan allocable to sick leave wages after 3/31/2021 field, enter the qualified health plan expenses allocable to qualified sick leave wages for leave taken after 3/31/2021.

- In the Collective bargaining allocable to sick leave wages after 3/31/2021 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to sick leave wages for leave taken after 3/31/2021.

- In the Qualified family leave wages after 3/31/2021 field, enter the qualified family leave wages paid to your employees for leave taken after 3/31/2021.

- In the Health plan allocable to family leave wages after 3/31/2021 field, enter the qualified health plan expenses allocable to qualified family leave wages for leave taken after 3/31/2021.

- In the Collective bargaining allocable to family leave wages after 3/31/2021 field, enter the collectively bargained defined benefit pension plan contributions and collectively bargained apprenticeship program contributions allocable to qualified family leave wages for leave taken after 3/31/2021.

- When you finish, save your changes.

Perform only the steps below which are necessary to update the return record.

Maintain a 941 return

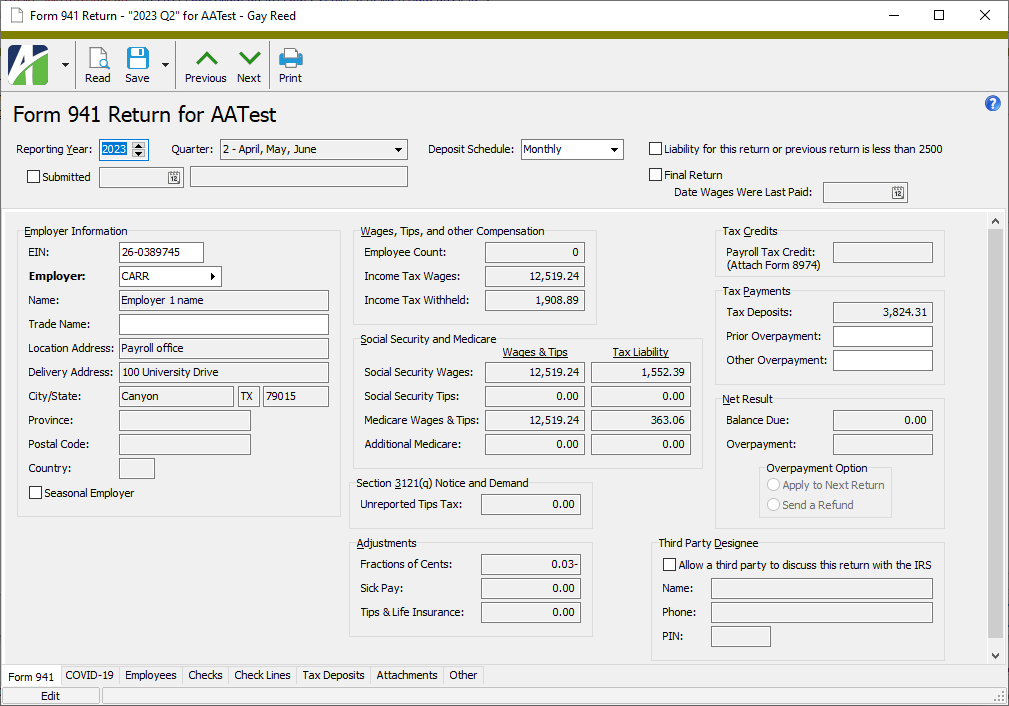

Until a 941 return is flagged as "Submitted", you can still make limited changes to the return record.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

In the HD view, locate and double-click the return to make changes to. The return record opens in the Form 941 Return window.

- In the Deposit Schedule field, select the frequency of your organization's tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period.

-

If the Final Return checkbox is marked and this, in fact, is not your final 941 return, clear the checkbox.

If the Final Return checkbox in not marked and this is your final 941 return, mark the checkbox and enter the Date Wages Were Last Paid to your employees.

- In the EIN field, enter your Employer Identification Number (EIN). The default value is the employer ID from your federal tax entity.

- In the Employer field, select the export employer record to associate with the return. The default employer is the employer designated when the 941 return was generated.

- If your trade name is the same as the value in the Name field, leave the Trade Name field blank. If you are a sole proprietor, enter your trade name in this field.

- In the Prior Overpayment field, enter the amount of any overpayment for a prior quarter.

- In the Other Overpayment field, enter the amount of any overpayment you applied from filing Form 941-X or 944-X in the current quarter.

-

If there is an amount in the Overpayment field, the Overpayment Option field is enabled. Select how to handle the overpayment amount. Your options are:

- Apply to Next Return

- Send a Refund

- If the Allow a third party to discuss this return with the IRS checkbox is marked and you need to revoke authorization, clear the checkbox. If the checkbox is clear and you need to authorize a third party, mark the checkbox and then enter information in the Third Party Designee section.

- If the Allow a third party to discuss this return with the IRS checkbox is marked, the fields in the Third Party Designee section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

- When you finish, save your changes.

Perform only the steps below which are necessary to update the return record.

Print a 941 return

The print process prints Form 941 for monthly depositors and both Form 941 and Schedule B for semiweekly depositors. A PDF of the output is attached to the 941 return record.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

- Start the Print Form 941 Returns wizard.

- To print all or a filtered subset of 941 returns:

- Right-click the Form 941 Returns folder and select Select and Print from the shortcut menu.

On the Selection tab, define any filters to apply to the 941 returns.

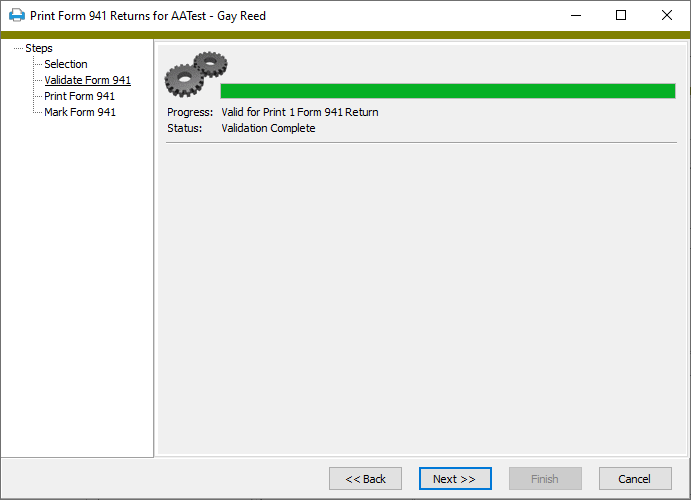

- Click Next >>. ActivityHD validates the returns for printing.

- To print specifically selected 941 returns:

- In the HD view, select the 941 returns to print.

- Click

. ActivityHD validates the returns for printing.

. ActivityHD validates the returns for printing.

- To print a particular 941 return from the Form 941 Return window:

- In the HD view, locate and double-click the 941 return to print. The Form 941 Return window opens with the return loaded.

- Click

. ActivityHD validates the return for printing.

. ActivityHD validates the return for printing.

- To print all or a filtered subset of 941 returns:

-

Click Next >>.

-

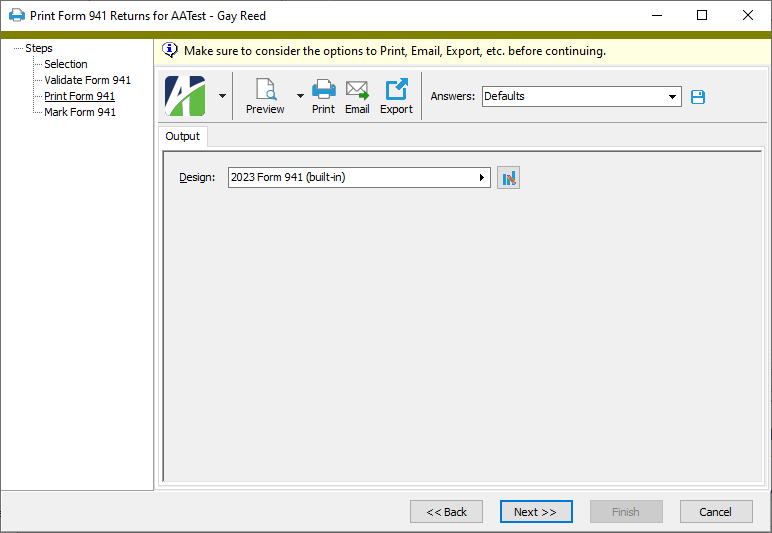

On the Output tab in the Design field, select the report design to use to print the 941 returns. The default design is the built-in design for the current reporting year. Report designs are named "20xx Form 941 (built-in)", where xx is the last two digits of the reporting year.

Note

Because the "Form 941 (built-in)" report design uses built-in images, "Data" access to the Images folder is required to use it.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the 941 returns in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the 941 returns in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns. - Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to.

- Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to. - Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

-

When you finish previewing, printing, and/or exporting returns, click Next >>.

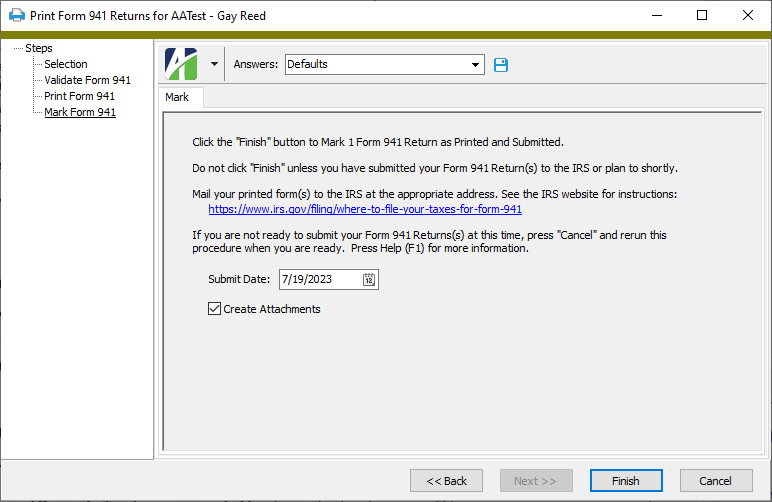

- The Submit Date field defaults to the current date. If today is not the actual submission date, enter the submission date.

- If you do not want to attach the Form 941 to its record, clear the Create Attachments checkbox.

- To flag the return(s) as "Submitted", click Finish.

The following data extension is available for the report:

- USA 941 returns

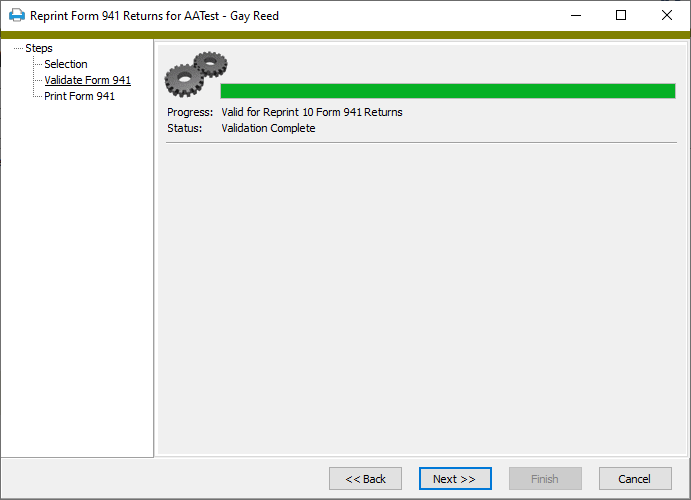

Reprint a 941 return

Use the Reprint Form 941 Returns wizard when you need to print 941 returns after they have been flagged as "Submitted".

The reprint process prints Form 941 for monthly depositors and both Form 941 and Schedule B for semiweekly depositors.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

- Start the Reprint Form 941 Returns wizard.

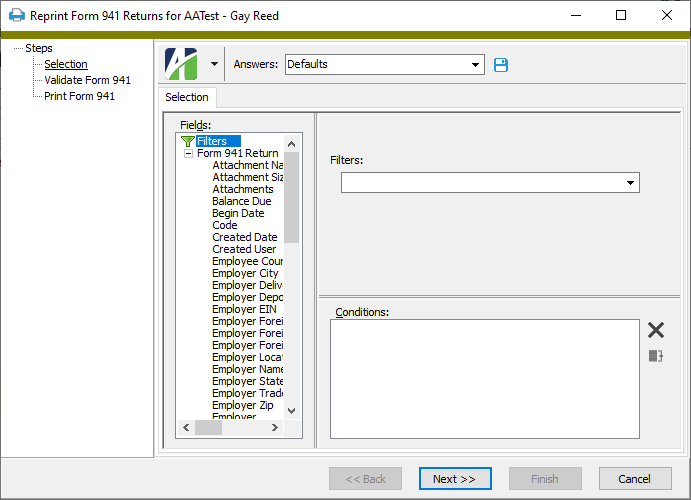

- To print all or a filtered subset of 941 returns:

- Right-click the Form 941 Returns folder and select Select and Reprint from the shortcut menu.

On the Selection tab, define any filters to apply to the 941 returns.

- Click Next >>. ActivityHD validates the returns for reprinting.

- To reprint specifically selected 941 returns:

- In the HD view, select the 941 returns to reprint.

- In the toolbar, click the drop-down arrow next to the Print icon and select Reprint from the drop-down menu. ActivityHD validates the returns for reprinting.

- To reprint a particular 941 return from the Form 941 Return window:

- In the HD view, locate and double-click the 941 return to reprint. The Form 941 Return window opens with the return loaded.

- In the toolbar, click the drop-down arrow next to the Print icon and select Reprint from the drop-down menu. ActivityHD validates the return for reprinting.

- To print all or a filtered subset of 941 returns:

-

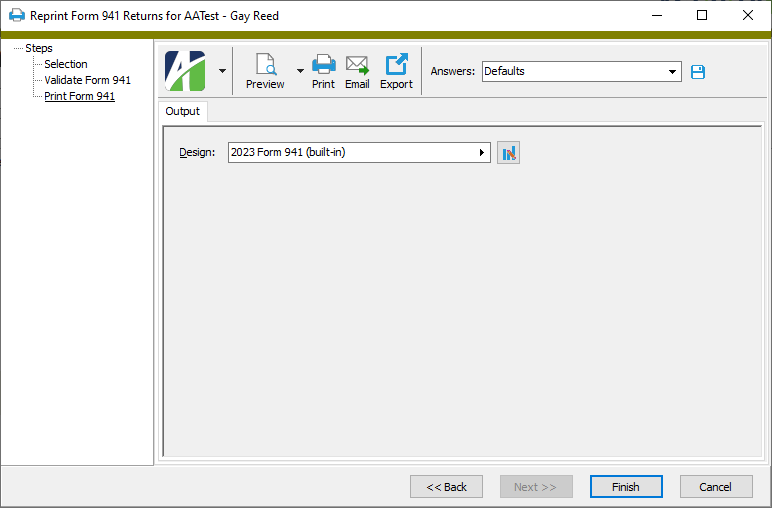

Click Next >>.

-

On the Output tab in the Design field, select the report design to use to reprint the 941 returns. The default design is the built-in design for the current reporting year. Report designs are named "20xx Form 941 (built-in)", where xx is the last two digits of the reporting year.

Note

Because the "Form 941 (built-in)" report design uses built-in images, "Data" access to the Images folder is required to use it.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the returns in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the returns in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns. - Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to.

- Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to. - Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- When you finish previewing, printing, and/or exporting returns, click Finish.

The following data extension is available for the report:

- USA 941 returns

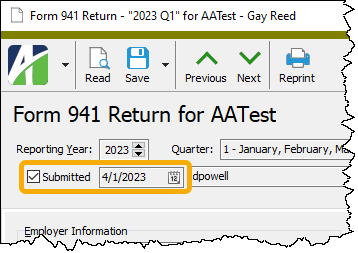

![]() Manually clear the "Submitted" flag on a 941 return

Manually clear the "Submitted" flag on a 941 return

ActivityHD flags 941 returns as "Submitted" when the printing process is completed. The Submitted flag prevents further changes to the return record. A return cannot be flagged as Submitted manually; however, if needed, it can be cleared to allow for corrections and reprinting.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 941 Returns folder.

-

In the HD view, locate and double-click the return for which you want to clear the Submitted flag. The return record opens in the Form 941 Return window.

- Clear the Submitted checkbox.

- Save your change. The submitted date and the username of the submitter are cleared.

Form 941 Return Record ID

This checkbox indicates whether the 941 return has been submitted to the federal government. ActivityHD prevents changes to returns with "Submitted" status.

In general, ActivityHD maintains the Submitted checkbox. When the printing process is completed, ActivityHD automatically flags the returns as "Submitted" and the submission date and username of the submitter are applied to the return record.

If you need to manually set the "Submitted" flag, mark the checkbox. If you need to reset the status, clear the checkbox; the date and username are cleared when you save the record.

Select the frequency of your tax deposits. Your options are:

- Monthly

- Semiweekly. You must make semiweekly deposits if you reported more than $50,000 in taxes during the lookback period (July 1 of the second preceding calendar year through June 30 of the preceding calendar year), or if you are a monthly schedule depositor that accumulated $100,000 in tax liability on any day during the deposit period.

This checkbox is marked if the Business has closed or is no longer paying wages checkbox was marked in the Generate Form 941 wizard when the 941 return was generated.

Mark this checkbox if this return is the last return that will be filed for your organization.

If your business has closed or you stop paying wages, you must file a final return. If two businesses merge, the continuing business must file a 941 return for the quarter in which the merger took place and the other business should file a final return.

If you mark the checkbox, the Date Wages Were Last Paid field is enabled.

Form 941 tab

The employer's Employer Identification Number (EIN). This value defaults from your federal tax entity. If the return has not been submitted, you can change the value in this field.

This field is disabled once the Submitted checkbox is marked.

The employer for the 941 return. If the return has not been submitted, you can select a different export employer.

This field is disabled once the Submitted checkbox is marked.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

If your trade name is the same as the legal name of the business, leave this field blank. If you are a sole proprietor, be sure your legal name appears in the Name field and enter your trade name in this field.

This field is disabled once the Submitted checkbox is marked.

This field is enabled if the return has not been submitted and there is an amount in the Overpayment field. Select how to handle the overpayment amount. Your options are:

- Apply to Next Return

- Send a Refund

The checkbox indicates whether a third party was authorized to discuss the return with the IRS when the 941 return was generated. If the checkbox is marked and you need to revoke the authorization, clear the checkbox. If the checkbox is clear and you need to authorize a third party, mark the checkbox and then enter information in the fields below.

This checkbox is disabled once the Submitted checkbox is marked.

The remaining fields are enabled if the Allow a third party to discuss the return with the IRS checkbox is marked and the Submitted checkbox is not marked.

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Employees tab

The Employees pane shows the Employees HD view filtered to show all employees represented on the 941 return.

Double-click a row in the pane to drill down to its record in the Employee window.

Checks tab

The Checks pane shows the Checks HD view filtered to show all pay checks represented on the 941 return.

Double-click a row in the pane to drill down to its record in the Check window.

Check Lines tab

The Check Lines pane shows the Check Lines HD view filtered to show all check lines represented on the 941 return.

Double-click a row in the pane to drill down to its record in the Check Line window.

Tax Deposits tab

The Tax Deposits pane shows the Tax Deposits HD view filtered to show all tax deposits made for the quarter covered by the 941 return.

Double-click a row in the pane to drill down to its record in the Tax Deposit window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Form 941 returns security

Common accesses available on Form 941 returns

Special accesses available on Form 941 returns

| Access | A user with this access can... |

|---|---|

| Generate | Generate 941 returns. |

| Print 941 returns. | |

| Reprint | Reprint 941 returns. |

Third party sick pay

Example

Excerpt from sample check:

| PRCode | Source | Result | AP Control | Groups | Debit Account | Credit Account |

|---|---|---|---|---|---|---|

| Pay.3rdSick | 685.71 | 685.71 | Compensation | 9999-00-00-A | ||

| Tax.3rdMedEE | 685.71 | 9.94 | 3rdPartySickPayMed, Medicare | 9999-00-00-A | ||

| Tax.3rdSocSecEE | 685.71 | 42.51 | 3rdPartySickPaySS, SocialSecurity | 9999-00-00-A | ||

| Tax.3rdUSA | 685.71 | 0.00 | 3rdPartySickPayTax, IncomeTax | 9999-00-00-A | ||

| Tax.MedER | 685.71 | 9.94 | 941 | Medicare | 5401-00-00-A | 2401-00-00-A |

| Tax.SocSecER | 685.71 | 42.51 | 941 | SocialSecurity | 5402-00-00-A | 2402-00-00-A |

| Ded.3rdSick | 633.26 | 633.26 | 9999-00-00-A |

Source and Result expressions for Ded.3rdSick

Source:

SumCheck.Result('Type=Pay AND Pay=3rdSick')

- SumCheck('3rdPartySickPayTax Amount')

- SumCheck('3rdPartySickPaySS Amount')

- SumCheck('3rdPartySickPayMed Amount')

Result:

Source

Noteworthy:

- Pay.3rdSick, Tax.3rdMedEE, and Tax.3rdSocSecEE, and perhaps Tax.3rdUSA, are input after-the-fact from the third-party claim.

- 3rdMedEE and 3rdSocSecEE have normal source expressions for wages, but a null result expression for entering the claim amount.

- Tax.3rdUSA has a normal source for taxable wages, but the result is blank or zero. This line is needed for taxable wages, even if the third-party payer did not deduct it (this is also true for state taxes).

- Employee-paid taxes in both the normal groups and the third-party groups.

- W-2 forms. Since they are in normal taxable groups, third-party totals are included in wage and withholding amounts on W-2 forms. Moreover, the third-party checkbox is marked on the W-2 if either the Third Party Sick Pay checkbox is marked on the employee record or the third-party Social Security or Medicare withholding amount is greater than zero.

- USA Tax Liability Report. Mark the Subtract Third-party Sick Pay checkbox to report your company's tax liability only. Clear the checkbox to include taxes paid by third parties.

- Form 941. Third-party sick amounts are reported on Form 941.

- There is no AP control for employee-withheld social security, Medicare, and income tax since these are paid by the third-party payer.

- Normal MedER and SocSecER are used for amounts the employer owes. These are assigned to an AP control.

- Ded.3rdSick reduces net pay to zero.

Sample Check GL Detail Report

Note the suspense account is used for 3rdMedEE, 3rdSocSecEE, 3rdUSA, and Ded.3rdSick.

| Accrual | ||||

| 9999-00-00-A | Suspense | 08/19/2023 | 685.71 | |

| 5401-00-00-A | Medicare Tax | 08/19/2023 | 9.94 | |

| 5402-00-00-A | Social Security Tax | 08/19/2023 | 42.51 | |

| 9999-00-00-A | Suspense | 08/19/2023 | 738.16 | |

| 738.16 | 738.16 | |||

| Liability | ||||

| 9999-00-00-A | Suspense | 08/19/2023 | 738.16 | |

| 9999-00-00-A | Suspense | 08/19/2023 | 685.71 | |

| 2401-00-00-A | Medicare Payable | 08/19/2023 | 9.94 | |

| 2402-00-00-A | Social Security Payable | 08/19/2023 | 42.51 | |

| 738.16 | 738.16 | |||

| Cash | ||||

| 9999-00-00-A | Suspense | 08/19/2023 | 0.00 | |

| 9999-00-00-A | Suspense | 08/19/2023 | 0.00 | |

| 0.00 | 0.00 | |||

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |