IRS Form 940 is used to report annual Federal Unemployment Tax Act (FUTA) tax. FUTA tax, along with state unemployment taxes, is used to pay unemployment compensation to workers who have lost their jobs.

![]() Expand this link to see prerequisites for using ActivityHD to produce Form 940.

Expand this link to see prerequisites for using ActivityHD to produce Form 940.

Setup

Ideally the following items should be in place before you attempt to produce a Form 940 return the first time:

- Export employer. Review the name and address fields for the export employer you will use with Form 940. It is likely that the export employer you use for Form 941 will also be appropriate for Form 940.

- Tax deposits. To calculate Line 13 of Form 940, "FUTA tax deposited for the year", it is necessary to record tax deposits for unemployment payments (unless you pay all taxes due when you submit Form 940). The following steps outline how to set up to automatically record tax deposits for Form 940 reporting:

- In Payroll, create an AP control which uses a built-in state tax deposit type (e.g., CASUTA).

- Add the AP control created in step 1 to the appropriate PRCode (e.g., "Tax.CASUTA").

- Post the check lines associated with the PRCode you created in step 2 (e.g., Tax.CASUTA) to AP invoices.

- Merge and pay the AP invoices.

Create the tax deposit by merging the AP payment.

Note

If the SUTA payments for the quarter have already been recorded in GL, override the bank account in the Payments dialog and change it to the SUTA liability account. This causes the payment to simply reverse the AP invoice which was created.

- Mark the tax deposit as "Paid".

-

FUTA wages. Your PRCode for tracking FUTA taxes (commonly "Tax.FUTA" or "Tax.FUI") must be assigned to the "Unemployment" check line group and have a tax entity of "USA".

Tip

If you previously used parameters for the FUTA rate (e.g., "Tax:FUTA:Percent") and maximum FUTA wages (e.g., "Tax:FUTA:Max"), consider deleting these parameters and using the equivalent built-in calculator functions. These functions are automatically updated for you each year, freeing you from annual upkeep of the parameters.

-

SUTA wages. If you are a multi-state employer, Form 940 Schedule A is also a filing requirement. Schedule A is used to identify the states in which you paid state unemployment during the reporting year. ActivityHD determines which state checkboxes to mark on Schedule A based on whether there are check lines in the reporting year with a PRCode that belongs to the "Unemployment" group and with a particular state's tax entity.

Tip

AccountingWare recommends you use the built-in parameter for the SUTA experience rate, "Tax:SUTA:Percent". This parameter is required for calculating Line 10 of Form 940 ("If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late"). If you previously used "Type:Tax:SUTAxxPercent", AccountingWare recommends that you transition to the built-in Tax:SUTA:Percent parameter instead.

-

FUTA wages by state. Schedule A also requires multi-state employers to report FUTA wages by state for states with a credit reduction rate greater than zero. Note: FUTA wages are not the same as SUTA wages which can have a different cutoff threshold than FUTA wages.

Credit reductions only apply when a state has fallen into arrears with the federal government with respect to unemployment payments. Since this is unpredictable from year to year, you should be prepared to collect this information. California, for instance, had a credit reduction for several years running.

The following formula is used to calculate SUTA wages:

state-specific FUTA wages = total result of check lines in group "Compensation" qualified by state tax entity up to the FUTA max for each employee for the year

The formula requires the following components:

- Group "Compensation" qualified by tax entity.

Take one of the following actions depending on your organization's circumstances:

- If all employees are in one state, add the state's tax entity (e.g., USA.TX) to all the segment items in group "Compensation".

- If the state code is already part of your compensation PRCodes (e.g., Pay.Reg.TX), mark the state pieces with the corresponding tax entity.

- If employees are in multiple states, you should create state-specific Pay PRCodes. (You can postpone this step if you are confident that your state will not have a state credit reduction.)

- FUTA max. The FUTA max ($7,000 in 2023) is built in to ActivityHD. You should consider deleting any segment item parameters which contain this value (e.g., Type:Tax:FUTAMax).

- For each employee. Only the first $7,000 of each employee's compensation for the year is added to the total.

Tracking total FUTA wages by state requires a new PRCode for each state where you pay unemployment.

- Group "Compensation" qualified by tax entity.

Generate a 940 return

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 940 Returns folder.

-

Click

. The Generate Form 940 Return wizard starts.

. The Generate Form 940 Return wizard starts.

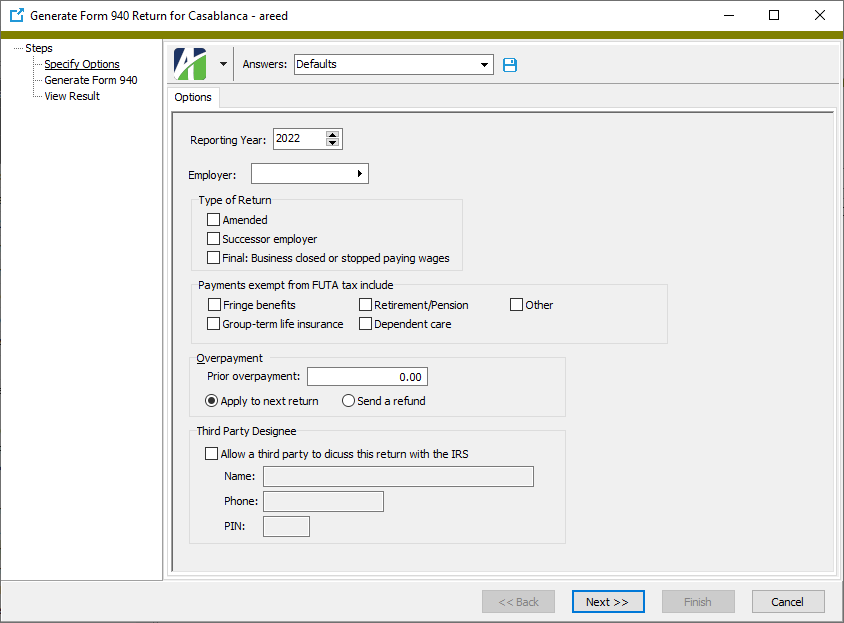

- On the Options tab in the Reporting Year field, select the year to generate the Form 940 for.

- In the Employer field, select the export employer to generate the 940 file for.

- In the Type of Return section, mark the checkbox for any special circumstance that applies to the return. You can mark multiple checkboxes. For a typical return, none of the checkboxes would be marked. Valid options are:

- Amended. Mark this checkbox if this return represents a correction to a previously filed return.

- Successor employer. Mark this checkbox if you are a successor employer

An employer who acquires substantially all the property used in a trade or business of another person (predecessor) or used in a separate unit of a trade or business of a predecessor; and immediately after the acquisition employs one or more people who were employed by the predecessor. [https://www.irs.gov/pub/irs-pdf/i940.pdf] and are either (1) reporting wages paid before you acquired the business from a predecessor who was required to file a Form 940 because they were an employer for FUTA purposes, or (2) claiming a special credit for state unemployment tax paid before you acquired the business by a predecessor who wasn't required to file a Form 940 because they were not an employer for FUTA purposes.

An employer who acquires substantially all the property used in a trade or business of another person (predecessor) or used in a separate unit of a trade or business of a predecessor; and immediately after the acquisition employs one or more people who were employed by the predecessor. [https://www.irs.gov/pub/irs-pdf/i940.pdf] and are either (1) reporting wages paid before you acquired the business from a predecessor who was required to file a Form 940 because they were an employer for FUTA purposes, or (2) claiming a special credit for state unemployment tax paid before you acquired the business by a predecessor who wasn't required to file a Form 940 because they were not an employer for FUTA purposes. - Final: Business closed or stopped paying wages. Mark this checkbox if this is a final return because you went out of business or stopped paying wages and will not be liable for filing Form 940 in the future.

- In the Payments exempt from FUTA tax include section, mark the checkbox for each kind of payment to exempt from FUTA tax. Your options are:

- Fringe benefits

- Group-term life insurance

- Retirement/pension

- Dependent care

- Other

- In the Prior overpayment field, enter the amount of any overpayment from a prior year to apply to this filing year's tax.

- In the Overpayment section, select what the IRS should do with any excess tax payments. Your options are:

- Apply to next return

- Send a refund

- If you want to Allow a third party to discuss this return with the IRS, mark the checkbox in the Third Party Designee section. The authorization is effective for one year from the 940 return due date and allows the designee to provide missing information from your return, call the IRS about your return, and respond to IRS notices that you have shared with the third party designee. If you mark the checkbox, the remaining fields in the section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

-

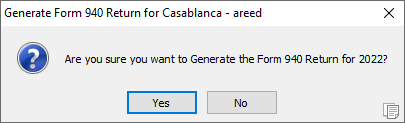

Click Next >>. ActivityHD prompts you to confirm that you want to generate Form 940.

-

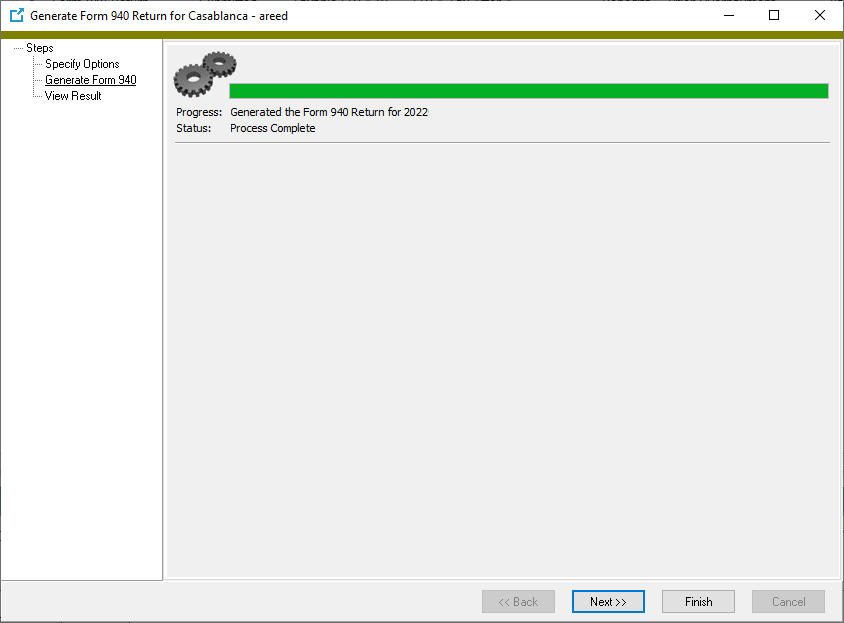

Click Yes. ActivityHD informs you when the process is complete and reports its results.

-

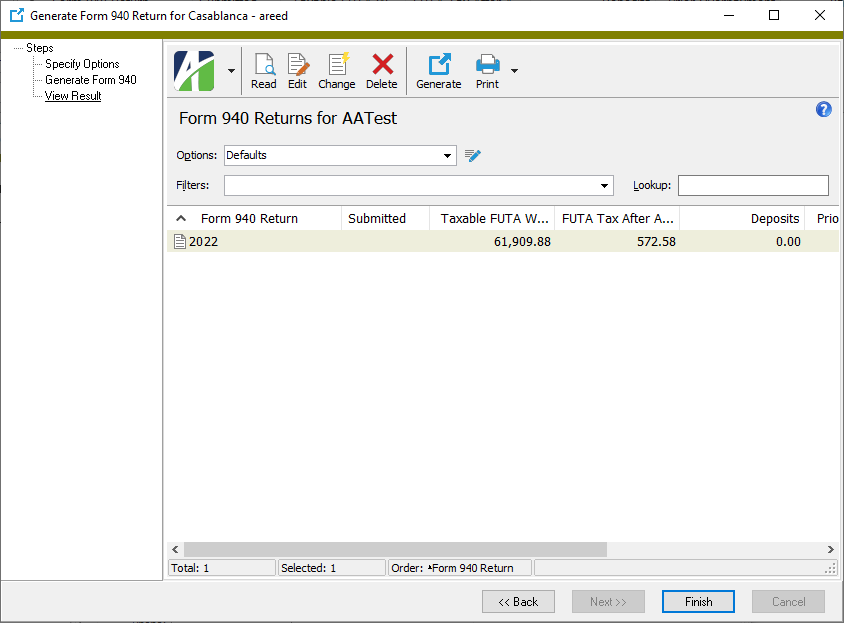

Click Next >>. ActivityHD shows the return that was created.

At this point, you can double-click the return in the right pane to drill down to the Form 940 Return window or you can print the return.

- When you finish viewing or working with the return, click Finish.

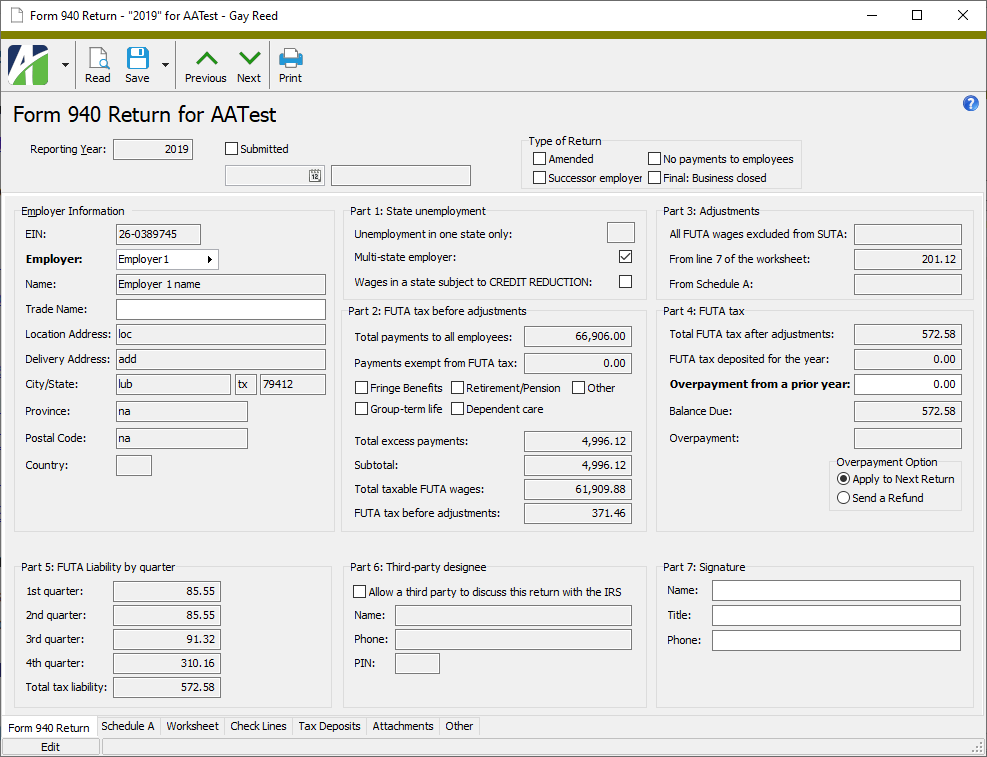

Maintain a 940 return

Until a 940 return is flagged as "Submitted", you can still make limited changes to the return record. The return status is updated to "Submitted" when the return is printed.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 940 Returns folder.

- In the HD view, locate and double-click the return you want to make changes to. The return record opens in the Form 940 Return window.

-

Click

.

.

- In the Type of Return section, mark the checkbox for any special circumstance that applies to the return; clear the checkbox for any circumstance that does not apply. You can mark multiple checkboxes. For a typical return, none of the checkboxes would be marked. Valid options are:

- Amended. Ensure the checkbox is marked if this return represents a correction to a previously filed return.

- Successor employer. Ensure this checkbox is marked if you are a successor employer

An employer who acquires substantially all the property used in a trade or business of another person (predecessor) or used in a separate unit of a trade or business of a predecessor; and immediately after the acquisition employs one or more people who were employed by the predecessor. [https://www.irs.gov/pub/irs-pdf/i940.pdf] and are either (1) reporting wages paid before you acquired the business from a predecessor who was required to file a Form 940 because they were an employer for FUTA purposes, or (2) claiming a special credit for state unemployment tax paid before you acquired the business by a predecessor who was not required to file a Form 940 because they were not an employer for FUTA purposes.

An employer who acquires substantially all the property used in a trade or business of another person (predecessor) or used in a separate unit of a trade or business of a predecessor; and immediately after the acquisition employs one or more people who were employed by the predecessor. [https://www.irs.gov/pub/irs-pdf/i940.pdf] and are either (1) reporting wages paid before you acquired the business from a predecessor who was required to file a Form 940 because they were an employer for FUTA purposes, or (2) claiming a special credit for state unemployment tax paid before you acquired the business by a predecessor who was not required to file a Form 940 because they were not an employer for FUTA purposes. - No payments to employees. Ensure this checkbox is marked if you are not liable for FUTA tax because you did not pay any employees during the filing year.

- Final: Business closed. Ensure this checkbox is marked if this is a final return because you went out of business or stopped paying wages and will not be liable for filing Form 940 in the future.

- In the Employer field, select the export employer record to associate with the return. The default employer is the employer designated when the 940 return was generated.

- If your trade name is the same as the value in the Name field, leave the Trade Name field blank. If you are a sole proprietor, enter your trade name in this field.

- In the Part 2: FUTA tax before adjustments section, ensure that the checkbox for each type of payment that is exempt from FUTA tax is marked. Valid options are:

- Fringe Benefits

- Group-term life

- Retirement/Pension

- Dependent care

- Other

- In the Overpayment from a prior year field, enter the amount of any overpayment for a prior year.

-

If there is a non-zero amount in the Overpayment from a prior year field, the Overpayment Option field is enabled. Select how to handle the overpayment amount. Your options are:

- Apply to Next Return

- Send a Refund

- If the Allow a third party to discuss this return with the IRS checkbox is marked and you need to revoke authorization, clear the checkbox. If the checkbox is clear and you need to authorize a third party, mark the checkbox and then enter information in the Third Party Designee section.

- If the Allow a third party to discuss this return with the IRS checkbox is marked, the fields in the Third Party Designee section are enabled.

- Enter the Name of the third party designee.

- Enter the third party designee's Phone number.

- Enter the third party designee's personal identification number (PIN). The PIN is a five-digit number chosen by the designee.

- In the Part 7: Signature section, provide the Name, Title, and Phone of the responsible party.

- When you finish, save your changes.

Perform only the steps below which are necessary to update the return record.

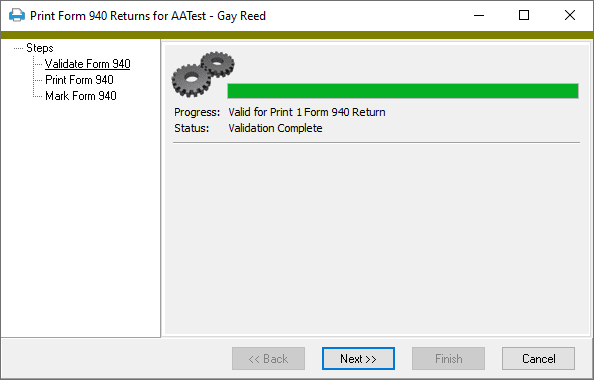

Print a 940 return

The print process prints Form 940 and its Schedule A. A PDF of the output is attached to the 940 return record.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 940 Returns folder.

-

In the HD view, highlight the 940 return to print, then right-click and select Print from the shortcut menu. The Print Form 940 Returns wizard starts and verifies that the return is valid to print.

-

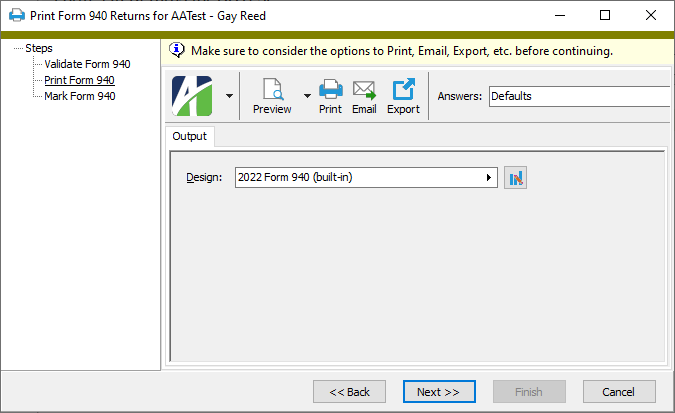

Click Next >>.

-

On the Output tab in the Design field, select the report design to use to print the 940 returns. The default design is the built-in design for the current reporting year. Report designs are named "20xx Form 940 (built-in)", where xx is the last two digits of the reporting year.

Note

Because the "Form 940 (built-in)" report design uses built-in images, "Data" access to the Images folder is required to use it.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the 940 returns in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the 940 returns in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns. - Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to.

- Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to. - Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

-

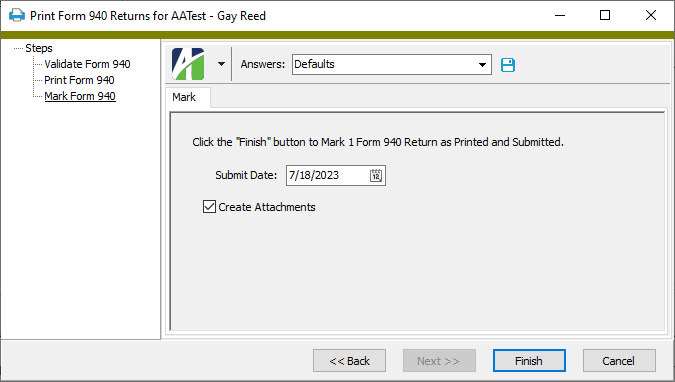

When you finish previewing, printing, and/or exporting returns, click Next >>.

- The Submit Date field defaults to the current date. If today is not the actual submission date, enter the submission date.

- If you do not want to attach the Form 940 to its record, clear the Create Attachments checkbox.

- To flag the return(s) as "Printed" and "Submitted", click Finish.

The following data extension is available for the report:

- USA 940 returns

Use the Reprint Form 940 Returns wizard when you need to print 940 returns after they have been flagged as "Submitted".

Reprint a 940 return

The reprint process prints Form 940 and its Schedule A.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 940 Returns folder.

-

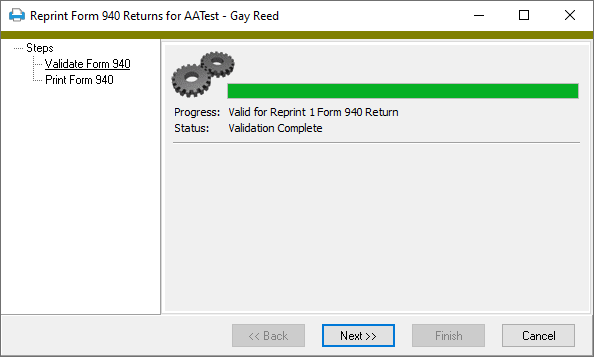

In the HD view, highlight the 940 return to reprint, then right-click and select Reprint from the shortcut menu. The Reprint Form 940 Returns wizard starts and verifies that the return is valid to reprint.

-

Click Next >>.

-

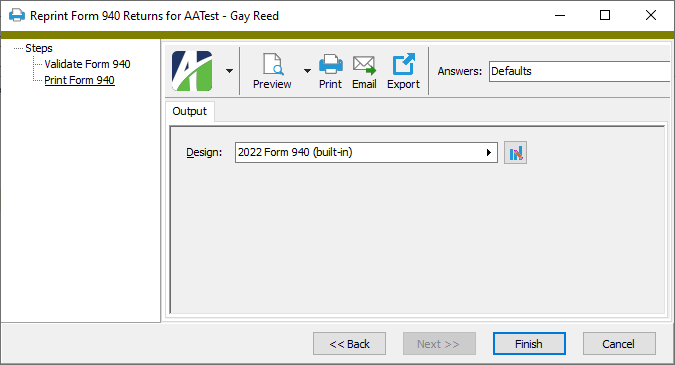

On the Output tab in the Design field, select the report design to use to reprint the 940 returns. The default design is the built-in design for the current reporting year. Report designs are named "20xx Form 940 (built-in)", where xx is the last two digits of the reporting year.

Note

Because the "Form 940 (built-in)" report design uses built-in images, "Data" access to the Images folder is required to use it.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the returns in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the returns in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the returns. - Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to.

- Opens the Report Email Options dialog so that you can address and compose an email that the returns will be attached to. - Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the returns to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- When you finish previewing, printing, and/or exporting returns, click Finish.

The following data extension is available for the report:

- USA 940 returns

![]() Manually clear the "Submitted" flag on a 940 return

Manually clear the "Submitted" flag on a 940 return

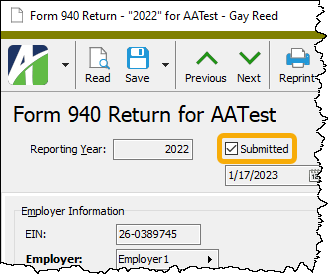

ActivityHD flags 940 returns as "Submitted" when the printing process is completed. The Submitted flag prevents further changes to the return record. A return cannot be flagged as Submitted manually; however, if needed, it can be cleared to allow for corrections and reprinting.

- In the Navigation pane, highlight the Payroll/Human Resources > Government > Form 940 Returns folder.

-

In the HD view, locate and double-click the return for which you want to clear the Submitted flag. The return record opens in the Form 940 Return window.

- Clear the Submitted checkbox.

- Save your change. The submitted date and the username of the submitter are cleared.

Form 940 Return Record ID

If the checkbox is cleared, the return has not yet been printed and submitted. Most non-calculated fields can be edited until the form is printed and is flagged as "Submitted".

If the checkbox is marked, the return has been printed and submitted and the form cannot be edited. However, if you need to make changes to the 940 return, you can clear the Submitted checkbox, make your changes, and print the 940 return again.

Form 940 Return tab

The checkboxes marked in this section indicate the types of exempt payments which are included in the Payments exempt from FUTA tax total. Valid payment types are:

- Fringe Benefits

- Group-term life

- Retirement/Pension

- Dependent care

- Other

The checkboxes can be marked or cleared if the return has not been printed and submitted.

If all taxable FUTA wages were excluded from state unemployment tax, this line shows the product of total taxable FUTA wages times 0.054 (factor as of 2023).

If you did not have to pay state unemployment tax because all of the wages you paid were excluded from state unemployment tax, this line shows the product of total taxable FUTA wages time 0.060 (factor as of 2023).

If there is a value on this line, the next two lines are blank.

If some of the taxable FUTA wages paid were excluded from state unemployment tax, or if you paid any state unemployment tax late, this line shows the amount of the adjustment to FUTA tax. This is the value which is shown on line 7 of the Line 10 worksheet.

If all the FUTA taxable wages paid were excluded from state unemployment tax, this line is blank.

If you had FUTA taxable wages which were also subject to state unemployment taxes in states that are subject to credit reduction, this line shows the amount from line 11 of Schedule A.

If all the FUTA taxable wages paid were excluded from state unemployment tax, this line is blank.

- Apply to Next Return

- Send a Refund

The signature block for the Form 940 return.

The person authorized to sign a return depends on the type of business entity. See the table below for a list of business entity types and the respective authorized signer roles.

| Business entity type | Authorized signer role |

|---|---|

| Sole proprietorship | Business owner |

| Partnership, including an LLC treated as a partnership or an unincorporated organization | Responsible and duly authorized partner, member, or officer with knowledge of the partnership's business affairs |

| Corporation, including an LLC treated as a corporation | President, vice president, or other principal officer who is duly authorized to sign |

| Single-member LLC treated as a disregarded entity for federal income tax purposes | Owner of the LLC or a principal officer duly authorized to sign |

| Trust or estate | Fiduciary |

Schedule A tab

Worksheet tab

The amount of state unemployment tax payments made on time.

Timely payments are calculated from the total of tax deposits where (1) the deposit is one of the built-in state unemployment types (xxSUTA), (2) the liability date is in the tax year, (3) the deposit date is on or before the Form 940 due date (January 31 of the following year), and (4) the deposit is flagged as "Paid".

The taxable SUTA wages for the corresponding state at the assigned experience rate.

This value is needed when the total amount of SUTA paid on time is less than the maximum credit (as of 2023, FUTA wages x .054).

The amount of state unemployment tax paid late.

Late payments are calculated from the total of tax deposits where (1) the deposit is one of the built-in state unemployment types (xxSUTA), (2) the liability date is in the tax year, (3) the deposit date is after the Form 940 due date (January 31 of the following year), and (4) the deposit is flagged as "Paid".

Check Lines tab

This tab contains a set of subtabs which show the check lines which contribute to various parts of this Form 940 calculation. Checks shown on the subtab must have a check date in the reporting year and must be merged.

USA Unemployment subtab

The Check Lines pane shows the Check Lines HD view filtered to show all records with a PRCode for federal unemployment tax; namely, Tax.FUTA. The total source in this pane should match "Total taxable FUTA wages".

State Unemployment subtab

The Check Lines pane shows the Check Lines HD view filtered to show all records with a PRCode for state unemployment tax; typically, Tax.XXSUTA, where XX is a two-character state abbreviation. If the total source in this pane is zero, Form 940 assumes that all FUTA wages are excluded from SUTA. Totals by state are shown in the "Taxable SUTA wages" column on the Worksheet tab.

Compensation subtab

The Check Lines pane shows the Check Lines HD view filtered to show all records with a compensation-type PRCode. The total result should match "Total payments to all employees".

PreUnemployment subtab

The Check Lines pane shows the Check Lines HD view filtered to show all records with a PRCode which contributes to pre-unemployment compensation. The total result should match "Payments exempt from FUTA tax".

State Compensation subtab

The Check Lines pane shows the Check Lines HD view filtered to show all records with a PRCode for state compensation; i.e., check lines in the Compensation group which are assigned to a US state tax entity. The first $7,000 (as of 2023) of each employee's compensation is used to calculate FUTA taxable wages by state on Schedule A.

Tax Deposits tab

Tax deposits shown on the FUTA and SUTA subtabs must have a liability date in the reporting year and must be marked "Paid".

FUTA subtab

The Tax Deposits pane shows the Tax Deposits HD view filtered to show all FUTA tax deposits associated with the 940 return; i.e., tax deposits with deposit type "USAFUTA". The total amount should match "FUTA tax deposited for the year".

SUTA subtab

The Tax Deposits pane shows the Tax Deposits HD view filtered to show all SUTA tax deposits associated with the 940 return; i.e., tax deposits with state deposit types of XXSUTA, where XX is the two-character state abbreviation. These tax deposits are used to calculate state unemployment paid on time and paid late on the Line 10 worksheet. Deposits dated on or before January 31 of the year following the reporting year are considered paid on time. Deposits dated after January 31 are late.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Form 940 returns security

Common accesses available on Form 940 returns

Special accesses available on Form 940 returns

| Access | A user with this access can... |

|---|---|

| Generate | Generate 940 returns. |

| Print 940 returns. | |

| Reprint | Reprint 940 returns. |

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |