Products are the goods and services your company purchases from different vendors. In addition, products can represent the expenses for which you need to reimburse an employee, such as mileage or daily subsistence.

Create a product record

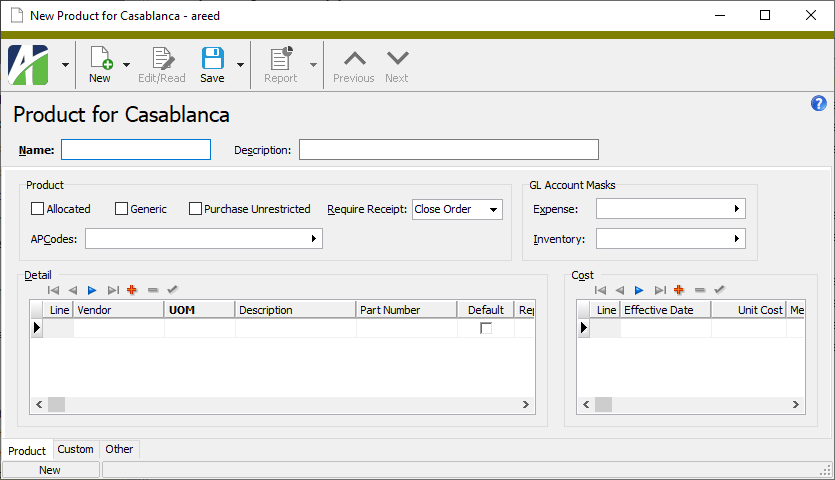

- In the Navigation pane, highlight the Purchasing > Setup > Products folder.

- Click

. The New Product window opens.

. The New Product window opens.

- Enter a unique Name for the product.

- Enter a Description of the product.

-

If the amount from the purchase of this product should be allocated to any purchases of non-allocated products included in the same shipment for a purchase order, mark the Allocated checkbox. Allocated product costs are posted to the accounts associated with the non-allocated products.

If you need to allocate an amount to some, but not all, non-allocated products in a shipment, isolate the products you do not want to allocate to in a separate shipment.

Example

You can create an allocated "product" for tax and freight charges so that these amounts can be allocated to the non-allocated purchases in a shipment.

- If the product represents a type of product rather than a specific product, mark the Generic checkbox. Currently, this setting is for informational purposes only; it does not affect the functioning of ActivityHD Purchasing.

- If the product can be purchased from any vendor with any unit of measure, mark the Product Unrestricted checkbox. If you do not mark this checkbox, the product can only be purchased in the vendor/unit of measure combinations defined in the Detail table.

-

From the Require Receipt drop-down list, select at which point to require a receipt for the product. Your options are:

- Close Order. Require a receipt before the product order can be closed.

- Merge Invoice. Require a receipt before the invoice for the product can be merged.

- Never. Never require a receipt. This option is appropriate for "products" such as sales tax and freight.

-

In the APCodes field, select the APCodes to apply to the purchase of this product when the purchase is invoiced. In particular, if the product is subject to 1099 reporting, be sure to designate a payment reporting-type APCode which specifies the appropriate 1099 type and then ensure that the appropriate rows in the Detail table below have the Reporting checkbox marked.

Example

If the purchase is subject to use tax, select the APCode for the applicable use tax.

If you enter multiple APCodes, separate them with commas.

Note

The Ctrl and Shift selection features are available in the Find dialog box so you can select multiple APCodes. ActivityHD automatically separates your selections by commas.

- The Expense field is enabled unless the Allocated checkbox is marked. Enter the account mask to use to derive the GL expense account number for purchases with this product.

- The Inventory field is enabled unless the Allocated checkbox is marked. Enter the account mask to use to derive the GL inventory account number for purchases with this product.

-

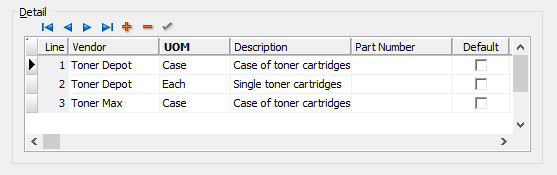

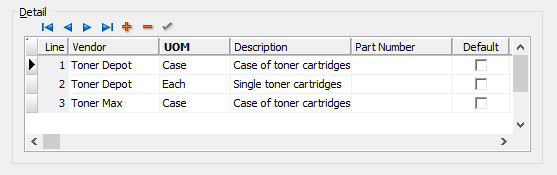

The Detail table allows you to define the allowable vendor/unit of measure combinations for the product. If you did not mark the Product Unrestricted checkbox, only the combinations entered in the table (that are not flagged as obsolete) are allowed for the product. If you can purchase the product from multiple vendors, you need at least one line per vendor. If you can purchase the product from a particular vendor in multiple units of measure, you need one line per vendor/unit of measure combination.

Example

Suppose you can purchase printer toner from two vendors. From Toner Depot, you can order single toner cartridges and you can order by the case. You can only buy toner from Toner Max by the case. Setup for this example would require three detail lines:

For each allowed vendor/unit of measure combination, perform the following steps:

- In the Vendor column, select the vendor that supplies the product. Leave this field blank if the product can be purchased from any vendor.

- In the UOM column, select the unit of measure in which the product can be purchased from the corresponding vendor.

- Enter a Description of the vendor/unit of measure combination.

- In the Part Number column, enter the vendor's part number for the vendor/unit of measure combination of the product.

- If the unit of measure should be used as the default whenever this product is entered on a purchase line for the vendor, mark the Default checkbox. This option applies whenever there are multiple units of measure for the product for the same vendor. If there is only one vendor/unit of measure combination for a vendor, it is automatically considered the default. Only one default can be specified per vendor per product.

-

If the vendor/unit of measure combination should be included in the basis for payment reporting-type APCodes on purchasing invoices, mark the Reporting checkbox. To ensure that PO invoices with the vendor/unit of measure combination are flagged as subject to 1099, mark the checkbox and ensure that a payment reporting-type APCode which specifies the appropriate 1099 type is designated in the APCodes field above.

Example

Suppose you have a "software consulting" product and that product can be provided by either your software provider or by an independent consultant. You would want to flag the vendor/unit of measure combination that represents the independent consultant for reporting so that any amounts paid to the consultant can be reported on a 1099-NEC. In this case, a payment reporting-type APCode for non-employee compensation would be assigned to the product.

- If the vendor/unit of measure combination should be included in the basis for payment withholding-type APCodes on purchasing invoices, mark the Withholding checkbox.

- In the Memo column, enter any notes about the vendor/unit of measure combination.

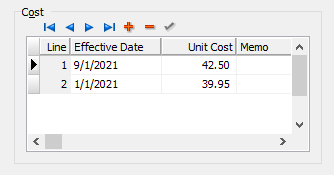

- With the same line still selected in the Detail table, move to the Cost table to enter cost information for the vendor/unit of measure combination.

- In the Effective Date column, enter the date the cost becomes effective for the selected vendor/unit of measure combination.

- In the Unit Cost column, enter the cost per unit of the product as of the specified effective date. This is the default cost of the product for the vendor/unit of measure combination during the effective date range. The default cost can be overridden when you enter a purchase.

- In the Memo column, enter any notes about the cost entry.

If you have knowledge of future cost changes that you want to enter for the vendor/unit of measure combination, repeat steps i-iii for each cost entry.

Example

Suppose a product costs $39.95 effective 1/1/2021 and will rise to $42.50 as of 9/1/2021.

With this setup, the unit cost for purchases made from 1/1/2021 to 8/31/2021 would default to $39.95. Starting on 9/1/2021, the unit cost would default to $42.50.

- When you finish, save the new product.

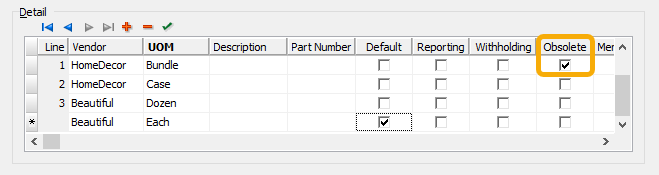

![]() Flag a vendor/unit of measure combination as obsolete

Flag a vendor/unit of measure combination as obsolete

If a vendor/unit of measure combination for a product is no longer valid, you can flag it as obsolete. Provided that the product is not marked as Purchase Unrestricted, flagging the detail line as obsolete makes the vendor/unit of measure combination ineligible for use on future purchases.

To flag a vendor/unit of measure combination as obsolete:

- In the Navigation pane, highlight the Purchasing > Setup > Products folder.

- In the HD view, locate and double-click the product with the detail line you need to flag as obsolete to open the Product window with the product loaded.

- In the Detail table, locate and select the detail line that contains the vendor/unit of measure combination you need to flag as obsolete.

- Mark the Obsolete checkbox for the selected detail line.

- Save your changes.

Products Listing

Purpose

The Products Listing provides a list of the products defined in Purchasing.

Content

For each product included on the report, the listing shows:

- description

- whether the amount from the purchase of the product is allocated to purchases of non-allocated products in the same shipment

- whether the product is generic

- whether the product can be purchased from any vendor with any unit of measure (unrestricted). If purchases are restricted, only the vendor-unit of measure combinations defined in the product detail are allowed.

- at what point a receipt is required for the product.

In addition, you can include one or more of the following:

- product detail (vendor, unit of measure, description, part number, unit cost)

- cost detail

- timestamps

- memos

- custom fields.

The following total appears on the report:

- record count.

Print the report

- In the Navigation pane, highlight the Purchasing > Setup > Products folder.

- Start the report set-up wizard.

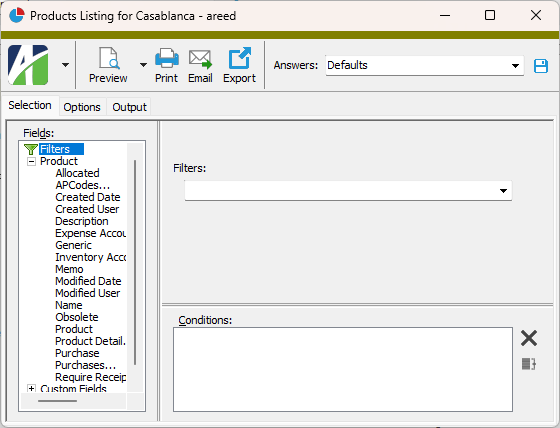

- To report on all or a filtered subset of products:

- Right-click the Products folder and select Select and Report > Products Listing from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected products:

- In the HD view, select the products to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To report on a particular product from the Product window:

- In the HD view, locate and double-click the product to report on. The Product window opens with the product loaded.

- Click

.

.

- To report on all or a filtered subset of products:

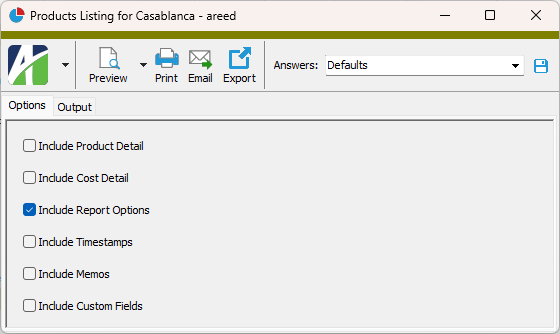

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Product Detail

- Cost Detail

- Report Options. To include a section at the end of the report with the report settings used to produce the report, leave the checkbox marked. To produce the report without this information, clear the checkbox.

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Products

- Product detail

- Product cost

Product Record ID

Product tab

If this checkbox is marked, the amount from the purchase of this product is allocated to any non-allocated product purchases in the same shipment for a purchase order. Allocation occurs during the invoice process.

If you need to allocate an amount to some, but not all, non-allocated products in a shipment, isolate the products you do not want to allocate to in a separate shipment.

The point at which to require a receipt for the product. Valid options are:

- Close Order. Require a receipt before the product order can be closed.

- Merge Invoice. Require a receipt before the invoice for the product can be merged.

- Never. Never require a receipt. This option is appropriate for "products" such as sales tax and freight.

The APCode(s) to apply to the purchase of this product when the purchase is invoiced. In particular, if the product is subject to 1099 reporting, be sure to designate a payment reporting-type APCode which specifies the appropriate 1099 type and also ensure that the appropriate rows in the Detail table are flagged for reporting.

If you enter multiple APCodes, separate them with commas.

Note

The Ctrl and Shift selection features are available in the Find dialog box so you can select multiple APCodes. ActivityHD automatically separates your selections by commas.

Example

If the purchase is subject to use tax, select the APCode for the applicable use tax.

Press F2 to open a dialog box where you can add and remove selections for this field.

Press F3 to look up the item.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

Press F2 to open the Account Expand dialog box where you can look up an account number, find an account number by its alias, build the account number by segment, or view setup and setup sources.

Press F3 to look up the account.

If an account is already selected, you can press F4 to open the record in the Account window.

Use this table to define the allowable vendor/unit of measure combinations for the product. If the Product Unrestricted checkbox is not marked, only the combinations entered in the table (that are not flagged as obsolete) are allowed for the product. If you can purchase the product from multiple vendors, you need at least one line per vendor. If you can purchase the product from a particular vendor in multiple units of measure, you need one line per vendor/unit of measure combination.

Example

Suppose you can purchase printer toner from two vendors. From Toner Depot, you can order single toner cartridges and you can order by the case. You can only buy toner from Toner Max by the case. Setup for this example would require three detail lines:

Enter the following information for each vendor/unit of measure combination:

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

Press F3 to look up the value.

If a value is already selected, you can press F4 to open the record in its native editor.

If this checkbox is marked, the vendor/unit of measure combination should be included in the basis for payment reporting-type APCodes on purchasing invoices. To ensure that PO invoices with the vendor/unit of measure combination are flagged as subject to 1099, mark the checkbox and ensure that a payment reporting-type APCode which specifies the appropriate 1099 type is designated in the APCodes field.

Example

Suppose you have a "software consulting" product and that product can be provided by either your software provider or by an independent consultant. You would want to flag the vendor/unit of measure combination that represents the independent consultant for reporting so that any amounts paid to the consultant can be reported on a 1099-NEC. In this case, a payment reporting-type APCode for non-employee compensation would be assigned to the product.

If this checkbox is marked, the vendor/unit of measure combination is flagged as obsolete and not eligible for future purchases.

Note

If this checkbox is marked and the Purchase Unrestricted flag is not marked, the vendor/unit of measure combination cannot be used on purchase lines.

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Purchases tab

The Purchases pane shows the Purchases HD view filtered to show all purchases of the selected product.

Double-click a row in the pane to drill down to its record in the Purchase window.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

|

Extras\Purchasing\Import PO Products.xls |

Products security

Common accesses available on products

Product filters

The following built-in filters are available for products:

| Filter Name | Effect |

|---|---|

| ? Description | Prompts for a product description and lists the products with a description that contains the specified search string. |

| ? Name | Prompts for a product name and lists the product with that name. |

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |