Currently, group term life insurance provided by an employer is nontaxable up to $50,000. The cost of coverage over $50,000 is taxable based on a table in IRS Publication 15-B. This table shows the cost per thousand dollars of excess coverage by age range. The employee's age is considered to be his/her age as of the last day of the tax year.

The discussion that follows describes the Payroll configuration and processing steps that AccountingWare recommends in order to comply with taxable treatment of excess group term life insurance.

Goals

- Calculate the taxable amount for the cost of excess group term life insurance.

- Allow simple entry of the values from the IRS Publication 15-B "Cost Per $1,000 of Protection for 1 Month" table.

- Print excess group term life amount on employee W-2s.

- Provide an option for employers to pay the extra withholding associated with excess group term life.

AccountingWare's recommendations

-

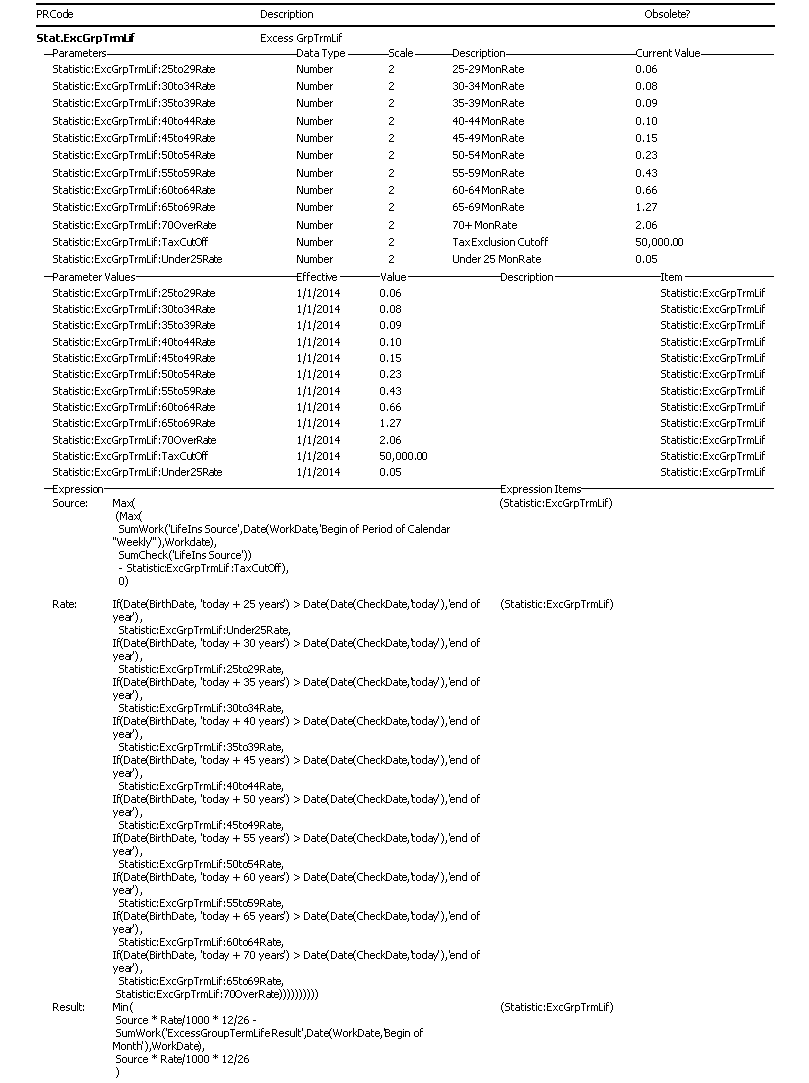

Create a statistical PRCode (Stat.ExcGrpTrmLif) to calculate the extra withholding based on the excess group term life and the employee's age.

Note

Every check that includes Ded.R.Life should also include this PRCode.

- Add the PRCode as an automatic to each employee that has the group term life employer deduction as an automatic.

-

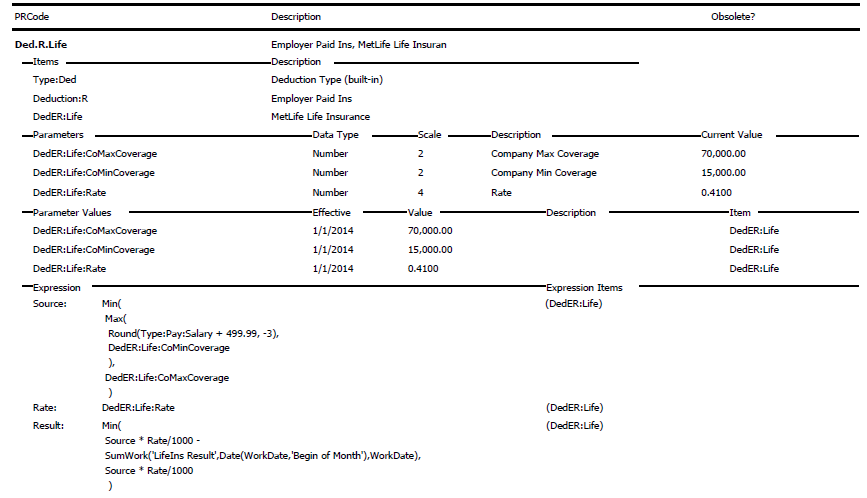

Apply the PRCode to previous checks this year that included the employer group term life deduction Ded.R.Life. The source of Ded.R.Life is the group term life coverage amount.

Notes

- The rate in the rate expression is in dollars per thousand of annual salary.

- Every check that includes this PRCode should also include Stat.ExcGrpTrmLif in order to capture the excess group term life that is taxable.

- If the employer wants to pay the taxable excess, then enter a separate adjustment check at the end of the year which includes a gross-up check line for the year-to-date sum result of the Stat.ExcGrpTrmLif PRCode.

- To print the excess group term life amount on W-2s, add Stat.ExcGrpTrmLif to the built-in group called "ExcessGroupTermLife".