If you want an employee's pay to net to a certain amount, you need to ensure that the taxable amount is high enough to cover the taxes that are withheld. The method for doing this is called "grossing up" the pay. Gross-up pay is sometimes used for bonus checks.

![]() Expand this link to learn how the formula for gross-up is derived.

Expand this link to learn how the formula for gross-up is derived.

Requirements

- All applicable taxes must be included in the gross-up pay.

- The social security cutoff should be honored.

Limitations of this method

- This method only works for a known withholding rate such as the USA 22% supplemental rate.

- Pay that is not subject to standard taxes should have another PRCode for Tax.GrossUp that only includes the applicable taxes.

AccountingWare's recommendations

- Create two groups: GrossUpAmt that contains the PRCode Pay.GrossUp and GrossUpTax that contains Tax.GrossUp.

- Create two PRCodes: Pay.GrossUp that allows the desired net pay to be entered and Tax.GrossUp that is an employer tax type to calculate the additional pay needed to cover the tax.

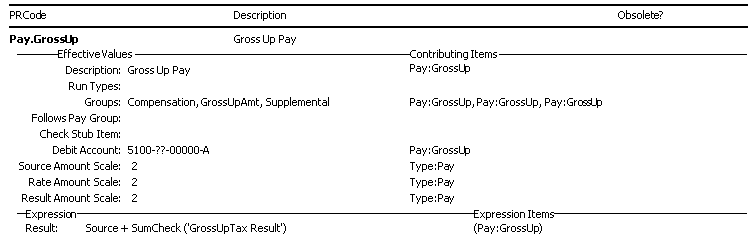

Sample Pay.GrossUp

Note

Checks or time sheets that use Pay.GrossUp should also include Tax.GrossUp.

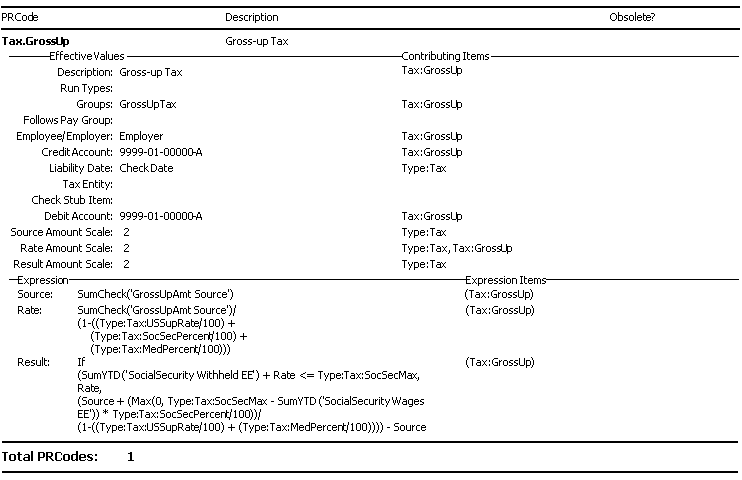

Sample Tax.GrossUp

Note

Checks or time sheets that use Tax.GrossUp should also include Pay.GrossUp.

Note

The example above does not include state tax. If you have a state tax, the Rate and Result expressions would need to be extended accordingly.

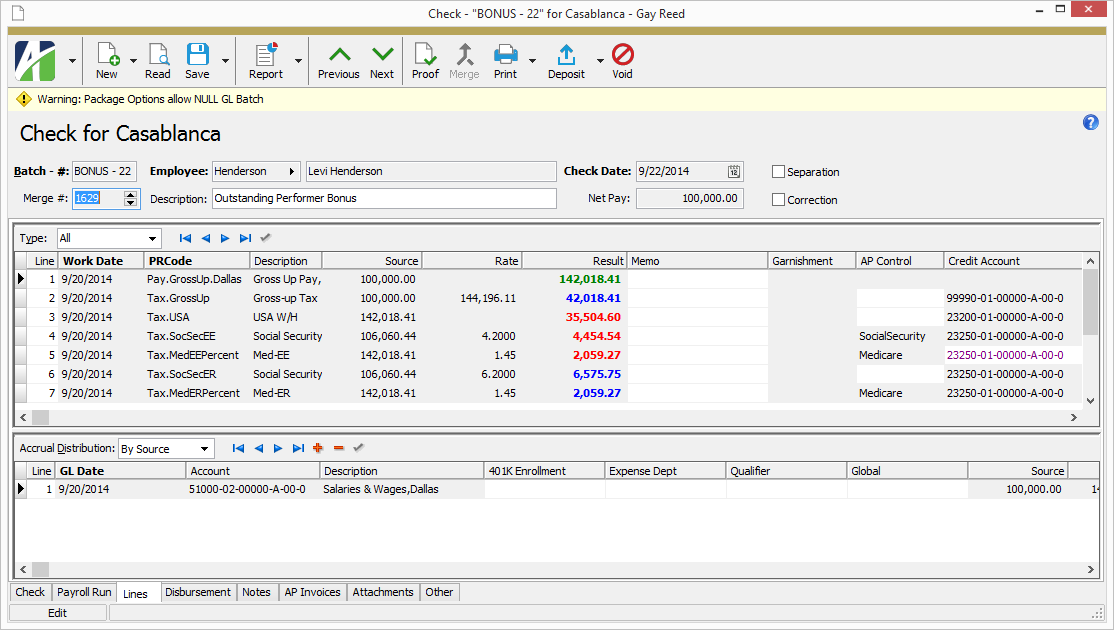

Sample check lines

Notes

- The check lines above do not include state tax. If you have a state tax, include the appropriate PRCode(s).

- Due to rounding issues, the net pay amount and gross-up amount may differ by a few cents. To resolve this, unlock the Result column for the Tax.USA PRCode and adjust the result amount up or down as needed.