Canadian sales tax calculations

- The provinces levy the Provincial Sales Tax (PST) (called QST in Quebec).

- The federal government levies the Goods and Services Tax (GST).

- The Harmonized Sales Tax (HST) is a blend of PST and GST which is used in many provinces. The Canada Revenue Agency collects HST and apportions it to the participating provinces.

GST is reported and controlled by the Canadian federal government, so the first level of the tax entity hierarchy is for the GST portion of sales tax collected in Canada. The second level of the hierarchy is used for the province tax.

Examples

| Tax Entity | Description |

|---|---|

| C | Canada (GST) |

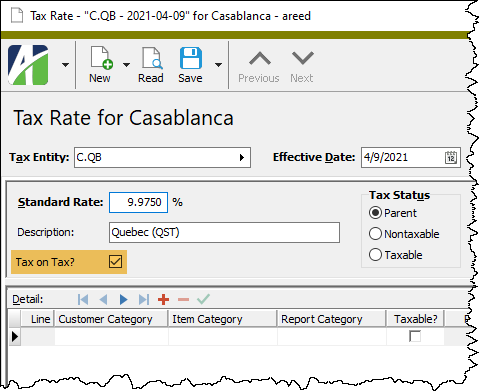

| C.QB | Quebec province tax |

| C.ON | Ontario province tax |

Some provinces which do not use HST apply the provincial sales tax to the taxable amount of an invoice plus the resulting federal tax. To enable this behavior on a tax rate, mark the Tax on Tax? checkbox.

Example

Quebec's 9.975% tax is applied to the extended price of an item plus the 5% federal GST on the line item. So, for an item that costs $100, the calculation looks like this:

[(PRICE * GST) + PRICE] * QST

[($100 * .05) + $100] * .09975 = $10.4738