Report independent contractors

The state of California requires businesses to file information documents to advise the Employment Development Department (EDD) about the amounts paid to California vendors who are deemed independent contractors.

Generate the Independent Contractors Report

The independent contractors report shows vendors that meet the following criteria:

- The vendor has one or more default 1099-NEC APCodes defined (or 1099-MISC APCodes for historical reporting).

- The vendor's last contractor report date falls before the range of dates specified on the Options tab. ActivityHD skips vendors who have already been reported in the specified date range since a vendor only needs to be reported once per reporting period (typically once a year).

- The total payments to the vendor must exceed the specified minimum amount or the vendor must be in contract for more than the minimum amount.

- The vendor must have a primary contact with all required information defined on the contact.

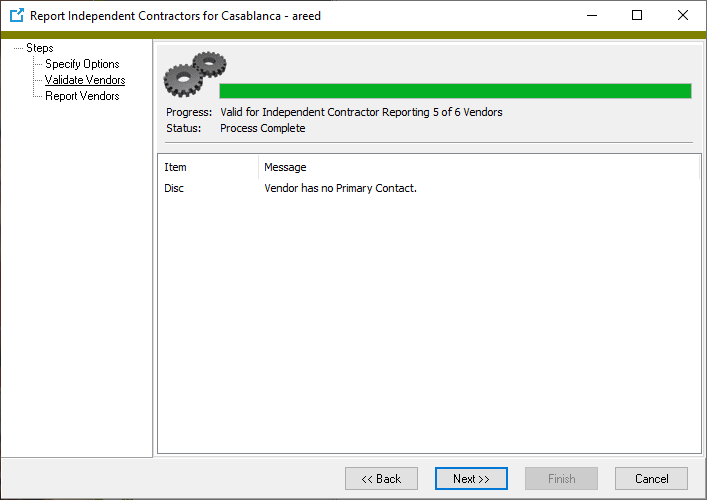

Vendors who cannot be reported are listed along with the reason they will not be included in the report. Vendors without a social security number (SSN) on file are reported with an SSN of "000-00-0000".

You can produce an electronic file of the report in California's EDD format. In addition, two printed formats are available for EDD forms: one for pre-printed EDD forms; the other is a plain paper alternate form.

Note

When printing on plain paper, follow these guidelines:

- Use 24-pound bond paper. NCR or recycled paper will not feed into the scanners.

- Do not use a dot matrix printer.

- Use black, non-ferric ink only.

To produce the report:

- In the Navigation pane, highlight the Accounts Payable > Government folder.

- Start the Report Independent Contractors wizard.

- Right-click the Government folder and select Report Independent Contractors from the shortcut menu.

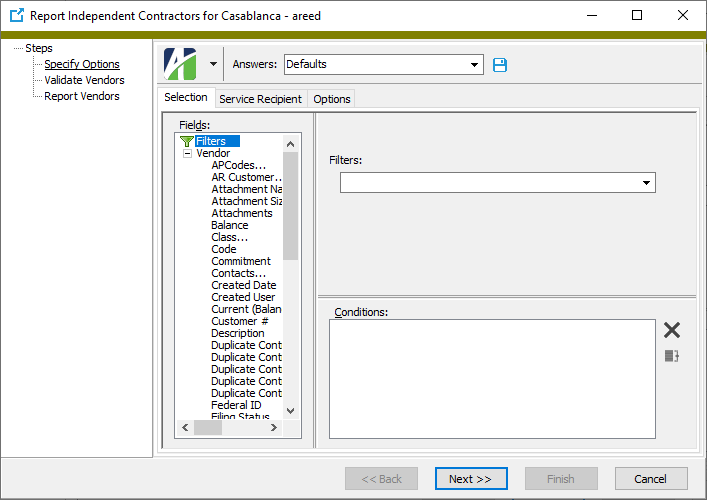

- On the Selection tab, define any filters to apply to the data.

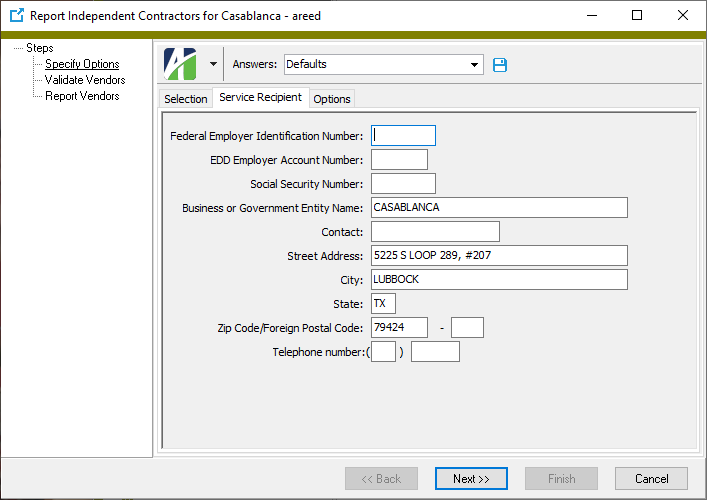

- On the Service Recipient tab in the Federal Employer Identification Number field, enter the recipient's nine-digit taxpayer identification number (EIN, SSN, or ITIN).

- In the EDD Employer Account Number field, enter the recipient's eight-digit number assigned by the California EDD, if applicable.

- Enter the recipient's nine-digit Social Security Number.

- In the Business or Government Entity Name field, enter the recipient's name.

- In the Contact field, enter the name of the recipient's contact person.

- In the Street Address, City, State, and Zip Code/Foreign Postal Code fields, enter the recipient's address information.

- In the Telephone number fields, enter the recipient's phone number.

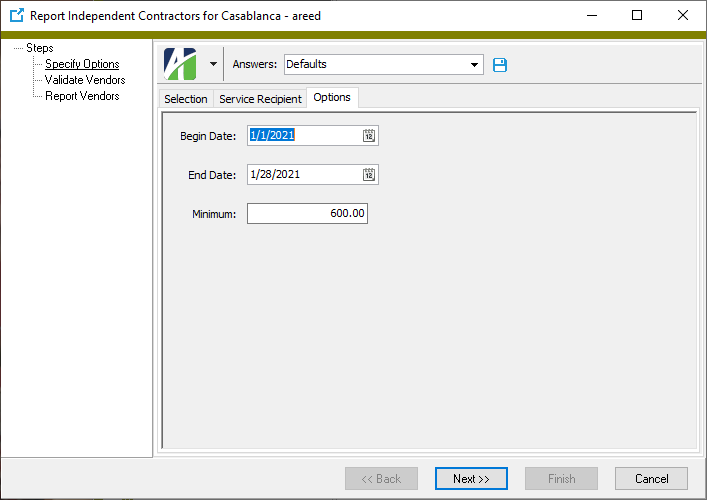

- Select the Options tab.

- In the Begin Date and End Date fields, enter the range of dates for which to include contractors on the report. This date range is compared with the Last Contractor Report date on the vendor record to determine whether or not a vendor is due to be included in the report.

- In the Minimum field, enter the minimum amount of payments to the vendor needed to qualify the vendor for inclusion on the report.

- Click Next >>. ActivityHD validates the vendor records.

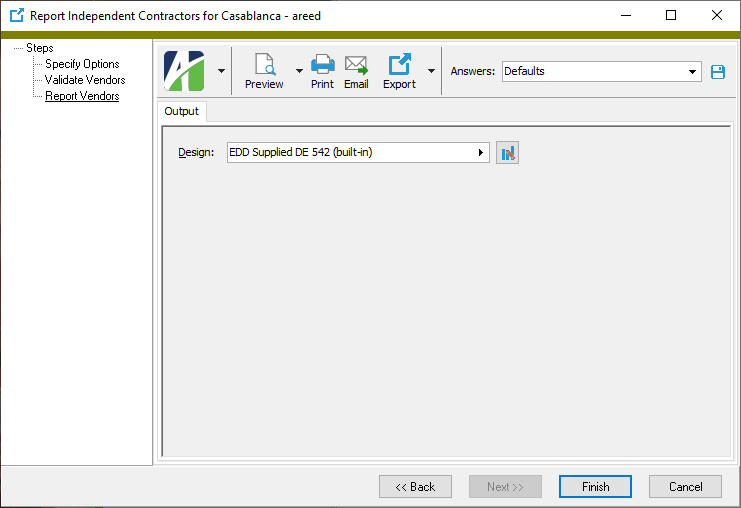

- Click Next >>. You are now ready to generate the report.

- In the Design field, look up and select the report design to use.

There are three built-in report designs for reporting contractors:

- EDD Listing

- EDD Supplied DE 542

- EDD Alternate DE 542

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

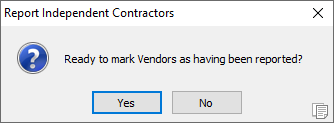

- When you finish producing the report, click Finish. ActivityHD asks if you're ready to mark the vendors as having been reported.

-

Click Yes.

Note

If you later discover the need to clear or change the report date on vendors, you can use the mass changer on vendor records to change the last contractor report date field.