Reconcile fixed assets to GL balances

Observing the following practices improves and simplifies the process of reconciling Fixed Assets to the General Ledger:

- Avoid making manual journal entries for assets. Manual journal entries are not reflected in asset detail. Instead, make corrections to the asset itself.

- Reprocess Post to FA to GL after correcting assets in order to self-correct the asset transactions.

- Use the proper reports for reconciliation.

Efficiently reconciling fixed assets to the General Ledger hinges upon running the right reports with the right settings. In Fixed Assets, you'll need the Asset GL History Report. On the GL side, you'll need to run the Trial Balance Report.

Trial Balance Report

For accurate results, AccountingWare recommends the following settings:

-

Limit the report to asset and depreciation accounts for a particular ledger only.

-

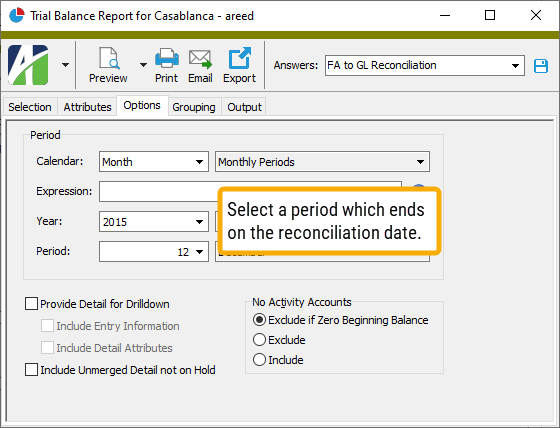

Run the report for the period which ends on the same date as the reconciliation date.

-

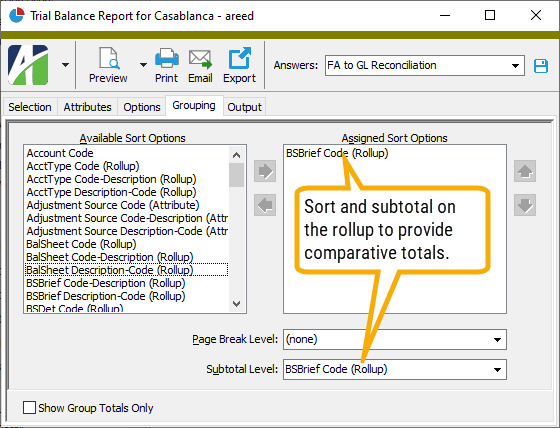

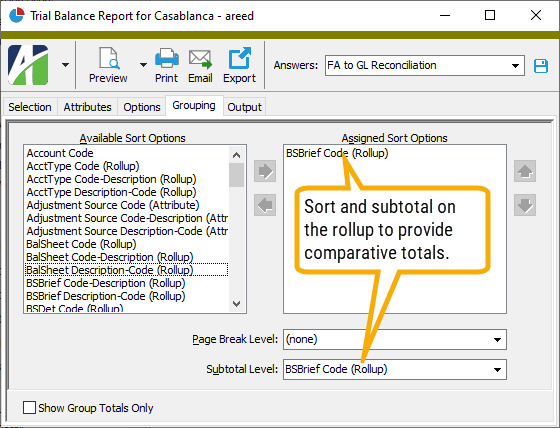

Use grouping to create subtotals for assets, accumulated depreciation, and depreciation expense.

Asset GL History Report

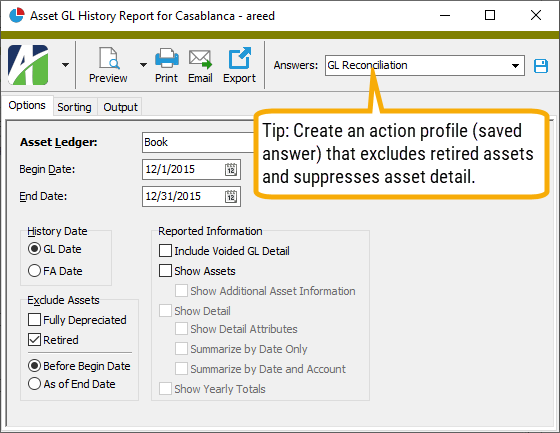

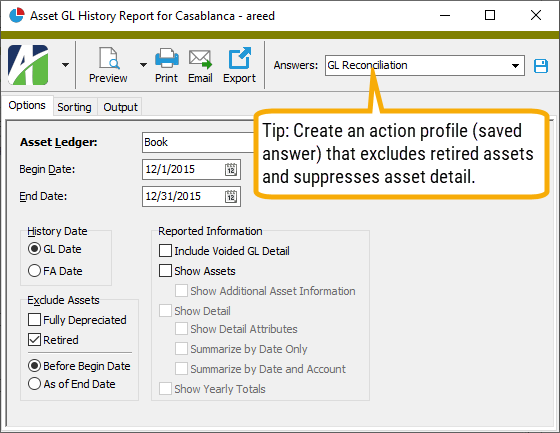

The following settings are recommended for the Asset GL History Report:

- Set the range of dates for reporting to the same date range as the Trial Balance Report.

- Set the history date to the "GL Date".

-

Exclude retired assets which were retired before the begin date you specified. Clear all options in the Reported Information section in order to show summarized entries rather than asset detail.

-

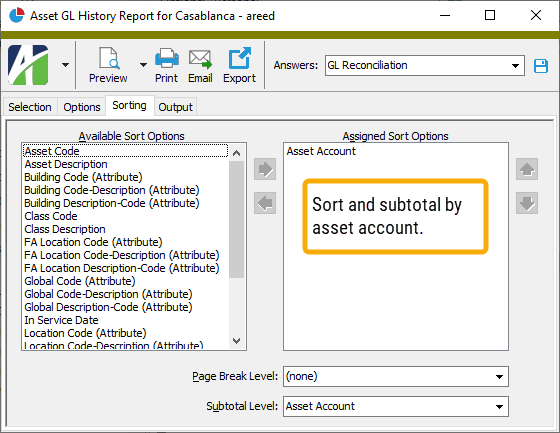

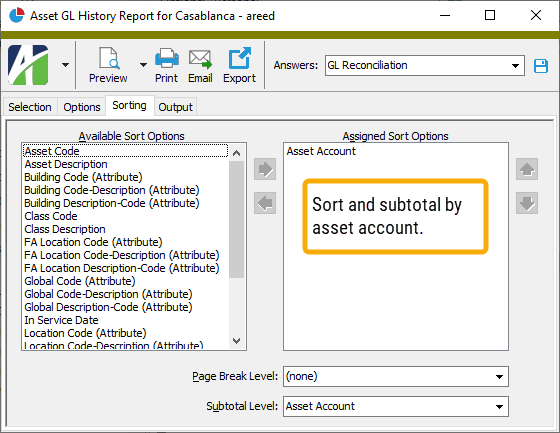

Sort and subtotal the report by asset account.

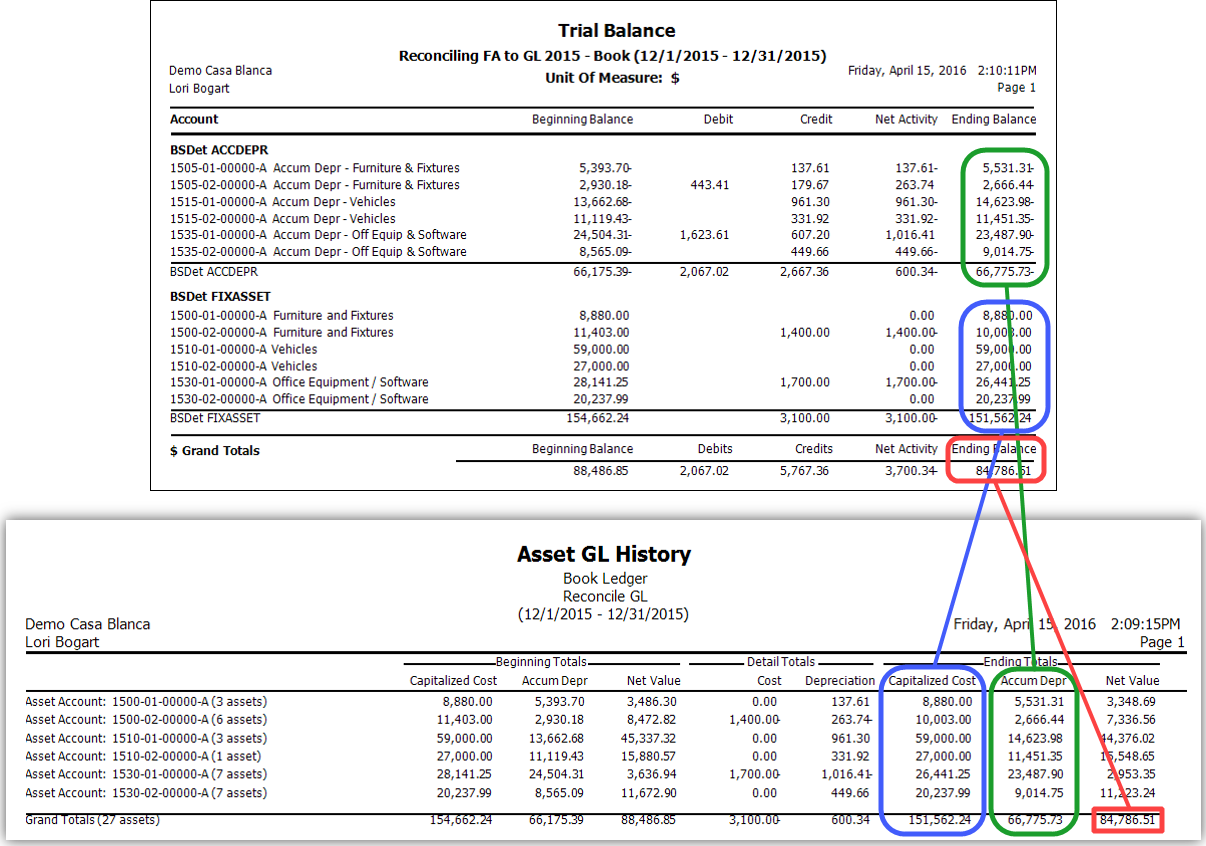

Reconciling

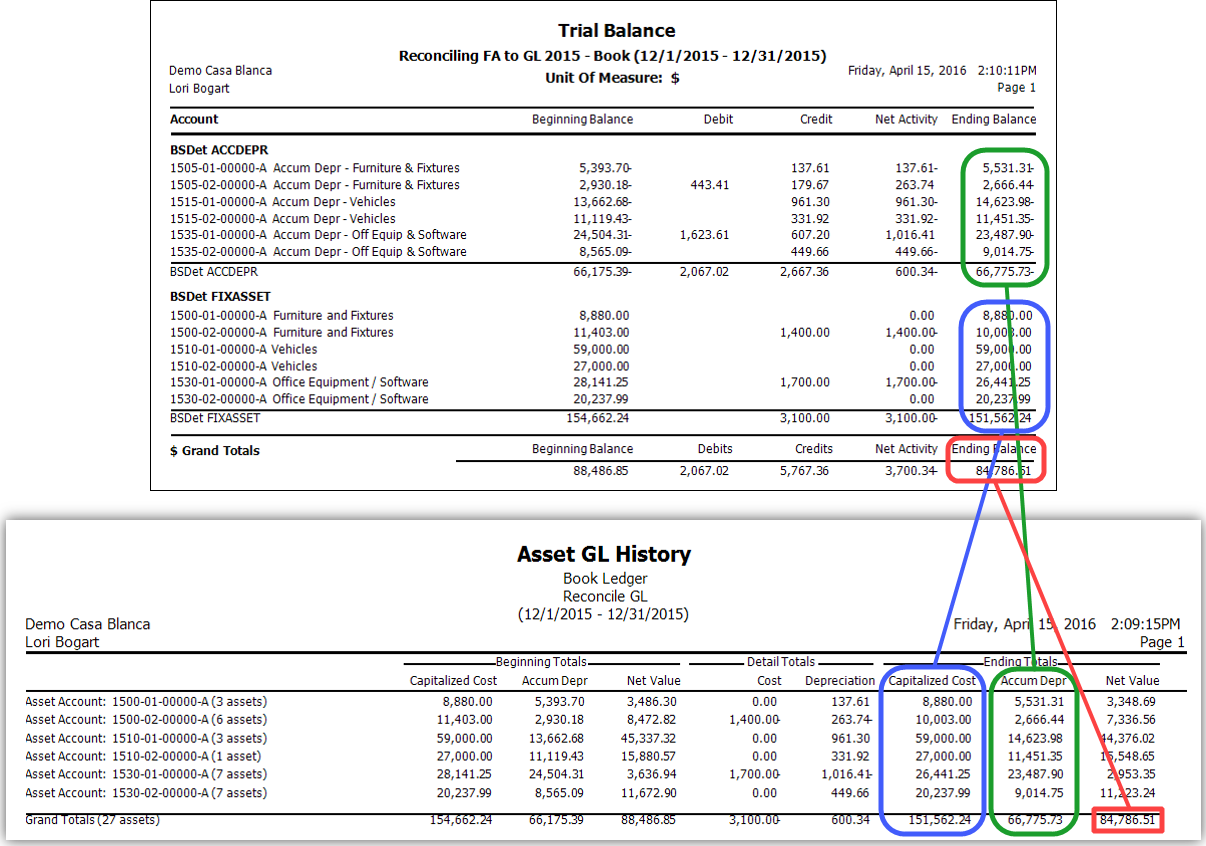

After you've generated the reports, it's time to compare the results. The following image illustrates how the report totals are related:

But wait...there's more

You can see the totals from the Asset GL History Report in the HD view! Here's how:

-

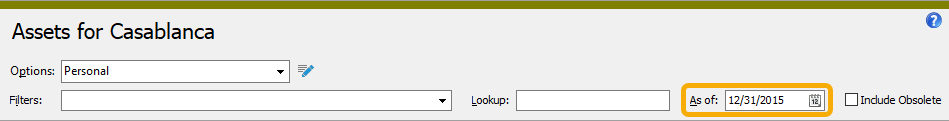

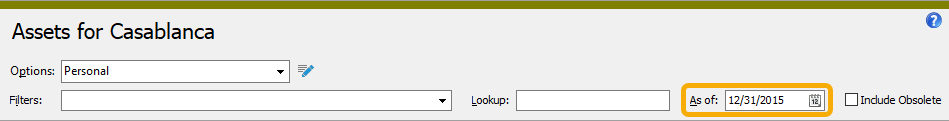

Set the As of date to the reconciliation date. This allows you to evaluate your assets at a particular point in time.

-

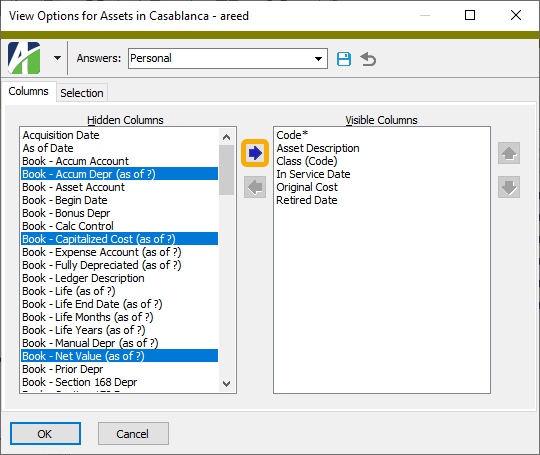

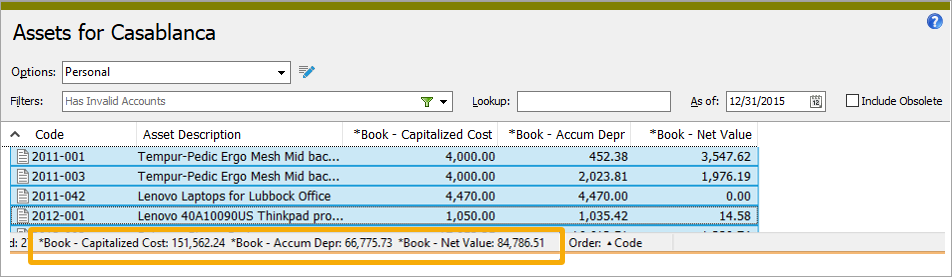

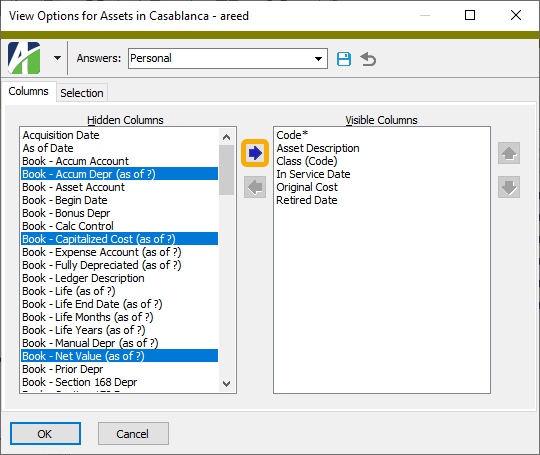

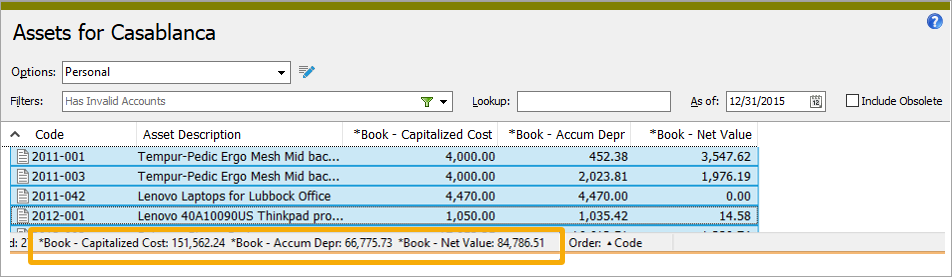

If they're not already displaying, use the Options dialog to show the Book - Capitalized Cost, Book - Accum Depr, and Book - Net Value columns in the HD view.

-

Press Ctrl+A to select all records in the HD view. The ledger totals for capitalized cost, accumulated depreciation, and net value as of the reconciliation date display in the status bar. Notice that they match the totals from the Asset GL History Report!

This works because the ledger totals in the HD view are based on GL dates and amounts.

Making corrections

Suppose you find an asset with a negative net value which needs to be corrected. You discover that the problem is that the wrong added value was added for additional cost. After you correct the asset, how should you correct the depreciation? The short answer is: "Let ActivityHD do it!"

To correct the issue, simply run the Post FA to GL process again. Use the original dates and accounts, or supply new dates and accounts if necessary. ActivityHD performs the cleanup for you.

As a matter of best practice, AccountingWare recommends you post the corrections from Fixed Assets. When Post to GL is processed for unmerged GL entries, the process deletes the original entries and replaces them with new entries. When Post to GL is processed for merged GL entries, the process voids the original entries and replaces them with new entries.

Purpose

The Trial Balance Report shows account activity and beginning and ending balances for the accounting period you specify and helps you analyze out-of-balance issues.

Content

For each account included on the report, the report shows:

- account number and description

- beginning balance for the period specified

- total debit transactions during the period

- total credit transactions during the period

- net activity for the period

- ending balance for the period.

In addition, you can include one or more of the following:

- detail for drilldown

- unmerged detail not on hold

- report dialog answers.

If you include drilldown detail, you can also include:

- entry information (batch name, entry number, sequence number)

- detail attributes.

The following totals appear on the report:

- subtotals as specified

- grand totals.

Print the report

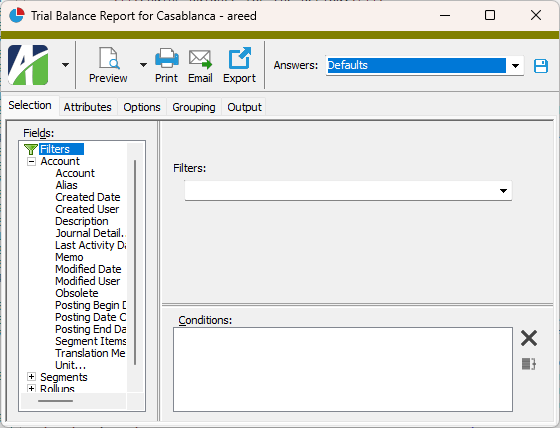

- In the Navigation pane, highlight the General Ledger > Chart of Accounts folder.

- Start the report set-up wizard.

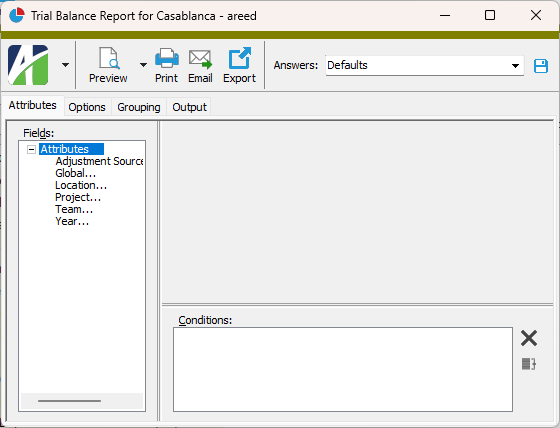

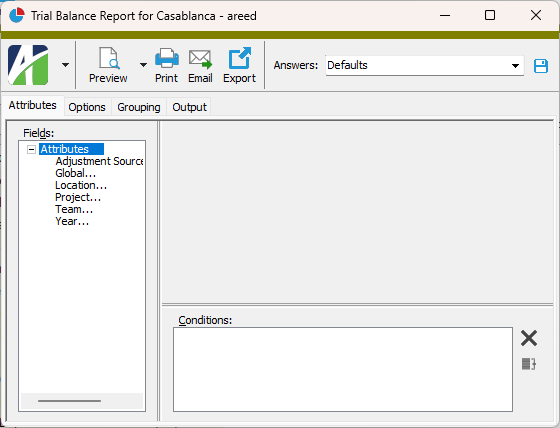

- Select the Attributes tab.

- Define any filters you want to apply to attributes.

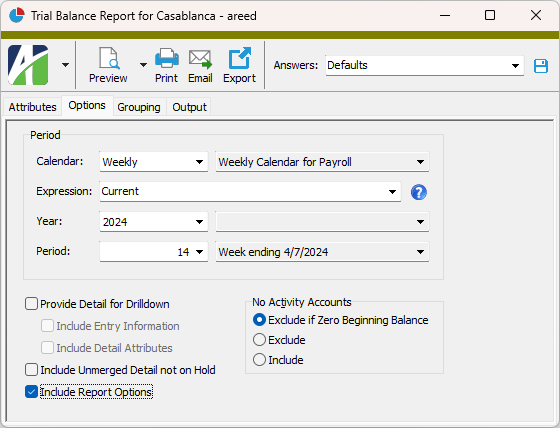

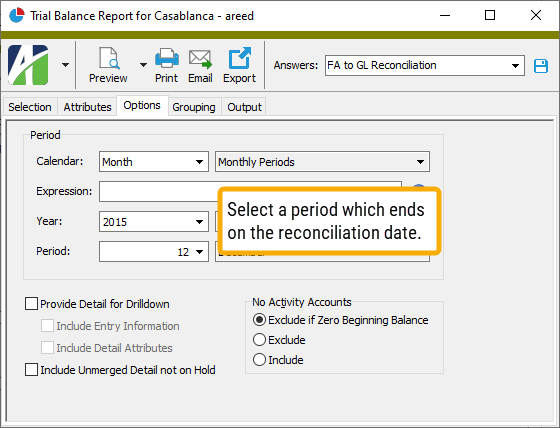

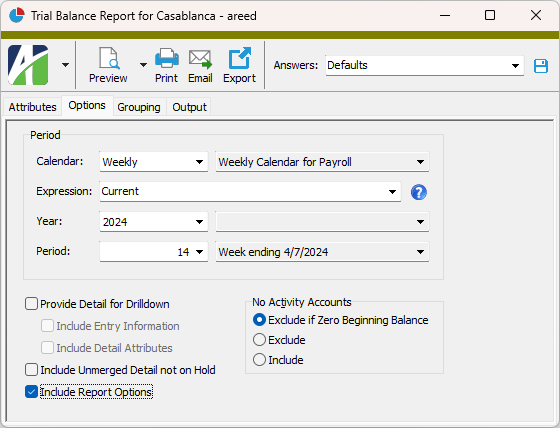

- Select the Options tab.

- From the Calendar drop-down list, select the calendar to base the report on. If the selected calendar contains today's date, the Year and Period fields default to the calendar period which contains today's date. Otherwise, if the calendar does not contain today's date, the fields default to the last valid period before the current date.

-

To define the reporting period using a relative expression, select or enter the period expression in the Expression field. If you prefer to explicitly enter the year and period, skip to step 8.

You can select from the following common period expressions:

- Current

- Current - 1 period

- Current - 1 year

Alternatively, you can type a valid period expression in the field. For help on period expression syntax, click the help button to the right of the field.

If you select or enter a period expression, ActivityHD adjusts the values in the Year and Period fields accordingly.

If you enter a period expression, skip to step 10.

- From the Year drop-down list, select the year of the period to report on.

- From the Period drop-down list, select the period to report on.

- Mark the checkbox(es) for the additional information to include:

- Provide Detail for Drilldown. Mark this checkbox to include transaction detail when you drill down on an account record on the report. If you mark this checkbox, the Entry Information and Detail Attributes checkboxes are enabled.

- Entry Information. Mark this checkbox to include batch name, entry number, and sequence number for each transaction listed in the detail drilldown.

- Detail Attributes. Mark this checkbox to include GL attributes for journal detail postings.

- Unmerged Detail Not on Hold

- Report Options. To include a section at the end of the report with the report settings used to produce the report, leave the checkbox marked. To produce the report without this information, clear the checkbox.

- In the No Activity Accounts field, select the option that describes how you want the report to handle accounts with no activity. Your options are:

- Exclude if Zero Beginning Balance. Exclude accounts with no activity in the specified period only if the balance at the beginning of the period was zero.

- Exclude. Exclude all accounts with no activity in the specified period.

- Include. Include all accounts in your selection regardless of posting activity.

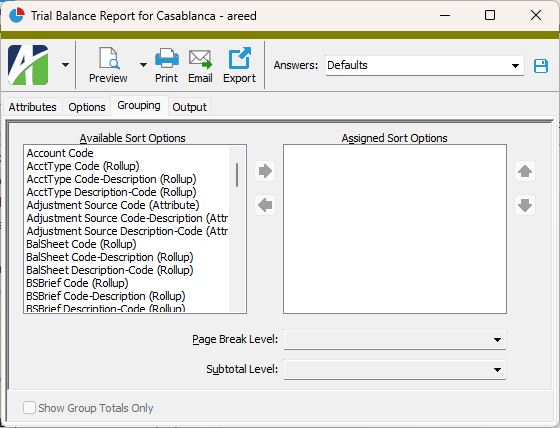

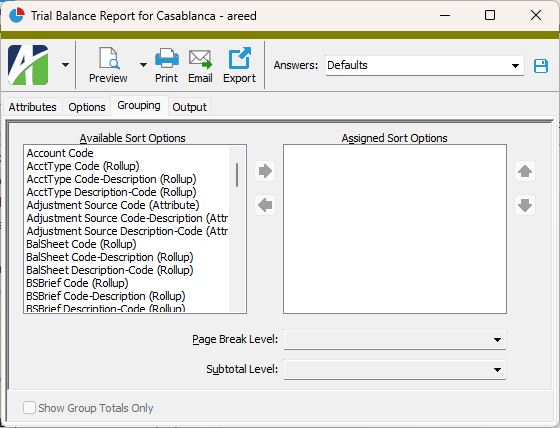

- Select the Grouping tab.

- In the Available Sort Options list box, highlight the segment(s), rollup(s), and/or attribute(s) to sort the report by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box.

- If you selected multiple groupings, use

and

and  to arrange the groups in the order you want them applied.

to arrange the groups in the order you want them applied.

- If you want the report to start a new page for each change in one of the sorting options you specified, select the sorting option to break on from the Page Break Level drop-down list. If you do not want to insert page breaks, accept "(none)".

- If you want the report to subtotal based on one of the sorting options you specified, select the sorting option to subtotal on from the Subtotal Level drop-down list. If you do not want to show subtotals, accept "(none)".

- If at least one sort option is assigned, the Show Group Totals Only checkbox is enabled. Mark this checkbox if you want the report to show group totals without the account-level information behind the totals.

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extension is available for the report:

×

Asset GL History Report

Which report do I choose: Depreciation Schedule vs Asset GL History Report?

Purpose

The Asset GL History Report shows posted depreciation, asset cost, and retirement information for a particular ledger for a historical range of dates. Use this report to help you reconcile general ledger postings. In particular, you can use the capitalized cost amount to reconcile the GL asset account, and the accumulated depreciation amount to reconcile the GL accumulated depreciation account.

Note

The Asset GL History Report does not calculate depreciation. It shows the historical GL detail for posted depreciation.

Because asset costs are only posted to GL when (1) a ledger GL batch is specified, (2) a ledger asset account is specified, (3) an asset cost offset account is specified, and (4) the offset account and the asset account are not the same, the GL History Report expects GL posting detail to be created by the Post to GL process and, therefore, doesn't report the asset cost record directly. Accordingly, you must run Post to GL over the asset cost date range in order to create the detail records for inclusion on the report. If the asset cost is not to be posted to GL, the report assumes the GL posting to the asset account was created by a manual GL entry (or with an AP invoice) and automatically creates a row in the report for the asset cost so that you can reconcile the GL asset account.

Note

Costs are not included on the report if the asset has not been placed in service. If the in-service date is blank, the capitalized cost of the asset is zero, even if there are entries in the asset's Cost Detail table. Those costs will not be posted to the GL asset account until the asset is placed in service. Any costs dated before the in-service date when costs are posted will be posted as of the in-service date.

For retirement postings, the retired asset cost amount is subtracted from the capitalized cost and retired accumulated depreciation is subtracted from accumulated depreciation. As a result, when an asset is fully retired, its capitalized cost, accumulated depreciation, and net value should all be zero.

Content

For each asset on the report, the report shows:

- asset code and description

- in-service date

- beginning totals for capitalized cost, accumulated depreciation, and net value

- detail totals for cost and depreciation

- ending totals for capitalized cost, accumulated depreciation, and net value.

By default the report includes all fully depreciated assets including retired assets. You have the options to exclude all fully depreciated assets or to exclude retired assets only.

In addition, you can include the following:

- original cost, asset class, acquisition date, salvage value, asset location, and retirement date

- GL detail postings for asset costs, depreciation, and extra depreciation, as well as generated entries for asset costs, depreciation, and extra depreciation, with or without summarized details by date or by date/account

- detail for attributes posted to GL

- yearly totals (based on the FA calendar).

The following totals appear on the report:

- asset totals

- grand totals.

Preinstalled saved answers

For your convenience, ActivityHD includes two preinstalled saved answers for common reporting scenarios:

- "By Accumulated Account without Assets"

- "By Asset Account with Assets"

Print the report

- In the Navigation pane, highlight the Fixed Assets > Assets folder.

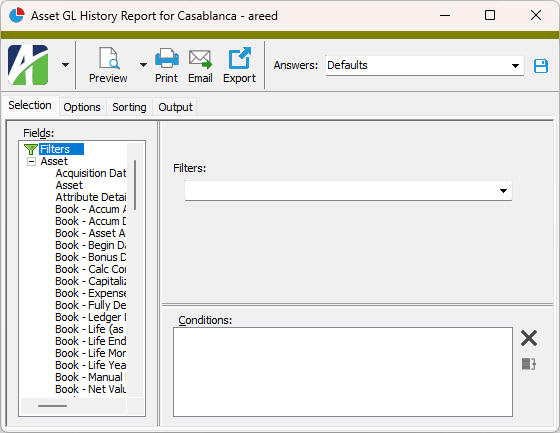

- Start the report set-up wizard.

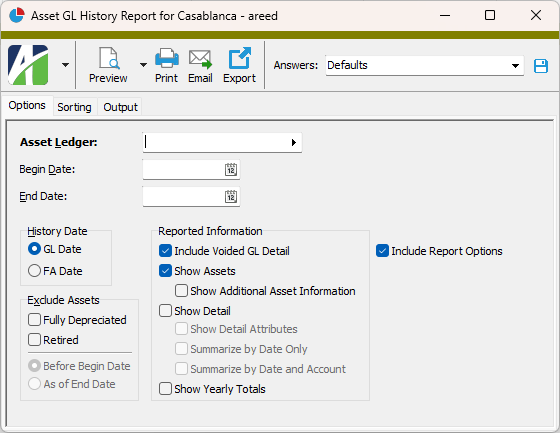

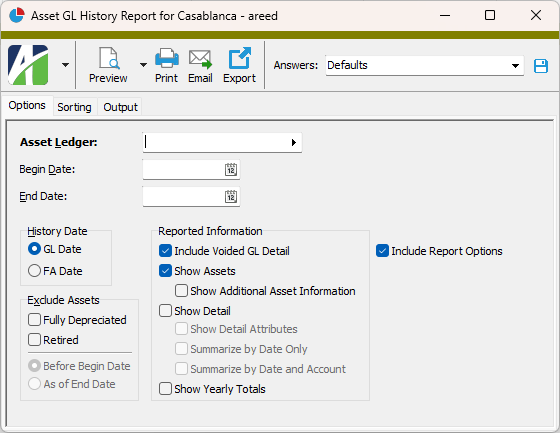

- Select the Options tab.

- Select the Asset Ledger to report on. Only ledgers which post to GL (i.e., ledgers with a GL batch specified) can be selected for reporting. (If only one non-obsolete ledger exists, that ledger is loaded for you.)

- In the Begin Date and End Date fields, enter the range of dates for which to include GL history on the report. The "Beginning Totals" column on the report shows the totals up to the Begin Date.

- In the History Date field, select the type of date you want the date range you entered to represent. Your options are:

- GL Date. Uses the GL posting date.

- FA Date. Uses the asset depreciation date.

- In the Exclude Assets section, select which, if any, assets you want to exclude from the report. Your options are:

- Fully Depreciated. Mark this checkbox to exclude all fully depreciated assets from the report. If you mark this checkbox, the Retired checkbox is marked and disabled. If you mark this checkbox, the date options below are enabled. Select which fully depreciated assets to exclude based on date. Your options are:

- Before Begin Date. Exclude assets that were fully depreciated before the report begin date.

- As of End Date. Exclude assets that were fully depreciated as of the report end date.

- Retired. This checkbox is enabled unless you marked the Fully Depreciated checkbox. Mark this checkbox if you want to exclude retired assets from the report but not other fully depreciated assets. If you mark this checkbox, the date options below are enabled. Select which retired assets to exclude based on date. Your options are:

- Before Begin Date. Exclude assets that were retired before the report begin date.

- As of End Date. Exclude assets that were retired as of the report end date.

- Mark the checkbox(es) for the additional information to include:

- Include Voided GL Detail. This option is marked by default and causes the report to include voided GL detail. If you are using this report to reconcile GL balances, you should include voided GL detail because reversal entries may have been posted to different dates and to different accounts than the original voided entries. On the other hand, if you are using the report to see the current state of asset cost and depreciation history, you may want to exclude voided GL detail in order to simplify the report. If that is the case, clear the checkbox.

- Show Assets. This option is marked by default and causes the report to show totals by asset. If this checkbox is marked, the following checkbox is enabled:

- Show Additional Asset Information. Mark this checkbox to include asset class, asset location, acquisition date, and retirement date for each asset on the report.

- Show Detail. Mark this checkbox to include detail transactions on the report. If you mark this checkbox, the following checkboxes are enabled, but you can select only one of them:

- Show Detail Attributes. Mark this checkbox to include detail of attributes posted to GL.

- Summarize by Date Only. Mark this checkbox to summarize detail by date only.

- Summarize by Date/Account. Mark this checkbox to summarize detail by date and account.

- Show Yearly Totals. Mark this checkbox to show annual totals on the report. Yearly totals use the FA calendar specified on the asset's ledger to summarize depreciation detail so that totals match your organization's fiscal year.

- To include a section at the end of the report with the report settings used to produce the report, leave the Include Report Options checkbox marked. To produce the report without this information, clear the checkbox.

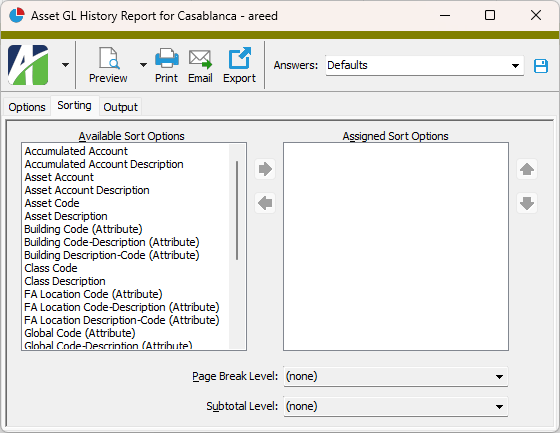

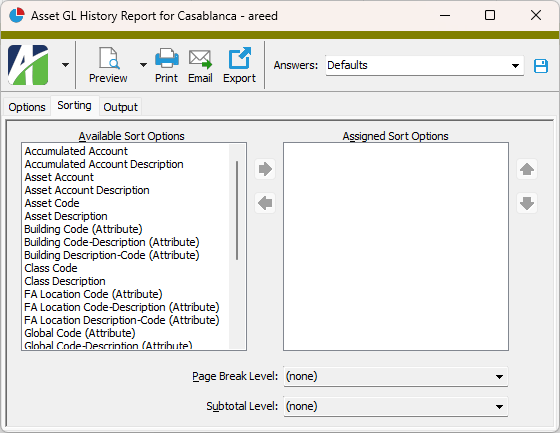

- Select the Sorting tab.

- In the Available Sort Options list box, highlight the field(s) to sort the report by, then click

to move your selection(s) to the Assigned Sort Options list box.

to move your selection(s) to the Assigned Sort Options list box.

- If you selected multiple sort fields, use

and

and  to arrange the sort fields in the order you want them applied.

to arrange the sort fields in the order you want them applied.

- If you want the report to start a new page for each change in one of the sorting options you specified, select the sorting option to break on from the Page Break Level drop-down list. If you do not want to insert page breaks, accept "(none)".

- If you want the report to subtotal based on one of the sorting options you specified, select the sorting option to subtotal on from the Subtotal Level drop-down list. If you do not want to show subtotals, accept "(none)".

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Assets

- Asset Cost Detail

- Asset GL Detail

- Asset Ledgers

- Asset Ledger Retirement

- Asset Ledger Extra Depreciation

- Asset Ledger Cost Detail