ActivityHD Release 8.43

System-wide

-

HD views

A change in ActivityHD 8.43-2 resulted in an access violation when a user tried to visit an HD view with a modified version of the "Defaults" view option, denoted by "Defaults*", applied. This problem is now fixed.

-

Saved Answers

An issue introduced in ActivityHD 8.42-0 caused security errors when a user tried to use a saved answer using features not permitted to the user. For example, a user without "Edit" access to the "Bots" resource who tried to use a saved answer in a Change process which contained a change bot would receive an error. Users must have "Edit" access before they can create change bots, but the user should still be able to use a saved answer that is shared and contains a change bot.

The issue has been fixed.

-

ActivityHD Explorer

Formerly, when a user double-clicked the Activity System or company folder in the navigation pane of ActivityHD Explorer, a connection was created and the folder immediately collapsed. Now double-clicking results in a connection and the Activity System folder or the company folder is expanded.

-

Automation

RecordList is an automation object which represents a list of records in ActivityHD. With this release, new Export and Import methods have been introduced for RecordList. These methods make it easier to use automation to export and/or import multiple records at once. These methods are very similar to the analogous methods already available on the Data automation object.

RecordListFunction Export([ByVal Content As String]) As String- Exports each record in the list to a single XML result based on the specified content.Function Import(ByVal Data As String, [ByVal XPath As String]) As String- Imports the specified data and automatically loads the resulting records into the list.

V8Script example

//--Create Record Lists for the Source and Destination

var vRecListSource = Company.NewRecordList("Administration", "Custom Data - Test1s");

var vRecListDestin = Company.NewRecordList("Administration", "Custom Data - Test2s");

//--Load the Source records

vRecListSource.Load(

"<p>" +

"<Selection>" +

"<Item Table='Custom Data' Field='Created Date' Version='3' Operator='5'>" +

"<Value1 Expression='today - 1'/></Item>" +

"</Selection>" +

"</p>");

//--Export the Source records

var vDataSource = vRecListSource.Export("<Content Value='Complete'/>");

MacroProcess.AddMessage(vDataSource);

//--Import the Source records to the Destination

var vDataImport = vRecListDestin.Import(vDataSource, "/XML/data");

MacroProcess.AddMessage(vDataImport);

//--Export the Destination records for review

var vDataDestin = vRecListDestin.Export("<Content Value='List'/>");

MacroProcess.AddMessage(vDataDestin);

-

Automation

The Report automation object methods have been improved to allow saved answers to be passed more easily. Saved answers can now be passed as part of the parameters to the following methods:

ReportSub Print([ByVal Parameters As String])Sub Email([ByVal Parameters As String])Sub Export([ByVal Parameters As String])Function ExportToTempFile([ByVal Parameters As String]) As String

JScript example

var report = Activity.ViewReport("Administration", "Authorized Users Listing");

//--Set answers separately

report.Answers("<Answers Name='Test'/>");

report.Export("<Export Prompt='False' FormatType='PortableDocFormat' DestinationType='DiskFile' DiskFileName='C:\Temp\Test.pdf'/>");

//--Set answers during the call to Export

report.Export(

"<p>" +

" <Answers Name='Test'/>" +

" <Export Prompt='False' FormatType='PortableDocFormat' DestinationType='DiskFile' DiskFileName='C:\Temp\Test.pdf'/>" +

"</p>");

-

Bots

[Company] > Administration > Setup > Bots

A new version of the BotDevTools bot module has been introduced. The new version has improvements to existing methods and some new methods for use in other bots.

-

Disconnecting from server

Previously, access violation errors could occur when disconnecting from an ActivityHD server while a report process was running. This issue has been corrected.

-

Email settings

A user's default choice for the personal email "From" option is automatically remembered based on the user's last choice when sending email. In the past, that choice was overridden if a different email was used when running non-interactive automation processes such as a bot which does not prompt the user but does specify a personal email. With this release, using a different email when running a non-interactive automation process no longer changes the user's default email setting. Instead, only the user's last interactive choice is remembered.

Accounts Payable

-

Generate 1099s

Accounts Payable > Vendors > [right-click] > Select and Generate 1099s

The Generate 1099s process is now ready to handle reporting for the 2023 tax reporting year. Updates have been introduced to 1099 reporting for forms 1099-DIV, 1099-INT, 1099-MISC, 1099-NEC, and 1099-R.

These updates include:

- Report designs for 2023 Copy A and Copy B

- Form images for Copy B with recipient instructions

- Copy A forms for 1099-DIV, 1099-INT, 1099-MISC, and 1099-NEC include optional 4-digit year for printing

There are no field changes or electronic file changes aside from changing the reporting year to "2023". As in the past, use the FIRE TEST system and the FIRE system for testing and submitting the 1099 transmission file.

Important!

If you file ten or more information returns in a calendar year, the IRS requires you to file Forms 1099 electronically in the format specified by Publication 1220. The following forms must be included when totaling the number of information returns: Form W-2, Form 1042-S, Form 1094 series, Form 1095-B, Form 1095-C, Form 1097-BTC, Form 1098, Form 1098-C, Form 1098-E, Form 1098-Q, Form 1098-T, Form 1099 series, Form 3921, Form 3922, Form 5498 series, Form 8027, and Form W-2G. For more information, visit https://www.irs.gov/filing/e-file-information-returns.

The new "2023 1099 Forms Copy A (built-in)" designs for 1099-DIV, 1099-INT, 1099-MISC, and 1099-NEC print a two-digit year which matches the currently published forms. If you purchase pre-printed Copy A forms which require a four-digit year, contact AccountingWare Support for assistance in creating a custom report design.

-

Invoices

Accounts Payable > Invoices

When an invoice has no discounts, the Discounts field in the Payment Terms section of the Invoice tab should display "(none)". In the past, however, if a discount was present and subsequently deleted, the information shown in the field did not update until the form was closed and reopened or until the user switched from read/edit mode. Now when the last discount is removed, the Discounts field updates without the need to close the form or change modes.

-

Vendors

Accounts Payable > Vendors

In the Vendors window, a few keyboard shortcuts have changed to resolve duplicate shortcuts:

- On the Defaults tab, the shortcut key for the Distribution Template field is now Alt+T (formerly Alt+D which conflicted with the Description field).

- On the Defaults tab, the shortcut key for the APCodes table is now Alt+P (formerly Alt+A which conflicted with the AP Account Mask field).

- On the PO tab, the Departments field no longer has a shortcut key.

Accounts Receivable

-

Tessitura Import

Accounts Receivable > Invoices > [right-click] > Tessitura Import

Preliminary changes to the Tessitura Import process were introduced in ActivityHD 8.33-0 to ensure future compatibility with Tessitura v16. As mentioned at the time, further changes could be required for ActivityHD to work with Tessitura v16. Those additional changes have been accomplished in this release so that the interface to the Tessitura API website is now functional.

Furthermore, additional error reporting is now provided for when there is a problem with a call ActivityHD makes to the Tessitura API website. The new errors have the following general format:

Error requesting data from the Tessitura API web site:

Error: xxx - xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Request URI: xxxxxxxxxxxxxxxx

Request Body:

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Response Content:

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

-

Process AR Recurring Invoices

Accounts Receivable > Invoices > Recurring > [right-click] > Select and Process

Process AR Recurring Invoices now validates posting control dates for attributes and GL accounts on the AR invoices that it creates. The process validates the invoice GL date against the control date. When an invoice date violates the control date, a validation message displays in the process message window but the AR invoice is still created. If the severity of the posting date control is "Error", the invoice cannot be merged.

A few examples of attribute item and account validation messages follow:

Calendar (Month) is closed to postings for the date (2023-11-01).

Account (0-1200-01-00000-A-03) is closed to postings for the date (2023-11-01). This error can be overridden, but the invoice cannot be merged until the issue is resolved.

Invoice attribute item (Employee:Curtis) is closed to postings for the GL date (11/1/2023).

Invoice Detail Line 1 - Attribute item (Employee:Raleigh) is closed to postings for the GL date (11/1/2023).

Posting control dates on related rollup attribute items are also validated and enforced, allowing date control enforcement at the rollup level. To see which rollup items have issues, open the attribute item from the AR invoice and review the banners shown.

ActivityHD System

-

Dashboard

A styling issue caused lists in the main menu to be indented excessively due to padding. The issue has been corrected.

-

Dashboard

The default styling of the main menu in the dashboard has been changed to increase its width from 13em to 15em. This allows the menu to handle longer item names without wrapping. In addition, the left margin of the display area has been changed from 14.3em to 16.5em to accommodate the new menu size.

Bank Reconciliation

-

Various HD views

The following description columns are now available in the corresponding HD views:

HD view Description columns Bank Accounts

Bank Description

Check Registers

Bank Account Description

Bank Contacts

Bank Description

Bank Statement Adjustments

Bank Statement Description

Voided By Description

Reverses Description

Reconciliation Account Description

Offset Account Description

GL Entry Description

Bank Statements

Bank Account Description

Bank Transactions

Bank Account Description

GL Account Description

GL Entry Description

Voided Forms

Bank Account Description

Contracts Processing

-

Settlement Report

Contracts Processing > Settlements > [right-click] > Select and Report > Settlement Report

A new Settlement Report has been introduced. The Settlement Report is a detailed report of the settlement which can be given to a customer for their review or to inform them of settlement amounts. The Settlement Report can be produced before or after invoicing. The Settlement Report is to settlements what the Contract Report is to contracts.

-

Various HD views

The following description columns are now available in the corresponding HD views:

HD view Description columns Contract Lines

Type Description

Product Description

Product Type Description

Payment Type Description

Contract Payables

Type Description

Account Description

Contract Payments

Payment Type Description

AR Invoice Description

Contract Type Description

Contracts

Type Description

Contract Types

Charge Invoice Type Description

Credit Invoice Type Description

Sales Tax Payment Type Description

Products

Product Type Description

Work Order Type Description

Payment Type Description

Settlement Lines

Contract Type Description

Product Description

Product Type Description

Payment Type Description

Settlement Payables

Contract Type Description

Account Description

AP Invoice Description

Settlements

Contract Description

Contract Type Description

AR Invoice Description

Work Orders

Work Order Type Description

Contract Type Description

Product Description

Product Type Description

Vendors (in AP)

Shipping Address Description

Freight Terms Description

Shipping Method Description

Fixed Assets

-

Various HD views

The following description columns are now available in the corresponding HD views:

HD view Description columns Asset Ledger Retirement

Retired Type Description

Gain/Loss Account Description

Bank Account Description

Asset Ledgers

Calc Control Description

Accumulated Account Description

Asset Account Description

Asset Retirement Detail

Retired Type Description

Assets

Parent Description

Retired Type Description

<ledger code> Calc Control Description

<ledger code> Accum Account Description

<ledger code> Asset Account Description

Asset GL Detail

Ledger Description

GL Entry Description

Ledgers

Calendar Description

Notes

Type Description

General Ledger

-

Ambiguous Check

General Ledger > Rollups >

A problem was introduced in ActivityHD 8.42-0 which caused the Ambiguous Check function to sometimes report rollup item rules as ambiguous when they were not. This could occur when rollup item rules specified more than one condition on a given segment or rollup.

For example, consider a simple rollup which provides rules for how to summarize the Main account segment into lines which appear on an income statement. The following rollup item rules would cause the Ambiguous Check function to erroneously report an ambiguity:

- COGS - Cost of goods sold

- Line 1 - Rule: Include Main Begin: 5010 End: 5015

- FREIGHT - Freight expenses

- Line 1 - Rule: Item: 5470

In this case, the Ambiguous Check window would report the following:

The following rollup detail lines produce multiple rollup codes for the same account.

The "Duplicates" column shows how many accounts are assigned both rollup codes.

The "Sample" column shows the first account that matches rules for both items.

This ambiguity must be resolved before the rollup can be activated.

Item 1 - Line #: COGS-1

Item 2 - Line #: FREIGHT-1

Duplicates: 3

Sample: 5470-00-00000-A

The problem has been alleviated.

-

ActivityHD Automation Services (AAS)

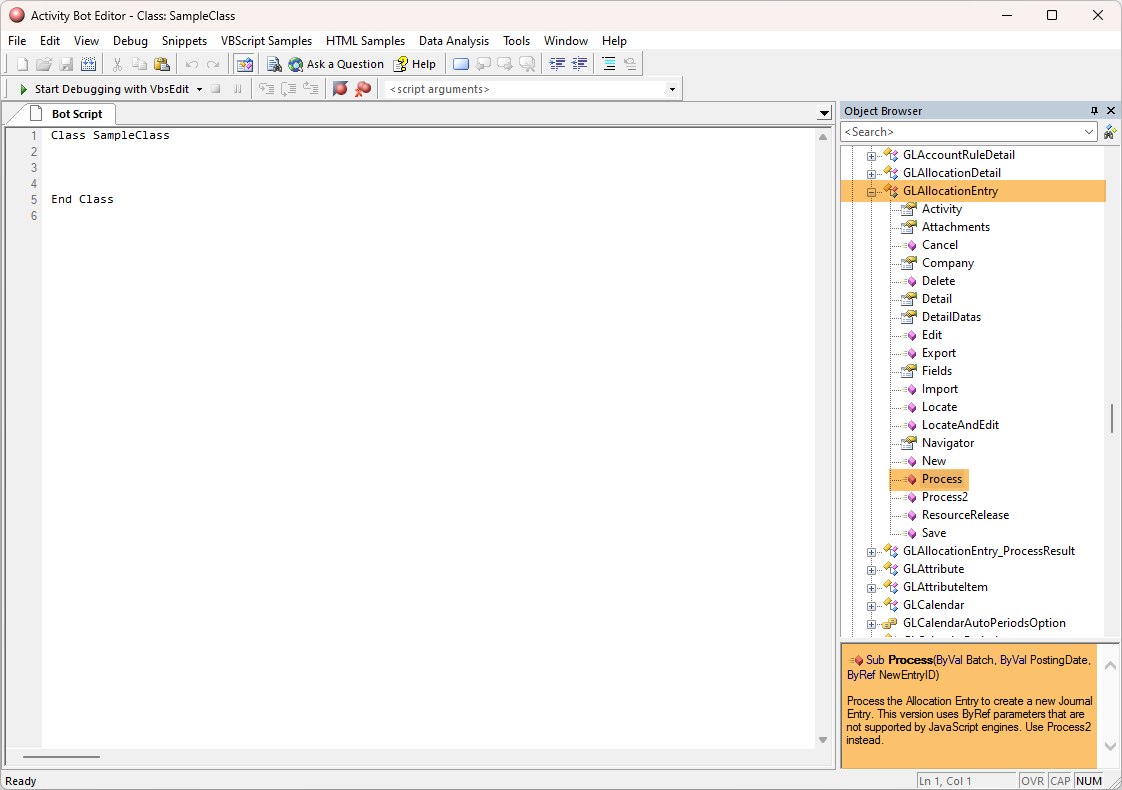

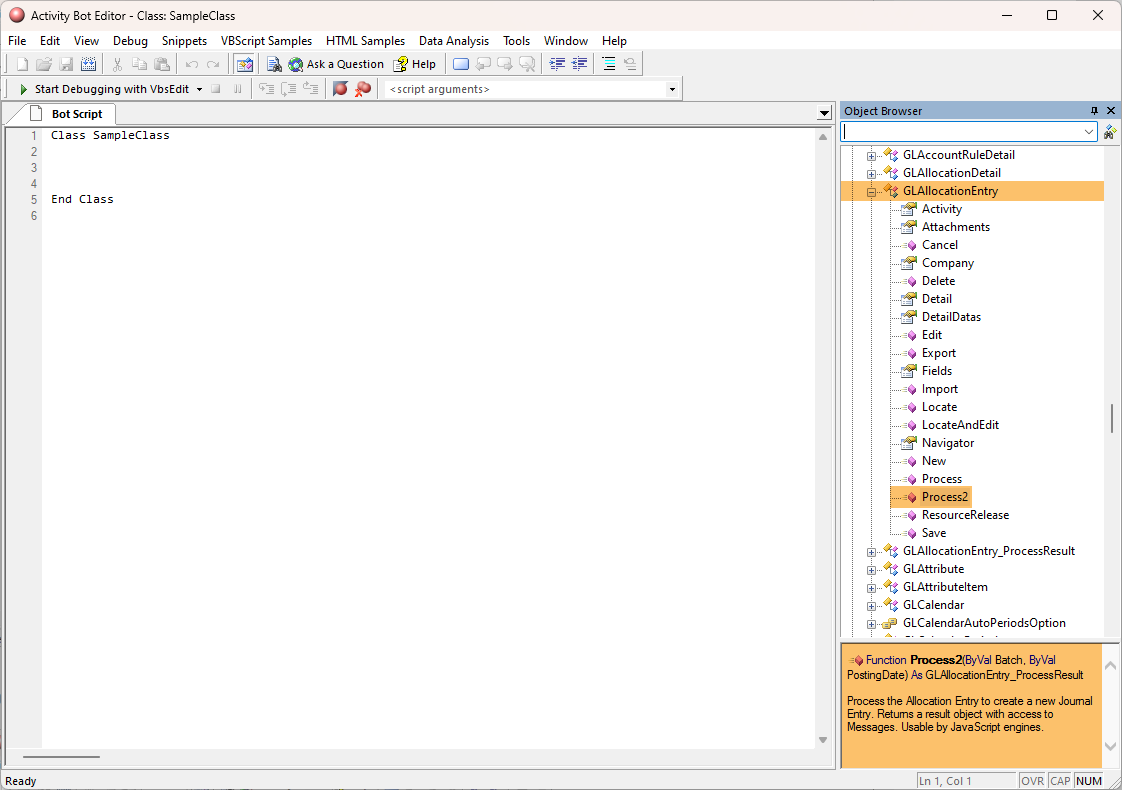

VBScript was the original scripting engine of choice for creating ActivityHD bots and automation macros. Many of the automation interface's procedures and functions use OUTPUT parameters to return values from the underlying function calls. However, the JavaScript scripting engines do not support OUTPUT arguments. As more and more ActivityHD bots and macros are written in JScript, JScript9, JScript (Chakra), or V8Script, a solution was needed to provide OUTPUT values from the methods in the ActivityHD automation interface.

AccountingWare intends to create a new interface for each method's "result" object. This object is method-specific and provides all return values for a method. This release of ActivityHD introduces the first attempt at an automation method which satisfies these requirements: the GL Process Allocation method. This method provides the new account/attribute posting date validation messages which were added in this release (see below).

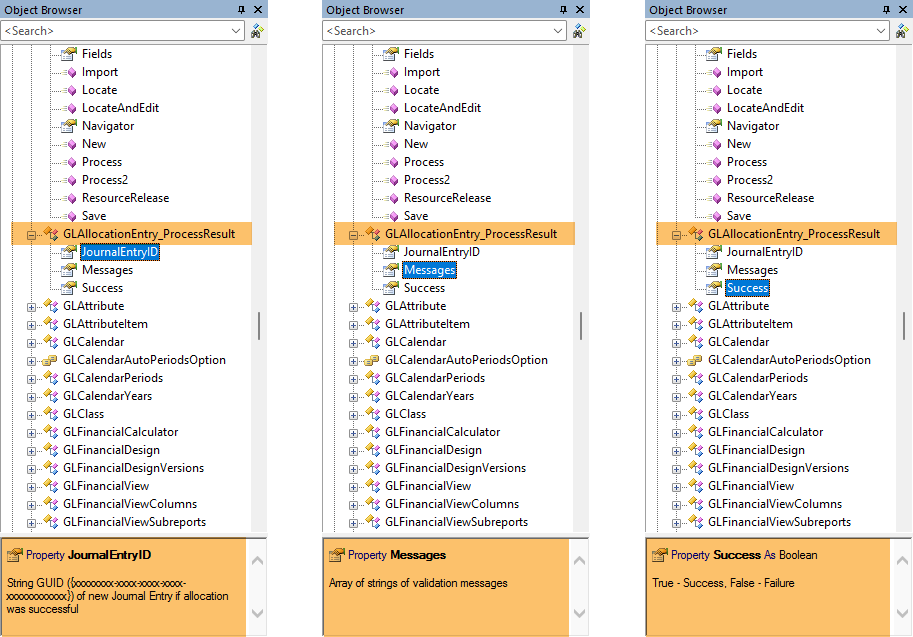

We plan to deprecate the current method in order to maintain backward compatibility and to introduce a replacement method using an intuitive naming convention which leads the bot/macro developer to the more functional method that works for all scripting engines. For this reason, two "Process" methods are now available on the IGLAllocationEntry interface. Notice what you see when you explore the interface in the Activity Bot Editor:

Process property

Process2 property

The next interface in the object browser is IGLAllocationEntry_ProcessResult. Its properties look like this:

GLAllocationEntry_ProcessResult properties

Example using Process2 method (V8Script)

//--------------------------------------------------------

// Main section

MacroProcess.AddMessage("Process Allocations 01 (V8Script)");

DoProcess();

//--------------------------------------------------------

// Local functions

function DoProcess()

{

var xBatch, xDate, xGLEntryID;

xBatch = "ALLOC";

xDate = new Date("2023-11-08");

// Record.Data.Process(xBatch, xDate, xGLEntryID); Does not work for JavaScript

var xResult = Record.Data.Process2(xBatch, xDate);

if (xResult.Success)

{

MacroProcess.AddMessage("Success.");

MacroProcess.AddMessages(xResult.Messages);

var xGLEntryData;

xGLEntryData = Company.GeneralLedger.JournalEntry;

xGLEntryData.Locate(xResult.JournalEntryID);

MacroProcess.Results.Add(xGLEntryData);

}

else

{

MacroProcess.AddMessage("Failure.");

MacroProcess.AddMessages(xResult.Messages);

}

}

XML script example

The XML interface for GL Allocation Entries has been extended to offer the new "Process" action. The XML script below can be imported to execute the "Process" action on an allocation entry.

<XML ID="{30004060-BD16-11D2-9FE8-00805FA321F9} Type="Allocation Entries">

<data Code="C-INCOME" ID="{59A2A8FC-DFCA-11D3-B830-00E018C12D4F}" Command="Read">

<Actions>

<Process Execute="true" Batch="Alloc" PostingDate="2023-11-15"/>

</Actions>

</data>

</XML>

-

Process Allocation Entries

General Ledger > Journal Entries > Allocation Entries > [right-click] > Select and Process

Process Allocation Entries now validates posting control dates on detail accounts and attribute items for non-closing allocations. The new posting date validations are skipped for closing allocations, allowing you to close revenue and expense accounts to the retained earning account(s) even though those accounts and/or attributes are closed to "new" postings.

When a posting date violates the control date for an account or attribute item, a validation message displays in the process message window, but the GL entry is still created. The severity of the posting date control determines whether the GL entry can be merged:

- Warning - Shows a message and allows the GL entry to be merged.

- Error - Shows a message and prevents the GL entry from being merged.

A few examples of account and attribute item validation messages follow:

GL Entry Line: 1 - Attribute item (xProject: 1001) is closed to postings for the date (11/30/2023).

GL Entry Line: 3 - Account (4000-2-00-00000-A) is closed to postings for this date (11/30/2023). The new GL entry cannot be merged.

GL Entry Line: 3 - Attribute item (xProject: 1002) is closed to postings for the date (11/30/2023). The new GL entry cannot be merged.

More notes about allocation validations:

- Posting control dates on related rollup attribute items are also validated and enforced.

- The new validation messages for Process Allocation Entries are not yet available through automation. A new automation method will be added to provide these validation messages.

- GL Proof/Merge validations have also been updated to skip account/attribute posting date validations for closing entries.

-

Process Recurring Entries

General Ledger > Journal Entries > Recurring Entries > [right-click] > Select and Process

Process Recurring Entries now validates posting control dates on detail accounts and attribute items.

When a posting date violates the control date for an account or attribute item, a validation message displays in the process message window, but the GL entry is still created. The severity of the posting date control determines whether the GL entry can be merged:

- Warning - Shows a message and allows the GL entry to be merged.

- Error - Shows a message and prevents the GL entry from being merged.

A few examples of account and attribute item validation messages follow:

Line: 1 - Account (1000-0-00-00000-A) is closed to postings for this date (11/7/2023).

Line: 1 - Attribute item (Project: 1001) is closed to postings for the date (11/7/2023).

Line: 2 - Account (1020-0-00-00000-A) is closed to postings for this date (11/7/2023). The new GL Entry cannot be merged.

Line: 2 - Attribute item (CC: 100) is closed to postings for the date (11/7/2023). The new GL Entry cannot be merged.

Posting control dates on related rollup attribute items are also validated and enforced.

-

Various HD views

The following description columns are now available in the corresponding HD views:

Note

"Calendar Description" columns are only available if the calendar is required on a segment.

HD view Description columns Accounts

Unit Description

Auxiliary Segments Items

Calendar Description

Ledger Segment Items

Default Unit Description

Calendar Description

Primary Segment Items

Calendar Description

Attributes

Rollup Parent Description

Allocation Entries

Calendar Description

Journal Detail

Unit Description

Voided By Description

Reverses Description

Journal Entries

Voided By Description

Reverses Description

Recurring Entries

Calendar Description

Payroll/Human Resources

-

2024 Canada tax updates

New withholding rates and bracket changes effective January 1, 2024 have been introduced for Canada and the provinces of Alberta, British Columbia, Manitoba, Ontario, and Saskatchewan.

In addition, two arguments have been added for all Canadian tax functions: "CPP2 this check" and "CCP2 year-to-date". AccountingWare Support will use a script available in the "...\Extras\Upgrade Tools" folder to update your segment items.

In the online help, refer to Reference > Canada payroll tax functions for the government documentation behind the calculations.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll Canada\Tax\Calculate 2024 Canada Income Tax.xlsx".

-

2024 state and local tax updates

The following state and local income tax changes have been introduced effective 1/1/2024:

- Illinois. The exemption allowance amount increased to $2,775.

- Iowa. The 2024 Iowa W-4 has changed; the changes to the state W-4 will be provided in a future release. However, users who still use employee parameters for state W-4 information can apply this update to have current calculations now. A change to the segment item result expression for Iowa tax is also required. Contact AccountingWare for assistance.

- Massachusetts. A 4% surtax for high earners has been added to the withholding calculation.

- North Dakota. The tax brackets have been updated.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

-

2024 SUTA wage base updates

The following wage base amounts for 2024 have been added to the state unemployment table:

State Year Wage base Hawaii 2024 $59,100 Idaho 2024 $53,500 Kentucky 2024 $11,400 Minnesota 2024 $42,000 North Dakota 2024 $43,800 Rhode Island 2024 $29,200 -

Garnishments

This version of ActivityHD introduces the 2024 exemption values used for calculating IRS levy garnishments. These values are based on IRS Publication 1494.

The built-in levy calculation determines which values to use based on the Year field on the garnishment record, not the check date year.

Note

This update will automatically apply to employees with IRS levy garnishments already set to the year 2024. All other IRS levies should be unaffected unless an employee requests a change with a new Part 3 of Form 668-W.

According to the American Payroll Association: "If the employee does not complete a new Part 3 of Form 668-W each year, the employer must continue to use the table for the year during which the levy notice was received. The employee may complete a new Part 3 at any time even if the employee's tax filing status or number of exemptions has not changed, in order to take advantage of higher exempt amounts contained in the new year's tables."

If you receive a new Part 3 of Form 668-W from an employee, you must change the year on the garnishment record in order for the new values to take effect.

-

2024 state and local tax updates

The following state and local income tax changes have been introduced effective 1/1/2024:

- Georgia. The tax has been changed to a flat tax of 5.49% with updated standard deduction and dependent allowance amounts.

- Indiana. The tax rate has been reduced from 3.15% to 3.05%.

- Indiana Counties. The tax rates have increased for the following eleven counties: Allen, Blackford, Crawford, Floyd, Howard, Jefferson, Ohio, Pike, Posey, Ripley, Steuben.

- Minnesota. The tax brackets have been adjusted and the withholding amount has increased to $5050.

- Vermont. The tax brackets have been adjusted and the withholding allowance has increased to $5100.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

-

2024 USA tax updates

Withholding updates were introduced according to the instructions in IRS Publication 15-T, "2024 Federal Income Tax Withholding Methods" (https://www.irs.gov/pub/irs-pdf/p15t.pdf).

Employers should implement the 2024 withholding tables on January 1, 2024.

A spreadsheet model of the USA income tax withholding function is provided in "...\Extras\Payroll\Tax\Analysis of 2024 USA Tax Changes.xls".

-

Checks

Payroll/Human Resources

Formerly, trying to save a payroll check from virtually any plausible location--Process Payroll Run, Process Time Sheets, the Check window, attach pay statements, mass changes, et al.--resulted in an infinite loop if no distribution attributes were defined. ActivityHD had to be stopped using Task Manager.

Now the infinite loop no longer occurs.

-

Payroll calculation (Arizona only)

The tax rate applied when an employee does not have a current Arizona A-4 record is now 2.0%.

-

2024 parameter updates for tax calculations

The following built-in segment item parameter values are effective January 1, 2024. Only the social security maximum value has changed from 2023.

Parameter Description 2024 Value Type:Tax:MedEEAddPercent Medicare Employee Additional Percent 0.90 Type:Tax:MedEEPercent Medicare Employee Percent 1.45 Type:Tax:MedEEThreshold Medicare Employee Wages Threshold 200,000.00 Type:Tax:MedERPercent Medicare Employer Percent 1.45 Type:Tax:SocSecEEPercent Social Employee Percent 6.20 Type:Tax:SocSecERPercent Social Employer Percent 6.20 Type:Tax:SocSecMax Social Security Maximum 168,600.00 The following values have also been added for California parameters if installed. Note that both values have changed since 2023. In particular, the California SDI maximum has been lifted; i.e., all wages are now subject to California SDI tax.

Parameter Description 2024 Value Type:Tax:CASDIMax CA SDI Maximum Wages 9,999,999,999.99 Type:Tax:CASDIPercent CA SDI Percent 1.10 Colorado FAMLI parameters are unchanged from 2023; however, the effective dates have been updated. For more information, see My FAMLI+ Employer User Guide.

-

2024 segment item parameter updates (Payroll Canada only)

Built-in segment item parameter values have been updated for 2024 for employment insurance and total claim segment items. Other values were added previously when CPP2 was introduced. Following is the complete list of updated parameters for Payroll Canada:

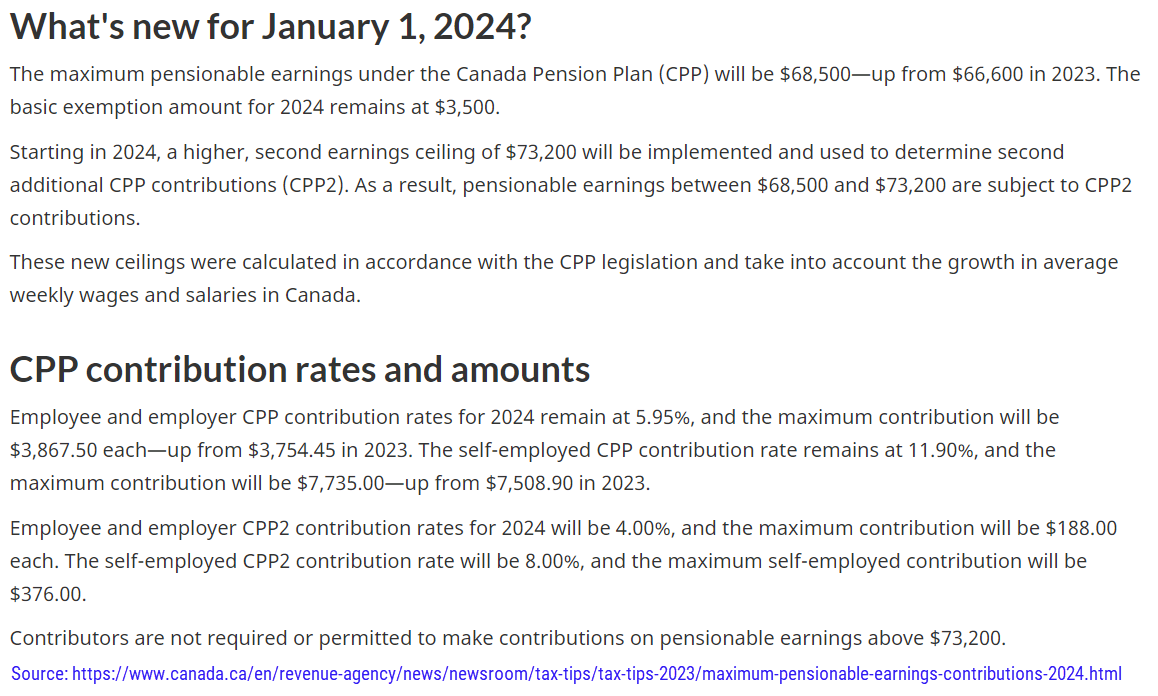

Type:Tax:CPPExemptAmt (Canada CPP Annual Exemption) 3,500 Type:Tax:CPPMaxContr (Canada CPP Maximum Contribution) 3867.50 Type:Tax:CPPMaxEarn (Canada CPP Maximum Earnings) 68,500.00 Type:Tax:CPPPercent (Canada CPP Percent) 5.95 Type:Tax:CPP2MaxContr (Canada CPP2 Maximum Contribution) $188.00 Type:Tax:CPP2MaxEarn (Canada CPP2 Maximum Earnings) $73,200 Type:Tax:CPP2Percent (Canada CPP Percent) 4.00 Type:Tax:EIMaxEarn (Canada EI Maximum Earnings) 63,200.00 Type:Tax:EIMaxPrem (Canada EI Maximum Premium) 1049.12 Type:Tax:EIPercent (Canada EI Percent) 1.66 Type:Tax:TC (Canada Total Claim Amount) 15,705 Source: https://www.canada.ca/content/dam/cra-arc/formspubs/pub/t4127-jan/t4127-01-24e.pdf.

-

2024 state tax updates

The following state income tax changes have been introduced effective 1/1/2024:

- California. The tax bracket ranges, low income exemption amounts, standard deduction amounts, and exemption allowance have been updated.

- Colorado. The default withholding allowance amounts have been updated.

- Connecticut. The lowest two tax rates have been reduced to 2% and 4.5% (from 3% and 5.0%), the phase-out add-back tables have been adjusted to phase out the 2% rate for some taxpayers, and tax recapture brackets and amounts have been adjusted.

- Kentucky. The flat tax rate has been reduced from 4.5% to 4.0% and the standard deduction has increased to $3,160.

- Maine. The tax brackets and standard deduction brackets have been adjusted for inflation and the withholding allowance has increased to $5,000.

- Michigan. The tax rate has reverted back to 4.25% and the personal exemption amount has increased to $5,600.

- Mississippi. The tax rate has been reduced from 5.00% to 4.70%.

- Missouri. The tax brackets have been adjusted and the top tax rate has been reduced from 4.95% to 4.80%.

- Montana. The calculation has been updated to accommodate the new 2024 MW-4 including tax brackets by filing status. The supplemental tax rate has been reduced from 6.00% to 5.00%.

- Nebraska. The upper three tax rates have been reduced to 5.77%, 5.94%, and 6.10% (from 6.20%, 6.39%, and 6.75%, respectively). The tax bracket ranges have been adjusted and the withholding allowance amount has increased to $2,250.

- New Mexico. The tax bracket ranges have been adjusted.

- North Carolina. The tax rate and supplemental tax rate have been reduced to 4.60%.

- Oklahoma. The upper two tax brackets for married filers were adjusted; otherwise, the tax calculation remains the same as 2023.

- Oregon. The exemption multiplier, standard deduction, federal deduction phase-out brackets, and tax brackets have been updated.

- Rhode Island. The exemption wage limit has increased to $274,650 and the tax brackets have been adjusted effective 1//1/2024.

- South Carolina. The tax brackets have been adjusted for inflation, the upper tax rate has decreased from 6.5% to 6.4%, and the personal allowance amount and standard deduction maximum have increased.

The through-dates for the following states/entities have been rolled over to December 31, 2024 because the states/entities had not reported income tax changes for 2024 as of 12/7/2024.

- Alabama

- Delaware

- District of Columbia

- Hawaii

- Idaho

- Illinois

- Indiana

- Indiana counties

- Kansas

- Louisiana

- Maryland

- Massachusetts

- Michigan cities

- Minnesota

- New Jersey

- New York

- New York City and Yonkers

- North Dakota

- Ohio

- Pennsylvania

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

-

2024 SUTA wage base updates

The following wage base amounts for 2024 have been added to the state unemployment table:

State Year Wage base Alaska 2024 $49,700 Connecticut 2024 $25,000 Illinoia 2024 $13,590 Iowa 2024 $38,200 Montana 2024 $43,000 Oregon 2024 $52,800 Utah 2024 $47,000 -

Export controls (Colorado only)

Payroll/Human Resources > Setup > Export Controls

Colorado employers submit unemployment wage reports from their MyUI Employer+ accounts. "Section 3.1 File Upload" on the linked page links to an ICESA file specification document. The new file format is a variation of the previously accepted ICESA file. The header record (type A) is no longer required and some fields (e.g., month of employment) are required.

This release introduces an export control which complies with the new format.

Setup

From the Export Controls folder, import this file from the distribution: ...\Extras\Payroll\Export Controls\State Unemployment\2024\CO 2024 SUTA.XML. The export control is named "CO 2024 SUTA".

Adjustments to Export Control

Consider making adjustments to the export control for the following fields:

- Unit Number. The export control presets the value to "000". Adjust if necessary.

- Seasonal Indicator. This field is set to blank (i.e., not seasonal) for all employees. If you need this value, create an employee attribute (e.g., "Seasonal Employee") with values of "S" for "seasonal" or "N" for "not seasonal"; assign these values to your employees. Change the export control to report the employee attribute item instead of blank.

- Officer Code. This field is set to blank (i.e., not an officer) for all employees. If you need this value, create an employee attribute (e.g., "Officer") with values of "Y" or "N"; assign these values to your employees. Change the export control to report the employee attribute item instead of blank.

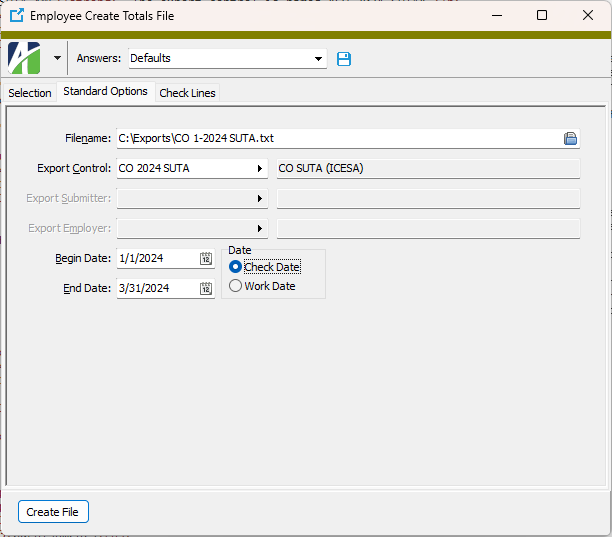

Create Totals File

Generate the totals file using the settings described below:

- Navigate to Payroll/Human Resources > Employees, right-click and select Report Totals File.

- Select the Standard Options tab. (It is not necessary to filter employees for the process because the export control only selects employees with non-zero compensation for the selected quarter.)

- In the Filename field, navigate to the location where you want to save the totals file and enter a file name with a .txt extension.

- In the Export Control field, select the "CO 2024 SUTA" export control that you imported.

- In the Begin Date field, enter the date of the first day of the reporting quarter.

- In the End Date field, enter the date of the last day of the reporting quarter.

- Save your answers for use in future quarters.

- Click Create File to generate the report.

Proof Results

The output file is not comma-delimited, so it is difficult to review in Word or Excel. To review the file before uploading it, run Report Totals File. To do so:

- Navigate to Payroll/Human Resources > Employees, then right-click and select Report Totals File.

- In the Filename field, navigate to the totals file you created and select it.

- In the Export Control field, select "CO 2024 SUTA".

- Preview the report.

-

Garnishments

Payroll/Human Resources > Employees > Records > Garnishments

The following states have announced new minimum wage rates taking effect 1/1/2024. ActivityHD has incorporated these new rates to calculate limits on civil garnishments for the affected states.

Alaska

Minimum hourly wage Effective date $11.73 01/01/2024 Missouri

Minimum hourly wage Effective date $12.30 01/01/2024 -

Groups

Payroll/Human Resources > Setup > Groups

The following built-in groups (among others) were added in version 8.34-0:

- DT - Double Time

- OT - Overtime Pay

- SalaryDec - Salary Decrement

In this release, these groups can now be qualified by tax entity.

-

Print Form 940 Returns

Payroll/Human Resources > Government > Form 940 Returns > [highlight a return in the HD view] >

Changes to Form 940 for tax year 2023 have been introduced.

The credit reduction rate for the Virgin Islands is 0.039 (3.9%)and 0.006 (0.6%) for California and New York.

A credit reduction rate results in a higher FUTA tax as calculated in Part 3 of Form 940. The standard FUTA rate is 6.0% with a reduction rate of 5.4% giving a net FUTA rate of 0.6%. In a credit reduction state the 5.4% is reduced, resulting in a higher net FUTA rate.

-

Segment Items (Alabama only)

Payroll/Human Resources > Setup > Segment Items

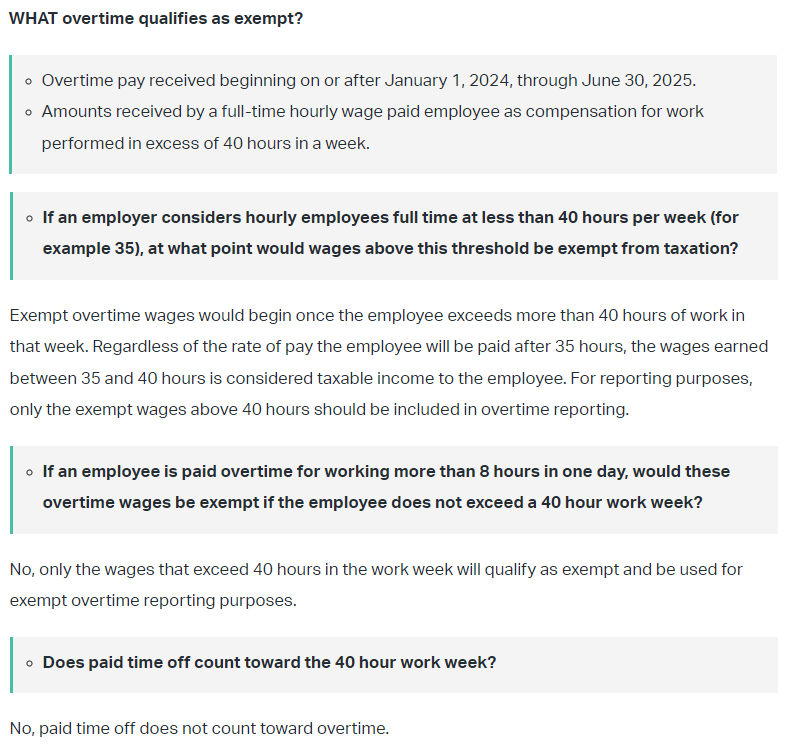

Guidance from the Alabama Department of Labor indicates that certain overtime pay in Alabama will be exempt from state tax from January 1, 2024 through June 30, 2025. The following questions and answers from the Alabama Department of Labor's website are of particular interest:

Follow the link above for additional guidance.

The source expression (taxable wages) on the segment item for Alabama income tax (TaxState:AL) has been modified to handle the overtime pay exemption. A new built-in "OTExempt" group has been introduced to track non-taxable overtime. (If a group with the same name already exists, the conversion process makes it the built-in group.) Starting January 1, if the check date falls between January 1, 2024 and June 30, 2025 (inclusive), the source expression of the TaxState:AL segment item subtracts the non-taxable overtime from taxable wages.

In addition, the "Proof AL Taxable Wages" filter has been modified to subtract exempt overtime from compensation before comparing it to Alabama taxable wages.

Note

The website linked to above contains instructions for reporting overtime employees, including instructions for creating a bulk upload file. This file is a one-record totals-only file which export controls are not suited to provide. Instead, run the Payroll Group Analysis report to determine the required totals and then enter them manually online.

-

State W-4s

Payroll/Human Resources > Employees > Records > State W-4s

The existing "? State" filter on state W-4 records prompts for a state's two-character postal abbreviation. If you enter a state's actual name or wildcards such as New*, the filter does not return the desired results.

With this release, a new "? Tax Entity" filter is introduced on the State W-4s folder. When you select the filter, you are prompted for a tax entity. Press F3 in the Tax Entity field to open the Tax Entity Find dialog where you can search for the tax entity by name. When you apply the filter, it returns state W-4 records for the same state as the selected tax entity.

The filter prompt can accept both state and local tax entities as well as wildcards. For instance, to select state W-4s for employees whose tax locality is Flint, Michigan, enter "Flint" at the prompt and, in the Tax Entity Find dialog, select tax entity "USA.MI.FL".

-

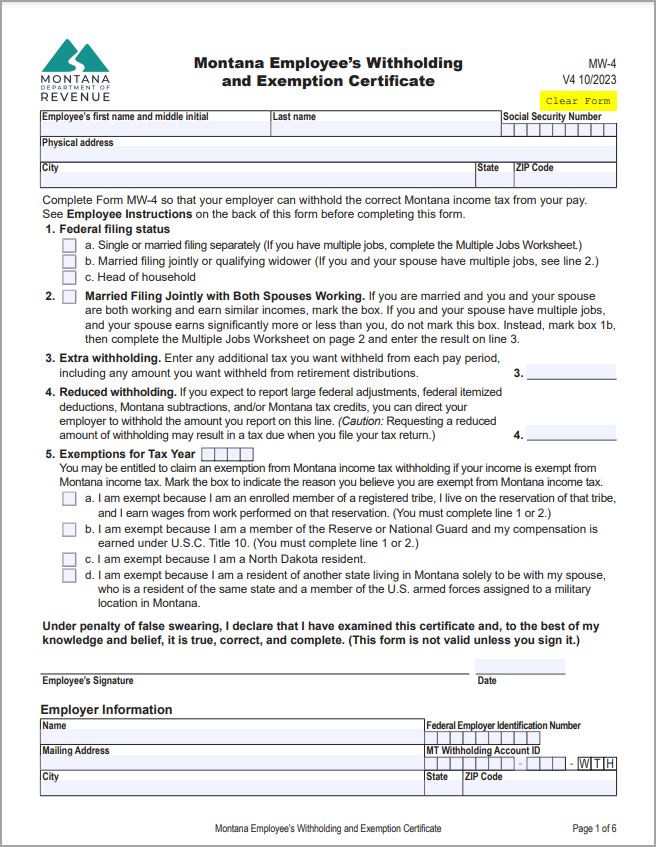

State W-4s (Montana only)

Payroll/Human Resources > Employees > Records > State W-4s

The Montana Department of Revenue has introduced an all-new "Montana Employee's Withholding and Exemption Certificate" (Form MW-4) for 2024. ActivityHD has been updated to use the new MW-4 and to perform the calculation changes needed to accommodate it.

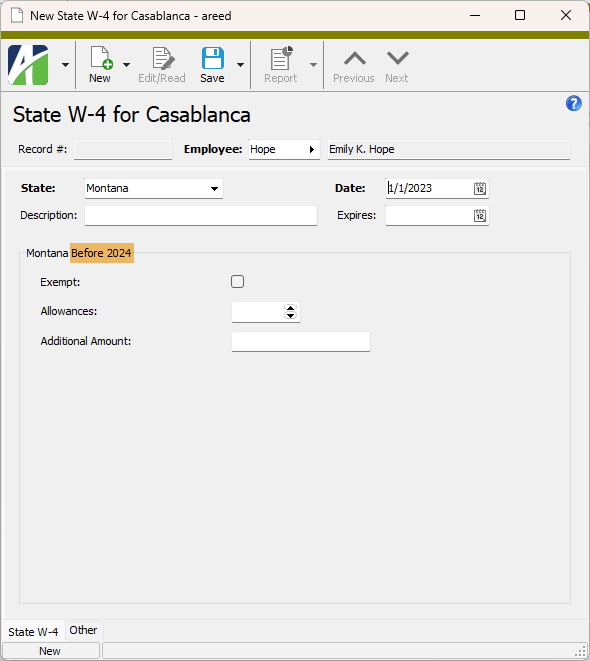

Montana State W-4 window

Montana state W-4 records dated before 1/1/2024 have the same fields as before. The group box containing the fields is now labeled "Montana Before 2024".

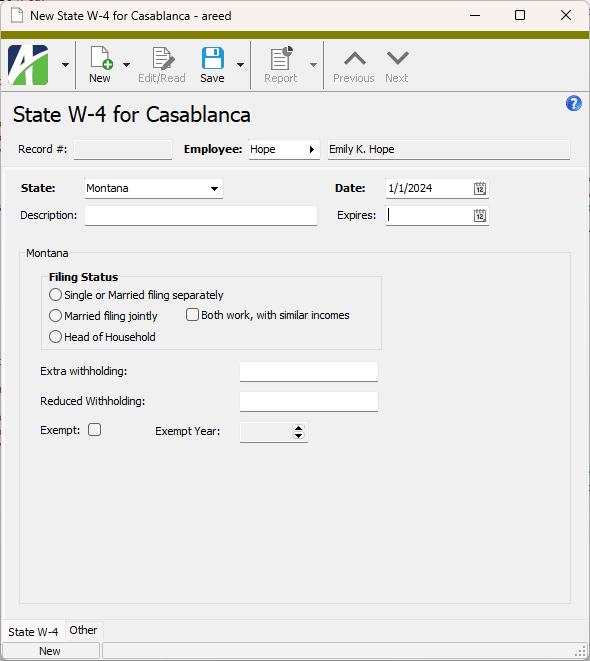

Records dated on or after 1/1/2024 reflect the new Montana MW-4:

A few things to note about the changes for 2024 and beyond:

- The Filing Status field is required.

- The Both work... checkbox is only enabled when "Married filing jointly" is selected as the filing status.

- The Extra withholding field corresponds to the Additional Amount field on the pre-2024 state W-4 records.

- Reduced Withholding is a new field. You can enter an amount in the Extra withholding field or the Reduced Withholding field (or neither), but you cannot enter an amount in both fields.

- If the employee marked any of the checkboxes in question 5 of the 2024 MW-4, mark the Exempt checkbox and enter or select the exemption year in the Exempt Year field. The Exempt Year is required if the Exempt checkbox is marked.

Note

Unlike state W-4 records for other states, marking Exempt does not clear and disable the other fields in the window. For instance, Filing Status is still required so that it can be used in the event that the employee does not submit another MW-4 once their exemption year has passed.

Calculation

The following modifications have been made to the Montana income tax calculation:

- For checks dated on or after 1/1/2024, the Montana tax function applies the new withholding formula using brackets by filing status.

- The supplemental tax rate is 5.00%.

- If no 2024 MW-4 is found for an employee, the calculator uses the employee's filing status from the federal W-4. If no federal W-4 is available, the filing status is assumed to be "Single".

- The "Exempt" setting is only applied for checks dated in the specified exempt year.

- The Result amount of segment item PRTaxState:MTx (MT Extra Withholding) comes from the amount specified in the Extra withholding field or is the negative of the amount in the Reduced Withholding field.

- A new "ExemptYear" keyword has been added to the check calculator; for example, StateW4.ExemptYear('MT').

State W-4s folder

The following columns are now available to the State W-4s HD view and to its selection fields:

- MT Exempt Year

- MT Filing Status

- MT Both Spouses Work

- MT Extra Withholding (also shows values from the Additional Amount field on pre-2024 MT state W-4 records)

- MT Reduced Withholding

In addition, the generic "Filing Status" column now displays the filing status for 2024 (and beyond) Montana state W-4 records.

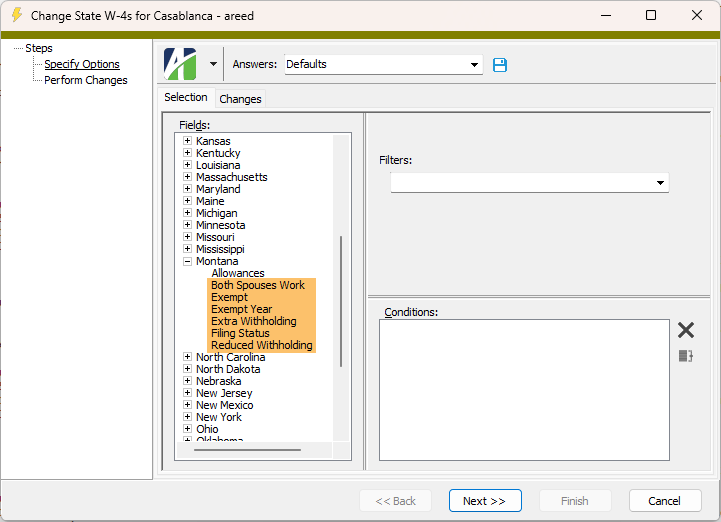

Change fields

Additional mass change fields are now available in the "Montana" group.

Automation

The following automation fields have been added for bots, dashboards, web applications, etc.:

- MTExemptYear

- MTFilingStatus

- MTBothSpousesWork

- MTExtraWithholding (can also be referenced as "MTAdditionalAmount")

- MTReducedWithholding

Reports

The following reports and processes are affected by the changes for the new MW-4:

- Pay Statements and Printed Checks. New fields have been added to the data streams for pay statements and printed checks. For each report, ensure there is at least one Montana state W-4 record, then export the XML schema and load it into a Crystal design. (Note: the existing W4_MTAdditionalAmount field shows extra withholding amounts for newer state W-4 records.)

- W4_MTExemptYear

- W4_MTFilingStatus - displays "S", "M", or "H"

- W4_MTFilingStatusDesc - displays the longer filing status description

- W4_MTBothSpousesWork

- W4_MTReducedWithholding

- Employee History Report. New Montana fields and their values are shown on the report when Montana records are selected in the report dialog.

-

2024 SUTA wage base updates

The following wage base amounts for 2024 have been added to the state unemployment table:

State Year Wage base Missouri 2024 $10,000 Vermont 2024 $14,300 Washington 2024 $68,500 -

2024 tax updates

The following state tax change has been introduced effective 1/1/2024:

- Arkansas. The top tax rate and supplemental rate has been reduced from 4.7% to 4.4% and the standard deduction has increased to $2,340.

-

ACA processing

The following processes have been updated for the 2023 tax year:

- Select and Proof 1095-Cs Report

- Select and Print Employee 1095-Cs

- Select and Print IRS 1095-Cs

- Select and Create IRS 1095-C Transmission

The changes for 2023 over 2022 are minimal. There are no new offer codes.

-

Export Controls (Payroll Canada only)

Payroll/Human Resources > Setup > Export Controls

The export control for electronic filing of T4 Slips for tax year 2023 is now available.

The following new fields have been added. See this note for more details on the new fields.

- Employer-offered dental benefits

- Employee's second Pension Plan (CPP) contributions

- Employee's second Pension Plan (QPP) contributions

- Total employees' second Pension Plan contributions

- Total employer's second Pension Plan contributions

The following existing field has changed:

- Canada Pension Plan or Quebec Pension Plan pensionable earnings. Total of CPP and CPP2 earnings (or QPP and QPP2 earnings if province of employment is "QC").

Setup

- Navigate to Payroll/Human Resources > Setup > Export Controls.

- Right-click the Export Controls folder and select Import to start the Import Export Controls wizard.

- In the File field, click

and browse to ...\Extras\Payroll Canada\Export Controls\ in your distribution area.

and browse to ...\Extras\Payroll Canada\Export Controls\ in your distribution area. - Select "CAN 2023 T4 Slips.XML".

- Import the selected file.

Usage

- Navigate to Payroll/Human Resources > Employees.

- Right-click the Employees folder and select Select and Create Totals File.

- In the Export Control field, browse to and select "CAN 2023 T4 XML".

- Respond to the remaining prompts on the Standard Options tab.

- If there is an Additional Options tab, select it and respond to those prompts as well.

- Click Create File.

For additional guidance, see "Prepare electronic T4 slips" in this help article.

-

Extras

In ActivityHD 8.25-0, a Memo column was introduced to the Statuses table in the Employee window. The purpose of the new column was for adding details about a status change. Now the memo field has been added to the "Import Employee Statuses.xls" import macro available in the Extras/Payroll folder of the distribution.

-

Garnishments

Payroll/Human Resources > Employees > Records > Effective date

The following states have announced new minimum wage rates taking effect 1/1/2024. ActivityHD has incorporated these new rates to calculate limits on civil garnishments for the affected states.

Arizona

Minimum hourly wage Effective date $14.35 01/01/2024 Nebraska

Minimum hourly wage Effective date $12.00 01/01/2024 South Dakota

Minimum hourly wage Effective date $11.20 01/01/2024 Vermont

Minimum hourly wage Effective date $13.67 01/01/2024 Washington

Minimum hourly wage Effective date $16.28 01/01/2024 -

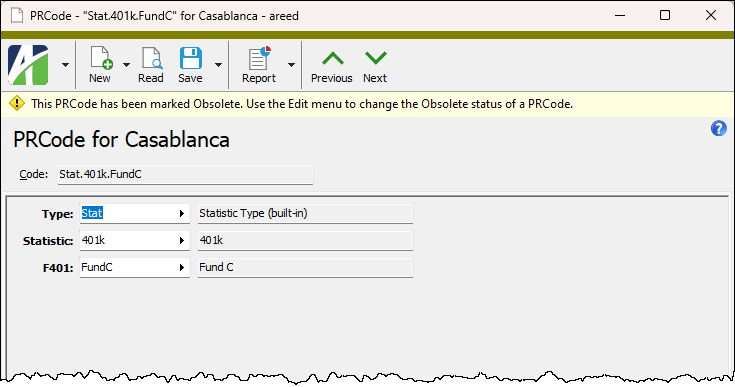

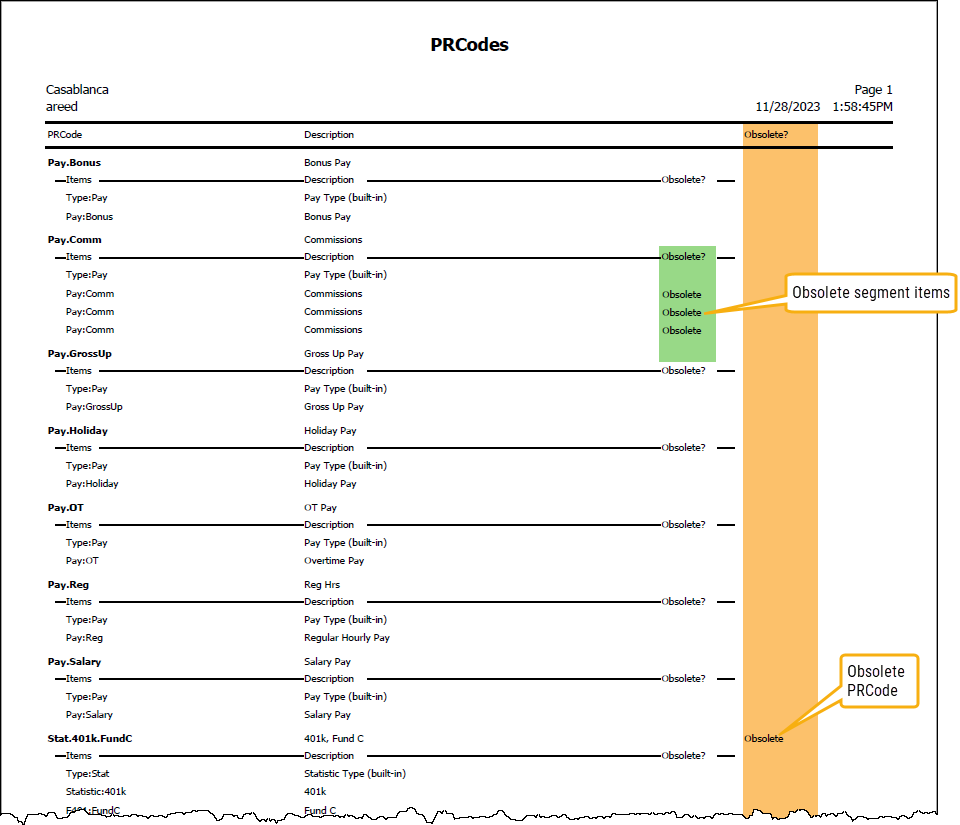

PRCodes

Payroll/Human Resources > Setup > PRCodes

In the past, the only way to flag a PRCode as obsolete was to flag one of its segment items as obsolete. However, sometimes users needed to make a PRCode obsolete even though all its segment items were still needed for other PRCodes. Now you can directly mark a PRCode as obsolete.

The specific changes made are described below.

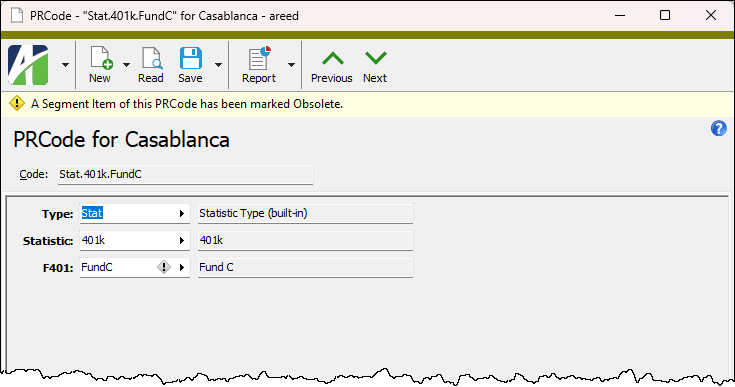

PRCode window

The methods for marking a PRCode obsolete correspond to the methods for marking other entities obsolete. You can:

- Select

> Edit > Obsolete from the PRCode window.

> Edit > Obsolete from the PRCode window. - Right-click in the PRCode HD view and select Obsolete from the shortcut menu.

- Use mass change to mark the Obsolete option on selected PRCode records.

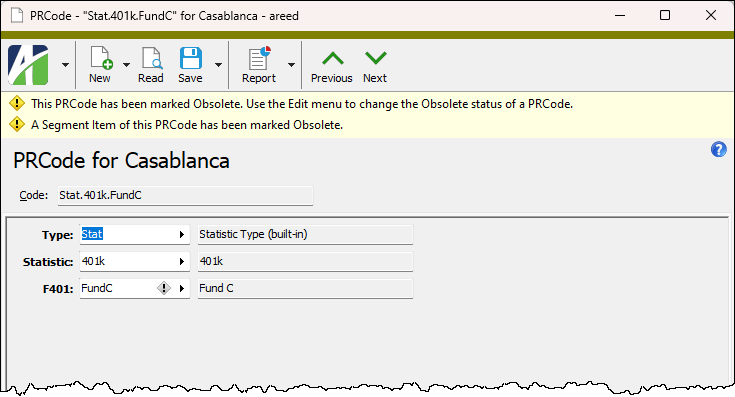

When a PRCode has been flagged obsolete, a banner displays in the PRCode window advising you that it is obsolete.

When a PRCode is obsolete because one of its segment items is obsolete, the following message displays as before:

When a PRCode has been flagged obsolete and at least one of its segment items is also obsolete, both messages display:

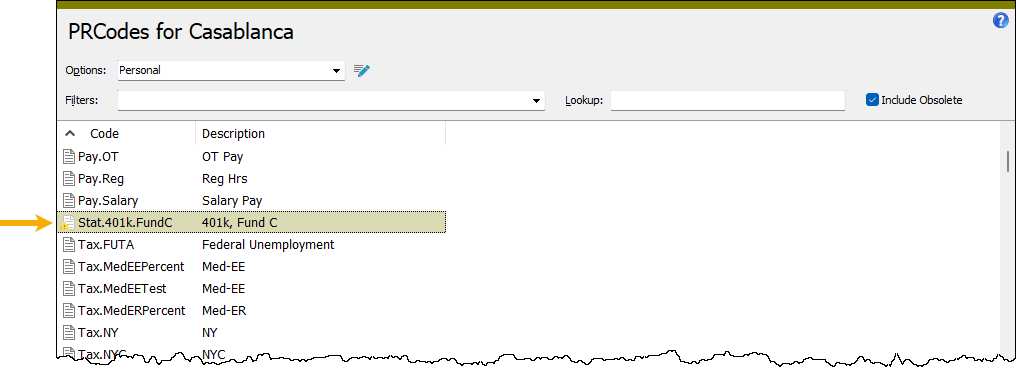

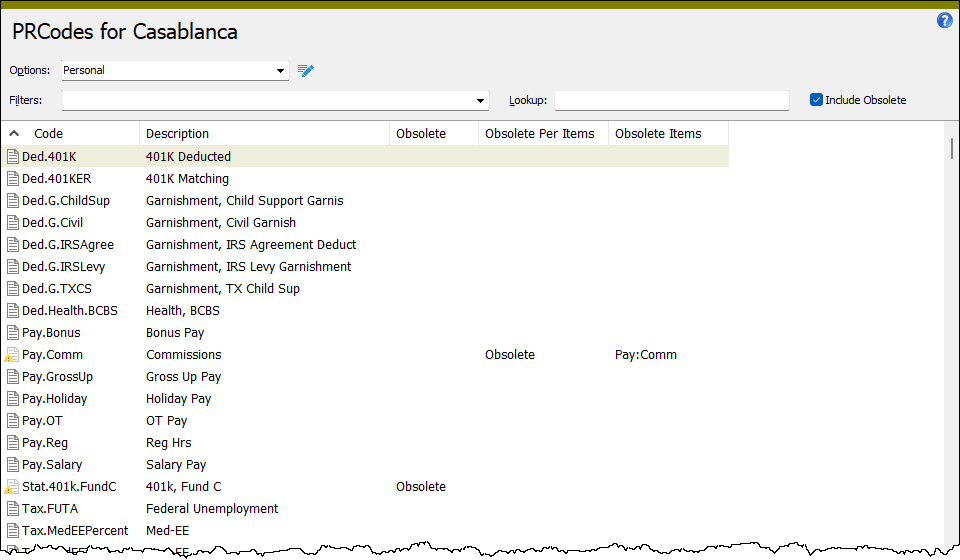

PRCodes HD view

The following changes have been introduced to the PRCodes HD view

- The obsolete icon displays to the left of the PRCode record if either the PRCode is obsolete or one of its segment items is obsolete (provided, of course, you have the Include Obsolete checkbox on the HD view marked).

- Marking the Include Obsolete checkbox on the HD view displays an obsolete PRCode whether the PRCode itself is obsolete or whether it is obsolete by virtue of one of its segment items being obsolete.

- The Obsolete column now works like similar columns in other views; it shows "Obsolete" only if the PRCode itself is obsolete.

- A new Obsolete Per Items column is available to the HD view to indicate when one of the PRCode's segment items is obsolete.

- The existing Obsolete Items column is unchanged; it displays the obsolete segment items of a PRCode.

PRCode Listing

The following changes have been introduced to the PRCode Listing:

- The Obsolete column for the PRCode now only displays "Obsolete" if the PRCode is obsolete; it does not display "Obsolete" if only one of its segment items is obsolete.

- A new Obsolete column has been introduced on the "Items" section of the report which is shown when the Include Items checkbox is marked on the Options tab of the report wizard. This column indicates which segment items are obsolete.

- Select

-

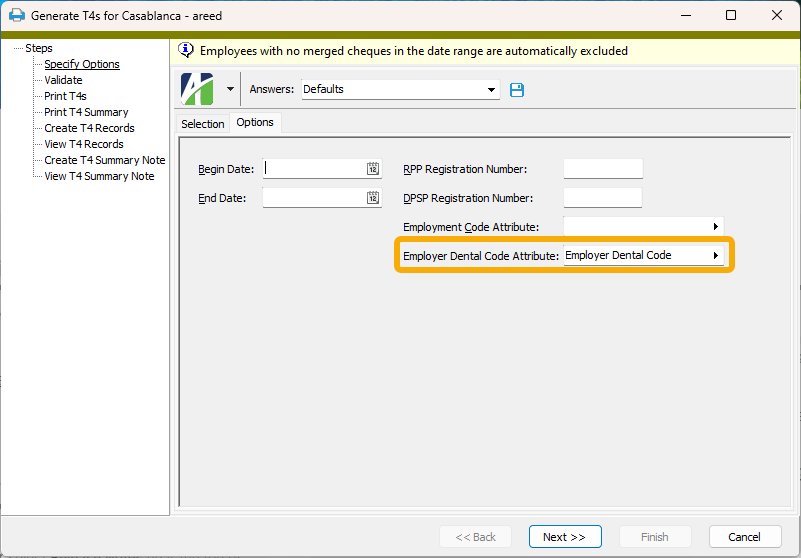

T4s (Payroll Canada only)

Payroll/Human Resources > Employees > Records > T4s

The following announcement has been issued by the Canada Revenue Agency regarding the Canada Pension Plan (CPP):

To support these changes, ActivityHD has introduced new built-in data.

Parameter values

New parameter values have been introduced for the existing CPP parameters:

Type:Tax:CPPMaxEarn Canada CPP Maximum Earnings 68,500.00 Type:Tax:CPPExemptAmt Canada CPP Annual Exemption 3,500.00 Type:Tax:CPPPercent Canada CPP Percent 5.95 Type:Tax:CPPMaxContr Canada CPP Maximum Contribution 3,867.50 New parameters and values have been introduced to support the CPP2 contributions:

Type:Tax:CPP2MaxEarn Canada CPP 2 Maximum Earnings 73,200.00 Type:Tax:CPP2MaxContr Canada CPP 2 Maximum Contribution 188.00 Type:Tax:CPP2Percent Canada CPP 2 Percent 4.00 Groups

A new group, "Pensionable" (Pensionable Income), has been introduced to determine CPP wages. If a group with the same name already exists, conversions make it the built-in group.

A new "CPP2" group has been added for the CPP additional second contribution. CPP2 is qualified by employee/employer.

Note

Another new group, "QPP2", has been added for the Quebec Pension Plan (QPP) additional second contribution. While ActivityHD does not currently support Quebec taxation, QPP2 is included for completeness in filling out the new T4 slip; specifically, for box 17A.

Segment items

Two new segment items have been introduced:

Tax:CPP2 CPP Second Contribution - Employee Tax:CPP2ER CPP Second Contribution - Employer Use these new segment items to create PRCodes Tax.CPP2 and Tax.CPP2ER. Add these new PRCodes to your employees' automatics with a begin date of 01/01/2024. Also, remember to add these PRCodes when you create new employees.

Spreadsheet model

A spreadsheet model has been added to Extras to demonstrate how the new segment items work. Find the spreadsheet at .../Extras/Payroll Canada/CPP2 model.xlsx.

-

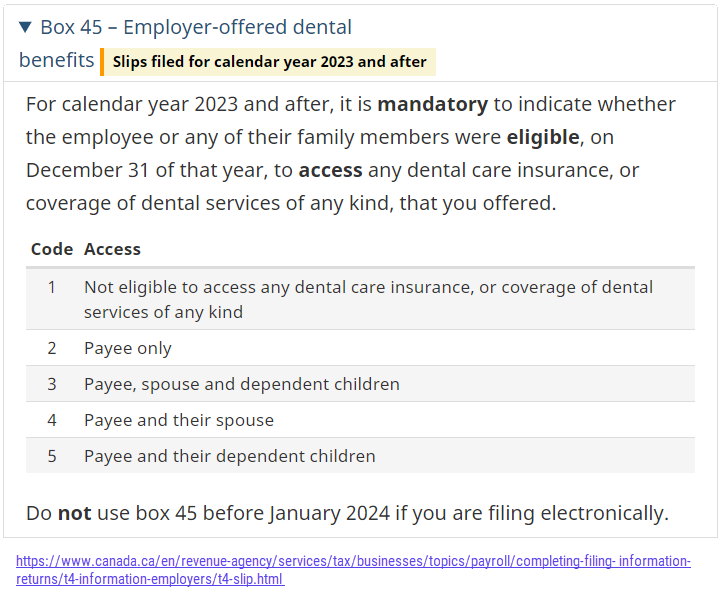

T4s (Payroll Canada only)

Payroll/Human Resources > Employees > Records > T4s

The 2023 T4 form introduces the following new box:

Box 45 - Employer-offered dental benefits

The Canada Revenue Agency includes the following related information about Box 45 in the T4 instructions:

ActivityHD has introduced a new "Employer Dental Code" employee attribute for supplying the value for Box 45.

Setup

Preparing ActivityHD to handle Box 45 requires three main steps:

Step 1: Import the new attribute

- Go to General Ledger > Setup > Attributes, then right-click the folder and select Import. The Import Attributes wizard starts.

- Click

, then browse to and select the import file in your ActivityHD distribution (...\Extras\Payroll Canada\Employer Dental Code attribute.XML).

, then browse to and select the import file in your ActivityHD distribution (...\Extras\Payroll Canada\Employer Dental Code attribute.XML). - Click Open.

- Click Next.

- Click Yes.

- Click Finish.

Step 2: Activate the new attribute

- Go to General Ledger > Setup > Attributes and highlight "Employer Dental Code" in the HD view.

- Click

.

. - Click OK.

- Click Finish.

Step 3: Import the attribute items

- Go to General Ledger > Setup > Attributes > Employer Dental Codes, then right-click the folder and select Import. The Import Employer Dental Code Attribute Items wizard starts.

- Click

, then browse to and select the import file in your ActivityHD distribution (...\Extras\Payroll Canada\Employer Dental Code attribute items.XML).

, then browse to and select the import file in your ActivityHD distribution (...\Extras\Payroll Canada\Employer Dental Code attribute items.XML). - Click Open.

- Click Next.

- Click Yes.

- Click Finish.

Once the attribute items are imported, assign the appropriate item to each employee who will have a T4 for 2023.

Tip

Use the import macro "...\Extras\Payroll\Import Employee Attribute Items.xls" to assign attribute items to employees.

-

T4s (Payroll Canada only)

Payroll/Human Resources > Employees > Records > T4s

The T4 Slip and T4 Summary designs have been updated for 2023 reporting.

T4 Slip changes

- Box 45 - Employer-offered dental benefits

- (new) The "Employer Dental Code" attribute item assigned to the employee as of the year-end date.

- Box 16A - Employee's second CPP contributions

- (new) Total Result amount of check lines in group CPP2 qualified by employee; typically, PRCode Tax.CPP2. (Applies to calendar year 2024 and after. Values are zero for 2023.)

- Box 17A - Employee's second QPP contributions

- (new) Total Result amount of check lines in group QPP2 qualified by employee. (Applies to calendar year 2024 and after. Values are zero for 2023.)

Note

ActivityHD does not currently support Quebec tax. Group QPP2 is merely included for completeness.

- Box 26 - CPP/QPP pensionable earnings

- (updated to include CPP2 and QPP2) Total Source amount of check lines in groups CPP and CPP2 qualified by employee; typically, PRCode Tax.CPP + Tax.CPP2. If the province of employment is "QC", groups QPP + QPP2.

T4 Summary changes

- Line 16A - Employee's second CPP contribution.

- (new) Total of Box 16A.

- Line 27A - Employer's second CPP contribution.

- (new) Total Result amount of check lines in group CPP2 qualified by employer; typically, PRCode Tax.CPP2ER.

Generate T4s - Options tab

A new Employer Dental Code Attribute field has been introduced to specify the attribute to use to determine the value for Box 45. The default value is "Employer Dental Code" which coincides with the new imported attribute discussed above.

Generate T4s - Print T4s

The "T4 Slips Template (built-in)" is now the default design and is updated for 2023 filing. If you need to reprint a T4 slip for a prior year, use the "T4 Slips Template pre-2023 (built-in)" design.

The older designs which required pre-printed forms have been deleted; i.e., "T4 Slips (built-in)" and "Employee T4 Slips (built-in)" are removed.

Generate T4s - Print T4 Summary

The "T4 Summary (built-in)" design is updated for 2023. If you need to reprint a T4 summary for a prior year, use the "T4 Slips Summary pre-2023 (built-in)" design.

-

Various HD views

The following description columns are now available in the corresponding HD views:

HD view Description columns Employee Position Changes

Position Description (Old)

Position Description (New)

Employee Position Pay Rate Changes

Position Description

Unit of Pay Description (Old)

Unit of Pay Description (New)

Positions

Supervisor Description

Pay Grade Description

ACA Transmissions

Original Transmission Description

Check Disbursements

Reverses Description

GL Cash Debit Entry Description

GL Cash Credit Entry Description

Bank Account Description

Liability Account Description

Check Distributions

PRCode Description

GL Accrual Entry Description

Debit Account Description

Voided By Description

Reverses Description

Check Lines

PRCode Description

Voided By Description

Reverses Description

Credit Account Description

GL Liability Entry Description

Check Stub Item Description

Tax Entity Description

Garnishment Description

Checks

Voided By Description

Reverses Description

Bank Account Description

Liability Account Description

Employee Attribute Items

Attribute Description

Employee Automatic Changes

PRCode Description (Old)

PRCode Description (New)

Employee Disbursement Rules

Group Description

Export Employers

ACA Employee Count Run Type Description

Employee Changes

Job Category Description (Old)

Job Category Description (New)

Ethnic Origin Description (Old)

Ethnic Origin Description (New)

Employees

Job Category Description

Ethnic Origin Description

Employee Status Changes

Status Description (Old)

Status Description (New)

ACA Records

Category Description

Notify Note Description

Notified Note Description

Response Note Description

Garnishments

PRCode Description

W-2s

W-3 Description

Payroll Runs

Run Type Description

PRCodes

Check Stub Item Description

Tax Entity Description

Follows Pay Group Description

Position Description

Run Types

Bank Account Description

Liability Account Description

Segment Item Parameters

Segment Description

Segments

Parent Segment Description

Parent Item Description

Segment Item Changes

Segment Description

Check Stub Item Description (Old)

Check Stub Item Description (New)

Tax Entity Description (Old)

Tax Entity Description (New)

Follows Pay Group Description (Old)

Follows Pay Group Description (New)

Position Description (Old)

Position Description (New)

AP Control Description (Old)

AP Control Description (New)

Segment Item Parameter Value Changes

Segment Item Description

Parameter Description

Segment Item Group Changes

Segment Item Description

Group Description (Old)

Group Description (New)

Segment Items

Segment Description

Check Stub Item Description

Tax Entity Description

Follows Pay Group Description

Position Description

Leave Ledger Balances

Ledger Description

Leave Entries

Plan Description

Leave Plans

Calendar Description

Tax Deposits

Deposit Type Description

AP Payment Description

Tax Entities

Parent Tax Entity Description

Time Codes

PRCode Description

Time Sheets

Run Type Description

Time Sheet Lines

Payroll Run Type Description

Time Code Description

PRCode Description

Form 940 Returns

Employer Description

Form 941 Returns

Employer Description

-

W-4s

Payroll/Human Resources > Employees > Records > W-4s

A new "? Current Records" filter has been added for W-4s.The filter prompts for a date and returns all W-4s in effect as of the specified date.

Purchasing

-

Various HD views

The following description columns are now available in the corresponding HD views:

HD view Description columns Purchasing Agents

Department Description

(in GL) Attributes Items folder for a PO attribute

PO Shipping Address Description

Departments

Shipping Address Description

Freight Terms

Shipping Method Description

Operators

Department Description

Purchase Orders

Agent Description

AP Terms Description

Shipping Address Description

Freight Terms Description

Shipping Method Description

Print Records

Order Description

Product Detail

Product Description

Unit of Measure Description

Purchases

Agent Description

Order Description

Product Description

Unit of Measure Description

Invoice Description

Receipt Description

Shipping Address Description

Freight Terms Description

Shipping Method Description

Receipts

Order Description

Vendors (in AP)

Shipping Address Description

Freight Terms Description

Shipping Method Description

Web Services

-

Self-Serve

Previously, when approving or disapproving a purchase order in Self-Serve, there was a slight chance that the user might receive a "404 Not Found" error and be unable to complete the approval or disapproval. The problem has been addressed.

-

Self-Serve

Formerly, values in the Date column on invoices in Self-Serve were not formatted properly. Dates were shown in YYYY-MM-DD format (e.g., 2023-12-27). Now date values are formatted in the user's chosen date format.

-

Self-Serve

A change to Self-Serve in ActivityHD 8.42-0 caused a potential problem when clicking invoice links from the pages listed in the Invoices menu:

- Invoices to Approve

- Approved Invoices

- New Invoices

- Outstanding Invoices

When a link was clicked from one of these pages, a "Page Not Found" error could occur. The error only occurred if the batch code for the invoice contained a slash ("/") character.

The problem has been corrected.

-

Self-Serve

The Self-Serve Leave Entries page has been reimplemented. Access the page by selecting Payroll Management > Leave Balances from the Self-Serve menu and then drilling down on the hyperlink in the Balance column for a selected employee.

-

Self-Serve

Previously, certain dates/times in some Self-Serve views would incorrectly display six hours (and, in some cases, a day) later than the actual date/time. This issue has been resolved.

-

Self-Serve

Formerly, an unhelpful modal alert about an ajax error might occur. Now, instead, users will see a red box in the upper right corner which states, "An error occurred. Please try again."

-

Self-Serve

Previously, attachments were not getting added to service tickets via Self-Serve. This issue has been resolved.

-

Self-Serve - User Locations

In the past, if an error occurred while updating a user location, the user was redirected to a generic error page. Now users will see a red box in the upper right corner with the specific error which occurred; for example, "The User Location is locked by areed".

-

ActivWebAPI

Several existing Data routes have been removed and replaced by routes with improved structure and function for the Record and RecordList routes. This is a breaking change.

The following Data routes have been removed:

- GET /api/data

- GET /api/data/{package}/{folder}

- POST /api/data

- POST /api/data/{package}/{folder}

- DELETE /api/data

- DELETE /api/data/{package}/{folder}

The following Record routes have been added:

- GET /api/record - Get a data record located by item parameter; return xml/json

- GET /api/record/{package}/{folder} - Get a data record located by item parameter; return xml/json

- POST /api/record/import - Post data records described by xml content from the request body (/XML/data/@Command(Import/New/Edit/Delete)); return xml/json

- POST /api/record/import{package}/{folder} - Post data records described by xml content from the request body (/XML/data/@Command(Import/New/Edit/Delete)); return xml/json

- DELETE /api/record/delete - Delete a data record located by item parameter

- DELETE /api/record/delete/{package}/{folder} - Delete a data record located by item parameter

The following RecordList routes have been added:

- POST /api/recordlist - Get data records limited by the parameters described as xml in the request body; return xml/json

- POST /api/recordlist/{package}/{folder} - Get data records limited by the parameters described as xml in the request body; return xml/json

- POST /api/recordlist/import - Post data records described by xml content from the request body (/XML/data/@Command(Import/New/Edit/Delete)); return xml/json

- POST /api/recordlist/import/{package}/{folder} - Post data records described by xml content from the request body (/XML/data/@Command(Import/New/Edit/Delete)); return xml/json

-

ActivWebAPI

All Report routes have been changed from GET routes to POST routes in order to fix a problem attempting to pass large answers and export parameters (XML) as part of an HTML query. Answers and export parameters are now passed within the request body of the POST request. This is a breaking change.

The following GET routes have been replaced with POST routes:

- DataSourceReport

- GET /api/datasourcereport/data

- GET /api/datasourcereport/data/{name}

- GET /api/datasourcereport/export

- GET /api/datasourcereport/export/{name}

- Report

- GET /api/report/data

- GET /api/report/data/{package}/{report}

- GET /api/report/export

- GET /api/report/export/{package}/{report}

- ViewReport

- GET /api/viewreport/data

- GET /api/viewreport/data/{package}/{report}

- GET /api/viewreport/export

- GET /api/viewreport/export/{package}/{report}

The following POST routes have been added:

- DataSourceReport

- POST /api/datasourcereport/data - Get report data for a data source, parameters (xml) from the request body; return xml/json

- POST /api/datasourcereport/data/{name} - Get report data for a data source, parameters (xml) from the request body; return xml/json

- POST /api/datasourcereport/export - Get report export for a data source, parameters (xml) from the request body

- POST /api/datasourcereport/export/{name} - Get report export for a data source, parameters (xml) from the request body

- Report

- POST /api/report/data - Get report data, parameters (xml) from the request body; return xml/json

- POST /api/report/data/{package}/{report} - Get report data, parameters (xml) from the request body; return xml/json

- POST /api/report/export - Get report export, parameters (xml) from the request body

- POST /api/report/export/{package}/{report} - Get report export, parameters (xml) from the request body

- ViewReport

- POST /api/viewreport/data - Get report data for a view report, parameters (xml) from the request body; return xml/json

- POST /api/viewreport/data/{package}/{report} - Get report data for a view report, parameters (xml) from the request body; return xml/json

- POST /api/viewreport/export - Get report export for a view report, parameters (xml) from the request body

- POST /api/viewreport/export/{package}/{report} - Get report export for a view report, parameters (xml) from the request body

Example: body of a report data route

<Answers Name="Test"/>

or

<p><Answers Name="Test"/></p>

Example: body of a report export route

<p>

<Answers Name-"Test"/>

<Export Prompt='False' FormatType='PortableDocFormat' DestinationType='DiskFile' DiskFileName='C:\Temp\Test.pdf'/>

</p>

- DataSourceReport

-

ActivWebAPI

In the past, you could not access OData1.0 routes through ActivWebAPI. Now the following routes have been added:

- GET /api/om/OData1.0/{package} - Get access for the outmoded OData1.0 root source

- GET /api/om/OData1.0/{package}/{resource} - Get access for the outmoded OData1.0 resources

-

ActivWebServer

In the past, an unhelpful error was returned if you attempted to connect to Self-Serve (i.e., ActivWebServer) when the "ActivWebAPIURL" key in the app.config file did not contain a trailing "/" character. So, while

<add key="ActiveWebAPIURL" value="https://localhost:44314/" />

DID work

<add key="ActiveWebAPIURL" value="https://localhost:44314" />

DID NOT work.

Now the code which forms the request to the ActivWebAPI server appends the trailing "/" character if it is missing so that no error occurs.

In addition, error reporting in this area has been improved to provide more information about the actual error. Specifically, the actual web request URI is now shown in the "Stack Trace" section of the error report.