ActivityHD Release 8.28

System-wide

-

RPC errors

In the past, when an RPC error occurred, the status value was reported and the text of the status value was shown. Going forward these errors will also include extended error information when available to help in diagnosing the source of the failure.

It is also possible to propagate extended error information from the server by enabling a group policy. The group policy is located in "Administrative Templates\System\Remote Procedure Call" in the policy named "Propagate extended error information". When enabled, the RPC errors also include information about the error from the server and how it was propagated to the client. In order for this policy change to take effect, the Activity servers must be restarted.

Propagation of extended error information is not recommended as a standard practice since it can reveal information such as machine names, security settings, etc., which some organizations may consider to be sensitive information. Therefore, we recommend only enabling extended error information temporarily when needed for diagnostic purposes.

Exercise caution when enabling the "Propagate extended error information" policy since it can affect any and all RPC servers on the system.

Accounts Payable

-

Void Invoices

Accounts Payable > Invoices > [right-click] > Select and Void

Until now when you selected multiple invoices for voiding, the Batch-EntrySeqno was shown only for the first invoice that could not be voided. Although reasons were displayed for the other invoices which could not be voided, the Batch-EntrySeqno was not shown for them. In addition, if the invoice came from Purchasing, no warning was given that an invoice from Purchasing was being voided.

Now the Void process shows the Batch-EntrySeqno for all invoices that cannot be voided and warning messages are returned for invoices from Purchasing.

-

ActivityHD Automation Services (AAS)

Until now, the fields supplied by the Purchasing package for vendors and invoices were not available as automation fields. Now the following fields are available through automation:

- Vendor

- PODefaults/POShippingAddress

- PODefaults/POFreightTerms

- PODefaults/POShippingMethod

- PODefaults/PODepartments

- Invoice

- PODepartment

- POAgent

- POOrder

- Vendor

-

Data extensions

Missing data extensions have been added to several Accounts Payable reports and subreports. Data extensions were originally introduced for Accounts Payable in version 8.24-0. The following reports/subreports now have data extensions:

- Recurring Invoices Listing

- AP Codes subreport

- Proof/Merge Payments Report

- Distributions subreport

- AP Codes subreport

- GL Detail subreport

- 1099 Detail Report

- Location Labels

- Print 1099 Forms

- Recurring Invoices Listing

-

Merge Invoices/Proof for Merge Invoices

Accounts Payable > Invoices > [right-click] > Select and Merge

Accounts Payable > Invoices > [right-click] > Select and Proof for Merge

Prior to this version of ActivityHD, the Merge action for AP invoices started immediately without displaying errors and warnings for the user to review. If the resulting report was not reviewed, out-of-balance or similar issues might not be discovered until attempting to merge journal entries in General Ledger. To see this information before merging, one needed to choose the Proof action first. Proofing required additional time and was not a common practice.

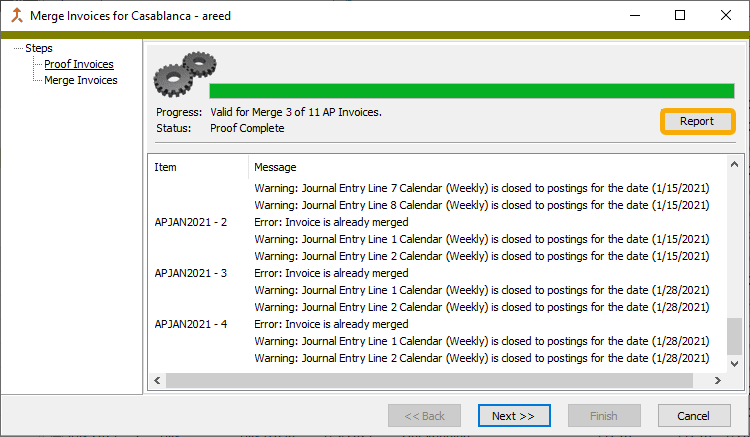

Now a new Proof step has been introduced to the Merge process. Validations begin immediately and all warnings and errors are displayed to the user prior to merging. The process includes a new Report button which provides a report of the warnings and errors.

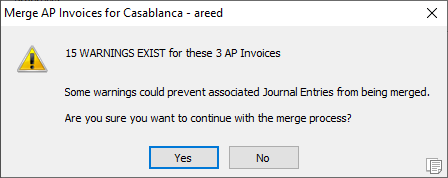

Although the user can cancel out of the process at any point, choosing the Next >> button continues to the Merge step. If no warnings exist, the typical message recapping the number of invoices to be merged is presented for the user to acknowledge. If any warnings exist, however, a message similar to the one illustrated below is presented. The message shows the number of warnings for invoices which can be merged and, in some cases, notes that further action may be required.

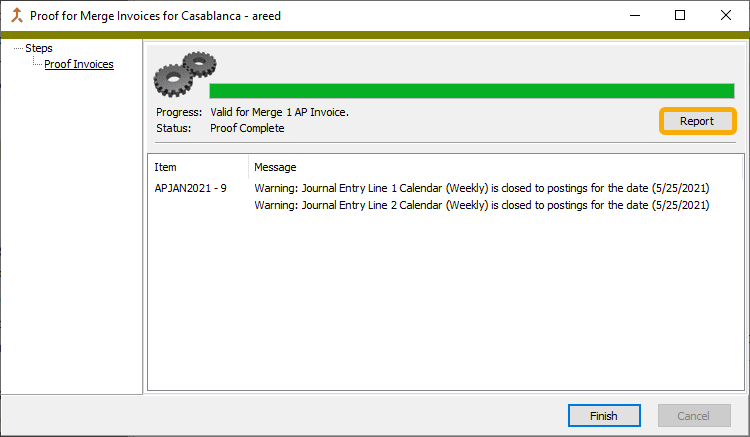

If the user proceeds, invoices which were found to be valid in the Proof step are merged and only warnings for those invoices are displayed. As with the Proof step, a Report button is available to show the validation results for the invoices in this step. Validation in this step handles situations in which invoice data changes between the Proof and Merge steps. For example, an invoice selected for this process could be merged separately, resulting in an error message that the invoice has already been merged.

The Proof process has also been updated to replace the Report step with a Report button.

-

Merge Payments/Proof for Merge Payments

Accounts Payable > Payments > [right-click] > Select and Merge

Accounts Payable > Payments > [right-click] > Select and Proof for Merge

Prior to this version of ActivityHD, the Merge action for AP payments started immediately without displaying errors and warnings for the user to review. If the resulting report was not reviewed, out-of-balance or similar issues might not be discovered until attempting to merge journal entries in General Ledger. To see this information before merging, one needed to choose the Proof action first. Proofing required additional time and was not a common practice.

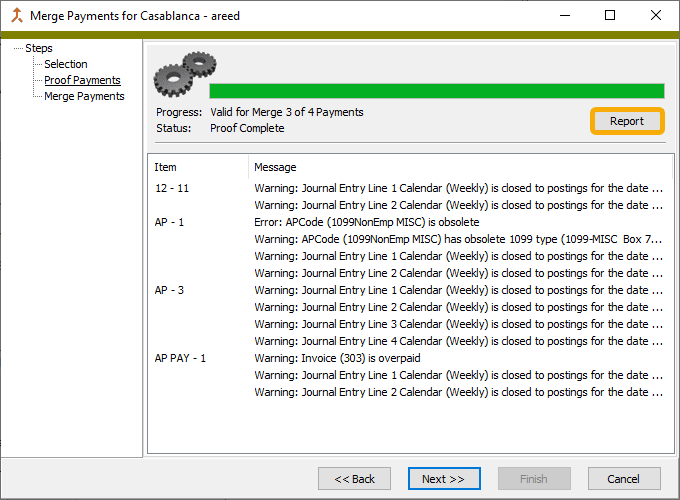

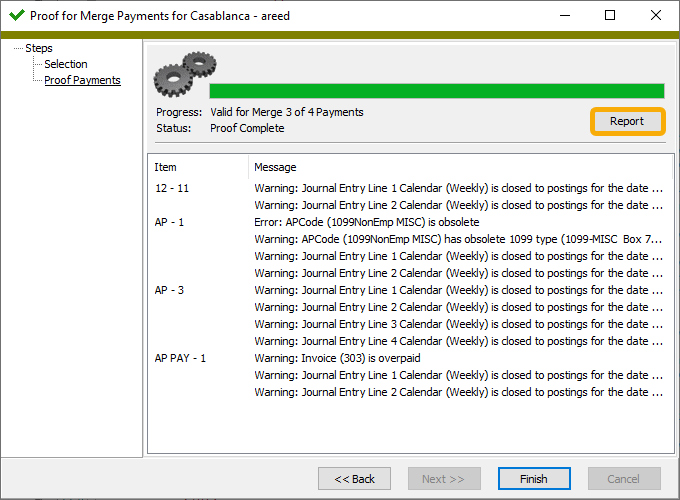

Now a new Proof step has been introduced to the Merge process. Validations begin immediately and all warnings and errors are displayed to the user prior to merging. The process includes a new Report button which provides a report of the warnings and errors.

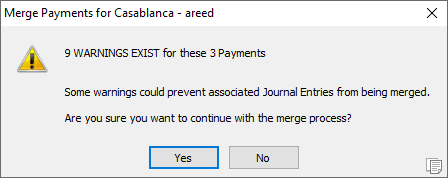

Although the user can cancel out of the process at any point, choosing the Next >> button continues to the Merge step. If no warnings exist, the typical message recapping the number of payments to be merged is presented for the user to acknowledge. If any warnings exist, however, a message similar to the one illustrated below is presented. The message shows the number of warnings for payments which can be merged and, in some cases, notes that further action may be required.

If the user proceeds, payments which were found to be valid in the Proof step are merged and only warnings for those payments are displayed. As with the Proof step, a Report button is available to show the validation results for the payments in this step. Validation in this step handles situations in which payment data changes between the Proof and Merge steps. For example, a payment selected for this process could be merged separately, resulting in an error message that the payment has already been merged.

The Proof process has also been updated to replace the Report step with a Report button.

Accounts Receivable

-

Data extensions

Missing data extensions have been added to several Accounts Receivable reports:

- AR Invoices Listing

- Print AR Invoices

- Proof/Merge AR Invoices Report

- AR Receipts Listing

- Proof/Merge AR Receipts Report

- Print AR Statements

- Summary Invoices Listing

- Print AR Summary Invoices

- Item Tax Categories Listing

- AR Recurring Listing

Contracts Processing

-

Data extensions

Missing data extensions have been added to the main report and/or subreports for contracts, settlements, products, and work orders. Data extensions were originally introduced for Contracts Processing in version 8.23.

General Ledger

-

Data extensions

Missing data extensions have been added for the Journal Entries Proof/Merge Report. Data extensions were originally introduced for General Ledger in version 8.24-0.

Payroll/Human Resources

-

2022 tax updates

The following state income tax changes have been introduced:

- Alabama. The gross income threshold for the maximum dependent allowance has been raised from $20,000 to $50,000 and the standard deduction amounts have increased. These changes are retroactive to 1/1/2022.

- Arkansas. The standard deduction has increased to $2270, the midrange cutoff cap has increased to $91,800, and the top tax rate and supplemental rate have decreased to 4.9%. These changes are effective 10/1/2022.

- Virginia. The standard deduction has increased from $4,500 to $8,000 for single filers and from $9,000 to $16,000 for married filers filing jointly. The change is effective 10/1/2022.

-

Change Check Distributions

Payroll/Human Resources > Checks > Distributions > [right-click] > Select and Change

In the past, when you attempted to mass change the GL account on a check line distribution, the attempt often resulted in the following error message:

Field 'Debit Account' cannot be modified.

Unfortunately, no explanation as to why the account could not be changed was given.

Now a reason is given. A couple of examples:

Debit account cannot be modified: GL entry is merged.

Debit account cannot be modified: voided or reversal check.

However, if the reason for the error is that the distribution method is "Follows Pay", this message is shown:

Distribution Method is Follows Pay. Change it to Manual?

[ ] Apply to all items?

[ Yes ] [ No ]

Click Yes to change the distribution method to "Manual" and then change the account as desired.

Click No to skip the change. If you click No, the following message ensues:

Debit account cannot be modified: distribution method is Follows Pay.

Before clicking Yes or No, you can mark the Apply to all items? checkbox to skip the prompt to change the distribution to "Manual" for affected distribution lines.

The behavior is similar when you attempt to mass change a distribution attribute on a line: a specific error is returned explaining why the attribute cannot be changed. If the reason the attribute cannot be changed is that the distribution method is "Follows Pay", you have the opportunity to change the method to "Manual".

Note

There is a good reason you may NOT want to change the distribution method to "Manual". If one of the lines being followed (e.g., a pay line) could change in the future, you probably want to maintain the "Follows Pay" functionality for the affected expenses.

-

Data extensions

Missing data extensions have been added to several Payroll reports. Data extensions were originally introduced on check-related reports in version 8.23-2 and more generally in version 8.25-0. The following reports now have data extensions:

- 1094-Cs Report

- 1095-Cs Report

- W-2s Report

- Payroll Run Comparison

- Check Totals Report

- Check GL Detail Report

- Pay Statements

- Print Payroll Checks

- Print/Reprint Form 941 Return

- W-3s Report

-

Employees

Payroll/Human Resources > Employees

Previously, if multiple contacts were flagged as an emergency contact for an employee, the contact listed as the employee's emergency contact in the Employees HD view was unpredictable. Now the four columns of emergency contact information have been removed from the HD view.

The most common way to identify an employee's emergency contact is to open the employee's record and select the Contacts tab.

-

Employees Listing

Payroll/Human Resources > Employees > [right-click] > Select and Report > Employees Listing

Previously, if multiple contacts were flagged as an emergency contact for an employee, the Employees Listing included an emergency contact alongside the name details; however, the contact listed as the emergency contact was unpredictable. Now an emergency contact is not listed with the name details, but emergency contacts are still included when the Contacts checkbox on the report Options tab is marked. Emergency contacts are indicated in the contacts section by an asterisk in the "Emer" column.

The most common way to identify an employee's emergency contact is to open the employee's record and select the Contacts tab.

-

Print Form 940 Returns

Payroll/Human Resources > Government > Form 940 Returns > [highlight a return in the HD view] >

Changes to Form 940 for tax year 2022 have been introduced in draft form. Currently, the report is useful for testing purposes only and cannot be filed. The final images will be updated when provided by the IRS.

Although for the last few years the Virgin Islands has been the only entity with a credit reduction rate, this year a credit reduction rate of 0.003 (.03%) has been introduced for the following states per instructions for Form 940 Schedule A:

- California

- Colorado

- Connecticut

- Illinois

- Massachusetts

- Minnesota

- New Jersey

- New York

- Pennsylvania

The credit reduction rate for the Virgin Islands has not yet been announced but will be updated in ActivityHD once the IRS publishes it.

A credit reduction rate results in a higher FUTA tax as calculated in Part 3 of Form 940. The standard FUTA rate is 6.0% with a reduction rate of 5.4% giving a net FUTA rate of 0.6%. In a credit reduction state the 5.4% is reduced, resulting in a higher net FUTA rate.