The preponderance of the calls which AccountingWare Support receives about GL balances fall into one of these categories:

- My trial balance doesn't.

- My financial designs are out of balance.

- My subsidiary balances don't match my GL balances.

Listed below are some questions you can ask and actions you can take to get to the bottom of your balance woes efficiently:

Out-of-balance Trial Balance

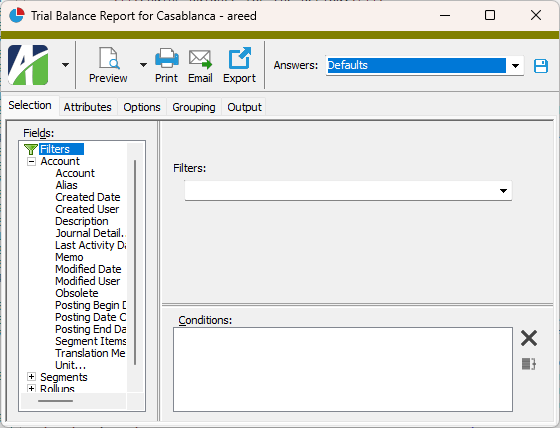

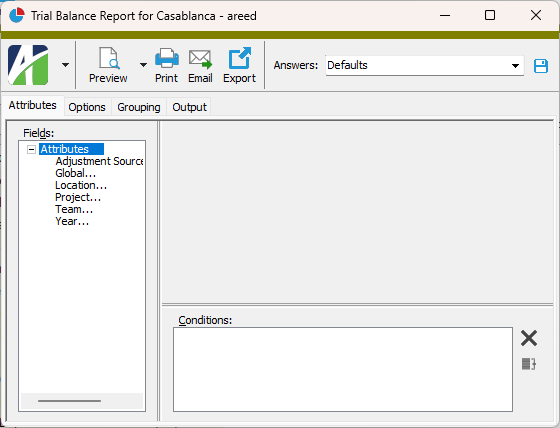

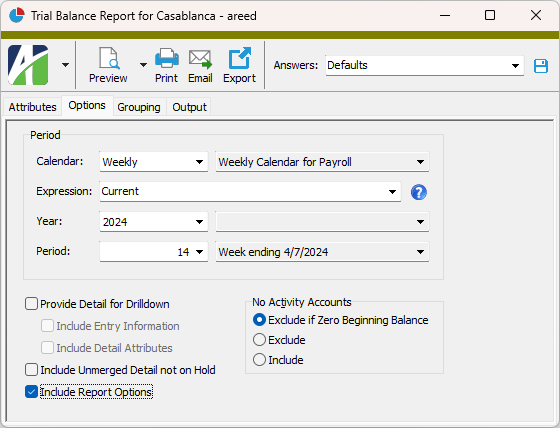

- Are you including unmerged GL detail when you run the Trial Balance?

- Proof your unmerged GL entries. When you get to the "Review Report" step of the proof process, be sure to select "Exceptions" in the Validation Status? field on the Options tab. This will allow you to see details for any out-of-balance errors.

- Resolve any invalid accounts or unbalanced entries. You should use the invalid GL columns and filters in the subsidiary packages to monitor for these on a routine basis.

Out-of-balance financial designs

- Are all accounts on the financial assigned to a rollup item? Every account in the actual ledger should have a home on the balance sheet—either net income or a balance sheet account. Use the Chart of Accounts HD view to confirm rollup assignment.

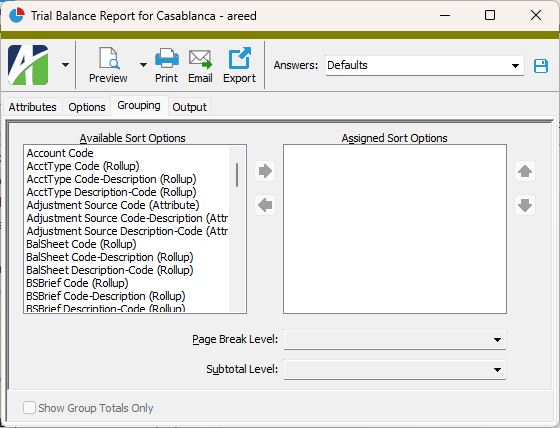

- Run the or sorted and summarized by rollup (balance sheet or income statement).

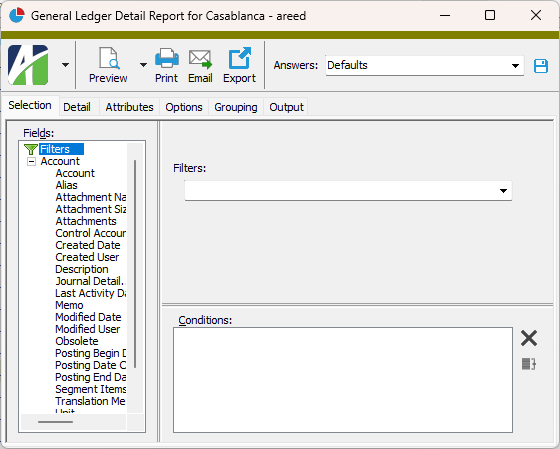

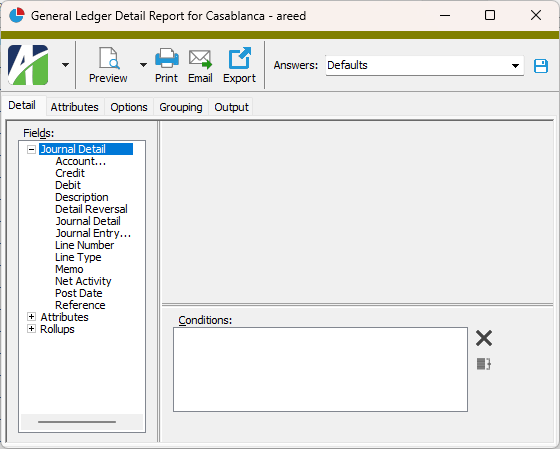

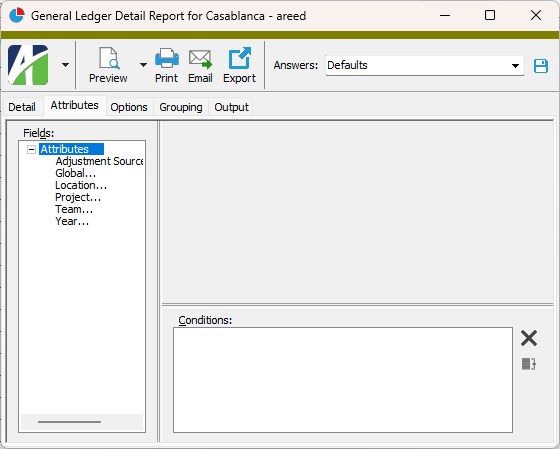

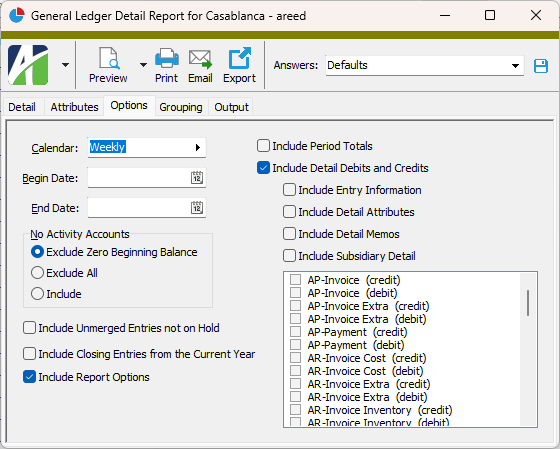

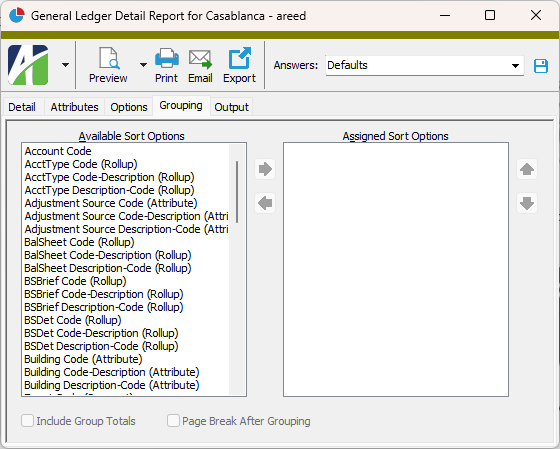

- Use the General Ledger Detail Report, financial views, the Journal Detail HD view, and/or other reports and views to review detail by limiting to a particular rollup item.

Subsidiary Balance and GL Balance Disagree

- Which reports and report options are you using to compare the subsidiary totals and the GL totals? AccountingWare suggests you use saved answers (aka "Saved Answers") so that it's easy to summon these reports and options on a routine basis. Consider these:

Report Options AP Aged Invoice Analysis In the Invoice Balance field, select "Calculate Using GL Date". AR Aged Invoice Analysis In the Invoice Balance field, select "Historical by GL Date". FA GL History Report In the History Date field, select "GL Date". Payroll The report and options you choose depend on whether you use a debit or credit account. - Review journal detail for the problematic account. Use the System-Journal column to determine if manual entries are affecting the account. Manual entries are the main reason accounts get out of balance!

Final thoughts...

- The Journal Detail folder is your friend!

- Use the drill-down capability of the trial balance financial view liberally!

- Run reports by rollup item: Trial Balance side-by-side with financial statements.

- Remember these best practices:

- Never adjust subsidiary balances with manual GL entries.

- Void if you need to! Let ActivityHD create an accurate audit trail for you.

- Routinely check subsidiary balances against GL.

- Use calendar controls.