Financial designs

Essentially, a financial design is an Excel worksheet that incorporates labels, ActivReporter functions, and Excel formulas to produce a customized financial statement. Because the functions are generalized, you can reuse a financial design from period to period and year to year.

Note

Financial designs always create a file in a certain baseline Excel file format regardless of which version of Excel is installed on your workstation. This means users can generally open and work with financial design worksheets no matter which version of Excel is installed.

Financial design worksheets can be created and stored in ActivReporter or external to it. There are several advantages to maintaining your designs within ActivReporter:

- Worksheets are backed up with the rest of the ActivReporter database.

- It is easy to share your worksheets with other ActivReporter users.

- Worksheets can be secured with standard ActivReporter security.

- Worksheets are versioned so that historical worksheets can be viewed and restored.

Preparing to design a financial statement

Before you start designing a financial, examine your current financial statement. Note that it consists of rows and columns. Each row and each column on the statement has an identifying characteristic or rule that can be associated with the row or column.

Rows typically identify which account or group of accounts appear on that row. In most cases, the group of accounts relates to a rollup code. Rows may also contain formulas which total sections of the report.

Columns usually either contain descriptions of lines, financial data, budget data, or calculations (such as variances and/or percentages). This type of information is retrieved from ActivReporter via financial functions. Often the formula for all cells in a column section is the same so that you can enter a formula in the cell at the top of the column section and drag down to copy the formula to all rows of that section of the financial.

The purpose of the remaining information in this topic is to help you translate your paper statements into generalized designs which can be used today and for years to come.

Create a financial design record

Create a financial design record

The procedure which follows describes how to create a design record. Concealed in step 15 of this procedure is the heart of the effort, setting up the design in Excel. This aspect of financial design creation is discussed in the topics on the "Design creation" tab.

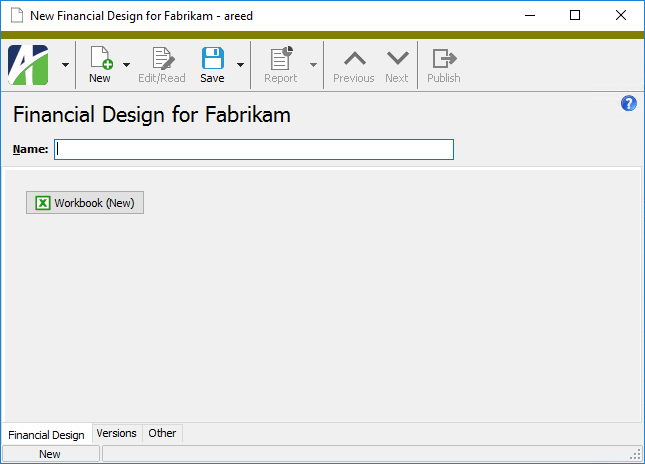

- In the Navigation pane, highlight the ActivReporter > Financial Designs folder.

-

Click

. The New Financial Design window opens.

. The New Financial Design window opens.

- Enter a unique Name for the financial design. You can use up to 40 characters.

-

Click Workbook. The Financial Options dialog box opens.

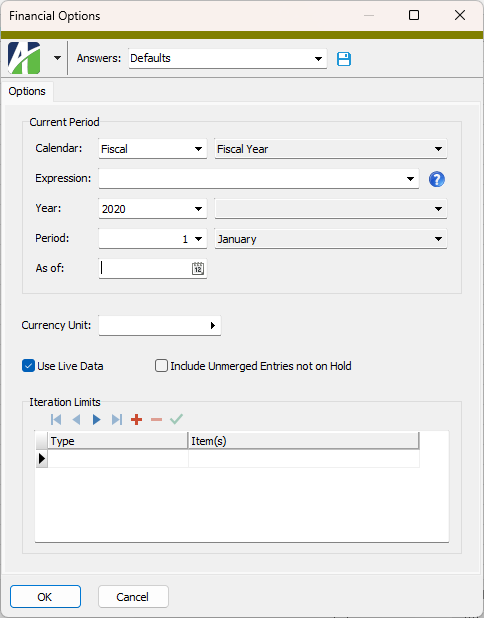

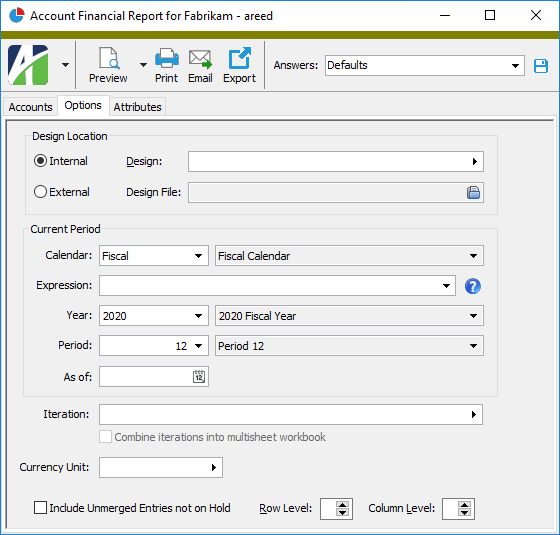

- From the Calendar drop-down list, select the calendar to base the financial statement on.

-

To define the reporting period using a relative expression, select or enter the period expression in the Expression field. (If you prefer to explicitly enter the year and period, skip to step 7.)

You can select from the following common period expressions:

- Current

- Current - 1 period

- Current - 1 year

Alternatively, you can type a valid period expression in the field. For help on period expression syntax, click the help button to the right of the field.

If you select or enter a period expression, ActivReporter adjusts the values in the Year and Period fields accordingly.

If you enter a period expression, skip to step 9.

- From the Year drop-down list, select the year of the period to report on.

- From the Period drop-down list, select the period to report on.

- If you only want the financial report to reflect postings through a particular date, enter the date in the As of field. All postings after the as of date are ignored. The as of date must fall between the current period begin and end dates.

- To report in a different unit than the unit(s) specified on the affected accounts, select the reporting unit in the Currency Unit field; otherwise, leave this field blank. This option is used to perform translation between units. For optimal performance, only use this option when translation is needed.

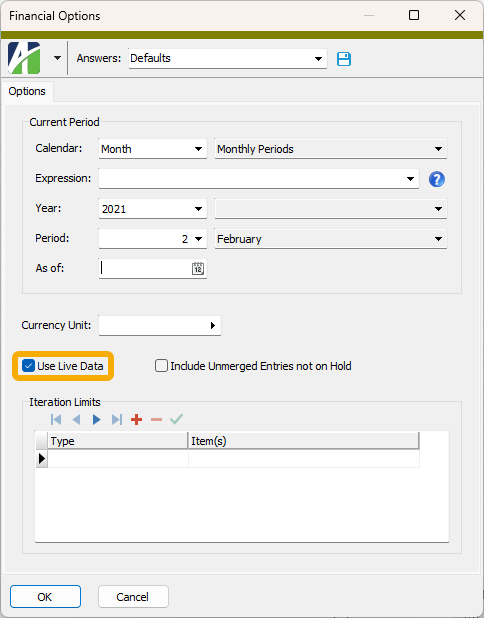

- If you want to display actual data in your financial design, mark the Use Live Data checkbox; otherwise, the design will show zeros for amounts.

- If you mark the Use Live Data checkbox, the Include Unmerged Entries Not on Hold checkbox is enabled. Mark this checkbox if you want the live data to include unmerged entries which are not flagged as "on hold".

- If needed, use the Iteration Limits table to restrict the data that is reported. To do so, for each limit you want to define:

- In the Type column, select whether to limit by account number, a specific segment, a specific rollup, or a specific attribute.

- In the Item(s) column, specify the mask or value(s) for the account number, segment item, rollup item, or attribute item to limit by.

Note

The Find dialog on the Item(s) field supports multi-select. For example, if you choose "Department" in the Type field, you could use Ctrl and/or Shift selection in the Find dialog on the Item(s) field to select multiple departments for iteration. This feature allows you to create a consolidated financial for a set of items.

- Click OK.

- Set up the financial design in the open Excel worksheet.

- When you finish, save the financial design worksheet in Excel.

- Close Excel.

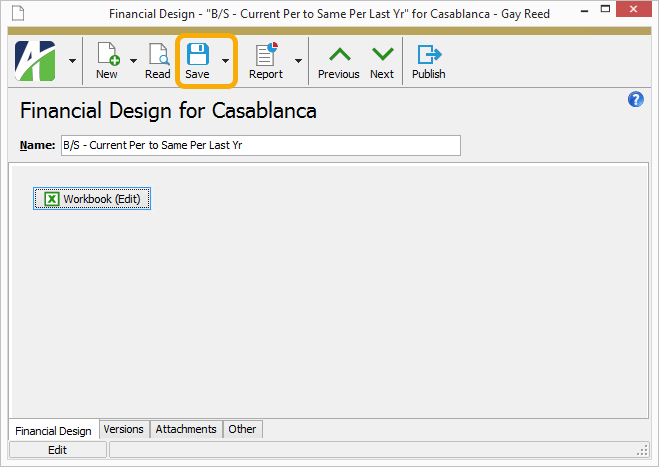

- In the Financial Design window, save the financial design record.

Tip

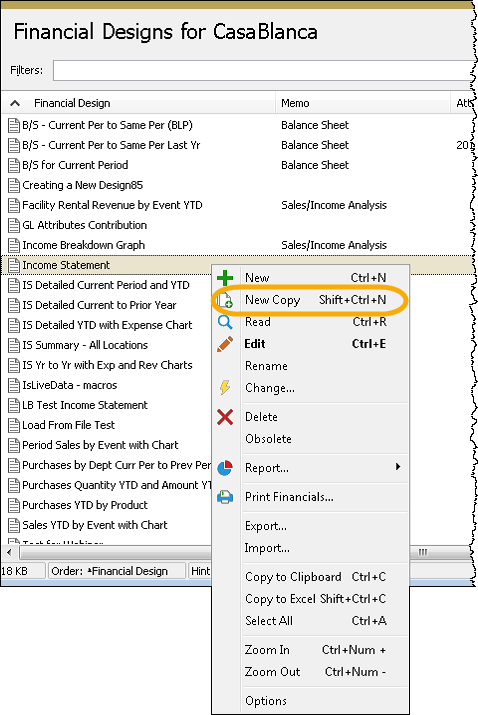

After you design a financial statement, consider reusing it as the basis for future financial designs. To copy a design to a new file, use the New Copy feature.

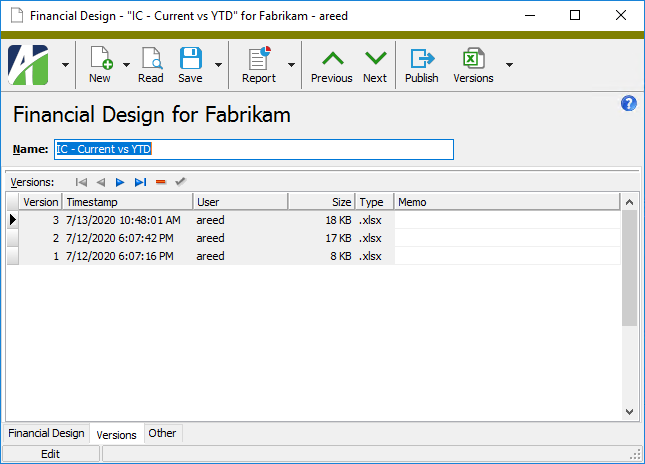

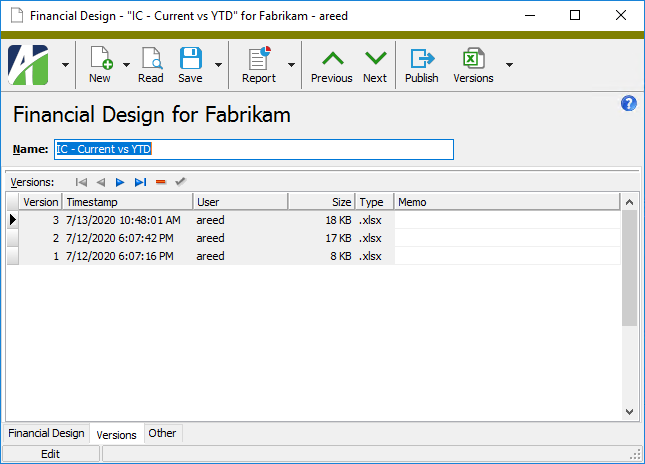

Work with design versions

Work with design versions

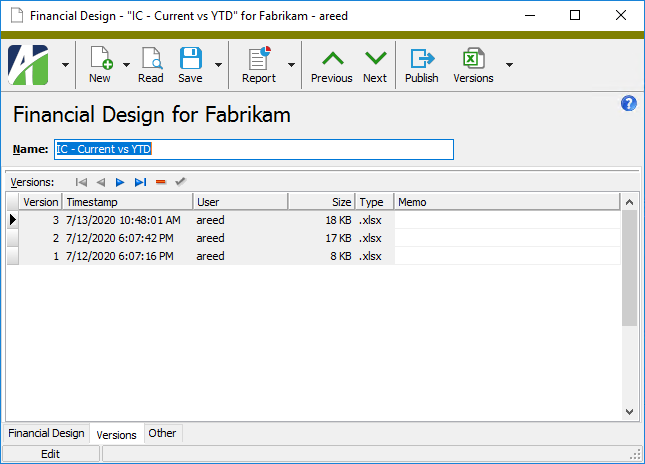

When you open a financial design for editing, you are opening the most recent version of the design (unless you intentionally select an older version). Financial designs are extracted to a temporary file on your hard drive or network and Excel is launched as an external application in its own process for editing the file. When you save changes to a design, first in Excel and then in ActivReporter, a new version of the design is added to the ActivReporter database and past versions of the design are retained (unless you choose to delete them).

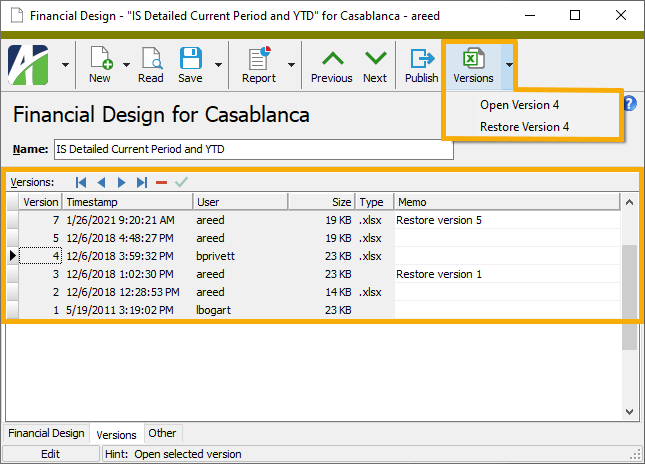

Open a historical version of a financial design

Open a historical version of a financial design

Opening a historical design creates a numbered version of the workbook in your tmp directory. This file is read-only. It is automatically removed from the tmp folder when you close the design unless you save the workbook with a new name or in a new location.

- In the Navigation pane, highlight the ActivReporter > Financial Designs folder.

- In the HD view, locate and double-click the financial design. The record opens in the Financial Design window.

- Select the Versions tab.

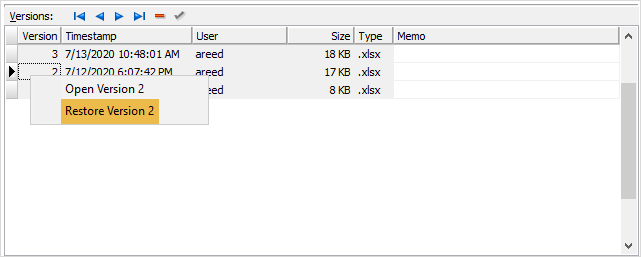

- In the Versions table, right-click in the Version column of the row which contains the financial design version you want to open and select Open Version n, where n is the version number.

The worksheet opens in read-only mode and the Financial Options dialog box opens.

Restore a historical version of a financial design

Restore a historical version of a financial design

Restoring a historical design creates a copy of the selected design and makes it the active design.

- In the Navigation pane, highlight the ActivReporter > Financial Designs folder.

- In the HD view, locate and double-click the financial design. The record opens in the Financial Design window.

- Select the Versions tab.

- In the Versions table, right-click in the Version column of the row which contains the financial design version you want to open and select Restore Version n, where n is the version number.

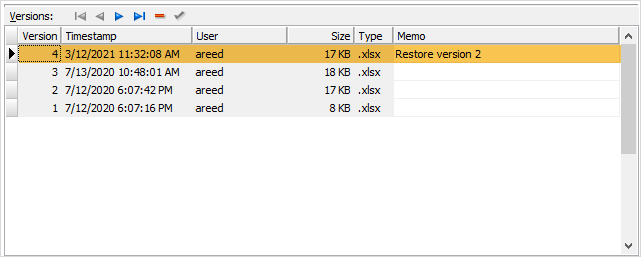

A row is added at the top of the Versions table with a memo of "Restore version n".

Delete a historical version of a financial design

Delete a historical version of a financial design

Note

You cannot delete the active version of a financial design.

- In the Navigation pane, highlight the ActivReporter > Financial Designs folder.

- In the HD view, locate and double-click the financial design. The record opens in the Financial Design window.

- Select the Versions tab.

- Click in the row in the Versions table for the version you want to delete.

- In the controls above the table, click

. You are prompted to confirm that you want to delete the selected version.

. You are prompted to confirm that you want to delete the selected version.

- Click OK. The row is removed.

Load a design from an external location

Load a design from an external location

If you have a financial design saved, for whatever reason, outside of the tmp directory where ActivReporter puts Excel design files for editing, it is possible to load that design for use in ActivReporter. Here's how:

- Create a new financial design record or open an existing design record to add a new version of it.

- From the toolbar, select

> Tools > Load Workbook from File. The Windows Open dialog opens.

> Tools > Load Workbook from File. The Windows Open dialog opens. - Navigate to and select the financial design you want to load.

- Click Open.

- Save the financial design record.

Save a design to an external location

Save a design to an external location

You can save a financial design stored in ActivReporter to an external file. To do so:

- Open the financial design record in ActivReporter.

- From the toolbar, select

> Tools > Save Workbook to File. The Windows Save As dialog opens.

> Tools > Save Workbook to File. The Windows Save As dialog opens. - Navigate to and select the location where you want to save the financial design.

- In the File name field, enter a file name for the financial design.

- Click Save.

Delete a financial design record

Delete a financial design record

Financial design records can be deleted with impunity.

To delete a financial design record, highlight it in the HD view and click ![]() , or open the financial design and select

, or open the financial design and select ![]() > Edit > Delete. In either case, ActivReporter prompts you to confirm your action. Click Delete to delete the financial design.

> Edit > Delete. In either case, ActivReporter prompts you to confirm your action. Click Delete to delete the financial design.

Elements of a financial design

Elements of a financial design

Although they can vary in their complexity, all financial designs have the following elements in common:

- Report and column headings. You can enter literal text in any cell of an Excel worksheet to produce report and column headings. At times you may want to retrieve information from ActivReporter to use in headings; e.g., company name, company address, segment item description, period ending date. To retrieve data for headings, use text functions or date functions.

- Literals. You can enter text in any cell of a worksheet. Do not use literal text, however, for row descriptions. Instead, use text functions to retrieve the descriptions of the rollup items for each row.

- Formulas. Formulas retrieve numerical values or text. Formulas often use rules that affect each row or column. Insert rules in the margins of the design.

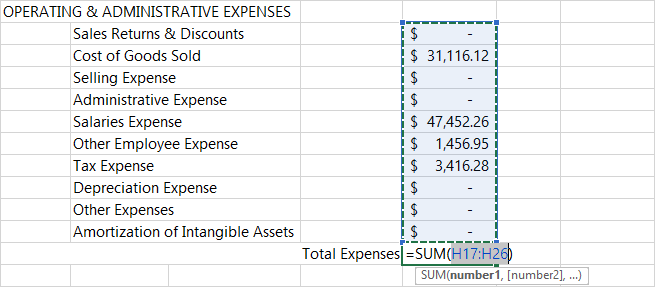

- Totals. Use Excel formulas to calculate totals in your financial designs. Totals are almost always defined using Excel's SUM function.

ActivReporter's extended function library for Excel lets you incorporate information from General Ledger in your financial design. One advantage of financial designs is that you can reorganize your rollups and have the changes immediately reflected in all affected financial designs.

Before you create a financial design, the following preparation is needed:

- Determine how to summarize information. Which accounts do you want to group together and report on a line? Do you have an existing rollup for these report groupings that you can use? If so, skip to step 5.

- Create a rollup that represents the report groupings you need.

- Add rollup items to the rollup that identify each line on the financial statement.

- Activate the rollup.

- Create a new financial design.

Tip

When possible, reuse rollups in multiple financial designs.

Best practices

Best practices

![]()

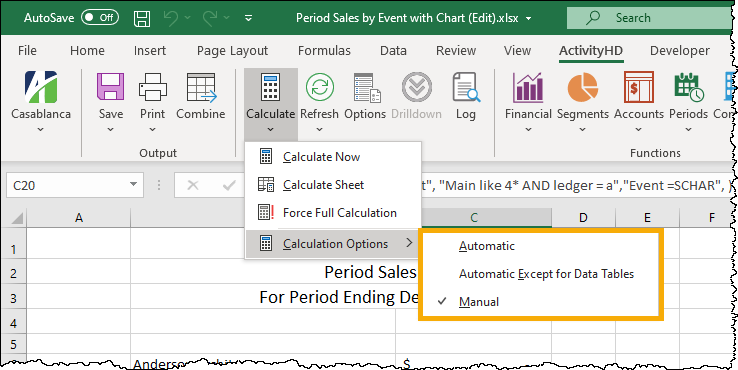

Large workbooks and calculation mode

The default calculation mode for ActivReporter is "Automatic". However, when designing a large workbook, set the calculation mode to "Manual". Then use F9 to recalculate the entire workbook, or Shift+F9 to calculate the current worksheet only.

Workbook storage location

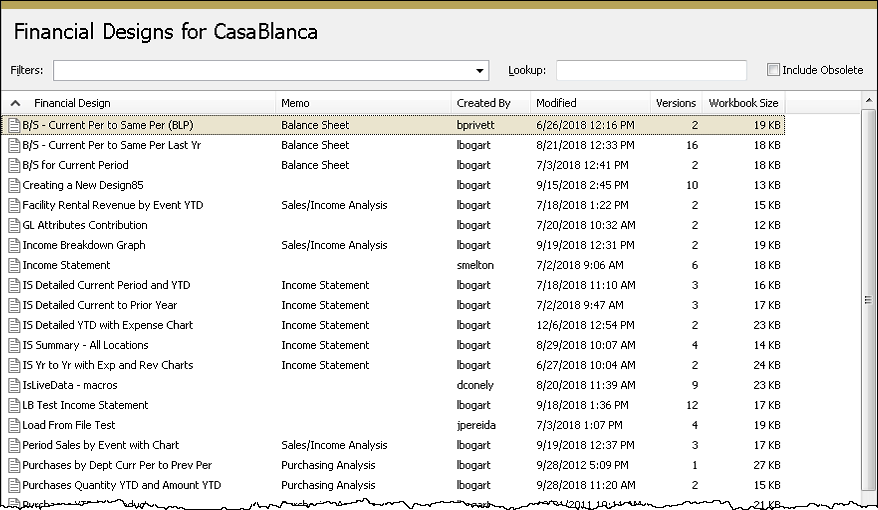

While workbooks can be stored in the Windows file system or internal to the ActivReporter application, AccountingWare recommends that you store workbooks in ActivReporter. The advantages of storing in ActivReporter include:

Versioning

Iteration

Memo

Add free text to describe the workbook design and its use. See who created the design, the last date/time the design was modified, and other information about the workbook.

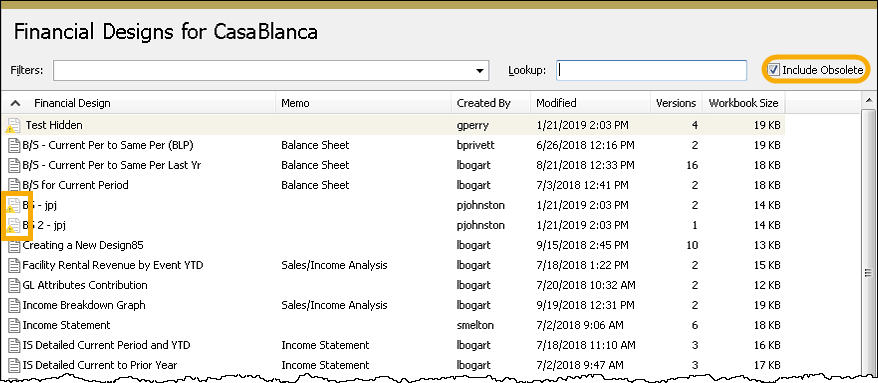

Obsolete workbooks

You can flag a workbook as obsolete while still retaining it for future use. When flagged "Obsolete", workbooks are hidden in the HD view unless you mark the Include Obsolete checkbox.

Attachments

If FileStream is enabled on the ActivReporter database (see your database administrator to get it enabled), you can add attachments to your financial designs. That could mean storing an entire database of published financials based on a design. If you do use attachments to store your published financial library, ActivReporter security will secure access to your financial information.

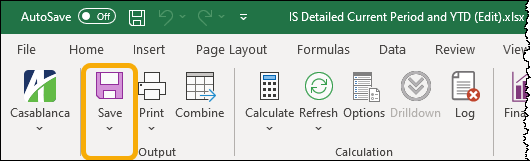

Note 1: Saving a workbook stored in ActivReporter

When a workbook is stored in ActivReporter, you must save the workbook in two places:

-

In Excel. Close the workbook and save when prompted, select the File tab and then select Save, or click Save in the ActivityHD ribbon.

-

In ActivReporter. Save the financial design record.

Note 2: Multi-company financial statements

When you need to create financial statements which combine data from two or more separate companies (i.e., databases), you can choose which ActivReporter company "hosts" the financial design; it does not matter which company you choose. The internal security for each company dictates whether you can access the data stored in the various company databases. Of course, if companies are delineated by using a segment of the chart of accounts, the issue of where to store the financial design is avoided.

Compound formulas in an Excel cell

Compound formulas in Excel workbooks occur when there are two Activity functions in the same cell combined by an addition (+) operator. For example:

=Balance("", "GL.Account=000-1100-00", , "Fabrikam") + Balance("", "GL.Account=000-1100-00", , "Fabrikam")

Avoid this construction because the drilldown feature can only drill down to the first function. To work around this limitation, place the two components in two distinct cells (columns). If you don't want to see these cells in the final output, you can hide them.

Use the ItemExpression function to simplify setting two strings equal

Parameters in a function often require you to set two strings equal to one another. For instance:

GL.Account = 000-1100-00-A

or

GP Balance Sheet = 032

The first example is not problematic. However, the left side of the second example is a string that includes spaces, so we must enclose the string in quotes so that the parameter parser can work properly; in other words:

"GP Balance Sheet" = 032

But this is still a problem because the parameters of a function are strings themselves, so they must likewise be enclosed in quotes. The natural solution seems like:

""GP Balance Sheet" = 032"

However, this still isn't a proper construction since the parser requires you to "escape" quotation marks. Therefore, the proper formulation for the parameter is:

"""GP Balance Sheet"" = 032"

The complexity increases when you use indirect references in cells such as:

GP Balance Sheet = $A7

To be parsed correctly, this must be written as """GP Balance Sheet"" = "&$A7

To avoid this confusion, there is a special ActivReporter ItemExpression function which simplifies equating two strings even if the strings contain spaces.

The function parameters in the examples above can be written as follows using the ItemExpression function:

ItemExpression("GP Balance Sheet", "032") [Note: "032" must be enclosed in quotes so that it is not interpreted as "32".]

ItemExpression("GL.Account", "000-1100-00-A")

ItemExpression("GP Balance Sheet", $A7)

The ItemExpression function can accept an unlimited number of item/value pairs.

ItemExpression(A1,A2,B1,B2,C1,C2,...) equates to "(A1=A2 AND B1=B2 AND C1=C2 AND ...)"

Note

Always quote both string parameters (i.e., "032" and "000-1100-00-A") unless the parameter is a reference to a cell (e.g., $A7) that is formatted as a string in Excel.

Tips for designing HUGE workbooks

ActivReporter can switch between "live data" mode and "non-live data". Live data updates your workbook with the current contents of the database whenever you press F9 in the financial design. You can control which mode ActivReporter is using by marking or clearing the Use Live Data checkbox in the Financial Options dialog. You can access the dialog by clicking Options in the ActivityHD ribbon.

If you are designing a huge workbook of many pages, your user experience may be improved by working with live data turned off. Alternatively, you can use Shift+F9 to update only the current worksheet instead of updating the entire workbook.

Publishing financial designs (workbooks)

There are several ways to publish/print your financial designs including:

- Excel's print function

- Right-click option on ActivReporter's Financial Designs folder

- Account Financial Report augmented with BOTs

Printing in Excel

When a workbook is open in Excel, Excel's print and save features are available. These are the primary ways to "publish" during the design process. Once the design is finalized, however, it is preferable to use another method to publish it since any time you open a workbook you run the risk of making inadvertent changes to the design.

Publish Financials option on the right-click menu of the Financial Designs folder

This method is AccountingWare's recommended method for publishing financial designs. The advantages include:

- Availability of iteration

- Ability to limit results by accounts, account segments, or rollups

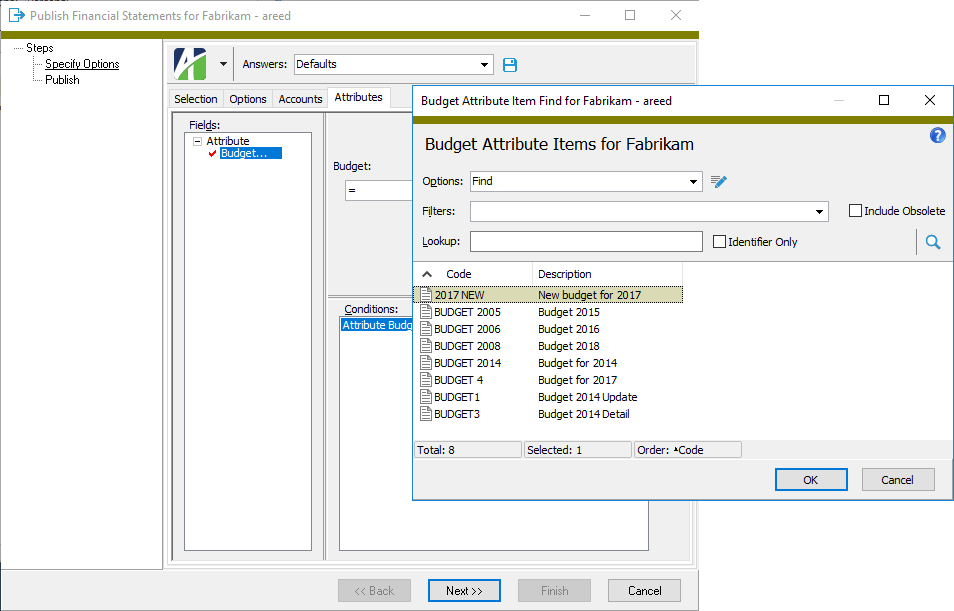

- Ability to switch budgets at runtime

- Elimination of accidental changes to the finalized design

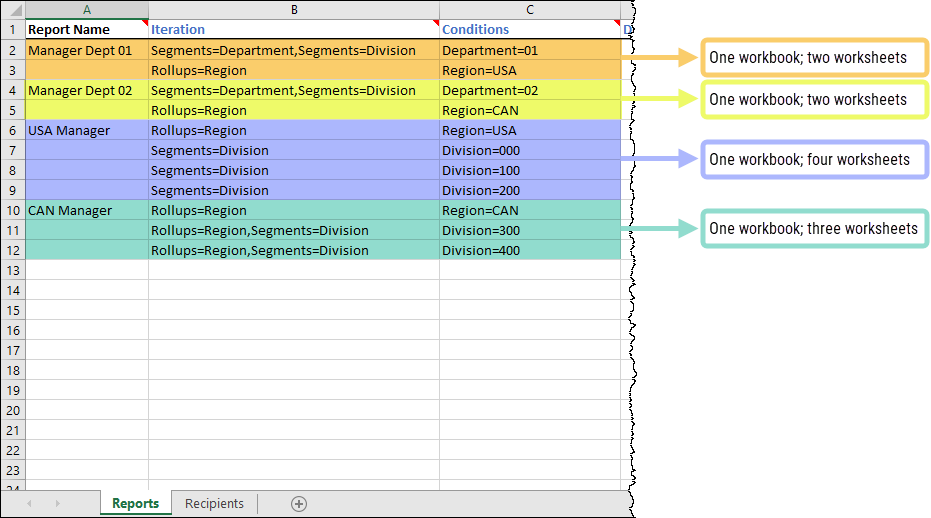

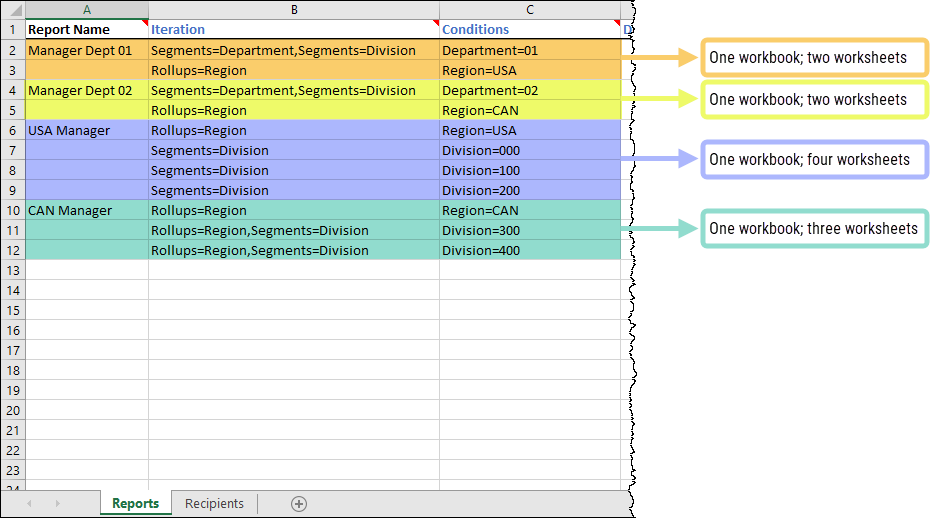

Iteration

Using iteration allows you to publish multiple financial statements with a single instantiation of a report. For instance, with one financial design you can use iteration to produce reports for each division/company/department/etc.

Limiting results by account(s), account segment(s), or rollup(s)

You can use the Publish Financial Statements wizard to filter a financial statement to a specific set of accounts, account segments, or rollups.

Switching budgets at runtime

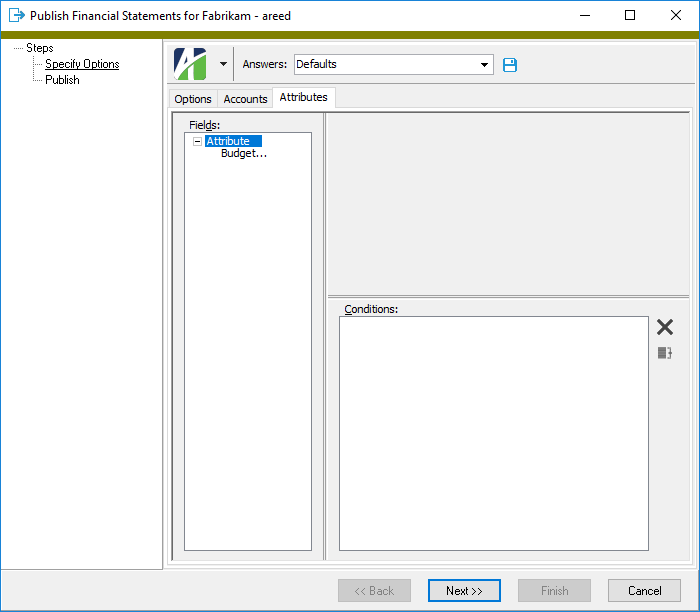

Many companies have multiple budgets active at any given time in Dynamics GP. If the financial statement is designed using the generic budget ledger (B), when it is published the user can select which budget to use in budget comparisons. You can do this by selecting the budget from the Attributes tab in the Publish Financial Statements process.

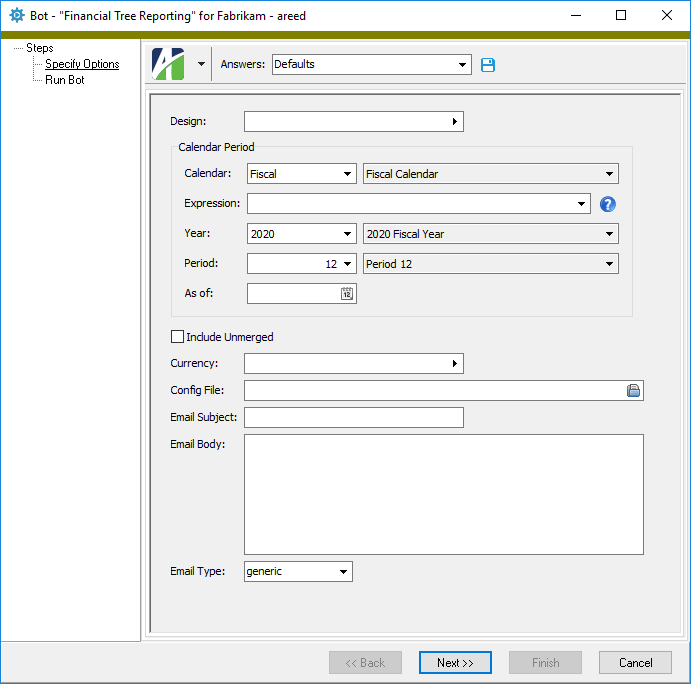

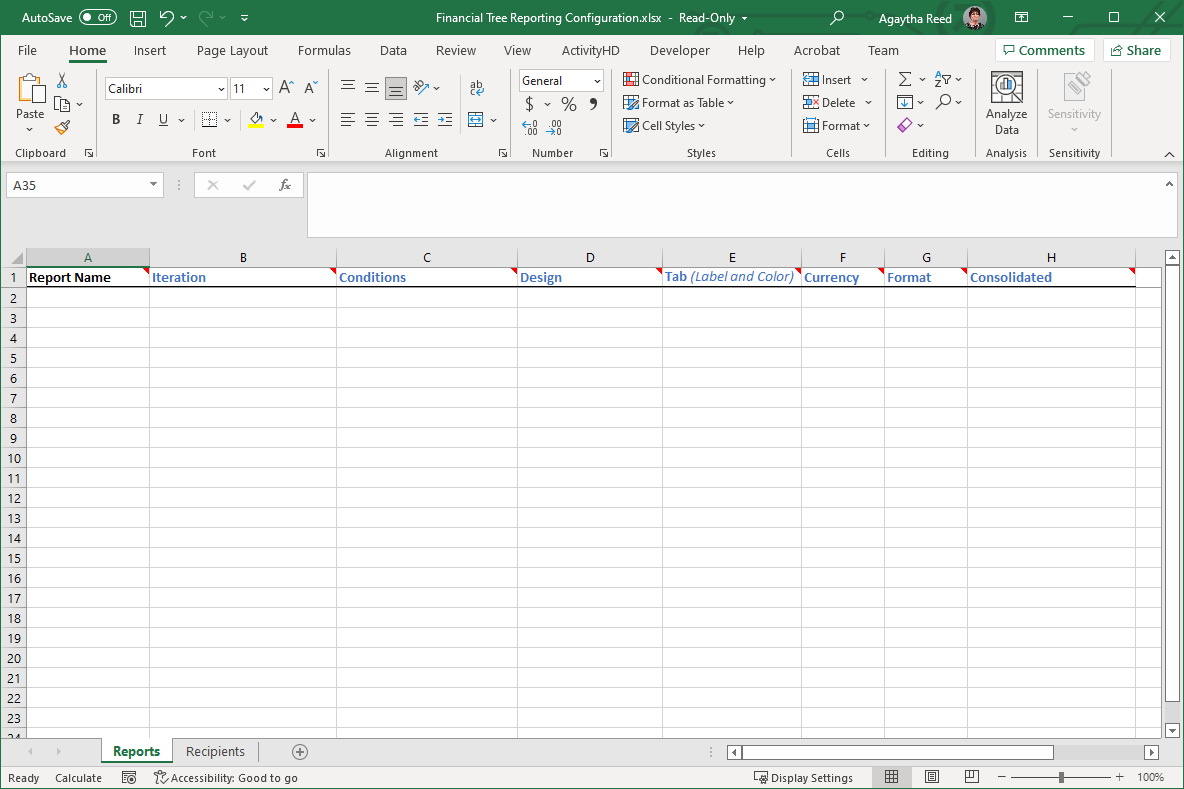

Account Financial Report augmented with BOTs

The Account Financial Report is a special report located at ActivReporter > Reports > Account Financial Report or ActivReporter > Chart of Accounts > [right-click] > Select and Report > Account Financial Report. This report is used primarily in conjunction with BOTs in order to automate the process of generating financial reports. BOT creation requires someone skilled in using VBScript or JScript.

BOTs can provide the capability to:

- Produce a set of financial reports

- Email specific financial reports to specific people

- Store specific financial reports in a specific location or library

- Attach specific financial reports to specific financial designs using a naming convention

BOTs are not a standard component of ActivReporter. BOTs are programmed to suit each individual customer's specifications and can be a tremendous time saver when properly designed and deployed.

Financial design presentation

While there are several ways to present your financial designs, the two most common are:

- Excel workbooks with numeric data only (no formulas)

- PDFs

Excel workbooks with numeric data only

If your goal is for the financial statement consumer to investigate the numbers in a financial statement, then disseminating statements as Excel workbooks is a logical choice. Distributing statements in this way retains the drilldown to detail function on financial amounts as well as drillback to Dynamics GP.

PDFs

PDFs are static and suitable for printing or saving to a library in the Windows file system or for attaching to the financial design record itself in ActivReporter.

Iteration hint

If you produce 15 financial reports using iteration and find errors in one or two of them, what should you do? Browse to the folder that contains the financial statement output and delete the statement(s) with errors. When you run the iteration again, you can opt to skip the regeneration of any statements which already exist in the output folder.

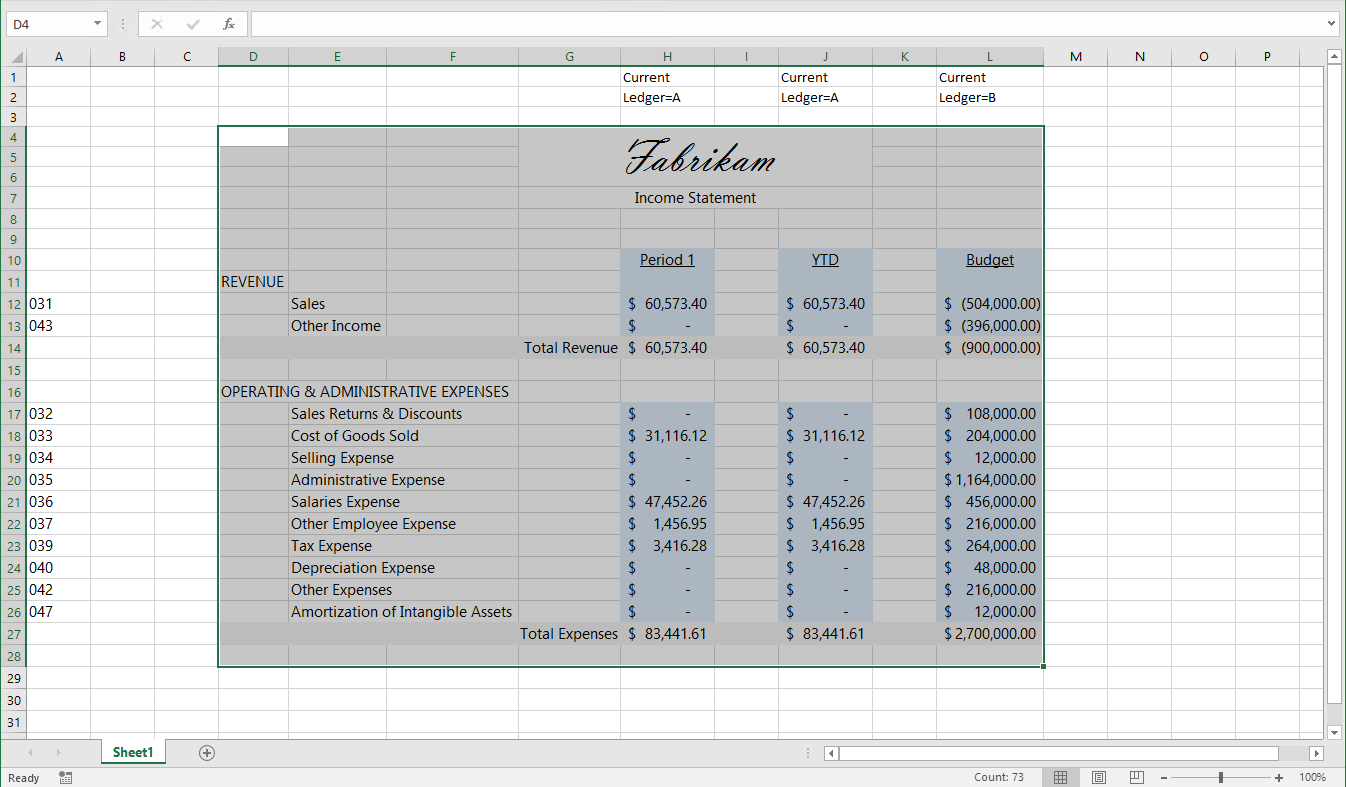

Reserving the first three columns and rows of a worksheet for indirect references

ActivReporter does not require any special row or column reservations. Every Excel financial function can be self-contained and free of indirect references.

On the other hand, ActivReporter financial designs can often benefit from the use of indirect references. If you choose to do so, we recommend you use a few of the left-most columns and top-most rows for this purpose. This recommendation is not mandatory; in fact, you can use any rows and columns for indirect references and then hide them in your final presentations. You can even use other worksheets in your workbook to manage indirect references.

Indirect references can be used to refer to ledgers, periods, accounts, rollups, and other items which support the financial design process. Refer to the sample reports to observe how indirect references can be used in financial designs.

Create a financial design from a blank Excel worksheet

Create a financial design from a blank Excel worksheet

The discussion that follows assumes that you have an intermediate knowledge of Microsoft Excel, including Excel functions (like SUM, COUNT, DATE), relative cell referencing, and formatting principles.

In addition, you should have a general knowledge of ActivReporter's extended function library for Excel plus ActivReporter's expression syntax and how to apply it.

Tip

The usual Excel commands are enabled when you are working on financial designs. Notably, the Split and Freeze Panes commands are available on the View ribbon.

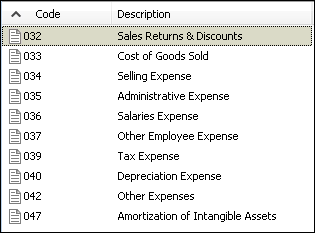

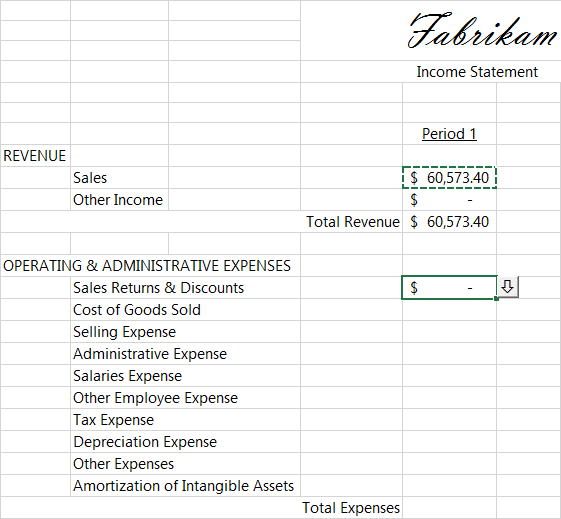

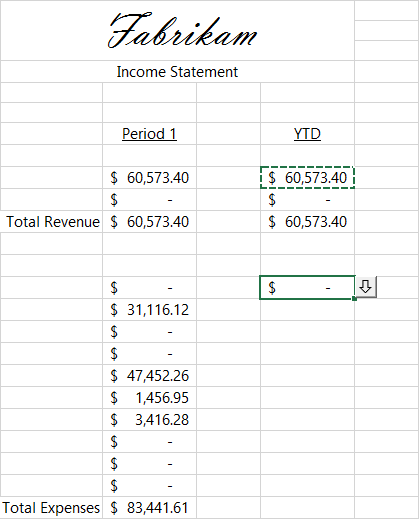

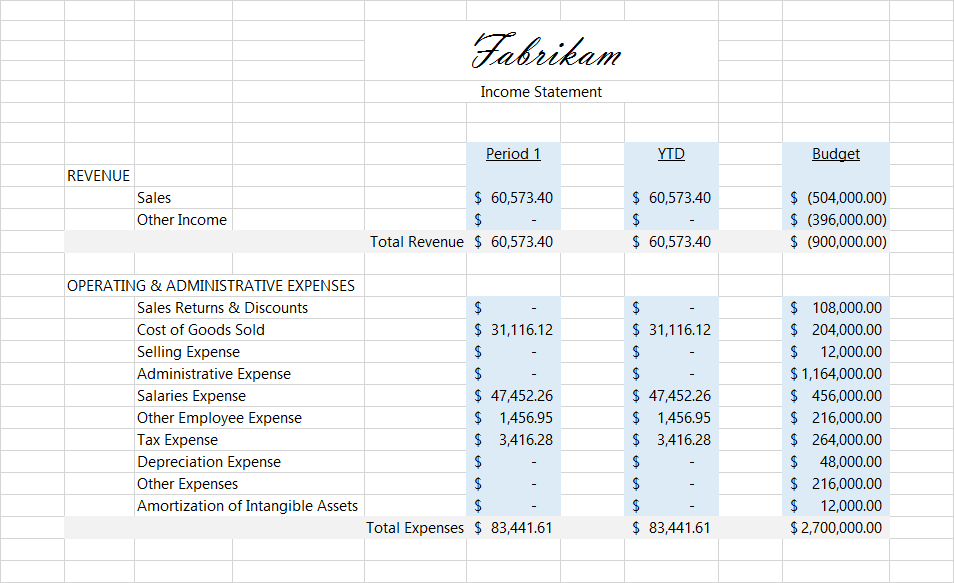

We'll illustrate the basic principles of financial design by creating a simple income statement.

Step 1: Design the financial statement on paper

Ask yourself a few questions:

- What should the general layout look like?

- What information do I want to present?

- How should I organize that information on the statement?

- How will I label the columns and rows on the statement?

- Do I have the rollups I need to group the accounts for reporting?

- Which ActivReporter formulas do I need to pull in the data I want?

- Which Excel functions do I need to summarize the data?

After you've answered the questions and gathered the facts you need, sketch the statement out on paper as a guideline while you implement your design.

Step 2: Create new rollups and rollup items if needed

For an income statement, it would be good to have a rollup representing revenues with rollup items that represent the categories of revenue we want the statement to show. Likewise, we should include a rollup for expenses with rollup items that represent the categories of expenses we want to show.

- Create rollups.

- Add appropriate rollup items to the rollups.

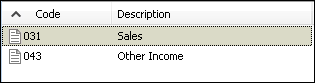

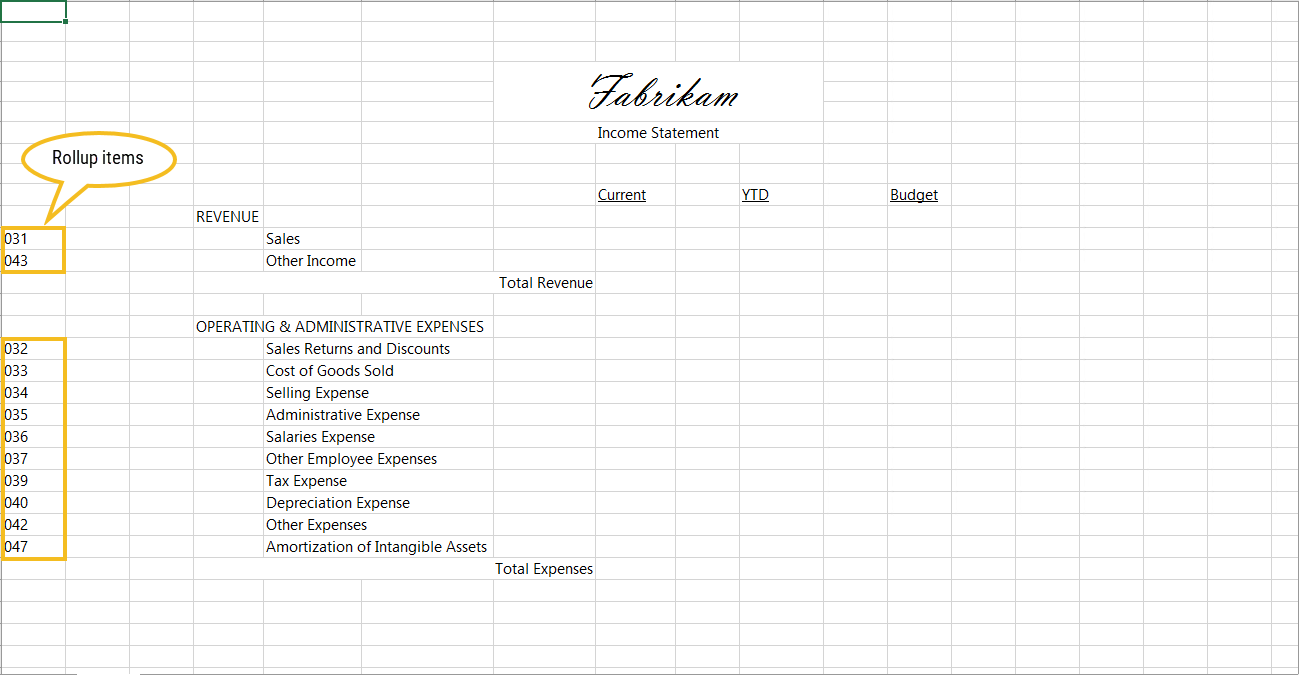

For our example, we are using a rollup called "REVS" for revenues. REVS has the following rollup items:

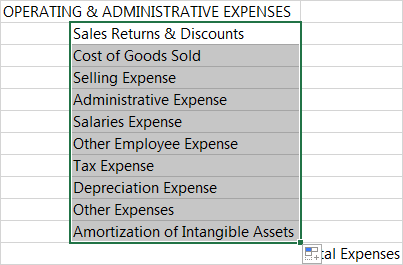

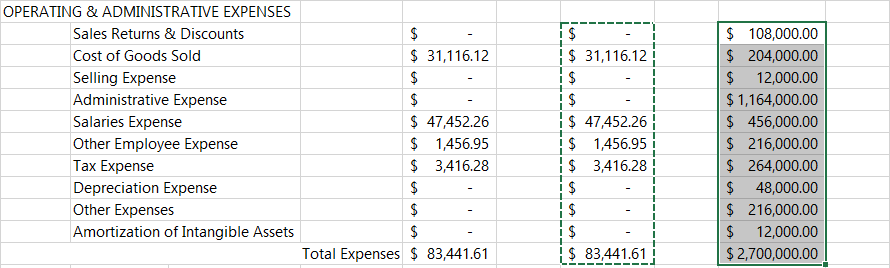

"EXP" is our rollup for expenses. It has the following rollup items:

Note

We could have created one rollup with both the revenue and expense items we need. Indeed, that would simplify our process a bit because it would allow us to make greater use of the fill feature and of copy and paste. However, for this illustration, we'll distinguish between the revenue rollup and the expense rollup.

Step 3: Add report headings and labels

Literal text can be entered in any cell of an Excel worksheet.

Enter the headings and labels you need. Some of these, like the report title and column headings may remain static; some we may automate later by replacing the labels with formulas. For now, we'll enter headings and labels to serve as placeholders. You can apply text formatting now or later.

Step 4: Create a "cheat column"

We're going to need to reference the rollup items which correspond to each of the rows in our income statement. In a column to the left of the rows where we need to bring in values from rollup items, type the rollup item codes that correspond to each row.

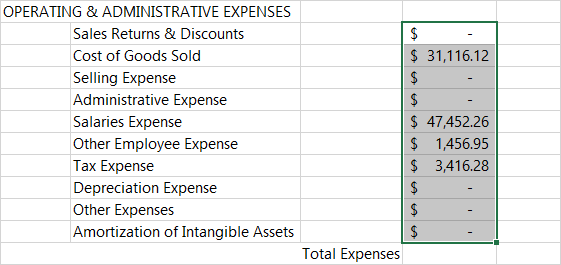

Step 5: Use ActivReporter functions to pull data into the report

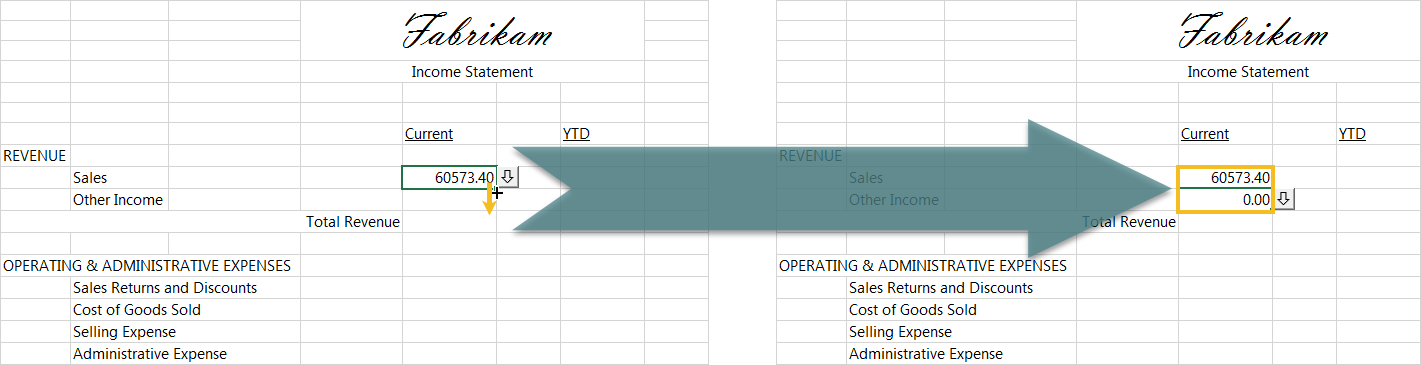

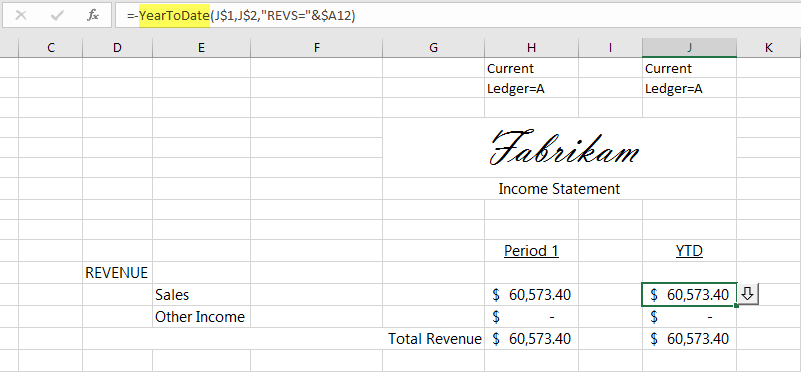

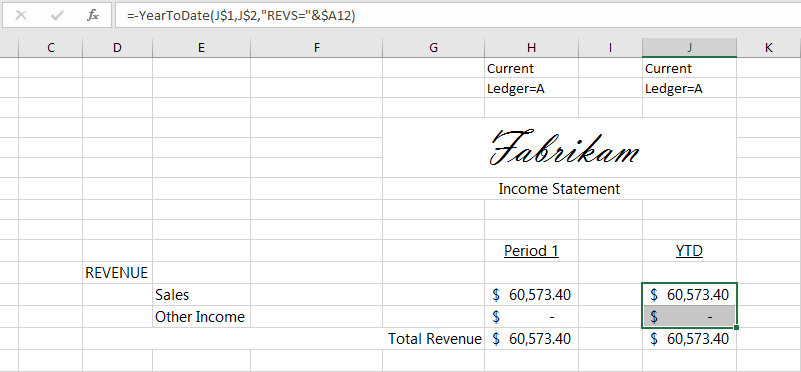

We'll start in the "Current" column of the REVENUE section.

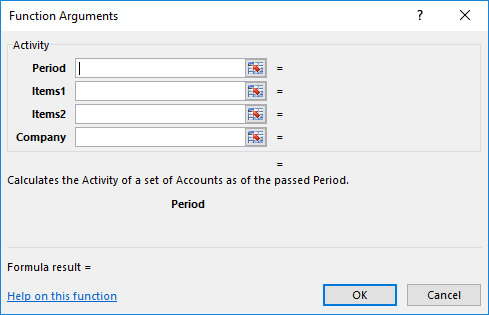

In the case of the our income statement, we want to see the current activity in each of our revenue categories. The function we need to do that is the Activity function. The arguments of the Activity function are Period, Ledger, Account(s), Company, and Unit.

- Place your cursor in the cell where you want to insert a value.

-

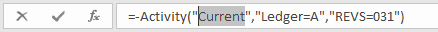

In the ActivityHD ribbon in the Functions group, select Financial > Activity. The Function Arguments dialog box opens.

- In the Period field, enter a period expression for the current period such as "Period 1 of 2016".

- In the Items1 field, enter a segment expression for the ledger such as "Ledger=A".

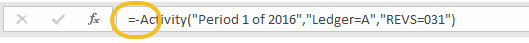

- In the Items2 field, enter a segment expression for the accounts. In this case, we'll use a rollup and designate the rollup item we need; for example, "REVS=031".

- Click OK.

- We need the negative of the calculated activity amount, so in the formula bar, type a minus sign after the equal sign and before the Activity function name.

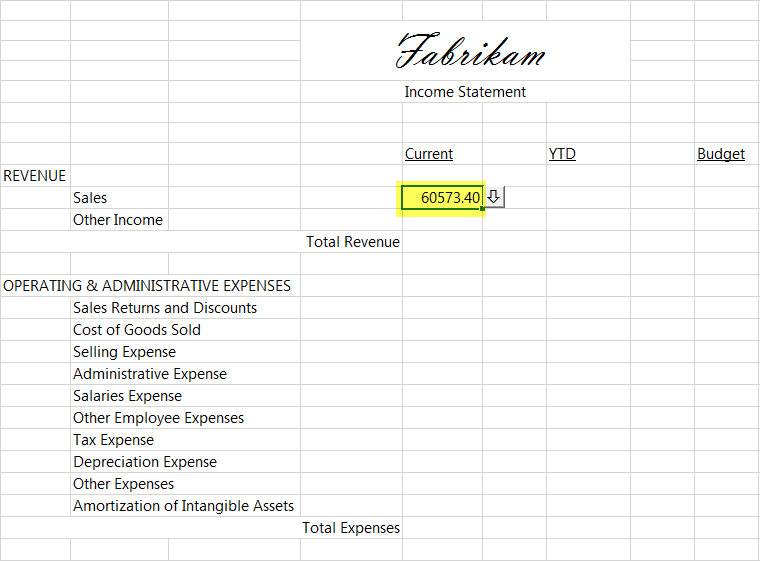

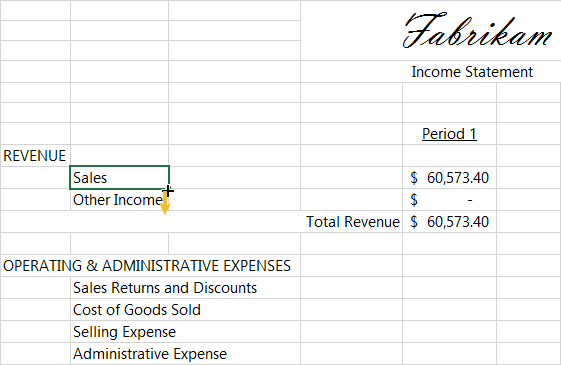

Notice that the amount for the sales revenue for the current period has been pulled into the design (provided you requested live data when you set up the design).

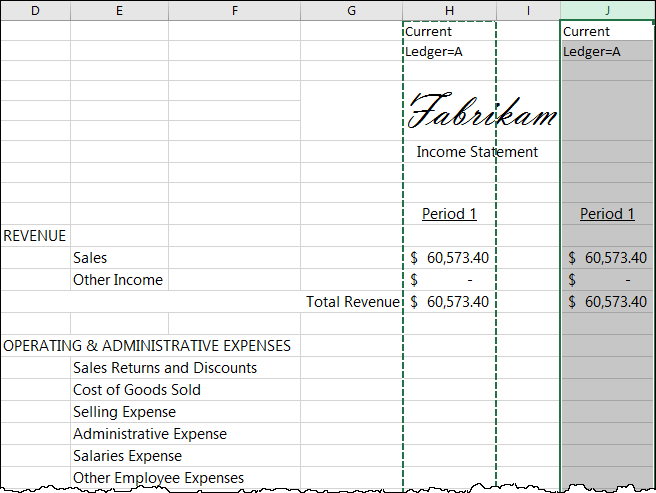

- We want to generalize the report so that it will work for any period, ledger, or account(s). To do so, we'll use relative cell referencing.

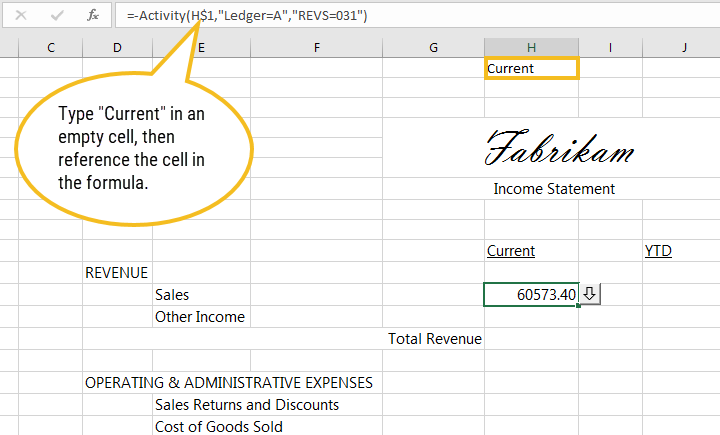

- Instead of specifying a particular "current" period, we want the design to report on whichever "current" period the user specifies when the report is run. To do this, we'll replace the specific period expression with the period expression "Current".

Since we'll be referring to "Current" for every revenue and expense in the "Current" column, let's go a step further and replace it with a relative cell reference. First, type "Current" in a cell somewhere in the rows above the title. Next, select the calculated cell again and go to the formula bar and replace "Current" with the relative cell reference.

Note

Notice that this cell reference uses a relative column and absolute row.

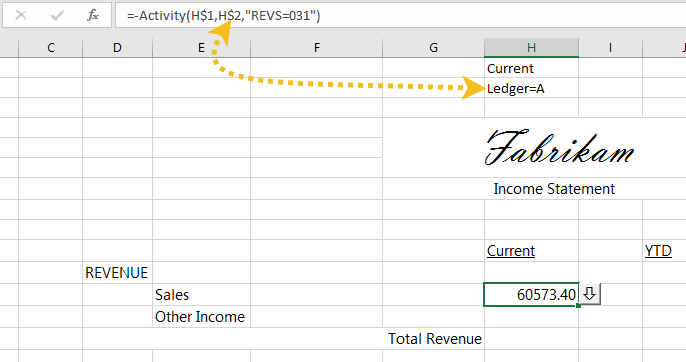

- We'll also be referring to Ledger A for every revenue and expense in the "Current" column, so let's use a relative cell reference for it as well. First, type "Ledger=A" in a cell somewhere above the title. Next, select the calculated cell, go to the formula bar, and replace "Ledger=A" with the relative cell reference.

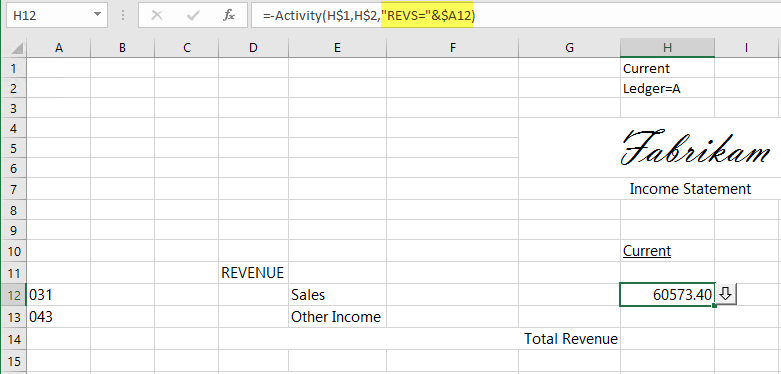

- Finally, let's generalize the segment expression that refers to the rollup we are using to derive the accounts we need. This is where our "cheat column" comes in. Instead of referencing the service rollup item by name, we can refer to the cell where we stored its name. Select the calculated cell and delete the rollup item name only (leave the closing quotation mark). We're going to concatenate the cell reference to the literal part of the expression, so after the closing quotation mark, type an ampersand (&) followed by the cell reference.

Note

Notice that this cell reference uses an absolute column and relative row.

- Instead of specifying a particular "current" period, we want the design to report on whichever "current" period the user specifies when the report is run. To do this, we'll replace the specific period expression with the period expression "Current".

- Next, we'll use the power of Excel to populate the row for the remaining revenue category. Select the cell we've already calculated, then click and drag its fill handle to fill in the value.

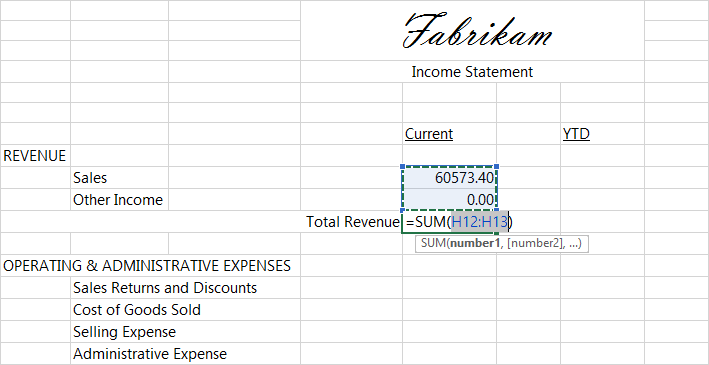

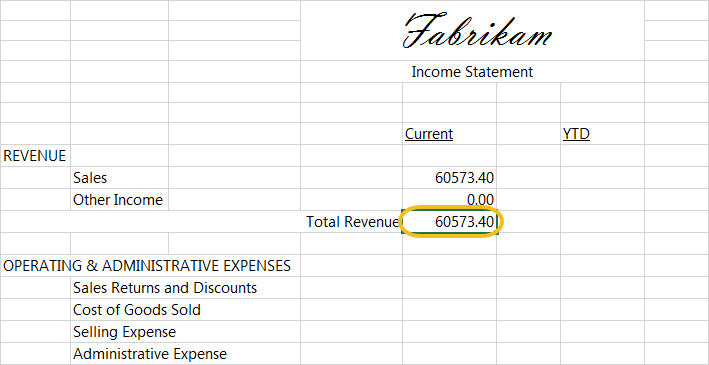

- Let's use Excel's SUM function to get a total for the revenue items. Highlight the cell where the Total Revenue row and the Current column meet. On Excel's Home tab in the Editing group, click

.

.

-

Press Enter to accept the highlighted range of cells and insert the sum.

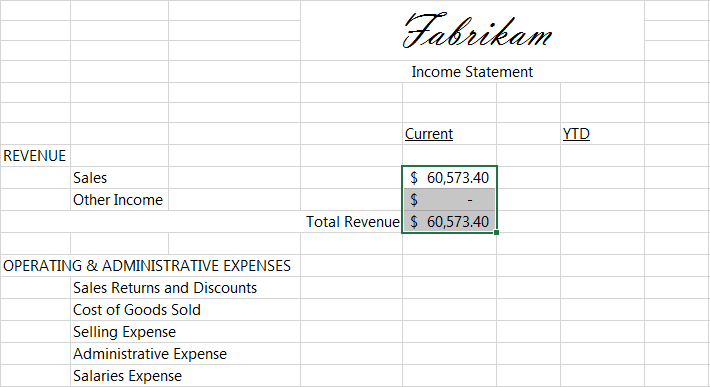

- Select the values in the Current Revenue section and format them as currency.

-

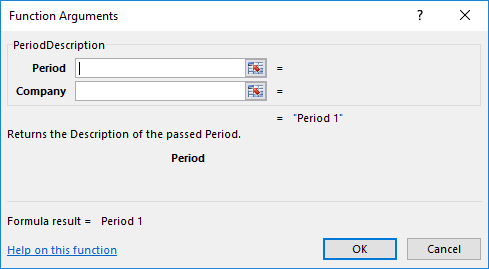

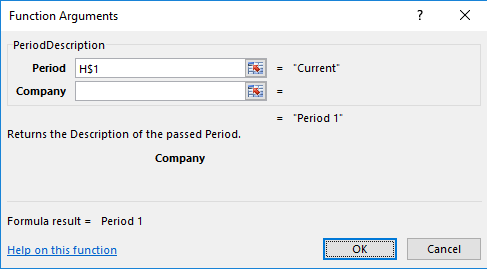

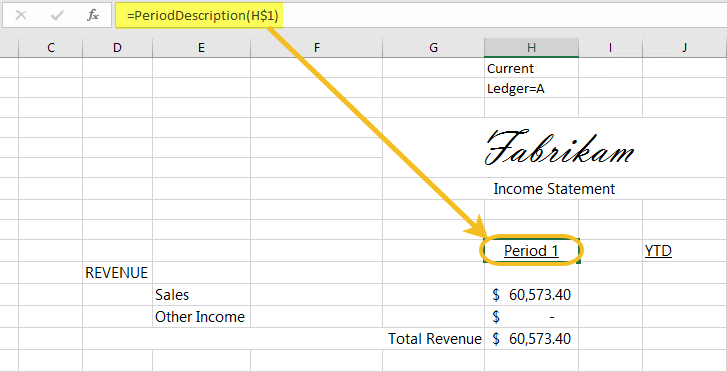

Let's make the label on the Current column dynamic. To do so, highlight the cell with the "Current" label and from the ActivityHD ribbon in the Functions group, select Periods > Period Description. The Function Arguments dialog box opens.

-

In the Period field, reference the field where you stored the text "Current".

-

Click OK.

-

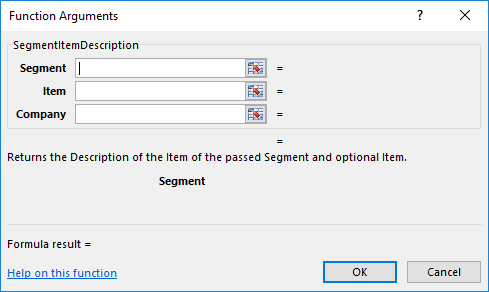

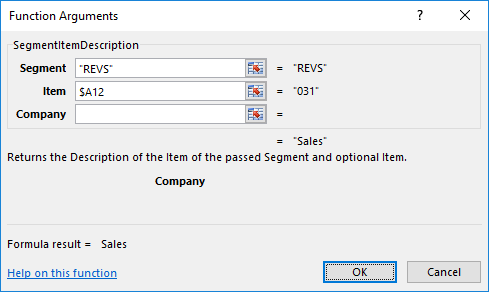

Next, let's make the category labels dynamic as well. Highlight the cell with the first category label and from the ribbon in the Functions group, select Segments > SegmentItemDescription. The Function Arguments dialog box opens.

-

The SegmentItemDescription function has three arguments, Segment (or rollup), Item (segment item or rollup item), and Company. In the Function Arguments dialog box in the Segment field, enter the name of the revenue rollup. In the Item field, enter a relative cell reference to the cell that contains the first rollup item name.

-

Click OK.

-

Finally, drag the fill handle on the first revenue description down to the last revenue description.

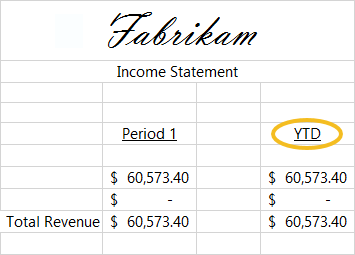

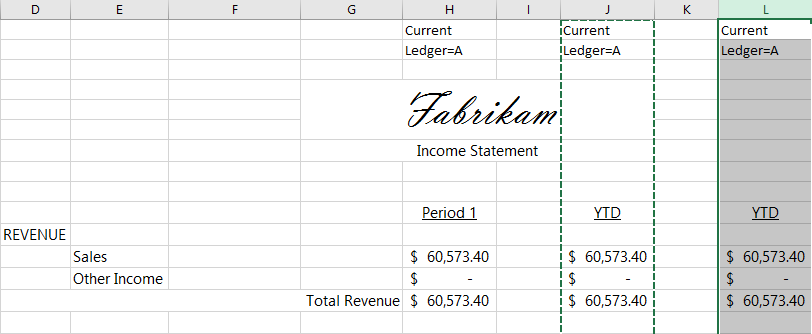

- Select the column formerly known as "Current", copy it, and paste the content into the YTD column.

- Replace the label on the revenue year-to-date column with the literal text "YTD" or some variation thereof.

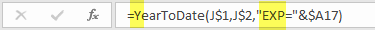

- To show year-to-date amounts, we need a different function. Not surprisingly, that function is called YearToDate. Select the cell for the first category in the YTD column. In the formula bar, replace the function name "Activity" with "YearToDate".

- Drag the fill handle on the cell that contains the amount for the first year-to-date category and drag down through the row for the last category. The formulas for these cells are updated to use the YearToDate function. (The values in our example for the current and year-to-date columns are equal because the current period we selected in the design set-up window is "1".)

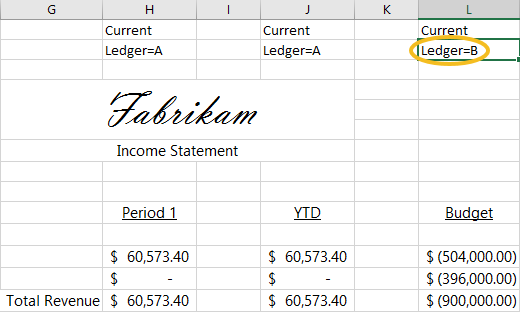

- To fill in the budget numbers for the REVENUE section, start by copying the column that contains the year-to-date information to the column reserved for budget information.

- Replace the "YTD" label in the Budget column with "Budget".

- To arrive at budget numbers, we need to show numbers from the budget ledger, "B". Since we used relative cell referencing for the ledger, we simply need to change the literal text we referenced for the ledger from "Ledger=A" to "Ledger=B".

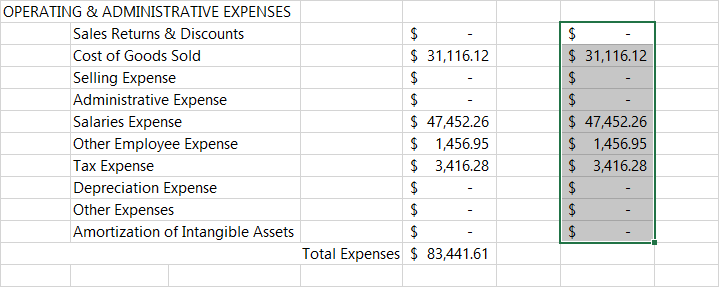

- Now let's turn our attention to the EXPENSES portion of the report. First, let's make the category names in the EXPENSES section dynamic. Copy the cell in the REVENUE section that contains the first category label and paste it in the cell in the EXPENSES section that contains the first category label. When you paste, use the Paste Special > Formulas option.

- In the formula bar, change the first parameter to refer to the name of the rollup that contains expense rollup items.

- Drag the fill handle on the cell that contains the first category name in the EXPENSES section to the last category name in the EXPENSES section. The labels are updated accordingly.

- Copy the cell that contains the current revenue for the first revenue category and paste it in the cell that contains the current expenses for the first expense category.

- The difference in the values we needed for REVENUE and the values we need for EXPENSES lies in the rollup. In the formula bar, change to the rollup name that contains your expense rollup items and remove the negative sign in front of the function name.

- Drag the fill handle on the cell that contains the current expense amount for the first expense category to the last expense category.

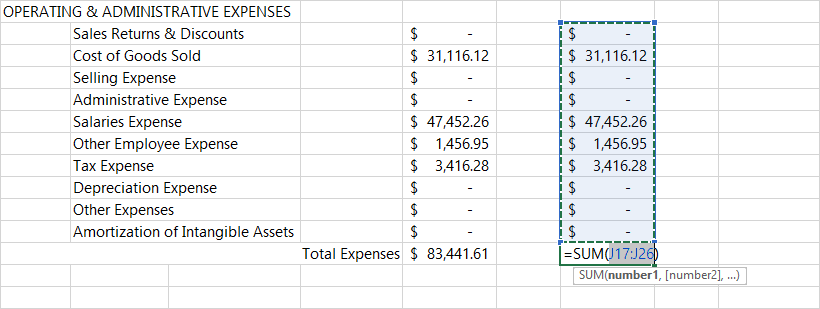

- Use the SUM function to calculate total expenses for the current column.

- In the REVENUE section, copy the year-to-date entry for the first revenue category and paste it in the cell that corresponds to the year-to-date entry for the first expense category.

- In the formula bar, change the rollup name to the name of the rollup that contains the expense rollup items and remove the negative sign.

- Drag the fill handle down to the last expense category in the year-to-date column.

- Use the SUM function to calculate total expenses for the year-to-date column.

- Copy the year-to-date values in the EXPENSE section (from the first category through the total expenses) and paste them in the corresponding cells of the Budget column in the EXPENSE section.

-

Apply any formatting you want to improve the presentation of the report.

-

With Excel open to the design worksheet you want to print, click in the upper leftmost cell you want to print and drag to the bottom rightmost cell you want to print.

- From the ActivityHD ribbon in the Layout group, select Print Area > Set Print Area.

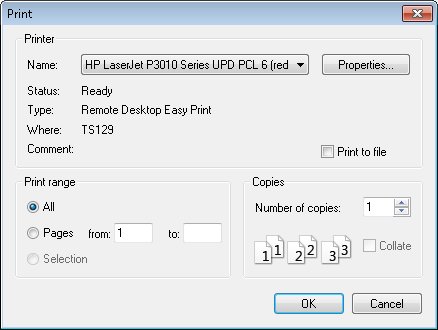

- In the Output group, click Print. The Print dialog opens.

- Select the print options you need, then click OK.

- When you finish, save the Excel workbook and close it.

- Save the financial design record.

Tip: Printing a Financial Design

To print the financial design as it is laid out in Excel:

Insert a function in a financial design

Insert a function in a financial design

- Open the Excel worksheet you need to add a function to.

- Select the ActivityHD ribbon.

- In the worksheet, select the cell where you want to insert the function.

- In the Functions group on the ribbon, click the button for the function category, then select the function from the drop-down menu. In most cases, the Function Arguments dialog will prompt you to input argument values for the function.

- Respond to the prompts as appropriate.

- When you finish, click OK.

Suppress rows with zero

Suppress rows with zero

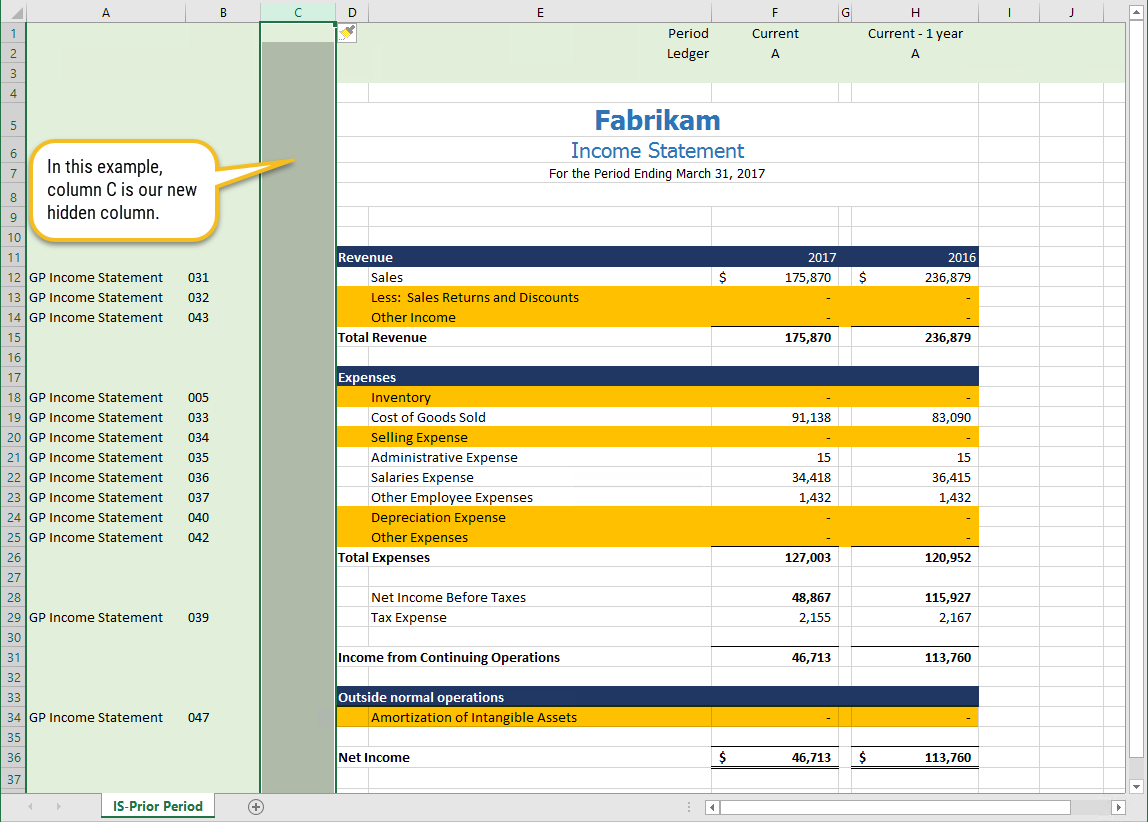

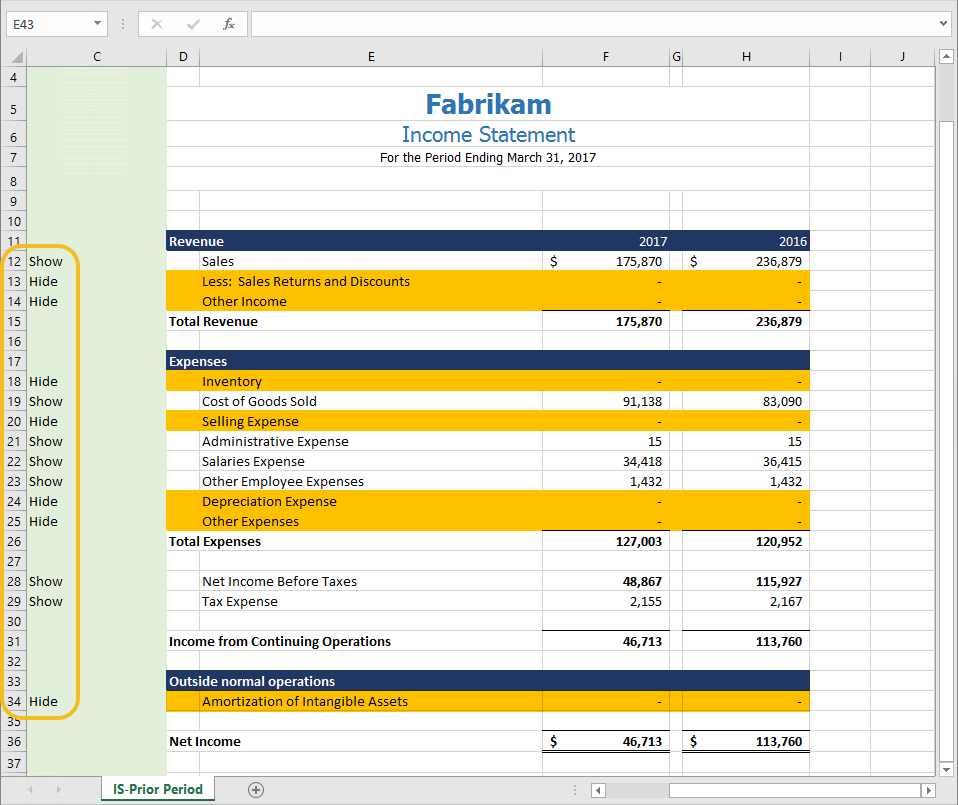

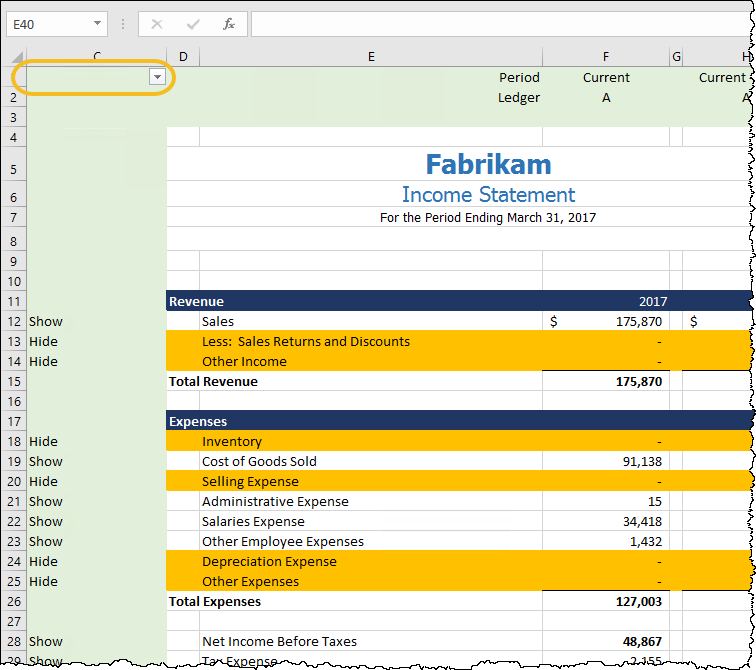

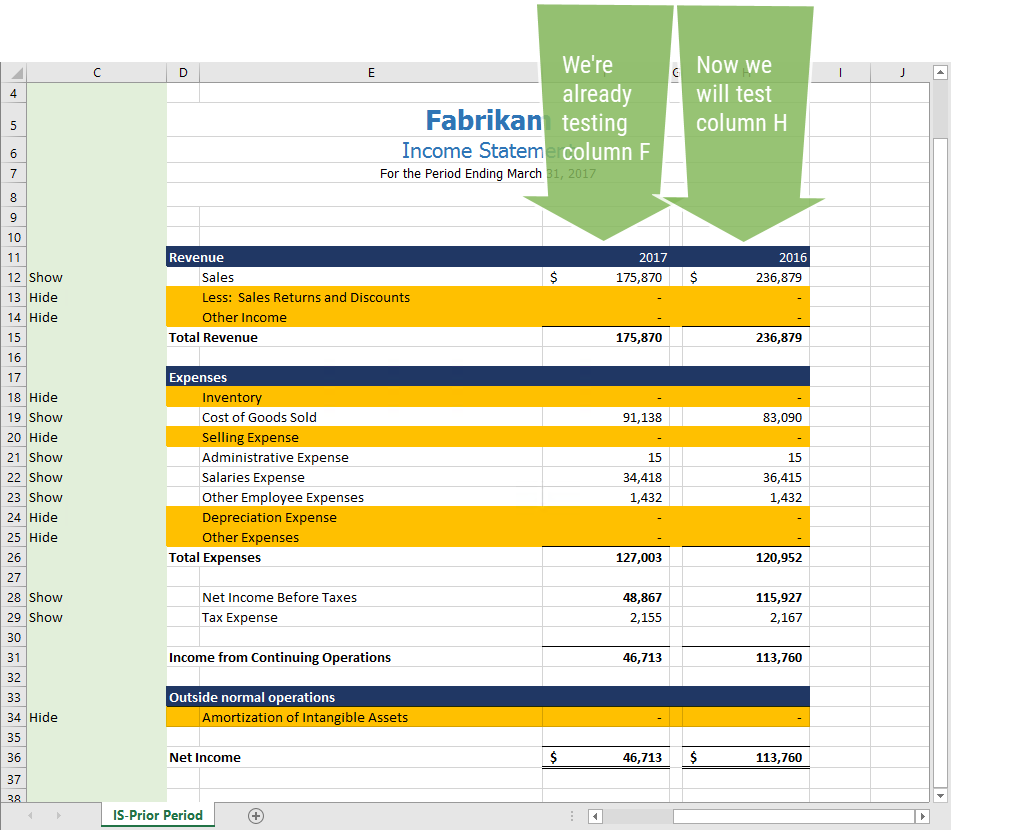

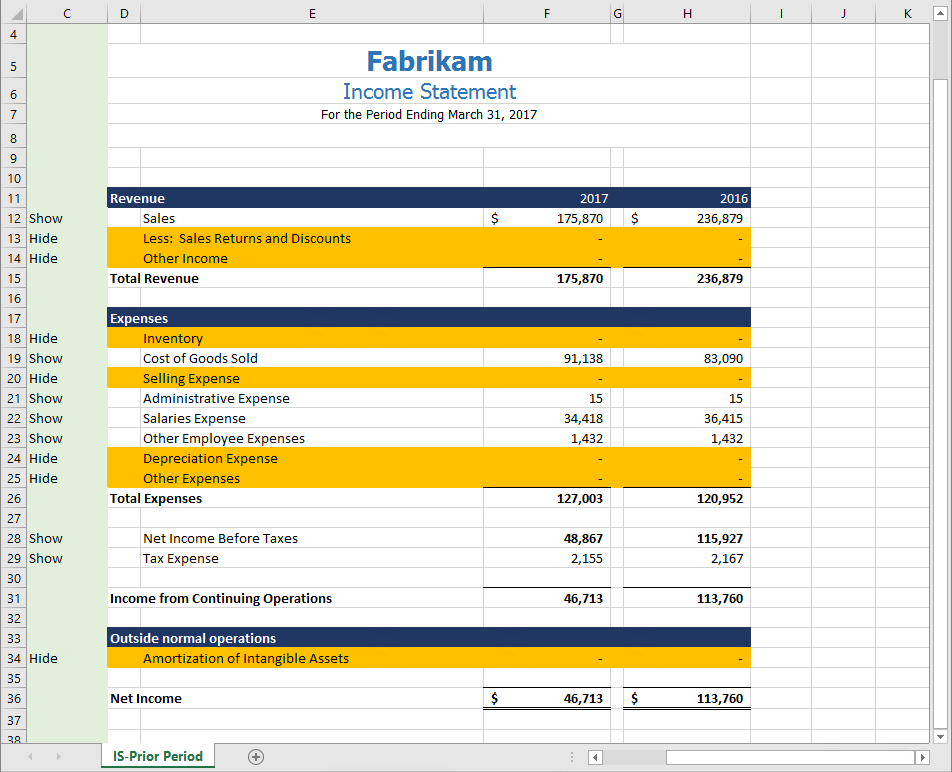

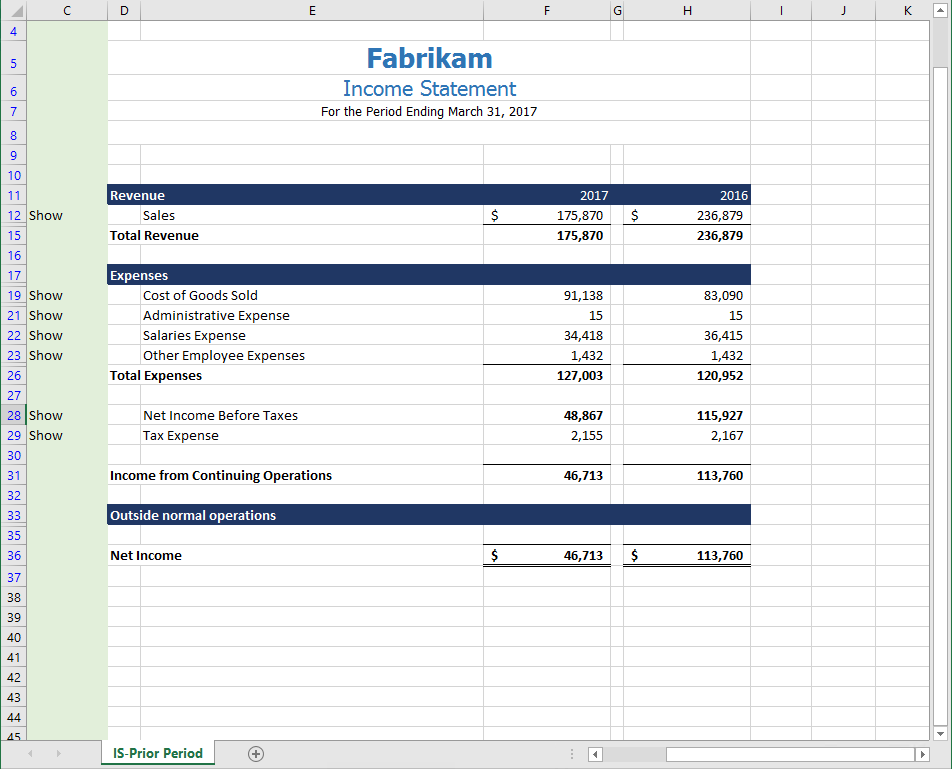

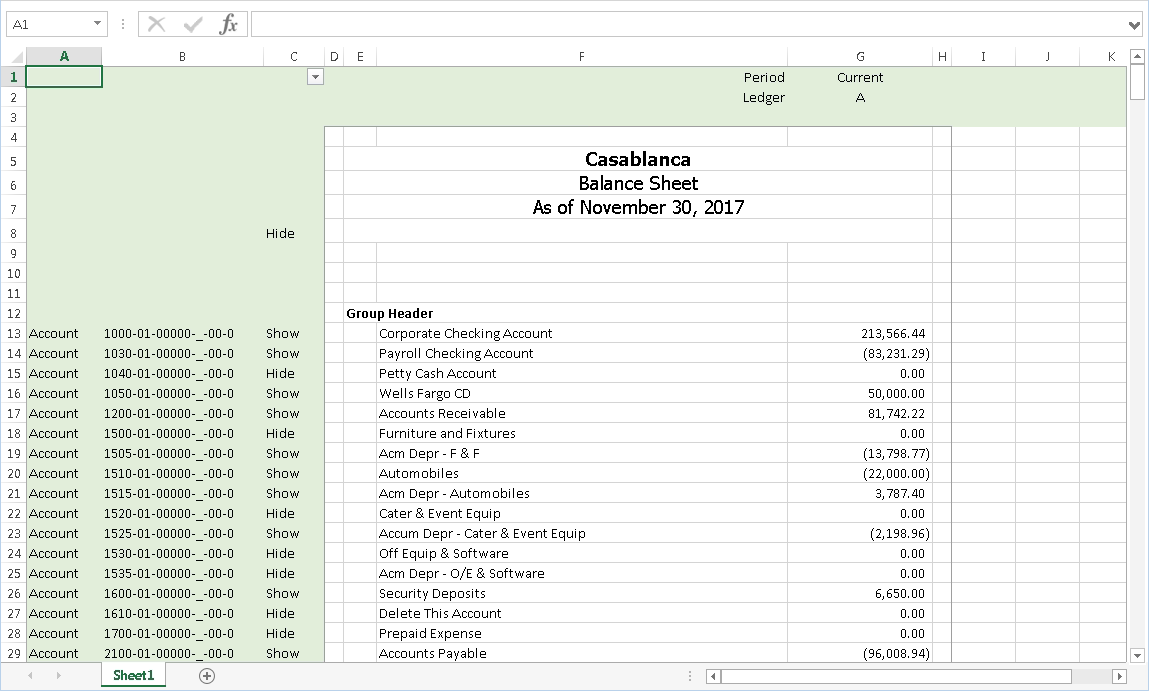

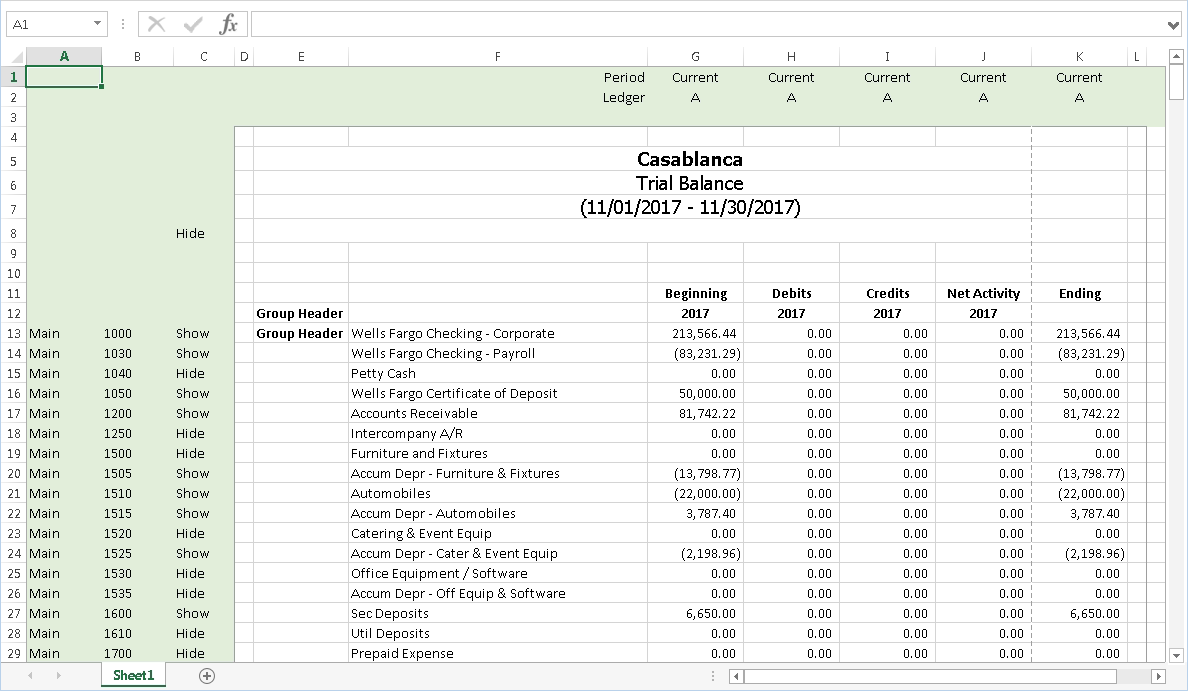

You can suppress rows which contain zeros from your financial statements. In the sample income statement below, notice that the values in rows 13, 14, 18, 20, 24, 25, and 34 are zeros.

Note

The procedures below describe how to perform actions in Excel 2013. Consult Microsoft's online help to learn how to accomplish the same results in your version of Excel.

Hidden formula filter method (featuring the IsLiveData function)

This method suppresses rows with zero for printing, but lets those rows show in design mode.

- Open the financial design worksheet, making sure you mark the Use Live Data checkbox in the Financial Options dialog box.

-

Add a hidden column in your financial design.

-

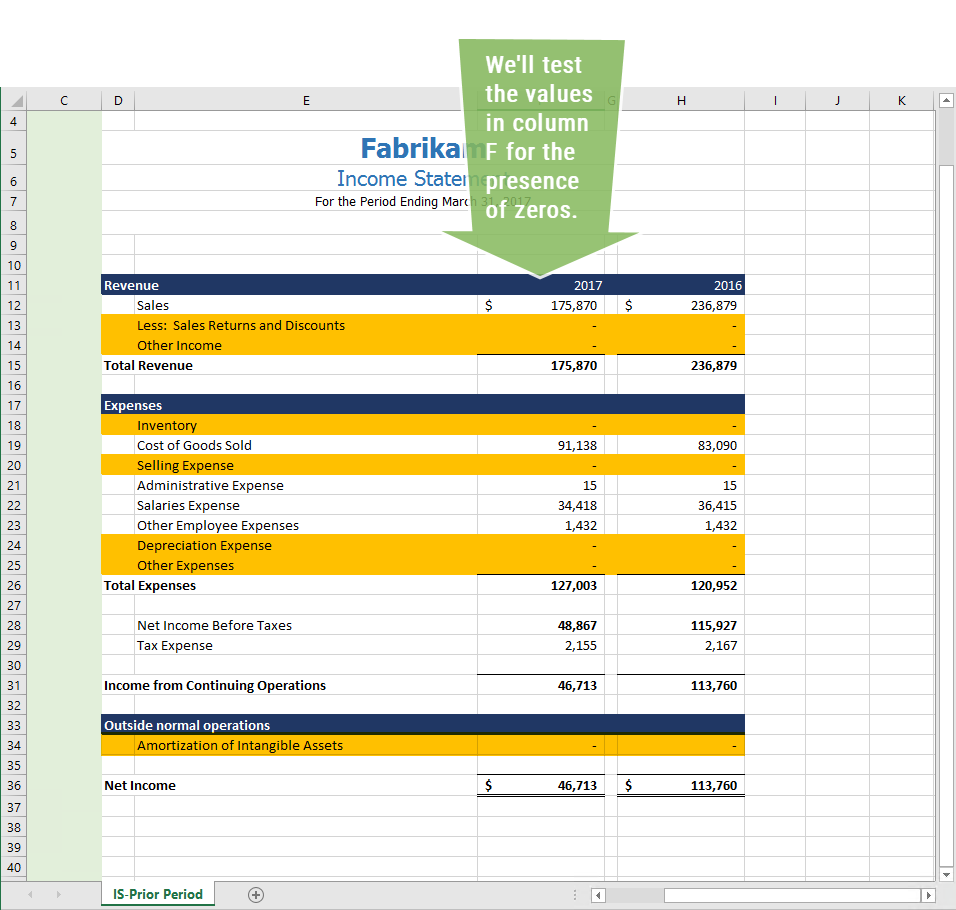

Determine which column to test for the presence of zeros. This will be a column which holds monetary values. (Notice we're moving rows 1-3 and columns A-B out of the view to lessen distraction.)

-

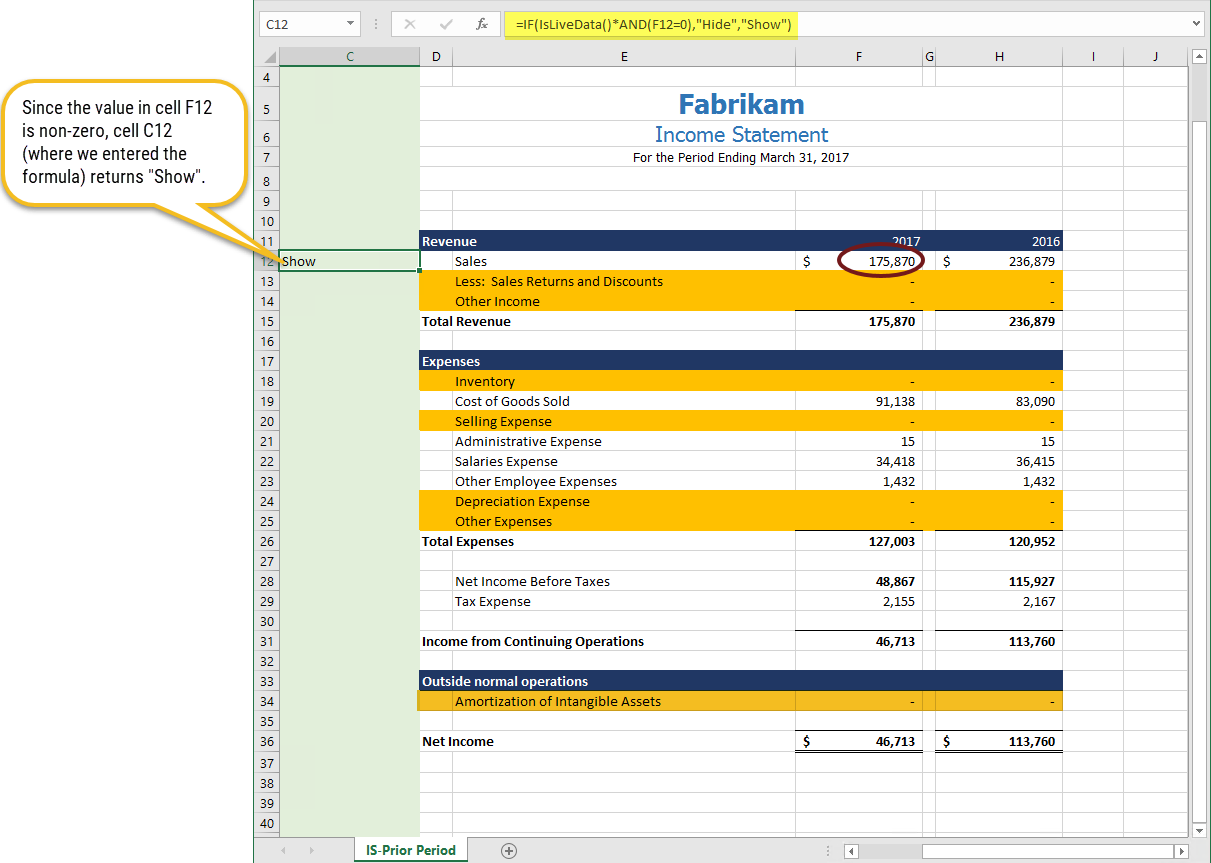

In your hidden column, in the row which corresponds to the first monetary value in the worksheet, enter the following formula, replacing the arbitrary cell position "F12" with the appropriate cell position in your worksheet:

=IF(IsLiveData()*AND(F12=0),"Hide","Show")

-

Continue by copying the formula to the cells in the hidden column which correspond to the rows with monetary amounts in the column you are testing, excluding rows with literal text or totals. If necessary, edit the cell references in the formulas to ensure the references in the hidden column and in the column with values correspond.

-

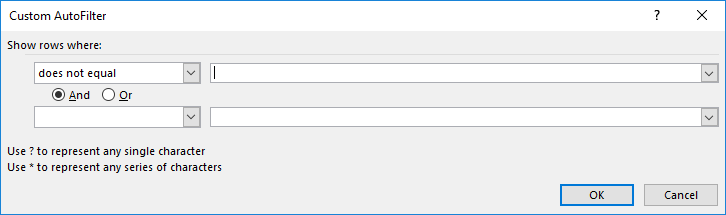

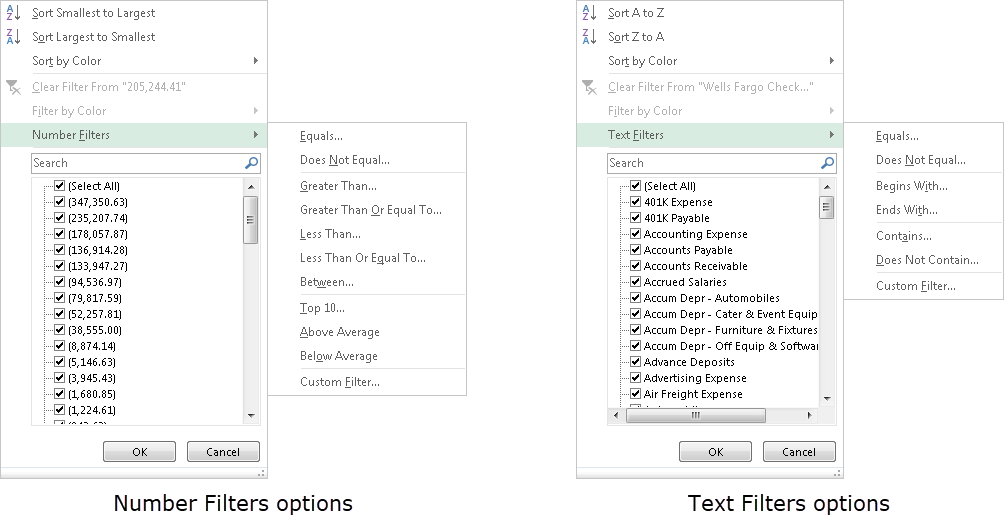

Select the hidden column, then select the Data ribbon and click Filter. A dropdown is added to the first cell in the column.

-

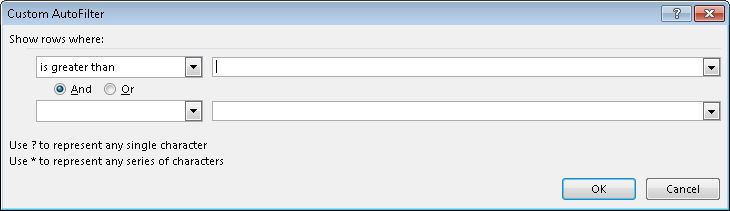

Open the dropdown and select Text Filters > Does Not Equal from the shortcut menu. The Custom AutoFilter dialog box opens with "does not equal" selected in the first Show rows where field.

-

From the adjacent drop-down list, select "Hide".

-

Click OK. The rows that contain "Hide" in the hidden column are suppressed.

- Save your changes in Excel.

- Close the worksheet.

- Save your changes in ActivReporter and close the financial design record.

The formula

To test for zeros we will compose a formula which uses Excel's IF function (aka Boolean function) and ActivReporter's IsLiveData function. The IF function evaluates a condition and performs one action if the condition is true and another action if the condition is false. The IsLiveData function refers to the Use Live Data checkbox in the Financial Options dialog box. When you publish a financial statement, live data is used; when the checkbox is marked, you use live data as well.

We want to hide rows with zero when we're using live data and show those rows when we're in design mode (i.e., not using live data). So, in literal terms, if data is live and the monetary cell(s) on the row are equal to zero, we want to return "Hide"; otherwise, we want to return "Show". Written as a formula, this is similar to:

IF(IsLiveData()*AND(F12=0),"Hide","Show")

IsLiveData() evaluates to 1 if TRUE; 0 if FALSE. Similarly, the AND() function evaluates to 1 if TRUE; 0 if FALSE. Therefore, the product of IsLiveData() and AND(F12=0) will be equal to 1 only if both are equal to 1.

Note: In actual practice, replace "F12" with the position of the cell you are testing for zero.

Next, we're going to apply a filter on our hidden column.

Notice that when you reopen the financial design in design mode (i.e., with Use Live Data unmarked) and open the financial design worksheet, all rows in which you added the formula now indicate "Show". This is because Excel detects that live data is not in use. So using this technique, you can see all rows in design mode and only non-zero rows when you print the financial design.

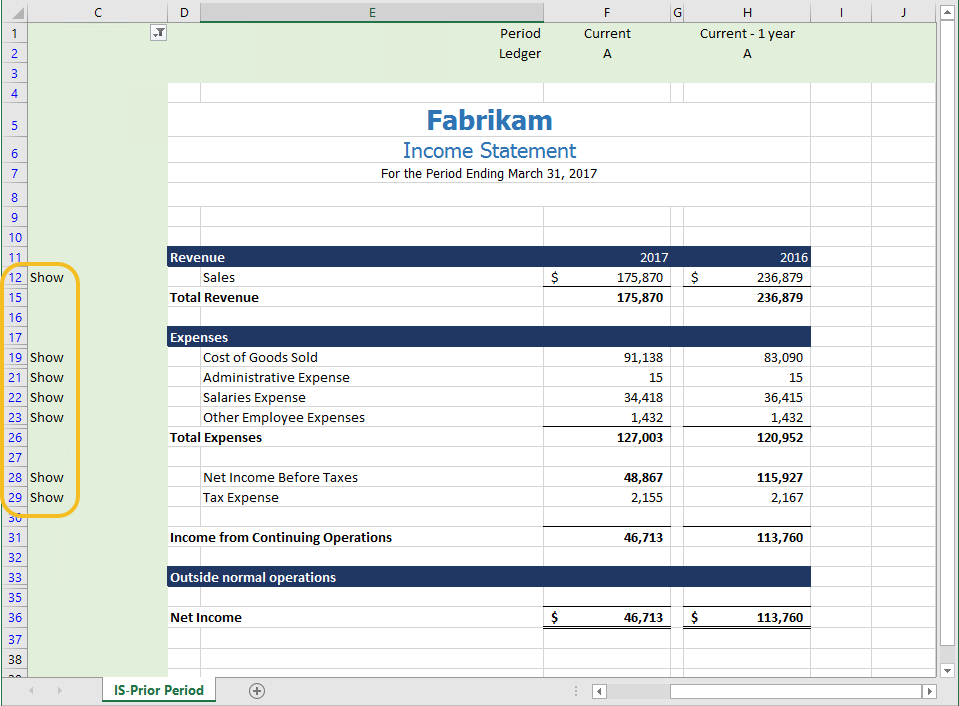

Extending the hidden formula filter method to multiple columns

In the previous example, we actually had amounts in two columns, but we suppressed zeros when the first column had zeros. This works great if you have only one column of amounts, but if you have multiple columns of data in your financial design, say amounts by month and year-to-date, or by period and prior year period as above, you will probably only want to suppress rows if every monetary value in the row is zero. To do so, you simply extend the formula discussed in the previous procedure by appending AND expressions to the condition statement. Using AND ensures that all conditions must be true before we hide a row.

We'll pick up where we left off in the prior example.

- Open the financial design worksheet, making sure you mark the Use Live Data checkbox in the Financial Options dialog box.

-

Determine which additional column(s) to test for the presence of zeros.

-

In the hidden column, in the row which corresponds to the first monetary values in the worksheet, enter the following formula, replacing the arbitrary cell positions with the appropriate cell positions in your worksheet.

=IF(IsLiveData()*AND(F12=0)*AND(H12=0),"Hide","Show")

-

Copy the formula to the cells in the hidden column which correspond to the rows with monetary amounts in the columns you are testing, excluding rows with literal text only or totals. Edit the cell references in the formulas to ensure the references in the hidden column and in the columns with values correspond.

In our example, the results mimic those from the one-column procedure since every row with a zero in column F also has a zero in column H.

-

Now apply the filter on the hidden column, showing everything that does not equal "Hide".

Helpful hints

Helpful hints

New Copy

Suppose you have a financial design and want to create another similar design. If your financial designs are stored in the ActivReporter database (best practice), this is a simple operation. In the Financial Designs HD view, highlight the design you want to emulate, right-click, and select New Copy from the menu. Provide a unique name for the new record, and you have the starting point for a new financial design.

You can also use the New Copy feature on the following entities:

- Calendars

- Financial views

Export/Import

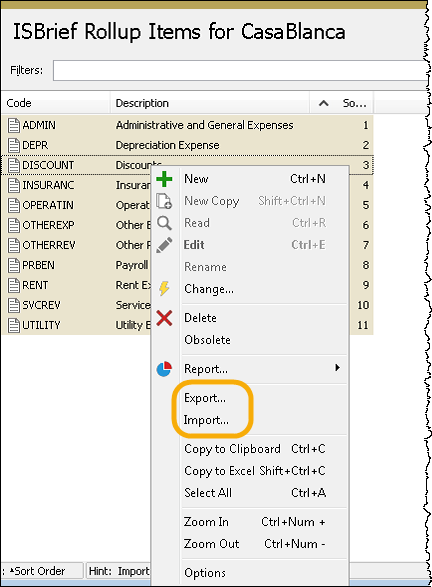

The New Copy feature is not available for rollups; however, there is a method for creating a rollup similar to an existing one. Using the Export command available in the right-click menu of a Rollup Items HD view, export the rollup items to an XML file on the Windows file system. Next, use the Import command to recreate the rollup in the same company with a different name.

Another useful application of Export/Import is to move rollup structures from one company database to another!

The Export and Import commands are also available for:

- Calendars

- Financial views

- Rollups

That means that these entities can also be moved from one company database to another.

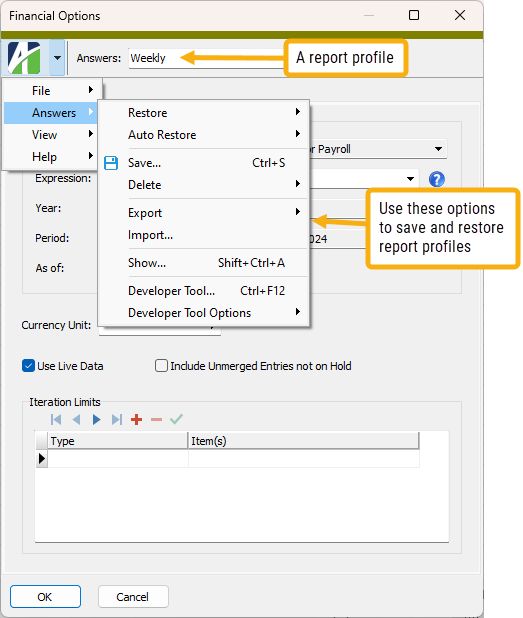

Report profiles for convenience and consistency

As you work with ActivReporter, you may find yourself entering the same answers to a dialog full of checkboxes, dates, and options repetitively. To alleviate this tedium, ActivReporter provides a report profile feature which allows you to save oft-used answers for subsequent reuse. The next time you run the dialog and need the same settings as a named report profile, simply load the report profile and ActivReporter fills in the answers for you!

Report profiles are available in the Financial Options dialog of financial designs and on all ActivReporter reports.

Reporting ledgers for intercompany eliminations

The reporting ledgers in Dynamics GP were designed to create journal entries which optionally could be included in financial reporting. These ledgers were for companies needing international reporting (IFRS) as well as reporting in the US (FASB). The ledgers can also be used for posting intercompany elimination entries or for tax reporting (depreciation, meals, etc.).

ActivReporter supports the Dynamics GP reporting ledgers.

Excel's outline feature

Excel includes a special feature called "outlining". Outlining allows you to embed supporting summary items into your Excel workbook details. Outlining can be applied to both rows and columns.

ActivReporter fully supports the Excel outlining feature. In fact, when publishing reports from Excel, you can determine the outline level to use on a "printed" (non-Excel) publication.

Functions

Functions

Click a category to learn about the functions in the category.

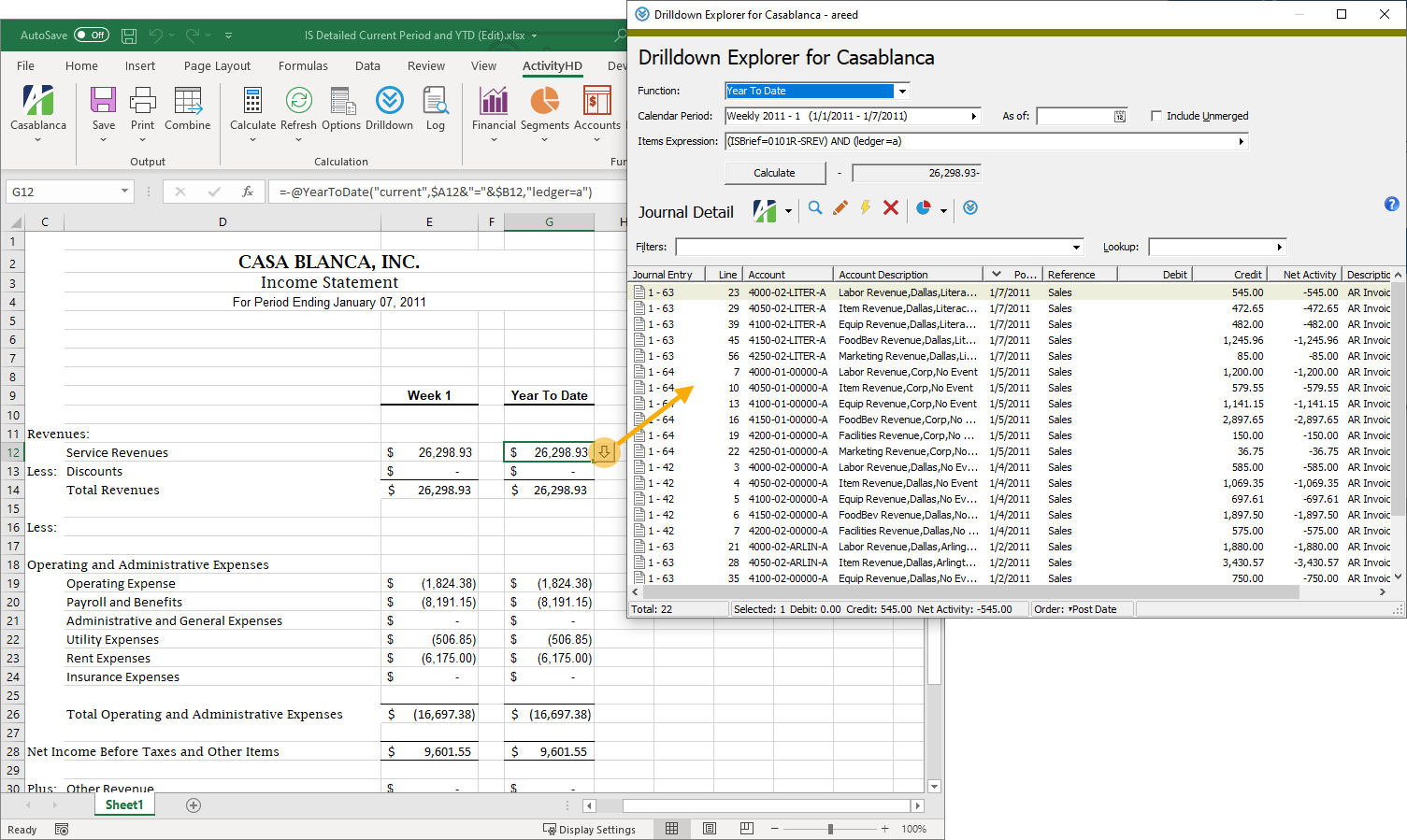

Drill down on functions in a financial design

Drill down on functions in a financial design

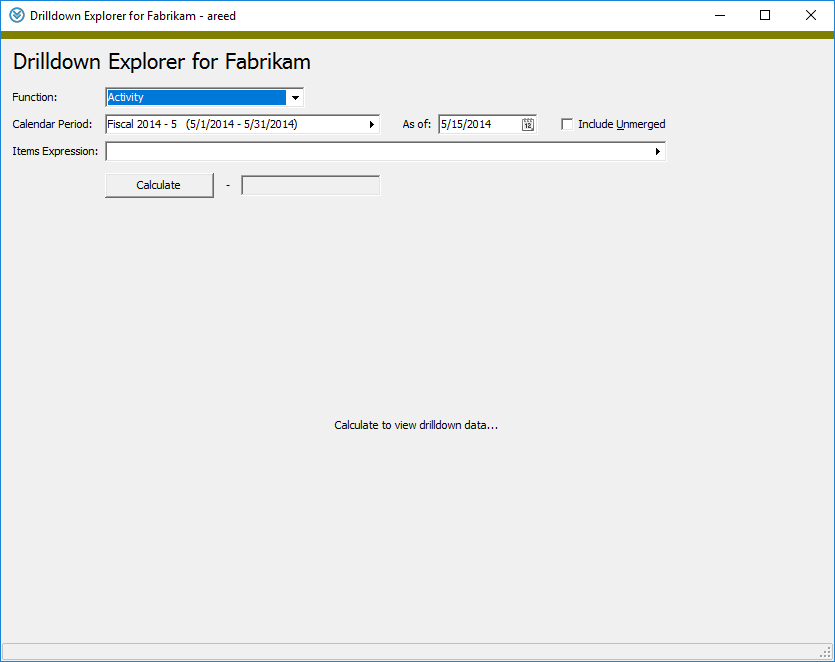

Anywhere you insert a financial function in a financial design, you can drill down on the function to see the journal detail behind the amount. When you select a cell with a financial function, a down arrow ![]() displays next to the cell signifying the drilldown capability. Clicking the arrow opens Drilldown Explorer with journal detail loaded. Initially, the journal detail reflects the settings from the Options dialog.

displays next to the cell signifying the drilldown capability. Clicking the arrow opens Drilldown Explorer with journal detail loaded. Initially, the journal detail reflects the settings from the Options dialog.

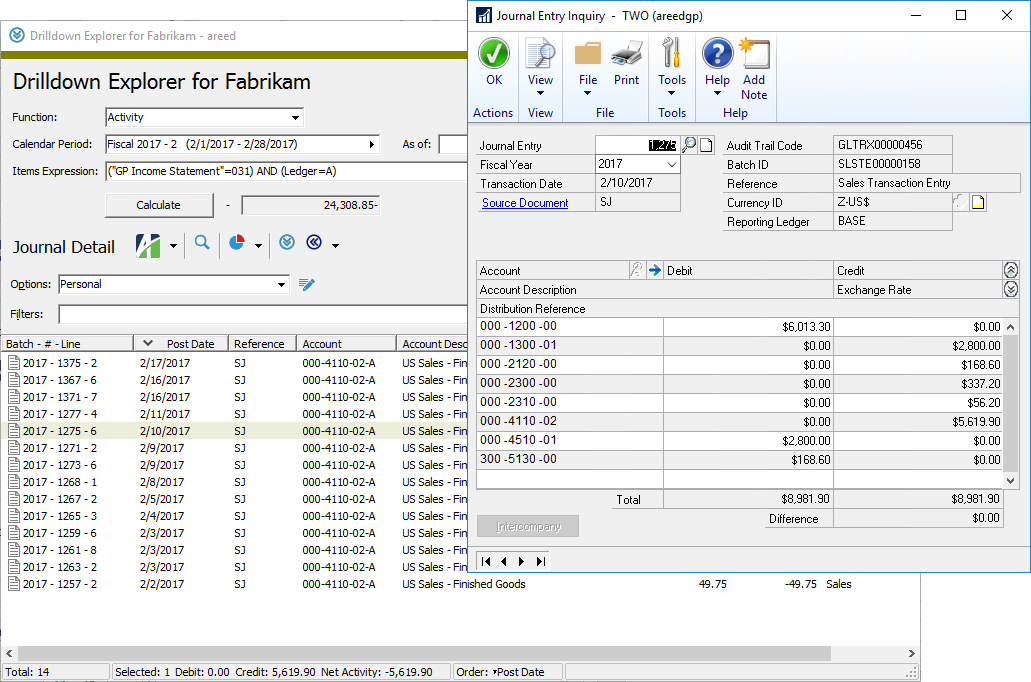

In Drilldown Explorer you have access to more analysis tools.

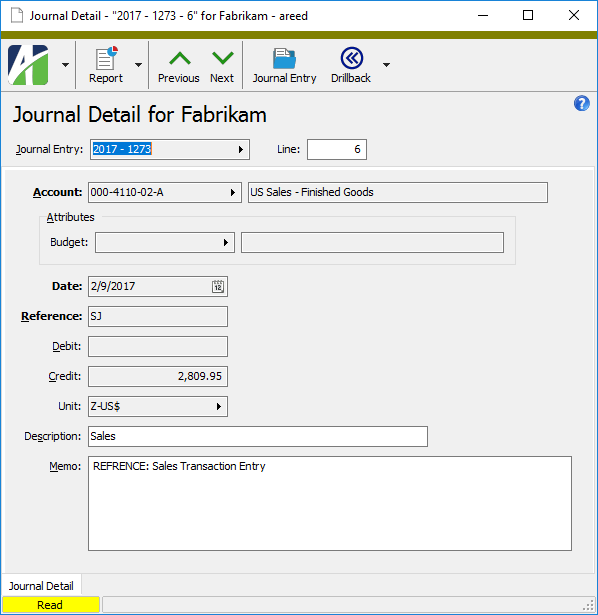

- Double-click a single record in the table, or highlight it and click

to view the selected detail record in the Journal Detail window.

to view the selected detail record in the Journal Detail window.

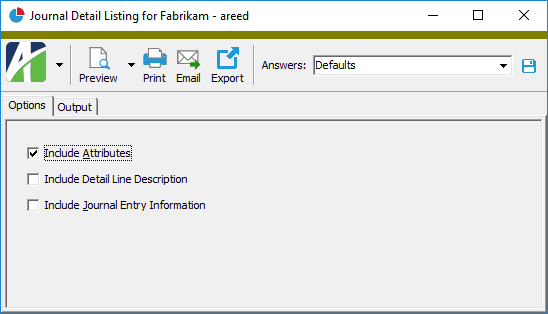

- Select one or more records in the table, click

and select Journal Detail Listing to open the Journal Detail Listing report set-up dialog where you can set options and print or preview the report.

and select Journal Detail Listing to open the Journal Detail Listing report set-up dialog where you can set options and print or preview the report.

- With focus in the table, click

. Another instance of the Drilldown Explorer opens.

. Another instance of the Drilldown Explorer opens.

- Highlight a single record in the table and press Ctrl+J or click

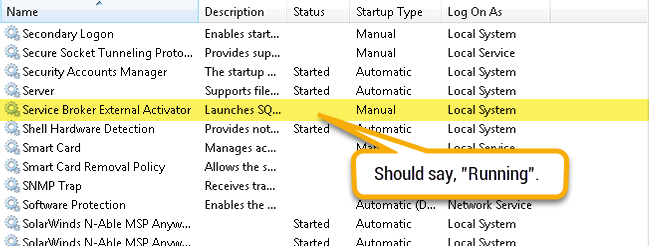

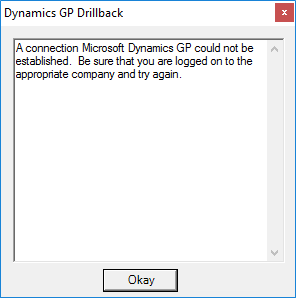

then select Journal Entry Inquiry from the drop-down menu to drill back to the corresponding journal entry record in Dynamics GP. (You must be connected to the Dynamics GP database.)

then select Journal Entry Inquiry from the drop-down menu to drill back to the corresponding journal entry record in Dynamics GP. (You must be connected to the Dynamics GP database.)

The following XML syntax can be used with the Drilldown action:

FinancialCalculator.Drilldown:

<Function @Name @Period @Items1 @Items2 @Items3 @Company @Unit/>

Company.RunAction("Drilldown")

<Function @Value/>

<CalendarPeriod>

<Calendar @Value/>

<Year @Value/>

<Period @Value/>

<PeriodContains @Value/@Expression/>

</CalendarPeriod>

<IncludeUnmerged @Value(True/False)/>

<ItemsExpression @Value/>

<Calculate @Value(True/False)/> Period expressions

Period expressions

A period expression describes an accounting period relative to the current period of a calendar.

The most common period expression is "CURRENT" or its equivalent of an empty string "".

Period expressions consist of keywords, numeric constants, string constants, and/or codes strung together using appropriate syntax.

Note

To help you interpret the syntax models that follow, keep these things in mind:

- Brackets "[ ]" indicate that the item enclosed is optional.

- A vertical pipe "|" indicates "or".

- NUMBER represents a numerical constant; it is interpreted as an Excel date number.

- STRING represents a string constant; it is interpreted as a date in SQL Server constant date format.

There are two basic types of period expressions:

- Current. This type of period expression has the following general syntax:

[CURRENT] [PERIOD] [[+/-] NUMBER] [PERIOD | PERIODS | YEAR | YEARS]

Examples

CURRENT

CURRENT PERIOD

CURRENT - 1

PERIOD 1

CURRENT - 1 YEAR

- Literal. This type of period expression starts with the PERIOD keyword in conjunction with either the THROUGH keyword or the CONTAINING keyword and has the following general syntax:

- PERIOD THROUGH

- A numeric constant interpreted as an Excel date number.

- A string constant interpreted as a date in SQL Server constant date format.

- An optional YEAR or PERIOD keyword followed by an optional BEGIN or END keyword followed by an optional CURRENT keyword followed by an optional PERIOD keyword and then optional period offsets all followed by an optional OF CALENDAR.

- PERIOD CONTAINING

- A numeric constant interpreted as an Excel date number.

- A string constant interpreted as a date in SQL Server constant date format.

- An optional YEAR or PERIOD keyword followed by an optional BEGIN or END keyword followed by an optional CURRENT keyword followed by an optional PERIOD keyword and then optional period offsets all followed by an optional OF CALENDAR.

A "period through" expression starts with PERIOD THROUGH keywords and is followed by one of the following:

PERIOD THROUGH [[NUMBER] | [STRING] | [[YEAR | PERIOD] [BEGIN | END] [CURRENT] [PERIOD] [[+/-] NUMBER] [PERIOD | PERIODS | YEAR | YEARS]]] [OF CALENDAR]

Examples

PERIOD THROUGH "2014-10-15"

PERIOD THROUGH YEAR END

PERIOD THROUGH CURRENT + 10

PERIOD THROUGH CURRENT PERIOD + 1 YEAR

A "period containing" expression starts with PERIOD CONTAINING keywords and is followed by one of the following:

PERIOD CONTAINING [[NUMBER] | [STRING] | [[YEAR | PERIOD] [BEGIN | END] [CURRENT] [PERIOD] [[+/-] NUMBER] [PERIOD | PERIODS | YEAR | YEARS]]] [OF CALENDAR]

Examples

PERIOD CONTAINING "2014-10-15"

PERIOD CONTAINING YEAR END

PERIOD CONTAINING CURRENT + 10

PERIOD CONTAINING CURRENT PERIOD + 1 YEAR

These can be condensed to the following general syntax statement:

[PERIOD THROUGH | CONTAINING] [[NUMBER] | [STRING] | [[YEAR | PERIOD] [BEGIN | END] [CURRENT] [PERIOD] [[+/-] NUMBER] [PERIOD | PERIODS | YEAR | YEARS]]] [OF CALENDAR]

Sub-expressions

Sub-expressions can be components of larger expressions. For period expressions, there are two sub-expressions we'll consider: PERIOD NUMBER and OF CALENDAR.

-

PERIOD NUMBER. A PERIOD NUMBER sub-expression has the following general syntax:

-

OF CALENDAR. An OF CALENDAR sub-expression has the following general syntax:

PERIOD NUMBER [OF] [STRING] [OF CALENDAR] [[+/-] NUMBER] [PERIOD | PERIODS | YEAR | YEARS]

Note

The STRING in this syntax statement is a string constant or code that is interpreted as a year code.

Examples

PERIOD 1 OF 2006

PERIOD 12 OF "2008"

PERIOD 4 OF 2008 OF Quarterly

OF STRING

Note

The STRING in this syntax statement is a string constant or code that is interpreted as a calendar name.

Examples

PERIOD THROUGH CURRENT OF "Quarterly"

PERIOD CONTAINING "2014-10-15" OF Daily

Period offsets

Period offsets are additions or subtractions from the base period (typically, from CURRENT). The portion of the syntax examples cited above in red text represent the period offset. Period offsets can be used more than once (see the third example below).

A period offset has the following general syntax:

[+/-] NUMBER [PERIOD | PERIODS | YEAR | YEARS]

Examples

CURRENT - 1

CURRENT - 1 YEAR

CURRENT - 1 PERIOD - 1 YEAR

Note

If no period or year is specified in a period offset statement, PERIOD or PERIODS is assumed.

Segment items expressions

Segment items expressions

Segment items expressions are sub-expressions which determine a set of accounts based on common segment items in their segment codes or rollups. The general form of a segment items expression is:

[SEGMENT/ROLLUP <operator> ITEM CODE/MASK]

The <operator> is one of the following: =, <>, <, >, <=, >=, LIKE, NOT LIKE.

Examples

Main=1000

Department=100

Ledger=B AND Store=Lubbock

Syntax rules

- Segment items expressions are optional.

- Segment items expressions can be combined with ANDs and ORs as in the third example above.

- Segment items expressions can be grouped using parentheses.

- Segment items expressions can be negated.

Example

(MAIN=1000 AND DEPARTMENT=100) OR MAIN=1100

Example

NOT Main=1000

More examples...explained

| Example | Explanation |

|---|---|

| Main=8733 | Includes all "Main" segments with a segment item equal to "8733". |

| Division<>Store32 | Includes all "Division" segments that do not have a segment item of "Store32". |

| Division LIKE Store | Includes all "Division" segments that have a segment item of "Store". |

| NOT Main=8000 | Includes all "Main" segments with any segment item except "8000". |

| Division=Store AND Main LIKE 8?33 | Includes all "Division" segments with a segment item of "Store" and "Main" segments with a segment item that satisfies the wildcard mask "8?33" (i.e., segment items with "8" in the first position, "3" in both the third and fourth positions, and any character in the second position). |

| "Balance Sheet"=CAP | Includes the "Balance Sheet" rollup with a rollup item equal to "CAP". In the expression, "Balance Sheet" is enclosed in quotes because of the space embedded in the rollup name. |

Connect to data

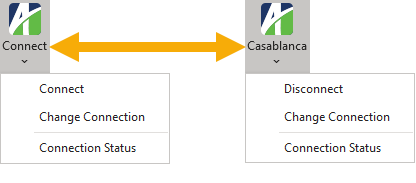

Connect to data

When editing a financial design you can work offline, meaning you are not connected to a dataset, or online, meaning that you are. It's easy to tell your connection status. When you are offline, the connection button is labeled "Connect". When you are online, the button is labeled with the name of the company you're connected to.

Connect to a dataset

Connect to a dataset

By default, when you open a financial design you are immediately connected to the database of the company you are working in. However, you can disconnect to work offline or connect to another company to work with its data if you are in a multi-company environment. If you are not currently connected to a database and want to connect to the database that you were last connected to during the current session, do the following:

-

In the ActivityHD ribbon, click Connect. The Financial Options dialog opens.

- Respond to the dialog as appropriate, then click OK. When the dialog closes, ActivReporter connects to the last database used.

Disconnect from a dataset

Disconnect from a dataset

- In the ActivityHD ribbon, click the down arrow on the Connect button to open a drop-down menu.

- Select Disconnect. You are immediately disconnected from the company and system.

Change the dataset you are connected to

Change the dataset you are connected to

- In the ActivityHD ribbon, click the down arrow on the Connect button to open a drop-down menu.

-

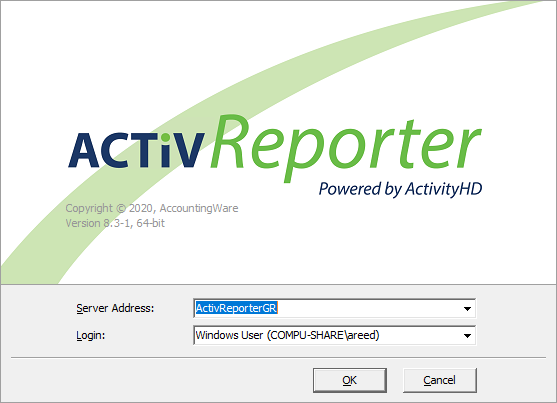

Select Change Connection. You are prompted for a system connection.

- From the Server Address dropdown, select the ActivityHD System server.

-

Click OK. You are prompted to select a company.

- Highlight the company to connect to and click OK. The new connection is established.

Calculate worksheets

Calculate worksheets

Calculate a worksheet

Calculate a worksheet

Click the Calculation button in the ribbon to open a drop-down menu, then select Calculate Sheet to manually recalculate the current worksheet and any charts and chart sheets linked to it.

Calculate all open worksheets immediately

Calculate all open worksheets immediately

Click the Calculation button in the ribbon to open a drop-down menu, then select Calculate Now to manually recalculate all open worksheets and chart sheets, including any data tables.

Force a full calculation of all open workbooks

Force a full calculation of all open workbooks

Click the Calculation button in the ribbon to open a drop-down menu, then select Force Full Calculation to manually perform a full calculation of the data and rebuild the dependencies for all open workbooks.

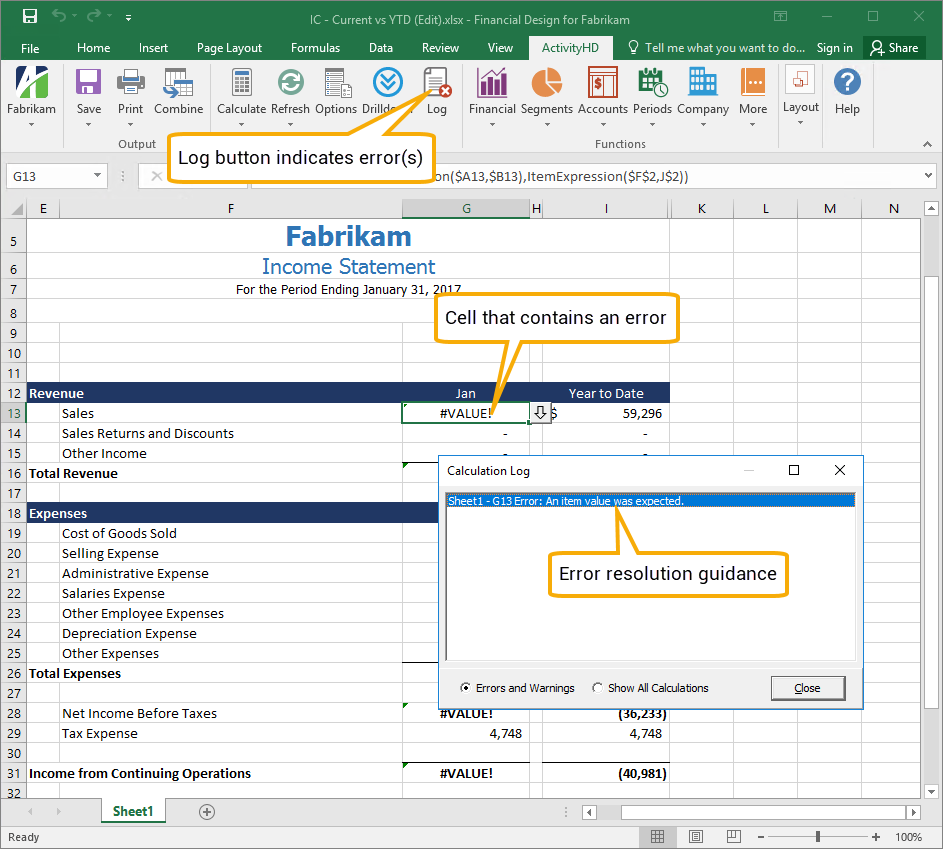

Use this action when the other calculation methods are ineffective. For instance, if a calculated cell in a financial design displays '#VALUE!' and the Calculate Now and Calculate Sheet methods fail to fix the problem, try Force Full Calculation. If the formula in the calculated cell is valid and the problem occurs because some cells are dependent on the values of other calculated cells, this option should remedy the situation.

Refresh the view

Refresh the view

Some native Excel functions cannot recalculate financial designs sufficiently. For this reason, ActivReporter provides three refresh actions to fill the gap.

Refresh data and filters

Refresh data and filters

Click the Refresh button in the ribbon to open a drop-down menu, then select Refresh All to refresh data and filters in one step. Refresh All is the default behavior of the main Refresh button.

Refresh data

Refresh data

Click the Refresh button in the ribbon to open a drop-down menu, then select Refresh Data to clear the cache of the financial calculator and run Excel's "CalculateFullRebuild" method. This is the same method as Calculate > Force Full Calculation. The addition of cache-clearing causes the financial calculator to relearn the information that was cached before Excel performs its most thorough calculation. As a result, the financial design will reflect the most current information available.

Refresh filters

Refresh filters

Click the Refresh button in the ribbon to open a drop-down menu, then select Refresh Filters to refresh filters only without any recalculation or cache-clearing. The Refresh Filters action is useful when the current calculation is adequate or if performing a recalculation of the financial design would be time-consuming. Refresh Filters is particularly useful in resolving show/hide issues.

Print layout

Print layout

Set a print area

Set a print area

The default print area of a worksheet is denoted by a dashed rectangle. If there are multiple vertical dashed lines across a page, these indicate where the pages will break horizontally when you print. Multiple horizontal dashed lines indicate where the pages will break vertically. You can override these defaults by setting the print area yourself.

- Open the worksheet in Excel.

- Select the cell in the upper left corner of the print region.

- Click and drag diagonally until you reach the lower right corner of the print region.

- Release the mouse to complete the selection.

- From the ActivityHD ribbon, select Print Area > Set Print Area. The print area is bounded on the right and below by solid lines.

Clear the print area

Clear the print area

- Open the worksheet in Excel.

- Click anywhere in the worksheet.

- From the ActivityHD ribbon, select Print Area > Clear Print Area.

Expand the print area

Expand the print area

There are two ways you can expand the print area of a financial design. Of course, you can clear the print area and then set it again. You can also add to the existing print area.

To add to the existing print area of a financial design:

- Open the worksheet in Excel.

- Select the region adjacent to the current print area that you want to include in the print area.

- From the ActivityHD ribbon, select Print Area > Add to Print Area.

Hide non-printing areas

Hide non-printing areas

To view only the part of a financial design that is designated as part of the print area:

- Open the worksheet in Excel.

- From the ActivityHD ribbon, select Print View > Hide Non-Print Areas.

Show non-printing areas

Show non-printing areas

If non-print areas are hidden in a financial design, but you want to view everything:

- Open the worksheet in Excel.

- From the ActivityHD ribbon, select Print View > Show Non-Print Areas.

Filter data

Filter data

Turn on auto-filtering

Turn on auto-filtering

- Open the worksheet in Excel.

- Select the range of cells to filter.

- In the ActivityHD ribbon, click

. A drop-down arrow

. A drop-down arrow  appears on the right side of the topmost cell(s) in your selection.

appears on the right side of the topmost cell(s) in your selection.

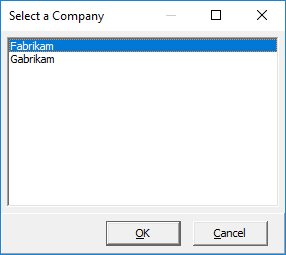

Apply filtering

Apply filtering

- Open the worksheet in Excel.

- Turn on auto-filtering.

-

At the top of the data you want to filter, click

and select Number Filters or Text Filters, depending on the type of data in the selected column, then from the second-level menu select the comparison operator to use to construct the filter.

and select Number Filters or Text Filters, depending on the type of data in the selected column, then from the second-level menu select the comparison operator to use to construct the filter.

The Custom AutoFilter dialog opens with its first prompt prefilled with the comparison operator you selected.

- Respond to the prompts as appropriate.

- Click OK to apply the filter.

Turn off auto-filtering

Turn off auto-filtering

- Open the worksheet in Excel.

- In the ActivityHD ribbon, click

. The drop-down arrows are removed.

. The drop-down arrows are removed.

Clear all filtering

Clear all filtering

If one or more filters is currently applied, the clear filter icon  is enabled.

is enabled.

- To clear all filters in the financial design, click

.

.

Reapply filtering

Reapply filtering

When a filter has been applied to data, the drop-down arrow changes from  to

to  and the reapply filter icon

and the reapply filter icon  is enabled.

is enabled.

A few reasons you might want to reapply a filter include:

- Data in the range has been added, modified, or deleted.

- A formula that affects the data has been changed.

- The worksheet has been recalculated.

To reapply a filter:

- Select the filter to reapply.

- From the ActivityHD ribbon, click

.

.

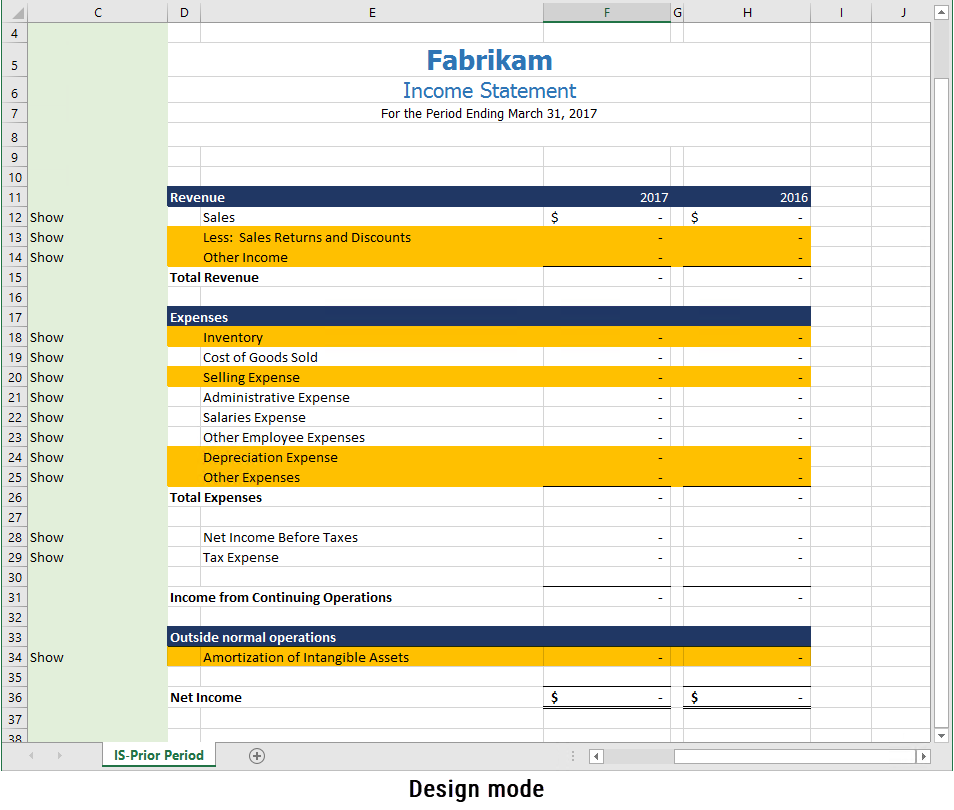

Use a built-in layout

Use a built-in layout

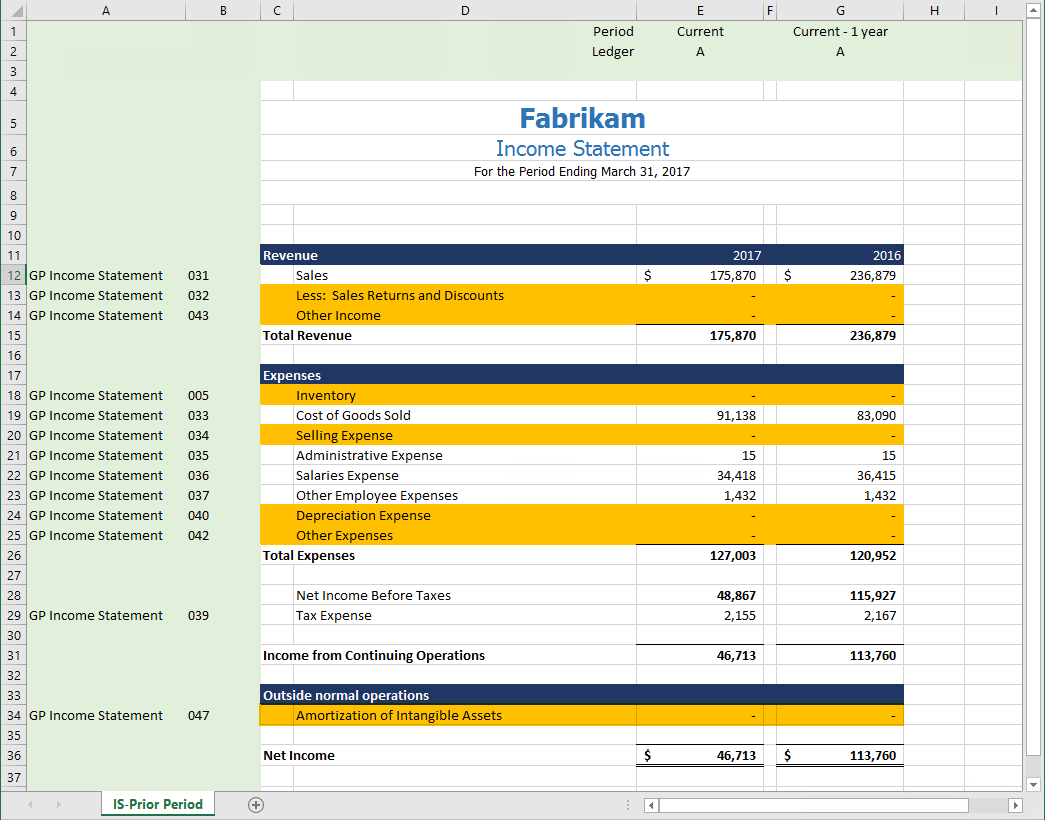

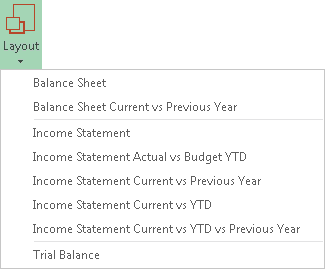

A good way to jumpstart a financial design is to start with a built-in layout. ActivReporter includes layouts for balance sheets, income statements, and a trial balance. Layout designs also include features such as the currency unit description (shows if specified in options) and embedded validation functions (ValidateAccounts, ValidateItems, ErrorsOrWarnings) for ensuring completeness and accuracy.

To load a built-in design:

- Click

.

. - From the drop-down menu, select the financial design layout to load.

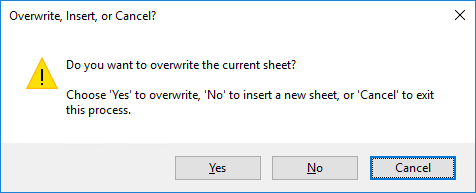

You are prompted whether to overwrite the current worksheet, insert a new worksheet, or cancel out of the process.

-

Click Yes or No. You are prompted with the opportunity to filter the data for the report.

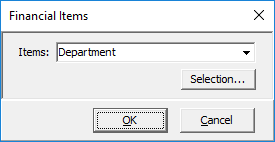

-

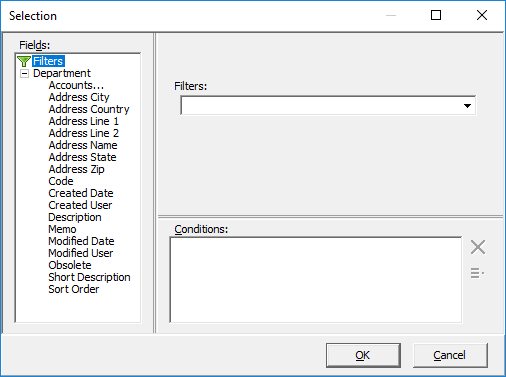

If you want to apply selection criteria to the report data, select an account, segment item, rollup item, or attribute item from the Items dropdown, then click OK. The Selection dialog opens.

- Define selection criteria for the financial design as needed. When you finish, click OK to close the Selection dialog.

-

Click OK to close the Financial Items prompt. ActivReporter advises you how many rows will be created in the generated output.

-

Click OK. The selected design loads according to your instructions.

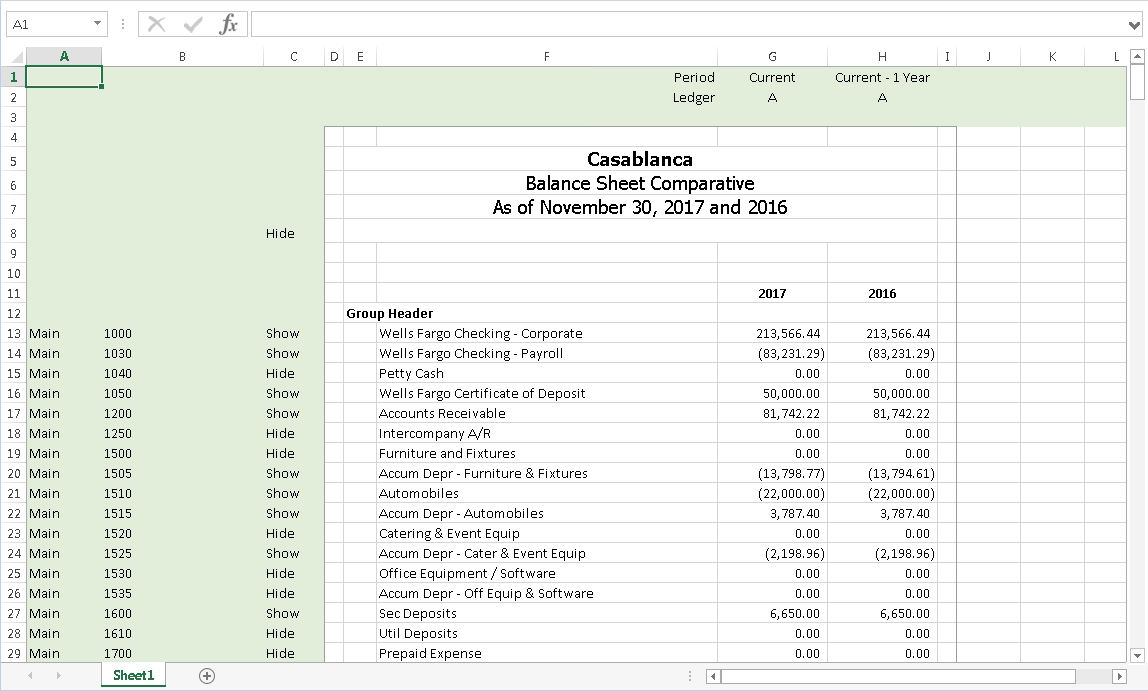

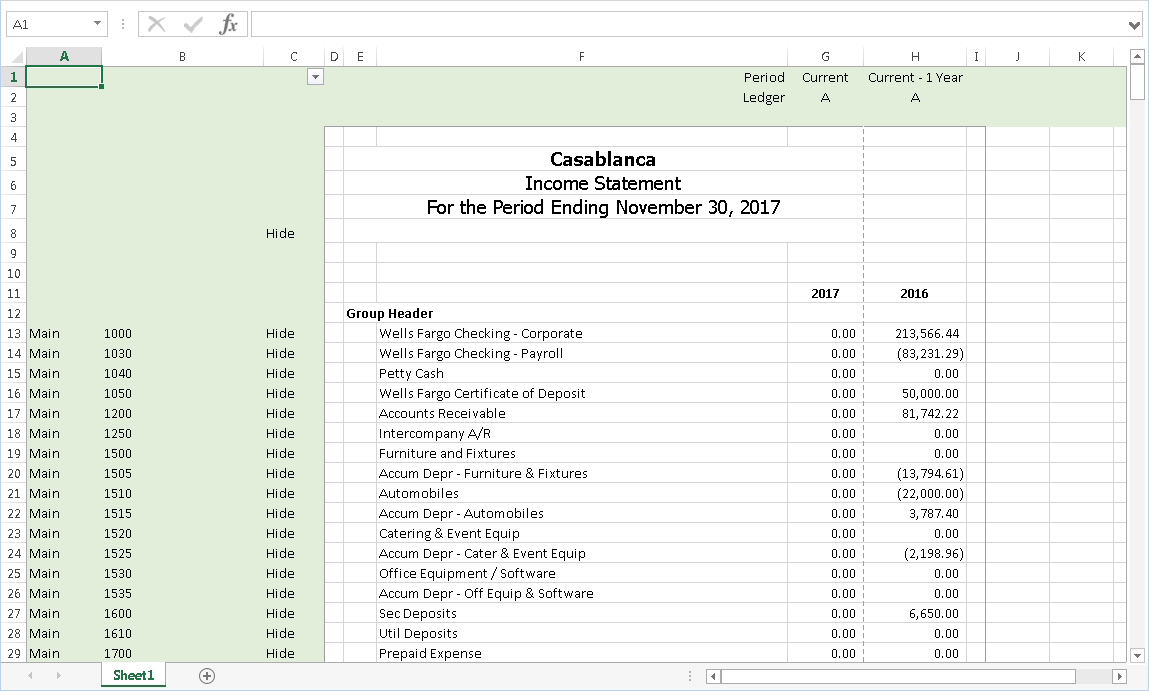

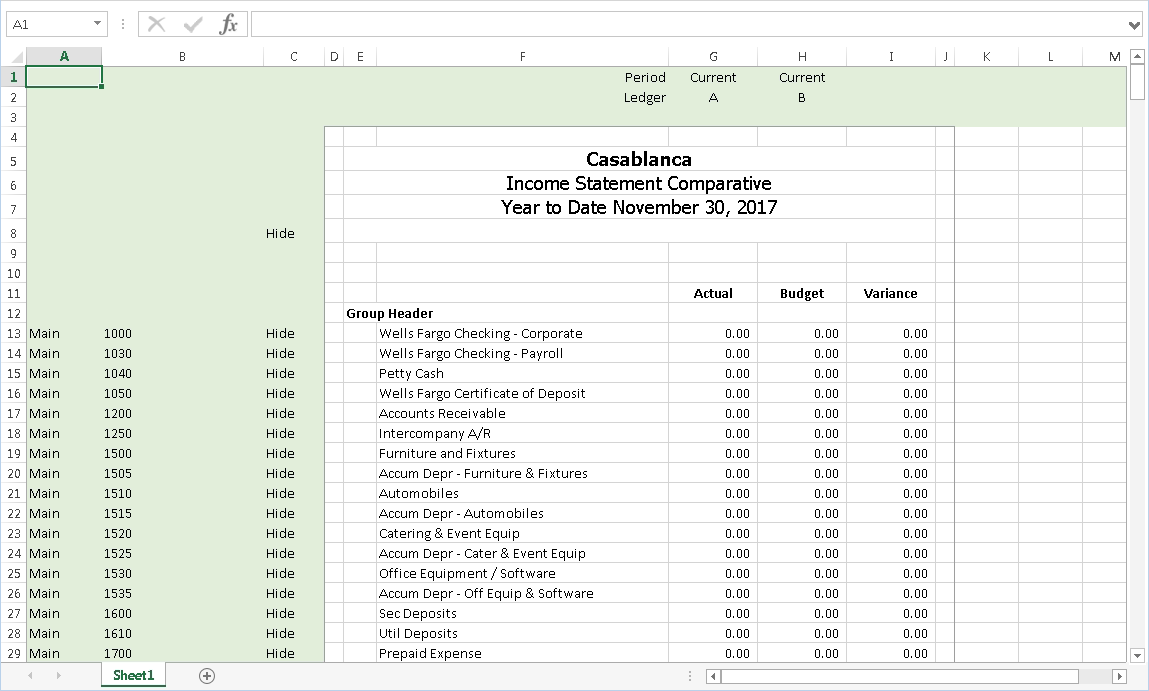

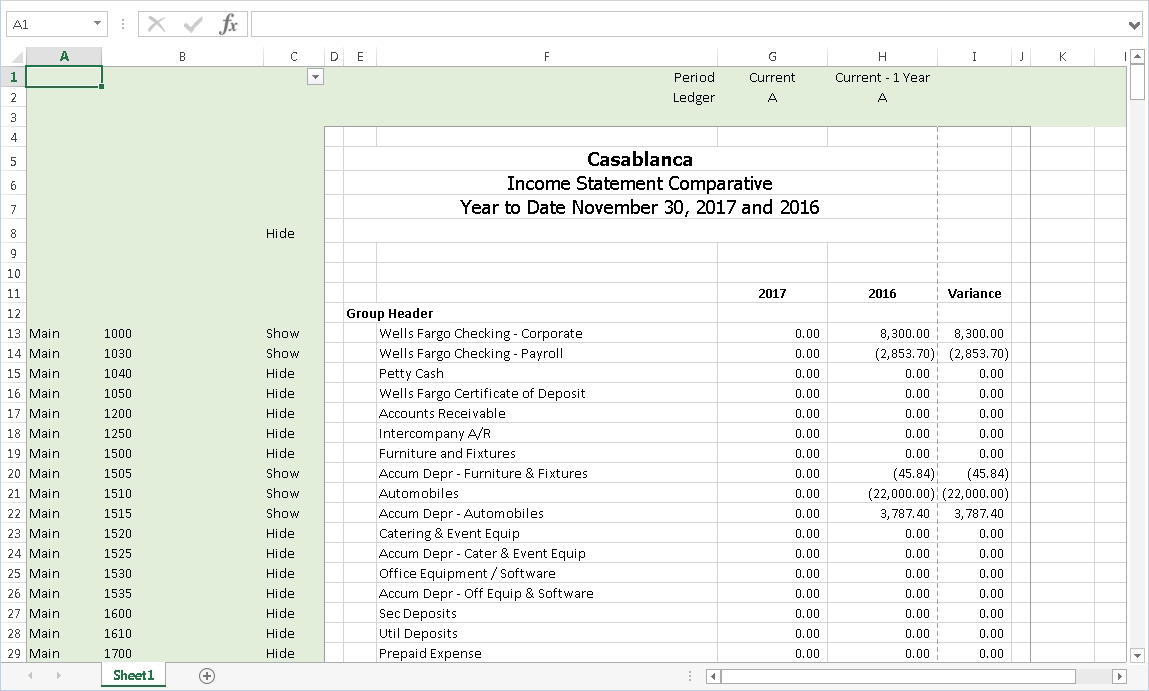

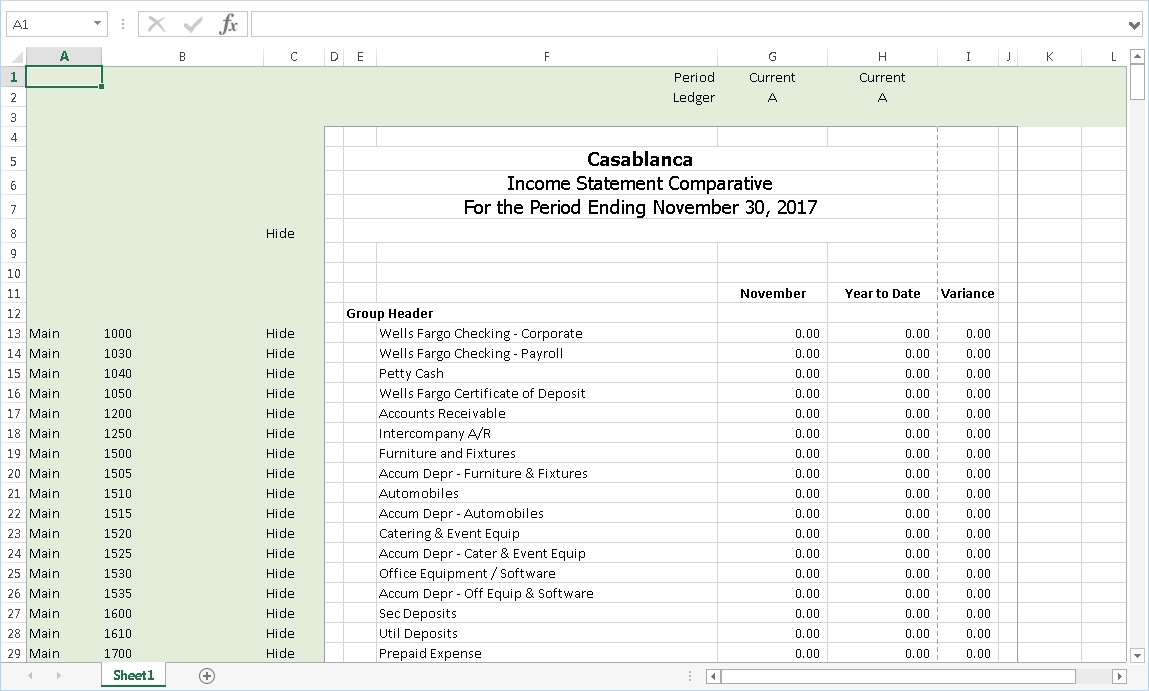

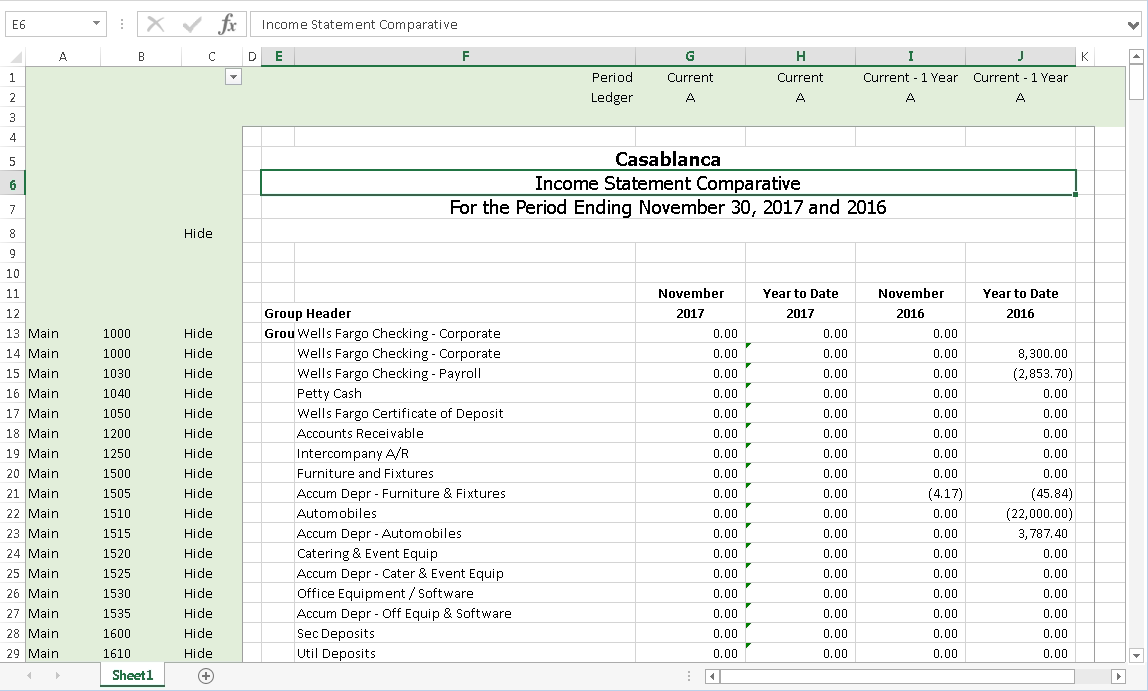

Cycle through the carousel below to see what the built-in layouts look like.

- Tweak the design as needed.

- When you finish, save your changes.

Use a sample financial design

Use a sample financial design

Several sample designs are provided so that you can see a variety of techniques for generating financial reports. When ActivReporter is installed, these samples are copied to the user's computer. In most cases, the sample designs are copied to the following folder:

C:\ProgramData\AccountingWare\Activity Explorer\Financial Design Samples\ActivReporter

When you access a sample file, the selected file is copied to a new file so that the original file is not overwritten if you save it. If you choose to save the file, you are prompted for a saving location via the standard Excel Save dialog.

If there are no sample files on your computer, the Samples icon will not be visible in the toolbar.

To access a sample financial design:

- Start Excel.

- Select the ActivityHD ribbon.

- In the Layout group, click Samples. A drop-down menu opens with the list of available samples.

- Select the sample to open. A copy of the sample design loads in Excel.

- Enjoy investigating or modifying the sample!

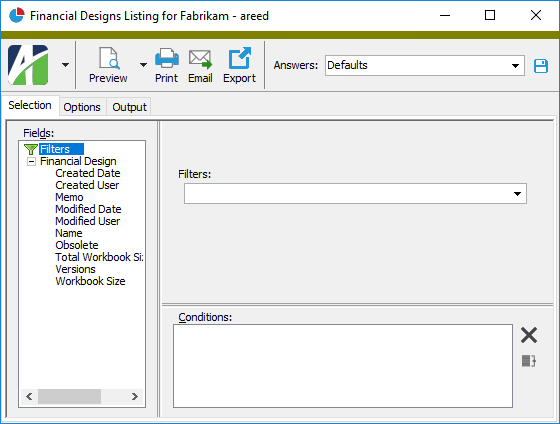

Financial Designs Listing

Financial Designs Listing

Purpose

The Financial Designs Listing provides a list of financial designs defined in your system.

Content

The basic report is simply a listing of the financial design names.

In addition, you can include one or more of the following:

- timestamps

- memos

- custom fields.

The following total appears on the report:

- record count.

Print the report

- In the Navigation pane, highlight the ActivReporter > Financial Designs folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of financial designs:

- Right-click the Financial Designs folder and select Select and Report > Financial Designs Listing from the shortcut menu.

- On the Selection tab, define any filters you want to apply to the data.

- To report on specifically selected financial designs:

- In the HD view, select the financial designs to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To report on a particular financial design from the Financial Design window:

- In the HD view, locate and double-click the financial design you want to report on. The Financial Design window opens with the financial design loaded.

- Click

.

.

- To report on all or a filtered subset of financial designs:

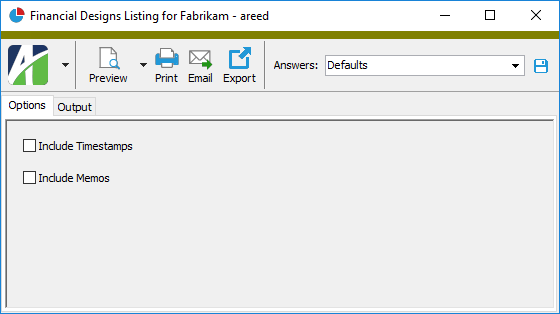

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- From

- The email account from which to send the email. Valid options are:

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

- To

- The email address(es) to which to send the email. Separate email addresses with semi-colons.

- CC

- The email addresses to copy on the email. Separate email addresses with semi-colons.

- BCC

- The email addresses to blind copy on the email. Separate email addresses with semi-colons.

- Subject

- The subject line.

- Text box

- The body of the email.

Report Email dialog

Data extensions

The following data extension is available for the report:

- Financial designs

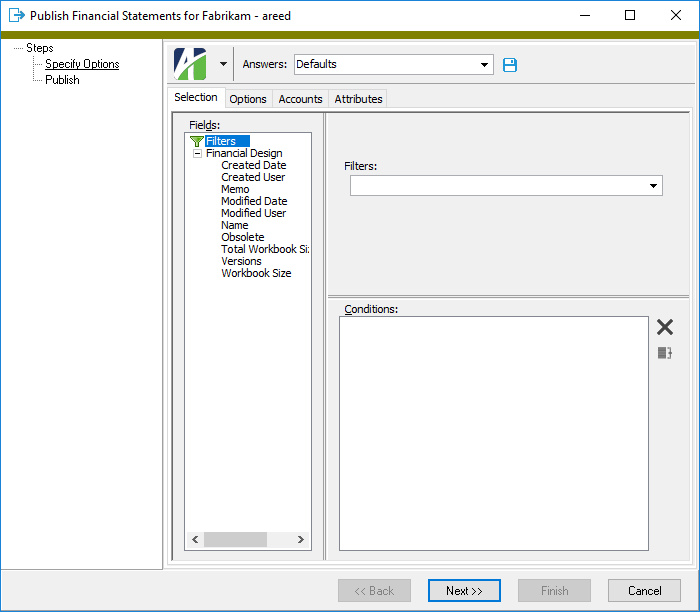

Publish a financial statement

Publish a financial statement

The Publish Financial Statements wizard lets you limit a financial statement to a particular account or set of accounts or to produce iterative financials on a financial design template. After you design a template, you can publish multiple financial statements from the design without having to alter the design.

- In the Navigation pane, highlight the ActivReporter > Financial Designs folder.

- Start the Publish Financial Statements process:

- To publish financial statements for all or a filtered subset of financial designs:

- Right-click and select Select and Publish Financials from the shortcut menu.

On the Selection tab, define any filters to apply to the data.

Tip

If you frequently run a process with the same settings, or infrequently run the process but want to easily recall the settings you used the last time you ran it, create an action profile. Action profiles "remember" settings you've used to run a process in the past.

- Right-click and select Select and Publish Financials from the shortcut menu.

- To publish financial statements for specifically selected financial designs:

- In the HD view, select the financial designs to publish financial statements for. You can use Ctrl and/or Shift selection to select multiple designs.

- Click

. The Publish Financial Statements wizard starts.

. The Publish Financial Statements wizard starts.

- To publish financial statements for all or a filtered subset of financial designs:

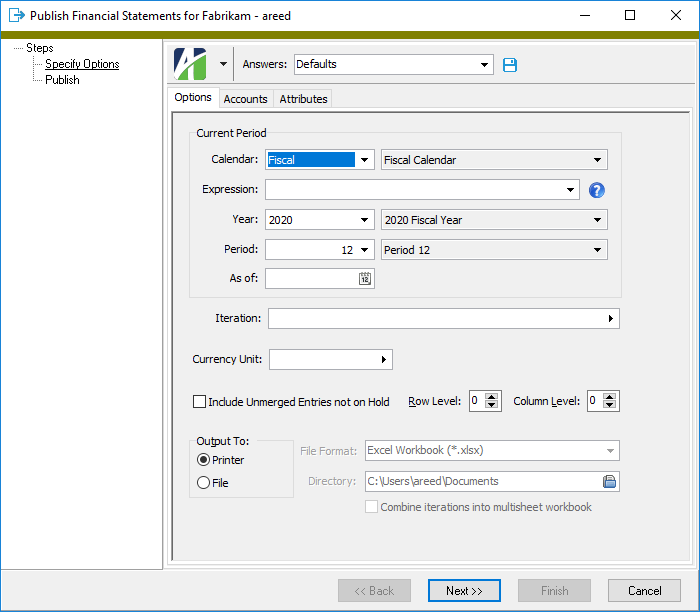

- On the Options tab from the Calendar drop-down list, select the calendar to publish financial statements for.

-

To define the reporting period using a relative expression, select or enter the period expression in the Expression field. If you prefer to explicitly enter the year and period, skip to step 5.

You can select from the following common period expressions:

- Current

- Current - 1 period

- Current - 1 year

Alternatively, you can type a valid period expression in the field. For help on period expression syntax, click the help button to the right of the field.

If you select or enter a period expression, ActivReporter adjusts the values in the Year and Period fields accordingly.

If you enter a period expression, skip to step 7.

- From the Year drop-down list, select the year of the period to publish financial statements for.

- From the Period drop-down list, select the period to publish financial statements for.

- If you only want the financial statement to reflect postings through a particular date, enter the date in the As Of field. All postings after the as of date are ignored. The as of date must fall between the current period begin and end dates.

-

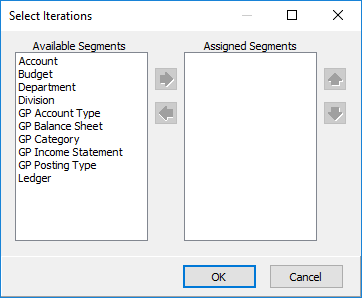

To iterate over segment(s), rollup(s), and/or attribute(s), click the right arrow on the Iteration field to open the Select Iterations popup.

If you do not need to perform iteration, skip to step 13.

- In the Select Iterations popup, highlight the segment(s), rollup(s), and/or attribute(s) to iterate over in the Available Segments list box, then click

to move your selection(s) to the Assigned Segments list box.

to move your selection(s) to the Assigned Segments list box. - If you selected multiple items to iterate over, use

and

and  to arrange the items in the order you want them applied.

to arrange the items in the order you want them applied. -

When you finish, click OK.

Note

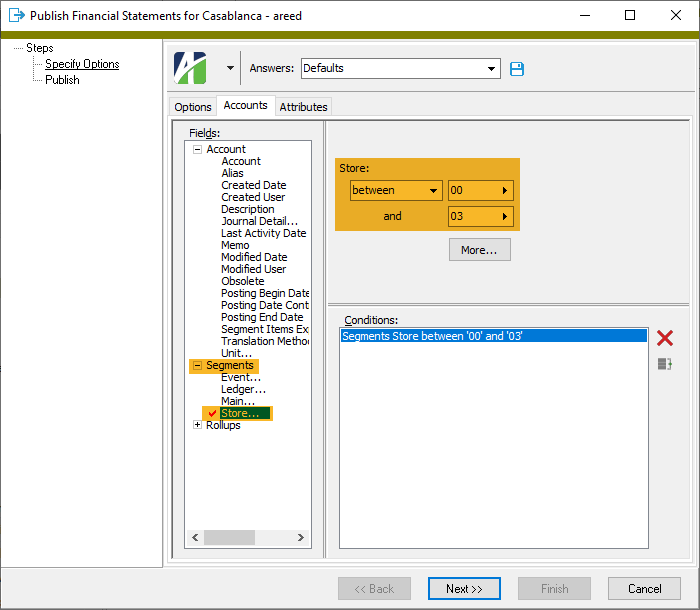

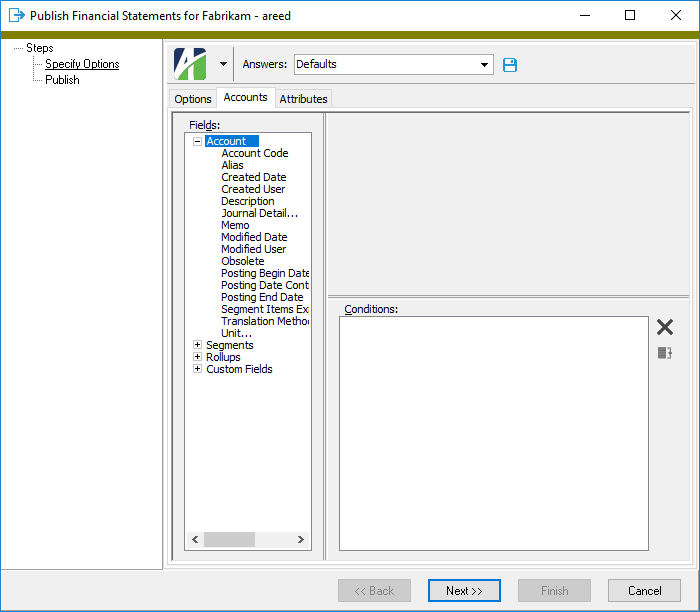

If you specified segments or rollups in the Iteration field, be sure to use the Accounts tab to specify which accounts, segments, and/or rollups to iterate over. If you specified attributes in the Iteration field, be sure to use the Attributes tab to specify which attributes to iterate over.

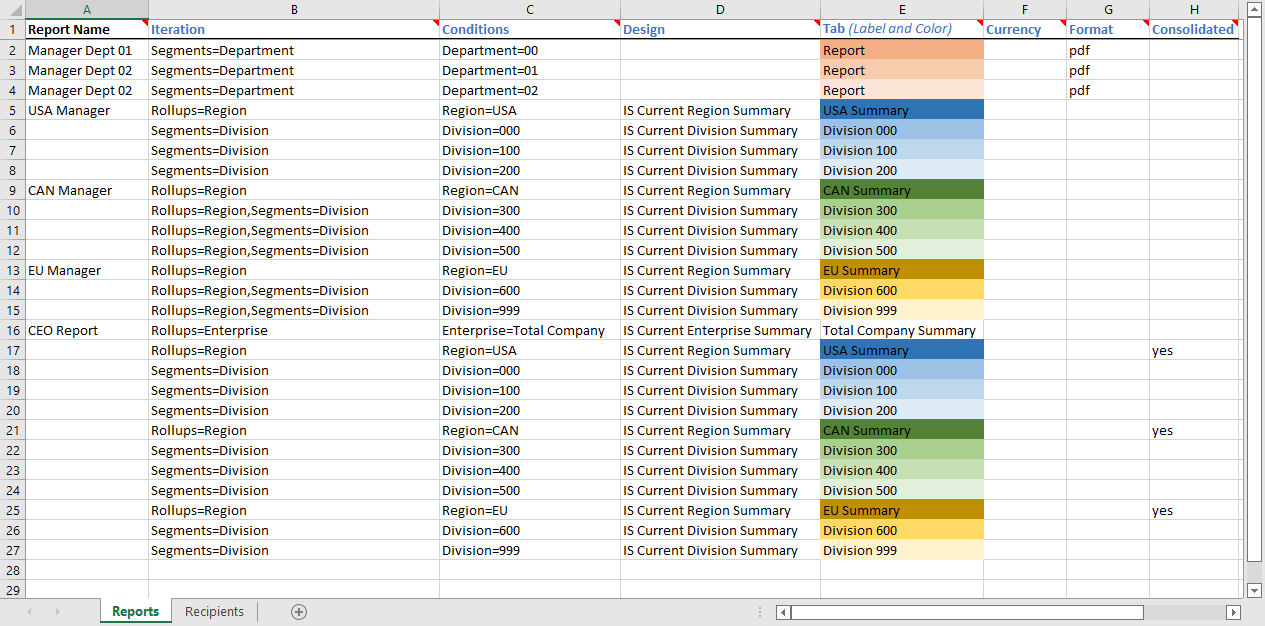

- If you selected one or more items to iterate over and select "File" in the Output To field, the Combine iterations into multisheet workbook checkbox is enabled. Mark the checkbox if you want the separate iteration worksheets to be combined in a single workbook.

-

If you selected one or more items to iterate over, the Include consolidated statement checkbox is enabled and marked. If you do not want your output to include a consolidated financial statement, clear the checkbox.

To learn more about consolidated statements, expand this link.

Example

Suppose you have a "Store" account segment with eight items (stores "00" through "07"). You want to generate financial statements for stores 00, 01, 02, and 03 and also generate a consolidated financial statement for those four stores.

- Open the financial design you want to generate and run the Publish Financial Statements process. We'll use "Income Stmt" for this example.

- On the Options tab, respond as indicated to the highlighted selections.

- On the Accounts tab, limit the selection to stores 00, 01, 02, and 03.

- Complete the process.

The process generates a single Excel workbook (Income Stmt.xls) in the file location you designated. The workbook contains five worksheets: one for the consolidated statement and a statement for each of the four stores.

You can use the @IterationDescription() function in your financial design to produce the worksheet title. When you iterate, the function returns "Consolidated" for the consolidated worksheet title and returns the iteration item description for the titles of the individual worksheets. For example:

- Income Stmt Consolidated - "Consolidated"

- Income Stmt 00 - "Corporate Office"

- Income Stmt 01 - "Lubbock"

- Income Stmt 02 - "Dallas"

- Income Stmt 03 - "Houston"

Note

- When you export a consolidated iteration, "Consolidated" is appended to the output filename: <Financial design name> Consolidated.xlsx.

Special note about consolidated statements when iterating over multiple iteration items

To include a consolidated statement when iterating over multiple iteration items (segments, rollups, and/or attributes), DO NOT exclude combinations of those items when creating selection conditions on the Accounts and Attributes tabs of the wizard. The list of iterations to be performed is not simply based on the iteration items matching the selection conditions but the selection conditions are also applied to determine the combinations of iteration items from the specified iteration items. The consolidated statement limits its financial functions to ALL combinations of iteration items from those specified.

Example

Suppose you have two segments, "Store" and "Department", and a rollup, "Performance". Performance is a rollup of Store + Department.

Store Department Performance 01 Apparel High 01 Furniture Low 01 Garden Low 01 Jewelry Medium 02 Apparel Medium 02 Furniture Medium 02 Garden High 02 Jewelry Low 03 Apparel High 03 Furniture Low 03 Garden Medium 03 Jewelry High To generate a financial statement with consolidated financial statement for each of your low-performing departments:

- On the Performance rollup, specify this condition: Performance = "Low"

- Select the following segments for iteration: Store, Department

The result will be a financial statement for the following combination of stores and departments since their Performance rollup value is "Low":

Store Department 01 Furniture 01 Garden 02 Jewelry 03 Furniture However, the consolidated statement will be limited to all combinations of the selected items from Store and Department: Store IN (01,02,03) AND Department IN (Furniture, Garden, Jewelry).

Store Department 01 Furniture 01 Garden 01 Jewelry 02 Furniture 02 Garden 02 Jewelry 03 Furniture 03 Garden 03 Jewelry - In the Currency Unit field, select the unit in which to report amounts. The unit selected must be flagged as a currency unit.

- If you want the statements to reflect unmerged entries that are not on hold, mark the Include Unmerged Entries Not on Hold checkbox.

-

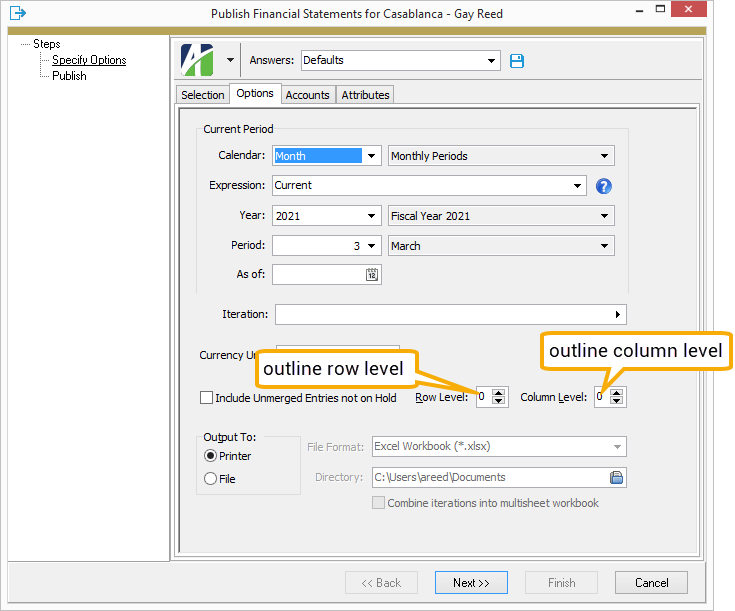

If you need to adjust the print area of the financial statements to start somewhere other than the upper left cell of the worksheet, select the row and column to start at in the Row Level and Column Level fields.

Note

This option is useful if you "outline" your financial statement in the leftmost columns and uppermost rows and want to hide those notations in your final output.

- In the Output To field, select the destination for the financial statements. Your options are:

- Printer

- File. If you select this option, the File Format and Directory fields are enabled.

From the File Format drop-down list, select the type of file to save the financial statement as.

- In the Directory field, enter the file path or click

and browse to the location where you want to save the file.

and browse to the location where you want to save the file.

-

If you specified segments and/or rollups in the Iteration field, select the Accounts tab. Otherwise, skip to step 20.

- To restrict the financial statements to particular accounts, define any filters to apply to the data.

-

If you specified attributes in the Iteration field, select the Attributes tab. Otherwise, skip to step 22.