ActivityHD Release 8.7

System-wide

-

System database conversion

Recently, the following error would occur when converting the system database to version 8.4 or higher if the Advanced Security package was not installed:

Convert Activity System to 804.01

Error... "Could not find stored procedure 'InheritPermissions'"...

The error no longer occurs.

-

Email

Until now ActivityHD servers did not support the TLS 1.2 or 1.1 encryption protocols for sending SMTP email messages when SSL is enabled on the SMTP server. Some SMTP servers require TLS 1.2 and do not allow connection with other encryption protocols. Now both TLS 1.2 and 1.1 are supported during negotiation for an encryption protocol with SSL-enabled SMTP servers.

-

ActivMonitor

Previously, ActivMonitor monitored all companies with a startup type of "Automatic". Now if a custom field named "Monitored" exists in the Companies folder, monitoring is controlled by the setting on that field. If the setting is "True" on a company, the company will be monitored; if "False", not monitored. If the custom field is not present, the original behavior based on the startup type is observed.

Accounts Payable

-

Delete 1099 Transmissions

Accounts Payable > Government > 1099 Transmissions > [select transmission(s) to delete] >

In the past, if you attempted to delete a 1099 transmission with a date received recorded on it, the following error message was returned:

Cannot delete a 1099 Transmission with a Receipt Date

The message could be confusing since the label on the corresponding field in the 1099 Transmission window is "Date Received". As a result, the error message has been changed to:

Cannot delete a 1099 Transmission with a Date Received

-

Invoices

Accounts Payable > Invoices

You can now specify attributes at the top level of an invoice instead of only at the invoice GL detail level. Furthermore, you can specify required settings for the liability and debit accounts at this level. Invoice-level attribute values are automatically applied to distribution detail lines but these default values can be overridden on the detail if the attribute is set up for invoice detail usage. Also, these values will automatically appear on the associated GL journal entries during the merge process if the attribute is set up to post to GL.

Invoice-level attributes also appear at the top of recurring invoices and are automatically copied to the invoice during recurring invoice processing.

When posting from PO to AP, an attribute with both purchase order usage and AP invoice usage populates at the invoice level.

Alongside the change to add invoice-level attribute handling, several changes to the Invoice form occurred to accommodate the change and to improve usability:

- The display area of the Invoice # field was widened.

- The Attributes section was added.

- The former Payment Terms section was collapsed into a single Terms display field from which you can press F2 to access the Invoice Payment Terms popup where you can edit details of the payment terms.

- The former Discount Dates section was collapsed into a Discounts display field from which you can press F2 to access the Invoice Discount Dates popup where you can maintain the table of discount dates. Also, the visibility of the Discount Dates section formerly depended on whether the Discounts Grid form option was marked. Now that option has been removed and the Discounts field is always visible.

- The scrolling of the Invoice window has been improved to better handle when multiple tables are visible at the bottom of the Invoice tab.

Accounts Receivable

-

Process AR Recurring Invoices

Accounts Receivable > Invoices > Recurring > [right-click] > Select and Process

A change was introduced in version 8.7-0 which caused "XML Parser Error (1)" errors to occur when a user attempted to process recurring invoices. The problem has been alleviated.

General Ledger

-

Custom Fields

While it has long been possible to define custom fields on attribute items, until now attribute items defined as "Sourced" could not be accessed on Custom tabs. This shortcoming has been addressed.

-

Journal Detail

General Ledger > Journal Entries > Journal Detail

Segment and rollup "code" columns were previously available to be shown in the Journal Detail HD view. Now you can also show segment and rollup description columns. Description columns are typically more informative than the arcane code columns.

-

Subsidiary postings

Previously, a confusing warning could be issued when a subsidiary package attempted to post to a closed period. The warning included an "Error" prefix (the condition was a warning, not an error) and the message was a tad vague.

Error: Calendar(XXX) is closed to postings for the date (yyyy-mm-dd)

Now the "Error" prefix is gone and the message has been improved to provide better context.

Calendar(XXX) is closed to postings for the date (yyyy-mm-dd)

GL transactions cannot be merged to a period that is closed in XX.

Payroll/Human Resources

-

Void Checks

Payroll/Human Resources > Checks > [select check(s) to void] > [right-click] > Void Checks

In the past, when you voided a payroll check the distribution attributes were not copied to the reversal check. Now the distribution attributes are copied correctly.

The following related issues are not addressed in this release but will be in the next:

- Fix distribution attributes on existing reversals which do not match the attributes on the voided check

- Prevent distribution attributes on reversals from being modified

- Automatically propagate changes to the distribution attributes on a voided check to the reversal check, and to all associated journal entries, if applicable

-

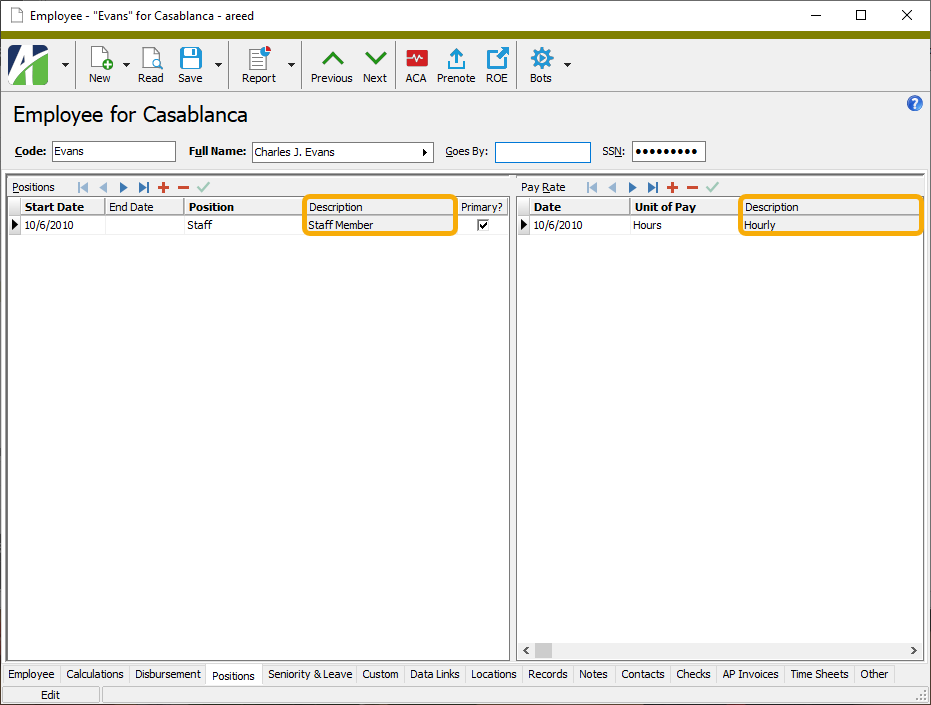

Employees

Payroll/Human Resources > Employees

Formerly, the Positions table on the Positions tab showed the position code but not its description. Similarly, the Pay Rate table showed the unit of pay code but not its description. Without the descriptions it could be difficult to verify that the correct selections were made, especially for sites using numeric codes assigned by the state.

Now position descriptions and unit of pay descriptions are shown on the Positions tab.

-

Employees

Payroll/Human Resources > Employees

The ability to tie employees to an external system such as an onboarding or time sheet entry application was introduced in version 7.39. However, sometimes the following error was mistakenly returned when the external ID was not a duplicate:

The external employee ID is assigned to another employee.

Now duplicate employee IDs are correctly handled.

-

Export Controls

Payroll/Human Resources > Setup > Export Controls

A 2021-specific export control has been introduced to help in determining the COVID-related values which are still in effect for 2021. The export control is included in the Extras folder of the distribution: ...\Extras\Payroll\Export Controls\Form 941 COVID Worksheet 2021.XML. For more background, see Worksheet 1 in the March 2021 revision of "Instructions for Form 941".

Setup

Import the export control from the distribution.

Process

- Go to

Payroll/Human Resources > Employees > [right-click] > Select and Create Totals File to start the Employee Create Totals File wizard. - Specify the following information on the Standard Options tab:

- Filename. Any file name with an extension of .CSV.

- Export Control. Select "COVID Worksheet 2021".

- Begin Date and End Date. Enter the begin and end dates of the quarter you are reporting.

- Date. Select "Check Date".

-

Specify the information requested on the Additional Options tab.

Note

The value in the Form 8974, line 11a field should match the payroll tax credit amount from the Options tab of Generate Form 941.

Tip

Save your answers.

- Click Create File.

-

Open the output file in Excel and review the totals.

The file contains three groups of columns:

- Employee totals (columns B - N). These values are used to calculate the remaining columns.

- Form 941 values (totals line for columns O - X). Enter these values in the Generate Form 941 wizard (instructions below).

- Worksheet 1 values (totals line for columns Y - BK). These values show how Worksheet 1 is calculated.

- Go to

Payroll/Human Resources > Government > Form 941 Returns > [right-click] > Generate to start the Generate Form 941 wizard. - Respond to prompts as appropriate, deriving COVID-related information from the following locations in the totals file:

Tab Field Corresponding column in the totals file Options Payroll Tax Credit Line 11a COVID-19 11b. Qualified Sick and Family Leave Line 11b COVID-19 11c. Employee Retention Credit Line 11c COVID-19 13c. Refundable Sick and Family Leave Credit Line 13c COVID-19 13d. Refundable Employee Retention Credit Line 13d COVID-19 13f. Advances from this Quarter's Form(s) 7200 Not in totals file; enter amount. COVID-19 19. Health Plan Allocable to Sick Leave Wages Line 19 COVID-19 20. Health Plan Allocable to Family Leave Wages Line 20 COVID-19 21. Employee Retention Credit (ERC) Wages Line 21 COVID-19 22. Health Plan Allocable to ERC Wages Line 22 COVID-19 23. Form 5884-C Credit Not in totals file; enter amount. - Complete the Generate process as usual.

Worksheet 1

The following discussion describes how the lines in Form 941 Worksheet 1 are calculated:

Step 1. Determine the employer share of social security tax for the quarter after it is reduced by credits. These fields are calculated using the same formula as the Generate Form 941 process.

Step 2. Determine the sick and family leave credit. The IRS says that employers can use "any reasonable method" to determine the amount of health expense allocable to COVID wages.

The export control uses the following formula for each affected employee:

Health expense x COVID hours / Total hours

The individual values in the formula are determined thusly:

- Health expense = total result amount of the check lines in the built-in group "ERSponsoredHlthCost"

- COVID hours = total source amount of the check lines in the built-in group "COVIDQualifiedSick" or "COVIDQualifiedFamily"

- Total hours = total source amount of the check lines in the group "TotalHours" (or whichever group you selected)

As for lines 2a(i) and 2e(i) of Worksheet 1, sick or family leave wages not included on Form 941, the values are zero. The source expression for built-in segment item Tax:SocSecER is written to avoid this issue.

Step 3. Determine the employee retention credit. The same formula from step 2 is used except that the built-in group "COVIDEmpRetention" replaces "COVIDQualifiedSick" or "COVIDQualifiedFamily".

- Go to

-

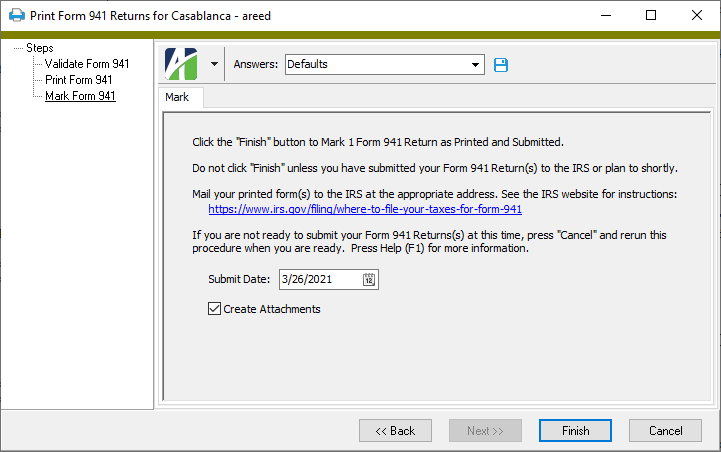

Print Form 941 Returns

Payroll/Human Resources > Government > Form 941 Returns > [right-click] > Select and Print

The finalized version of Form 941 for 2021 quarter 1 has been released by the IRS. Images of the form have now been incorporated in the print process. The only differences from the form for quarter 4 of 2020 are that Lines 13b and 24 have been changed to "Reserved for future use" since employer and employee social security can no longer be deferred. However, the fields for qualified sick leave wages, qualified family leave wages, employee retention credit, etc., remain.

-

Print Form 941 Returns

Payroll/Human Resources > Government > Form 941 Returns > [right-click] > Select and Print

In the past, the "Mark Form 941" step displayed the following:

The message was unclear about how to actually submit Form 941. Now the message has expanded to provide better guidance:

-

ActivityHD Automation Services (AAS)

A new IPRForm941 automation interface has been introduced to provide access to Form 941 Returns, including information for Schedule B.

-

AP Controls (applies only if the PR/AP interface is installed)

Payroll/Human Resources > Setup > AP Controls

Formerly, the keywords used on AP controls to produce the invoice number and invoice description for AP invoices generated in Payroll were not validated. Now when you create a new AP control or edit an existing one, keywords are validated and a warning is returned if invalid keywords are detected. Changes to an AP control cannot be saved until all keyword errors are resolved.

-

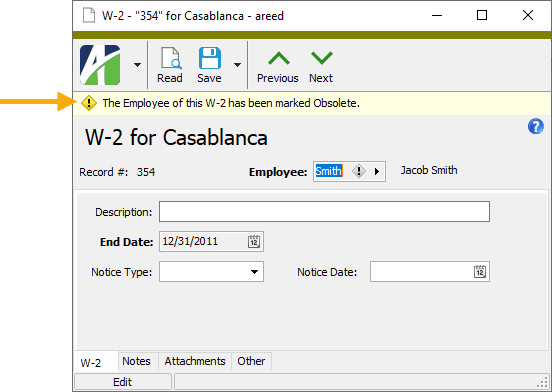

Employees

Payroll/Human Resources > Employees

Until now, flagging an employee record as obsolete did not automatically make the records associated with the employee obsolete as well. This was true for all record types. Now when an employee is flagged as obsolete, all associated records are also flagged as obsolete. Furthermore, each associated obsolete record sports a banner on its edit window that notes the obsolete status of the associated employee.

-

Payroll security view import files

ActivityHD provides the following files in your Extras folder for importing security views which limit Payroll and HR folders to the employees a user is allowed to see:

...\Extras\Payroll\PR Security Views for allowed employees.xml

...\Extras\Human Resources\HR Security Views for allowed employees.xml

Prior to this release, the import files resulted in errors. The errors have been resolved.

Note

There are some employee folders for which a security view is not currently supplied. Look for those security views in a future release of ActivityHD.

-

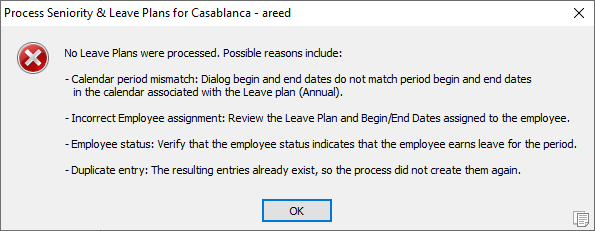

Process Seniority & Leave Plans

Payroll/Human Resources > Leave Plans > [right-click] > Select and Process

In the past, users who tried to process leave plans with invalid dates were greeted with an unhelpful error message:

No Seniority & Leave Plans were selected.

Now the message provides possible reasons for the error to help you remedy the underlying issue.