ActivityHD Release 8.49

System-wide

-

ActivityHD Automation Services (AAS)

Since ActivityHD release 8.22-0, INavigators are set to static behavior by default. While this change worked for most entity types, it did not work when deleting some entity types such as AP invoices.

Previously, scripts similar to the following pseudo code script succeeded for most entity types but would fail for a few entity types like AP invoices:

Dim d

Set d = Company.AccountsPayable.APInvoice

d.Navigator.Parameters = "..."

d.Navigator.First

Do While Not d.Navigator.Eof

d.Edit

d.Delete

d.Navigator.Next

Loop

The problem has been corrected.

-

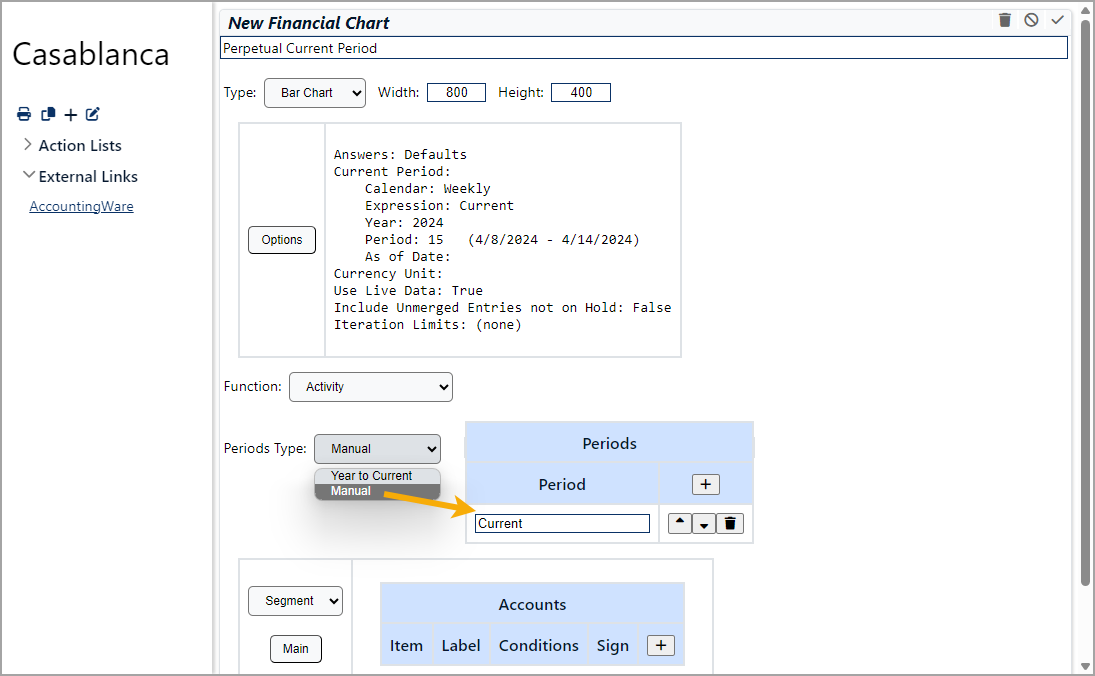

Dashboard

Previously, a financial chart gadget in the dashboard always used the periods of the year to the current period as the x coordinates (horizontal axis values) of the chart. Although this facilitated interesting and useful charts, users do not always need or want to include all periods of the year through the current period in the result. There are numerous cases where other period sets would be more useful.

For that reason, users can now specify "Manual" periods instead of only "Year to Current". When you choose manual periods, a new table becomes available where you can add, reorder, or remove periods. You specify the periods using financial design period expressions.

The new manual feature opens up financial charts for many new use cases. For example, by simply using one manual period of "Current", a chart with a single x coordinate for the moving current period can be created. In a similar way, expressions like "Current - 1" (the previous period) or "Current - 1 year" (the same period one year ago) can be created. In fact, any valid period expression is supported.

When you use manual periods, each period specified becomes a new x coordinate on the chart. You can specify any number of periods and you can control their display order.

Not to worry, the old behavior is retained. You can specify "Year to Current" and periods are automatically defined for the current year from the beginning of the year through the current period.

-

Dashboard

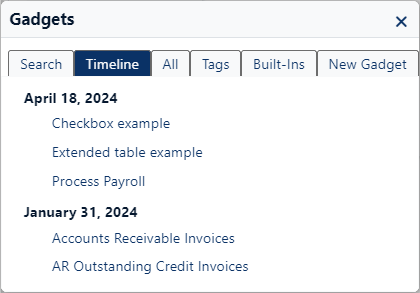

The title of the popup window which opens when you click the

icon in the main dashboard menu has changed from "Add new Gadget" to simply "Gadgets" to better reflect its actual use. Creating a new gadget is only one of the popup window's uses. It can also be used to search for and open existing gadgets.

icon in the main dashboard menu has changed from "Add new Gadget" to simply "Gadgets" to better reflect its actual use. Creating a new gadget is only one of the popup window's uses. It can also be used to search for and open existing gadgets.

-

Dashboard

In the past, the modal macro required five parameters but the first parameter was always unused. That parameter has been removed and the macro now only allows four parameters.

-

Date expressions

Date expressions can now reference quarters. In particular, you can reference the beginning or end of the current quarter, reference the beginning or end quarter of the current year, and add or subtract quarters from any date.

Following are examples of the basic syntax possible with quarters. The list is not comprehensive.

To reference the beginning or end of the current quarter:

BEGINNING OF QUARTER

END OF QUARTER

To reference the beginning or end of any quarter of the current year:

BEGINNING OF Q1

END OF Q1

BEGINNING OF Q2

END OF Q2

BEGINNING OF Q3

END OF Q3

BEGINNING OF Q4

END OF Q4

To add or subtract quarters from any date:

TODAY - 1 QUARTER

BEGINNING OF YEAR + 2 QUARTERS

Combining new syntax with existing syntax:

BEGINNING OF Q1 + 1 WEEK

END OF Q3 - 21 DAYS

-

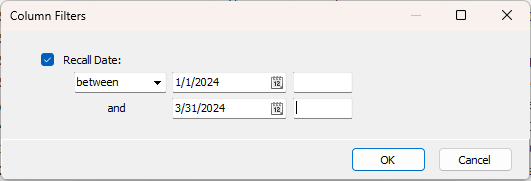

Date-time fields

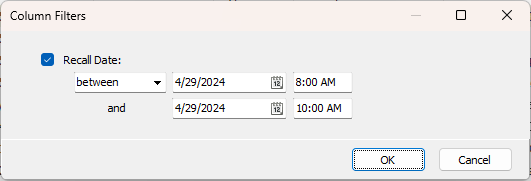

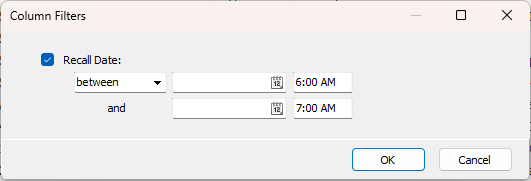

Date-time fields are available in many places throughout ActivityHD. In the past, selection conditions did not support time limits. Now date-time selections have improved functionality. Date-time fields can be limited by date only as before, by date and time, and even by time only.

For example, the following selection conditions are possible for the Recall Date on notes:

- Note recall date between 1/1/2024 and 3/31/2024 (date only)

- Note recall date between 4/29/2024 8:00 AM and 4/29/2024 10:00 AM (date and time)

- Note recall date between 6:00 AM and 7:00 AM (time only)

Note

Parameterized selection conditions are date only at the current time. For example, a filter on journal entries with a parameter for Create Date only prompts for a date, not a date and time.

- Note recall date between 1/1/2024 and 3/31/2024 (date only)

-

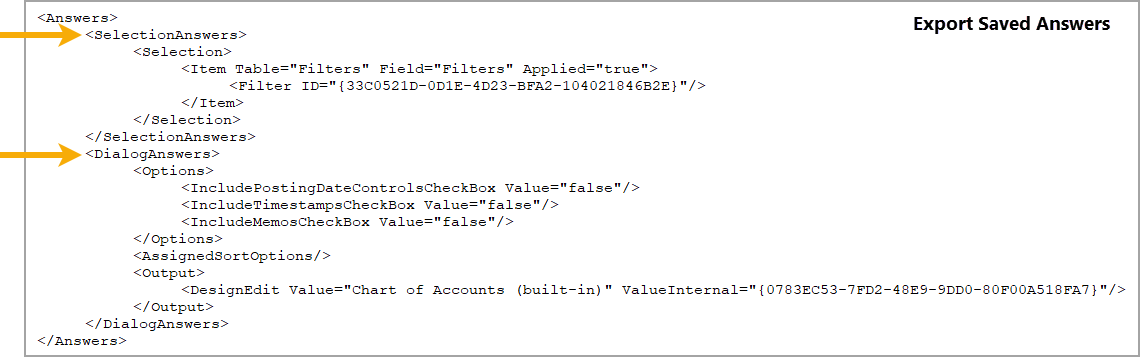

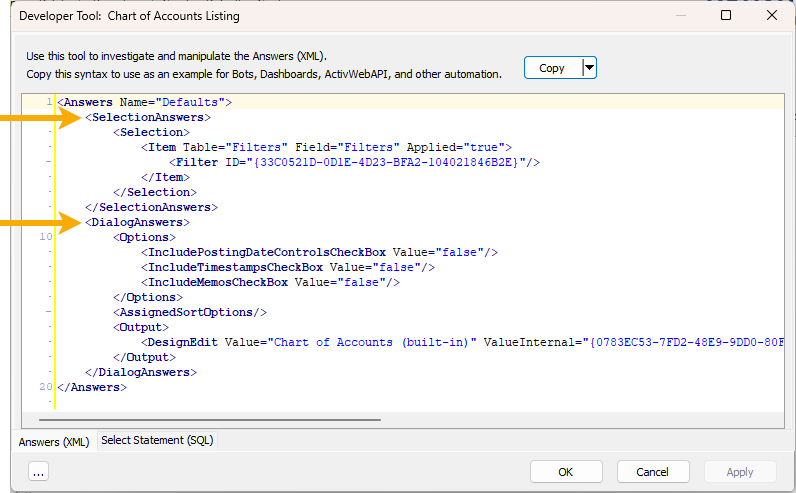

Dialog XML

The SelectionAnswers and DialogAnswers sections of Dialog XML are now shown in a more logical order. This is especially noticeable when exporting saved answers or when using the Developer Tool from a dialog or report.

-

Filtered HD views

In the past, a problem could occur when an HD view was open in a separate window while the main HD view in ActivityHD Explorer was showing the same HD view but with different filters applied. In this case, the passed filter settings were not properly applied in the separate window; instead, the filters used in the main HD view were applied erroneously.

Now the passed filter settings are properly applied and the filter settings in the main HD view are ignored.

-

Saved answers

A problem was introduced in ActivityHD 8.42-0. The change in 8.42-0 fixed an issue with saving an edited view option when the last selection condition was removed. A side-effect of the change, however, was that when editing a saved answer with selection conditions while the selection conditions were not visible caused the selection conditions to be removed. This situation was not intended and existing selection conditions should be preserved during editing. Now they are.

-

Time entry

Fields which allow time entry now support the following shortcut keys:

T, t Inserts the current time + Adds one minute to the current time entry. - Subtracts one minute from the current time entry.

Accounts Payable

-

ActivityHD Automation Services (AAS)

The InvoiceGroupingOption automation property on vendors was modified in ActivityHD 6.29-0 to use the internal single-letter codes (L, A, I, P) instead of presentation index numbers to identify the grouping option that was selected. However, the sample import workbook (..\Distribution\Extras\Accounts Payable\Import AP Vendors.xls) was not updated at that time to reflect the change. As a result, you could not use the workbook to set an option in the Invoice Grouping field unless you modified the macro code to set values correctly.

Now the sample import workbook AND the automation method have been modified to handle all the historical and current index numbers, codes, and text values. Therefore, the values on each of the following rows are equivalent and can be used to set the InvoiceGroupingOption property.

Index value Single-letter code Label in the Vendor window Other 1 L Location 2 A Location, AP Account Account 3 I One Invoice per Payment Invoice 4 P Process Default

Contracts Processing

-

Contracts

Contracts Processing > Contracts

In a prior release of ActivityHD, editing of the invoice date and due date on AR invoices that were posted from scheduled payments was restricted. While you could correct dates by deleting an unmerged invoice or by voiding a merged invoice and reposting, dates on scheduled payments could not be changed if the contract was in "Master" status. This restriction was determined to be too restrictive when work orders or settlements existed that require "Master" status.

Now the following fields can be changed on scheduled payments for contracts in "Master" status provided they are not posted to AR:

- Invoice Date

- Due Date

- Description

Fixed Assets

-

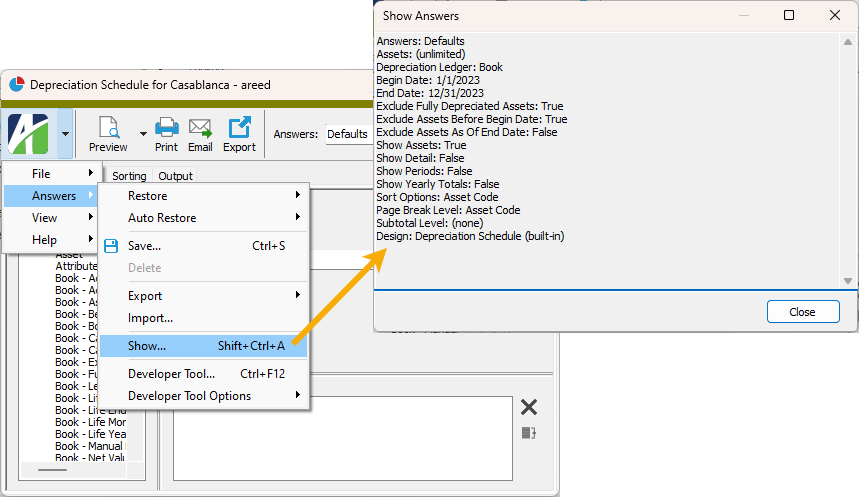

Process and report wizards

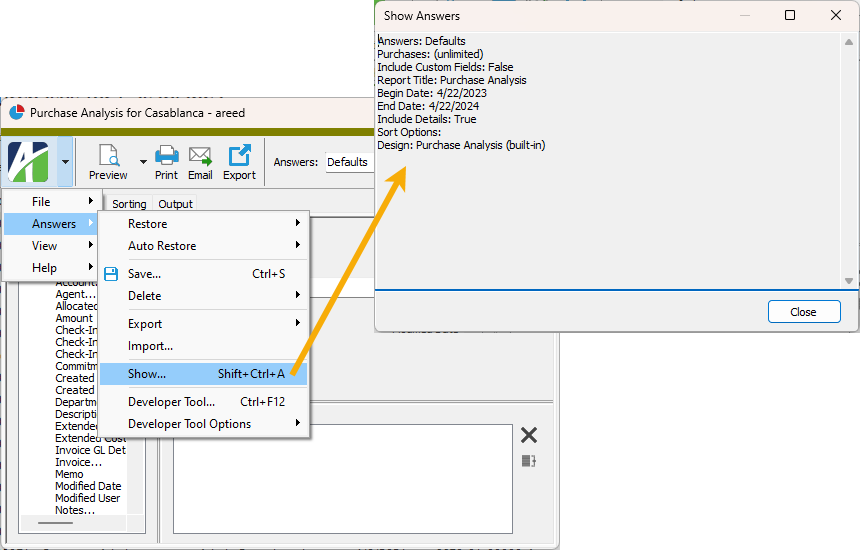

Fixed Assets > [open a Fixed Assets process or report wizard] >

> Answers > Show

> Answers > ShowThe Show Answers feature for all process and report wizards in Fixed Assets now has well-formatted answer captions and values.

General Ledger

-

Journal Entries

General Ledger > Journal Entries

A previous change in version 8.49-3 modified the Journal Entry window's SQL query for journal detail to also provide links which match the original source lines to the automatically generated reversal lines on auto-reversal journal entries. Unfortunately, that change sometimes resulted in an error similar to this:

Cannot create a row of size 8425 which is greater than the allowable maximum row size of 8060.

The error only occurred when there were numerous active segments, rollups, and attributes, and then only when the accounts used in an entry's journal detail actually had values for those rollups.

In version 8.49-4, another attempt was made to fix the problem, but there were still cases in which the solution provided did not work.

In this release, the new part of the query which matches source lines to reversal lines has been changed to use the underlying JournalDetailData table instead of the JournalDetail view since the table does not need any of the rollup item values provided by the JournalDetail view. Now the error no longer occurs.

-

Journal Entries

General Ledger > Journal Entries

Previously, a situation could occur where the strict SQL Server limit on the size of the data in a SELECT statement could be exceeded. When this occurred, the following error resulted:

The maximum size of the data in a row in SQL Server is 8KB or 8060 bytes.

This situation particularly occurred when the number of columns selected by the Journal Entry window was large especially due to numerous GL attributes and active rollups.

The problem has been corrected and the number of allowable GL attributes and active rollups can now be greater without returning the error.

-

Journal Entries

General Ledger > Journal Entries

An auto-reversal journal entry adds detail lines during the merge process which reverse each original detail line of the journal entry on the first day of the "next" GL period. In the past, users could not change the attributes on detail lines for auto-reversal journal entries. This ensured that attributes on a given reversal detail line match the attributes on the original detail line which it reverses. However, this restriction proved to be too restrictive. At times, the attributes on an auto-reversal journal entry need to be changed. For instance, this ability is especially important when transitioning an account segment to a new attribute since the GL postings need to be updated to maintain posting history for the attributes before the account segment is removed.

Now you can modify attributes on original detail lines for auto-reversal journal entries. Attributes on the system-generated reversal lines cannot be changed directly, but when the attributes on an original detail line are changed, the new attribute values are propagated to the corresponding reversal line.

If an auto-reversal detail line cannot be linked to a "source" line for some reason, the attributes of that auto-reversal detail line can be manually changed to correct the situation and to synchronize attribute values.

These changes are available in the Journal Entry window, in automation, and in the mass change action on rows in the Journal Detail HD view.

To help you identify the auto-reversal detail lines which are created when an auto-reversal journal entry is merged, a "Detail Reversal" column is now available in the Journal Detail HD view.

-

Attributes

General Ledger > Setup > Attributes

An issue was introduced in ActivityHD 8.41-0 which caused an error similar to the following if a user tried to remove GL usage from an attribute when that attribute existed with GL usage prior to upgrading to version 8.41-0 or later:

The object 'JournalDetail_FK_GLAttribute13Item' is dependent on column 'GLAttribute13Item'.

ALTER TABLE DROP COLUMN GLAttribute13Item failed because one or more objects access this column.

AccountingWare Support can run a script to fix the problem in databases prior to upgrading to version 8.49-1 or later.

-

Financial calculator functions

The following Accounts Payable financial functions have been introduced. These functions can be called by Excel using the GL financial calculator. To insert any of the new financial functions into a financial design from the ActivityHD ribbon, go to More > Accounts Payable and then locate the financial function in the drop-down menu.

- APExpenses

-

Calculates total AP expenses from invoice distributions for the specified period.

APExpenses(Period, Items1, Items2, Company, Unit)

Example

APExpenses("Current", "IS=COGS", "Ledger=A")

- APExpensesYTD

-

Calculates the year-to-date AP expenses from invoice distributions for the specified period.

APExpensesYTD(Period, Items1, Items2, Company, Unit)

Examples

APExpensesYTD("Current", "IS=COGS", "Ledger=A")

APExpensesYTD("Current", "IS=COGS AND AP.Attribute.Project=1003", "Ledger=A")

APExpensesYTD("Current", "IS=COGS AND AP.Vendor=ACME", "Ledger=A")

APExpensesYTD("Current", "IS=COGS AND AP.VendorClass=SUPPLIER", "Ledger=A")

- APExtraActivity

-

Calculates the AP extra GL activity as of the specified period.

APExtraActivity(Period, Items, Company, Unit)

Example

APExtraActivity("Current", "IS=COGS AND Ledger=A")

- APExtraDebitActivity

-

Calculates the AP extra GL debit activity as of the specified period.

APExtraDebitActivity(Period, Items, Company, Unit)

Example

APExtraDebitActivity("Current", "IS=COGS AND Ledger=A")

- APExtraCreditActivity

-

Calculates the AP extra GL credit activity as of the specified period.

APExtraCreditActivity(Period, Items, Company, Unit)

Example

APExtraCreditActivity("Current", "IS=COGS AND Ledger=A")

- APExtraYearToDate

-

Calculates the AP extra GL year-to-date activity as of the specified period.

APExtraYearToDate(Period, Items, Company, Unit)

Examples

APExtraYearToDate("Current", "IS=COGS AND Ledger=A")

APExtraYearToDate("Current", "IS=COGS AND AP.Attribute.Project=1001 AND Ledger=A")

APExtraYearToDate("Current", "IS=COGS AND AP.Vendor=ACME AND Ledger=A")

APExtraYearToDate("Current", "IS=COGS AND AP.VendorClass=SUPPLIER AND Ledger=A")

- APExtraDebitYearToDate

-

Calculates the AP extra GL year-to-date debit activity as of the specified period.

APExtraDebitYearToDate(Period, Items, Company, Unit)

Example

APExtraDebitYearToDate("Current", "IS=COGS AND Ledger=A")

- APExtraCreditYearToDate

-

Calculates the AP extra GL year-to-date credit activity as of the specified period.

APExtraCreditYearToDate(Period, Items, Company, Unit)

Example

APExtraCreditYearToDate("Current", "IS=COGS AND Ledger=A")

- APPaymentsBank

-

Calculates total AP payments bank postings for the specified period.

APPaymentsBank(Period, Items1, Items2, Company, Unit)

Example

APPaymentsBank("Current", "Bal=CASH", "Ledger=A")

- APPaymentsBankYTD

-

Calculates the year-to-date AP payments bank postings for the specified period.

APPaymentsBankYTD(Period, Items1, Items2, Company, Unit)

Example

APPaymentsBankYTD("Current", "Bal=CASH", "Ledger=A")

APPaymentsBankYTD("Current", "Bal=CASH AND AP.PaymentVendor=ACME", "Ledger=A")

APPaymentsBankYTD("Current", "Bal=CASH AND AP.PaymentVendorClass=SUPPLIER", "Ledger=A")

- APPaymentsDiscount

-

Calculates total AP payments discount postings for the specified period.

APPaymentsDiscount(Period, Items1, Items2, Company, Unit)

Example

APPaymentsDiscount("Current", "IS=DISC_TAKEN", "Ledger=A")

- APPaymentsDiscountYTD

-

Calculates the year-to-date AP payments discount postings for the specified period.

APPaymentsDiscountYTD(Period, Items1, Items2, Company, Unit)

Example

APPaymentsDiscountYTD("Current", "IS=DISC_TAKEN", "Ledger=A")

- APAttribute

-

Returns the name of the specified AP attribute.

APAttribute(AttributeName, Company)

Example

APAttribute("Project")

- APAttributePluralName

-

Returns the plural name of the specified AP attribute.

APAttributePluralName(AttributeName, Company)

Example

APAttributePluralName("Project")

- APAttributeMemo

-

Returns the memo of the specified AP attribute.

APAttributeMemo(AttributeName, Company)

Example

APAttributeMemo("Project")

- APAttributeCustomField

-

Returns the value of a custom field for the specified AP attribute.

APAttributeCustomField(Field, AttributeName, Company)

Example

APAttributeCustomField("Type", "Project")

- APAttributeItem

-

Returns the name of the specified AP attribute item.

APAttributeItem(AttributeName, Item, Company)

Example

APAttributeItem("Project", 1003)

- APAttributeItemDescription

-

Returns the description of the specified AP attribute item.

APAttributeItemDescription(AttributeName, Item, Company)

Example

APAttributeItemDescription("Project", 1003)

- APAttributeItemMemo

-

Returns the memo of the specified AP attribute item.

APAttributeItemMemo(AttributeName, Item, Company)

Example

APAttributeItemMemo("Project", 1001)

- APAttributeItemCustomField

-

Returns the value of the custom field for the specified AP attribute item.

APAttributeItemCustomField(Field, AttributeName, Item, Company)

Example

APAttributeItemCustomField("Cost Estimate", "Project", 1001)

- APVendor

-

Returns the code of the specified AP vendor.

APVendor(VendorCode, Company)

Example

APVendor("ACME")

- APVendorDescription

-

Returns the description of the specified AP vendor.

APVendorDescription(VendorCode, Company)

Example

APVendorDescription("ACME")

- APVendorMemo

-

Returns the memo of the specified AP vendor.

APVendorMemo(VendorCode, Company)

Example

APVendorMemo("ACME")

- APVendorCustomField

-

Returns the value of a custom field for the specified AP vendor.

APVendorCustomField(Field, VendorCode, Company)

Example

APVendorCustomField("Franchisee?", "ACME")

- APClass

-

Returns the code of the specified AP class.

APClass(APClassCode, Company)

Example

APClass("SUPPLIER")

- APClassDescription

-

Returns the description of the specified AP class.

APClassDescription(APClassCode, Company)

Example

APClassDescription("SUPPLIER")

- APClassMemo

-

Returns the memo of the specified AP class.

APClassMemo(APClassCode, Company)

Example

APClassMemo("SUPPLIER")

- APClassCustomField

-

Returns the value of a custom field for the specified AP class.

APClassCustomField(Field, APClassCode, Company)

Example

APClassCustomField("Rating", "SUPPLIER")

Certain keyword values can be added to the items expressions for AP financial amount functions.

AP functions Available keyword values APExpenses, APExpensesYTD,

APExtraActivity, APExtraDebitActivity, APExtraCreditActivity,

APExtraYearToDate, APExtraDebitYearToDate, APExtraCreditYearToDate

AP.Attribute.<attribute_name> = <attribute_item>

AP.Vendor = <vendor_code>

AP.VendorClass = <vendor_class_code>

APPaymentsBank, APPaymentsBankYTD,

APPaymentsDiscount, APPaymentsDiscountYTD

AP.PaymentVendor = <vendor_code>

AP.PaymentVendorClass = <vendor_class_code>

-

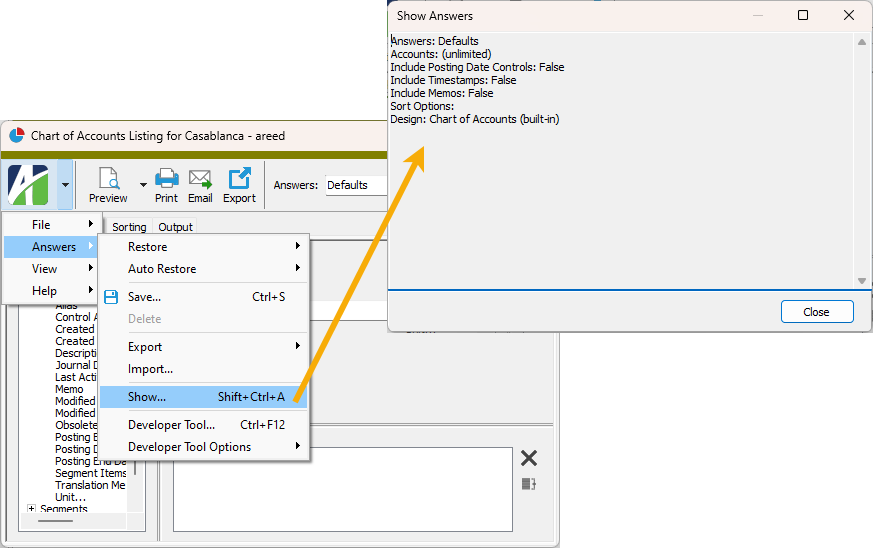

Process and report wizards

[open a General Ledger process or report wizard] >

> Answers > Show

> Answers > ShowThe Show Answers feature for most process and report wizards in General Ledger now has well-formatted answer captions and values.

For technical reasons, the General Ledger Detail Report and GL Summary were not improved at this time.

Payroll

-

2024 tax updates

The following state income tax changes have been introduced:

- Arkansas. The top tax rate has decreased from 4.4% to 3.9%. The tax change is effective as of 7/1/2024 but retroactive to 1/1/2024. In addition, the supplemental tax rate is reduced to 3.9%.

- Georgia. The flat tax rate has decreased from 5.49% to 5.39%. The tax change is effective as of 7/1/2024 but retroactive to 1/1/2024. In addition, the supplemental tax rate is now 5.39% across the board instead of being based on income level.

- Kansas. The tax rates have decreased and a standard deduction has been introduced. The tax changes are effective as of 7/1/2024.

- Ohio. The tax rate for the uppermost bracket has decreased from 4.41% to 3.8%. The tax change is effective as of 7/1/2024.

- Utah. The tax rate has decreased from 4.65% to 4.55% and the base allowance and standard deduction amounts have increased for both filing statuses ("Single" and "Married"). The tax change is effective as of 6/1/2024.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls."

-

2024 tax updates

The following state income tax change has been introduced:

- Idaho. The Idaho tax rate and the supplemental tax rate have been reduced to 5.695%. The annual exemption amount has increased to $3,600. These changes were published 5/21/2024 and are retroactive to 1/1/2024; however, employers are not required to implement the tax change until their next payroll checks.