ActivityHD Release 8.15

System-wide

-

Companies

Activity System > Companies

In the past, an error would occur when attempting to open a company record if the system SMTP port was not configured. This error no longer occurs.

-

Bots

Activity System > Administration > Bots

[Company] > Administration > Bots

The recommended version of VBSEdit has been updated to v9.6237. The installer is available in the distribution folder Extras\VBSEdit.

VBSEdit is an optional and separately installed editor and debugger which can be used for bot creation and maintenance in ActivityHD.

-

Bots

Activity System > Administration > Bots

[Company] > Administration > Bots

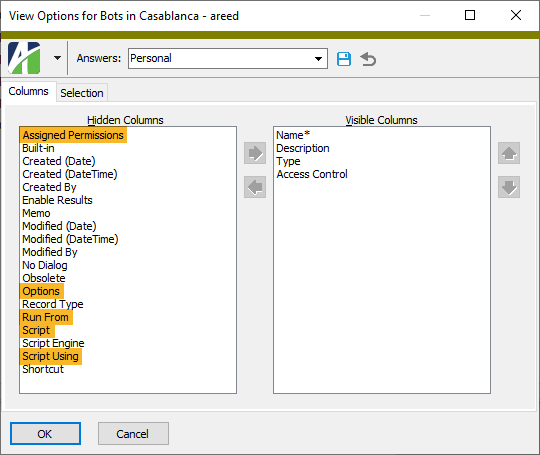

Before the current release, there were several columns which were not available to be shown in the Bots HD views. Now the following columns are available along with column filtering capability:

- Options

- Assigned Permissions (as a comma-separated list)

- Run From (as a comma-separated list)

- Script (as text, including "Script", "ScriptInit", and "ScriptFinal")

- Script Using (as a comma-separated list)

Accounts Payable

-

Generate 1099s

Accounts Payable > Vendors > [right-click] > Select and Generate 1099s

Generation, printing, and transmission of Forms 1099-DIV, 1099-INT, 1099-MISC, and 1099-NEC for tax year 2021 are now available for use. The changes recently released in Publication 1220 (Specifications for Electronic Filing of Forms...) have been applied. The most notable of these changes are documented in this version 8.14-0 patch.

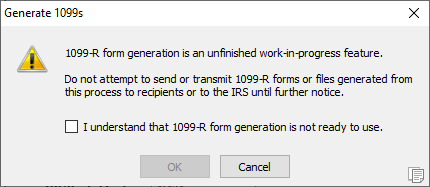

The warning message about the 2021 updates being incomplete has been removed. However, 1099-R processing is still not available, so attempting to process 1099-Rs results in the following message:

Note

The 1099 transmission file layout changed for the 2022 processing year. As a result, the new Proof 1099 Transmission process (see "Proof 1099 Transmission" below) only works for files created in the 2022 processing year. The new process cannot be used for prior years until ActivityHD is changed to handle processing of year-specific electronic file formats.

-

Generate Payment EFT

Accounts Payable > Payments > [right-click] > Payment EFT > Select and Generate Payment EFT

In the past, EFT files generated from AP payments used Canadian Payments Association (CPA) code 200 "Payroll Deposit". This description was used on the payments that vendors received. Now EFT files produced in Accounts Payable use code 460 "Accounts Payable".

-

Invoices

Accounts Payable > Invoices

Previously, the following error could occur saving an invoice when duplicate checking on the vendor included checking the invoice number if the invoice being saved, or another AP invoice, contained only spaces for the invoice number:

Error converting data type varchar to numeric

The error no longer occurs.

-

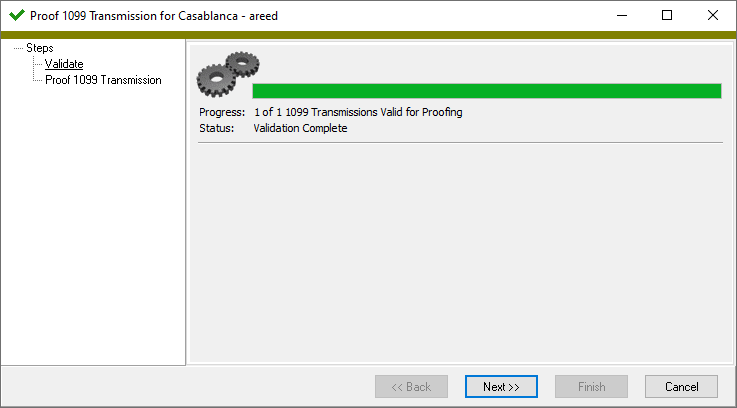

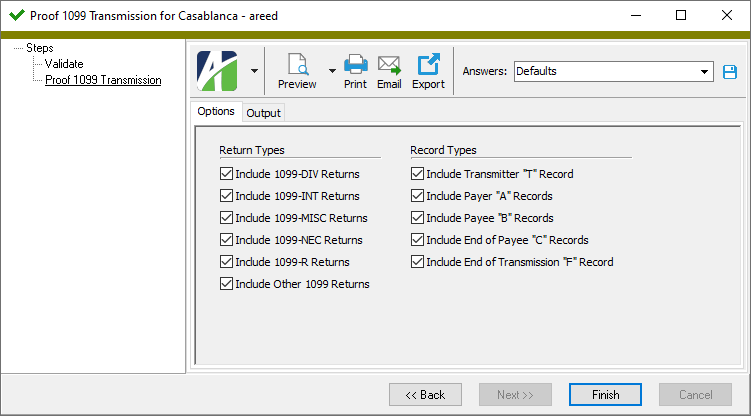

Proof 1099 Transmission

Accounts Payable > Government > 1099 Transmissions > [highlight a transmission in the HD view] >

A new Proof 1099 Transmission process has been introduced to provide a means to list the contents of the electronic file that is attached to a 1099 transmission. The process parses the content of the electronic file (based on Publication 1220 guidelines) and produces a report. This provides an additional way to proof 1099 information before submitting the electronic file to the IRS.

The new "Proof" access on AP "1099 Transmissions" is required to run the new process. During data conversion, any existing permissions which have all accesses enabled will automatically receive "Proof" access.

The Proof 1099 Transmission process can be run from the 1099 transmission record, by selecting a 1099 transmission in the HD view and clicking

, or by selecting a 1099 transmission in the HD view, right-clicking, and selecting Proof from the shortcut menu.

, or by selecting a 1099 transmission in the HD view, right-clicking, and selecting Proof from the shortcut menu.Note

Currently, the Proof 1099 Transmission process only works for transmissions generated for the 2022 processing season due to file format changes for the 2021 tax year (2022 processing season). The following error message is returned if you attempt to run the process on transmissions created for earlier processing seasons:

This process currently only works for transmissions from the 2022 processing year.

Accounts Receivable

-

Customers

Accounts Receivable > Customers

An obscure problem could occur during customer import or when using the ActivWebAPI if the user was creating a new customer with data links to an existing customer. In this situation, data links were being established before setting other field values thus causing a cascading problem in which two customer records were being set to the same customer code. As a result, a "no duplicates" error was returned.

The issue has been corrected.

-

Invoices

Accounts Receivable > Invoices

Previously, the following error could occur saving an invoice when duplicate checking on the invoice type included checking the invoice number if the invoice being saved, or another AR invoice, contained only spaces for the invoice number:

Error converting data type varchar to numeric

The error no longer occurs.

ActivityHD Manager

-

Company configuration

Sometimes restoring a company database on SQL Server could cause problems when trying to set the database owner during company configuration. Now the process of updating the company confirms the database login and resets the database owner if needed.

Fixed Assets

-

Extras

Previously, the ...\Extras\Fixed Assets\Import Assets.xls macro could fail with an access violation. The error occurred when a non-date-driven attribute was entered in the attribute detail section of the import workbook.

Now a better error occurs when this happens: Attribute (<Attribute Name>) is not date-driven.

Furthermore, the workbook demonstrates how to import both date-driven and non-date-driven attributes:

- Specify non-date-driven attributes as column headings in the main asset section and modify the macro code to match.

- Specify date-driven attributes in the attribute detail section as before. The section is now marked "(date-driven)".

General Ledger

-

Rollups

General Ledger > Setup > Rollups

Changes to direct rollup assignments were not active (i.e., immediately updated) in HD views. Now they are.

-

Combine Accounts/Segment Items

General Ledger > Accounts > [right-click] > Select and Combine

General Ledger > Setup > Segments > [Segment] > [right-click] > Select and Combine

An issue was introduced in version 8.10 which caused account masks not to be modified correctly in the Combine Accounts and Combine Segment Items processes. As a result, an error would be returned when combining segment items that caused the combine operation to fail. The issue has been addressed.

-

Rollup Health

A new Rollup Health feature has been introduced to provide feedback about rollup issues in the Account window, during the Publish Financials process, and when using Financial Drilldown.

To enable the Rollup Health feature for a rollup, ensure the AcctType built-in rollup is activated and set the financial type on the rollup to "Balance Sheet" or "Income Statement".

Balance Sheet rollups are considered healthy if all asset, liability, equity, revenue, and expense accounts have an assigned value for the rollup. Income Statement rollups are considered healthy if all revenue and expense accounts have an assigned value for the rollup.

-

Rollups

General Ledger > Setup > Rollups

A problem was introduced in version 8.14-0 which prevented assignment rule-type rollups from being imported correctly. The problem has been fixed.

-

Rollups

General Ledger > Setup > Rollups

When direct assignment rollups are deactivated, the assignments are removed. Now users will see a message to that effect when deactivating direct assignment rollups.

-

Rollups

General Ledger > Setup > Rollups

Errors could occur if you attempted to set a direct assignment rollup to "Required". Now you can set a direct assignment rollup to "Required" either before or after activation. If you set a direct assignment rollup to "Required", you are prompted for the default item to use when a reference is currently blank. The prompt occurs either when activating the rollup or when saving an active rollup.

-

Rollups

General Ledger > Setup > Rollups

A built-in rollup called AcctType has been introduced to ActivityHD. AcctType is not automatically activated. Enhancements such as the Rollup Health feature will utilize AcctType when it is activated.

The AcctType rollup can be deactivated and its assignment settings can be modified. However, AcctType's rollup items are built in and cannot be modified.

In addition, when a new company is installed, the following rollups are automatically installed:

- AcctCategory - Direct assignment on "Main"

- AcctType - Direct assignment on "AcctCategory"

- BalSheet - Direct assignment on "AcctCategory"

- IncomeStmt - Direct assignment on "AcctCategory"

AcctCategory, BalSheet, and IncomeStmt can be modified or deleted as desired.

-

Rollups

General Ledger > Setup > Rollups

Since version 8.13-0 it was possible to select the "Specify Items Only" rules option even though the associated rollup items had excludes, masks, or ranges. Now this is prevented.

-

Rollups

General Ledger > Setup > Rollups

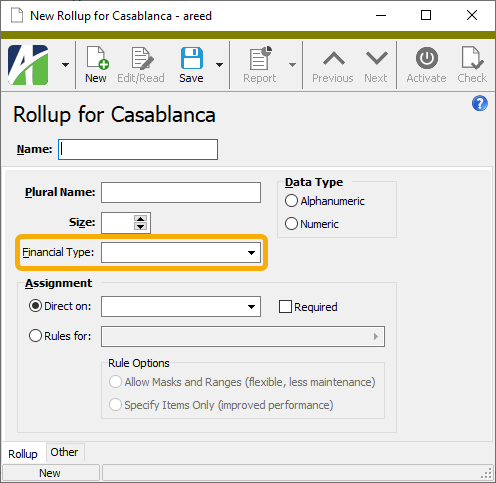

In preparation for the new Rollup Health feature, a Financial Type field has been introduced on rollups. A financial type can be either "Balance Sheet", "Income Statement", or blank. The financial type will be used in conjunction with the new AcctType rollup.

Balance Sheet rollups are considered healthy if all asset, liability, equity, revenue, and expense accounts have an assigned value for the rollup. Income Statement rollups are considered healthy if all revenue and expense accounts have an assigned value for the rollup.

Payroll/Human Resources

-

Employee Create Totals File

Payroll/Human Resources > Employees > [right-click] > Select and Create Totals File

Previously, access violations could occur when attempting to enter a date in the Employee Create Totals File process. The error occurred when the export control was set up to have dates entered on the Additional Options tab. The access violations no longer occur.

-

2021 SUTA wage base update

The 2021 SUTA wage base increase to $11,100 for Kentucky was rescinded retroactively. The record has been removed from the state unemployment table. The 2021 Kentucky SUTA wage base is $10,800, the same as 2020.

-

2022 SUTA wage base update

The following wage base amount for 2022 has been added to the state unemployment table:

State Year Wage base Iowa 2022 $34,800 -

2021 tax updates

The following local income tax changes have been introduced:

- Indiana Counties. Owen and Warrick Counties have increased their tax rates effective 10/1/2021.

-

2022 tax updates

The following state income tax changes have been introduced:

- Georgia. The standard deduction amounts have been increased effective 1/1/2022.

- Wisconsin. The withholding tax brackets, supplemental tax brackets, deduction brackets, and exemption amount were updated effective 1/1/2022.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

-

Employee Contacts

Payroll/Human Resources > Employees > Contacts

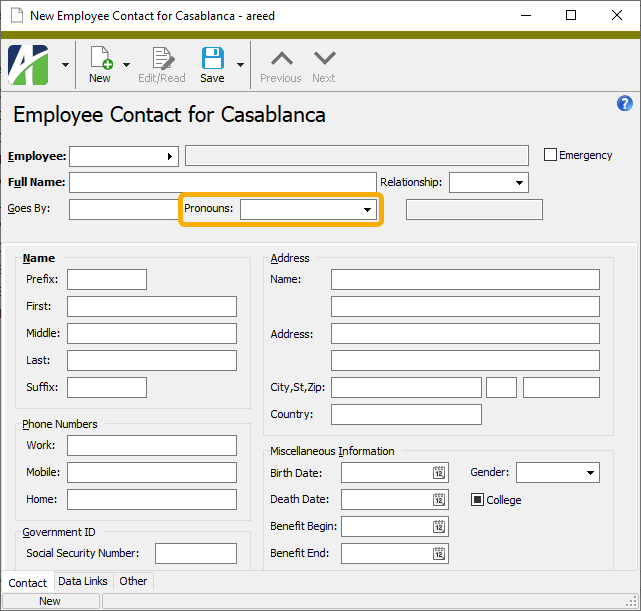

A Pronouns field has been introduced to the header section of the Employee Contact window. The header area has been arranged to accommodate the introduction of this field.

The Pronouns field offers three pre-defined values plus allows manual entry of values not in the list:

- He/Him/His

- She/Her/Hers

- They/Them/Theirs

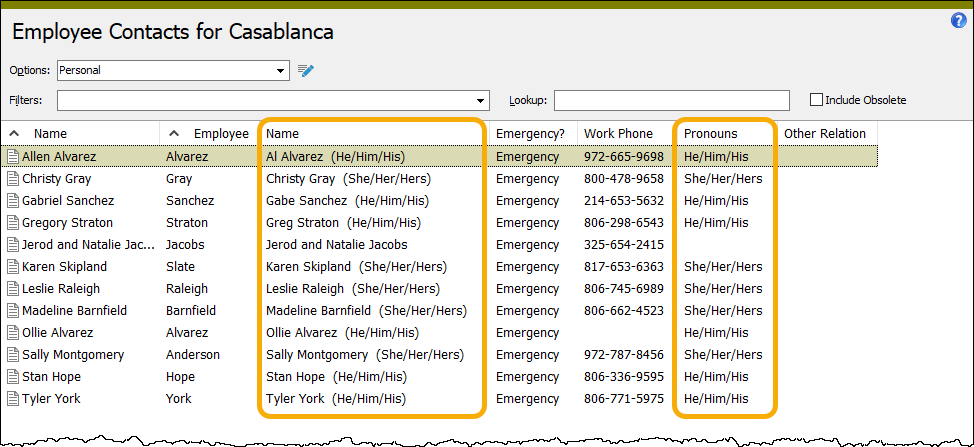

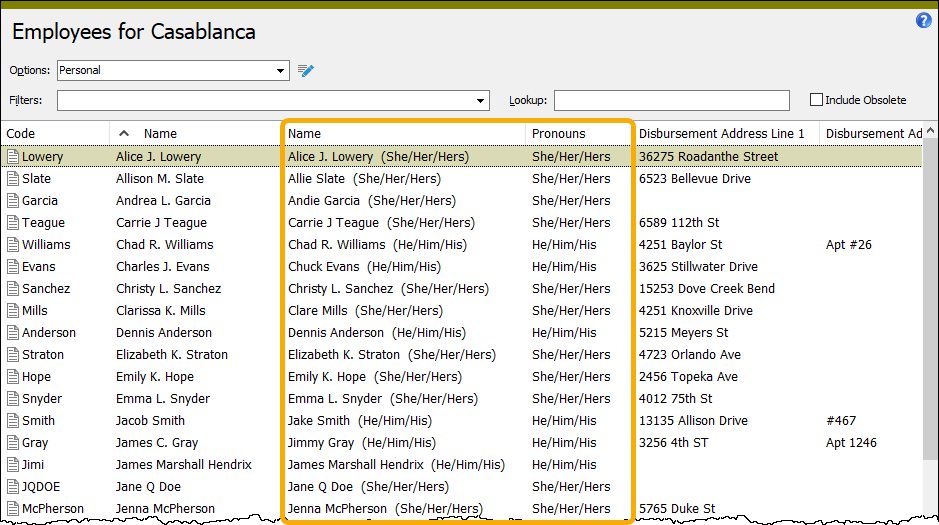

In addition, columns have been added to the Employee Contacts folder to show pronouns and preferred names.

The Name column for preferred names includes "goes by" names and pronouns. If a "goes by" name does not exist for a contact, the contact's first and middle name are shown instead.

-

Employee Contacts

Payroll/Human Resources > Employees > Contacts

The following error could be returned when editing an existing employee contact record:

Invalid Gender.

The error was caused by an internal issue where lowercase gender codes "m" and "f" could be stored in the database rather than uppercase codes "M" and "F". When the non-binary gender ("X") was introduced in version 8.11-0, the database codes were assumed to be uppercase and, as a result, lowercase codes are no longer recognized.

A database conversion is provided to convert lowercase gender codes to uppercase.

-

Employees

Payroll/Human Resources > Employees

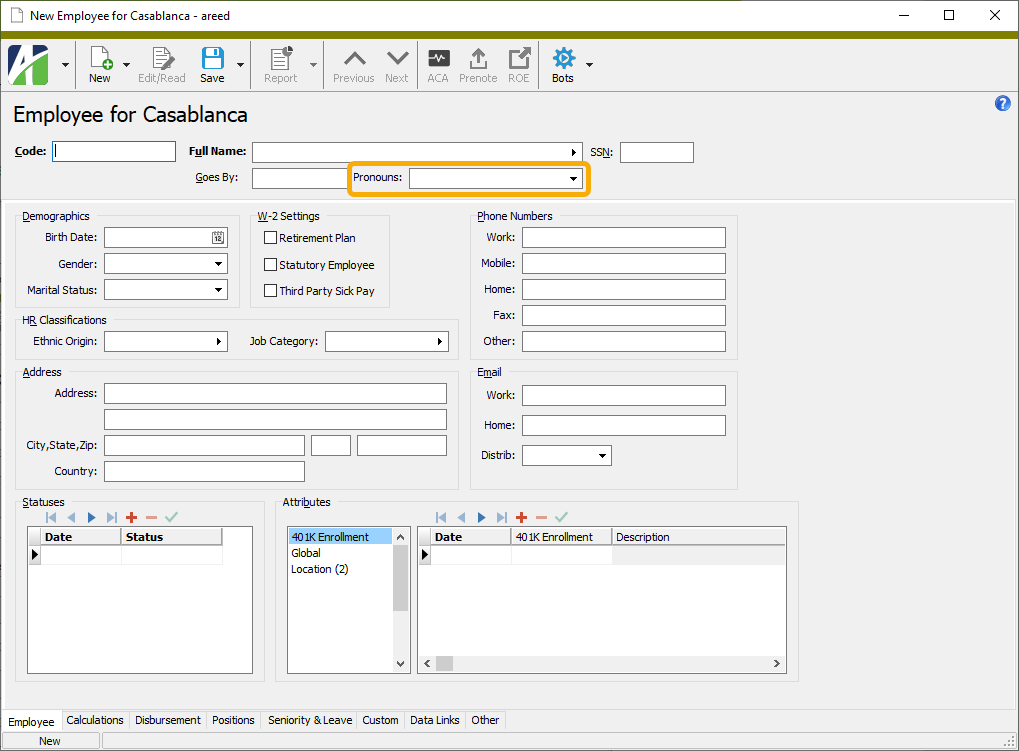

A Pronouns field has been introduced to the header section of the Employee window. The header area has been arranged to accommodate the introduction of this field.

The Pronouns field offers three pre-defined values plus allows manual entry of values not in the list:

- He/Him/His

- She/Her/Hers

- They/Them/Theirs

In addition, columns have been added to the Employees folder to show pronouns and preferred names.

The Name column for preferred names includes "goes by" names and pronouns. If a "goes by" name does not exist for an employee, the employee's first and middle name are shown instead.

In addition to the Employees folder, the preferred names column is available as the "Employee Name (Preferred)" option on any folder in Payroll/Human Resources with current references to employee name.

-

Employees

Payroll/Human Resources > Employee

Previously, the following error could be returned when attempting to save changes to an employee name under an obscure combination of circumstances:

String or binary data would be truncated

The error occurred when the following conditions were all true:

- The employee first-name-first (i.e., prefix + first name + middle name + last name + suffix) exceeded 40 characters

- The first Address Name field on the employee location had not been overwritten.

- The change log on employee locations was enabled.

When these circumstances existed, attempting to change the employee's name--even to something shorter--returned the error trying to set the "Address Name 1 (Old)" column in the employee locations change log.

Now the "Address Name 1 (Old)" column is set to the first 40 characters of the first-name-first value.

-

Employees

Payroll/Human Resources > Employee

It is possible to create new items for several entities from the context tabs in the Employee window by simply selecting the appropriate tab and clicking

in the tab heading. Typically, the new entity record opens with the employee code prefilled in the Employee field in the new record. However, under certain circumstances it was possible for the wrong employee code to be prefilled on the new record. For example:

in the tab heading. Typically, the new entity record opens with the employee code prefilled in the Employee field in the new record. However, under certain circumstances it was possible for the wrong employee code to be prefilled on the new record. For example:- Open the employee record for "MSmith".

- Select the Contacts tab.

- Click

. The New Employee Contact window opens with the employee code "MSmith" prefilled.

. The New Employee Contact window opens with the employee code "MSmith" prefilled. - Close the Employee Contact window.

- Click

in the main toolbar to advance to the next employee record, we'll say "MThomas".

in the main toolbar to advance to the next employee record, we'll say "MThomas". - Click

. The New Employee Contact window opens with the employee code "MSmith" prefilled instead of "MThomas".

. The New Employee Contact window opens with the employee code "MSmith" prefilled instead of "MThomas".

Now the employee code which corresponds to the current employee record always loads on new entity records created from the Employee window.

The issue has been corrected for the following entity types:

- ACA records

- Contacts

- Insurance coverage

- Leave entries

- Time sheets

-

Export Employees

Payroll/Human Resources > Employees > [right-click] > Select and Export

Previously, Export Employees only exported the employee's primary position and pay rates. Now all positions and pay rates for an employee are exported and imported.

-

Garnishments

Payroll/Human Resources > Employees > Records > Garnishments

Seven states have announced new minimum wages for 2022. ActivityHD has incorporated these new rates to calculate limits on these states' civil garnishments.

Arizona

Minimum hourly wage Effective date $12.80 01/01/2022 Minnesota

Minimum hourly wage Effective date $10.33 01/01/2022 New York

Minimum hourly wage Effective date $13.20 12/31/2021 Ohio

Minimum hourly wage Effective date $9.30 01/01/2022 South Dakota

Minimum hourly wage Effective date $9.95 01/01/2022 Vermont

Minimum hourly wage Effective date $12.55 01/01/2022 Washington

Minimum hourly wage Effective date $14.49 01/01/2022 -

Print Form 941 Returns

Payroll/Human Resources > Government > Form 941 Returns > [right-click] > Select and Print

Previously, a user could create an attachment and mark a 941 return as submitted even when the specified report design was invalid for the year of the selected data. Now when you click Next >> in the Print step, the report design is validated. If it is invalid, an error similar to the following is returned and the user is prevented from advancing to create attachments and mark as submitted:

One or more of the selected Form 941 Returns are incompatible with the current report design.

Report design year: 2019

Form 941 year: 2021

-

Segment items

Payroll/Human Resources > Setup > Segment Items

In the past, the result amounts on the built-in Tax:FUTA and TaxSUTA:xx (where xx is a two-character state abbreviation) segment items were not correct if the rate changed during the year. This was due to the result expression containing an amount up to maximum wages times the current rate.

For example, consider the following scenario: Suppose an employee in Texas, where the maximum year-to-date wages are $9,000 and the SUTA rate at the beginning of the year is 2%, earns $4,000 per pay period. Further suppose that the SUTA rate dropped to 1% in March.

For January and February, the SUTA check lines looked like this:

Date PRCode Source Rate Result 1/5/2021 Tax.SUTA.TX 4000.00 2.00 80.00 2/5/2021 Tax.SUTA.TX 4000.00 2.00 80.00 But for March the SUTA check line looked like this:

Date PRCode Source Rate Result 3/5/2021 Tax.SUTA.TX 1000.00 1.00 0.00 Before this change, the March result was 0.00 because the year-to-date result ($160.00) already exceeded the maximum wages times the current rate ($9.000 * .01 = $90.00).

Now the result expression for all FUTA and SUTA segment items is source times rate as it should be.

The previous formula for each employee was calculated as maximum wages times rate in order to better handle rounding. But this formula did not account for mid-year rate changes and did not really help with rounding after all--the total SUTA wages (source amount) for all employees times rate was usually a few pennies different from the total result amount anyway.