ActivityHD Release 8.14

System-wide

-

ActivityHD Explorer

Until now, the embedded web browser in ActivityHD Explorer used features from Internet Explorer 6. This mostly affected the way "Internet Address" custom fields displayed web pages. Some web pages could not display correctly because of the limitations of IE6's feature set. Now web pages with the standards-based !DOCTYPE directive will display in IE11 Edge mode, thus increasing the number of pages which will display correctly in the "Internet Address" custom fields.

-

Bots

Activity System > Administration > Bots

[Company] > Administration > Bots

In the past, bot using modules which use the VBScript engine were marked as "global" code when debugging in the VBSEdit script editor. Now instead of being marked as global, these act as "include" modules. Bot using modules which use the JScript or JScript9 engines are not affected.

Accounts Payable

-

1099s

Accounts Payable > Vendors > Records > 1099s

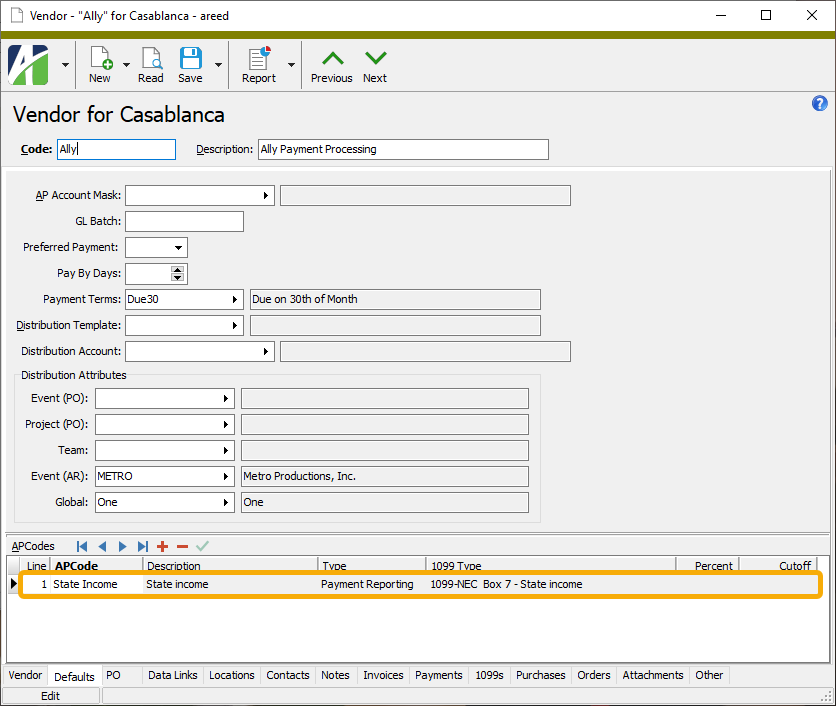

Starting with tax year 2021, the "State Income" amount can be reported on Forms 1099-MISC and 1099-NEC.

To report state income for payments to a vendor:

- Create an APCode which references the appropriate 1099 type.

- For 1099-MISC, the APCode should reference "1099-MISC Box 17 - State income".

- For 1099-NEC, the APCode should reference "1099-NEC Box 7 - State income".

-

For all vendors for which you are required to report state income, add the state income APCode to the APCodes table on the Defaults tab.

- Add the state income APCode to existing invoices and payments for the tax year (2021 or later). To do so:

- Run Update Invoice APCodes from Vendors for invoices paid in 2021 (or that will be paid in 2021 or later) in order to apply the changes made to the default APCodes on vendors.

- Run Update Payment APCodes from Invoices for payments made in 2021 to apply changes to invoice APCodes.

Alternatively, you can manually add the new state income APCode to existing 2021 payments and outstanding invoices.

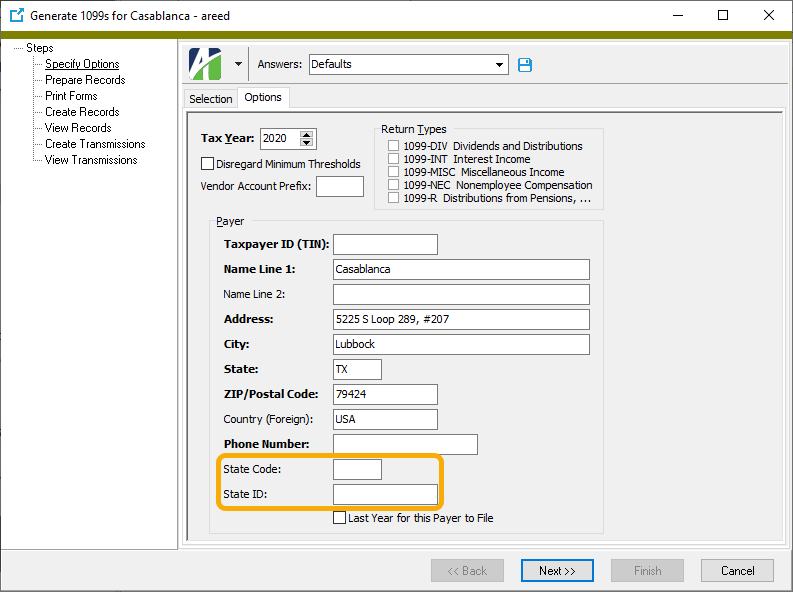

If you are reporting state tax withholding or state income, ensure that you respond to the State Code and State ID fields when running the Generate 1099s process.

Currently, state tax withholding and state income reporting only work when reporting for a single state. ActivityHD does not currently support multi-state 1099 reporting.

- Create an APCode which references the appropriate 1099 type.

-

APCodes

Accounts Payable > Setup > APCodes

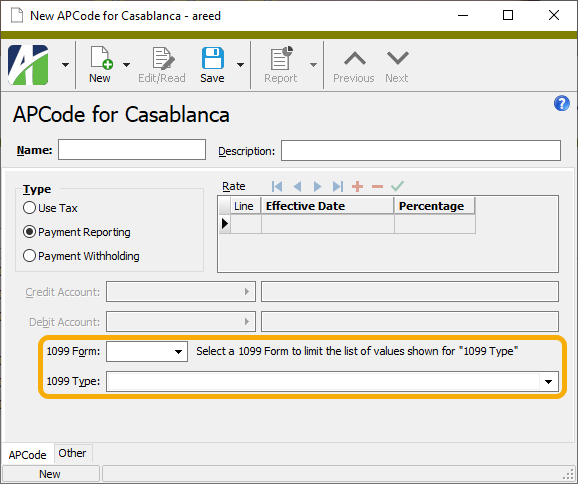

A new 1099 Form field has been introduced to the APCode window. This field filters the values in the 1099 Type drop-down list so that you only see options for the selected form. If you do not make a selection in the 1099 Form field, options for all supported 1099 forms appear in the drop-down list.

Moreover, if you select an option from the 1099 Type field without first making a selection in the 1099 Form field, the 1099 Form field is set to the appropriate form automatically.

Finally, if you select a different option in the 1099 Form field while there is a selection in the 1099 Type field, the 1099 Type field is blanked out so that you can select a type from the correctly filtered list of 1099 types.

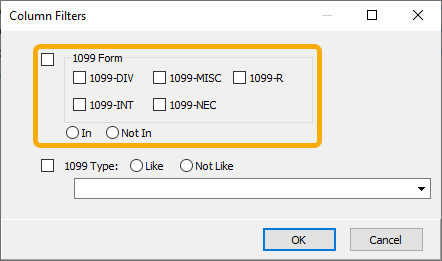

A 1099 Form column is also now available in the APCodes HD view. The column filter for the 1099 Form column allows you to limit by 1099 form.

-

Generate 1099s

Accounts Payable > Vendors > Records > 1099s > [right-click] > Generate 1099s

State Code and State ID fields have been added to the Payer section of the Generate 1099s Options tab for use when reporting state withholding and/or income.

The values from these fields print on the appropriate 1099s when withholding and/or income exist for a vendor:

- On 1099-DIV if state tax is withheld

- On 1099-INT if state tax is withheld

- On 1099-MISC if state tax withheld and there is state income

- On 1099-NEC if state tax withheld and there is state income

Presently, the state values will only work when there is only one state code and it is the same for all payments to all vendors.

-

Generate 1099s

Accounts Payable > Vendors > [right-click] > Select and Generate 1099s

Copy A and Copy B report designs and images have been introduced for the 2021 tax year for the following 1099 forms:

- 1099-DIV

- 1099-INT

- 1099-MISC

- 1099-NEC

Among the significant changes for tax year 2021:

- 1099-DIV. Two new boxes have been added:

- Box 2e - Section 897 ordinary dividends

- Box 2f - Section 897 capital gain

- 1099-MISC. One new box has been added:

- Box 11 - Fish purchased for resale

- 1099-NEC. The Copy A (red ink) form now prints three forms per page rather than two.

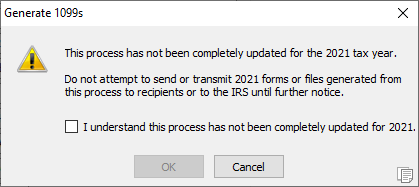

This is a preliminary release of changes for 2021 since the IRS has not yet released updated publications describing the required format for the electronic submission file. As a result, new amount types added for 2021 are not yet available. At this point, if you select the 2021 tax year for processing, the following message appears in the Generate 1099s process:

The message will be removed when all necessary updates have been applied.

-

Generate 1099s

Accounts Payable > Vendors > [right-click] > Select and Generate 1099s

An upcoming release of ActivityHD will support the generation of Form 1099-R for reporting of distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. The current release lays the foundation for those changes.

New 1099 types for Form 1099-R have been added to the 1099 Type drop-down list in the APCode editing window so that you can begin tracking 1099-R reporting amounts for 2021. Assign APCodes for these 1099 amounts to vendors, invoices, and payments as appropriate. The new 1099 types are:

- Box 1 - Gross distribution

- Box 2a - Taxable amount

- Box 3 - Capital gain (included in "Taxable amount")

- Box 4 - Federal income tax withheld

- Box 5 - Employee contributions/designated Roth contributions or insurance premiums

- Box 6 - Net unrealized appreciation in employer's securities

- Box 7b - Traditional IRA/SEP/SIMPLE distribution or Roth conversion

- Box 8 - Other

- Box 9b - Total employee contributions

- Box 10 - Amount allocable to IRR within 5 years

- Box 14 - State tax withheld

- Box 16 - State distribution

- Box 17 - Local tax withheld

- Box 19 - Local distribution

Form 1099-R requires additional information which is not currently available in Accounts Payable. The ability to input this information for 1099-R reporting will be introduced in future updates.

- Box 2b

- Taxable amount not determined checkbox

- Total distribution checkbox

- Box 7 - Distribution code(s)

- Box 8 - Other %

- Box 9a - Your percentage of total distribution

- Box 11 - 1st year of desig. Roth contrib.

- Box 12 - FATCA filing requirement checkbox

- Box 13 - Date of payment

Because this is a preliminary release of 1099-R features, when you select the 2021 tax year for processing 1099-Rs, the following message appears in the Generate 1099s process:

The message will be removed when 1099-R processing is fully supported.

Accounts Receivable

-

XML interface

In the past, the XML interface for ARNotes used the name "NoteReferences" for item references; however, the automation interface simply used "References" as illustrated in the following syntax sample:

MyARNote.Fields("References/Customers")

Now, for consistency, both the XML interface and the automation interface use "References".

General Ledger

-

Rollups

General Ledger > Setup > Rollups

As teased in version 8.13, rollups can now be defined either by direct assignment or by assignment rules. Assignment rules, the traditional method, are created on rollup items to determine which accounts an item is assigned to. The new direct assignment feature will allow rollup item references to be edited directly. When you create a direct assignment rollup, you will choose where the assignment appears, either on the chart of accounts or on any segment or rollup.

Payroll/Human Resources

-

Export Controls

Payroll/Human Resources > Setup > Export Controls

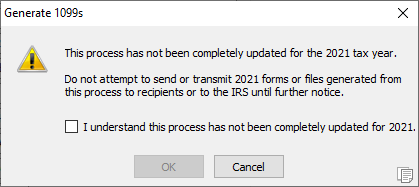

Previously, when you specified a field on an export control with Origin = "General" and Source = "Literal - Date", you had to enter a date in the parameters. If you did not enter a date, the following error was returned:

"Value" parameter required

Now blank literal dates are permitted.

Examples

-

Export Controls

Payroll/Human Resources > Setup > Export Controls

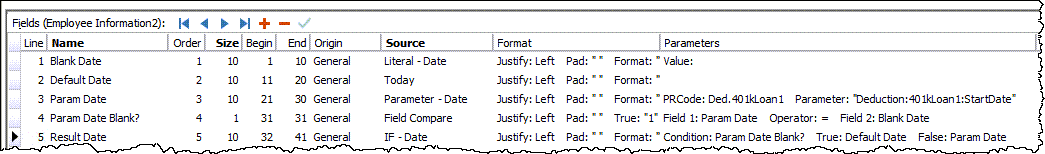

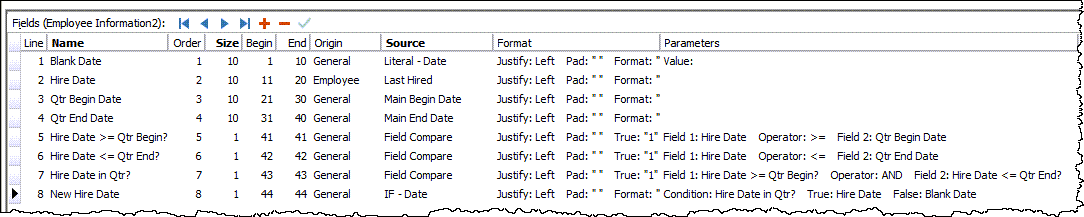

New "Sequence Number" and "Employee Sequence Number" sources have been introduced to export controls. Both have an origin of "General".

The "Sequence Number" source returns the line number in the output file inclusive of headers, detail, and footers. The "Employee Sequence Number" source returns the sequence of reported employees. For instance:

Record Type Seq Emp Seq # Employee Name File Header 1 Batch Header 2 Employee Detail (1) 3 1 Amy Apple Employee Detail (2) 4 1 Amy Apple Employee Detail (1) 5 2 Barney Banana Employee Detail (2) 6 2 Barney Banana Employee Detail (1) 7 3 Claire Cherry Employee Detail (2) 8 3 Claire Cherry Batch Footer 9 File Footer 10 -

Export Controls

Payroll/Human Resources > Setup > Export Controls

Export controls for creating state unemployment upload files have been introduced.

Setup

Import the export control from the distribution. Find the state unemployment export controls (XX 2021 SUTA.xml, where XX is the two-character postal code of the state) at ...\Extras\Payroll\Export Controls\State Unemployment\.

If needed, create export submitter and export employer records. It's likely that you can use the same export submitter record that you use for federal and state W-2 files.

Create an export employer record for each applicable state, using your state UI account number in the Other EIN field. You can leave all fields except Code, Description, and Other EIN blank. (Although some states distinguish between "submitter" and "employer", the provided SUTA export controls assume they are the same entity. Hence, all company and contact information comes from the export submitter record and only the UI account number comes from the export employer record.)

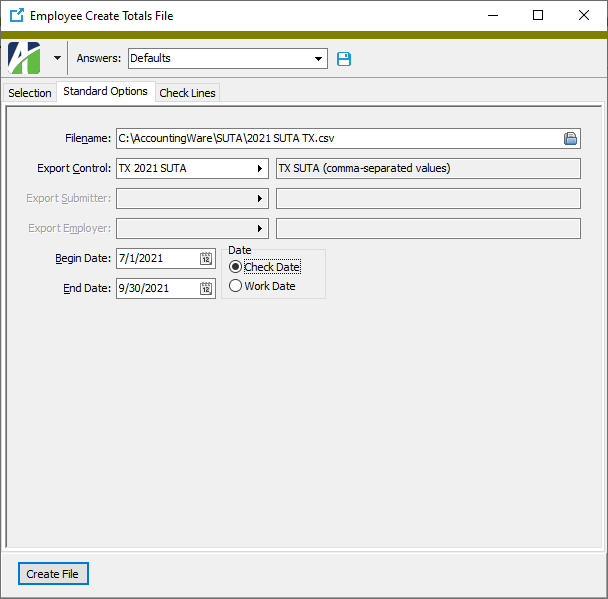

Create Totals File

- Go to

Payroll/Human Resources > Employees > [right-click] > Select and Create Totals File to start the Employee Create Totals File wizard. - Generally, you can skip the Selection tab since the export control selects only the employees with non-zero compensation in the state. However, if you need to filter the selection, do so.

- Specify the following information on the Standard Options tab:

- Filename. Click

and browse to the appropriate folder. Enter a name for the output file. Specify a file type of .csv for export controls which produce comma-separated values; otherwise, specify a file type of .txt. Some states dictate the name of the file.

and browse to the appropriate folder. Enter a name for the output file. Specify a file type of .csv for export controls which produce comma-separated values; otherwise, specify a file type of .txt. Some states dictate the name of the file. - Export Control. Select "XX 2021 SUTA".

- If the export control requires an Export Submitter and Export Employer, select the appropriate submitter and employer records.

- Begin Date and End Date. Enter the begin and end dates of the quarter you are reporting.

- Date. Select "Check Date".

- Filename. Click

-

Specify the additional information required by the state (if any) on the Additional Options tab.

Tip

Save your answers.

- Click Create File.

File review

Review the export file in Excel or run the Employee Totals File Report (

Payroll/Human Resources > Employees > [right-click] > Report Totals File ).- Comma-separated-value (CSV) files. CSV files can be reviewed in Excel. If you change something in the file, ensure that you do not change the format from CSV when you save the file.

- Text files. Use the Employee Totals File Report to review text files. Simply enter the name of the output file and the export control you used to produce it.

- Online. Some states provide the ability to review your file online once it is uploaded.

File upload

Many states allow more than one upload format. Heed the description of the export control which indicates the format of the generated file.

Import notes

Some state SUTA export controls require special setup before they can be imported. Namely:

- "HrWorkAll" group. A number of states require you to report hours worked. The SUTA export controls calculate hours worked from the total Source amount of the check lines in the HrWorkAll group. HrWorkAll is not a built-in group. If you use a different group for hours, either edit the XML file before importing the export control or rename your hours group temporarily, import the export control, and then rename it back to the original name.

- "AK Geographic Code" attribute. Assign attribute values as appropriate to employees in Alaska. (Refer to https://labor.alaska.gov/estax/forms/TQ01D.pdf for codes and descriptions.)

- "DC Worker Relationship" attribute. Assign attribute values as appropriate to employees in the District of Columbia. (See Appendix 12.1 in https://essp.does.dc.gov/ESSP%20File%20Specifications%20V1_07.pdf.)

- IN "WComp" attribute. Assign attribute values as appropriate to employees in Indiana. This attribute determines the Standard Occupation Class (SOC) code.

- IN "EmpType" attribute. Assign attribute values as appropriate to employees in Indiana. This attribute indicates the Seasonal code (FT = full-time, PT = part-time, nn = seasonal, where nn is a two-digit seasonal code).

- NM "PRDept" attribute. This attribute is used in New Mexico to determine the owner/officer (Dept 4 = Y, Other = N).

- NM "NMWComp" group. This group is used to calculate New Mexico workers' compensation fees (total Result amount). Before you import the NM export control, create the group or rename your existing group.

- VT "PayType" attribute. Vermont uses this attribute to determine hourly employees (PayType = H).

Field sources

Field Source Federal EIN The employer ID on tax entity "USA". UI Account Number From the export employer record specified in the Create Totals file. Wages All SUTA export controls use the following formulas to calculate wages. Sometimes only Total Wages are reported; sometimes Total Wages, Taxable Wages, and Excess SUTA are all reported. Regardless, these values are calculated the same way.

Total Wages = Taxable Wages + Excess Wages Taxable Wages = Total Source amount of check lines in: - the Unemployment group

- state-specific tax entity, and where applicable

- employer amount (e.g., Unemployment USA.PA ER)

Excess SUTA = State Compensation - (PreUnemployment * State Compensation / Total Compensation) - State Unemployment Wages Out-of-state Wages Calculated same as "Wages" above except uses all wages not in tax entity "USA" and not in the state tax entity. Hours Worked Total Source amount of check lines in the HRWorkAll group (or your equivalent group). Weeks Worked Hours worked/40, not to exceed 13 or 14 (depending on state rules). UI Due Taxable unemployment wages * SUTA percent [(Tax:SUTA:Percent amount from built-in state segment item)/100]. - Go to

-

Export Controls

Payroll/Human Resources > Setup > Export Controls

The export control for reporting USA 2021 W-2 forms electronically in EFW2 format is now available. No field changes were required for the 2021 EFW2 file according to Social Security Administration (SSA) Publication 42-007, EFW2 Tax Year 2021 "Specifications for Filing Forms W-2 Electronically (EFW2)". However, there is a change in how ActivityHD sets the "Location Address" field.

Previously, the "Delivery Address" in the Employee Wage Record was set to AddressLine1 from the employee's government location, but "Location Address" was left blank (positions 66-87). Now "Location Address" is set to AddressLine2 from the employee's government location. According to EFW2 guidance, the "Location Address" typically contains information such as attention, suite, room number, etc., which may exist in AddressLine2.

For tax year 2021, electronic filers must file wage reports by January 31, 2022.

Since 2016, the Social Security Administration will return electronic and paper wage reports which contain a W-2 with any of the following:

- Medicare Wages and Tips less than the sum of Social Security Wages and Social Security Tips.

- Social Security Tax greater than zero, but Social Security Wages and Social Security Tips equal to zero.

- Medicare Tax greater than zero, but Medicare Wages and Tips equal to zero.

The Generate W-2s wizard validates for these conditions.

The Social Security Administration recommends you use AccuWage to check EFW2 files for format correctness before submitting the files to SSA. For more information, visit the AccuWage Online information page.

-

Extras

A potential problem existed in the state-specific installation script ...\Extras\Payroll\PRBuiltInStateData.sql. The following error could occur when attempting to update tax deposit types:

The MERGE statement attempted to UPDATE or DELETE the same row more than once. This happens when a target row matches more than one source row. A MERGE statement cannot UPDATE/DELETE the same row of the target table multiple times. Refine the ON clause to ensure a target row matches at most one source row, or use the GROUP BY clause to group the source rows.

This error no longer occurs.

-

Payroll tax functions

It is possible for Maryland taxpayers to be exempt from state withholding, local withholding, both, or neither. In order to support these cases, two new required arguments have been added to the end of the MD tax function for exempt from state and exempt from local. Both new arguments are of true/false type.

-

Segment item parameters (Payroll Canada only)

Payroll/Human Resources > Setup > Segment Items > Parameters

The following built-in segment item parameters have been introduced for Canada:

- Type:Tax:CPPExempt - Canada CPP Employee is Exempt

- Type:Tax:CPPExemptAmt - Canada CPP Annual Exemption

- Type:Tax:CPPMaxContr - Canada CPP Maximum Contribution

- Type:Tax:CPPMaxEarn - Canada CPP Maximum Earnings

- Type:Tax:CPPPercent - Canada CPP Percent

- Type:Tax:EIMaxEarn - Canada EI Maximum Earnings

- Type:Tax:EIMaxPrem - Canada EI Maximum Premium

- Type:Tax:EIPercent - Canada EI Percent

- Type:Tax:HDF1 - Canada Annual Deductions

- Type:Tax:K3 - Canada Other Tax Credits

- Type:Tax:LCF - Canada LCF Shares

- Type:Tax:TC - Canada Total Claim Amount

Note

If your site already has parameters with any of these names, they will be hijacked to become the new built-ins. If you do not want this to happen, you should rename your parameters before data conversions occur.

Conversions will set the value of Type:Tax:CPPExempt to "False". You will need to override this value for employees who are exempt. The 2022 values for the CPP and EI parameters as well as the default value for TC will be updated after the Canada Revenue Agency publishes the values. The other parameters are employee-specific.

Province-specific parameters and values will be introduced once province-specific income tax segment items are built in.