ActivityHD Release 8.10

System-wide

-

Bots

Activity System > Administration > Bots

[Company] > Administration > Bots

You can now add alternate bases to date fields through bot options.

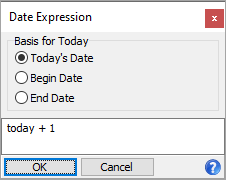

For instance, suppose you have the following dates as options for your bot: Begin Date, End Date, Log Date. Log Date has a date expression of "today + 1".

Normally, "today + 1" indicates one day after the current system date. However, you can now base the date expression off either Begin Date or End Date. When you press F2 on the log date, the Date Expression popup opens.

Leave the date expression as is, but change the Basis for Today options as needed. Valid options are:

- Today's Date. The basis for "today" is the current system date. This is the normal basis of a date. So, "today + 1" is tomorrow.

- Begin Date. "today + 1" is the day after the begin date.

- End Date. "today + 1" is the day after the end date.

Setup

<Options>

<Field Name="Begin Date" Type="Date" />

<Field Name="End Date" Type="Date" />

<Field Name="Date" Type="Date" DefaultExpression="today + 1">

<AltBases>

<AltBasis Name="Begin Date"/>

<AltBasis Name="End Date"/>

</AltBases>

</Field>

</Options>

Accounts Payable

-

Invoices

Accounts Payable > Invoices

A performance issue was introduced in version 8.7-0 which slows down the creation, editing, modifying, and merging of AP invoices. The performance issue was more evident when you have numerous invoices. The issue has been corrected and previous performance levels are restored.

-

Recurring Invoices Listing

Accounts Payable > Invoices > Recurring > [right-click] > Select and Report > Recurring Invoices Listing

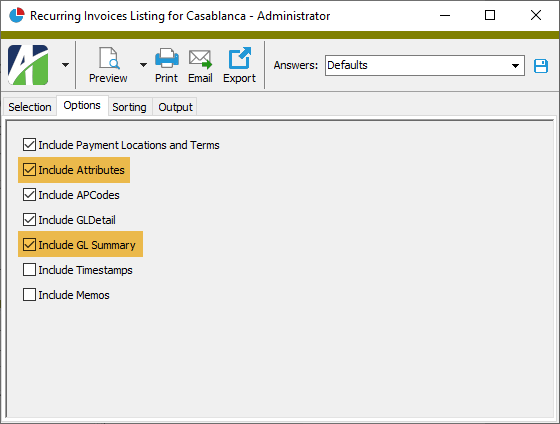

Users can now show invoice usage attributes in addition to invoice detail attributes on the Recurring Invoices Listing.

The checkbox on the Options tab which was previously labeled "Include Detail Attributes" has been replaced with the Include Attributes checkbox. Marking this checkbox includes both invoice and invoice detail usage for invoices, invoice GL detail, and for the GL summary. In addition, an Include GL Summary checkbox was added. In the past, the GL Summary section only showed if the Include GL Detail checkbox was marked. Now if the new Include GL Summary checkbox is marked, all GL detail is included. Attributes which post to GL are included or excluded from the GL Summary section based on whether the Include Attributes checkbox is marked.

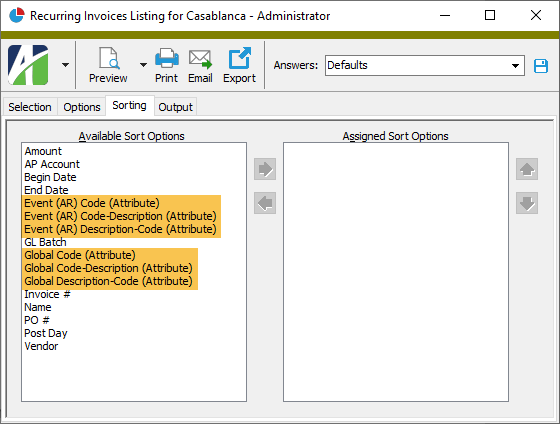

Along with these changes comes the ability to sort the listing by AP invoice usage attributes and attributes which rollup AP invoice usage attributes.

In addition, a problem was fixed where detail usage attributes which post to GL were not being reported in the GL Summary section. Now when attributes are included on the report, all attributes which post to GL are shown in the GL Summary.

-

Vendor Invoices Report

Accounts Payable > Vendors > [right-click] > Select and Report > Vendor Invoices Report

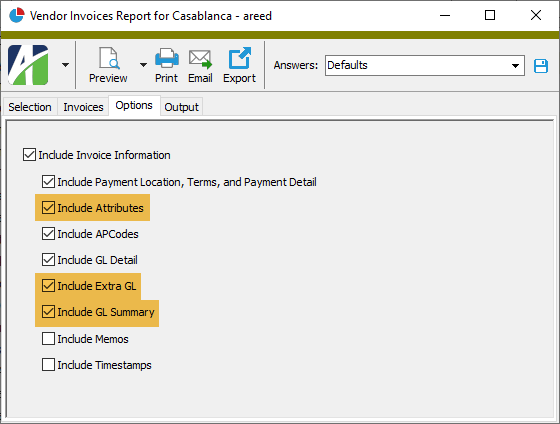

Users can now show invoice usage attributes in addition to invoice detail attributes on the Vendor Invoices Report.

The checkbox on the Options tab which was previously labeled "Include Detail Attributes" has been replaced with the Include Attributes checkbox. Marking this checkbox includes both invoice and invoice detail usage for invoices, invoice GL detail, extra GL, and for the GL summary. In addition, an Include GL Summary checkbox was added. In the past, the GL Summary section only showed if the Include GL Detail checkbox was marked. Now if the new Include GL Summary checkbox is marked, all GL detail is included.

Furthermore, an Include Extra GL checkbox has been added so that extra GL is available for inclusion on the report. Also, detail attributes are now included in the GL Summary section.

-

Vendors

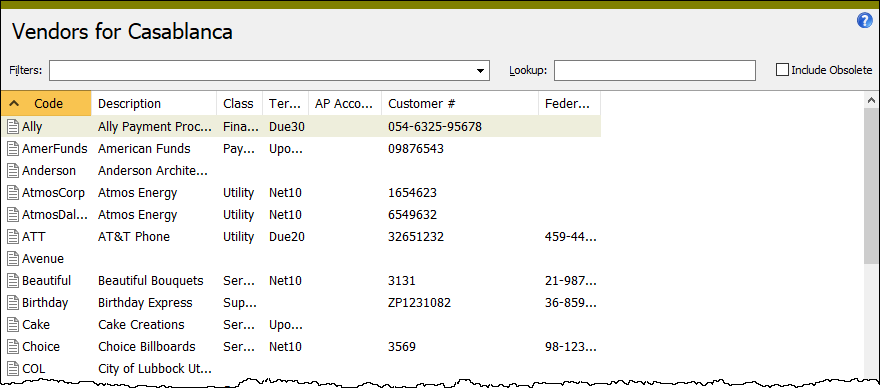

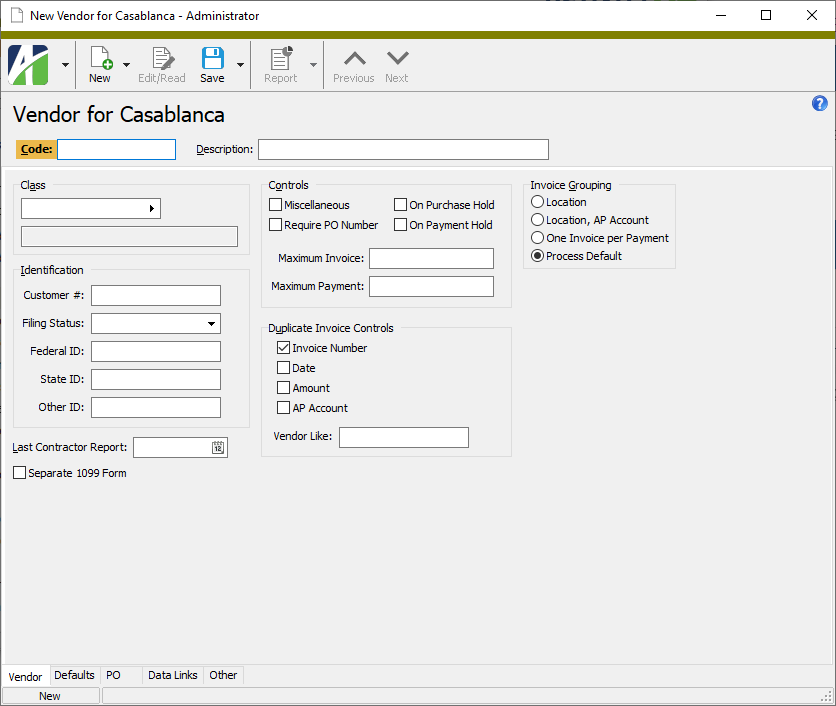

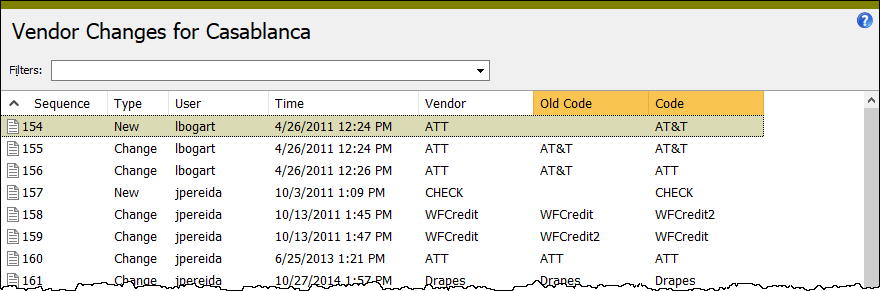

Accounts Payable > Vendors

The name of the 30-character field which uniquely identifies an AP vendor record has been changed from "Name" to "Code".

This change is manifested in a number of ways:

- The column in the Vendors HD view which was formerly labeled "Vendor" is now labeled "Code".

- The field in the Vendor window which was formerly labeled "Vendor" is now labeled "Code".

- The related selection field which was formerly named "Name" is now named "Code"; however, "Name" is available as a compatibility name so that any existing macros, bots, filters, and saved answers which reference "Name" remain functional.

- The columns in the Vendor Changes HD view which were formerly labeled "Name" and "Old Name" are now labeled "Code" and "Old Code".

- The vendor field name in the automation interface has been changed from "Name" to "Code". "Name" is provided as a compatibility name so that existing automation objects remain functional.

- The "Code" property will be added to the vendor automation interface; "Name" will remain as a deprecated property.

- The shortcut keystroke to access the Code field is now Alt+C. To make this shortcut keystroke available, the shortcut keystroke for the Class field which was former Alt+C has changed to Alt+A.

In addition, the tab order of the Vendor tab was adjusted to put the Separate 1099 Form checkbox after the Last Contractor Report field.

- The column in the Vendors HD view which was formerly labeled "Vendor" is now labeled "Code".

ActivityHD System

-

System Authorized User

Activity System > Administration > Security > Authorized Users

In the past, the following error could occur when attempting to create a new system authorized user if the user's view of the Authorized User folder was limited by a security view:

The multi-part identifier 'AuthorizedUser.SystemUserGroup' could not be bound

The error no longer occurs.

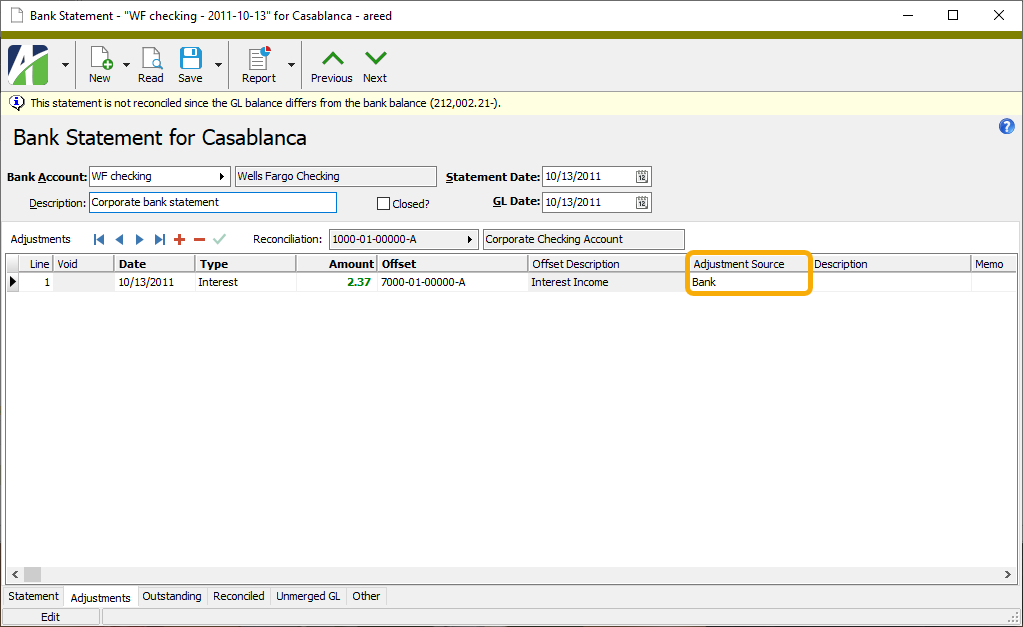

Bank Reconciliation

-

Bank Statement Adjustments

Bank Reconciliation > Statements > Adjustments

Attributes can now be set up for use on the offset posting of bank statement adjustments (see "Attributes" below). An attribute value can be specified on an adjustment line on the Adjustments tab of the Bank Statement window.

General Ledger

-

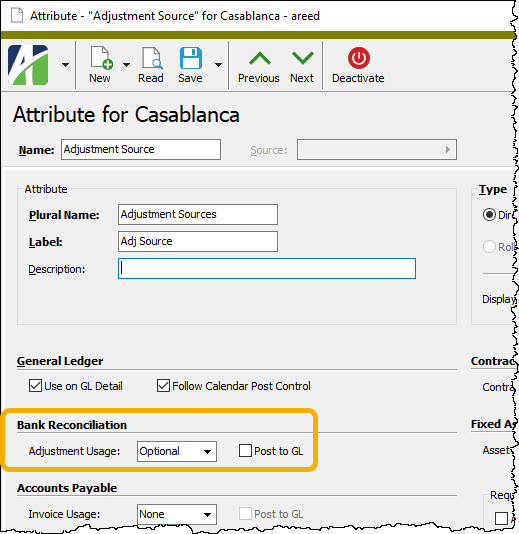

Attributes

General Ledger > Setup > Attributes

You can now define attributes to use on the offset posting of bank statement adjustments (excluding transfers). To support this new feature, a Bank Reconciliation section has been added to the Attribute window. To use an attribute on statement adjustments, set the Adjustment Usage field to "Optional" or "Required". Mark the Post to GL checkbox if you want the attribute value to automatically appear on the offset posting of the journal entry associated with the bank statement.

-

Combine Accounts

General Ledger > Chart of Accounts > [right-click] > Select and Combine

Formerly, the Combine Accounts process processed one account at a time. Now the process performs the combine operation on all records at once. If any errors occur during processing, none of the records are combined. The entire combine process now takes roughly the same amount of time as it previously took to process each individual record.

Automation

The following automation method now handles multiple records:

- GLPackage.CombineAccounts(FromAccounts, ToAccount)

-

Combine Segment Items

General Ledger > Setup > Segments > [select a segment folder] > [right-click] > Select and Combine

Formerly, the Combine Segment Items process processed one segment item at a time. Now the process performs the combine operation on all records at once. If any errors occur during processing, none of the records are combined. The entire combine process now takes roughly the same amount of time as it previously took to process each individual record.

Automation

The following automation methods now handle multiple records:

- PrimarySegmentItem.CombineItems(FromItems, IntoItem)

- LedgerSegmentItem.CombineItems(FromItems, IntoItem)

- AuxiliarySegmentItem.CombineItems(FromItems, IntoItem)

Sample bot

Set vData = Company.GeneralLedger.AuxiliarySegmentItem("Department")

vFromItems = Array("91", "92")

vIntoItem = "90"

vData.CombineItems vFromItems, vIntoItem

-

Financial designs

General Ledger > Financial Designs

Two built-in financial design layouts, Income Statement Actual vs Budget YTD and Income Statement Current vs Previous Year, could produce the following error when users attempted to use them:

application-defined or object-defined error

Now the error no longer occurs and generation of the layout succeeds.

Payroll/Human Resources

-

Self-Serve

Prior to this version, the self-serve pages for Employee Leave Balances and Payroll Management Leave Balances included all leave ledgers with the Print flag set on. Now these pages only include the ledgers which are applicable based on existing leave entries.

-

Leave Entries | Leave Balances

Payroll/Human Resources > Leave Plans > Leave Entries

Payroll/Human Resources > Leave Plans > Leave Balances

An inadvertent change in version 8.10-0 removed the Employee Name column from the Leave Entries and Leave Balances folders. The column has been restored to these folders.

-

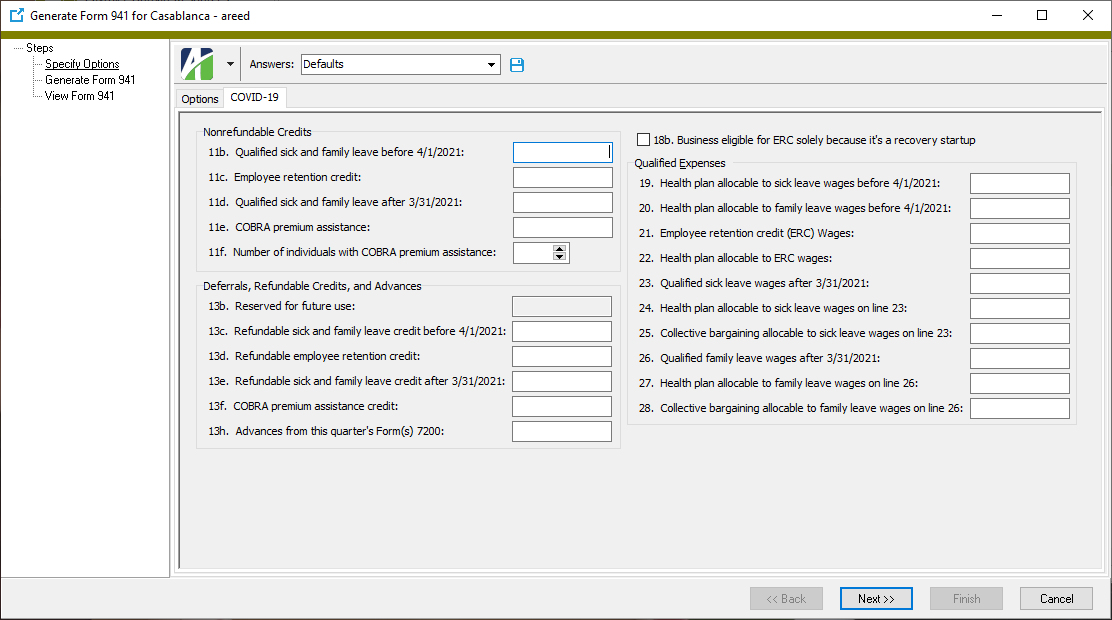

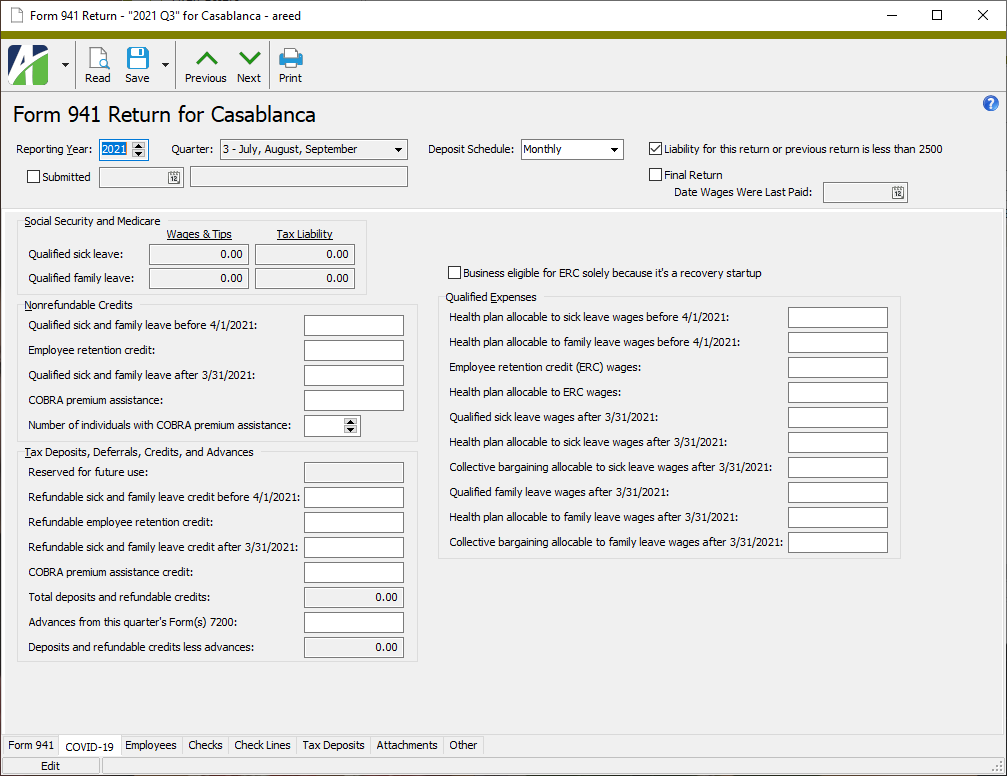

Form 941 Returns

Payroll/Human Resources > Government > Form 941 Returns > [right-click] > Generate

Payroll/Human Resources > Government > Form 941 Returns

The Generate Form 941 process and the Form 941 Return window have been updated to accommodate the IRS changes to Form 941 for quarters 2 through 4 of 2021. Numerous fields have been added for Q2 and an additional checkbox applies for Q3 and Q4. Note that it is up to the user to calculate the values for the new fields using Worksheets 1-5 provided in the instructions for Form 941 and to enter those values on the COVID-19 tab of the Generate Form 941 process. As before, you can modify these values in the Form 941 Return window before you print the form.

Remember that the Generate Form 941 process can still produce forms for prior years and quarters. Since quarter 2 of 2020, 26 fields have been added for COVID; the COVID-19 tab morphs to support each variation.

The calculation of line 5a(i) Qualified sick leave wages and 5a(ii) Qualified family leave wages has not changed. These values are still the total results of check lines in the COVIDQualifiedSick and COVIDQualifiedFamily groups, respectively. However, the totals now should only include wages for leave taken before April 1, 2021; therefore, if you paid wages for leave taken after March 31, 2021, you need to track those wages with a different PRCode that is not in the COVID group since they are no longer eligible for the employer social security discount.

-

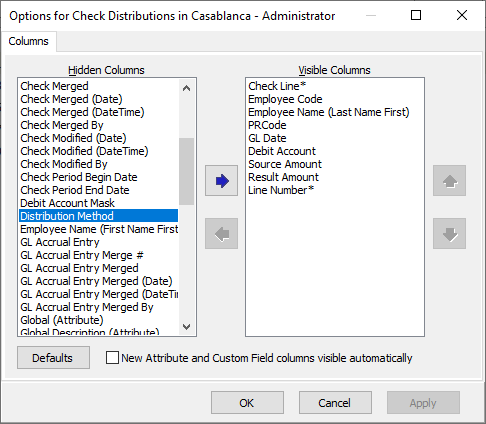

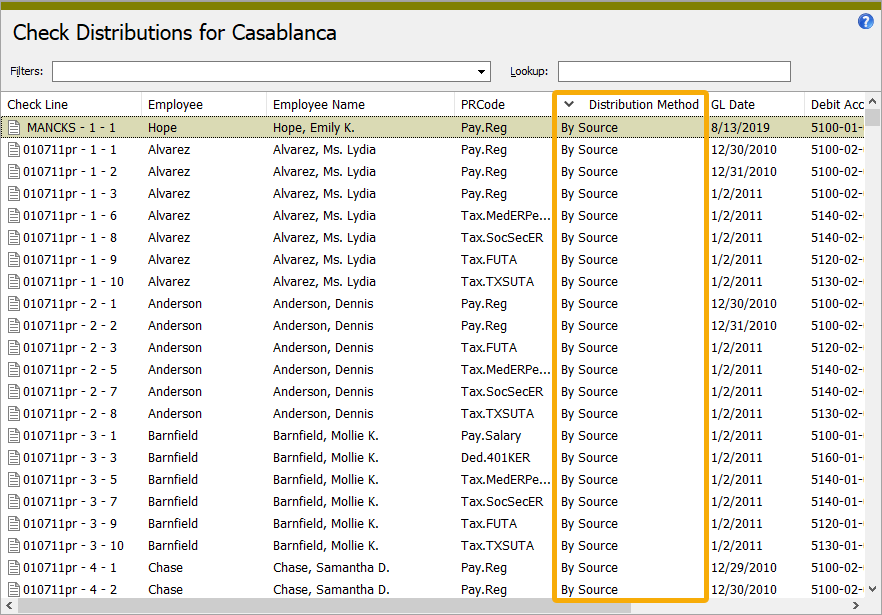

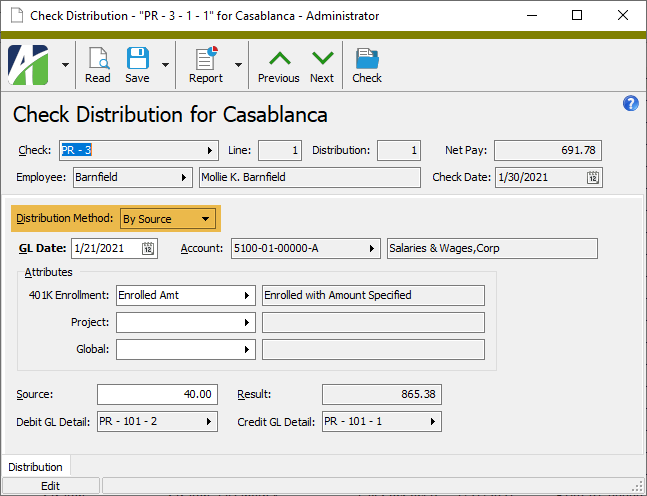

Check Distributions

Payroll/Human Resources > Checks > Distributions

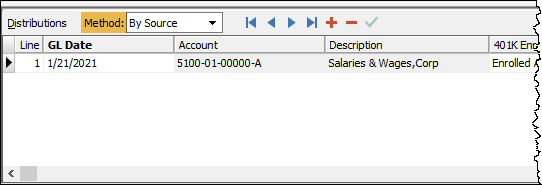

The Check Distributions HD view is a valuable tool for mass changing check distribution lines. However, sometimes changes do not take effect and it is not immediately obvious why they did not. The reason some changes do not occur is that some distributions are created by the "Follows Pay" or "Split Period" methods and cannot be changed. Until now, there was no easy way to determine the distribution method. Now the Distribution Method column can be shown in the Check Distributions HD view and the Distribution Method field appears in the Check Distribution window.

In a related change, the dropdown above the Distributions table on the Lines tab of the Check window is now labeled "Method" to clarify its purpose and to be consistent with how the field is referred to elsewhere in the software.

The distribution method still cannot be changed from the Check Distributions HD view or from the Check Distribution window since a change could possibly affect other distributions on the check. Changing the distribution method must occur in the Check window or via mass change from the Check Lines HD view.

-

Checks

Payroll/Human Resources > Checks

Check line distributions which "follow pay" get their GL date, account, attributes, and allocated amounts from the distributions on the pay lines they follow. Because of this, users should not be able to modify the fields on distributions which follow pay. In the past, you could modify attributes on distributions which follow pay. That oversight has been corrected; modifications to attributes on distributions which follow pay are now disallowed.

To correct checks with modified attributes on distribution lines which follow pay, make a change on one of the source pay lines. This causes the follows pay lines to be recalculated. If the check has been merged and the associated accrual distribution GL entries are merged, ActivityHD automatically creates adjusting distribution lines to achieve the desired follows pay allocation.

-

Checks

Payroll/Human Resources > Checks

When a check is voided, ActivityHD creates a reversal check which negates the effect of the voided check on check lines, check distributions, check disbursements, and related GL entries. Reversal distributions for the same GL date (or a reversal date override), account, attributes, and negative source/result are created.

To allow transitioning of GL account segments to a new GL attribute, attributes on voided check distributions can be modified—even on merged checks with merged GL entries. This means that the GL account segment value can be copied to the replacement attribute value. Changes made to original voided check distributions are now propagated to the associated reversal check distributions to maintain the integrity of attribute-level accounting.

Note

Changing attributes on a voided check distribution which is the source of "follows pay" lines also updates the distributions for the associated "follows pay" lines on both the original voided check and the associated reversal check. If some of the distribution GL entries have been merged, additional distributions are added to net out merged values with new values so that the total summarized values for all date/account/attribute combinations match the calculated "follows pay" allocation amounts.

Along with this change, a data conversion is provided which corrects existing reversal check distributions that do not correctly negate original voided check distributions. In the process, new unmerged GL entries may be created to accomplish the correction, even in historical GL periods which are currently closed. The net effect of these new correction entries is to recategorize the posting into different attributes; the existing posting accounts and/or dates do not change. If these GL entries are created, you must review and merge them.

These changes also solidify the integrity of changes to associated reversal distributions by locking the reversal check and its related GL entries before changes are applied. Before these locks were in place, it was possible for multiple users to make undetected conflicting changes to a reversal check's distributions. This vulnerability has been removed and the database conversion corrects any inconsistent distributions.

-

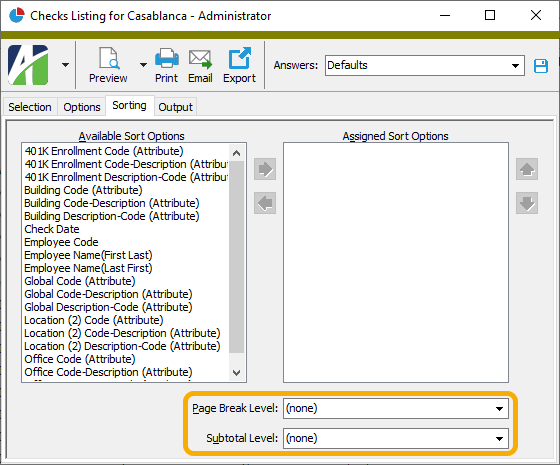

Checks Listing

Payroll/Human Resources > Checks > [right-click] > Select and Report > Checks Listing

While the Checks Listing previously provided sorting options, it did not provide the ability to page break or subtotal on those options. Now it does.

The Checks Listing includes four report designs. The designs were changed as follows:

- Checks. This design reports check information based on your selections on the Options tab. This design now offers up to four levels of subtotals and page breaks.

- Checks Proof. This design has the same behavior as the Checks design but it also groups check lines in Employee/Employer sections and sorts lines by Pay|Deduction|Tax|Statistic line type within those sections.

- Checks Proof Color. This design is the same as the Checks Proof design except that it shows check line results in green, red, or blue, depending on the line type.

- Checks Sign-off. This design prints a piece of paper which employees can sign when they pick up their printed checks. As such:

- The design only lists check disbursements with a method of "Printed Check" and a non-blank reference (i.e, check number). Reversal checks are excluded.

- The design ignores selections on the Options tab.

- The design does NOT support the new page break and subtotal feature. Both the Page Break Level and Subtotal Level fields must be set to "(none)". If these fields are not set to "(none)", the following error occurs:

The Subtotal level (1) exceeds the number of levels of the report design (0).

- The design now supports sorting by the various employee code/name and check date fields. Prior to this version, the report only sorted by employee in last name first order. If no employee field is selected for sorting, the report is sorted by batch-entry number.

- The design supports sorting by one employee attribute with a page break between each attribute item. The attribute name displays in the heading and in the totals. (Previously, the design always displayed "Department".) The design selects the first employee attribute in the sort options regardless of where it appears in the order, and ignores all other attributes in the list.

- To achieve the previous behavior of this design, specify sort options of an employee attribute and "Employee Name (Last First)". If you created a saved answer for the report in a previous version of ActivityHD, the answer should still be valid.

-

Employee Create Totals File

Payroll/Human Resources > Employees > [right-click] > Select and Create Totals File

You can now specify multiple periods for totals in the Create Totals File process. This is useful, for instance, when you need to report:

- all the weeks, months, or quarters in a year

- month-to-date, quarter-to-date, and year-to-date

- all the check dates in a month.

In the past, you could specify the various end dates on the Additional Options tab and create a saved answer; however, the next year or month you had to specify all new dates. This effort was tedious and prone to errors. Alternatively, you could enter date expressions for the dates; however, date expressions are based off the current system date.

Now you can define dates on the Additional Options tab which are relative to one of the dates on the Standard Options tab; namely, Begin Date or End Date.

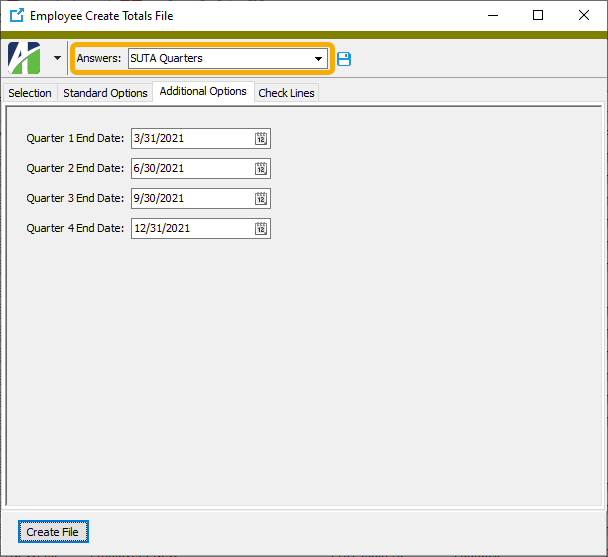

Example

If you enter an end date of 12/31/2020 on the Standard Options tab and have four quarter end dates on the Additional Options tab, the quarter end dates now can be automatically calculated based on the specified end date. In 2021, when you enter an end date of 12/31/2021, the 2021 quarter end dates are automatically correct.

Here's how to make that happen:

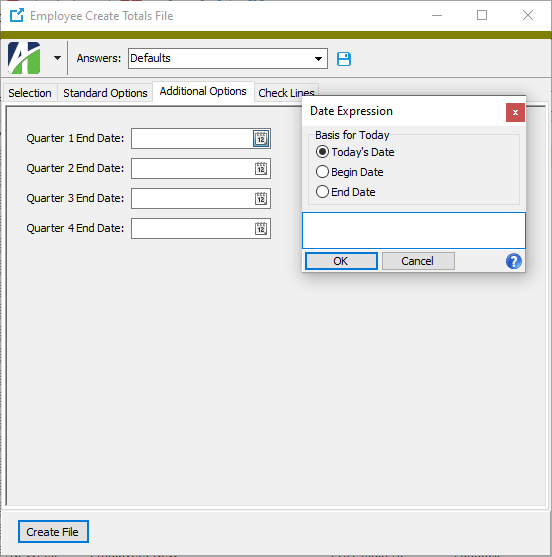

- On the Additional Options tab in the quarter 1 field, press F2. The Date Expression popup opens.

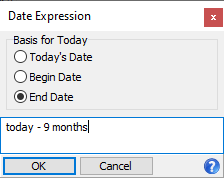

- In the Basis for Today field, select "End Date".

- In the text area, enter the date expression "today - 9 months".

- Repeat steps 2-3 for the remaining quarter end dates, EXCEPT:

- For quarter 2, the date expression is "today - 6 months".

- For quarter 3, the date expression is "today - 3 months".

- For quarter 4, the date expressions is "today".

- After you've completed all prompts, create a saved answer. Next year when you create the totals file, you need only load the saved answer and enter the end date on the Standard Options tab to derive the needed quarter end dates!

-

Garnishments

Payroll/Human Resources > Employees > Records > Garnishments

Florida and Virginia have announced new minimum wage rates taking effect this year and beyond. ActivityHD has incorporated these new rates to calculate limits on each state's civil garnishments.

Florida

Minimum hourly wage Effective date $10.00 09/30/2021 $11.00 09/30/2022 $12.00 09/30/2023 $13.00 09/30/2024 $14.00 09/30/2025 $15.00 09/30/2026 Virginia

Minimum hourly wage Effective date $9.50 05/01/2021 $11.00 01/01/2022 $12.00 01/01/2023 -

Pay Statements and Print Checks

Payroll/Human Resources > Checks > [right-click] > Select and Report > Pay Statements

Payroll/Human Resources > Checks > [right-click] > Print Checks > Select and Print Checks

Until now adding federal W-4 information to pay statements and printed checks required special formulas which referenced the custom function library. Federal W-4 functions are now available in the data stream for easy placement in the report design.

Additionally, state W-4 fields are now also available in the data stream. In the past, state W-4 fields were not available as fields or as special formulas. Contact AccountingWare Support to incorporate W-4 fields in your pay statement and printed check designs.

-

Tax deposit types

Payroll/Human Resources > Setup > Tax Deposit Types

Income tax deposit types have been introduced to the state-specific installation script in Extras (...\Extras\Payroll\PRBuiltInStateData.sql).

Depending on the states you specify at the top of the script, the new feature adds up to 42 tax deposit types, one for each of the 41 taxable states plus the District of Columbia. Each income tax deposit type has one field for the state plus fields for the local entities if there are any (CA, IN, MI, NY).

The script makes a best effort to create the tax deposit types. However, if a tax deposit type already exists with the same name as the built-in that the script wants to create, the script will not create another one. If you want to install the built-in, first rename the existing tax deposit type and then run the script again. For example, if you have a tax deposit type "CA" and need to create the built-in tax deposit type "CA", first rename the existing tax deposit ("CA_Old", for example).

The script can be run multiple times on the same database to fill in any missing pieces.