ActivityHD Release 7.19

General Ledger

-

Account Defaults

Prior to this version of ActivityHD, an error would occur if the user clicked OK in the Account Defaults dialog after using Find (F3) on the Account field. The issue could also occur using Find (F3) on any segment field if the user had enabled the new View Options feature (

> View > New View Options).

> View > New View Options).Cannot perform this operation on a closed dataset.

This issue has been resolved.

-

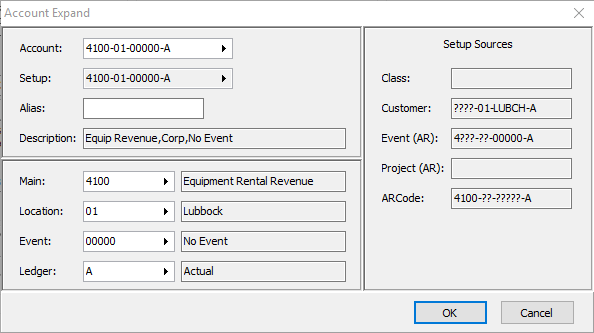

Account Expand

A new Setup Sources panel has been added to the Account Expand dialog when an account is provided a default value from other sources. For example, a default value for the sales account on an AR invoice detail line is automatically determined by sequential application of the following account masks:

- Sales account mask from the customer class.

- Sales account mask from the customer record.

- Sales account mask from the attribute item for all applicable attributes.

- Sales account mask from the ARCode.

The Setup Sources panel shows values for all available contributing sources, even when they don't make a contribution. This lets you see which contributing sources are available.

The order that account masks are applied is prescribed in the software and significant. An account mask specified on a source which is applied earlier in the hierarchy can be overridden by a value specified later. For the AR invoice detail example cited above, a main account value that is specified on the ARCode sales account would override the main account specified on any of the other sources (customer class, customer, or attribute).

-

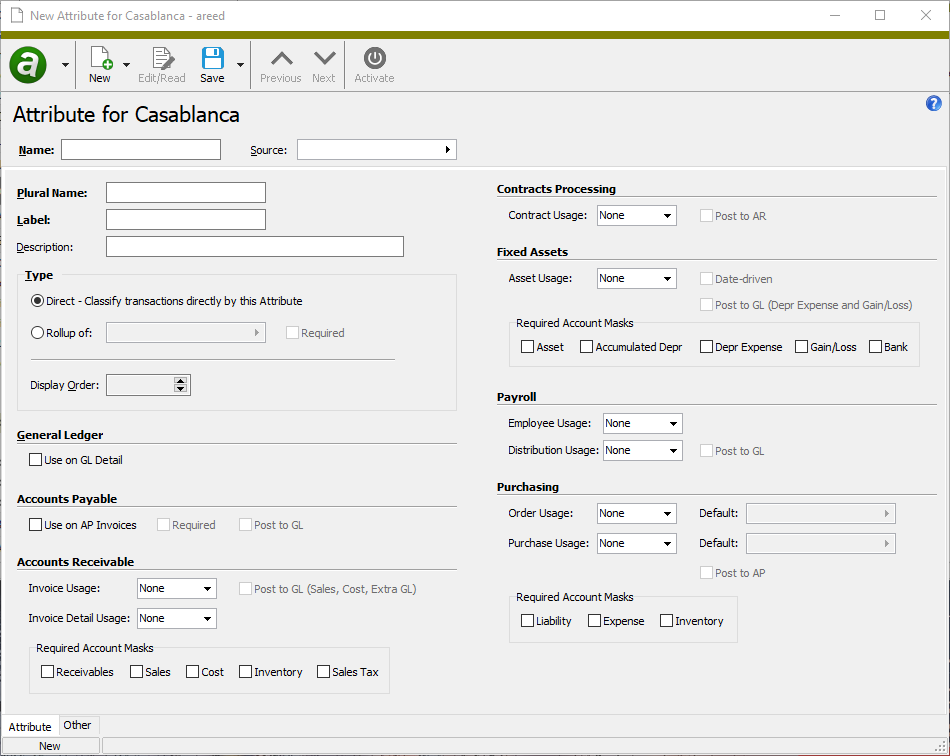

Attributes

General Ledger > Setup > Attributes

The Attribute window formerly consisted of a single column which grew vertically to contain options for all the ActivityHD packages you have installed. While you could use the vertical scrollbar to access options which were not visible, the process was cumbersome. The window now automatically creates a second column when needed to keep the height of the window manageable. In addition, rather than grouping options in boxes, options are now separated by a single title and horizontal line. The goal is to reduce screen clutter and make the elements in the window more readable.

A few captions were modified for consistency and brevity.

- In the General Ledger section, the checkbox caption was changed from "Use this Attribute to classify GL transactions" to "Use on GL Detail".

- In the Fixed Assets section, the checkbox labeled "Post Depr Expense and Gain/Loss to GL" was changed to "Post to GL (Depr Expense and Gain/Loss)".

- In the Purchasing section, the group labeled "Item Account Mask Requirements" was changed to "Required Account Masks".

To automatically resize the window to fit the new column arrangement, select

> Tools > Reset Form.

> Tools > Reset Form.

-

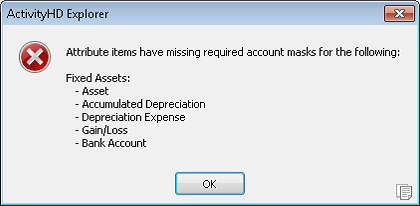

Attributes

General Ledger > Setup > Attributes

Now when you save an attribute that has required account masks and any of the related attribute items is blank, ActivityHD returns an error.

This change ensures that if an attribute requires an account mask, the attribute cannot be saved until masks have been entered on all its attribute items.

-

Attributes

General Ledger > Setup > Attributes

Prior to this version of ActivityHD, users could encounter a lock conflict or access violation if using Find (F3) to select a default item for a required attribute while activating or editing the attribute. This problem no longer occurs.

-

Financial Views

General Ledger > Financial Views

Preinstalled financial views are now flagged as "active" when they are installed. This makes these financial views immediately available for viewing.

-

GL Summary Report

General Ledger > Journal Entries > Journal Detail > [right-click] > Select and Report > GL Summary

The GL Summary Report was introduced in version 7.18. The report included a Balance column which was used to summarize debits minus credits for selected journal detail. Since the report shows net activity in this column instead of account balances, the name was bewildering. The column name has been changed to "Net" so that the value shown in subtotals is the net debits minus credits of summarized journal detail. Moreover, the net amount is no longer shown on individual journal detail lines (if you include detail lines on the report) because a net value does not make sense for a single journal detail posting.

-

GL Summary Report

General Ledger > Journal Entries > Journal Detail > [right-click] > Select and Report > GL Summary

The GL Summary Report now shows both the code and description for the selected sort items for the following sort options:

- Unit

- Account Code

- Segments

- Rollups

- Attributes

Payroll/Human Resources

-

Tax Deposits

Payroll/Human Resources > Government > Tax Deposits

Tax deposits are now used to calculate the amount of state unemployment taxes (SUTA) paid on time and paid late.

Form 940 Line 10 states:

If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for filing Form 940), complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet.

The worksheet requires:

- The amount of SUTA you paid on time, where on time means you paid by the due date for Form 940.

- The amount of SUTA you paid late (after the Form 940 due date).

Prior to this version of ActivityHD, Form 940 incorrectly calculated the amount paid on time from tax deposits for federal unemployment instead of state unemployment. The amount of SUTA paid late was gleaned from a question in the Generate process.

The following changes have occurred:

- The SUTA paid late field has been removed from the Generate wizard.

- The amount of SUTA paid on time is calculated from the total of tax deposits which satisfy these conditions:

- The tax deposit type is one of the built-in state unemployment types (e.g., xxSUTA).

- The liability date is in the tax year.

- The deposit date is on or before the Form 940 due date (i.e., January 31 of the following year).

- The deposit is marked "Paid".

- The amount of SUTA paid late is calculated using the same criteria as for SUTA paid on time EXCEPT the deposit date is after January 31.

The upshot of these changes is that you will need to create tax deposits for your state unemployment using one of the built-in tax deposit types. If you do not, the following error is presented in the Generate process:

No paid state unemployment tax deposits found.

Use the following method to create tax deposits automatically:

Note

You must create manual tax deposits for any unemployment payments made during the year before this upgrade.

- In Payroll, create an AP control which uses a built-in state tax deposit type (e.g., CASUTA).

- Add the AP control to the appropriate PRCode (e.g., Tax.CASUTA).

- Post Tax.CASUTA check lines to AP invoices.

- Merge and pay the AP invoices.

-

Merge the AP payment. The tax deposit is created in this step.

Note

If the SUTA payments for the quarter have already been recorded in GL, override the bank account in the Payments dialog and change it to the SUTA liability account. This causes the payment to simply reverse the AP invoice which was created.

- Mark the newly-created deposit as "Paid".

The worksheet also requests taxable SUTA wages at the assigned experience rate. This value is needed when the total amount of SUTA paid on time is less than the maximum credit (currently, FUTA wages times 0.054). The assigned experience rate comes from built-in segment item parameters. Now if a parameter value for the calculation is missing, the Generate process presents this error:

Missing "Type:Tax:SUTAxxRate" value for a state where you paid unemployment tax.