ActivityHD Release 6.5

System-wide

-

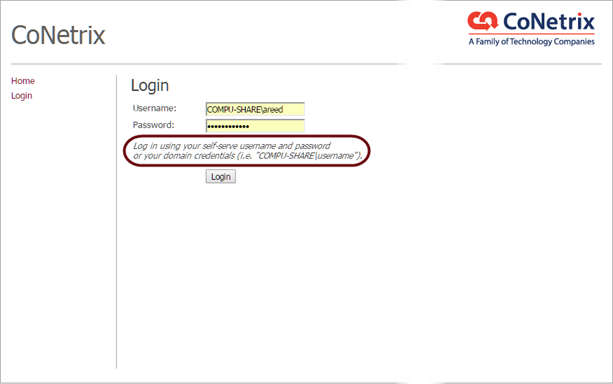

ActivityHD Help

Context-sensitive help is now more widely available within the ActivityHD system. Press F1 within the interface to open the help system to a relevant topic.

-

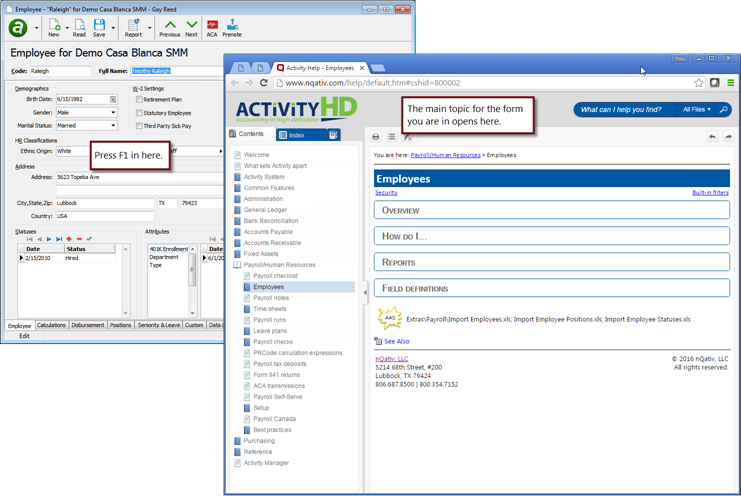

Custom Fields

[Package] > [navigate to the entity folder the custom field is associated with] > [right-click] > Custom Fields

A New Copy checkbox has been added on custom fields so that you can determine whether the custom field value will be copied whenever a "New Copy" is performed on an entity record. If the checkbox is marked, the value will be copied to the custom field on the new entity record; if unmarked, the custom field is set to the default value or is blank if no default value is specified.

-

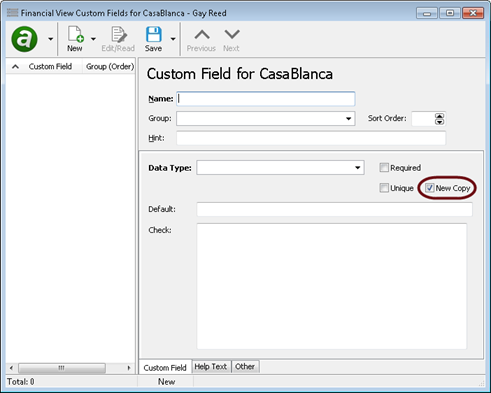

Dashboard

Highlight the company folder

The Gadgets folder (Administration > Gadgets) contains built-in and user-defined gadget records. Each gadget record can contain one or more dashboard gadgets, and multiple gadget records can contain the same dashboard gadget. Permissions control which gadget records are loaded to a user's dashboard. It is possible for the same dashboard gadget to be loaded more than once to the dashboard from different gadget records. When this happens, the dashboard doesn't know which gadget record to give preference to. Now when this happens, the dashboard displays a message to inform you of the conflict.

-

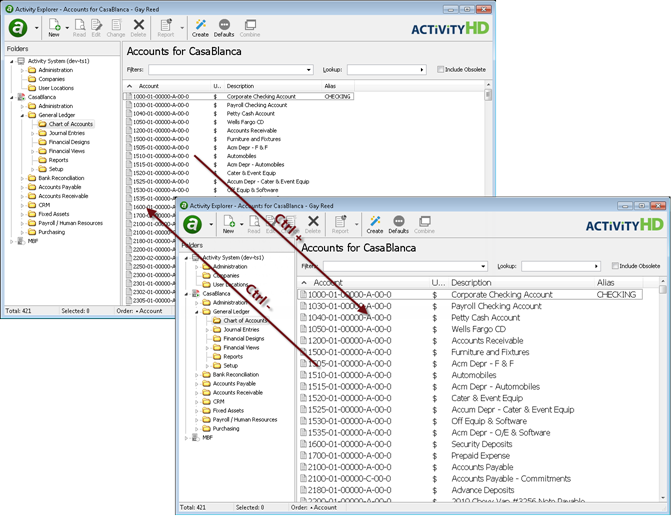

HD Views

You can now enlarge and reduce the size of the font in HD views. With focus in the HD pane, press Ctrl + to zoom in (enlarge) and Ctrl - to zoom out (reduce after the font has been enlarged).

The feature can also be accessed by selecting Zoom In or Zoom Out from the HD pane's right-click menu or from the

> View menu.

> View menu.

-

HD Views

Before release 6.5, when you pressed Ctrl+C to copy to clipboard or Ctrl+A to select all, the command was always executed on the data in the HD view, whether or not the HD view had focus. Now, Ctrl+C copies data in the HD view only if the HD view has focus, and Ctrl+A selects all HD data only if focus is in the HD view or on a folder. If the Lookup field or another field has focus, the action affects that field.

-

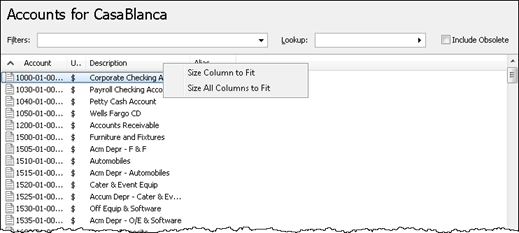

HD Views

You can now easily size one column or all columns to a width that matches the longest visible value in the column(s). To access this feature, right-click in the HD pane header to reveal a shortcut menu with two options: Size Column to Fit and Size All Columns to Fit. Size Column to Fit affects only the column whose header you clicked on.

-

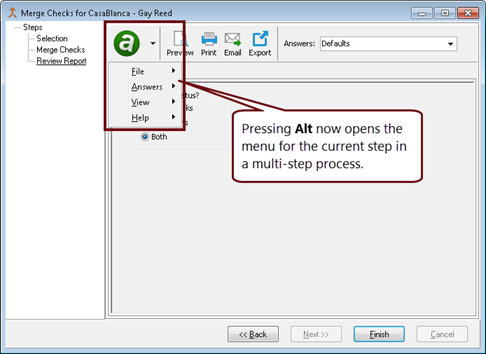

Multi-step Processes

Pressing the Alt key while in a multi-step process now opens the main menu for the step you are currently on. In the past, pressing Alt sometimes invoked the main menu of ActivityHD Explorer.

-

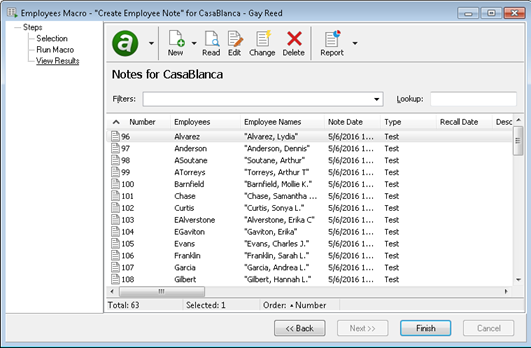

Process Macros

[Highlight the entity with the macro you want to run] > [right-click] > Macros > [select macro]

Before release 6.5, if you rearranged the columns in the "View Results" step of macro processing and closed the process window, the order of the columns could be saved incorrectly and would not restore the order the next time you processed the macro. Now, the column order saves and restores correctly.

Administration

-

Authorized Users

Administration > Security > Authorized Users

Since release 5.36, there has been a problem sorting by the Windows Username column in the HD pane when a new authorized user was added or when the Windows Username field on the authorized user record was modified. Upgrading to release 6.5 will correct any authorized users previously affected and will prevent the problem in the future.

-

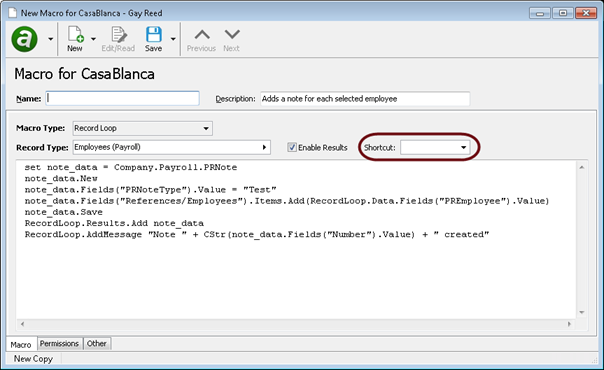

Macros

Administration > Macros

Before release 6.5, when you performed a "New Copy" of a macro, the shortcut key was included in the copied information. If the new macro was saved without changing the shortcut key, ActivityHD would return an error. Now when you perform a "New Copy" of a macro, the shortcut key is blank.

Fixed Assets

-

Assets

Fixed Assets > Assets

Since release 5.34, column changes to the Assets HD view were lost if the As of date setting was changed after the column settings were changed and before leaving and returning to the HD view. Now, column changes are saved and restored appropriately.

General Ledger

-

ActivityHD Automation Server (AAS)

GL segments are now exposed for use by AAS so that you can create, modify, and delete segments using COM-based solutions such as Microsoft Office solutions, Visual Basic, VBScript, and ActivityHD macros. Security and data integrity are enforced just as if segments were being entered through ActivityHD.

-

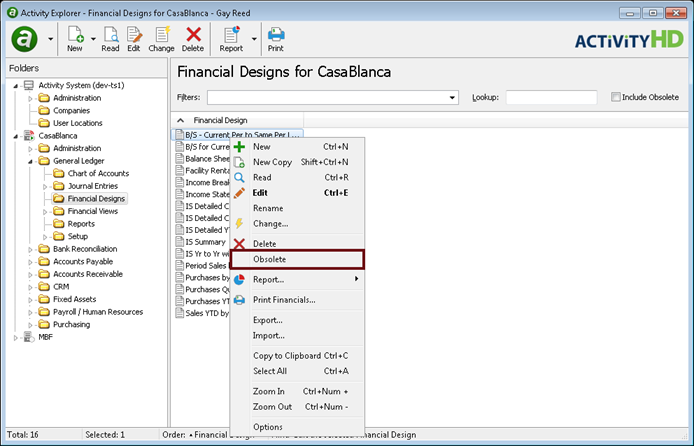

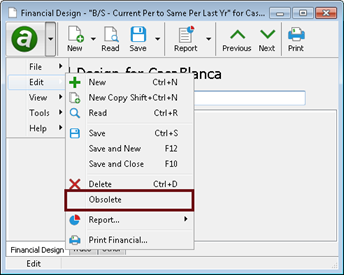

Financial Designs

General Ledger > Financial Designs

You can now flag financial designs as obsolete. By default, obsolete objects are excluded from views and from use as references.

To make a financial design obsolete, locate the design in the HD pane, right-click, and select Obsolete, or open the financial design record and select

> Edit > Obsolete.

> Edit > Obsolete.

-

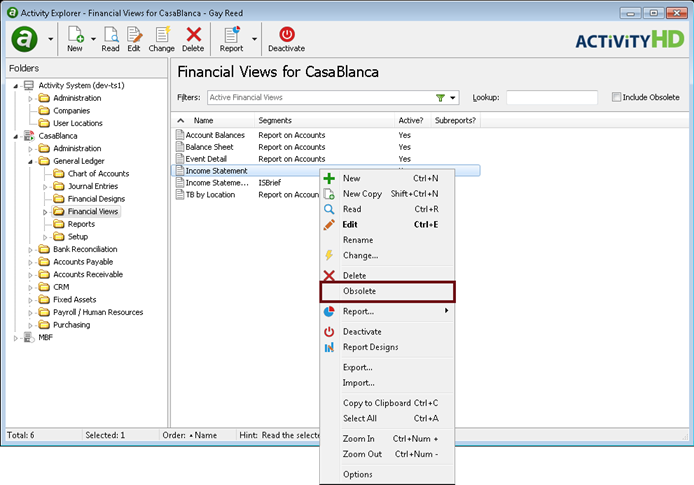

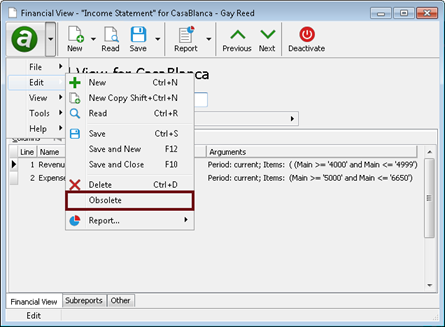

Financial Views

General Ledger > Financial Views

You can now flag financial views as obsolete. By default, obsolete objects are excluded from views and from use as references.

To make a financial view obsolete, locate the financial view in the HD pane, right-click, and select Obsolete, or open the financial view record and select

> Edit > Obsolete.

> Edit > Obsolete.

Payroll/Human Resources

-

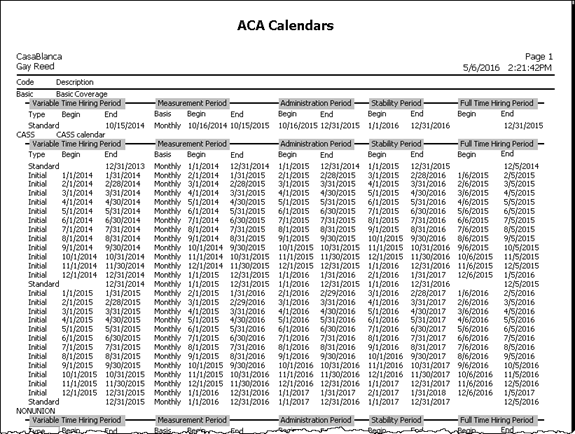

ACA Calendars Listing

Payroll/Human Resources > Setup > ACA > Calendars > [right-click] > Select and Report > ACA Calendars Listing

The ACA Calendars Listing is a new report which lists the ACA calendars defined in your system. You can print only the code and description for each calendar in your selection, or you can print the complete calendar definitions.

-

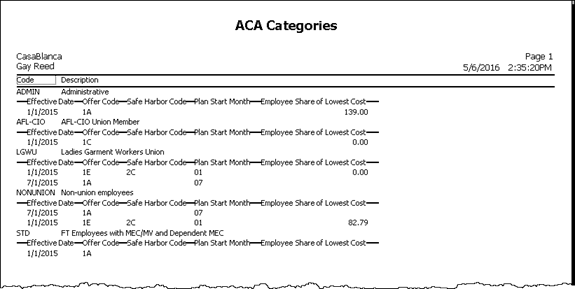

ACA Categories Listing

Payroll/Human Resources > Setup > ACA > Categories > [right-click] > Select and Report > ACA Categories Listing

The ACA Categories Listing is a new report which lists the ACA categories defined in your system, including the code, description, and category defaults by effective date.

-

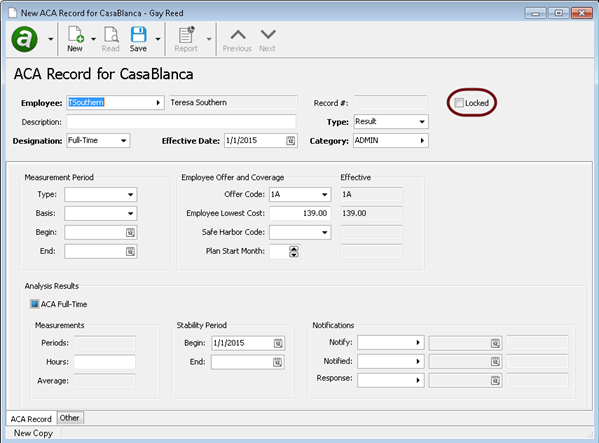

ACA Records

Payroll/Human Resources > Employees > Records > ACA

Prior to this release, when you performed a "New Copy" of a locked ACA record, the new record was also locked. Now, the new record defaults to unlocked.

-

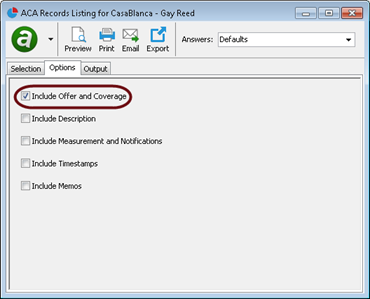

ACA Records Listing

Payroll/Human Resources > Employees > Records > ACA > [right-click] > Select and Report > ACA Records Listing

A new Include Offer and Coverage option has been added to the ACA Records Listing. If you mark this checkbox, the report shows the default offer code, employee-only lowest cost (if applicable), safe harbor code, and plan start month for each ACA record for each employee included on the report.

-

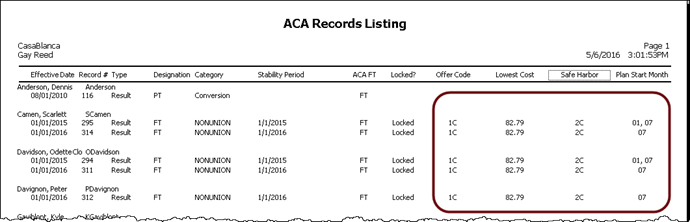

Checks

Payroll/Human Resources > Checks

When a payroll check is saved in the Check window, ActivityHD now analyzes the check for certain problems. If problems are detected, they are displayed in a pop-up message.

-

Checks

Payroll/Human Resources > Checks

The payroll check calculator now issues warnings for tax entities with an out-of-date tax function so that you know that tax calculations may be incorrect for the given check date. The message is similar to the following: "The tax calculation for USA may be invalid for checks dated after December 31, 2016."

If you know the tax tables for the entity have not changed, you can safely ignore the warning.

The warning appears in a pop-up message if you save an edited check while the tax function is out-of-date.

-

Employees

Payroll/Human Resources > Employees

In some cases an employee may have checking and savings accounts with the same routing number and same account number. In the past, ActivityHD returned an error if you attempted to enter both accounts: "This Bank Account already exists for this Employee." Now, ActivityHD does not consider accounts to be duplicates unless the routing number, account number, AND account type are all the same. (If this does occur, ActivityHD returns the following error: "This Bank Account and Account Type already exists for this Employee.")

The new direct deposit format appends an indicator of the account type (C or S) at the end: 111900659 : 1234567890 : C.

In the Disbursement Accounts table on employee records, in the prenotes process, and on the Prenotes Report, bank accounts are sorted in routing number + account number + account type order.

This change also affects ActivityHD Automation Server (AAS). The account type argument has been added to the LocateByAccount method of PREmployeeBankAccounts. If you have macros which use the LocateByAccount method, you need to update them to add the new argument. The "Import Employee Disbursement Rules.xls" macro in the Extras folder has already been updated for you and could be used as an example.

-

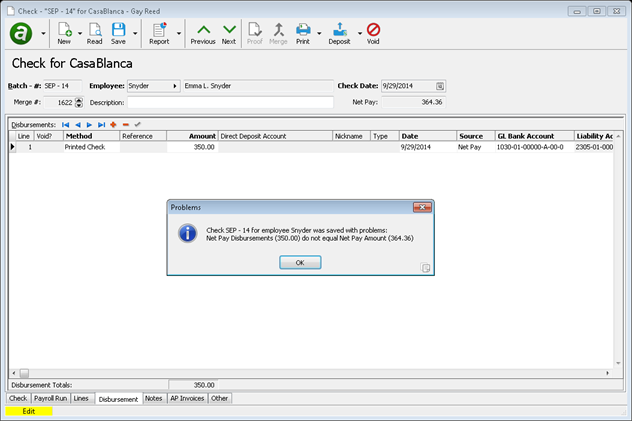

Export Employers

Payroll/Human Resources > Setup > Export Employers

A Name Control field has been added to the Employer tab of the Export Employer window. The name control is a four-character code issued to a company by the IRS when it issued the company's EIN. This field is optional for the electronic transmission of 1095-Cs to the IRS. If the value doesn't match IRS records, your transmission could be rejected, so leave this field blank if you are unsure of the actual value.

-

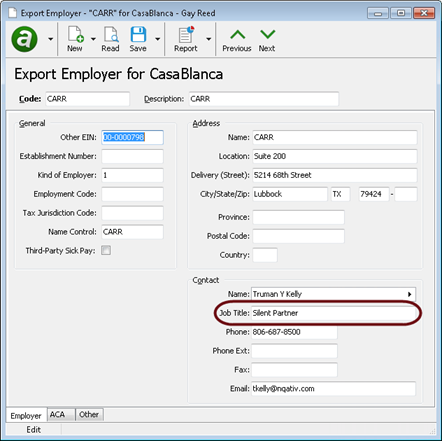

Export Employers

Payroll/Human Resources > Setup > Export Employers

A Job Title field has been added to the Contact section of the Employer tab of the Export Employer window. The job title allows up to 40 characters and is used to fill the "Title" field on the first page of the 1094-C transmission.

-

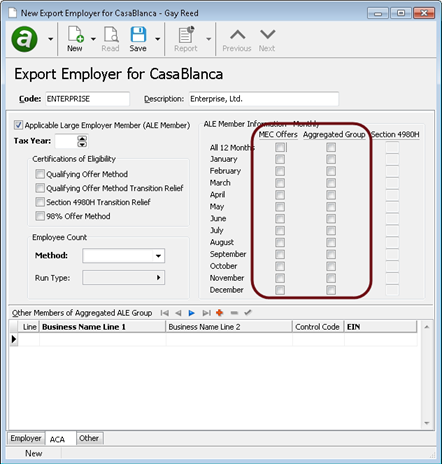

Export Employers

Payroll/Human Resources > Setup > Export Employers

Originally, the MEC Offers and Aggregated Group checkboxes were tri-state checkboxes, meaning the value could be true, false, or undefined (neither true nor false). ActivityHD warned you if you failed to give a complete response to either column. Some users found this confusing. Now, the checkboxes are initialized to false when the Applicable Large Employer checkbox is marked. The only valid values now are false (unmarked) and true (marked). While less confusing, it's important that you don't overlook these columns and that you set the checkboxes in these columns to the appropriate values.

-

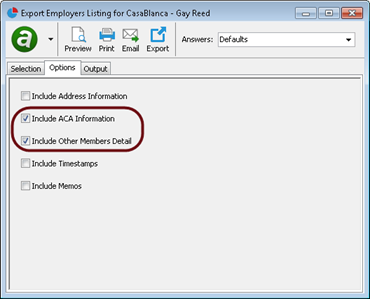

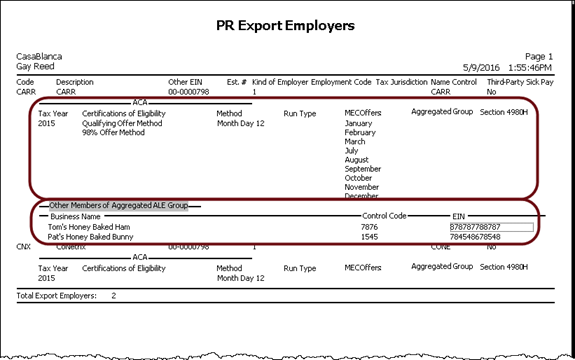

Export Employers Report

Payroll/Human Resources > Setup > Export Employers > [right-click] > Select and Report > Export Employers Listing

The Export Employers Listing has been expanded to include ACA information. If you mark the Include ACA Information checkbox, the tax year, certifications of eligibility, employee count method, run type, MEC offer indicators, Aggregated Group indicators, and Section 4980H codes for the selected export employers are included on the report. If you mark the Include Other Members Detail checkbox, the report includes the business name, control code, and EIN for each aggregated member listed in the Other Members of Aggregated ALE Group table on each export employer's ACA tab.

-

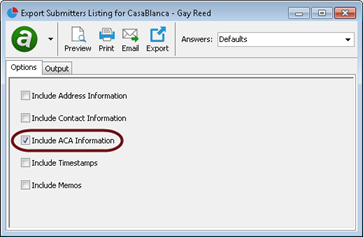

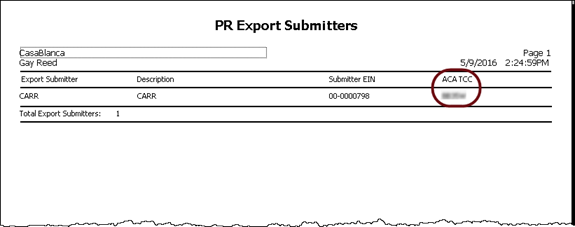

Export Submitters Report

Payroll/Human Resources > Setup > Export Submitters > [right-click] > Select and Report > Export Submitters Listing

The TCC field which was recently added to the Export Submitter window, has now been added to the default report design. The Include ACA Information checkbox in the report wizard allows you to include or exclude this information.

In addition, with the recent change to the Contact Name field to separate the name into its component parts, several different ways of expressing the contact name as fields have been added, including FirstNameFirst and LastNameFirst, and the more restrictive ContactName field has been removed.

-

Payroll Check Calculator

There are a number of circumstances in which year-to-date calculations can occur in the payroll check calculator. These circumstances involve the following PRCode calculation expression functions:

- SumYTD

- CountYTD

- MinYTD

- MaxYTD

- W4.Withholding

In the course of normal payroll processing, where checks are processed in increasing date order, YTD calculations include all matching check lines for checks within the year since there are no checks for later in the year. However, in the unusual case when a check is dated before one or more existing checks, a problem can arise because these functions may calculate a total that does not include lines from the later dated check(s). Now when this sort of situation occurs, ActivityHD produces a warning. The warning does not deter check processing, it simply reminds the operator that the results need to be checked for correctness.

The warnings returned look similar to one of the following:

- "There is 1 check line that belongs to a check dated later in the year that was not included in the year-to-date total."

- "There are <n> check lines that belong to one or more checks dated later in the year that were not included in the year-to-date total."

To avoid the warning, use history functions instead of YTD functions (but be aware of the problems that can result).

Example

SumHistory('Group Result', Date(CheckDate, 'begin of year'), Date(CheckDate, 'end of year'))

-

Payroll Extras

The Extras folder of your ActivityHD distribution includes TaxableWages.xml in the ...\Extras\Payroll\Export Controls\ folder. This file is used to foot taxable wages before W-2s are generated. Before this release, the export control formatted negative numbers with the minus sign to the right; Excel couldn't interpret numbers formatted this way as negative numbers. Now, numeric fields are formatted with the minus sign to the left.

Also, the output type for this file has changed from a tab-delimited txt file to a comma-delimited csv file. While both file types can be opened from Excel, you can double-click a csv file and have it open immediately in Excel.

-

Payroll Extras

A new script has been introduced to the Extras\Payroll folder of your ActivityHD distribution. PREmployee1099Data.sql is now available to register employee check data as an alternate source for AP 1099 reporting. Check Total Compensation is reported on Check Date as 1099-MISC - Amount 7.

-

PRCode Calculation Expression Language

Two new functions have been added to the PRCode expression language with this release: WARN and ERR. These functions are used to generate user-defined warnings and errors during payroll check calculation.

The syntax for the new functions is:

- WARN("message",value)

- ERR("message",value)

The first argument is a string literal which consists of the message to be added. The second argument is the value of the function.

If either of the functions is evaluated, the warning or error is added as a new message. The message appears during Process Payroll Run, Process Time Sheets, and Proof Checks, or when saving a manually edited check.

Examples

IF(IsNull(segment:item:parameter),ERR("segment:item:parameter is null. Every employee should have a value.",segment:item:parameter),segment:item:parameter))

WARN("PRCode Pay.Reg.TX is deprecated and should no longer be used.",source*rate)

-

Print Employee 1095-Cs

Payroll/Human Resources > Employees > [right-click] > ACA Processing > Select and Print Employee 1095-Cs

Before release 6.5, Print Employee 1095-Cs used the Other EIN field from the export employer record to validate the EIN. Now, the Employer ID field from the USA tax entity is used for validation.

-

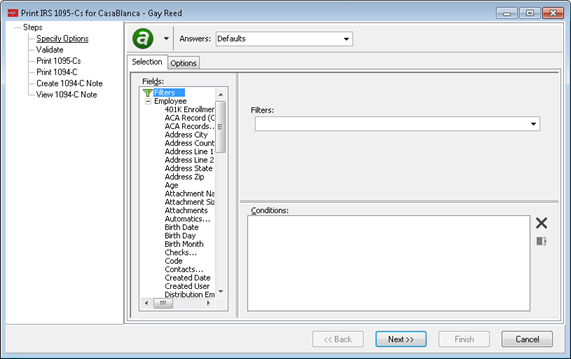

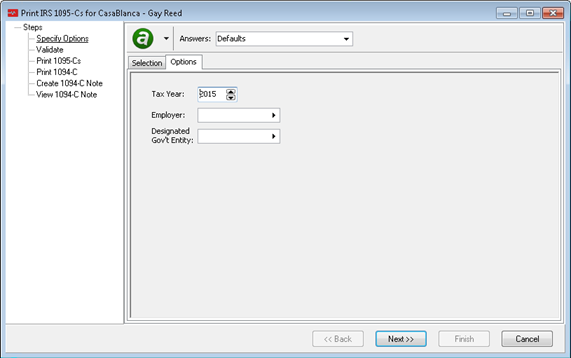

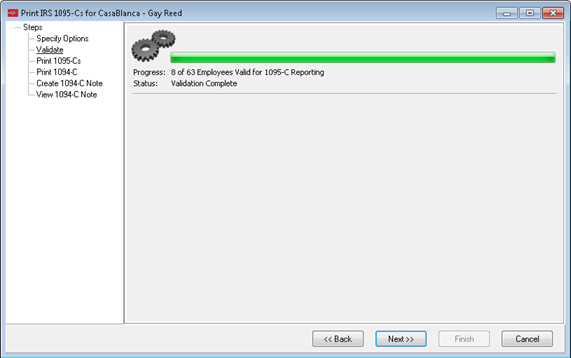

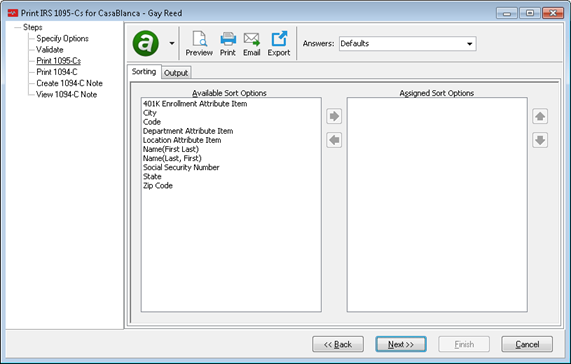

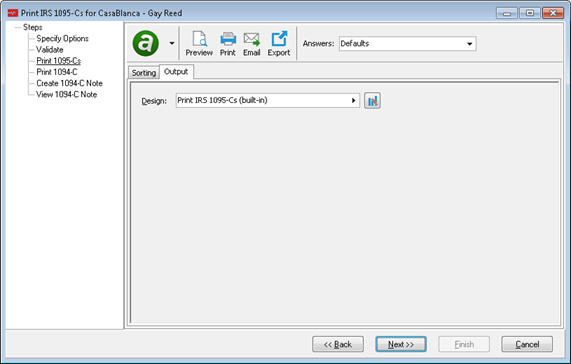

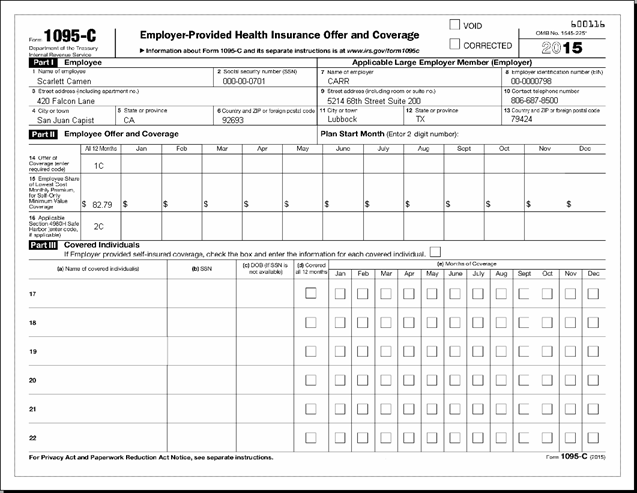

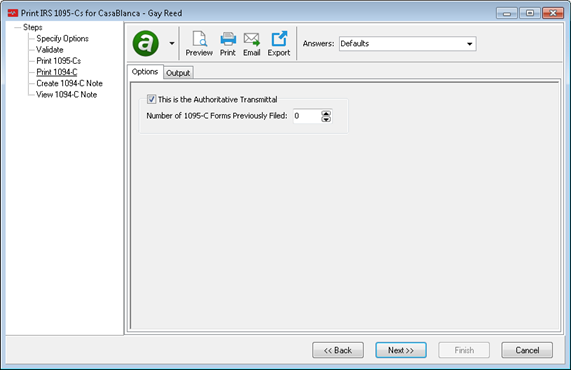

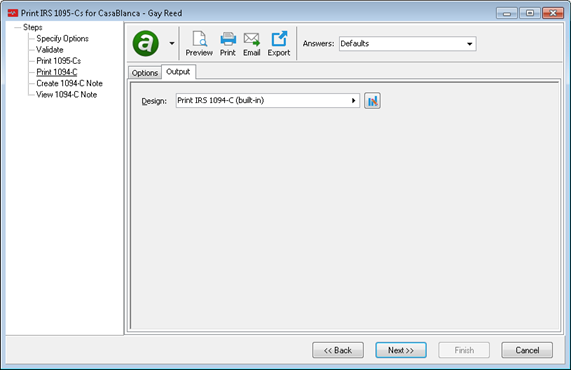

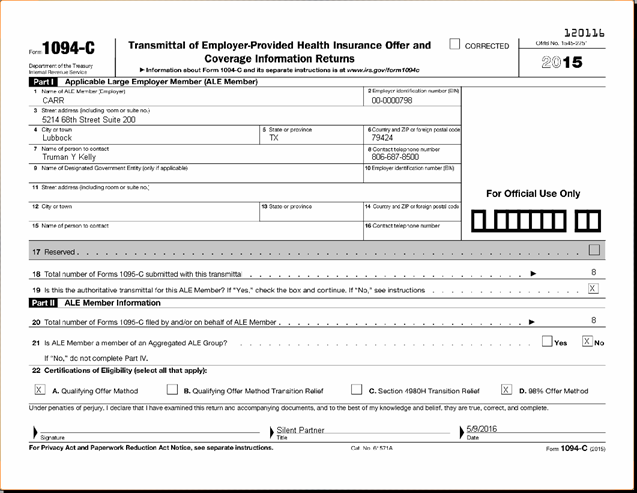

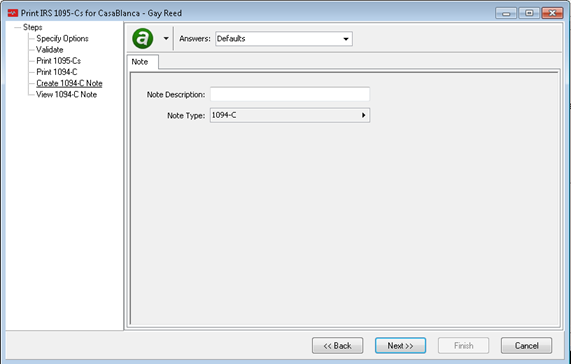

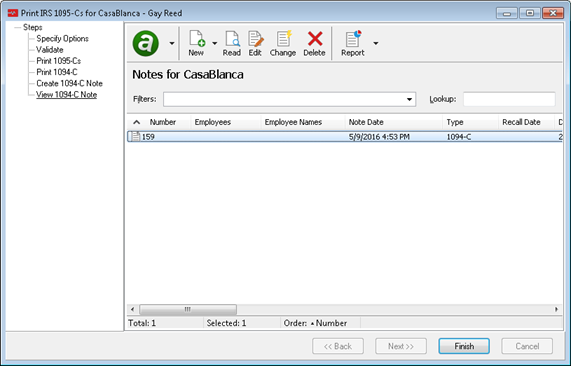

Print IRS 1095-Cs

Payroll/Human Resources > Employees > [right-click] > ACA Processing > Select and Print IRS 1095-Cs

This release introduces the Print IRS 1095-Cs process for printing paper 1095-Cs for submission to the IRS. Only employers with 250 or fewer 1095-Cs to submit should use paper submission. The IRS requires employers with more than 250 1095-Cs to submit them electronically.

If Advanced Security is installed, users must have "Process" access to PR 1095-Cs in order to run Print IRS 1095-Cs.

Note

Print IRS 1095-Cs does not support printing of Designated Governmental Entity information on lines 9-16 of Form 1094-C.

-

Process Payroll Run

Payroll/Human Resources > Payroll Runs > [right-click] > Select and Process

When a payroll run is processed, ActivityHD now analyzes the checks for certain problems. If problems are detected, they are reported in the process messages page of the Process Payroll Run wizard.

-

Process Payroll Run

Payroll/Human Resources > Payroll Runs > [right-click] > Select and Process

The payroll check calculator now issues warnings for tax entities with an out-of-date tax function so that you know that tax calculations may be incorrect for the given check date. The message is similar to the following: "The tax calculation for USA may be invalid for checks dated after December 31, 2016."

If you know the tax tables for the entity have not changed, you can safely ignore the warning.

The warning message displays on the process messages page of the Process Payroll Run wizard if you process a payroll run while the tax function is out-of-date.

-

Process Time Sheets

Payroll/Human Resources > Time Sheets

When time sheets are processed, ActivityHD now analyzes the checks for certain problems. If problems are detected, they are reported in the process messages page of the Process Time Sheets wizard.

-

Process Time Sheets

Payroll/Human Resources > Time Sheets

The payroll check calculator now issues warnings for tax entities with an out-of-date tax function so that you know that tax calculations may be incorrect for the given check date. The message is similar to the following: "The tax calculation for USA may be invalid for checks dated after December 31, 2016."

If you know the tax tables for the entity have not changed, you can safely ignore the warning.

The warning message displays on the process messages page of the Process Time Sheets wizard if you process time sheets while the tax function is out-of-date.

-

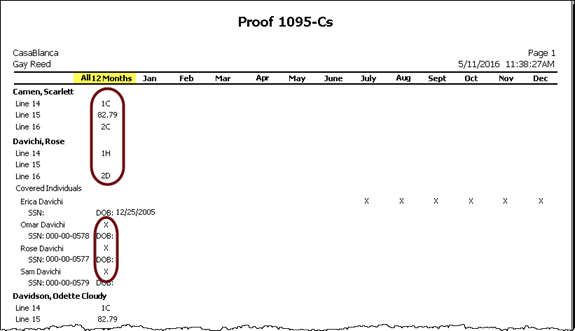

Proof 1095-Cs

Payroll/Human Resources > Employees > [right-click] > ACA Processing > Select and Proof 1095-Cs Report

An All 12 Months column has been added to the report to show when the value of the following fields is the same for all 12 months of the year:

- Line 14 (offer code)

- Line 15 (employee share of lowest cost)

- Line 16 (safe harbor code)

- covered individuals months of coverage indicator

When an All 12 Months field is marked or has a value, the monthly values for the corresponding row are suppressed.

-

Proof 1095-Cs

Payroll/Human Resources > Employees > [right-click] > ACA Processing > Select and Proof 1095-Cs Report

Before release 6.5, Proof 1095-Cs used the Other EIN field from the export employer record to validate the EIN. Now, the Employer ID field from the USA tax entity is used for validation.

-

Proof Checks

Payroll/Human Resources > Checks > [right-click] > Select and Proof

When time sheets are processed, ActivityHD now analyzes the checks for certain problems. If problems are detected, they are reported in the process messages page of the Proof Checks wizard.

-

Tax Calculation Functions

New tax calculation functions have been introduced for the following tax jurisdictions:

Jurisdiction Tax Type Effective Date District of Columbia Income Tax January 1, 2016 Idaho Income Tax July 1, 2015 Indiana Counties Income Tax January 1, 2016 You can find the government documentation supporting the calculations in ActivityHD Help.

A spreadsheet model of most tax functions is provided with your distribution at ...\Extras\Payroll\Tax\Test Tax functions.xls.

Purchasing

-

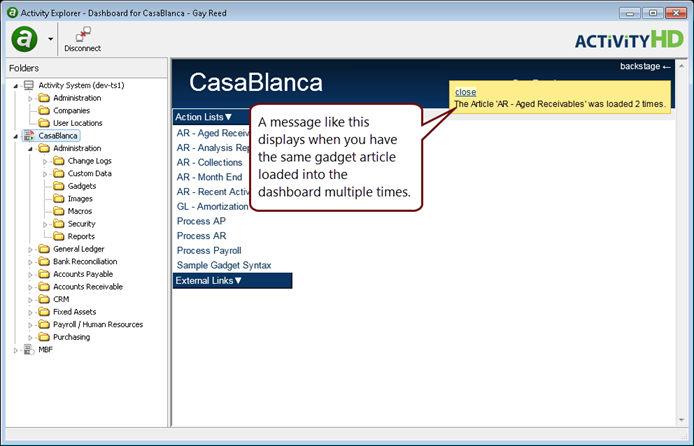

Approval Notifications

An approval notification e-mail can optionally contain a link to your Self-Serve site. Previously, the message wording did not make it clear that the link actually went to the specific order to be approved. The wording has been changed to "Go to <link> to approve the order."