ActivityHD Release 6.28

ActivityHD Manager

-

Splash screen

A splash screen has been added to ActivityHD Manager so that it is clearer which application is launching.

ActivityHD System

-

ActivityHD Automation Server (AAS)

The implementation of the Access Control field in Authorized Users has been improved to use the full-word description of the access control values instead of the initial letter only, echoing the field options in ActivityHD's Authorized Users window:

- All instead of A.

- None instead of N.

- Permitted instead of P.

Note

This change is not backward-compatible. Any existing macros or bots which set values for this field will require modification.

Bank Reconciliation

-

Bank Transactions

Bank Reconciliation > Transactions

Since version 6.10, setting the transaction type to "Fee" on a transaction would not stick. If you selected "Fee" and left the Type field or saved the transaction, the transaction type would switch to "Deposit". This behavior no longer occurs.

General Ledger

-

ActivityHD Automation Server (AAS)

The APInvoice automation object, along with each of its detail objects such as APInvoice.GLDetails, has been updated to contain a complete fields collection.

In addition, the AccountBasis field value is now automatically updated when the InvoiceAmount changes. Previously, the invoice amount was only updated in the Invoice window.

-

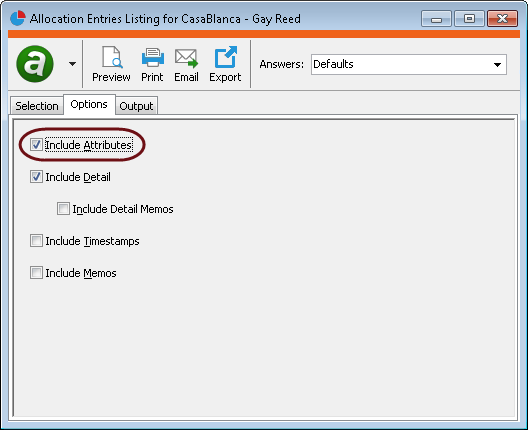

Allocation Entries Listing

General Ledger > Journal Entries > Allocation Entries > [right-click] > Select and Report > Allocation Entries Listing

The Allocation Entries Listing now includes an option to Include Attributes for offset and distribution postings. Any attribute set to follow "Source" postings will not be included. Those set to <blank> or set to a specific attribute value will print on the report.

-

Journal Entries & Journal Detail

General Ledger > Journal Entries

General Ledger > Journal Entries > Journal Detail

The Journal Source column which was available to the Journal Entries and Journal Detail HD views has been removed. The values in the column could be confusing for non-GL entries. The raw data for the journal source is still available in various report data streams. The information from the column is available in the System-Journal Source column which combines the package name with the easy to understand package-specific source.

In a related change, a System Source selection field has been added on the Journal Entries folder so that you can filter journal entries by package.

Payroll/Human Resources

-

2017 income tax (California only)

2017 tax updates for California occurred in version 6.19 of ActivityHD. Unfortunately, the lower bound of the 8.8% bracket for married filers was set to $93,258, but should have been $83,258. As a result, employees who earn between $83,258 and $93,258 may have been underwithheld. The bracket has been corrected.

-

2017 tax updates

Tax changes for New York City which took effect July 1, have been introduced to ActivityHD. The online help has been updated at Reference > Payroll tax functions > TAX FUNCTIONS BY JURISDICTION > 2017.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test Tax functions.xls".

-

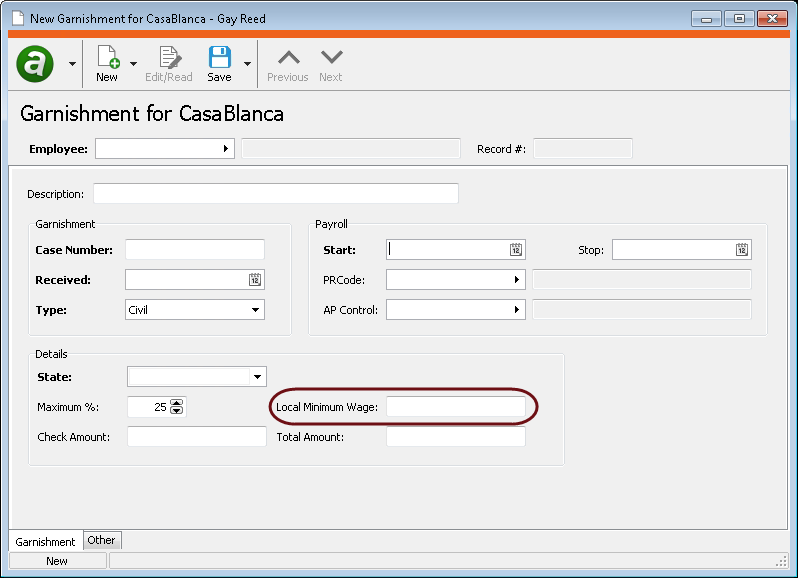

Garnishments

Payroll/Human Resources > Employees > Records > Garnishments

Civil and local garnishments are capped by the amount of disposable earnings a garnished employee has in excess of a certain multiple of hourly minimum wage. In general, this is a multiple of federal minimum wage unless the state minimum wage is higher. ActivityHD tracks the multiplier and minimum wage for each state. However, some municipalities such as Oakland, San Jose, and Los Angeles, California, have local minimum wages that are higher than the state's. Rather than attempt to track each individual local minimum wage that is higher than the federal or state minimum, ActivityHD allows you to enter the local minimum wage directly on the garnishment record. For this reason, a Local Minimum Wage field has been added for civil and local garnishments.

Only enter a value in the Local Minimum Wage field if the local minimum wage is higher than the state and federal minimum wage AND it is used to calculate garnishment limits.

Note

The local minimum wage amount must be updated manually.

With this change, the way the Garnishment.Deduction function in segment item expressions determines which minimum wage to use has been altered. To determine the applicable minimum wage, the Garnishment.Deduction function:

- Checks the ActivityHD system tables to find the minimum wage in effect for the state of the garnishment on the date the garnishment was received.

- If the state is not found in the table or its minimum wage is not used for calculating garnishment limits, the federal minimum wage is selected.

- If the local minimum wage on the garnishment record is not blank and exceeds the selected state or federal minimum wage, the local minimum wage is selected.

Reference: http://www.courts.ca.gov/34892.htm

-

Garnishments

Payroll/Human Resources > Employees > Records > Garnishments

Before July 1, 2016, civil and local garnishments in California were limited to the minimum of:

- the Consumer Credit Protection Act (CCPA) limit, currently 25% of disposable earnings, or

- disposable earnings in excess of 40 times the minimum wage.

As of July 1, 2016, however, the second provision changed to:

- 50% of disposable earnings in excess of 40 times the minimum wage.

The Garnishment.Deduction function in segment item expressions was modified accordingly.

Example

Suppose an employee has a civil garnishment for California, is paid weekly, with a per check garnishment amount of $500.00. The employee has no other garnishments. For a check date of 8/1/2017 (i.e., after 7/1/2016), the employee's disposable earnings is $800.00.

The calculated CCPA limit is $800.00 x .25 = $200.00.

The excess over 40 x minimum wage is $800.00 - (40 x $10.50) = $380.00.

Before this change, the garnishment amount was $200.00 since $200.00 < $380.00.

Now, since the excess over minimum wage is multiplied by 50%, the comparison amount is now $380.00 x 50% = $190.00. Since $190.00 < $200.00, the new garnishment amount is $190.00.

Reference: http://www.courts.ca.gov/34892.htm