ActivityHD Release 6.18

System-wide

-

ActivityHD import classes

Prior to version 6.18, the ActivityHD import classes for Excel would not process rows of data which didn't contain field values for the main data object. As a result, rows that contained only a LocateBy value could not be processed. With version 6.18, you can now set up imports which do not change fields on the main data object, but which may only add detail rows to an existing record.

-

Attachments

Occasionally, users previewing Word document attachments would receive the following error message: "The object invoked has disconnected from its clients." This problem has been alleviated.

-

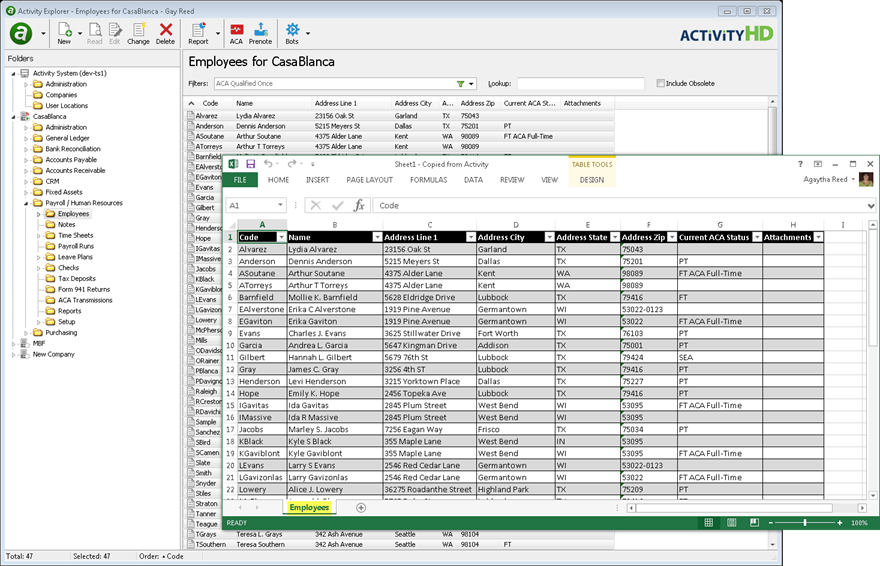

HD views: Copy to Excel

Until now, when you copied ActivityHD records to Excel, the resulting worksheet was automatically named "Activity Sheet". Now, the worksheet is automatically named after the folder the data was copied from.

Accounts Payable

-

1099 Filing

Accounts Payable > Vendors > [right-click] > Government > US 1099 Report > Select and Create File

1099 Filing Deadlines

Some of the filing dates for Forms 1099 have changed from prior years. Refer to the following table for due dates for tax year 2016 filing.

Form Copy B due to recipient by Copy A due to IRS by 1099-MISC

January 31, 2017

February 15, 2017 if reporting payments in Box 8 or Box 14

January 31, 2017 if reporting payments in Box 7

Otherwise:

Paper: February 28, 2017

Electronic: March 31, 2017

1099-INT

January 31, 2017

Paper: February 28, 2017

Electronic: March 31, 2017

1099-DIV

January 31, 2017

Paper: February 28, 2017

Electronic: March 31, 2017

Refer to Publication 1220 and to the "Instructions for Payer" section of each form's instructions for additional details.

Updates are now complete for paper and electronic filing of 1099-MISC, 1099-INT, and 1099-DIV forms for tax year 2016.

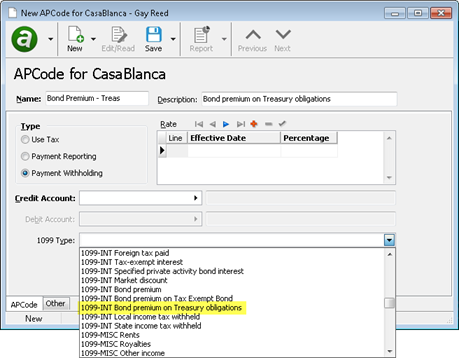

A 1099 type has been added to support reporting of amounts for bond premiums on Treasury obligations. This amount prints in Box 12 of Form 1099-INT. To use the new amount code, create an APCode and select "1099-INT Bond premium on Treasury obligations" from the 1099 Type drop-down list.

For 2016, year-specific report designs have been introduced. The following report designs are now available.

- 2016 1099 Forms Copy A (built-in)

- 2016 1099 Forms Copy B (built-in)

- 2015 1099 Forms Copy A (built-in)

- 2015 1099 MISC Copy B (built-in)

Note

2015 report designs have not been updated with 2016 requirements.

If you attempt to print 1099s using a report design for a year which doesn't match the year specified when you run the wizard, ActivityHD returns a message similar to the following:

The selected report design year is not compatible with the year in the data file.

Report Design Year: 2015

Data Year: 2016

The default report design is now "2016 1099 Forms Copy B (built-in)". This report design uses images to print Copy B of 2016 Forms 1099-MISC, 1099-INT, and 1099-DIV, with instructions. Because the report design uses images, "Data" access to the Images folder is required.

-

1099 Report Forms

Accounts Payable > Employees > [right-click] > Government > US 1099 Report > Print Forms

Before this change, the image for printing 2016 Forms 1099-INT ["AP1099INT-2016-P2 (built-in)"] did not include all of the "Instructions for Recipient". The image has been updated so that when you use the "1099 Copy B Forms (built-in)" report design to print 1099-INTs, the instructions print correctly.

-

Aged Invoice Analysis

Accounts Payable > Vendors > [right-click] > Select and Report > Aged Invoice Analysis

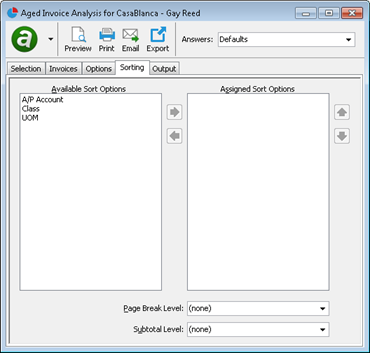

A Sorting tab has been added to the report set-up wizard to allow sorting and subtotaling by AP account, vendor class, and/or unit of measure.

Within the sort(s) you select, invoices are further sorted by vendor; debit balance, then credit balance; aging date; invoice number; and merge number. Invoices are also subtotaled by vendor.

In addition to new sorting options, extended views have been added to the report to make the following additional data available for custom report designs:

- class code

- class description

- invoice description

- liability account code

- liability account description

- terms code

- terms description

- UOM code

- UOM description

If you need assistance with custom database views or custom report designs, contact nQativ support.

-

Aged Invoice Analysis

Accounts Payable > Vendors > [right-click] > Select and Report > Aged Invoice Analysis

Several improvements have been made to the report to improve its usability.

- Handling of outstanding credits.

In the past, the report always included all invoices with a credit balance regardless of their due date, sorted them after invoices with a debit balance, and applied them to the oldest aging columns with outstanding balances. If needed, the credit balance would be split among multiple aging columns. This approach ensured that you knew about all the credits which were available on a vendor's account so that you didn't accidentally overpay the vendor.

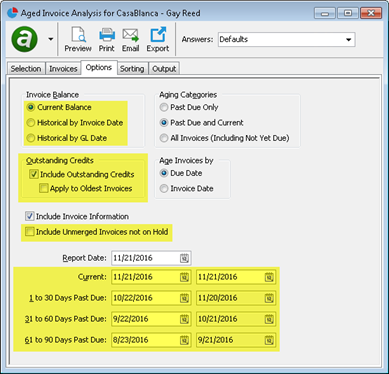

However, sometimes users either wanted to exclude outstanding credits or wanted to age them into the appropriate aging columns based on due date. To accommodate this, a couple of checkboxes have been added to the Options tab of the report set-up wizard.

The Include Outstanding Credits checkbox preserves the current behavior and is marked by default. You can clear the checkbox to exclude outstanding credits. If the Include Outstanding Credits checkbox is marked, the new Apply to Oldest Invoices checkbox is enabled but not marked. If you do not mark the Apply to Oldest Invoices checkbox and you are not including "Not Yet Due" invoices, then invoices with a credit balance which are not yet due are excluded from your selection. On the other hand, if you mark the Apply to Oldest Invoices checkbox, all invoices with a credit balance are included, even the ones which aren't yet due, and they are applied to the oldest aging columns with outstanding balances.

- Handling of unmerged invoices.

An Include Unmerged Invoices not on Hold checkbox has been added so that you can do just that.

- Interface improvements.

Some changes have been made for clarification and to make the AP aged analysis similar to the AR aged analysis. These include:

- Some elements have been repositioned.

- The aging periods now have both begin and end dates.

- The length of the default aging period has changed from 1 month to 30 days.

- The order and names of the options in the Invoice Balance section have changed. Now the options are "Current Balance", "Historical by Invoice Date", and "Historical by GL Date", in that order.

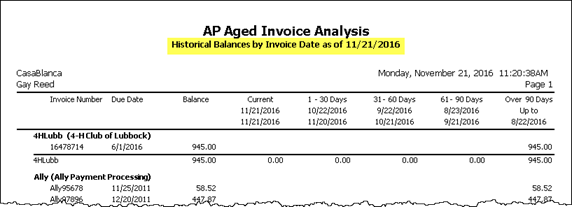

- Report subtitle changes.

The report subtitle now more accurately reflects the content of the report. Depending on the option selected in the Invoice Balance section of the Options tab, the report is subtitled as follows:

- Current Balance

- Historical Balances by Invoice Date as of xx/xx/xxxx

- Historical Balances by GL Date as of xx/xx/xxxx

- Handling of outstanding credits.

-

APCodes

Accounts Payable > Setup > APCodes

A new type called "1099-INT Bond premium on Treasury obligations" has been added to the 1099 Type dropdown for 2016 tax year reporting. If needed, amounts for this 1099 type print in Box 12 of Form 1099-INT.

-

Invoices

Accounts Payable > Invoices

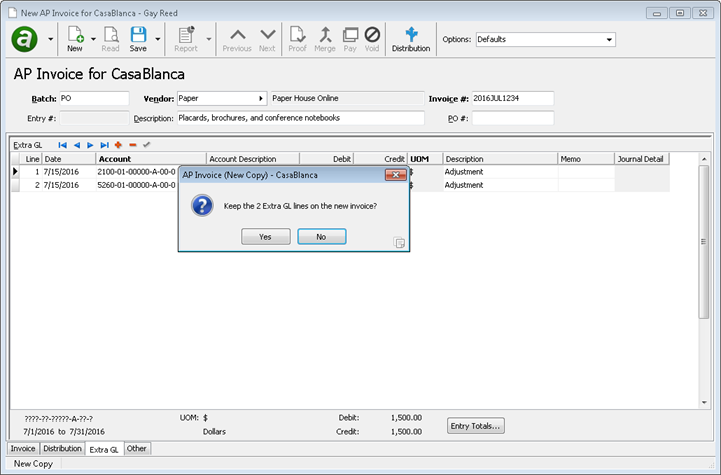

Recently an option was added to AP invoices to allow you to copy extra GL lines when you perform a "New Copy". When you were prompted to decide whether or not to copy extra GL lines to the new invoice, ActivityHD told you how many lines would be copied, but you could not see the lines. Now, ActivityHD shows you the Extra GL tab when you are prompted whether to copy extra GL so that you can make an informed decision.

-

Invoices

Accounts Payable > Invoices

Before this change, users could receive errors while closing ActivityHD Explorer with an invoice open. This could also occur in an automated process with an APInvoice data object which didn't get destroyed before disconnecting from the company. These disconnection errors have been addressed.

Accounts Receivable

-

Invoices

Accounts Receivable > Invoices

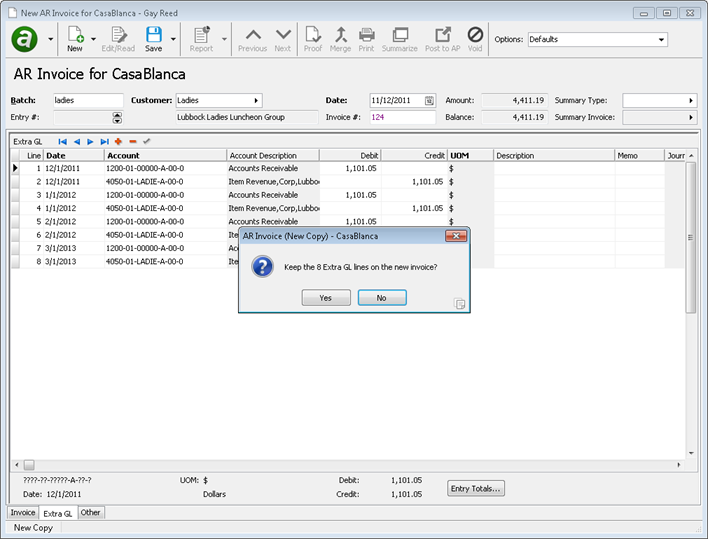

Before this change, the "New Copy" command on AR invoices always copied all extra GL entries to the new invoice. Because the extra GL entries occupy their own tab, it was easy to overlook them when editing the new invoice. This was especially troubling when the extra GL entries were corrections to the original invoice that did not need to be carried over to the new invoice. As you might imagine, some users were frustrated when they discovered unexpected extra GL entries merged to GL without their knowledge. In order to prevent such a surprise in the future, users are now asked whether they want to include extra GL entries in the new copy. In addition, when the user is prompted about extra GL entries, the view shifts to the Extra GL tab so the user can see the entries which would be copied.

Note

"Accounts" access to AR Invoices is required to copy extra GL lines to a new invoice.

-

Tessitura interface

Accounts Receivable > Setup > Tessitura Controls

Tessitura Software is a third-party application used by arts, cultural, and entertainment organizations for ticketing, donations, promotions, solicitations, campaigns, etc. nQativ has developed a new interface package to provide an automatic import of AR invoices with immediate payments directly from the Tessitura website.

You must be licensed for the interface in order to see the Tessitura Controls folder.

If your organization uses Tessitura software and you want to learn more about the Tessitura interface, contact sales@nqativ.com.

Fixed Assets

-

Assets

Fixed Assets > Assets

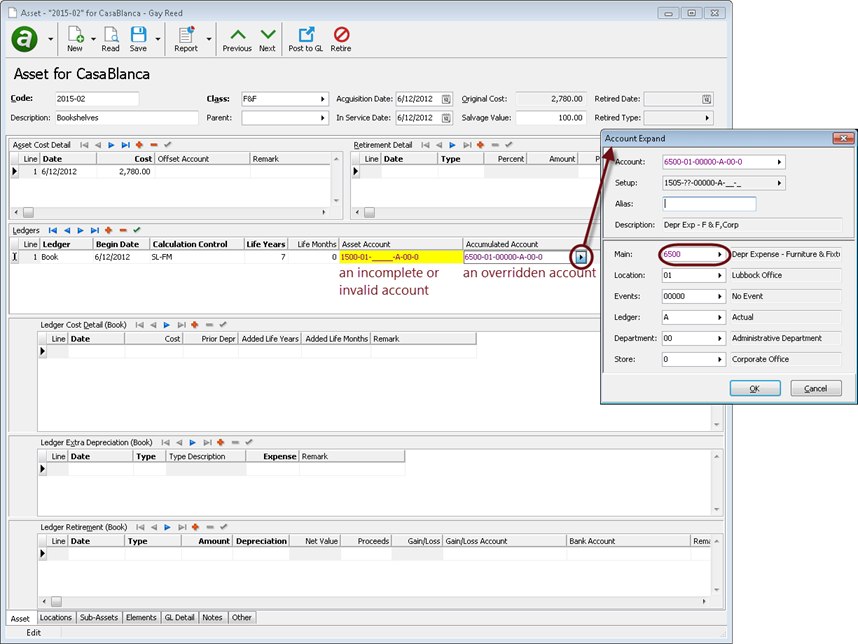

Until now, if a default account was incomplete or invalid based on the pieces contributed by the asset class, ledger, location, and/or retirement type, the field was simply left blank. This gave you little to go on unless you researched each piece individually. Now, incomplete or invalid accounts display in the account field but are highlighted in yellow to indicate that attention is required.

Also, sometimes you may need to override a default account on an asset. Before this change, you could not tell if the account in an account field was the default account or an override of the default. Now an account that is not the default account (or an account with a default that changed since the asset was originally entered) is indicated by a purple font. If you press F2 on such a field, the Account Expand dialog box shows the override account in the Account field and the default account in the Setup field. In the segment breakdown of the Account Expand dialog, any segments which deviate from the default account are also denoted by purple font.

These changes apply to the Asset Account and Accumulated Account columns in the Ledgers table, and the Gain/Loss Account and Bank Account columns in the Ledger Retirement table.

Note

Once an account is entered and saved on an asset, changes to the asset's class, ledger, location, and/or retirement type do not cause the defaults to be reapplied. Although the account number may change colors, the actual account value will not change. If you want to revert to the default account, clear the field and exit it.

Payroll/Human Resources

-

2017 tax updates

Tax changes for Minnesota, Nebraska, and South Carolina which take effect January 1, 2017, as well as changes for Indiana Counties which took effect October 1, 2016, have been introduced to ActivityHD; updated documentation has been added to the online help at Reference > Payroll tax functions > TAX FUNCTIONS BY JURISDICTION > 2017.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test Tax functions.xls".

-

2017 tax updates (Canada)

Tax changes for Canada and the provinces which ActivityHD supports, namely Alberta, British Columbia, Manitoba, Ontario, and Saskatchewan, which take effect January 1, 2017, have been introduced to ActivityHD. Updated documentation has been added to the online help at Reference > Canadian Payroll tax functions.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Calculate 2017 Canada Income Tax.xls".

-

ActivityHD Automation Server (AAS)

Before this change, attempts to use AAS on ACA category detail fields would result in this error: "Object reference not set..." Now, AAS macros can access ACA category detail fields without complaint.

-

Create IRS 1095-C Transmission

Payroll/Human Resources > ACA Transmissions > Create

The ACA transmissions process has been updated to generate 1094-C/1095-C XML files for filing years 2015 and 2016.

-

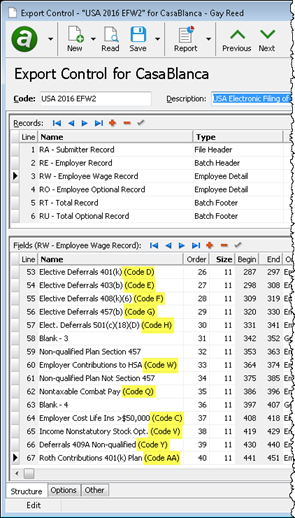

Export Controls

Payroll/Human Resources > Setup > Export Controls

The 2016 EFW2 export control for electronically filing W-2 forms is now available for import into ActivityHD. No field changes were required for 2016; however, the field names for fields related to Box 12 codes were expanded to show the code.

Note

For tax year 2016, both paper and electronic filers must file wage reports by January 31, 2017.

-

Groups

Payroll/Human Resources > Setup > Groups

For tax year 2011 the Advance EIC Payment was eliminated. However, until now the built-in "EIC" group was left active in ActivityHD to accommodate prior year reporting requirements. Now, the "EIC" group has been flagged as obsolete.

The calculations for the "EIC" group are still performed, but the results are not shown on W-2s. If data is found in the date range for the "EIC" group, the W-3 report will still show the amount.

-

Print Employee/IRS 1095-Cs

Payroll/Human Resources > Employees > [right-click] > Select and Print Employee 1095-Cs | Select and Print IRS 1095-Cs

The built-in report designs for Forms 1094-C and 1095-C for reporting year 2016 have been introduced to ActivityHD. These report designs can only be used to print 2016 information returns.

In a related change, the report designs for 2015 have been renamed as follows:

- 2015 Print Employee 1095-Cs (built-in)

- 2015 Print IRS 1095-Cs (built-in)

- 2015 Print IRS 1094-Cs (built-in)

The report designs listed above can only be used to print 2015 information returns.

Note

"Data" access to the Images folder is required to print 1094-C and 1095-C information returns. The report designs use images of the respective forms as the report background, so unless a user has "Data" access, the image will not display on the report.

Purchasing

-

Commitment invoices

In the past, the date of an agent commitment invoice would be calculated as the earliest purchase date for the agent that had not yet been invoiced--even when the purchase was already included on a different commitment invoice. Now the date of an agent commitment invoice is the earliest purchase date for a purchase actually on that commitment invoice.

-

Purchase Orders

Purchasing > Orders

A couple of errors could occur when performing a "New Copy" on a purchase order. If you attempted to copy a purchase order which had canceled purchase lines, a "Field 'Ship' cannot be modified" error could occur. Also, if an error was returned when performing a "New Copy", an access violation could occur after that. Both isssues have been addressed.

Web Services

-

Self-Serve login

Before this change, a Self-Serve user would be redirected to the "Email Address Edit" page during login if the user's email address was blank. If the email address was data-linked, the user was caught in a state where they could not set their email address and could not view other self-serve pages. With this change, the redirect only occurs when the user has a blank email address and it is not data-linked.