ActivityHD Release 9.3

System-wide

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

Formerly, there could be a problem with the order in which bot modules were loaded. In particular, with multiple modules and nested dependencies because of the bots specified in the Script Using field, modules could be executed in the wrong order.

The issue has been corrected. Bots with multiple modules each possibly referencing other modules, etc., are now executed in the correct order.

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

The recommended version of VBSEdit has been updated to v25.1.30.7. The installers for both the 32-bit and 64-bit versions are available in the distribution folder Extras\VBSEdit.

This version of VBSEdit fixes problems with the execution order of bot modules, with blank bots, and with variables.

VBSEdit is an optional and separately installed editor and debugger which can be used for bot creation and maintenance in ActivityHD.

Note

AccountingWare strongly recommends uninstalling any existing version of VBSEdit, both 32-bit and 64-bit, before installing the new version.

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

The version of ActivScriptNode has been updated to 1.0.0.14. This new version represents performance improvements, most notably for large or long-running bots or for bots which access a large number of COM interface methods or properties. The improvements are related to garbage collection of temporary data.

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

The recommended version of VBSEdit has been updated to v24.11.25.5. The installers for both the 32-bit and 64-bit versions are available in the distribution folder Extras\VBSEdit.

VBSEdit is an optional and separately installed editor and debugger which can be used for bot creation and maintenance in ActivityHD.

Note

AccountingWare strongly recommends uninstalling any existing version of VBSEdit, both 32-bit and 64-bit, before installing the new version.

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

Three new packages, ahd_date_time_package, ahd_customfields_package, and ahd_datasources_package, are now included in the set of preinstalled npm packages for ActivScriptNode.

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

The recommended version of VBSEdit has been updated to v24.11.13.5. The installers for both the 32-bit and 64-bit versions are available in the distribution folder Extras\VBSEdit.

VBSEdit is an optional and separately installed editor and debugger which can be used for bot creation and maintenance in ActivityHD.

Version 24.11.13.5 fixes a few problems with debugging of ActivScriptNode bots.

In addition, the new version includes an option to use Visual Studio Code for editing bots instead of VBSEdit from ActivityHD (for advanced and technical users only). To install and use Visual Studio Code:

- Install the activescript-debug-1.0.15.vsix extension. To do so:

- Run Visual Studio Code.

- From the View menu, select Command Palette.

- In the search box, type "VSIX" and press ENTER. The Install from VSIX dialog opens.

- In the dialog, navigate to your Distribution\Extras\VBSEdit folder.

- Double-click the activescript-debug-1.0.15.vsix file. It should finish installing almost instantaneously.

Tip

You can alternatively install activescript-debug-1.0.15.vsix from a command line:

code --install-extension activescript-debug-1.0.15.vsix

- Install the latest version of VBSEdit (24.11.13.5), both 64-bit and 32-bit (see note below).

- Double-click the toggle_vscode.vbs file (also in the Distribution\Extras\VBSEdit folder) to toggle the editor between VBSEdit and Visual Studio Code. This works by making a registry change in HKEY_CURRENT_USER.

Note

AccountingWare strongly recommends uninstalling any existing version of VBSEdit, both 32-bit and 64-bit, before installing the new version.

- Install the activescript-debug-1.0.15.vsix extension. To do so:

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

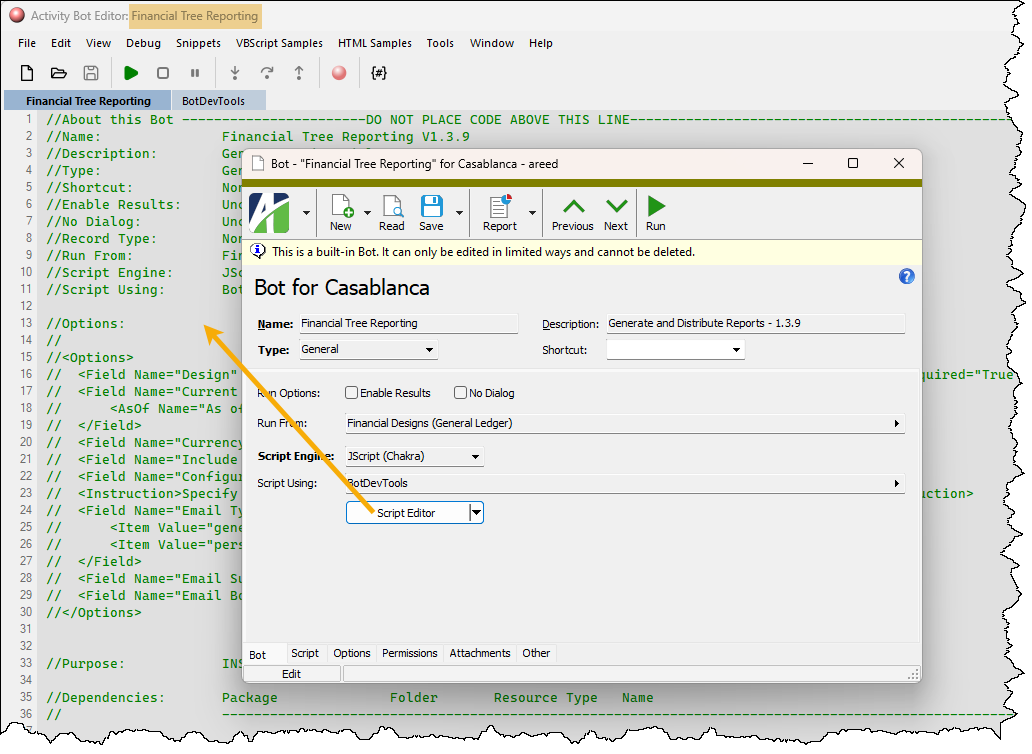

In the past, when you launched the script editor from the Bot window, the name in the title bar of the Activity Bot Editor was always "Bot Script". Now the document title is the name of the bot.

-

Bots

Activity System > Administration > Setup > Bots

[Company] > Administration > Setup > Bots

Archiver 7.0.1, Mssql 11.0.1, ahd_log_package, and ahd_logger are now included in the set of preinstalled npm packages for ActivScriptNode.

-

Error messages

When a database action violates a database constraint on an attachment table, SQL Server returns an error that includes the internal name of the constraint; however, this information does little to convey what the user did to cause the error. These error messages are difficult to interpret without knowledge of the internal names in SQL Server.

Now the error messages are improved by removing the internal constraint name. The messages can be made even more understandable by adding custom database constraint messages in each data module.

-

Import processes

An XPath directive is used in an import process to locate the portions of an XML document which should be considered for the import operation. The default value for the XPath directive is

/XML/data. Until this release, import processes did not handle XPath directives which allow for more specific limits. Now additional XPath directives are supported.Sample XPath Behavior /XML/data[2]Consider only the second XML element in the /XML/datapath./XML/data[@Code="A"]Consider only the XML elements in the /XML/datapath which have a Code attribute with the value "A".These changes pose a few backward compatibility issues since the new feature follows XML standards. These issues are:

- Prior to this change, XPath was assumed to begin at the root but did not require a beginning forward slash (/). Now if an XPath does not include the initial slash, the root is ignored.

- Prior to this change, the XPath was compared without regard to case sensitivity. Now, as stated in the note above, comparisons are case-sensitive.

-

VBSEdit

A script for uninstalling VBSEdit (uninstall_vbsedit.vbs) has been added to the \Distribution\Extras\VBSEdit folder along with a Readme.txt file which explains how to install VBSEdit.

Accounts Payable

-

Vendors

Accounts Payable > Vendors

At some point in the past, the "Balance", "Current", and "Past Due" columns available in the Vendors HD view began showing blanks instead of "0.00" for vendors with no balance but with prior activity. Now the previous behavior of showing "0.00" in this case has been restored.

-

Payments

Accounts Payable > Payments

In the past, users were always required to enter a valid account mask in the Discount field in the GL section of the Payments window. Since this field is only used when the payment actually claims a discount, requiring an entry in the field is confusing and unnecessary when there is no discount. This can be particularly annoying for sites which never claim AP discounts and do not even have a "Discount Taken" account in their chart of accounts.

Now the Discount field is only required on payments which claim a discount.

The label on the Discount field indicates whether a discount account is required. The label is only bolded if the payment claims a discount. When bolded, a discount account is required and the payment cannot be saved without it. If the payment does not claim a discount, a discount account is not required.

Accordingly, the Quick Pay table in the AP Invoice window also allows the Discount Account field to be blank if no discount is claimed on the payment.

Tip

If you never claim discounts taken, consider using the Form Options for AP Invoices dialog to remove the Discount Account column from the Quick Pay table.

The Pay Invoices process no longer requires a discount account in the Discount field on the Pay tab in the GL section. Furthermore, if the process attempts to create a payment with a discount and no discount account is specified, the payment is not created and none of the invoices that would have been paid by that payment are paid. The final progress message at the end of the "Create Payments" step formerly showed only the number of invoices paid. Now it shows the number of invoices paid, the number of invoices selected for payment, and the number of payments created.

Old message: Paid 15 Invoices

New message: Paid 15 of 18 selected invoices with 4 new payments

Also, the Pay Invoices process has been improved to better indicate which fields are required and which are not:

- The following fields are bolded to indicate they are required: Date, Batch, Bank (Account), GL Batch.

- The Discount field is not bolded since it is no longer required.

- The Reference field is only bolded when the "Manual" payment type is selected.

In addition, a validation has been added to the Proof for Merge Payments/Merge Payments processes to ensure that payment GL detail for discount taken matches the discount amount claimed by the payment. If the payment's discount account entry is an account mask, the discount is allocated based on the discount account mask and the invoice distribution accounts. If the generated discount allocation account code does not exist, the GL detail (credit) is not created. When this happens, the following error is shown (in addition to the out-of-balance messages):

Invoice (xxxxx-xx) discount taken (xxx.xx) is different than GL Detail (xxx.xx)

The Proof for Merge Payments/Merge Payments processes have additional validations to provide clarity when the discount taken is different than GL detail:

Invoice (xxxxx-xx) has discount taken (xxx.xx) but the payment discount account is blank

Invoice (xxxxx-xx) has discount taken (xxx.xx) but no discount GL Detail

-

Payments

Accounts Payable > Payments

The Payment window and automation interface have been updated to allow a blank discount account even when the payment claims a discount taken. The following warning message is issued when a user tries to save such a payment:

Discount Account is needed since there is discount taken.

The message can be overridden and the user is allowed to save the payment with a blank discount account.

The situation which results causes the GL detail to be out-of-balance since the discount taken line cannot be generated. The following validations have been added to the Proof for Merge Payments/Merge Payments processes to check related issues with discounts taken:

Warning: Invoice (xxxxxx) has discount taken (xxx.xx) but the payment discount account is blank

Warning: Invoice (xxxxxx) has discount taken (xxx.xx) but no discount GL Detail

Warning: Invoice (xxxxxx) discount taken (xxx.xx) is different than GL Detail (xxx.xx)

Notice that all the validations described above are warnings only. This means that payments can be merged even if they have these issues. In addition, the The Proof for Merge Payments/Merge Payments validations have been modified to change the severity of many of the GL validation issues to "Warning" instead of "Error". This change improves Payroll operationally, allowing users to merge and disburse payments without having to resolve all GL issues beforehand. Most notably, users can merge payments even when their GL postings are out-of-balance.

In order to catch and resolve these issues at the proper time, the following validations are now performed when users attempt to merge payments' GL entries. These validation issues all have a severity of "Error" so that they do prevent GL entries from being merged. Furthermore, the validation messages point explicitly to the AP payment and invoice where the user can find and correct the issue.

Payment (xxxxx-xx), Invoice (xxxxx-xx) - Has discount taken (xxx.xx) but the payment discount account is blank

Payment (xxxxx-xx), Invoice (xxxxx-xx) - Has discount taken (xxx.xx) but the payment discount account is blank

Payment (xxxxx-xx) - Discount taken (xxx.xx) is different than GL Detail (xxx.xx)

Payment (xxxxx-xx) - GL Detail is not balanced (xx/xx/xxxx)

Accounts Receivable

-

Receipts Proof for Merge | Receipts Merge

Accounts Receivable > Receipts > [right-click] > Select and Proof for Merge

Accounts Receivable > Receipts > [right-click] > Select and Merge

Previously, an extremely rare problem could occur during the Receipts Proof for Merge and Receipts Merge processes. If the receipt detail line command was "Miscellaneous" and the sales tax on the detail line did not equal the total sales tax amount on the corresponding invoice, the processes could return an

invalid variant type for conversionerror. While the situation is rare, it should produce an error; however, the error it was attempting to report was that the invoice sales tax does not equal the total detail tax. Instead, the variant error arose while trying to build the message to report the correct error.The problem has been corrected. The appropriate error is now reported.

Bank Reconciliation

-

Bank statements

Bank Reconciliation > Statements

In the past, the ActivityHD process could appear to hang in some cases when saving a bank statement. The only recourse when the process hung was to stop the process. The problem could occur saving a bank statement when another bank statement with the same bank account and statement date already existed.

Instead of hanging, the process should have returned a message similar to the following:

BRAccount, Statement Date must be unique.

Now the process does not hang in this circumstance and the message is appropriately returned.

Fixed Assets

-

Assets

Fixed Assets > Assets

Formerly, the Retired Lock checkbox was in the tab order of the Assets window. To improve the workflow, since it is not regularly used, it has now been removed from the tab order.

-

Assets

Fixed Assets > Assets

In the past, you could select only one invoice at a time in the Asset Cost Detail table on the Asset tab. Now the Find dialog supports multi-select so that you can add multiple invoices in the same operation.

General Ledger

-

ActivityHD Automation Services (AAS)

When assignment rules are changed on active rollups, the changes are immediately applied to rollup items stored in the Accounts table (or Journal Detail table for rollups of attributes). Applying rollup assignment rules can be an intricate process and can affect many rows. Rollups of attributes are even more involved since rollup item values are stored on journal detail.

In this release, changes have been made which can potentially result in significant performance improvements when updating rollup assignment rules in certain situations.

With the change, one customer with more than 580,000 journal detail rows saw an improvement from 5 to 6 minutes waiting for a change to assignment rules for a rollup with attributes to about 16 seconds to perform the same operation. Your results may not be quite so dramatic.

Payroll/Human Resources

-

2025 state tax updates

The following state and local income tax changes have been introduced effective 1/1/2025:

- Arkansas. The tax brackets have been adjusted for inflation and the standard deduction has increased to $2,410.

- Colorado. The flat tax rate increased from 4.25% to 4.4%.

- Hawaii. A new lump sum deduction of $1,650 has been introduced and tax tables have been updated.

- Illinois. The exemption allowance amount increased to $2,850.

- Indiana. The flat tax rate decreased from 3.05% to 3.00%.

- Indiana Counties. The tax rates have increased for Floyd (1.89%), Gibson (1.30%), Jay (2.50%), Monroe (2.14%), Rush (2.15%), and Switzerland (1.45%) counties.

- Louisiana. The income tax has been converted to a flat tax rate with $0 standard deduction for taxpayers who do not claim a standard deduction, $12,500 standard deduction for single taxpayers, and a $25,000 standard deduction for married taxpayers.

Note

The flat tax was enacted in late 2024. For that reason an emergency bulletin was released with a preliminary tax calculation. That calculation is subject to change when the final tax bulletin is released. AccountingWare will make further changes as necessary when that information is available.

- Maryland. Tax rates have been updated for Anne Arundel, Calvert, Cecil, Frederick, and St. Mary's counties.

- Massachusetts. The income threshold at which the 4% high earner surtax takes effect has been increased to $1,083,150.

- Minnesota. The tax brackets have been adjusted for inflation and the withholding allowance has increased to $5,200.

- Mississippi. The flat tax rate was reduced from 4.70% to 4.40%.

- Montana. The tax brackets have been adjusted for inflation.

- North Carolina. The flat tax rate decreased from 4.60% to 4.35%. (Note: There appears to be a discrepancy in the NC-30 document. There are two references to a rate of 4.25%; however, all percentage method computations in the booklet cite a factor of .0435. AccountingWare will monitor and correct as needed.)

- North Dakota. The tax brackets have been updated and the withholding allowance amount for employees with pre-2020 W-4s has increased to $5,050.

- Oregon. The tax brackets, standard deduction amounts, exemption amount, and phase-out limits have been adjusted for inflation.

- Vermont. The tax brackets have been adjusted for inflation and the withholding allowance has increased to $5,300.

- West Virginia. The Two Earner/Two or More Jobs bracket has been updated subsequent to a difference identified between the bracket originally published and the final publication.

The through-dates for the following states/entities have been rolled over to December 31, 2025 because the states/entities had not published income tax changes for 2025 as of 1/3/2025. Several of these states had mid-2024 tax changes.

- Alabama

- Delaware

- District of Columbia

- Idaho

- Kansas

- Michigan cities

- New Jersey

- New York

- New York City and Yonkers

- Ohio

- Pennsylvania

- Utah

- Virginia

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

-

2025 SUTA wage base updates

The following wage base amounts for 2025 have been added to the state unemployment table:

State Year Wage base Hawaii 2025 $62,000 Idaho 2025 $55,300 Kentucky 2025 $11,700 Michigan 2025 $ 9,000 Minnesota 2025 $43,000 Montana 2025 $45,100 New Mexico 2025 $33,200 North Carolina 2025 $32,600 Oklahoma 2025 $28,200 Rhode Island 2025 $29,800 -

2025 USA tax updates

Withholding updates were introduced according to the instructions in IRS Publication 15-T, "2025 Federal Income Tax Withholding Methods" (https://www.irs.gov/pub/irs-pdf/p15t.pdf).

Employers should implement the 2025 withholding tables on January 1, 2025.

A spreadsheet model of the USA income tax withholding function is provided in "...\Extras\Payroll\Tax\Analysis of 2025 USA Tax Changes.xls".

-

Extras (Payroll Canada only)

In 2024, the Canada Revenue Agency announced a second level of CPP contributions (CPP2). When CPP2 was introduced to ActivityHD, a spreadsheet model named "CPP2 model.xlsx" was added to the Extras folder (...\Extras\Payroll Canada\CPP2 model.xlsx) to demonstrate how the new calculations work.

The CPP and CPP2 parameter values for 2025 were added to ActivityHD in versions 9.4-0 and 9.3-1. A 2025 tab which uses the new values has now been added to the spreadsheet model.

-

USA Tax Liability Report

Payroll/Human Resources > Checks > [right-click] > Select and Report > USA Tax Liability Report

Starting in ActivityHD 9.1-0, the USA Tax Liability Report always showed and sorted by the employee code; the Employee Order options of "First Name First" and "Last Name First" were ignored. The prior behavior of showing and sorting by the order specified in the Employee Order section has been restored.

-

2025 Canada tax updates

New withholding rates and bracket changes effective January 1, 2025 have been introduced for Canada and the provinces of Alberta, British Columbia, Manitoba, Ontario, and Saskatchewan.

In the online help, refer to Reference > Canada payroll tax functions for the government documentation behind the calculations.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll Canada\Tax\Calculate 2025 Canada Income Tax.xlsx".

-

2025 state tax updates

The following state income tax change has been introduced effective 1/1/2025:

- Oklahoma. Oklahoma has no withholding changes for 2025. The through-date has been rolled over to December 31, 2025.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

-

2025 SUTA wage base updates

The following wage base amounts for 2025 have been added to the state unemployment table:

State Year Wage base Alaska 2025 $51,700 Illinois 2025 $13,916 North Dakota 2025 $45,100 -

Garnishments

This version of ActivityHD introduces the 2025 exemption values used for calculating IRS levy garnishments. These values are based on IRS Publication 1494.

The built-in levy calculation determines which values to use based on the Year field on the garnishment record, not the check date year.

Note

This update will automatically apply to employees with IRS levy garnishments already set to the year 2025. All other IRS levies should be unaffected unless an employee requests a change with a new Part 3 of Form 668-W.

According to the American Payroll Association: "If the employee does not complete a new Part 3 of Form 668-W each year, the employer must continue to use the table for the year during which the levy notice was received. The employee may complete a new Part 3 at any time even if the employee's tax filing status or number of exemptions has not changed, in order to take advantage of higher exempt amounts contained in the new year's tables."

If you receive a new Part 3 of Form 668-W from an employee, you must change the year on the garnishment record in order for the new values to take effect.

-

Groups (Payroll Canada only)

Payroll/Human Resources > Setup > Groups

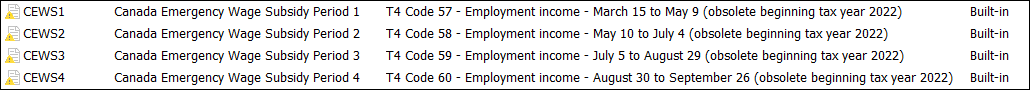

The following built-in groups used for T4 slips have been flagged as obsolete:

Visit the following links for more information: https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4120.html and https://www.canada.ca/en/revenue-agency/services/wage-rent-subsidies/cews-frequently-asked-questions.html.

-

2025 parameter updates for tax calculations

The following built-in segment item parameter values are effective January 1, 2025. Only the social security maximum value has changed from 2024.

Parameter Description 2025 Value Type:Tax:MedEEAddPercent Medicare Employee Additional Percent 0.90 Type:Tax:MedEEPercent Medicare Employee Percent 1.45 Type:Tax:MedEEThreshold Medicare Employee Wages Threshold 200,000.00 Type:Tax:MedERPercent Medicare Employer Percent 1.45 Type:Tax:SocSecEEPercent Social Employee Percent 6.20 Type:Tax:SocSecERPercent Social Employer Percent 6.20 Type:Tax:SocSecMax Social Security Maximum 176,100.00 The following values have also been added for California parameters if installed. The SDI rate has increased since 2024. The California SDI maximum was lifted in 2024; i.e., all wages are now subject to California SDI tax.

Parameter Description 2025 Value Type:Tax:CASDIMax CA SDI Maximum Wages 9,999,999,999.99 Type:Tax:CASDIPercent CA SDI Percent 1.20 Colorado FAMLI parameters are unchanged from 2024; however, the effective dates have been updated. For more information, see My FAMLI+ Employer User Guide.

-

2025 segment item parameter updates (Payroll Canada only)

Built-in segment item parameter values have been updated for 2025 for CPP, CPP2, employment insurance, and total claim segment items. Following is the complete list of updated parameters for Payroll Canada:

Type:Tax:CPPExemptAmt (Canada CPP Annual Exemption) 3,500.00 Type:Tax:CPPMaxContr (Canada CPP Maximum Contribution) 4034.10 Type:Tax:CPPMaxEarn (Canada CPP Maximum Earnings) 71,300.00 Type:Tax:CPPPercent (Canada CPP Percent) 5.95 Type:Tax:CPP2MaxContr (Canada CPP2 Maximum Contribution) 396.00 Type:Tax:CPP2MaxEarn (Canada CPP2 Maximum Earnings) 81,200.00 Type:Tax:CPP2Percent (Canada CPP Percent) 4.00 Type:Tax:EIMaxEarn (Canada EI Maximum Earnings) 65,700.00 Type:Tax:EIMaxPrem (Canada EI Maximum Premium) 1077.48 Type:Tax:EIPercent (Canada EI Percent) 1.64 Type:Tax:TC (Canada Total Claim Amount) 16,129.00 Source: https://www.canada.ca/content/dam/cra-arc/formspubs/pub/t4127-jan/t4127-01-25e.pdf.

-

2025 state tax updates

The following state income tax changes have been introduced effective 1/1/2025:

- California. The tax bracket ranges, low income exemption amounts, standard deduction amounts, and exemption allowance have been updated.

- Connecticut. Connecticut has announced no withholding changes for 2025. The through-date has been rolled over to December 31, 2025.

- Michigan. The personal exemption amount has increased from $5600 to $5800.

- Missouri. The standard deduction amounts have increased for each filing status, brackets have been adjusted, and the top tax rate dropped from 4.8% to 4.7%.

- Nebraska. The withholding allowance has increased to $2,360, brackets have been adjusted for inflation, and the tax rates for the top three brackets have been reduced.

- New Mexico. The tax brackets have been adjusted for inflation and several bracket rates have been reduced.

- Rhode Island. The exemption limit and tax brackets have been adjusted.

- South Carolina. The tax rate for the top bracket has been reduced from 6.4% to 6.2%, the tax brackets have been inflation-adjusted, the personal allowance has increased to $4,860, and the maximum standard deduction has increased to $7,300.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

-

2025 SUTA wage base updates

The following wage base amounts for 2025 and beyond have been added to the state unemployment table:

State Year Wage base Connecticut 2025 $26,100 Oregon 2025 $54,300 Utah 2025 $48,900 Wyoming 2025 $32,400 -

Export Controls (Payroll Canada only)

Payroll/Human Resources > Setup > Export Controls

Before this version, the electronic file created for submitting T4 slips and T619 summary information included employees with no amounts to report. Now if the reported amounts for T4 slips are all zero for an employee, the employee is excluded from the file.

To get the updated version of the export control, delete the existing "CAN 2024 T4 Slips" export control and import the updated one at "...\Extras\Payroll Canada\Export Controls\CAN 2024 T4 Slips.XML".

-

Garnishments

Payroll/Human Resources > Employees > Records > Garnishments

The following state has announced a new minimum wage rate taking effect 1/1/2025. ActivityHD has incorporated this new rate to calculate limits on civil garnishments for the affected state.

Alaska

Minimum hourly wage Effective date $11.91 01/01/2025 -

Generate T4s (Payroll Canada only)

Payroll/Human Resources > Employees > [right-click] > Select and Generate T4s

In the past, the Generate T4s process did not validate employee amounts for T4 slips. If a merged check was found in the specified date range, a T4 slip was generated. This behavior was not consistent with how the Employee Create Totals process creates employee records and did not meet Canadian T4 reporting requirements.

Now T4 amounts are validated during the generation process. T4s are not created for employees amounts that satisfy either of the following conditions and a message is displayed during processing in these cases:

- T4 slip has all zero amounts

- T4 slip has negative amount(s)

Note

Any non-zero amount causes a T4 to be created, even when compensation is zero.

-

Print Form 940 Returns

Payroll/Human Resources > Government > Form 940 Returns > [highlight a return in the HD view] >

Final changes to Form 940 for tax year 2024 have been introduced.

The credit reduction rate for the Virgin Islands is 0.042 (4.2%)and 0.009 (0.9%) for California and New York. The credit reduction rate for all other states is zero.

A credit reduction rate results in a higher FUTA tax as calculated in Part 3 of Form 940. The standard FUTA rate is 6.0% with a reduction rate of 5.4% giving a net FUTA rate of 0.6%. In a credit reduction state the 5.4% is reduced, resulting in a higher net FUTA rate.

-

2025 state tax updates

The following state income tax changes have been introduced effective 1/1/2025:

- Iowa. In 2025, Iowa completes its transition to a flat tax. The new flat rate (and supplemental rate) is 3.8%. The standard deduction is now based on filing status rather than allowance amount. For employees with a 2024 or 2025 IA W-4 on file the standard deduction amounts are:

Other, or Married Filing Jointly with Spouse Having Earned Income $12,000 Head of Household $18,050 Married Filing Jointly with Spouse Having No Earned Income $24,050 For employees with a 2023 or earlier IA W-4 on file the standard deduction amounts are:

Single (or married but legally separated) $12,000 Married $24,050 If an employee does not have an IA W-4 on file, the filing status is assumed to be "Other".

The allowance amount is the allowance amount the employee entered on the IA W-4.

- West Virginia. The tax for all brackets has been reduced by 4% of the former rates.

A spreadsheet model of the new tax functions can be found in "...\Extras\Payroll\Tax\Test State Tax Functions.xls".

- Iowa. In 2025, Iowa completes its transition to a flat tax. The new flat rate (and supplemental rate) is 3.8%. The standard deduction is now based on filing status rather than allowance amount. For employees with a 2024 or 2025 IA W-4 on file the standard deduction amounts are:

-

2025 SUTA wage base updates

The following wage base amounts for 2025 and beyond have been added to the state unemployment table:

State Year Wage base Delaware 2025 $12,500 2026 $14,500 2027 $16,500 Iowa 2025 $39,500 Missouri 2025 $ 9,500 Nevada 2025 $41,800 New Jersey 2025 $43,300 Vermont 2025 $14,800 Washington 2025 $72,800 -

AP Controls

Payroll/Human Resources > Setup > AP Controls

Previously, the AP Control window required entry of a discount account in the Discount field of the Quick Pay section if quick pay was set up for the AP control. This was necessary because a discount account was always required on an AP invoice Quick Pay line. But now a discount account is no longer required on the invoice Quick Pay line if the payment does not have a discount, so the Discount field is no longer required in the AP control Quick Pay section. Since AP invoices coming from payroll deductions would seldom if ever have an early payment discount option, it is sensible to allow most AP controls to specify a blank Quick Pay discount account.

However, in case an AP invoice Quick Pay payment does claim a discount and has a blank discount account, the Proof for Merge Invoices/Merge Invoices validation returns the following error:

Invoice (xxxxx-xx) discount taken (xxx.xx) is different than GL Detail (xxx.xx)

In this circumstance, the invoice should be edited to enter the Quick Pay discount account and then the invoice can be merged. Subsequently, update the AP control to specify a Quick Pay discount account for future usage.

-

Create IRS 1095-C Transmission

Payroll/Human Resources > Government > ACA Transmissions > [right-click] > Create

The Create IRS 1095-C Transmission process has been updated to provide the IRS-issued software ID for the 2024 tax year. The IRS requires an updated software ID each year for software applications like ActivityHD to identify the vendor that produces the software used to build the 1095-C/1094-C transmission files.

With this latest update, the 1095-C/1094-C transmission process is ready for use when the IRS opens the 2025 reporting season for active submission.

-

Employees

Payroll/Human Resources > Employees

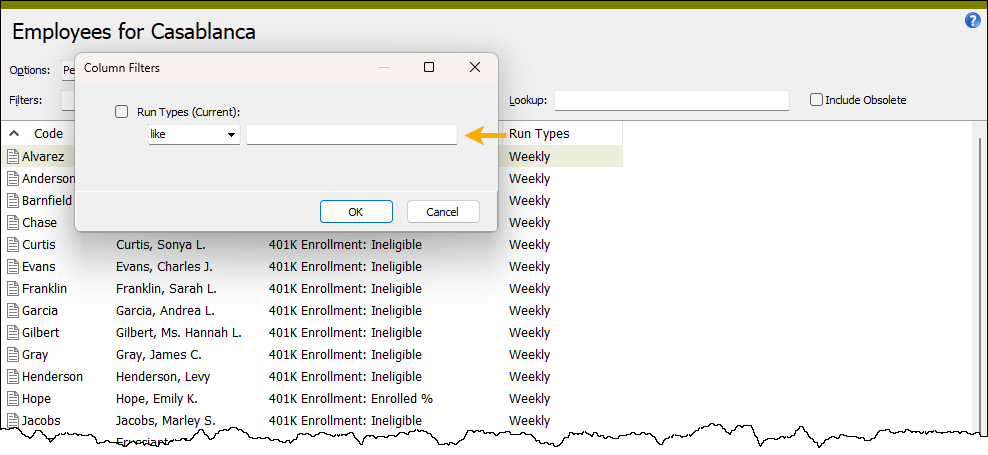

A new string-type selection field named Run Types (Current) has been added to the Employees HD view. The Run Types column in the HD view now uses the new selection field.

The already existing "Run Types" selection field is still available for use in filters as well.

-

Export Controls

Payroll/Human Resources > Setup > Export Controls

In the past, the headings of the Order column in the Records table and the Not Duplicated column in the Fields table were truncated.

The issue has been resolved.

-

Export Controls (Payroll Canada only)

Payroll/Human Resources > Setup > Export Controls

The export control for electronic filing of T4 Slips (including the T619 summary) for tax year 2024 is now available.

Beginning January 13, 2025, the Transmitter Account Number and/or Transmitter Representative ID which are used to sign in for transmission is required in the T619 record. The former prompt for Transmitter Number has been replaced with prompts for these. The Transmitter Account Number field expects a business number. If one of these values is not applicable for your company, leave it blank in the Create Totals File dialog.

To be consistent with the Generate T4s process, the T4 XML condition "Skip Zero" which required the compensation amount has been removed. To apply the restrictions needed, use the same filter in the Create Totals File process and in the Generate T4s process. If needed, contact AccountingWare Support for help changing the "Skip Zero" conditions for T4 XML amounts. Note that this is only a temporary workaround. Validations to only include employees with a reportable amount for both processes is planned in a future release.

The following changes have been made for T610 fields:

- Added

- Transmitter Account Number (prompted for in the Create Totals File process)

- Transmitter Representative ID (prompted for in the Create Totals File process)

- Updated

- Transmitter name

- Transmitter Country Code

- Removed

- Report Type Code

- Transmitter Number

- Transmitter Type Indicator

- Transmitter address

- Transmitter city

- Transmitter province or territory code

- Transmitter postal code

The following changes have been made for T4 Slip fields:

- New "Other Income Amount" codes

- Code 90. Group SecOptBenefit. Security options benefits - On or after June 25, 2024

- Code 91. Group SecOptDedd. Security options deduction 110(1)(d) - On or after June 25, 2024

- Code 92. Group SecOptDedd1. Security options deduction 110(1)(d.1) - On or after June 25, 2024

- Code 94. Group IndianExemptRPPCont. Indian (exempt employment income) - RPP contributions

- Code 95. Group IndianExmptUnionDues. Indian (exempt employment income) - Union dues

- Changed "Other Income Amount" codes

- Code 38. Group SecOptBenefitPre2024. Security options benefits - Before June 25, 2024

- Code 39. Group SecOptDeddPre2024. Security options deduction 110(1)(d) - Before June 25, 2024

- Code 41. Group SecOptDedd1Pre2024. Security options deduction 110(1)(d.1) - Before June 25, 2024

Numerous fields for T619 and T4 Slips records were revised to match updated field specifications.

For a deeper dive into the additions and updates for 2024, see these links: T619 and T4 Slips.

The Employer's Guide is not yet available for tax reporting year 2024. Once published, additional changes, if needed, will be provided in a future release.

Setup

- Navigate to Payroll/Human Resources > Setup > Export Controls.

- Right-click the Export Controls folder and select Import to start the Import Export Controls wizard.

- In the File field, click

and browse to ...\Extras\Payroll Canada\Export Controls\ in your distribution area.

and browse to ...\Extras\Payroll Canada\Export Controls\ in your distribution area. - Select "CAN 2024 T4 Slips.XML".

- Import the selected file.

Usage

- Navigate to Payroll/Human Resources > Employees.

- Right-click the Employees folder and select Select and Create Totals File.

- In the Export Control field, browse to and select "CAN 2024 T4 XML".

- Respond to the remaining prompts on the Standard Options tab.

- If there is an Additional Options tab, select it and respond to those prompts as well.

- Click Create File.

For additional guidance, see "Prepare electronic T4 slips" in this help article.

- Added

-

Garnishments

Payroll/Human Resources > Employees > Records > Garnishments

The following states have announced new minimum wage rates taking effect 1/1/2025 and beyond. ActivityHD has incorporated these new rates to calculate limits on civil garnishments for the affected states.

Alaska

Minimum hourly wage Effective date $13.00 07/01/2025 $14.00 07/01/2026 $15.00 07/01/2027 Arizona

Minimum hourly wage Effective date $14.70 01/01/2025 California

Minimum hourly wage Effective date $16.50 01/01/2025 Colorado

Minimum hourly wage Effective date $14.81 01/01/2025 Delaware

Minimum hourly wage Effective date $15.00 01/01/2025 Maine

Minimum hourly wage Effective date $14.65 01/01/2025 Michigan

Minimum hourly wage Effective date $10.56 01/01/2025 $12.48 02/21/2025 Minnesota

Minimum hourly wage Effective date $11.13 01/01/2025 Missouri

Minimum hourly wage Effective date $13.75 01/01/2025 $15.00 01/01/2026 Montana

Minimum hourly wage Effective date $10.55 01/01/2025 Nebraska

Minimum hourly wage Effective date $13.50 01/01/2025 $15.00 01/01/2026 New Jersey

Minimum hourly wage Effective date $15.49 01/01/2025 Ohio

Minimum hourly wage Effective date $10.70 01/01/2025 South Dakota

Minimum hourly wage Effective date $11.50 01/01/2025 Vermont

Minimum hourly wage Effective date $14.01 01/01/2025 Virginia

Minimum hourly wage Effective date $12.41 01/01/2025 Washington

Minimum hourly wage Effective date $16.66 01/01/2025 -

Generate T4s (Payroll Canada only)

Payroll/Human Resources > Employees > [right-click] > Select and Generate T4s

Two new built-in groups have been introduced for printing 2024 T4s:

- IndianExemptRPPCont: Code 94 - Indian (exempt employment income) - RPP contributions

- IndianExmptUnionDues: Code 95 - Indian (exempt employment income) - Union dues

Additional changes for T4 slips and electronic T4 filing are anticipated, including more built-in groups. These will be provided as information is made available by the Canada Revenue Agency.

For more information follow this link.

-

Generate T4s (Payroll Canada only)

Payroll/Human Resources > Employees > [right-click] > Select and Generate T4s

Changes have occurred for T4 groups used to report security options benefits and deductions. The changed and new groups use different T4 codes based on date.

To report amounts before June 25, 2024, use the following groups:

- SecOptBenefitPre2024 (previously named SecOptBenefit)

- SecOptDeddPre2024 (previously named SecOptDedd

- SecOptDedd (previously named SecOptDedd1)

To report amounts on or after June 25, 2024, use the following new groups:

- SecOptBenefit

- SecOptDedd

- SecOptDedd1

For more information follow this link.

-

Notes

Payroll/Human Resources > Notes

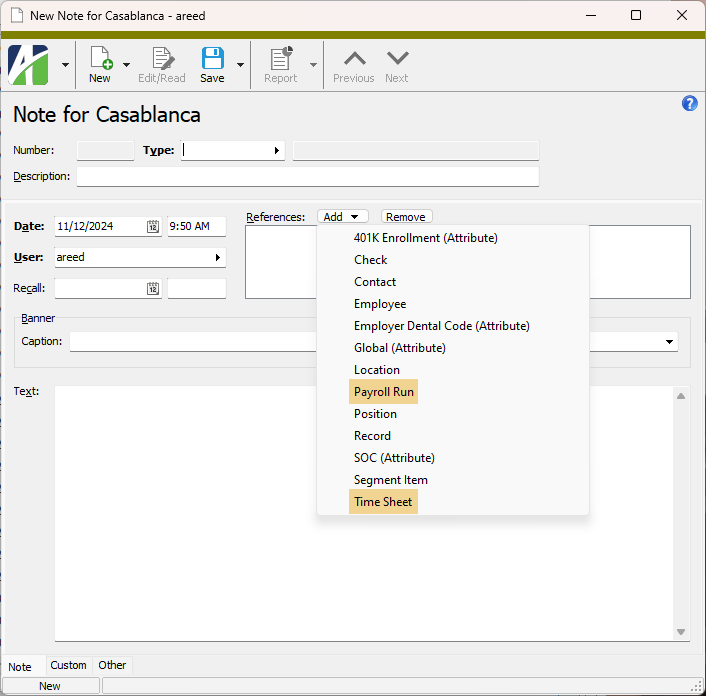

Two new reference types, "Payroll Run" and "Time Sheet", are now available on payroll notes.

-

Print Form 940 Returns

Payroll/Human Resources > Government > Form 940 Returns > [highlight a return in the HD view] >

The initial changes for Form 940 for tax year 2024 have been introduced.

Note

The current images are marked DRAFT. The report is useful for testing purposes only at this time and cannot be filed. The final images will be updated when the IRS provides them.

The credit reduction rate for California, Connecticut, and New York is 0.009 (0.9%). The rate for the Virgin Islands has not yet been determined but will be updated when the IRS publishes its final instructions.

A credit reduction rate results in a higher FUTA tax as calculated in Part 3 of Form 940. The standard FUTA rate is 6.0% with a reduction rate of 5.4% giving a net FUTA rate of 0.6%. In a credit reduction state the 5.4% is reduced, resulting in a higher net FUTA rate.

-

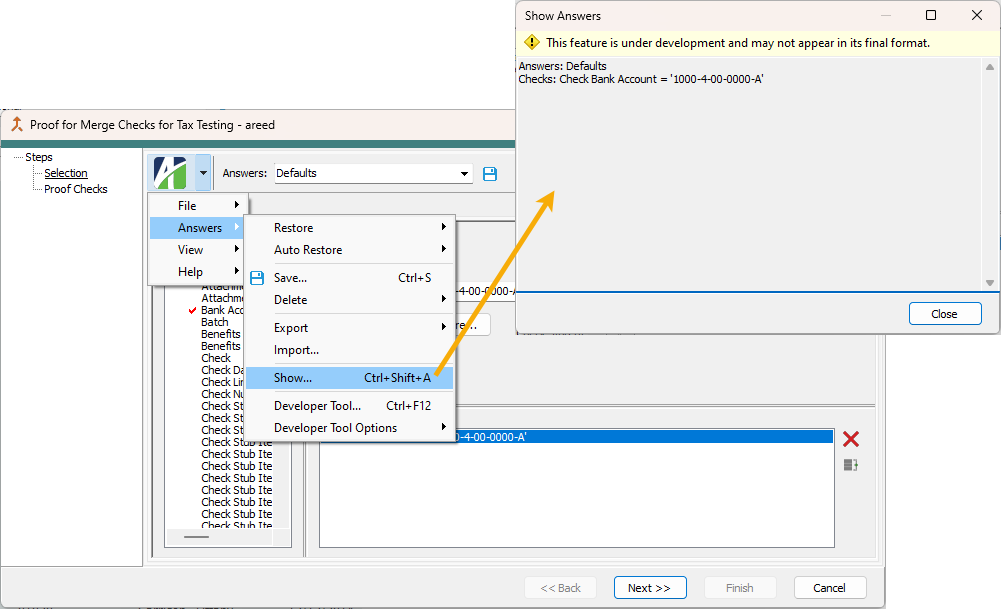

Process wizards

The Show Answers feature for some process wizards in Payroll now has well-formatted answer captions and values. The processes updated in this release are:

- Proof for Merge Checks Report

- Specify Options step of Direct Deposit

- Mark Checks step of Direct Deposit

- Specify Options step of Generate Prenotes

- Specify Options step of Generate W-2s

- Specify Options step of Process Leave Plans

-

Segment Items

Payroll/Human Resources > Setup > Segment Items

A new built-in filter called "Does not have PRCodes" has been introduced on the Segment Items HD view. The filter returns any segment items which are not used in a PRCode.

-

T4s

Payroll/Human Resources > Employees > Records > T4s

Formerly, the Record Number field in the T4 window was blank when a T4 record was loaded. While the record numbers were created, they did not display in the window. Now record numbers are visible in the T4 window.

-

T4s

Payroll/Human Resources > Employees > Records > T4s

Designs for T4 slips and for the T4 summary have been updated for tax year 2024. The following sections describe the changes.

T4 Slip

Three codes were renamed for reporting:

- Code 38. Group SecOptBenefitPre2024. "Security options benefits - Before June 25, 2024"

- Code 39. Group SecOptDeddPre2024. "Security options deduction 110(1)(d) - Before June 25, 2024"

- Code 41. Group SecOptDedd1Pre2024. "Security options deduction 110(1)(d.1) - Before June 25, 2024"

Five new codes were added for reporting:

- Code 90. Group SecOptBenefit. "Security options benefits - On or after June 25, 2024"

- Code 91. Group SecOptDedd. "Security options deduction 110(1)(d) - On or after June 25, 2024"

- Code 92. Group SecOptDedd1. "Security options deduction 110(1)(d.1) - On or after June 25, 2024"

- Code 94. Group IndianExemptRPPCont. "Indian (exempt employment income) - RPP contributions"

- Code 95. Group IndianExmptUnionDues. "Indian (exempt employment income) - Union dues"

T4 Summary

No changes were required to the form design; however, amounts for renamed and new T4 codes are now available for reporting.

Generate T4s > Print T4s

The following changes have been made to built-in T4 slips designs:

- The "T4 Slips Template (built-in)" design is updated for 2024.

- The "T4 Slips Template pre-2023 (built-in)" design has been updated to account for renamed groups.

- Reprinting a T4 slip for a tax year prior to 2023 requires the "T4 Slips Template pre-2023 (built-in)" design.

Generate T4s > Print T4 Summary

The following changes have been made to built-in T4 summary designs:

- The "T4 Summary (built-in)" design is updated for 2024.

- The "T4 Summary pre-2023 (built-in)" design has been updated to account for renamed groups.

- Reprinting a T4 summary for a tax year prior to 2023 requires the "T4 Summary pre-2023 (built-in)" design.

Purchasing

-

AP Invoices

Accounts Payable > Invoices

In the past, invoices with an approval status of "Disapproved" were included in the Ready to Approve (All/Limited or Master/Limited/Required) filters. Those invoices were also included in the Invoices to Approve folder in Self-Serve. This was a problem since ActivityHD does not let you approve an invoice with an approval status of "Disapproved". Before you can approve such an invoice, you must change the approval status to "New" (or press the Submit button in the invoice's Approval section).

Now invoices with an approval status of "Disapproved" do not appear in the Ready to Approve... filters or in the Invoices to Approve folder of Self-Serve.

-

AP Invoice Approval

Accounts Payable > Invoices > [highlight an eligible invoice in the HD view] >

Formerly, when an operator disapproved an invoice at any level, there was no way for another operator to override the disapproving operator's disapproval. In order for the invoice to be approved, the disapproving operator had to remove the disapproval. If the disapproving operator was unavailable (in a meeting, out to lunch, on vacation, retired, etc.), the invoice was "stuck" in a disapproved state until the operator returned and removed the disapproval.

Now a master approver can approve a disapproved invoice at the "Master" level, overriding level-specific disapprovals and allowing the invoice to be merged and paid.

-

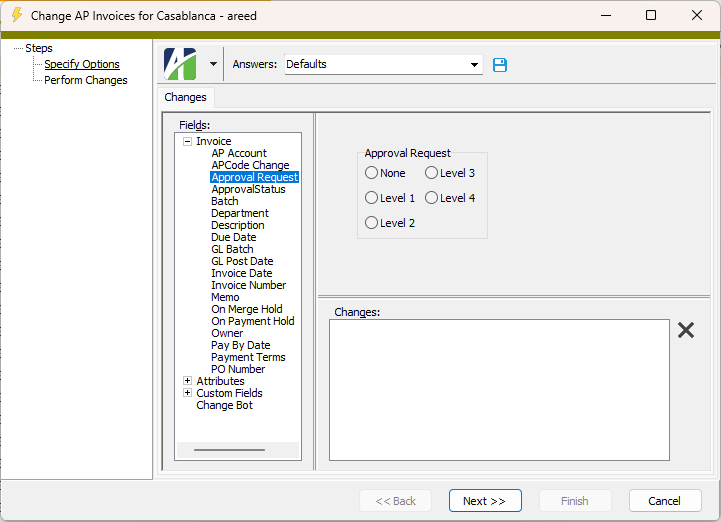

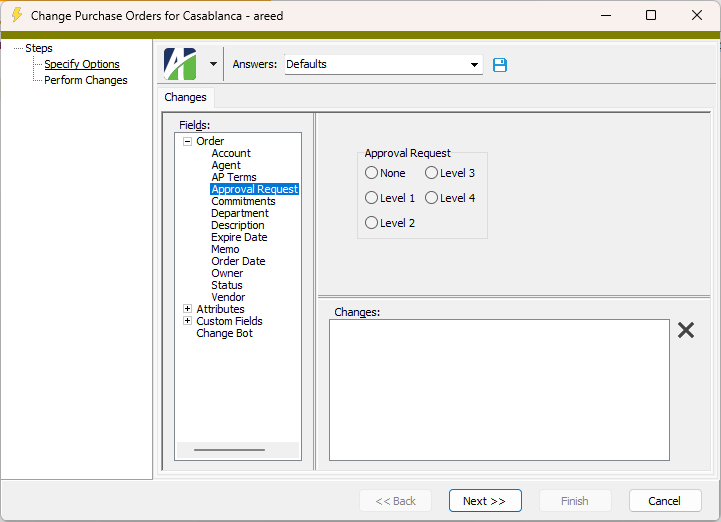

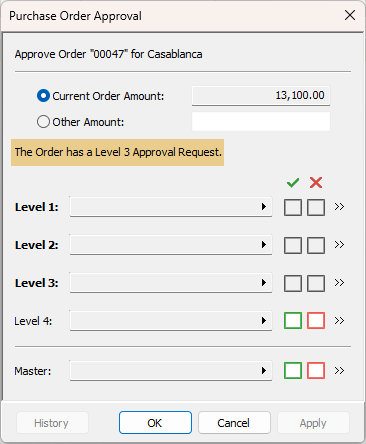

Purchase Order Approval | AP Invoice Approval

Purchasing > Orders > [highlight an eligible order in the HD view] >

Accounts Payable > Invoices > [highlight an eligible invoice in the HD view] >

Approval Request is a feature available on AP invoices and purchase orders which allows an extra level of approval to be requested that goes beyond the approval rules set up on the department. The primary method for setting an approval request is through the Change processes on invoices and orders.

Accounts Payable > Invoices > [highlight an eligible invoice] >

Purchasing > Orders > [highlight an eligible order] >

Now an informational message has been added to the Approval dialogs for both invoices and orders to make it clear when an approval request is set.

-

Purchase Order Approval | AP Invoice Approval

Purchasing > Orders > [highlight an eligible order in the HD view] >

Accounts Payable > Invoices > [highlight an eligible invoice in the HD view] >

In the past, an invoice or order was not considered approved even after master approval if the approval level of the top level approver was less than the amount of the invoice or order. Now master approval causes the invoice or order to be approved regardless of any approval limits.

-

Self-Serve

The behavior for approval and disapproval of orders and invoices on the Self-Serve website has been standardized, including the availability of action buttons.

Situation Order/invoice is ready for approval. Location Invoice appears in the Invoices to Approve folder. Button behavior Both the Approve and Disapprove buttons are shown on the invoice page. Situation Order/invoice has been approved by the current operator. Location Invoice appears in the Approved Invoices folder. Button behavior The Remove Approval button is shown on the invoice page. Situation Order/invoice has been disapproved by the current operator and the status is "Hold". Location Invoice does not appear in any Self-Serve folder. Behavior The following message shows on the invoice page: The Status of this Order/Invoice is set to Hold.

Situation Order/invoice has been disapproved by the current operator and its status has been set to "Ready". Location Invoice appears in the Invoices to Approve folder. Button behavior The Remove Approval button is shown on the invoice page. Likewise, disapproved invoices on "Hold" status are no longer included in the following built-in filters on AP invoices:

- Ready to Approve (All)

- Ready to Approve (Limited or Master)

- Ready to Approve (Limited)

- Ready to Approve (Required)

In addition, the following behavior changes have been made to approval/disapproval in Self-Serve:

- A user can no longer remove approval or disapproval from an order or invoice that has a status of "Hold".

- A user must remove "Disapprove" status before approving an order or invoice.

Web Services

-

Self-Serve

New default sort orders for columns in Self-Serve views have been set to mirror those in ActivityHD. If you have previously accessed a view, previous settings are restored when you open a view; to see the new default sort orders, clear the cookies in your browser.

The following default column sort orders have been applied:

Page Column Sort Order Invoices Batch # Ascending My Leave Entries Ledger Ascending My Leave Entries Date Ascending PR Management > Leave Balances Employee Code Ascending PR Management > Leave Balances Ledger Ascending PR Management > Leave Entries Date Ascending Purchases Purchase Ascending Purchase Orders Number Ascending Tickets Number Ascending User Locations User Ascending AP/PO > Approval History Date Descending -

Self-Serve

In the past, when the number of rows for an HD view in Self-Serve exceeded the buffer size (calculated based on screen size), the last row of the data did not load. The buffer size is typically about 170 rows.

This issue has been remedied.