Calendars

Calendars define an organization's fiscal year and period structure.

In ActivReporter, the calendar serves a couple of purposes:

- To organize the general ledger postings.

- To provide date-based groups of postings for reporting.

ActivReporter includes the following preinstalled calendars: Annual, Quarterly, Monthly, Weekly, and Forever. The "Forever" calendar contains one period which spans all possible dates in ActivReporter--from 1/1/1900 to 12/31/2999. The preinstalled calendars can be added to, modified, or deleted as needed. In addition, a Fiscal calendar is automatically created when an ActivReporter database is seeded from a Dynamics GP database. This calendar is flagged as a built-in calendar so that its contents cannot be changed and so that it always matches the Dynamics GP fiscal calendar. A built-in calendar cannot be deleted, its years and periods cannot be changed in a material way, and you cannot delete or insert years or periods.

You can also create more calendars for custom reporting. If your fiscal calendar uses monthly periods, you may want to also create calendars for daily, weekly, and quarterly reporting. Multiple calendars can be used to define alternate date ranges for the same company or to consolidate financials in a multi-company environment where the different companies have different fiscal years.

You can define as many accounting years for a calendar as you need. You must define accounting periods for each year that has general ledger data.

The Fiscal calendar from Dynamics GP should be designated as the default calendar.

Create a GL calendar

Create a GL calendar

- In the Navigation pane, highlight the ActivReporter > Setup > Calendars folder.

- Click

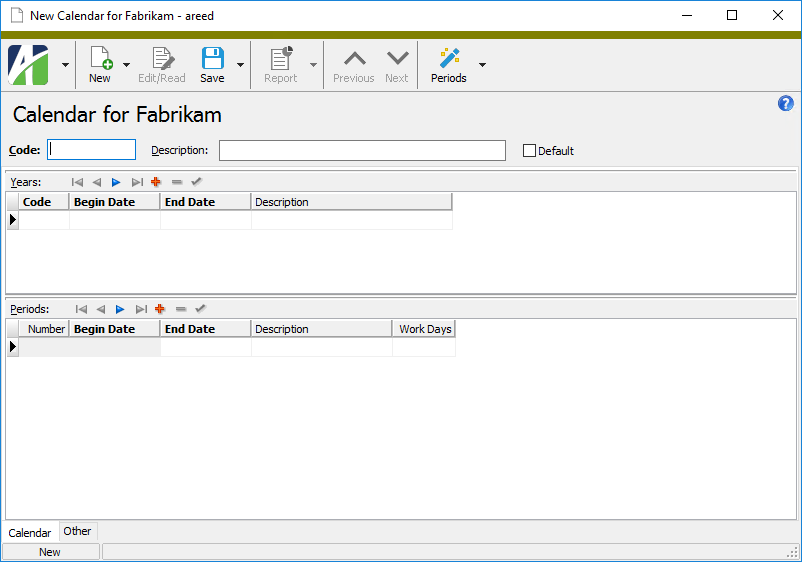

. The New Calendar window opens.

. The New Calendar window opens.

- Enter a unique Code for the calendar.

- Enter a Description of the calendar.

- If you want ActivReporter to default to this calendar whenever a calendar is prompted for, mark the Default checkbox. Only one calendar can be designated as the default calendar. This calendar is also used if no segment in the chart of accounts requires a calendar.

- In the Years table, enter the years that the calendar is valid. To do so, do the following for each valid year:

- In the Code column, enter a year code. Typically, this would be the four-digit year. This code is used in date expressions and financial expressions to refer to a specific year of a calendar.

- In the Begin Date column, enter the date of the first day of the fiscal year. The date must be valid and less than the End Date for the same year.

- In the End Date column, enter the date of the last day of the fiscal year. The date must be valid and greater than the Begin Date for the same year.

- In the Description column, enter a description of the year.

- In the Periods table, enter the periods of the selected years that are valid. You can use the to create the periods or enter the periods directly in the table. Do one of the following for each year you need to create periods for:

- To use the Automatic Periods wizard:

- Select a fiscal year in the Years table.

- Click

.

. - From the drop-down menu, select the type of accounting periods to create. Your options are:

- Monthly

- Semimonthly

- Quarterly

- Weekly

- Biweekly

- Daily

- Four Weeks

- Four/Four/Five

- Five/Four/Four

- Four/Five/Four

The wizard loads the periods into the Periods table.

- Modify the settings in the Periods table if needed.

- To enter the periods directly in the table:

- Select a fiscal year in the Years table.

- In the End Date column, enter the date of the last day of the period.

- Enter a Description of the period.

- The Work Days column is calculated for you. If you need to override the number, type the actual number of work days in the period.

- Repeat steps b-d for each period in the fiscal year.

Note

The Begin Date, End Date, and Work Days for the first row are loaded for you. On subsequent rows, the Begin Date loads and you are immediately prompted for the End Date.

- To use the Automatic Periods wizard:

- When you finish, save the new calendar.

Delete a GL calendar

Delete a GL calendar

A calendar cannot be deleted if it has any references.

To delete a calendar that is not in use, highlight the calendar in the HD view and click ![]() , or open the calendar and select

, or open the calendar and select ![]() > Edit > Delete. In either case, ActivReporter prompts you to confirm your action. Click Delete to delete the calendar.

> Edit > Delete. In either case, ActivReporter prompts you to confirm your action. Click Delete to delete the calendar.

Calendars Listing

Calendars Listing

Purpose

The Calendars Listing provides a list of GL calendars defined in the General Ledger.

Content

For each calendar included on the report, the listing shows:

- description

- whether it is the default calendar.

In addition, you can include one or more of the following:

- year information (year, date range, description)

- period information (period number, date range, description, work days)

- timestamps

- memos

- custom fields.

The following total appears on the report:

- record count.

Print the report

- In the Navigation pane, highlight the ActivReporter > Setup > Calendars folder.

- Start the report set-up wizard.

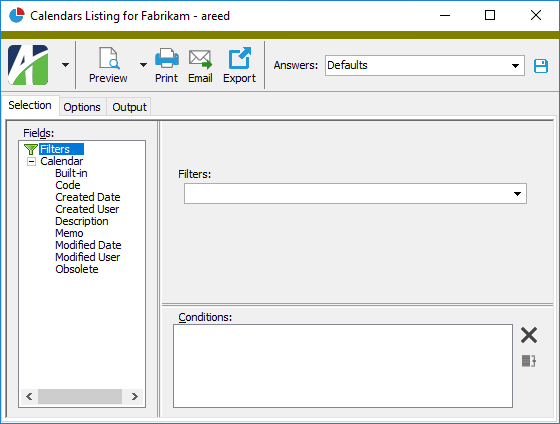

- To report on all or a filtered subset of calendars:

- Right-click the Calendars folder and select Select and Report > Calendars Listing from the shortcut menu.

- On the Selection tab, define any filters you want to apply to the data.

- To report on specifically selected calendars:

- In the HD view, select the calendars to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To report on a particular calendar from the Calendar window:

- In the HD view, locate and double-click the calendar you want to report on. The Calendar window opens with the calendar loaded.

- Click

.

.

- To report on all or a filtered subset of calendars:

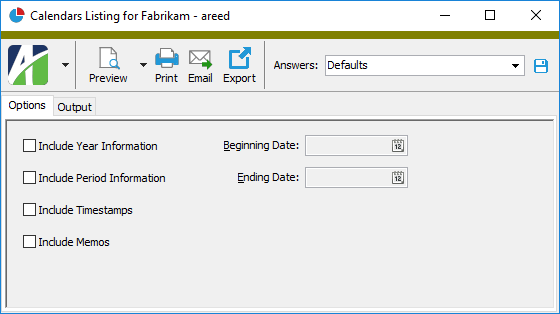

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Year Information. If you mark this checkbox, the Beginning Date and Ending Date fields are enabled. Enter the range of dates to report on.

- Period Information. If you mark this checkbox, the Beginning Date and Ending Date fields are enabled. Enter the range of dates to report on.

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- From

- The email account from which to send the email. Valid options are:

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

- To

- The email address(es) to which to send the email. Separate email addresses with semi-colons.

- CC

- The email addresses to copy on the email. Separate email addresses with semi-colons.

- BCC

- The email addresses to blind copy on the email. Separate email addresses with semi-colons.

- Subject

- The subject line.

- Text box

- The body of the email.

Report Email dialog

Data extensions

The following data extension is available for the report:

- Calendars

Calendar Record ID

Calendar tab

Use this table to define the periods that are valid for a selected fiscal year. You can enter periods directly in the table or you can use the to populate the table.

To use the wizard, select the fiscal year to create periods for in the Years table, click ![]() , and select the type of accounting periods to create from the drop-down menu. Your options are:

, and select the type of accounting periods to create from the drop-down menu. Your options are:

- Monthly

- Semimonthly

- Quarterly

- Weekly

- Biweekly

- Daily

- Four Weeks

- Four/Four/Five

- Five/Four/Four

- Four/Five/Four

After you make your selection, the wizard loads the periods in the table. You can modify the entries in the Periods table as needed.

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Other tab

Automatic Periods wizard

Accounting systems typically operate on a 12-month period called a fiscal year. The fiscal year is typically the basis for organizing postings for financials and controlling the dates which can be entered on postings. A fiscal year does not always correspond to a calendar year, but it represents the time for which a company budgets and records its spending and revenue. A fiscal year is necessary for normal reporting periods. When a company files its tax return, it must declare its accounting periods.

The Automatic Periods wizard generates standardized accounting periods for a selected fiscal year. ActivReporter also supports additional calendars for custom reporting. For instance, while fiscal years commonly use monthly periods, you may want to create calendars for reporting by days, weeks, or quarters. The wizard can generate periods for these additional calendars too.

After you generate periods using the wizard, you can modify them manually if needed.

The table below lists the types of accounting periods that the Automatic Periods wizard can generate, a description of each type, and the default label which ActivReporter uses for each type of period.

Note

If the Automatic Periods wizard is run for a year which already has periods defined, the existing periods will be replaced.

| Period Type | Description | Default Label |

|---|---|---|

| Monthly |

Monthly intervals. If the beginning date of the year is the first day of a month, each period is defined as a calendar month. If the ending date of the year is not the last day of a month, the final period of the year is a partial month. If the beginning date of the year is not the first day of a month, each period will begin on the same day of the month. |

Name of the month in which the beginning date falls |

| Semimonthly |

Half-month intervals where there are 15 days in the first half and the remaining days in the month make up the second half. If the beginning date for the year is the first day of a month, each period will start on the 1st or the 16th day of the month. If the ending date of the year is not the last day of a month, the final period of the year is a partial month. If the beginning date of the year is not the first day of a month, each odd-numbered period will begin on the same day within the month and will contain 15 days. Each even-numbered period will contain the remaining days in the "month". |

Period # |

| Quarterly |

Three-month intervals. If the beginning date for the year is the first day of a month, quarters will start on the first day of the first, fourth, seventh, and tenth months. If the ending date of the year is not the last day of a month, the final quarter in the year is a partial quarter. If the beginning date of the year is not the first day of a month, quarters will begin on the same day of the first, fourth, seventh, and tenth months. |

Quarter # |

| Weekly | Weekly intervals (7 days per period) | Week # |

| Biweekly | Two-week intervals (14 days per period) | Period # |

| Daily | Daily intervals | Actual date |

| Four Weeks | Four-week intervals (28 days per period) | Period # |

| Four/Four/Five | Successive intervals of four, four, and five weeks | Name of the month in which the period principally falls. Periods beyond 12, are numbered (Period 13, etc.). |

| Five/Four/Four | Successive intervals of five, four, and four weeks | Name of the month in which the period principally falls. Periods beyond 12 are numbered (Period 13, etc.). |

| Four/Five/Four | Successive intervals of four, five, and four weeks | Name of the month in which the period principally falls. Periods beyond 12 are numbered (Period 13, etc.). |